Conditions for tax refund

Receiving 13% of the amount deposited into an IIS is subject to a number of requirements and restrictions. Only persons who are personal income tax payers are entitled to this benefit.

Otherwise, the investor is not entitled to any deductions, and the only option left is to open an account for another person who pays income taxes.

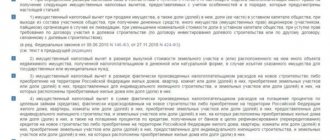

Important: The procedure for processing and paying tax deductions is regulated by Article 219.1, paragraph 1, paragraph. 2 of the Tax Code of the Russian Federation.

The state has introduced restrictions on amounts and terms:

- The maximum IIS deposit amount, which is the basis for calculating the return, is 400,000 rubles. As a result, the tax office returns no more than 52,000 rubles. per calendar year.

- The amount payable cannot exceed the amount of income tax actually withheld at the place of employment.

- This year you can get 13% only for the past year or for the past three years. If money was deposited into an IIS in 2021, you can apply for a 13% return in 2021–2022.

- The IIS must be closed no earlier than three years from the opening date.

- Payment of the deduction does not require waiting for the expiration of the three-year period. But if the IIS was closed before the deadline, the 13% received will have to be returned to the state budget. And also pay a penalty - 1/300 of the rate of the Central Bank of the Russian Federation, for each day of unlawful possession of returned tax funds.

You can replenish the IIS deposit at any time: at the beginning, middle or end of the calendar year. The moment of depositing money does not matter; a deduction is due from the entire amount, up to 400,000 rubles.

This means that you can deposit money two weeks before the account is closed and receive a benefit. Such a scheme is not a violation of the conditions, and it is not necessary to participate in trading on the stock exchange.

In this case, replenishment implies the transfer of money in rubles. Currency or other securities are not accepted.

Important: IIS is opened for a period of three years, accordingly, the investor can receive the benefit three times. The total amount that can be returned for the entire period will be 156,000 rubles: 52,000 rubles each. for every year.

Features of using IIS to apply for benefits

Let's take a closer look at several nuances related to using IIS and obtaining a tax deduction:

- A previously opened brokerage account cannot be transferred to an IIS. However, in parallel with the investment one, you can have any number of brokerage ones.

- You cannot withdraw money from an individual IP, even partially. Upon transfer, the account is immediately closed and if 3 years have not passed from the date of opening, the right to the benefit is lost irrevocably.

- Registration of a tax deduction under type “A” does not cancel the obligation to pay tax on profits under an individual investment account. It is calculated at the time of closing. That is, the user does not pay tax for all three years, but can use this money for investment purposes.

- A period of three years is the minimum period for using the account. After this time, it is not necessary to close it and take the money.

- It is permissible to close one IIS, and then open another and receive a deduction for it. There are no legal restrictions here. However, the period during which the first contract must be terminated cannot exceed one calendar month.

- To receive personal income tax there are no restrictions on the number or amount of transactions. The account can be used regularly or once in all three years.

- When dividends and interest income are credited to an IIS account by a broker, this is not considered a deposit, whereas from a bank account an investor is. An individual also has the right to receive a deduction from this money.

If all conditions are met, there will be no problems with refunds. It is recommended to select an account type not immediately, but closer to closing.

This will allow you to make calculations and understand which of the two options is more profitable.

Step-by-step video instructions for receiving an IIS deduction

The step-by-step process for processing compensation payments looks like this:

- Open an IIS with any broker.

- To put money into the account.

- For the next calendar year, submit the required package of documents to the Federal Tax Service at your place of residence.

- The tax office reviews the application and documents within three months.

- Within a month, the money is transferred to a bank account.

When an investor issues a tax refund under IIS “A” type, he submits documents to the Federal Tax Service independently.

Type “B” deductions are made through a broker - he is provided with certificates confirming that the benefit has not yet been used.

After which the tax agent, whose role is the broker, does not withhold income tax.

Required documents

The list of documents submitted to the Federal Tax Service to obtain a tax deduction under IIS includes:

- Application for deduction under IIS. It is necessary to indicate the bank details to which you want to transfer money. You can fill out a sample

- 3-NDFL. The IIS deduction is reflected in the declaration; it can be drawn up for a fee, from specialists, or through the “Legal Taxpayer” program - it is available on the tax office website and is available for use free of charge. A blank form for 2021 is possible, but it is important to remember that the Federal Tax Service periodically updates document forms.

- Documentary proof of payment of income tax indicating the amount. This may be a standard 2-NDFL certificate issued at the place of work.

- One of the documents confirming the right to personal income tax compensation: agreement to open an individual investment account; agreement on brokerage services or on trust management, drawn up in the form of a single document (which was signed by both parties); notification/application/notification of accession to a brokerage service or trust management agreement.

- Confirmation of crediting money to the IIS deposit: bank payment order; PKO on depositing funds in cash (issued at the cash desk when replenishing the deposit); if funds are transferred from another account, a transfer order is provided.

Important: It is necessary to submit to the Federal Tax Service not originals, but copies of papers and certificates. Therefore, they should be certified in advance by a notary.

The package of documents for obtaining a tax deduction under the IIS is submitted to the tax specialist in person; you must have a civil passport with you.

It can also be sent by registered or valuable mail with an inventory. First, inspection staff review the papers, then the funds are transferred to the specified details.

Official step-by-step instructions for receiving a deduction can be found on the tax service website at this link.

IIS

Brokerage services are provided by PJSC Sberbank (Bank), general license of the Bank of Russia for banking operations No. 1481 dated August 11, 2015, license for the provision of brokerage services No. 045-02894-100000 dated November 27, 2000.

You can obtain detailed information about the Bank's brokerage services by calling 8-800-555-55-50, on the website www.sberbank.ru/broker or at Bank branches. This website also contains the current conditions for the provision of brokerage and other services. Changes in conditions are made by the Bank unilaterally.

The content of this document is provided for informational purposes only and does not constitute an advertisement of any financial instruments, products, services or an offer, obligation, recommendation, or inducement to engage in transactions on the financial market. Despite receiving information, you independently make all investment decisions and ensure that such decisions comply with your investment profile in general and in particular with your personal ideas about the expected profitability from operations with financial instruments, the period of time for which such profitability is determined, as well as the acceptable You are at risk of losses from such transactions. The Bank does not guarantee income from the operations with financial instruments specified in this section and is not responsible for the results of your investment decisions made on the basis of the information provided by the Bank. No financial instruments, products or services mentioned herein are offered or sold in any jurisdiction where such activity would be contrary to securities laws or other local laws and regulations or would subject the Bank to compliance with registration in such jurisdiction. In particular, we would like to inform you that a number of states (in particular, the United States and the European Union) have introduced a sanctions regime that prohibits residents of the relevant states from acquiring (assisting in the acquisition) of debt instruments issued by the Bank. The Bank invites you to ensure that you are eligible to invest in the financial instruments, products or services mentioned herein. Therefore, the Bank cannot be held liable in any way if you violate any prohibitions applicable to you in any jurisdiction.

Information about financial instruments and transactions with them, which may be contained on this website and in the information posted on it, is prepared and provided impersonally for a certain category or for all clients, potential clients and counterparties of the Bank not on the basis of an investment consulting agreement and not based on the investment profile of site visitors. Thus, such information represents information that is universal for all interested parties, including publicly available information about the ability to carry out transactions with financial instruments. This information may not correspond to the investment profile of a particular site visitor, may not take into account his personal preferences and expectations for the level of risk and/or return and, thus, does not constitute an individual investment recommendation to him personally. The Bank reserves the right to provide website visitors with individual investment recommendations solely on the basis of an investment consulting agreement, solely after determining the investment profile and in accordance with it. The terms of use of information when carrying out activities on the securities market can be found here.

The Bank cannot guarantee that the financial instruments, products and services described therein are suitable for persons who have read such materials. The Bank recommends that you do not rely solely on the information you have been provided with in this material, but rather make your own assessment of the relevant risks and, if necessary, engage independent experts. The Bank is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.

The Bank makes reasonable efforts to obtain information from sources it believes to be reliable. However, the Bank makes no representation that the information or estimates contained in this information material are true, accurate or complete. Any information provided in this document is subject to change at any time without notice. Any information and estimates contained herein do not constitute terms of any transaction, including any potential transaction.

Financial instruments and investment activities involve high risks. This document does not contain a description of such risks, information about the costs that may be required in connection with the conclusion and termination of transactions related to financial instruments, products and services, as well as in connection with the performance of obligations under the relevant agreements. The value of shares, bonds, investment shares and other financial instruments may decrease or increase. Past investment performance does not determine future returns. Before entering into any transaction in a financial instrument, you must ensure that you fully understand all the terms of the financial instrument, the terms of the transaction in such instrument, and the legal, tax, financial and other risks associated with the transaction, including your willingness to bear significant losses.

The bank and/or the state does not guarantee the profitability of investments, investment activities or financial instruments. Before making an investment, you must carefully read the conditions and/or documents that govern the procedure for its implementation. Before purchasing financial instruments, you must carefully read the terms and conditions of their circulation.

The Bank draws the attention of Investors who are individuals to the fact that funds transferred to the Bank as part of brokerage services are not subject to the Federal Law of December 23, 2003. No. 177-FZ “On insurance of deposits of individuals in banks of the Russian Federation.

The Bank hereby informs you of the possible existence of a conflict of interest when offering the financial instruments discussed in the information materials. A conflict of interest arises in the following cases: (i) the Bank is the issuer of one or more financial instruments in question (the recipient of the benefit from the distribution of financial instruments) and a member of the Bank’s group of persons (hereinafter referred to as the group member) simultaneously provides brokerage services and/or (ii) a group member represents the interests of several persons simultaneously when providing them with brokerage or other services and/or (iii) a group member has his own interest in performing transactions with a financial instrument and simultaneously provides brokerage services and/or (iv) a group member acts in the interests of third parties or interests another group member, maintains prices, demand, supply and (or) trading volume in securities and other financial instruments, including acting as a market maker. Moreover, group members may have and will continue to have contractual relationships for the provision of brokerage, custody and other professional services with persons other than investors, and (i) group members may receive information of interest to investors and participants the groups have no obligation to investors to disclose such information or use it in fulfilling their obligations; (ii) the conditions for the provision of services and the amount of remuneration of group members for the provision of such services to third parties may differ from the conditions and amount of remuneration provided for investors. When resolving emerging conflicts of interest, the Bank is guided by the interests of its clients. More detailed information about the measures taken by the Bank regarding conflicts of interest can be found in the Bank’s Conflict of Interest Management Policy, posted on the Bank’s official website: (https://www.sberbank.com/ru/compliance/ukipk)

Reasons for refusal to pay personal income tax

If we analyze the responses on the Internet, sometimes income tax payers encounter difficulties in obtaining a tax deduction for IIS.

Legally, a refusal can occur in several cases:

- Violation of the conditions for receiving benefits.

- Incorrect documentation.

- No reason.

If there are suspicions of fraud - when an account is opened and used exclusively for personal income tax refunds - the tax office may refuse.

This is a rather controversial point, because there are no restrictions on the minimum number of transactions. At the same time, it is better to participate in bidding - this will reduce the attention of authorized employees, and will also allow you to make greater profits.

One more point - an individual should have only one IRA. Technically, you can open two of them and claim a deduction for both. However, this is a direct violation of the law and an obvious financial fraud for the purpose of profit.

Also, a lawful refusal goes to everyone who is not a personal income tax payer. This category includes informally employed persons and individual entrepreneurs. The deduction is provided only for income tax, and not for any tax paid to the budget.

Important: Payment of a tax deduction is due both for independent and trust management of an IIS by a broker.

There are several models of individual investment accounts; this does not affect the size or procedure for processing payments.

When a refund is not beneficial

Persons who are not income tax payers cannot claim personal income tax deduction under IIS. These include individual entrepreneurs on the simplified tax system, UTII and Patent, unofficially employed citizens, and non-working pensioners.

When investing large sums in any assets, the tax on which exceeds the amount of payment. For example, there are no tax charges on profits from OFZs or municipal bonds, and it is profitable to return 13% of the investment. Individuals are required to pay tax to the budget on income from dividends or from the purchase and sale of shares, corporate bonds and other securities. In this case, it is worth calculating which benefit option is more interesting from a financial point of view.