Tax policy is one of the most important attributes of the state and the full functioning of its institutions. Tax should be understood as a mandatory gratuitous payment to the state, which is made by legal entities and individuals with a certain frequency and at a specific rate.

In accordance with Russian legislation, all fiscal fees are divided into federal and local. This criterion determines which level of budget the collected funds are used to replenish.

Paying taxes is one of the duties of a citizen. Various types of sanctions are provided for failure to comply with the legal requirements of fiscal authorities. However, certain categories of persons are completely exempt from paying part of the tax payments.

We are talking about the most socially vulnerable of them, including pensioners. In particular, the latter are completely exempt from payments for property they own. In this regard , many pensioners who own vehicles are concerned about whether they are entitled to benefits associated with paying the corresponding tax. Let's look at it in more detail later in the article.

Transport tax - what is it?

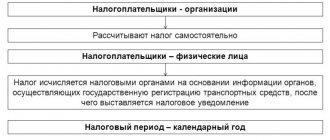

Transport tax is a special payment made by citizens and organizations that own vehicles.

Among other things, these include:

- cars and trucks;

- motorcycles and scooters;

- self-propelled vehicles;

- water vehicles.

To charge this fiscal fee, you only need to have ownership of a vehicle without additional conditions.

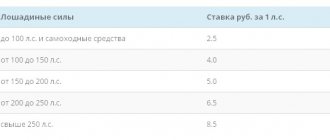

When it comes to transport tax, the fee primarily applies to a car or truck. It should also be noted that its amount may be different for different categories of vehicles. This is due to the fact that the tax base for its calculation is the power of the car engine, which is traditionally measured in horsepower. Accordingly, the larger it is, the more significant the amount the owner will have to pay.

Important! The tax rate may vary depending on the specific region. As a rule, the further north the federal subject is, the higher it is.

Transport tax falls under the category of local taxes. This means that all funds collected are sent to the budget of the subject of the federation. Accordingly, regional authorities use this money to repair existing roads , build new ones, and also cover the costs of maintaining road infrastructure.

How is transport tax calculated for pensioners in Moscow?

The tax is calculated by multiplying the vehicle power indicator with a fixed tax rate for a specific type of transport. The liability is calculated only for the period of actual ownership of the property.

Example 1

A pensioner registered in Moscow owns a passenger car with a capacity of 120 hp. On July 22, 2021, the vehicle was sold and re-registered to a new owner. The tax in this case will be calculated and billed for payment in 2021, and the annual amount of the liability will be divided between the owners in proportion to the periods of ownership of the taxable car.

Transport tax for pensioners in Moscow 2021 is calculated at the rates indicated in Art. 2 of Law No. 33. Applicable to passenger cars with a power range from 100 to 125 hp. a tariff of 25 rubles applies.

If a pensioner owned a car for a whole year, he would have to pay a tax of 3,000 rubles to the budget. (120 hp x 25 rub.). But the citizen sold the vehicle at the end of July, so his tax liability will be calculated for the period from January to July inclusive - July is included in the billing period as a full month, since the vehicle was deregistered after the 15th (clause 3 of Article 362 of the Tax Code RF).

The amount of a pensioner’s tax liability at the end of 2021 will be 1,750 rubles. (120 hp x 25 rubles x 7 months of ownership / 12 months of tax period).

Does a pensioner pay transport tax?

Pensioners belong to one of the categories of citizens who, by virtue of their status, have the right to claim many types of benefits, including those related to taxation. However, current federal legislation does not provide for their exemption from payment of transport tax. In addition, existing regulations do not imply a reduction in the tax rate for this category of citizens.

In this regard , the pensioner will need to pay the appropriate tax for vehicles owned. However, among retired citizens, there are certain categories that have benefits.

In addition, a number of constituent entities of the federation have adopted their own regulations, where pensioners are exempt from paying transport tax or the conditions for calculating it are much softer. However, local regulations are valid only in the territory of a specific region, and are not generally binding for the entire country.

Who is exempt from paying

It has been established at the federal level that the following categories of citizens are exempt from paying transport tax or pay it in a smaller amount:

- disabled people and veterans of World War II and military operations;

- prisoners of Nazi concentration camps;

- persons affected by the radiation disaster at the Chernobyl nuclear power plant;

- disabled people of groups I and II;

- large families;

- parents of disabled children.

Reference! This benefit is provided on an application basis. This means that the Federal Tax Service will accrue payments until the person entitled to it submits a corresponding application to the tax service.

Are there any benefits for pensioners

In general, the status of “pensioner” itself is not a basis for providing the opportunity not to pay transport tax. However, this applies only to the general procedure for providing benefits for the payment of the transport tax in question, provided for at the federal level.

Regional

Transport tax belongs to the category of local tax; in this regard, the subjects of the federation have quite broad powers and opportunities in terms of its assessment. They are also responsible for issues related to the provision of benefits to socially vulnerable categories of the population.

For example, in many of them, labor veterans, as well as disabled people of group III, are exempt from the need to make this fiscal payment.

Some regions establish that this benefit is also available to pensioners who have no other grounds for receiving it. It can be expressed either in complete exemption from tax or in a significant reduction in its amount, which may be associated, among other things, with the engine power of the vehicle.

In this case, the example of the Kirov region is quite typical. Thus, pensioners here pay only 50% of the accrued tax, but on the condition that they own a car with an engine power of no more than 150 horsepower. And, for example, disabled pensioners of group III receive a “discount” of 70% of the accrued payment.

Federal

Federal legislation does not allocate pensioners to a separate category of beneficiaries for the payment of transport tax. However, if they have other reasons for receiving relief, then they have the right to use it on a general basis.

Interesting!

Discussions about the need to amend tax legislation to provide transport tax benefits for pensioners at the federal level regularly arise among experts. However, given the shortage of funds in regional budgets and the poor quality of roads owned by federal subjects and municipalities, this idea is unrealizable in the near future.

Who should pay car tax?

Modern legislation recognizes all citizens who, by right of ownership, own a car or other vehicle as tax payers. Preferential categories of payers for whom discounts are thought out or a zero interest rate is applied include heroes of the Russian Federation, the USSR, disabled people, large families and some pensioners.

Citizens who:

- have reached 55 or 60 years of age (for women and men, respectively) and are old-age pensioners - they have been assigned an appropriate pension;

- Disability pensioners are citizens recognized as irrevocably disabled and who have a corresponding conclusion from a medical commission;

- lost the main breadwinner in the family, and a pension for the loss of a breadwinner was assigned;

- military pensioners who are assigned appropriate payments after completing a certain number of years of service.

The Tax Code does not include pensioners in the list of preferential categories for transport tax, and then privileges for them are established exclusively by local authorities. In general, transport tax benefits for pensioners in 2015 have the following features:

- Most often, they are provided in the form of a complete exemption from contributing the amount to the budget or a 50 percent discount on payment of the fee.

- Benefits in most cases are limited to only one vehicle owned by the retiree. For all other taxes, tax is charged in full in accordance with tax legislation.

- The pensioner must declare his rights to benefits: collect a full package of documents, among which the main one will be one that confirms the preferential status, and transfer it to the tax structure at the place of residence.

- If there are several grounds for receiving a discount (for example, the applicant is not only a pensioner, but also a disabled person), the benefit is not cumulative and can be provided only for one of the taxpayer statuses.

If in the specific region of residence of the pensioner he is not entitled to benefits, then he makes the payment on the same basis as everyone else:

- Payment must be made by the end of November of the following reporting year.

- The pensioner learns about the required payment amount from the tax notice that he receives at his place of residence. It is easy to calculate the amount of car tax yourself: it is equal to the tax rate multiplied by the number of horsepower of the car and the period in months during which the car is in the possession of the payer. In 2021, the fee amount will also include coefficients indicating the environmental class of the car, its cost and age, that is, the date of manufacture. The more expensive and powerful a car a taxpayer owns, the greater the amount of tax he will have to contribute to the state budget.

- For non-payment or late payment, a penalty is charged, and then a fine.

How to apply for a benefit

If a pensioner has grounds for receiving transport tax benefits, then he needs to submit a corresponding application to the Federal Tax Service. It should be noted that even if you have the right to a tax break, without an application from the citizen, the inspectorate will continue to accrue it.

Rules for filling out an application

The application for exemption from paying the fiscal fee has a strict and approved form.

The general rules for filling it out are:

- entering current, factual information;

- use of black ink (when handwritten);

- inadmissibility of corrections and blots;

The application is submitted with a set of documents identifying the citizen, as well as confirming the right to receive the corresponding benefit.

How to submit documents

The pensioner has the right to submit an application and related documents using one of several methods available to him.

- Personal appeal to the Federal Tax Service. A citizen can contact any tax office, even one located outside his place of residence.

- Through MFC. Multifunctional centers have convenient operating hours for citizens and are also located in almost every municipality. Please note that documents are not submitted to the tax office on the day they are submitted to the MFC.

- Electronic. You can submit an application through the State Services portal or your personal account on the Federal Tax Service website. To authenticate them, you will need an electronic digital signature.

- Through a representative. If a pensioner does not have the opportunity to submit documents personally, then a third party - a representative - can do this for him.

Attention! The authority of the representative must be confirmed by a properly executed power of attorney.

Federal legislation does not provide special benefits for pensioners in terms of exempting them from paying transport tax. However, such preferences are provided by regulations of some regions of the country. To apply for a benefit, a pensioner must contact the Federal Tax Service and provide documents confirming their right to it.