| A busy schedule prevents you from attending professional development events? We found a way out! |

Consultation provided on March 30, 2016

In May 2014, a government agency (Krasnoyarsk) purchased a UAZ-29892 car with 8 seats (without driver). The PTS indicates the type of vehicle - special, passenger vehicle, vehicle category - B; the STS (a document issued by the State Traffic Safety Inspectorate) indicates the type of vehicle - “special, other”. In the document “Industry standard OH 025 270-66”, which regulates the classification and designation system of motor vehicles, such a model is not specified.

What transport tax rate is the institution entitled to apply for the specified vehicle (the rate for a bus or for a car)?

If OH 025 270-66 does not assign vehicle type 29 (bus or passenger car), then is it possible to apply the classification of motor vehicles adopted by the UNECE to prove to the tax authority that this car is a passenger car?

On this issue we take the following position:

In relation to the vehicle specified in the question, it is possible to apply the transport tax rate established for passenger cars.

If a dispute arises with the tax authority, we believe that the chances of proving in court that this vehicle belongs to the category of passenger cars are quite high.

Justification for the position:

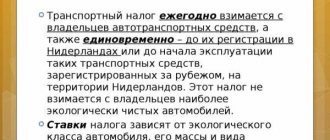

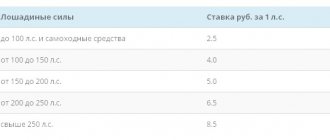

In accordance with paragraph 1 of Art. 361 of the Tax Code of the Russian Federation, tax rates are established by the laws of the constituent entities of the Russian Federation, in particular, depending on the engine power per horsepower of the engine of the vehicle (hereinafter referred to as the vehicle). It also follows from this norm that, in addition to engine power, transport tax rates are differentiated depending on the type of vehicle (including passenger cars, trucks, buses and other self-propelled vehicles (Article 358 of the Tax Code of the Russian Federation)).

In this case, it is allowed to establish differentiated tax rates for each category of vehicle, as well as taking into account the number of years that have passed since the year of production of the vehicle and (or) their environmental class (clause 3 of Article 361 of the Tax Code of the Russian Federation).

In view of this, for cars of the same power, different tax rates are provided depending on the category of vehicle.

So, in 2021, the Law of the Krasnoyarsk Territory of November 8, 2007 N 3-676 “On Transport Tax” in relation to engine power up to 150 hp. inclusive for passenger cars, a tax rate of 14.5 rubles is provided, for buses with an engine power of up to 200 hp. inclusive - 25 rub. Accordingly, it is necessary to determine which category the vehicle belongs to.

The Tax Code of the Russian Federation does not establish criteria on the basis of which it is possible to classify a vehicle, in particular, into the category of passenger cars or into the category of buses.

In this regard, you should refer to the Methodological Recommendations for the application of Chapter 28 “Transport Tax” of Part Two of the Tax Code of the Russian Federation, approved by Order of the Ministry of Taxes and Taxes of Russia dated 04/09/2003 N BG-3-21/177 (hereinafter referred to as the Methodological Recommendations), which are currently in force in parts that do not contradict the Tax Code of the Russian Federation.

It should be taken into account that the Methodological Recommendations do not relate to acts of legislation of the Russian Federation on taxes and fees, but at the same time, being intradepartmental documents, they are mandatory for execution by tax authorities (clause 2 of Article 4 of the Tax Code of the Russian Federation, Resolution of the Federal Antimonopoly Service of the Central District dated April 3, 2006 N A68-AP-279/12-05).

Procedure for calculating transport tax for buses

The transport tax calculator contains basic tariffs and rates required by law.

In Art. 359 “Tax Base” lists the conditions under which the collection from buses is calculated. You can easily calculate the transport tax for buses yourself. To do this, use the formula: Br × Av × Ml × 1 = Int.

- Br — base tariff (RUB);

- Ср — regional rate;

- Mls - engine power (hp);

- 1—holding period (1 year);

- Vn is the amount of tax.

Transport tax rate in Moscow for 2021

| Name of taxable object | Rate (RUB) |

| Passenger cars with engine power (per horsepower): | |

| up to 100 l. With. (up to 73.55 kW) inclusive | 12 |

| over 100 hp up to 125 hp (over 73.55 kW to 91.94 kW) inclusive | 25 |

| over 125 hp up to 150 hp (over 91.94 kW to 110.33 kW) inclusive | 35 |

| over 150 hp up to 175 hp (over 110.33 kW to 128.7 kW) inclusive | 45 |

| over 175 hp up to 200 hp (over 128.7 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 225 hp (over 147.1 kW to 165.5 kW) inclusive | 65 |

| over 225 hp up to 250 hp (over 165.5 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters with engine power (per horsepower): | |

| up to 20 l. With. (up to 14.7 kW) inclusive | 7 |

| over 20 l. With. up to 35 l. With. (over 14.7 kW to 25.74 kW) inclusive | 15 |

| over 35 l. With. (over 25.74 kW) | 50 |

| Buses with engine power (per horsepower): | |

| up to 110 hp (up to 80.9 kW) inclusive | 15 |

| over 110 hp up to 200 hp (over 80.9 kW to 147.1 kW) inclusive | 26 |

| over 200 l. With. (over 147.1 kW) | 55 |

| Trucks with engine power (per horsepower): | |

| up to 100 l. With. (up to 73.55 kW) inclusive | 15 |

| over 100 l. With. up to 150 l. With. (over 73.55 kW to 110.33 kW) inclusive | 26 |

| over 150 l. With. up to 200 l. With. (over 110.33 kW to 147.1 kW) inclusive | 38 |

| over 200 l. With. up to 250 l. With. (over 147.1 kW to 183.9 kW) inclusive | 55 |

| over 250 l. With. (over 183.9 kW) | 70 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms (per horsepower) | 25 |

| Snowmobiles, motor sleighs with engine power (per horsepower): | |

| up to 50 l. With. (up to 36.77 kW) inclusive | 25 |

| over 50 l. With. (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles with engine power (per horsepower): | |

| up to 100 l. With. (up to 73.55 kW) inclusive | 100 |

| over 100 l. With. (over 73.55 kW) | 200 |

| Yachts and other sailing-motor vessels with engine power (per horsepower): | |

| up to 100 l. With. (up to 73.55 kW) inclusive | 200 |

| over 100 l. With. (over 73.55 kW) | 400 |

| Jet skis with engine power (per horsepower): | |

| up to 100 l. With. (up to 73.55 kW) inclusive | 250 |

| over 100 l. With. (over 73.55 kW) | 500 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 200 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 250 |

| Airplanes with jet engines (per kilogram of thrust) | 200 |

| Other water and air vehicles without engines (per vehicle unit) | 2000 |

Deadlines for payment of transport tax

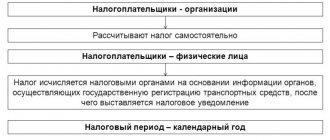

Bus owners are obliged to transfer funds to the state for transport tax within the established period. The main condition for taxation is registration of equipment with the registration authority (MREO STSI, GIMS, Gostekhnadzor and others). The list of vehicles is approved in paragraph 1 of Art. 358 Tax Code of the Russian Federation. And in the legal norm of the Tax Code of the Russian Federation, clause 1, art. 363 the deadline for payment is December 1.

“The tax is payable by individual taxpayers no later than December 1 of the year following the expired tax period.”

GOST R 52051-2003 “Mechanical vehicles and trailers. Classification and definitions"

Since the regulatory documents specified in paragraph 16 of the Methodological Recommendations also do not allow us to unambiguously classify some vehicles of the UAZ, as well as IZH, GAZ brands as trucks or cars, it is advisable to refer to GOST R 52051-2003 “Motor vehicles and trailers. Classification and Definitions" (adopted and put into effect by Decree of the State Standard of Russia dated 05/07/2003 N 139-st, hereinafter referred to as GOST R 52051-2003). This is dictated by the provisions of Art. 11 of the Tax Code of the Russian Federation, according to which the institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation, used in the Tax Code of the Russian Federation, are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code of the Russian Federation.

GOST R 52051-2003, in particular, identifies the following categories of vehicles:

- category M1 - vehicles used for the transport of passengers and having, in addition to the driver’s seat, no more than eight seats (clause 3.1 (see also 9.1) GOST R 52051-2003);

- category M 2 - vehicles used for the transport of passengers, having, in addition to the driver’s seat, more than eight seats, the maximum weight of which does not exceed 5 tons (clause 3.2 of GOST R 52051-2003).

At the same time, in accordance with clause 6.1 of GOST R 52051-2003, special-purpose vehicles include vehicles of categories M, N and O, intended for passenger and cargo transportation associated with the performance of special functions, which require a special body and (or) special equipment (which are listed below in clause 6.1 of GOST R 52051-2003).

In accordance with GOST R 52051-2003, vehicle certification data must be indicated by the manufacturer in the technical documentation for the vehicle.

When determining the type of vehicles produced by the Ulyanovsk Automobile Plant OJSC, specialists from the Department of Tax Administration of Russia for Moscow (letter dated 08/03/2004 N 23-01/3/50988) recommend using the information provided by the plant’s chief designer service for vehicles produced.

Using this information, tax specialists indicate that car models, their modifications, versions and configurations, the designation of which begins with numbers:

- 3151, 3153, 3159, 3160, 3162 - must be classified as passenger cars, as they are certified under category M1 “Motor vehicles for the transport of passengers with no more than 8 seats (except for the driver’s seat)”;

- 2206, 3962 - must be classified as buses, since they are certified under category M2 “Mechanical vehicles for the transport of passengers with more than 8 seats (except for the driver) and the maximum weight of which does not exceed 5 tons.”

However, with regard to modern car models, in particular the UAZ-29892 car, we have not currently found such clarifications. In this regard, we believe that the organization can make an official request to the manufacturer.

At the same time, based on the analysis of the information presented in the letter, we believe that if the car in question is also certified in category M1 “Motor vehicles for the transport of passengers with no more than 8 seats (except for the driver’s seat)”, then it must be classified as passenger cars.

If the transport tax has not arrived

According to current legislation, individuals pay transport tax based on a receipt from the Federal Tax Service. Their distribution was completed at the end of October. The document contains details for transferring money, a unique identifier and the amount to be paid. However, some bus owners are not receiving notifications. For example, they live at the actual address in another city, or the postman mixed up the addresses. In this case, the citizen is obliged to independently contact the local Federal Tax Service for a receipt. The maximum period is until December 31 (clause 2.1 of Article 23 of the Tax Code of the Russian Federation).

Responsibility for non-payment of transport tax

If an individual fails to pay the transport tax for buses, he will be charged a fine of 20% of the arrears. And for each day of delay, a penalty of 0.003–0.006% “drips” (Tax Code of the Russian Federation, clause 4, article 75 “Penya”, No. 146-FZ), depending on the period of non-payment. First the minimum, then the maximum.

For malicious evasion of tax obligations, the sanction is increased to 40% of the amount of the fee (TK, Art. 122, No. 146-FZ “Non-payment or incomplete payment of tax amounts”). At the same time, the violator may be prohibited from registering actions with property (movable and immovable). And the accounts will be blocked by the bank or bailiffs by court order until the debt, penalties and fines are fully repaid.

Vehicle passport

Clause 5 of Annex 6 of the Convention lists vehicle categories. In particular, cars, with the exception of those belonging to category A, the permissible maximum mass of which does not exceed 3500 kg and the number of seats, in addition to the driver’s seat, does not exceed eight, are classified by the Convention as category B.

In turn, in accordance with clause 28 of the Regulations on vehicle passports and vehicle chassis passports, approved by order of the Ministry of Internal Affairs of Russia, the Ministry of Industry and Energy of Russia and the Ministry of Economic Development of Russia dated June 23, 2005 N 496/192/134 (hereinafter referred to as the Regulations), in line 4 “Vehicle category (A, B, C, D, trailer)” of the vehicle passport (PTS) indicates the category that corresponds to the vehicle classification established by the Convention.

Line 2 of the PTS “Vehicle brand, model” indicates the symbol of the vehicle, assigned in the manner established for products of the automotive industry, and given in the Vehicle Type Approval (VTA), the Vehicle Design Safety Certificate or in registration documents and consisting of: as a rule, from the letter, digital or mixed designation assigned to the vehicle, independent of the designation of other vehicles (for example, UAZ 29892) (clause 26 of the Regulations).

According to clause 27 of the Regulations, line 3 “Name (vehicle type)” indicates the characteristics of the vehicle, determined by its design features and purpose.

There is no consensus on what information from the title must be taken into account when determining the category of a car for the purpose of paying transport tax and the transport tax rate.

There is an opinion that if a vehicle belongs to category “B” it automatically means that the vehicle is a passenger car. This opinion is supported by some courts (see, for example, resolutions of the Federal Antimonopoly Service of the West Siberian District dated 06/03/2009 N F04-3338/2009, FAS Moscow District dated 06/03/2009 N KA-A40/4697-09-2, dated 12/08/2008 N KA-A40/10120-08, FAS Volga-Vyatka District dated May 15, 2009 N A11-10035/2008-K2-26/558, FAS East Siberian District dated March 12, 2009 N A58-3798/08-F02-869/ 09, FAS of the Ural District dated July 24, 2007 N F09-5697/07-S3, FAS of the North Caucasus District dated December 25, 2006 N F08-6558/2006-2712A) and in 2007 was supported by the Ministry of Finance of Russia (see letter dated March 29, 2007 N 03-05-06-04/17).

However, in our opinion, this opinion is incorrect. Thus, in the above classification concepts such as “passenger car”, “truck”, “bus”, etc. are not used. Therefore, it is impossible to say unequivocally that, for example, a bus cannot be included in category “B”. There is also no explanation of these concepts in the Regulations, and these terms do not appear at all in the Convention.

Therefore, we believe that classifying a vehicle into category “B” does not mean at all that for the purposes of calculating transport tax, this vehicle should be considered as a passenger car.

Let us note that at present this is the position on this issue that the Russian Ministry of Finance adheres to (see letters dated 12/10/2013 N 03-05-06-04/54111, dated 08/13/2012 N 03-05-06-04/137, dated 10/21/2010 N 03-05-06-04/251, dated 03/19/2010 N 03-05-05-04/05, dated 07/01/2009 N 03-05-06-04/105, dated 02/07/2008 N 03 -05-04-04/01, dated 01/17/2008 N 03-05-04-01/1). The Financial Department believes that the vehicle category established for tax purposes is determined based on the type of vehicle and its purpose (category) specified in the PTS based on the OTTS. In this case, the main indicator for the purposes of imposing transport tax is the type of vehicle specified in the PTS, since vehicles of the same category may have different types depending on the purpose (passenger car, truck or bus).

There is also judicial practice with similar conclusions (see, for example, appeal rulings of the Investigative Committee for civil cases of the Pskov Regional Court dated April 29, 2014 in case No. 33-660/2014, the Investigative Committee for civil cases of the Khabarovsk Regional Court dated November 8, 2013 in case No. 33- 7121/2013, IC for civil cases of the Lipetsk Regional Court dated July 17, 2013 in case No. 33-1780/2013).

In the appeal ruling of the Investigative Committee for Civil Cases of the Pskov Regional Court dated April 29, 2014 in case No. 33-660/2014, it was noted that it is impossible to determine whether a vehicle belongs to “trucks” or “passenger cars” only by category.

Thus, we see that in order to determine the category of any vehicle for tax purposes, one should take into account the aggregate information on both the type of vehicle and its purpose (“category”) specified in the PTS. However, in the case under consideration, the type of vehicle - a special passenger vehicle - also does not allow us to determine the category of the vehicle for tax purposes.

According to clause 4 of the Regulations, PTS are issued to vehicle owners by organizations and citizens registered in the prescribed manner and carrying out their business activities without forming a legal entity, who are manufacturers of vehicles in the manner established by regulatory legal acts of the Russian Federation, by customs authorities of the Federal Customs Service of Russia or divisions of the State Traffic Safety Inspectorate in the manner established by the Regulations .

Consequently, the authority to classify a vehicle as a particular type of vehicle is vested in manufacturing organizations, customs authorities and traffic police departments.