When calculating transport tax on expensive passenger cars, for some time now it is necessary to apply an increasing coefficient, but only if the car model is on the list of the Ministry of Industry and Trade of Russia, a specified number of years have not passed since the date of its release and its average cost is 3 million rubles. and more. And this is not all the hassle regarding vehicles. Sometimes a vehicle is stolen, what to do with the transport tax in this case - and there is no vehicle, and still have to pay the transport tax?

A list of expensive cars for calculating transport tax for 2019 has been published.

Also, payment according to Plato introduces confusion into the procedure for paying transport tax: sometimes we reduce the transport tax by the amount of payment to Plato, sometimes not; then we recognize as expenses only the amount of payment to Plato that exceeds the transport tax, then we take the entire amount into account as expenses; either we do not pay advance payments for transport tax when making payments to Plato, or we pay. We will consider all this in more detail in the article.

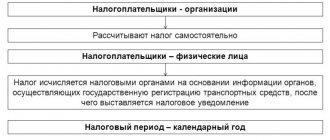

Who pays?

Transport tax is paid by persons who, in accordance with the legislation of the Russian Federation, are registered cars, motorcycles, motor scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and other water and air vehicles (Articles 357, 358 of the Tax Code of the Russian Federation).

Vehicles that are not subject to transport tax are listed in paragraph 2 of Article 358 of the Tax Code of the Russian Federation. This:

- rowing boats, as well as motor boats with an engine power not exceeding 5 horsepower (hp);

- passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 hp. (up to 73.55 kW), received through social protection authorities in the manner prescribed by law;

- fishing sea and river vessels;

- passenger and cargo sea, river and aircraft owned (with the right of economic management or operational management) by organizations and individual entrepreneurs whose main activity is passenger or cargo transportation;

- tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, for transporting and applying mineral fertilizers, veterinary care), registered to agricultural producers and used in agricultural work for the production of agricultural products;

- vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military or equivalent service;

- airplanes and helicopters of air ambulance and medical services;

- ships registered in the Russian International Register of Ships;

- offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

Main meanings of the formula

The main parameters for calculating tax are the tax base and tax rate . They are not excluded from the formula in any case. Other indicators complement it, if necessary in a specific situation.

The NB value can be found in the registration certificate or other documents for the vehicle. The base becomes engine power, gross tonnage or vehicle unit.

Please note that the engine power indicated in kW must be recalculated in horsepower: the number of kW must be multiplied by 1.35962 (this is a constant value). The resulting result must be rounded to 2 decimal places.

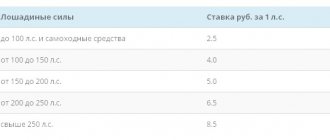

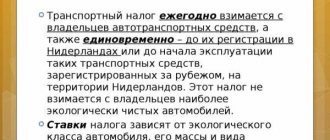

As for the tax rate, it is set by regional authorities and depends on:

- tax bases

- age of technology

- vehicle categories

- environmental class

If the LSG body has not determined the rates, companies have the right to use the basic indicators prescribed in Art. 361 Tax Code of the Russian Federation .

To find out the tax authorities in a specific region, you can use the Federal Tax Service help service:

- Specify region.

- Enter “About transport tax” into the search. The system will automatically display the law that is in force in the desired subject of the Russian Federation.

- Click "More details".

- Go to the “Bets” tab.

- Check the box next to “Legal Entity”.

- Click the “Show” button.

The service will display rates for TN in the selected region.

Calculation example

The calculation, made with only the basic values, is very simple. For example, during 2021 the company owned a passenger car with a power of 145 hp, which is the tax base. The tax rate in the region is 35 rubles.

We multiply the two indicators and get the amount of transport tax:

145*35 = 5 075 rubles

This is how much the organization needs to pay without taking into account advance payments, benefits and coefficients.

Transport tax in case of theft or theft of a vehicle

We will especially focus on the theft or theft of a vehicle. In case of theft or theft of a vehicle, it is not subject to transport tax while it is wanted. But in order for such vehicles not to be taxed, it is necessary to confirm the fact of their theft or theft with a document issued by an authorized body. However, neither the Tax Code of the Russian Federation nor other regulations contain a specific list of documents confirming the fact of theft or theft of a vehicle. The Federal Tax Service of Russia believes that the fact of theft or theft can be confirmed by one of the following documents (Information of the Federal Tax Service of Russia “On the new procedure for terminating the registration of a wanted car”):

- certificate of theft (theft) of a vehicle;

- a certificate or resolution to initiate a criminal case in connection with theft or theft of a vehicle, issued by law enforcement agencies;

- by resolution, or decision, or determination of the courts that have entered into force;

- a certificate of termination of a criminal case on the fact of theft or theft of a vehicle, issued by an authorized body due to the fact that the statute of limitations for criminal prosecution has expired.

In addition, in this letter, the Federal Tax Service of Russia indicated the need to annually confirm the fact that a vehicle was being searched in connection with its theft or theft.

Indeed, in accordance with paragraph 1 of Article 360 of the Tax Code of the Russian Federation, the tax period for transport tax is a calendar year. In addition, the new rules for registering motor vehicles with the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of Russia, approved by Order of the Ministry of Internal Affairs of Russia dated June 26, 2018 N 399, have simplified the procedure for terminating the registration of vehicles that are on the wanted list. According to the new rules, the registration of the wanted car with the traffic police can be terminated. To do this, the owner of the car must submit an application to the traffic police to terminate the registration of a wanted vehicle. In this case, the traffic police authorities transmit information about the deregistration of the vehicle to the tax authorities. Based on such information, the tax authorities stop calculating transport tax to the owner of the vehicle, regardless of the period of search for the car.

How much tax should I pay?

The amount of transport tax is calculated as the product of the tax base and the tax rate (clause 2 of Article 362 of the Tax Code of the Russian Federation). In this case, the tax base is determined separately for each vehicle (Article 359 of the Tax Code of the Russian Federation):

- in relation to vehicles with engines, with the exception of air vehicles for which the thrust of a jet engine is determined, as the vehicle engine power in horsepower;

- in relation to air vehicles for which the thrust of a jet engine is determined - as the nameplate static thrust of the jet engine (the total nameplate static thrust of all jet engines) of the aircraft at take-off mode in terrestrial conditions in kilograms of force;

- in relation to non-self-propelled (towed) water vehicles, for which gross tonnage is determined - as gross tonnage in registered tons.

- In relation to water and air vehicles not mentioned above, the tax base for transport tax is determined as a unit of vehicle separately from other vehicles.

The basic rates of transport tax are established in paragraph 1 of Article 361 of the Tax Code of the Russian Federation.

But constituent entities of the Russian Federation can set their own transport tax rates. In any case, deviations in the transport tax rate established by the constituent entities of the Russian Federation should not differ from the base rates by 10 times. This restriction was introduced by paragraph 2 of Article 361 of the Tax Code of the Russian Federation. However, this restriction does not apply to passenger cars with an engine power (per horsepower) of up to 150 hp. (up to 110.33 kW) inclusive. For such vehicles, tax rates can be reduced by the laws of the constituent entities of the Russian Federation by more than 10 times. This relaxation was made to encourage the purchase of low-power vehicles. Since such vehicles are less harmful to the environment.

Also, the tax rate may be different for each category of vehicle. In addition, the transport tax rate may depend on the number of years that have passed since the year of manufacture of the vehicles and (or) their environmental class.

The calculation of the number of years that have passed since the year of manufacture of the vehicle is made from the year following the year of manufacture of the vehicle. The number of years is determined as of January 1 of the current year in calendar years.

Basic rates of transport tax are applied if tax rates are not determined by the laws of the constituent entities of the Russian Federation.

Instructions on how to calculate transport tax

Transport tax is calculated using the formula:

TN = NB x NS , where:

- NB – tax base

- TS – tax rate current at the time of payment

The formula becomes more complicated if the company:

- makes advance payments

- wants to take advantage of tax benefits

- applies different coefficients

If all three conditions above are met, the calculation looks like this:

TN = NB x NS x Kv x Kp - NL - AP , where:

- Kv – vehicle ownership coefficient

- Кп – increasing coefficient

- AP – advance payments

- NL - benefits to which the payer is entitled

This is the complete formula, but it may vary depending on the situation.

Transport tax on expensive cars

For passenger cars, the cost of which is 3 million rubles.

and more, increasing coefficients may be applied. Depending on the cost of a passenger car, the following increasing factors are applied: 1.1 - for passenger cars with an average cost of 3 million to 5 million rubles. inclusive, if no more than 3 years have passed since the year of manufacture of such cars;

2 - for passenger cars with an average cost of 5 million to 10 million rubles. inclusive, if no more than 5 years have passed since the year of manufacture of such cars;

3 - for passenger cars with an average cost of 10 million to 15 million rubles. inclusive, if no more than 10 years have passed since the year of manufacture of such cars;

3 - for passenger cars with an average cost of 15 million rubles, if no more than 20 years have passed since the year of manufacture of such cars.

If you have such cars, you need to check the list of cars with an average cost of 3 million rubles, subject to application in the next tax period, approved by the Ministry of Industry and Trade of Russia. The list is approved for each tax period and posted no later than March 1 of the next tax period on the official website of the Ministry of Industry and Trade of Russia on the Internet information and telecommunications network. For 2021, such a list is certified by the Information of the Ministry of Industry and Trade of Russia “List of passenger cars with an average cost of 3 million rubles, subject to application in the next tax period.”

If your car model is not on the list approved for the corresponding tax period, then the increasing factor is not applied to it, for example, for a Tesla car. If you find your car model in the list, then you need to calculate the average cost of the car. The average cost of a car is determined in the manner approved by Order of the Ministry of Industry and Trade of Russia dated February 28, 2014 No. 316 “On approval of the Procedure for calculating the average cost of passenger cars for the purposes of Chapter 28 of the Tax Code of the Russian Federation.”

The Procedure provides formulas for calculating the average cost of a car for a certain basic version of the car. The calculation of the average cost of a car differs depending on whether the manufacturer or an authorized representative of the manufacturer is represented in the Russian Federation, and whether data on the recommended retail price are provided by the manufacturer or an authorized representative of the manufacturer.

If data on the recommended retail price of the manufacturer or an authorized representative of the manufacturer is provided, then the calculation of the average cost of cars is based on determining the average cost of cars based on the recommended retail prices for cars of this make, model and year of manufacture of the corresponding basic versions of cars as of July 1 and December 1 the corresponding tax period.

If data on the recommended retail price by the manufacturer or an authorized representative of the manufacturer is not provided, or if the manufacturer or an authorized representative of the manufacturer is not represented in the Russian Federation, then the calculation of the average cost of cars is based on determining the average cost of cars based on the retail prices for new cars of this make, model and year of manufacture the corresponding basic versions of cars as of December 31 of the corresponding tax period, indicated in Russian catalogs.

As you can see, the price of a taxpayer’s purchase of an expensive car does not matter for the application of the increasing coefficient. If the average cost of a car is equal to or higher than 3 million rubles, then you need to calculate the age of the car.

The age of such cars is calculated from the year of manufacture of the corresponding passenger car. For example, if a taxpayer has an Audi A6 Limousine quattro with a diesel engine type and an engine capacity of 2967, a car with a year of manufacture in 2017, then for such a car an increasing factor is applied when calculating the transport tax for 2021, 2021 and 2021, and for 2020 The year no longer applies, since the list sets the number of years that have passed since the year of manufacture of such a car to 3 years.

For expensive passenger cars, advance payments for transport tax are also paid taking into account an increasing coefficient.

Table of increasing coefficients

The amount of transport tax on expensive cars is calculated taking into account the increasing coefficient (clause 2 of Article 362 of the Tax Code of the Russian Federation):

| Size of the multiplying factor | Average car cost | Vehicle age |

| 1,1 | 3,000,000 – 5,000,000 rubles | 2-3 years |

| 1,3 | 3,000,000 – 5,000,000 rubles | 1 – 2 years |

| 1,5 | 3,000,000 – 5,000,000 rubles | up to 1 year |

| 2 | 5,000,000 – 10,000,000 rubles | up to 5 years |

| 3 | 10,000,000 – 15,000,000 rubles | up to 10 years |

| 3 | from 15,000,000 rubles | up to 20 years |

In accordance with clause 2 of Article 362 of the Tax Code of the Russian Federation, the age of a car is calculated from the year of manufacture, and not from the moment of purchasing the car at a car dealership.

Example 1. Calculation of transport tax for an Audi Q7 quatro diesel passenger car with an engine capacity of 2967 cc. will be carried out taking into account the increasing coefficient:

- from the date of purchase to 1 year – 1.5;

- 1-2 years – 1.3;

- 2-3 years – 1.1.

After three years, the increasing coefficient is not used when calculating the transport tax for this car.

If the vehicle is registered or deregistered during the tax period

If a vehicle is registered to a taxpayer during a calendar year, then the tax is calculated using a coefficient.

The coefficient is calculated as the ratio of the number of full months during which the vehicle was registered to the taxpayer to the number of calendar months in the tax (reporting) period. The month of registration is taken as a full month if the registration of the vehicle occurred before the 15th day of the corresponding month, inclusive, or the deregistration of the vehicle (deregistration, exclusion from the state ship register, etc.) occurred after the 15th day of the corresponding month.

The month of registration is not taken into account if the registration of the vehicle occurred after the 15th day of the corresponding month or the deregistration of the vehicle (deregistration, exclusion from the state ship register, etc.) occurred before the 15th day of the corresponding month inclusive.

Ownership coefficient (adjusting)

This coefficient can be used if the vehicle has been owned for less than a full year. It is calculated by dividing the number of complete months of vehicle ownership by 12.

A full month is considered to be the month in which the vehicle was purchased before the fifteenth day or sold after the fifteenth day.

Payers who are legal entities must indicate this coefficient in the declaration, in the second section, in line 130. It must be written in the form of a decimal fraction.

Individual payers can see this coefficient in the notification that will come to them from the tax office. It is indicated in the fifth column of the calculation.

Similar articles

- Increasing factor: transport tax

- List of cars subject to luxury tax

- Transport tax: advance payments in 2021

- Transport tax coefficient Kv in 2016-2017

- The current increasing transport tax coefficient

Transport tax on heavy trucks

Until January 1, 2021, in the case of payment to Plato in relation to a vehicle with a permissible maximum weight of over 12 tons, the organization did not pay advance payments for transport tax.

This was provided for in paragraph 2 of paragraph 2 of Article 363 of the Tax Code of the Russian Federation. In addition, the organization reduced the transport tax at the end of the year by the amount paid to Plato for the corresponding tax period. If, in the event of a reduction in the transport tax for payment to Plato, the amount of tax payable to the budget took a negative value, then the transport tax was not paid. But, according to paragraph 4 of Article 2 of the Federal Law of July 3, 2016 N 249-FZ, this procedure was in effect until December 31, 2018. In this connection, from 01.01.2019, such organizations pay transport tax in the general manner, that is, pay advance payments, unless otherwise established by the laws of the constituent entities of the Russian Federation, and the tax itself.

Kp coefficient for transport tax in 2016-2017: legal entities

Kp is the increase factor. Due to it, the tax amount for expensive passenger cars worth more than three million rubles increases. The transport tax coefficient Kp was introduced back in 2014. Since that time, all companies that own vehicles worth more than 3 million rubles and are included in a special list of the Ministry of Industry and Trade must pay tax taking into account increasing factors.

By the way, not only organizations, but also citizens are required to use this coefficient.

When to pay transport tax?

The deadlines for payment of advance payments for transport tax and transport tax at the end of the year are established by the constituent entities of the Russian Federation. But for organizations, the deadline cannot be set earlier than February 1 of the year following the expired tax period - the deadline for submitting a tax return for transport tax.

In Moscow, for example, organizations pay transport tax no later than February 5 of the year following the expired tax period (Clause 1, Article 3 of Moscow Law No. 33 dated 07/09/2008). In this case, the organization does not pay advance tax payments during the tax period.

But in the Moscow region, advance payments for transport tax are paid no later than the last day of the month following the reporting period (Clause 1, Article 2 of the Law of the Moscow Region of November 16, 2002 No. 129/2002-OZ).

Let us remind you that the reporting periods for transport tax are 2 quarters - the second and third quarters (clause 2 of Article 360 of the Tax Code of the Russian Federation). And the tax for the tax period is paid no later than March 28 of the year following the expired tax period. Individuals pay transport tax no later than December 1 of the year following the expired tax period.

Advance payments and final technical specification

The frequency of advance payments depends on whether the regional authorities have established reporting periods or not. If yes, then you need to pay quarterly, if not, then at the end of the year.

Advance payments are made in equal installments. The formula used to calculate them is as follows:

AP = ¼ x TN

At the end of the year, TN is calculated minus advance payments:

TN = NB x NS – AP

Calculation example

Throughout 2021, the company owned a passenger car with an engine power of 150 hp, which is considered the tax base. The regional rate is 10 rubles.

First, the tax amount is calculated:

150*10=1500 rubles

Then the advance payment is determined from it:

¼*1500=375 rubles

The final transport tax, taking into account advances made every quarter (that is, 3 times), is calculated as follows:

1500- (375*3)=375 rubles

Income tax

The transport tax paid is taken into account in other expenses associated with production and sales.

From January 1, 2021, due to the fact that the payment to Plato does not reduce the transport tax, this payment is included in income tax expenses in full. From Article 270 “Expenses not taken into account for tax purposes”, the Tax Code of the Russian Federation invalidated clause 48.21, which did not allow reducing income tax in the amount by which, in accordance with paragraph 2 of Article 362 of the Tax Code of the Russian Federation, the amount of transport tax calculated for the tax was reduced (reporting) period for heavy goods vehicles.

Similar changes regarding the accounting of transport tax amounts from heavy trucks in expenses were made under the taxation systems of the Unified Agricultural Tax and the simplified tax system (clause 45, clause 2, article 346.5, clause 37, clause 1, article 346.16 of the Tax Code of the Russian Federation).