How to keep records of construction materials

The specificity of working with building materials is that their volume and price must be known in advance. Their cost estimate is included in the overall cost estimate at the design stage. The accounting data should include the actual price of building materials. It includes the costs incurred in the purchase and sale transaction and the amounts transferred to counterparties for the delivery of purchased values. The cost may include mandatory customs duties and funds spent on consulting services for the selection of materials. In tax accounting, the valuation of incoming materials is derived based on the total amount of expenses incurred for the purchase of specific resources.

NOTE! The choice of methodology for writing off building materials should be made at the stage of drawing up accounting policies.

One of the write-off methods is documented at the level of an individual enterprise:

- with reference to the cost of each unit of raw materials (relevant when using valuable resources or assets that cannot be replaced by other raw materials);

- by average cost - the total cost for a group of materials subject to write-off is displayed and divided by the number of resource units taken into account in the sample;

- FIFO method (materials are written off for construction projects in compliance with the strict chronological sequence of receipt at warehouses; the earlier the raw materials were received, the sooner they will be transferred to construction).

Losses of building materials within the established standards can be shown in accounting as losses due to natural loss. The reason may be shrinkage, loss in volume due to changes in temperature during storage, leakage when pouring into another container, or accidental damage. Losses corresponding to standard indicators can be written off as expenses of the organization. If losses exceeding the limit occur, then it is necessary to identify the reasons for what happened and identify the perpetrators. Deficiencies in such a situation must be attributed to the culprit and repaid by him.

When organizing the accounting of construction materials, for each resource it is necessary to indicate its exact name and key characteristics. For example, for cement you need to register its brand, for crushed stone - its fraction, for paint - its type and color. For liquid materials, it is necessary to use a special mechanism for release into construction. If opened containers of paint, varnish or other raw materials have not yet been emptied, it is not recommended to open new cans.

BY THE WAY, the consumption rates included in the estimate documentation cannot be adjusted. Excess of planned expenses is compensated by the developer company.

Document flow system for building materials

In the tax accounting system, companies must comply with the requirement for economic and documentary justification of all expenses incurred for construction materials. All materials available to the organization must be assigned to financially responsible persons. Each case of movement of assets between objects within the same enterprise or between counterparties is recorded in the primary documentation.

If construction materials are transferred from one storage location to another warehouse, but the owner of the resources does not change, then the transaction will be recorded using an internal movement invoice. Invoices with limit-fence cards are used when sending materials to construction sites. If the approved standards for the consumption of materials are exceeded, then a demand act and supporting documentation justifying the increased need for resources are drawn up for the excess volume.

To carry out the purchase of materials, the company must complete the following set of documentation:

- purchase and sale agreement;

- invoice issued by the supplier;

- certificates, references, technical documents confirming the quality class of the acquired assets.

If, in the process of receiving building materials from the supplier, the receiving person identifies discrepancies between the actual availability and the primary data or the declared quality level does not correspond to the real one, then a materials acceptance certificate must be drawn up. Such a document may become the basis for starting claim activities.

Every month, storekeepers prepare reporting forms for the remaining construction materials stored in their warehouses. If an enterprise has several warehouse facilities, all reports are collected by the chief warehouseman, and a summary report is generated on their basis. The final document should contain an object-by-object breakdown of the balances and movements of assets.

FOR REFERENCE! In accounting, the write-off of building materials is carried out on the basis of the monthly material reports of the superintendents.

It is impractical to store some types of building materials in warehouses remote from construction sites. For such resources, open storage areas are used on the construction site. This category of materials includes sand and crushed stone. Their peculiarity is that during consumption it is impossible to accurately identify the amount of raw materials consumed and primary documentation is not drawn up for each collection of materials. For this reason, inventory checks of the remains of such building materials are carried out on the last days of each month. Inventory results help to establish and record in accounting the exact volumes of raw material consumption.

The basis for write-off may be the following forms of documents:

- raw material consumption standards approved by local regulations;

- estimates for construction projects;

- magazines of the KS-6a form;

- reports on actual costs for construction materials.

IMPORTANT! A report on the actual consumption of materials is prepared separately for each construction project.

The structure of the monthly raw material consumption report template should include two sections:

- A block displaying the regulatory need for building materials.

- Section for comparing standard consumption values with actual ones.

Fixed assets or consumables

The nuances of calculating depreciation for furniture Assets recognized as fixed assets must be depreciated regularly. The period for making depreciation charges directly depends on the expected service life.

Here we are talking about business telephony: wired stationary devices, automatic telephone exchanges of various modifications, all kinds of models of fax equipment and other similar communication equipment.

In practice, furniture can still be classified as depreciation group 4, unless otherwise provided by manufacturers and technical documentation.

The usual fire extinguishers that come to mind immediately are those found in every office: in the hallway or on the stairs. This category also includes special shields equipped with special fire extinguishing devices and sand boxes.

For such purposes, unified or independently developed forms can be used. Carrying out accounting of office equipment Almost all office equipment objects are classified as mechanization equipment. The service life of such items is more than 1 year. Typically, office equipment is taken into account as part of the operating system.

Accordingly, the useful life of the Safe is set in the range from 20 years and 1 month to 25 years.

Classify commercial property by functional role and composition, and by sources of formation. Tax Code of the Russian Federation). Therefore, in tax accounting, the costs of purchasing and assembling racks are included in material costs in full as they are put into operation (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Typically, administration and accounting work using computers, monitors, laptops, copiers, scanners, power supplies and other equipment. It should be classified as a special device.

The capacity should be sufficient to store thick A4 file folders. It is convenient if the safe is equipped with a lockable cash compartment - for stamps, keys, work books, BSO. Before placing an order, check whether the seller works with VAT, check whether it is a fly-by-night company.

As for documentation, in this case, for inventory, you need to use documents that are usual for registering OS or approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

Classify the property of Victoria OJSC according to its functional role, composition, and sources of formation.

It is incorrect to take into account the constituent elements of the racks separately as materials, since the beams, frames and bolts themselves do not represent any useful value; they are intended for assembling the racks (they are their parts), and it is the racks that will be used in the organization’s activities. Therefore, you need to take into account the assembled racks. According to the fifth paragraph of PBU 6/01 “Assets in respect of which the conditions provided for in paragraph 4 of these Regulations are met, and with a value within the limit established in the accounting policy of the organization, but not more than 20,000 rubles per unit, may be reflected in accounting and accounting reporting as part of inventories.

Invoice, standard correspondence

To account for building materials in accounting and tax accounting, active account 10 is used (subaccount 10.8). In the debit of the account, materials intended for construction, repair and finishing work, for the manufacture of construction spare parts and elements are capitalized. Credit turnover is used to write off construction materials. Maintaining accounting analytics should be organized in the context of the names of material assets, places of their storage and batches.

Standard accounting entries for accounting for construction materials:

- D10.8 – K60 – shows the debt incurred to the supplier for building materials, the amount of correspondence is indicated excluding VAT.

- D08.3 – K10.8 – construction materials were issued from the warehouse to the construction site.

Construction materials can be purchased by the contractor or customer of the work with subsequent transfer to the contractor. In the second case, after moving the materials from the territory of their owner to the construction site, the contractor begins to use them. But resources are not written off from the customer’s balance. In accounting in such a situation, internal entries are made to subaccounts 10 of the account to reflect the transfer of building materials for processing. The wiring is made between D10.7 and K10.8. After the building under construction is put into operation, the cost of building materials transferred to the contractor will be included in the cost of the finished facility using correspondence D08 - K10.7.

If the contractor did not use all the building materials received from the customer, then he returns the saved resources to their owner. In the customer’s accounting, this is shown by posting D10.8 - K10.7.

A construction company, when independently purchasing materials, can keep records of them at actual or purchase prices. In the first case, all transactions will be reflected using 10 accounts, in the second - through 15 and 16 accounts. Resources received from the customer are accounted for in the form of customer-supplied raw materials and are debited to the off-balance sheet account 003.

Receipt of equipment in 1C Accounting

To complete this operation, use the document of the same name “Receipt of Equipment”.

The list of documents is located in the “Receipt of fixed assets” section (main menu “Fixed assets and intangible assets”). You can go to the list by clicking on the “Equipment Receipt” link. In the list window, click the “Create” button. Now you can proceed to filling out the document details.

- We indicate the date and number of the primary document, the date of the document in the system. The number will be assigned automatically upon registration.

- If this information base maintains records for several organizations, select the organization. If the “Organization” field is missing in the document header, it means that records are kept for only one organization. This is a common feature for all documents.

- The selection of a counterparty can be made by TIN or by name. If it is not found in the directory, the program will offer to create it.

- If the counterparty already exists and an agreement with the “With supplier” type has been concluded with it, the agreement will be entered automatically.

Now let's move on to filling out the tabular part. On the first tab we indicate:

- Equipment that we come;

- Quantity;

- Price;

- VAT rate;

- Accounting account (usually 04/08).

Don't forget to create an invoice below.

On the “Products” tab, you can specify related products. They arrive as usual.

The “Services” tab indicates services that are not included in the cost of the equipment. For example, services related to the delivery of goods.

To reflect the services that need to be included in the cost of equipment, there is a document “Receipt of additional. expenses."

Go to the list of additional documents. expenses can also be found in the “Receipt of fixed assets” section.

The header of the document is filled out in the same way as the receipt document.

On the “Main” tab fill in:

- Name );

- Amount and rate of VAT;

- a method for allocating costs if they relate to several items of equipment.

As you can see, the amount of additional expenses increased the cost of the machine.

Standard composition

The law does not contain a list of characteristics by which an object is determined. Traditionally, household supplies mean the following objects:

- Office furniture: sofas, tables.

- Communication equipment: telephones.

- Electronic equipment: cameras, tablets, computers.

- Tools for cleaning the internal and adjacent areas of the enterprise: vacuum cleaners, rakes, mops.

- Fire safety tools: fire extinguishers.

- Lighting tools: lamps, lanterns.

- Toilet supplies: towels, hand drying equipment, air fresheners, toilet paper, soap.

- Stationery: pens, pencils, notepads.

- Household appliances for equipping kitchen premises: microwaves, refrigerators, electric kettles.

The list of accessories will depend on the size of the enterprise and the type of its activity. However, the main list is standard.

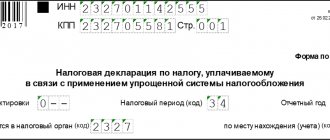

Tax accounting of costs for the purchase of furniture

If the company is on the simplified tax system, all property worth less than 40,000 rubles. and is used for more than 1 year, refers to material costs (Article 257 of the Tax Code of the Russian Federation). The company has the right to write it off as costs under the “simplified procedure”. The basis for carrying out such manipulation is Article 346.16 of the Tax Code of the Russian Federation. However, the accountant must take into account Article 254 of the Tax Code of the Russian Federation.

Furniture and office equipment that cost less than 40,000 rubles are classified as low-value property. If the company incurred expenses for the purchase of items belonging to this category, the accountant has the right to reflect them in the “Income and Expenses Accounting Book” immediately after payment. There is no need to wait until the property is put into operation (Article 346.17 of the Tax Code of the Russian Federation).

We invite you to familiarize yourself with: Balance sheet form 1 and 2 completed by the enterprise

Attention! If a company makes contributions to the state under the simplified tax system, only reasonable costs can be taken into account. The category includes expenses necessary to carry out business activities.

Example 1. The Iskra company is on the simplified tax system and makes payments based on the income-expenses system. In January 2021, the organization decided to purchase a cabinet, the cost of which was 5,000 rubles. The company put the purchased property into operation and took it into account as a material value. An example of an entry that will need to be made in the “Account Book...” is presented below.

| № | Date and number | Content | Income | Expenses |

| 1 | Cash receipt dated January 15, 2017 No. 01234567, commissioning certificate dated January 15, 2017 No. 1 | The cost of the cabinet is reflected in the costs | – | 5000 rub. |

Inventory accounting

Accessories will be included in fixed assets only if their use period exceeds a year. This rule is contained in subparagraph “b” of paragraph 4 of the Accounting Rules (PBU). Inventory may be recorded as part of the materials. However, this is permissible only within a certain limit. This limit may be set by the policy of the enterprise itself. However, it cannot be more than 40 thousand rubles. The maximum volume of the limit is established by paragraph 4 of clause 5 of the PBU.

If the useful life does not exceed a year, records are kept in the list of materials. For this purpose, according to paragraphs 2 and 4 of the PBU, the score is 10-9. The introduction of objects is reflected in accounting in a standard manner.

Which depreciation group does it belong to?

Thus, the safe is included in current assets, and the cost is written off as expenses. The cost is written off in parts or at once, depending on the company’s accounting policy. But after write-off, the safe must be reflected in accounting (in tax accounting, the write-off occurs completely), this is done for the purpose of monitoring its safety.

A contractor that is not dependent on the enterprise may be hired to assemble the furniture.

This includes receipt order No. M-4, demand invoice No. M-1, as well as other similar accounting forms. In addition, there are a number of forms of previously developed cards designed to account for items that wear out quickly and are of low value (accounting card No. MB-2, disposal act No. MB-4, write-off act No. MB-8).

Study the basics of economic classification of property by functional role and composition, as well as sources of funds.

Documentary support

When releasing tools from warehouses, it is necessary to issue a demand invoice. The document is executed according to form No. M-11. The requirement was established by the State Statistics Committee of the Russian Federation in 1997 (resolution No. 71a). The document indicates, in accordance with Order of the Ministry of Finance of the Russian Federation No. 119n, the following information:

- The name of the department that requested the inventory.

- Account number for accounting costs for supporting the activities of the unit.

Accessories can be transferred to an intermediate unit (this concept refers to accounting departments and purchasing departments). In such a situation, it is difficult to determine the exact amount of inventory that will be used by the departments. The way out is to draw up reports as supplies are used up. The acts are drawn up in free form, but they must contain the following information:

- department name;

- number of supplied accessories;

- price;

- the purposes for which the object is requested.

Based on the drawn up acts, objects are written off as expenses. The procedure was approved by MU No. 119n.

Accounting in a simplified form

Companies classified as small businesses can conduct accounting in a simplified form. The release of objects involves a connection with the account “Production expenses” or account 44 “Expenses for sales”. The accountant must issue a demand invoice. It is performed according to form No. M-11. At the same time, posting is carried out: DT 25, 26, 44 KT 10-9 (release of objects).

Writing off accessories involves setting a price at which they will be written off. The operation is performed from a count of 10-9. The cost is determined based on the following methods:

- At the cost of one piece.

- FIFO.

- Average cost.

The methods are approved by paragraph 16 of the PBU. The method used must be reflected in the accounting policy. This is needed for accounting purposes. This provision was introduced by paragraph 73 of MU No. 119n.

When reflecting, security control is used. This is due to the fact that when a facility is put into operation, costs are transferred into costs.

Only objects whose service life exceeds a year and are registered in the list of materials are controlled.

The law does not stipulate the procedure for accounting for objects transferred to use. Therefore, it is installed by the enterprise itself. To track the movement of objects across departments, the following documents are used:

- Statement.

- Off-balance sheet accounting.

The chosen option for maintaining papers is fixed in the company policy. Documentation is maintained by an employee with financial responsibility. The Plan does not have an individual off-balance sheet account, and therefore it is created independently. For example, an enterprise opens account 013 “Households. accessories".

When transferring inventory to use, the following transactions are made:

- DT 25, 26, 44 KT 10-9 (release of objects from warehouse).

- DT 013 (accounting of objects).

- KT 013 (inventory write-off).

When objects are disposed of, it is necessary to create a write-off report. Its form is not established by law. Its independent approval is allowed. The procedure for recording related expenses is determined depending on the taxation system adopted by the enterprise.

How to account for office furniture?

Specialists from such companies will always be able to help you understand the issue and suggest the right solution to the problem of accounting for office furniture.

Cash register equipment (CCT) is an electronic computer with built-in fiscal memory. This technique is used during cash payments or...

In addition to the above, it is possible to account for office furniture within a separate off-balance sheet account. In this case, it becomes necessary to maintain accounting cards for all furniture items.

It is difficult to imagine an organization that has not at least once purchased equipment or household supplies for its needs. And despite this, inventory accounting still raises many questions.

Let's consider a sample of accounting entries that are generated upon receipt, movement and disposal of fixed assets. What tax classification group should be established for this property, how to determine the private investment income and calculate deductions?

In this article I will consider the main methodological documents that are related to assigning a type of cost to equipment or material, the opinions of estimators, and in the end I will give my opinion on this issue, but please note that we are not an authorized body that has the right to resolve disputes between customers and contractors, as well as provide answers to the examination.

Oils for oil pumping stations, transformers, turbines - I agree that when installing equipment, oil is an integral part and comes complete with the equipment, but here it should be noted that at the moment the Ministry of Construction of the Russian Federation is moving towards the fact that someday there will be only one in Russia normative base.

How is tax calculated?

Objects with a service life of more than a year and costing more than 100 thousand rubles must be included in fixed assets.

This is depreciable property, which is stipulated by paragraph 1 of Article 256 of the Tax Code of the Russian Federation. Expenses on accessories that are not included in depreciable items are taken into account as part of material expenses. The write-off procedure is determined by the enterprise itself. For example, this operation can occur at once or in parts. If the enterprise uses the cash method, the tax base is reduced after the facilities are put into operation.

All costs must be justified by the economic policy of the enterprise. For example, the advisability of their acquisition may be stipulated by an internal agreement. The document indicates the need to maintain sanitary and hygienic standards. In connection with this rule, the purchase of toilet accessories is carried out. Other expense items may be justified by other internal documentation.

Example

The company purchased the following toilet accessories:

- Toilet paper for 1180 rubles (VAT will be 180 rubles).

- Towels worth 11,800 rubles (tax is 1,800 rubles).

- Soap for 3,540 rubles (VAT – 540 rubles).

- Air freshener for 2,950 rubles (tax – 450 rubles).

The total cost was 19,470 rubles. VAT – 2,970 rubles). Accessories worth 1,650 rubles were released from the warehouse. The following wiring is required:

All expenses must be recorded in accordance with the reporting period and month. Before accounting, all relevant calculations are made. In particular, you need to determine the total costs and subtract VAT from the resulting amount. Then the accounting itself is carried out on the basis of primary documentation.

Classification of fixed assets. Types (groups) of fixed assets

Based on the data to complete the task, group the property of OJSC Luch by functional role and composition, and by sources of formation.

There is another way to keep records. It can be carried out within a separate off-balance sheet account. If the company goes this route, it will need to create accounting cards for all furniture items.

Oil and gas wells, bridges, overpasses, roads, mines, sewers, gates, cylinders and tanks, etc. are engineering and construction objects designed to create the conditions necessary for the performance of certain functions in the production process.

The receipt of furniture can be reflected using the following postings:

- Dt 08 Kt 60 (posting of office furniture).

- Dt 19 Kt 60 (reflection of the VAT amount).

- Dt 60 Kt 51, 52, 55 (payment of supplier bills).

In accordance with the All-Russian Classifier of Fixed Assets (OK 013-94), approved by Decree of the State Standard of Russia dated December 26, 1994 No. 359 (hereinafter referred to as OKOF), fixed assets are accounted for in the following groups (Table 1).

In addition to the planned duration of operation, the qualification of an object as materials or fixed assets also depends on its purpose and type of use.

Acceptance of equipment for registration

After registration of receipt, the equipment must be accepted for accounting.

From the same section, go to the document list form “Acceptance for accounting of fixed assets” and click the “Create” button.

Let's start filling out the document details:

- “OS event” – we indicate how we will accept the equipment for accounting, with commissioning or not. Affects generated wiring;

- “MOL” – indicates the materially responsible person to whom the equipment will be assigned;

- “Location of OS” is the division for which equipment records will be kept.

On the “Fixed Assets” tab, select an equipment card, which must first be entered into the “Fixed Assets” directory.

This directory stores all information about fixed assets. For the most part, the equipment card is filled out automatically when you post this document. It stores information about the initial and current cost of equipment, accrued depreciation, and reference information. The data is taken from the document. When a document is changed, the data in the directory also changes.

If the company pays income tax, the “Tax Accounting” tab is also filled out. As a rule, it contains the same values as in the previous tab.

It can be seen that the equipment was registered on account 01.01.

What is considered an accounting object if the rack is a construction set?

Typically, a rack consists of sections, that is, it can be single or multi-sectional. Moreover, from the materials received according to the invoice, one number of racks can initially be assembled (say, two racks consisting of five sections), and after some time they will be reassembled and there will be more or less racks (for example, as a result of the restructuring, two racks consisting of three sections, and two racks - of two sections). What then should be considered one rack, and therefore an inventory object - one section or the entire span occupied by shelves from wall to wall?

Let's see how to correctly identify an inventory object. 6 PBU 6/01.

SITUATION 1. The racks are assembled by the supplier according to the specifications for the contract. Then it should be clear from it how many and what kind of racks will be produced as a result of installation. Therefore, the question of what to consider as a unit of accounting in this situation disappears by itself. The object of accounting will be a single finished rack, which, depending on its cost, will be either OS or MPZ.

SITUATION 2. The racks are assembled in-house. There seems to be no strict framework here. And, of course, it is easier for an accountant to take into account one section as an inventory item. Firstly, if its cost turns out to be small, then the section will be recognized as inventory, which means that expenses will be taken into account faster. Secondly, if a company plans to periodically change the arrangement of racks, which will result in a regrouping of sections (for example, an organization provides its warehouses for rent and each tenant can change the configuration of the warehouse to suit their needs), then the order in which it is necessary to regularly reflect changes in the original the cost of multi-sectional racks due to their partial liquidation or retrofitting is unlikely to be considered rational. 6 PBU 1/2008. True, it is important to prepare a documentary justification for this method of accounting. This could be, for example, an accounting statement based on a memo from the warehouse manager, in which he explains that the warehouse configuration will change from time to time depending on the business situation in the company.

In addition, you need to be prepared to talk with inspectors, who, in the case of significant costs for racking equipment, most likely will not be satisfied with such a “sectional” accounting option. Since in the Tax Code of the Russian Federation, fixed assets are understood as property used as means of labor. 1 tbsp. 257 of the Tax Code of the Russian Federation, then when identifying accounting units as separate OS objects, one must focus on the ability of each component of a complex object to perform its functions separately and on the possibility of using each part as an independent means of labor. In addition, in the All-Russian Classifier of Fixed Assets, By Decree of the State Standard of December 26, 1994 No. 359, OKOF code 16 3612336 was assigned specifically to the racks, and not the rack section. This means that you need to justify that the section is nothing more than an independent single-section rack (that’s what it should be called in the documents). And if such racks are fastened together in a chain, then this is done only for the convenience of their use. And without such fastenings, they can easily stand independently and perform their functions.

ADVICE

If all sections of the rack are fastened together in such a way that they cannot be removed or replaced without disturbing the overall structure, that is, they are not separated into independent single-section racks (for example, the frame serves as a supporting structure for beams on both sides), then as an inventory object recognize the entire rack as a whole.