Employee remuneration

The employee who manufactured defective products is paid as follows. If the manufactured product is a complete (irreparable) defect, then in this case the employee’s work is not paid. If a partial (correctable) defect is identified due to the fault of the employee, then it is paid at reduced rates depending on the degree of suitability of the manufactured products. Such rules are established by parts 2 and 3 of Article 156 of the Labor Code of the Russian Federation.

Situation: in what documents are losses from marriage recorded?

In documents approved by the head of the organization.

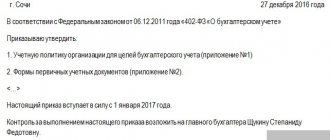

Any fact of economic life, including the release of marriage, must be confirmed by a primary document (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

The forms of primary accounting documents are approved by the head of the organization (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ). For example, if a defect is detected in production, a report can be issued. In this case, the document must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. In addition, the act should indicate the reasons for the defect, the quantity of defective products, the culprit of the defect, the costs of eliminating the defect and (or) the cost of the defective product, the amounts to be recovered from the culprits of the defect.

Make deductions from your salary to reimburse expenses related to the release of marriage in the same way as deductions related to compensation for material damage.

Accounting

Accounting for defects caused by an employee depends on whether the defect is partial (correctable) or complete (irreparable).

If there is a partial defect, reflect all costs for its correction in the following entries:

Debit 28 Credit 10 (70, 69, 25, 68…)

– expenses for correcting defects committed by the employee are reflected.

If there is a complete defect, reflect its amount by posting:

Debit 28 Credit 20, 21, 43

– the cost of work in progress, semi-finished products, finished products recognized as defective is written off.

The amount that is withheld from the employee for releasing a defect is reflected as follows:

Debit 73 Credit 28

– reflects the amount that will be withheld from the employee to reimburse the costs of releasing the defect.

Such wiring can be done in one of the following cases:

- the amount of the defect does not exceed the employee’s average monthly earnings (if it exceeds, make the entry for the amount of the average monthly earnings);

- the employee admitted guilt for the marriage and its amount;

- The court made a decision to withhold the amount of the marriage from the employee.

If these conditions are not met, write off the reject amount as follows:

Debit 20 Credit 28

– losses from defects are included in the costs of main production.

This procedure follows from the Instructions for the chart of accounts.

Which entry reflects non-reimbursable losses from defects?

1. For insurance work experience of up to five years, temporary disability benefits are paid in the amount? (Temporary disability benefits (up to 5 years of experience) are paid in the amount of 60 percent of average earnings)

2. What kind of posting is used to document the accrual of temporary disability benefits? (D 69.1 K 70)

3. What kind of posting is used to document retention for defects? (deductions for marriage from wages are documented by posting D. 70 K. 28)

4. How are deposited salary amounts recorded? (Debit 70 Credit 76 subaccount “Settlements on deposited amounts”)

5. In what document are synthetic wage records kept? (I’m not sure here, but 80% I think the answer is Journal Order No. 10, and 20% I think it’s a time sheet)

6. Is personal income tax withheld from temporary disability benefits? (Not withheld. Thus, payments for certificates of incapacity for work (payment for the first five days of temporary disability at the expense of the employer and temporary disability benefits) for the purposes of personal income tax are equated to wages and are taxed taking into account the norms of paragraph 164.6 of Art. 164 NKU.)

7. Is income tax withholding reflected by posting? (Debit 70 Credit 68 subaccount “Personal Tax Payments”)

8. The cashier will make up the salaries for the uncollected amounts? (Wages not received on time are deposited and recorded in the deposited salary book)

9. Income tax is withheld from what base? (I didn't find anything else except the tax base)

10. The amount of temporary disability benefits depends on what? (The amount of temporary disability benefits depends on the employee’s insurance length)

11. How to take into account the bank commission for transferring wages to employee card accounts? (For transferring wages to the card accounts of employees, the bank receives a remuneration (commission). The organization either pays these amounts to the bank from its own funds or withholds them from the employee’s wages. D.20 K.

70 — Wages accrued to the organization’s employees, D.70 K.68 — Personal income tax withheld, D.70 K.51 — Wages were transferred from the organization’s current account to employee cards, D.68 K.51 — Transferred to the budget tax amount, D.91.2 K.51 - The amount of the bank commission is written off from the organization’s current account)

1. In accordance with international accounting standards, in the balance sheet finished products are valued by: ? (In the balance sheet, in accordance with the Regulations on accounting and financial reporting, finished products are subject to evaluation at actual or standard (planned) production costs)

2. Accounting entry: d-t 45 K-t 43 means: ? (Finished products were shipped to customers at production (planned) cost)

3. When writing off the actual cost of products sold, an entry is made in the accounting accounts: ? (Dt 90 Kt 45)

The most common are quarterly and annual reporting periods)

3. The first reporting year of the financial statements is recognized as the period:? (The first reporting year for newly created enterprises and institutions is considered to be the period from the moment of acquisition of the rights of a legal entity to December 31 inclusive. Newly created enterprises (but not on the basis of liquidated (reorganized) enterprises and their structural divisions) after October 1 are allowed to consider the period from the moment of acquisition of the rights of a legal entity until December 31 of the following year inclusive.)

4. The first reporting year of the financial statements of an economic entity whose state registration was made after September 30 is recognized as the period:? (Created enterprises (but not on the basis of liquidated (reorganized) enterprises and their structural divisions) after October 1 are allowed to consider the period from the moment of acquisition of the rights of a legal entity to December 31 of the following year inclusive as the first reporting year.)

5. Types of financial statements:? (Accounting statements are divided into types according to the following main characteristics: A) According to their purpose, they distinguish between external and internal reporting. B) Based on frequency, a distinction is made between annual and interim reporting. C) Based on the degree of generalization of reporting data, individual, consolidated and consolidated reporting are distinguished.)

6. Accounting statements are signed by: ? (The accounting statements are signed by the head and chief accountant (accountant) of the organization. The accounting statements of organizations in which accounting is maintained by a centralized accounting department, a specialized organization or a specialist accountant are signed by the head of the organization, a centralized accounting department or a specialized organization or a specialist accountant conducting accounting.

Depending on the nature of the defects identified during technical acceptance, the defect is divided into correctable and irreparable (final). Correctable defects are considered to be products, semi-finished products (parts, assemblies) and work that, after correction, can be used for their intended purpose and the correction of which is technically possible and economically feasible.

Based on the location of detection, defects are divided into internal, identified at the enterprise before sending products to consumers, and external, identified at the consumer during the assembly, installation or operation of the product.

The cost of internal correctable defects includes the costs of raw materials, materials and semi-finished products spent when correcting defective products, wages of production workers accrued for operations to correct defects, as well as the corresponding share of the costs of maintaining and operating equipment and shop expenses.

The cost of external defects consists of the production cost of products (products) that are finally rejected by consumers, reimbursement to the buyer of the costs incurred in connection with the purchase of these products, the costs of dismantling the rejected products, as well as transportation costs caused by the replacement of rejected products, or from the costs of correction such products from the consumer, if the defect is correctable.

To determine losses from internal and external defects attributable to the cost of production, the costs of correcting the defects are added to the cost of internal and external final defects and the cost of rejected products is subtracted at the price of their possible use, the amounts actually withheld from those responsible for the defects, and the amount of compensation for losses, awarded by an arbitration court or actually collected from suppliers for the supply of substandard materials or semi-finished products.

Any detected defect must be documented.

Both internal and external marriages are formalized by deed. Currently, there is no unified form of marriage certificate, so the organization must develop it independently, and the manager must approve it by order.

name of the rejected product;

nomenclature, technical number of the product;

what marriage is and its reasons;

quantity of rejected products;

fixable marriage or not;

who allowed the marriage;

cost of defects by direct cost items.

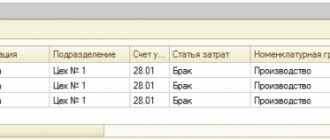

All operations related to the accounting and write-off of defects are subject to reflection on synthetic account 28 “Defects in production”. Analytical accounting on this account is carried out by individual structural divisions, types of products (works), expense items, reasons and culprits of the defect. The debit of account 28 reflects the costs of identified internal and external defects.

The amounts collected on account 28 are written off to the production cost accounts as losses from defects, with the exception of amounts attributable to reducing losses from defects: the cost of rejected products at the price of possible use, amounts to be withheld from those responsible for the defects, from suppliers for the supply of substandard materials and semi-finished products, the use of which resulted in defects, etc.

If those responsible for the marriage are identified, then in accordance with Article 238 of the Labor Code of the Russian Federation they are obliged to compensate the employer for actual damage. But the total amount of compensation from one employee cannot exceed his average monthly earnings. You can withhold no more than 20% of your earnings each month.

For tax purposes, losses from defects on the basis of paragraph 47, paragraph 1, Article 264 of the Tax Code of the Russian Federation are classified as other expenses associated with production and (or) sales.

Example 1. Accounting for losses from defects in the absence of perpetrators

There was a defect in the assembly of the watch. The cost of rejected watches is 8,000 rubles.

Debit 28, Credit 20 - 8000 rub. — the cost of the marriage is written off;

Debit 20, Credit 28 - 8000 rub. — the cost of defects is included in production costs.

Example 2. Accounting for losses from defects caused by an employee

Vympel LLC produces parts for machine tools. Due to non-compliance with technology, a defect was allowed. The marriage has been declared repairable. The culprit has been identified. The marriage was partially corrected by him. Non-compensable damage amounted to 6,000 rubles. Damage in the amount of average earnings was presented to the employee for compensation. The average monthly salary of an employee is 4,000 rubles. The cost of materials at the price of their possible use is 12,000 rubles.

The cost of the rejected products was 15,000 rubles, the cost of materials used to correct the defects was 3,000 rubles.

Debit 28, Credit 20 - 15,000 rub. — the cost of the marriage is written off;

Debit 28, Credit 10 - 3000 rub. — materials for correcting defects were written off;

Debit 10, Credit 28 - 12,000 rubles. — materials are capitalized at the price of their possible use;

Debit 73, Credit 28 - 4000 rub. — the employee’s debt for damages is reflected;

Debit 70, Credit 28 - 800 rub.

- part of the losses from marriage is compensated from the worker’s wages (4000 x 20%);

Attention

Tax Code of the Russian Federation). UTII The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the amount of compensation an employee receives for losses from marriage does not affect the calculation of the single tax. OSNO and UTII If an organization combines a general taxation system and UTII, it is obliged to keep separate records of income, expenses and business transactions (clause

Attention

Accounting for external defects It may become apparent much later than the month in which the product was produced. This point causes some difficulties in accounting for losses from defects.

- confirmed costs for correcting defects from the consumer;

- costs of transporting defective products;

- reimbursement of other buyer expenses associated with defective products.

This rule also applies when alimony is withheld, but with two exceptions that allow more than 50% to be withheld from an employee: - if the employee is deducted simultaneously under a notarized agreement on the payment of alimony and other executive documents (Article 110 of the RF IC); If an employee must pay under two or more writs of execution at the same time, one must be guided by subparagraph 1 of paragraph 1 of Article 111 of Law No. 229-FZ. When an enterprise receives a writ of execution and an order, it is obliged to return to the state executor a completed notification of its receipt (the stub of the order). What requirements may be contained in the writ of execution? A demand for compensation for harm caused to health or in connection with the death of a breadwinner, compensation for damage caused by a crime, for the collection of a fine imposed as punishment for committing a crime or offense. But most often, an accountant is faced with a letter for the collection of alimony. The payment of alimony has some features in comparison with the fulfillment of other payment obligations. Please note: from January 1, 2012, the procedure for issuing accountable amounts has been changed. Now, in order to receive accountable money, each time an employee must write a statement on which the head of the company must put a resolution on the amount, the period of issue and his signature and date. The amount of alimony will be: 1,712,600 × 25% = 428,150 rubles. Next, we compare the amount of alimony with 50% of the average subsistence level budget per capita. In May 2013, the amount of BPM amounted to RUB 974,110. and 50% – 487,055 rubles. Taking into account the fact that the amount of alimony withheld is less than 50% of the BPM, it is necessary to withhold and transfer the amount of 487,055 rubles to the alimony recipient. The types of earnings from which alimony is withheld for minor children are determined by the List of types of earnings and (or) other income from which alimony is deducted for the maintenance of minor children, approved by Resolution of the Council of Ministers of the Republic of Belarus dated August 12, 2002 No. 1092. Collection of alimony for Maintenance of minor children is made from all types of earnings (both from the main place of work and from part-time work and other income due to the person paying alimony) after deducting income tax from this earnings and other income in accordance with tax legislation. An employee of the organization, from whose income, according to the writ of execution, alimony for the maintenance of a minor child in the amount of 25% is withheld, was accrued wages for May 2013.

Income tax

When calculating income tax, losses from marriage are taken into account in full as part of other expenses (subclause 47, clause 1, article 264 of the Tax Code of the Russian Federation). It does not matter at whose expense the defect is written off: at the expense of the employee or at the expense of the organization.

The amount of damage that the employee must pay must be reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation).

Under the cash method, the amount of non-operating income will be equal to the amount of deductions from the employee’s salary in each reporting period (clause 2 of Article 273 of the Tax Code of the Russian Federation).

When using the accrual method, determine income as the amount of compensation for damage as of the date the guilty party was found guilty (for example, on the date of signing an order to withhold damage from an employee’s salary). If the organization seeks compensation for damages through the court, the date of recognition of income is the day the court decision enters into force.

This is stated in subparagraph 4 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation.

The court decision comes into force within 10 days from the date of its adoption by the court, provided that it has not been appealed (Articles 209, 321, 338 of the Civil Procedure Code of the Russian Federation). In this case, income is recognized in the amount specified in the court decision.

An example of deducting the cost of a repairable defect from an employee’s salary. The organization applies a general taxation system

LLC "Proizvodstvennaya" applies a general taxation system. The contribution rate for insurance against accidents and occupational diseases is 0.9 percent. The organization pays contributions to compulsory pension (social, medical) insurance at general rates. The organization produces office furniture. In March, a correctable defect occurred in the production of products. The reason for the defect was failure to comply with the technology by worker A.I. Ivanov. The employee does not have rights to deductions for personal income tax.

The organization's expenses for correcting the defect amounted to 24,188 rubles, including:

- cost of materials used – 8480 rubles;

- the salary of employees correcting marriages is 12,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance – 3600 rubles;

- the amount of contributions for insurance against accidents and occupational diseases is 108 rubles.

Ivanov’s average monthly salary is 27,000 rubles.

Ivanov's partial marriage was paid at reduced rates. In March, when the employee committed marriage, his salary was accrued in the amount of 22,000 rubles, personal income tax on this amount is 2,860 rubles. (RUB 22,000 × 13%).

Since the amount of the marriage is less than the average salary of an employee, Ivanov fully compensates for the damage caused to the organization. The maximum amount that can be withheld from an employee in March is: (RUB 22,000 – RUB 2,860) × 20% = RUB 3,828.

The accountant made the following entries in accounting.

In March:

Debit 28 Credit 10 – 8480 rub. – the cost of materials used to correct the defect has been written off;

Debit 28 Credit 70 – 12,000 rub. – salaries were accrued to employees correcting marriages;

Debit 28 Credit 69 “Settlements with the Pension Fund” – 2640 rubles. (RUB 12,000 × 22%) – pension contributions have been accrued;

Debit 28 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 348 rubles. (RUB 12,000 × 2.9%) – contributions to the Russian Social Insurance Fund have been accrued;

Debit 28 Credit 69 “Settlements with FFOMS” – 612 rubles. (RUB 12,000 × 5.1%) – contributions to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 28 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 108 rubles. (RUB 12,000 × 0.9%) – premiums for insurance against accidents and occupational diseases have been calculated;

Debit 73 Credit 28 – 24,188 rub. – the costs of correcting the defect are attributed to the guilty employee;

Debit 20 Credit 70 – 22,000 rub. – Ivanov’s salary for March was accrued;

Debit 20 Credit 69 “Settlements with the Pension Fund” – 4840 rubles. (RUB 22,000 × 22%) – pension contributions are calculated from Ivanov’s salary;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 638 rubles. (RUB 22,000 × 2.9%) – contributions to the Russian Social Insurance Fund were accrued from Ivanov’s salary;

Debit 20 Credit 69 “Settlements with FFOMS” – 1122 rubles. (RUB 22,000 × 5.1%) – contributions to the FFOMS are accrued from Ivanov’s salary;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 198 rubles. (RUB 22,000 × 0.9%) – contributions for insurance against accidents and occupational diseases were calculated from Ivanov’s salary;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 2860 rubles. (RUB 22,000 × 13%) – personal income tax was withheld from Ivanov’s salary.

Debit 70 Credit 73 – 3828 rub. – losses from marriage were withheld from Ivanov’s salary.

In April:

Debit 70 Credit 50 – 15,312 rub. (22,000 rubles – 2860 rubles – 3828 rubles) – Ivanov’s salary was issued.

When calculating income tax, the accountant included in expenses the cost of the correctable defect - 24,188 rubles, and reflected the amount of compensation in income - 24,188 rubles.

An example of deducting the cost of an irreparable defect from an employee’s salary. The organization applies a general taxation system

LLC "Proizvodstvennaya" applies a general taxation system. The contribution rate for insurance against accidents and occupational diseases is 0.9 percent. The organization pays contributions to compulsory pension (social, medical) insurance at general rates. Due to non-compliance with technology in April, worker A.I. Ivanov allowed the product to be defective. Marriage cannot be fixed. The commission estimated losses from defects (cost of materials, employee’s salary, salary accruals, etc.) at 20,000 rubles.

The average salary of an employee is 15,000 rubles. Ivanov has no rights to deductions for personal income tax.

Complete marriage is not paid for. Therefore, in April, when the employee committed a marriage, his salary was accrued in a smaller amount - 10,000 rubles.

In this case, the amount of material damage (RUB 20,000) is greater than the average employee salary (RUB 15,000). Therefore, by order of the manager, the cost of losses within 15,000 rubles is withheld from the employee’s earnings.

The accountant made the following entries in accounting.

In April:

Debit 28 Credit 20 – 20,000 rub. – the actual cost of the defect is written off;

Debit 73 Credit 28 – 15,000 rub. – losses from defects have been reduced by the amount of the employee’s average monthly earnings;

Debit 20 Credit 28 – 5000 rub. (20,000 rubles – 15,000 rubles) – losses from defects are written off against the cost of similar products manufactured in the reporting period;

Debit 20 Credit 70 – 10,000 rub. – the employee’s wages are accrued;

Debit 20 Credit 69 “Settlements with the Pension Fund” – 2200 rubles. (RUB 10,000 × 22%) – pension contributions accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 290 rubles. (RUB 10,000 × 2.9%) – contributions to the Russian Social Insurance Fund have been accrued;

Debit 20 Credit 69 “Settlements with FFOMS” – 510 rubles. (RUB 10,000 × 5.1%) – contributions to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 90 rubles. (RUB 10,000 × 0.9%) – premiums for insurance against accidents and occupational diseases have been calculated;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1300 rubles. (RUB 10,000 × 13%) – personal income tax withheld.

In April, when an employee committed a marriage, the organization can recover only 1,740 rubles at a time. ((RUB 10,000 – RUB 1,300) × 20%).

Debit 70 Credit 73 – 1740 rub. – losses from marriage are withheld from the employee’s salary.

In May:

Debit 70 Credit 50 – 6960 rub. (RUB 10,000 – RUB 1,300 – RUB 1,740) – the employee’s salary was issued.

The organization calculates income tax on a monthly basis (accrual method). In April, the accountant included in expenses the cost of an irreparable defect - 20,000 rubles, and reflected the amount of compensation in income - 15,000 rubles.

Losses from marriage: accounting and use

Personal income tax is withheld from each employee’s salary at the following rates:

- 13% - if the employee is a resident of the Russian Federation;

- 30% - if a non-resident of the Russian Federation;

- 35% - in case of winning, savings on interest, etc.;

- 15% - from dividends of a non-resident of the Russian Federation;

- 9% - from dividends until 2015; interest on mortgage-backed bonds until 2007, from the income of the founders of the trust management of the mortgage coverage.

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 30 000,00 | Salary accrued |

| 70 | 68 | 3 900,00 | Personal income tax withheld |

The amount under the writ of execution is withheld from wages, taking into account personal income tax. The amount of additional expenses under the writ of execution (for example, transfer fees) is debited from the employee.

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 20 000,00 | Salary accrued |

| 70 | 68 | 2 600,00 | Personal income tax withheld |

| 70 | 76.41 | 4 350,00 | The amount under the writ of execution was withheld |

| 76.41 | 50 | 4 350,00 | The amount according to the writ of execution was transferred from the cash register |

Deductions for the purpose of debt repayment are regulated by the Labor Code and other federal laws. In this case, it is necessary to issue an order no later than a month from the date of payment and obtain written permission from the employee.

If upon dismissal the amount of deductions is not completely written off, then, by agreement with the employee, the amount can be repaid:

- Judicially;

- By depositing funds into the cash register;

- Gift to an employee (in this case, expenses are not taken into account when calculating income tax);

- At the request of the employee, write off 20% of the salary monthly.

| Dt | CT | Operation description |

| 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 73.2 | The amount of compensation for the shortage is withheld |

| 70 | 71 | Unreturned accountable amount withheld |

| 70 | 73.1 | Repayment of the issued loan |

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 73.1 | 1 500,00 | Deduction for loan repayment |

At the request of the employee, the manager can deduct the necessary amounts from wages, but the manager can also refuse such deductions. At the same time, the amount of deductions at the request of the employee is not limited.

| Dt | CT | Operation description |

| 70 | 76 | Amount withheld at the request of the employee |

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 76 | 174,00 | Union dues withheld |

Requests for alimony are granted first priority. Withholding of alimony under writs of execution is carried out by debiting the accounts on which the employee’s income is accrued, and by crediting account 76 “Settlements with various debtors and creditors”, to which the “Alimony” sub-account is opened. After all, not all of the employee’s income from which alimony is collected is reflected in account 70 “Settlements with personnel for wages.”

The minimum amount of alimony for one child cannot be less than 30 percent of the subsistence level for a child of the corresponding age (Part 2 of Article 182 of the Family Code). Article 62 of the Law of Ukraine dated December 19, 2006 No. 489-V “On the State Budget of Ukraine for 2007” established from October 1, 2007 the cost of living for a child under 6 years of age in the amount of 470.00 UAH, for a child aged 6 — 18 years old — in the amount of 604.00 UAH.

The document is certified by members of a commission formed from among the company’s employees by order of the manager. Amounts in the debit of account 28 “Defects in production” are formed in different ways. It all depends on whether the marriage is recognized as final or reparable. Internal marriage is incorrigible. Let's assume that it is impossible or economically infeasible to correct low-quality products. When calculating losses, the accountant adds up the cost of raw materials, the costs of maintaining and operating equipment, part of the overhead costs, wages, and unified social tax.

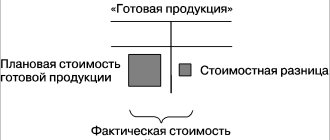

To account for defects in production, the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, provides account 28. Its debit reflects all costs associated with defective products, their list is given in the previous part of the article. The loan records the amounts that reduce the cost of the marriage (see.

Let us note the moment of documenting the marriage. When withdrawing defective products, it is necessary to draw up a report or notice of the defect. The company develops the form of the document independently; it indicates all the necessary details for the primary documents, as well as the name of the defective product, its number or code, the reasons for the defect, and those responsible for the defect.

For information on the rules for filling out a demand invoice drawn up when releasing materials, read the article “Procedure for filling out form M-11 demand invoice”.

Let's look at examples of typical transactions that will appear in accounting if an enterprise encounters defects in production. The first example is compiled for an internal correctable marriage.

Example 1

When sewing workwear, defective semi-finished products of our own production were discovered - product parts glued with dublerin. The reason for the marriage was poor-quality dublerin. The costs for correcting the defect were:

- cost of dublerin - 15,000 rubles;

- salary and social contributions - 73,800 rubles;

- share of ODA - 14,200 rubles.

| Description | Dt | CT | Amount, rub. |

| The cost of dublerin for eliminating defects is reflected | 28 | 10 | 15 000 |

| Salary and social benefits accrued. fees for eliminating defects | 28 | 70, 69 | 73 800 |

| ODA related to eliminating defects written off | 28 | 25 | 14 200 |

| The amount of the claim has been accrued to the supplier | 76.2 | 28 | 88 800 |

| Received refund from dublerin supplier | 51 | 76.2 | 88 800 |

| Losses from defects are included in the cost of the semi-finished product | 20, subaccount “Production of semi-finished products” | 28 | 14 200 |

In the next example, consider the reflection of an internal incorrigible marriage.

Example 2

Due to the inattention of the shift foreman when setting the input data on the equipment, 120 pieces were produced. low-quality metal parts. It is impossible to correct the shortcomings. The costs that were incurred to manufacture these parts were:

- cost of materials - 47,600 rubles;

- salary and social contributions - 39,400 rubles;

- share of ODA - 17,400 rubles.

| Description | Dt | CT | Amount, rub. |

| The cost of defective parts is reflected | 28 | 20 | 104 400 (47 600 39 400 17 400) |

| Defective parts are capitalized at the price of possible sale | 10.6 | 28 | 24 000 |

| An amount has been charged that will be recovered from the culprit - the shift foreman. | 73 | 28 | 47 600 |

| The amount in the first month is withheld from the culprit’s salary (posting is done every month until the debt is fully repaid) | 70 | 73 | 14 800 |

| Losses from defects are included in the cost of production | 20 | 28 | 32 800 |

Analytical accounting on account 28 is carried out in the context of the product range, structural divisions of the enterprise, causes of defects, cost items and culprits.

D28-K20,21,43 – the cost of the defect was written off; – Losses from defects are included in the cost of production

10. What types of expenses are classified as entertainment? Planned and targeted expenses

11. Do I take into account the costs of developing new types of products on the account? (on account08)

12. What type of account is account 25: “General production expenses”? Active, collectively - distributive

13. Are production overheads reflected in the balance sheet? (No)

14. Representation expenses are taken into account on account? D20,26,44 in correspondence with Section IV of accounts (60,71 and others)

15. The incremental method of accounting for production costs and costing is used in which enterprises? In enterprises with complex use of raw materials, as well as in industrial sectors with mass and large-scale production, where raw materials go through several stages of processing in succession

16. Are analytical accounting of overhead costs carried out? (By division in the statement “Costs by division”)

17. Are the costs of maintaining and operating equipment of internal divisions of the enterprise taken into account as part of general production expenses? Costs of servicing internal divisions and managing them

Important

This confirms the manufacture of a low-quality product - correctable or irreparable. In some cases, defects occur when receiving low-quality raw materials from suppliers. A report on defects detected during the acceptance of goods will help to file a claim against the counterparty.

Important

Search for Lectures ⇐ Previous12 D28-K20,21,43 – the cost of the defect was written off D10,21,41-K28 – the defect was capitalized at the price of possible capitalization D73-K28 – amounts to be recovered from the culprits were accrued D76-K28 – Amounts to be recovered from suppliers of defective materials were accrued D20 ,23-K28 – Losses from defects are included in the cost of production 10. What types of expenses are classified as representative expenses? Planned and targeted expenses 11.

Info

How to take into account the bank commission for transferring wages to employee card accounts? (For transferring wages to the card accounts of employees, the bank receives a remuneration (commission). The organization either pays these amounts to the bank from its own funds or withholds them from the employee’s wages.

D.20 K.70 - Wages have been accrued to the organization's employees, D.70 K.68 - Personal income tax has been withheld, D.70 K.51 - Salaries have been transferred from the organization's current account to employee cards, D.68 K. 51 - The amount of tax was transferred to the budget, D.91.2 K.51 - The amount of the bank commission was written off from the organization’s current account) QUESTIONS TO PREPARE FOR THE TEST on topic 6: 1.

simplified tax system

Regardless of what object of taxation the organization uses when calculating the single tax under simplification, the cost of defects paid by the employee increases the tax base (Clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Take into account the amount of non-operating income at the time of deduction from wages, when depositing money into the cash register, etc. (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization calculates a single tax on the difference between income and expenses, then take into account losses from the production of defective products in this order.

If there was an irreparable defect, then do not include the amounts of expenses associated with the production of defective products in the tax base. These costs are not in the list of expenses that can be taken into account when calculating the single tax (Clause 1, Article 346.16 of the Tax Code of the Russian Federation).

If there was a correctable defect, then the amount of expenses associated with its correction is included in the tax base for the corresponding cost items. For example, write off the cost of additional material resources spent on correcting a defect as material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). And the salary of an employee involved in eliminating the defect (if the defect is corrected by another employee) is in the amount of labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation).

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the amount of compensation an employee receives for losses from marriage does not affect the calculation of the single tax.

The concept of marriage and taking into account its characteristics

A defect in the manufacture of a certain type of product (turning parts, spare parts, etc.) is called non-compliance with quality requirements. This may be the appearance, characteristics of the product, including its functionality. That is, any defects that are such due to deviations from the standard adopted by the enterprise.

Most often, marriage occurs:

- through the fault of the employee responsible for the production of products;

- for a reason objectively beyond the employee’s control. For example, poor quality material or equipment malfunction.

Payment for labor in the manufacture of defective products can be full or partial, as well as the degree of defect. In some cases, the defect can be corrected and is not a serious violation of the requirements of the standard. However, the employee is obliged to notify the employer about the fact of a defect, documenting it. This will help avoid difficulties when referring to labor legislation to establish the degree of guilt of the employee or its absence.

OSNO and UTII

If an organization combines the general taxation system and UTII, it is obliged to keep separate records of income, expenses and business transactions (clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

When calculating income tax, include in non-operating income the amount of compensation for damage by an employee who is engaged in activities on the general taxation system.

If the defective products were produced by an employee who is engaged in both types of activities, then when compensating the employee for damages, include the entire amount of non-operating income in the calculation of the tax base for income tax. This is stated in letters of the Ministry of Finance of Russia dated March 15, 2005 No. 03-03-01-04/1/116 and the Federal Tax Service of Russia for Moscow dated November 6, 2007 No. 20-12/105713. This position is based on the fact that the current tax legislation does not contain a mechanism for distributing non-operating income between different types of activities.