How to calculate transport tax

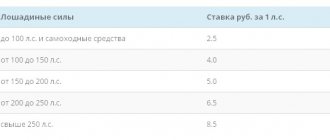

Transport tax is calculated separately for each vehicle.

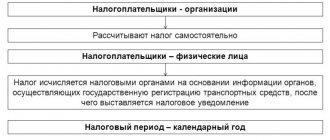

Firms independently determine the amount of transport tax. Entrepreneurs do not need to calculate the tax: the inspectorate will send them a request to pay transport tax. The amount of transport tax that needs to be paid to the budget is determined by the formula:

If you have owned the vehicle for less than a year (for example, a few months),

then the tax is paid only for these months. To calculate transport tax for several months, you need to determine the coefficient:

The tax amount is calculated as follows: the tax base is multiplied by the tax rate and by the correction factor. In this case, the month of registration of the vehicle, as well as the month of deregistration of the vehicle are taken as full months.

Starting from the payment of the tax for 2021, for the new owner of a car, the month of its registration will be considered complete if it was completed before the 15th day inclusive (clause 3 of Article 362 of the Tax Code of the Russian Federation as amended by Federal Law of December 29, 2015 No. 396- Federal Law).

For example, if a car is deregistered by the previous owner and registered by the new owner on the 15th, the tax for the entire month will be paid by the new owner. But if re-registration occurs on the 16th, then the previous owner will have to pay tax.

Before January 1, 2021, if one owner deregistered a car, and the next owner registered it in the same month, then both had to pay transport tax (letter of the Ministry of Finance of Russia dated August 25, 2015 No. 03-05-06- 04/48944).

According to the Russian Ministry of Finance, a similar procedure, which is in force when registering a car from January 1, 2021, can be applied in the event of theft of a vehicle. Therefore, if the owner of the car submits a certificate of theft to the Federal Tax Service before the 15th day of the month inclusive, then he will not have to pay tax for that month. If the certificate is submitted after the 15th, then you will need to pay transport tax for the entire month (letter dated March 17, 2021 No. 03-05-05-04/14738).

At the end of each reporting period (I, II and III quarters), firms pay advance payments for transport tax. They are calculated as follows: the total amount of transport tax (the product of the tax base and the tax rate, taking into account the correction factor) is divided by 4.

And at the end of the tax period (year), the difference between the annual tax amount and the amount of advance payments transferred during the year is transferred to the budget.

Regional authorities may exempt certain categories of firms from paying advance payments for transport tax. In this case, Osvobozhdeniye residents will have to remit tax only at the end of the year.

note

If the vehicle is stolen (stolen), then there is no need to charge tax on it. But to do this, the car owner must submit a theft certificate to the tax office. The Federal Tax Service of Russia recalled this in a letter dated September 30, 2015 No. BS-3-11/ [email protected]

Such a certificate is issued by the Ministry of Internal Affairs (GUVD, OVD, Department of Internal Affairs) of Russia, which investigate and solve crimes, including vehicle thefts.

Consequently, if you submit the original theft certificate to the tax office, the wanted car will not be subject to transport tax. After all, there is no object of taxation. After submitting the certificate, you will have to pay tax only for those months during which you owned the car.

But if not the original, but a copy of the theft certificate is submitted to the Federal Tax Service, the tax authorities will send a request to the department of the Ministry of Internal Affairs that issued the copy to confirm the fact of the theft of the vehicle. And only after confirmation of the theft (theft) of the car will its owner be exempt from paying transport tax.

Please note: a stolen car is not subject to transport tax only during the period of its search.

What is the state trying to achieve?

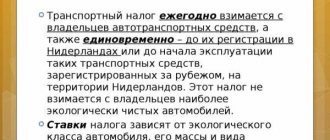

The authorities' concern for reducing harmful emissions into the atmosphere is not limited to increasing the transport tax for older cars. New ones, although on a smaller scale, also pollute the environment. The ideal solution to the problem is to transfer citizens to environmentally friendly transport.

When personal gain is not involved, a person will not lift a finger. No one cares about the cleanliness of the atmosphere as long as one can breathe tolerably. The most reliable stimulus that can make you involuntarily think about the environment is a material promise. Therefore, the transport tax for buyers of electric vehicles has been abolished in Russia.

Transport tax for heavy goods vehicles

From January 1, 2021, organizations can reduce the amount of transport tax in relation to trucks weighing more than 12 tons by the so-called “Platonovsky” fee (Federal Law of July 3, 2016 No. 249-FZ).

The “Platon” system or “Platonovsky” fee is an automated system for collecting additional tax for vehicles with a permissible weight over 12 tons. Such “heavy loads” cannot travel on public roads of federal significance without paying a “road” toll into the Platon system.

Owners of heavy-duty trucks have the opportunity to reduce the amount of transport tax calculated for the tax period by the amount of the fee paid into the Platon system in the same tax period.

If the amount of the actually paid “road” toll is less than the calculated amount of transport tax, the taxpayer has the right to reduce the transport tax by the entire amount of the fee. If the amount of the “road” tax is greater than the amount of transport tax, the taxpayer is completely exempt from paying transport tax.

Both organizations and individuals can reduce transport tax.

At the same time, organizations do not pay calculated advance payments for transport tax in relation to “heavy loads”. You can use the Platonov deduction when paying transport tax from January 1, 2021.

Citizens wishing to apply a benefit in the form of a reduction in transport tax on the “Platonov” fee must submit an application and documents to the tax office confirming the right to this benefit (Article 361.1 of the Tax Code of the Russian Federation). Individuals can reduce the transport tax by the “Platonov” fee when paying the tax for 2015.

In addition, Law No. 249-FZ supplemented the closed list of simplified taxation expenses contained in paragraph 1 of Article 346 of the Tax Code. From January 1, 2021, payers of a “simplified” tax with the object “income minus expenses” can reduce the base for the simplified tax system by that part of the amount of the “road” tax that exceeds the amount of the transport tax (clause 37, clause 1, article 346.16 of the Tax Code RF). This procedure for calculating transport tax is valid for both organizations and individuals until December 31, 2021 inclusive.

What is a multiplying factor?

Tax legislation requires the use of an increasing coefficient (Kp) if the company owns a high-value passenger car. This value depends on the average price and age of the car.

The list of cars for which the KP must be applied when calculating tax is published on the official website of the Ministry of Industry and Trade. This list is updated every year. The new version can be viewed no later than March 1 .

Calculation of TN taking into account KP is carried out according to the following formula:

TN=NB*NS*Kp – AP

Advance is calculated as follows:

AP = ¼*NB*NS*Kp

Calculation example

Throughout 2021, the company owned a BMW 340i xDrive Gran Turismo passenger car with a power of 326 hp (HP), costing 3,200,000 rubles. The tax rate in the region is 150 rubles. In accordance with the list of the Ministry of Industry and Trade, the increasing coefficient for such a machine is 1.1.

Prepaid expense:

¼*326*150*1,1=13 448 rubles

Final transport tax:

(326*150*1,1) – (3*13 448)=13 446 rubles

Procedure and deadlines for reporting

Only companies are required to submit transport tax returns. Entrepreneurs do not need to do this - they pay tax based on the notifications that the tax office sends them. The notification form was approved by order of the Federal Tax Service of Russia dated December 25, 2014 No. ММВ-7-11/ [email protected]

The transport tax declaration form was approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/ [email protected] The deadline for submitting the declaration is no later than February 1 of the year following the expired tax period.

Organizations do not have to submit interim reports on transport tax - quarterly calculations on advance payments - to the tax office.

However, firms remain obligated to make advance payments throughout the year (if provided for by regional laws).

Payment of transport tax by separate divisions

The procedure for paying transport tax and submitting reports if a “simplified” company has separate divisions has its own characteristics.

If a vehicle owned by an organization is registered at the location of a separate division, then the tax should be paid at the location of this division. The tax return is also submitted here.

If vehicles are registered at the location of a separate subdivision for temporary registration, then payment of transport tax at the place of their temporary registration is not made. In this case, transport tax is payable at the place of permanent state registration of the vehicle.

If deregistration in one subject of the Russian Federation and registration (re-registration) of a vehicle for the same taxpayer in another subject of the Russian Federation are carried out in the same month, the location of the vehicle in that month is recognized as the place of its registration as of the 1st day of that month.

Starting from the month following the month of re-registration of this vehicle to another separate unit, transport tax is paid to the budget at the location of the “separate unit”. Moreover, at the rates that apply in this region. When calculating the tax, it is necessary to take into account the number of months of vehicle registration at each address (letter of the Ministry of Finance of the Russian Federation dated October 21, 2013 No. 03-05-06-04/43844).

Accounting for vehicle ownership coefficient

An organization applies a ownership coefficient (Q) when equipment is not registered for it for the entire reporting year or quarter. If the vehicle is owned for a full year, then the coefficient is 1 and does not affect the final amount of the TN. Therefore it is not taken into account.

The coefficient is calculated using a separate formula:

Kv = number of full months of vehicle ownership/number of months in the reporting period

Who is eligible for tax breaks?

Article 358 of the Tax Code of the Russian Federation contains a list of vehicles for which legal entities are not required to pay tax. But regional authorities have the right to establish additional benefits.

For example, in the capital, companies that transport passengers on public transport do not pay the fee. In St. Petersburg, companies that own floating docks pay 50% less tax.

You can find out if there are benefits in your region by contacting the tax office.

When calculating, the amount of the benefit is deducted from the amount of the transport tax. The resulting amount must be paid to the Federal Tax Service.

Is a tax declaration required?

A transport tax return is no longer required . Federal Tax Service employees independently request information from the State Traffic Safety Inspectorate and Rostechnadzor about which equipment is registered to a legal entity. As a reminder, the inspectorate sends the payer a notice of the tax amount.

If a citizen has calculated the fee himself, and his result differs from the Federal Tax Service, he can defend his position if it is correct. You will need to justify the correctness of your independent calculations with documentation. The tax service allows 10 days from the date of receipt of notification of the amount of transport tax.