An invoice in form M-15 is used by organizations to reflect operations involving the movement of inventory items (inventory). It is drawn up when transferring inventory items between branches of an organization that are located at a distance from each other. However, the law does not prohibit its use in other cases. It should be noted that processing the transfer of goods and materials of the M-15 invoice is an optional procedure, but when it is carried out, it is necessary to necessarily reflect the content of the transactions in the company’s local documentation.

What is the invoice form used for?

Any movement of products, goods and materials must be recorded in special accompanying documentation. One of these documents is the invoice. It confirms the release of goods, and also serves as the basis for carrying out various accounting operations (primarily, writing off inventory items from the warehouse).

Thus, the priority value of the document is to take into account the movement of products within the organization itself.

The invoice can also be used when returning goods to the supplier, for example, in cases where, during sales or after purchase, a defect, breakage or defect was discovered in the product, as well as when it turned out that the products were not delivered in the required configuration or have low quality.

Who draws up the document

Typically, the responsibility for generating an invoice rests with the financially responsible person: this can be a seller, manager, storekeeper, etc. Subsequently, the document is transferred to the accounting department, where a department specialist carries out all further necessary actions.

Who can sign the form

Immediately after compilation, the form is signed by the employee who releases the goods, and upon receipt - by the employee (or buyer) who received it.

As for the final signature with the right to authorize the release of valuables from the warehouse and their subsequent movement to a specific recipient, the following has the right to put it:

- a representative of the accounting department - this can be either the chief accountant or an accountant directly responsible for a given area or division (branch);

- a designated responsible employee who replaces the accountant;

- any employee who has the right to sign a power of attorney issued by the employer (for example, in the absence of an accountant).

The seller must affix an original seal reflecting the full name and details of the company, since this is essentially about the execution of a purchase and sale transaction and the transfer of the relevant goods to the buyer. On the buyer's part, it is enough to simply put his signature.

At what stage of shipment of goods is an invoice generated?

The invoice is drawn up immediately at the time of the transaction.

Since accounting entries are made on its basis, you should be very careful when filling it out. In particular, it is undesirable to make any errors or inaccuracies in the invoice or make corrections.

And it is absolutely forbidden to enter unreliable or deliberately false information into the form - if such facts are revealed by regulatory authorities, the responsible persons or even the organization may incur serious administrative punishment, in the form of large fines.

It should also be borne in mind that in some cases the invoice may acquire the status of a legally significant document - when one of the parties, due to some unfavorable circumstances, decides to go to court.

Where is an invoice for outward material issue used?

Most often, as practice shows, this document is in demand within enterprises, for example, when transferring materials from the parent company to branches and structural units located at a geographical distance. The invoice is also used when releasing materials to other organizations, but only if there is a special agreement between them.

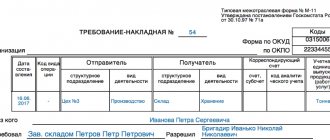

Why do you need an invoice? M-15

The M-15 invoice form is most often used to document operations for the transfer of materials between company divisions, if they are geographically remote from each other. It is also used when carrying out business operations involving the transfer of customer-supplied raw materials for processing. There is no prohibition on the use of M-15 to process shipments to the buyer. However, for the last operation, a consignment note of the TORG-12 form is traditionally used.

Invoice M-15 is one of the unified forms approved by the State Statistics Committee of Russia (Resolution No. 71a dated October 30, 1997), the mandatory use of which has been canceled since 2013. Instead, it is possible to use another document of similar content, drawn up in accordance with the requirements for the primary document.

Purpose of the document

Essentially, the document is an invoice that accompanies material assets moving within the enterprise or beyond its boundaries:

- The most common case is when raw materials are moved within one’s own enterprise - for example, from a warehouse to other divisions that are geographically located at a distance from each other.

- Since the law does not prohibit the issuance of an invoice in form M-15 when transferring goods to the buyer, theoretically the document can be used in these cases. However, the TORG 12 form is most often used.

In this case, the type of material assets, their features, size and shape do not matter - i.e. each unit fits into one invoice:

- goods;

- raw materials;

- mechanisms;

- designs, etc.

The document is always drawn up in two identical copies, which are legally equivalent:

- The first copy remains with the party that issued the valuables (i.e., it is stored in a warehouse).

- The second accompanies the cargo (i.e. it is transferred to the recipient along with the cargo).

NOTE. Filling out the document and submitting it at the first request of the official checking the movement of goods is mandatory. In addition, the M-15 form allows you to track all internal and external movements of property.

Basic rules for drawing up form M-15

There is no unified, single form of this document, therefore legal entities and individual entrepreneurs have the right to independently develop its template or issue an invoice in any form. Despite complete freedom in developing an invoice, it is recommended to adhere to previously generally accepted standards, as well as take into account some norms and requirements of office work.

In particular, you should always indicate the name of the company that issues the invoice, information about the recipient, the date of its preparation, as well as the specific materials that are transferred under it and their cost.

The document is filled out by the enterprise accountant and partly by the storekeeper. In addition, the invoice must be signed by the responsible employees of the organization and the recipient. There is no need to put a seal with the company details on the document - as of 2021, legal entities have acquired the right not to use stamps and seals in their work.

The invoice must be written out in two copies, one of which should be transferred to the warehouse of the company dispensing the materials, and the second should be given to the recipient.

Registration procedure

In general, the procedure for drawing up a document is as follows:

- First, an application is submitted in a free form, which is established at the enterprise. As a rule, this is an application for the movement of goods or the transfer of inventory items indicating the period, date and reason for such transfer.

- Next, the procedure for arranging and packaging the corresponding product is carried out.

- Then all the notes are entered into the pre-printed form of the M-15 consignment note (list of goods, the header and both tabular parts are filled out). Corrections are permitted if they are made in such a way that the new entries are readable. A “corrected believer” visa and the signature of the person who made the corrections are affixed.

- After this, the form is signed by all officials - the chief accountant (or the employee who performs his duties), the storekeeper. One copy is transferred to the accounting department, since the document relates to primary accounting, and the other is attached to the cargo.

NOTE. Thus, Form M-15 is drawn up exclusively upon transfer of goods and upon delivery. That is, it is undesirable to draw up and sign a document in advance and then transfer the valuables - this not only violates the procedure, but can also lead to unforeseen consequences when, for some reason, it is not possible to transfer the entire list.

Instructions for filling

The document consists of two tables. You can fill them out either manually or by typing the text. In this case, blots, errors and corrections are not allowed - in this case it is necessary to draw up a new invoice.

The rules for filling out the first table are as follows:

- The actual date of registration is indicated. It should be borne in mind that the invoice must be issued on one day, therefore, if a large volume of material assets is expected to be issued, several documents are drawn up.

- The “Sender” line indicates the full name of the organization (its structural unit - for example, a warehouse), as well as the activity code based on the accepted classification.

- The item number of a product or other value is filled in only if available. If it is not there, you should cross out the line.

- The operation code is indicated only if the enterprise uses an appropriate system with code designations. If it is absent, a dash is added.

- In the “Recipient” line, the full name, as well as the type of activity, are similarly indicated.

- The person who is responsible for moving the property to its destination is also entered in the appropriate column. The performer code is entered, and the type of activity is also specified.

Then the name of the document is recorded, on the basis of which the M-15 form is drawn up. Indicate the recipient (including the buyer's full name, if we are talking about a product).

The rules for filling out the second table are discussed below.

| graph | filling features |

| 3 | the name of the object being moved, as well as its parameters - all characteristics that are accepted according to the nomenclature are indicated (grade, dimensions, brand, etc.) |

| 4 | The number is written if available, otherwise a dash is entered |

| 5 | the code is written according to OKEI |

| 6 | name of units of measurement of quantity of goods, raw materials, etc. |

| 7 | the total quantity expected to be transferred from the warehouse to the recipient |

| 8 | quantity that was actually released (it is registered directly by the employee who released the goods - most often the storekeeper) |

| 9 | exact price (up to kopecks) per unit excluding VAT |

| 10 | the price of all goods that were released from the warehouse, excluding VAT |

| 11 | total VAT amount |

| 12 | total amount of property including VAT (i.e. adding the price in 10 and 11 columns) |

| 13 | inventory number |

| 14 | this column is filled in only if precious metals and/or products made from them are transferred, otherwise a dash is entered |

| 15 | the number of the corresponding record is indicated (recorded in the accounting card) |

The form does not allow empty lines. Those. the total size of the table is adjusted according to need.

Filling out the main table of form M-15

Further in the document there is the following table:

- Columns 1 and 2 contain information about the accounting subaccount and the analytical accounting code for materials that are written off.

- Column 3 indicates the name of the materials with some details: characteristics, brand, grade and size.

- Column 4 contains the nomenclature number that is given to one or another type of materials at the enterprise. If there are no such numbers, you need to leave the cell empty.

- Column 5 contains the code of the unit of measurement of materials according to OKEI (All-Russian Classifier of Units of Measurement).

- Column 6 is the specific name of the unit of measurement for these materials.

- Column 7 contains the exact quantity of materials released according to the invoice.

- Column 8 is filled in by the storekeeper and includes information about materials actually released from the warehouse.

- Column 9 concerns the cost of goods supplied. Here is their total price.

- Column 10 contains the price excluding VAT.

- Column 11 contains data on allocated VAT.

- Column 12 - total cost of materials including VAT (i.e. the amount from the previous columns).

- Column 13 includes the materials inventory number.

- Column 14 indicates the material passport number (if any).

- Column 15 contains the entry number on the warehouse registration card.

After filling out the table below, you need to indicate in words the data on the quantity of materials released from the warehouse, as well as their full cost and VAT.

Finally, the invoice must be signed by the accountant, the employees responsible for the release of materials from the warehouse, and the recipient. It is not necessary to stamp the document, but if the recipient requires this, then it is better to put a stamp (if available).

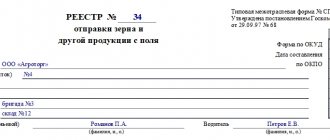

Related documents

- Sample. Statement No. 16

- Sample. Statement No. 18

- Sample. Statement No. 2

- Sample. Statement No. 2.1

- Sample. Statement No. 5

- Sample. Statement No. 7 on analytical accounting

- Sample. Sheet for monitoring the inclusion of the cost of shipped products in financial statements (Form No. 2) and in tax calculations

- Sample. Statement for replenishment (withdrawal) of a permanent stock of tools (devices). Form No. MB-1

- Sample. Statement of accrual and payment of wages

- Sample. Statement of receipt of funds at the cash desk of a branch of a foreign legal entity. Form No. 2-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. List of requirements for materials and calculation of the cost of materials for the object and sections of the estimate (form No. 4-mat)

- Sample. List of requirements for construction machines and calculation of the costs of operating these machines for the facility as a whole and sections of the estimate. Form No. 4-fur

- Sample. Statement of expenditure of funds from the cash desk of a branch of a foreign legal entity. Form No. 4-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement of results identified by inventory (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7

- Sample. Payroll records for branch employees in the Russian Federation. Form No. 3-pp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement of accounting for intangible assets and depreciation (No. 17)

- Sample. A list of remaining materials in the warehouse. Form No. m-14

- Sample. Statement of accounting of expenses of a branch of a foreign legal entity. Form No. 2-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Product sales accounting sheet for shipment (No. 16/1)

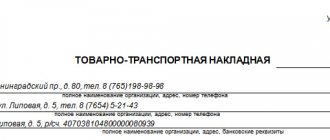

Invoice for goods release - form OP-4

Invoice for goods release form OP-4 is a document that is used to account for the release of goods or products, as well as containers from the enterprise’s pantry to the production kitchen, small retail chain, buffets, as well as to account for one-time release of finished products from the kitchen to buffets, branches , a small retail network, separated from the main production by a dispenser. The code of the invoice form according to the OKUD form is 0330504. The unified form was approved by the Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 under number 132.

An invoice for the release of goods is issued based on the request to the storeroom. The invoice is drawn up in two copies. One copy is kept by the financially responsible person who received the goods or products, the second copy is transferred to the accounting department along with the commodity report.

The document indicates the products and goods sold, their name and code, units of measurement of the products, their name and their OKEI code, the quantity of products and goods requested and released, as well as the accounting and sales prices for them. The note indicates additional information about products and goods (if any)

Basis for drawing up the document

The invoice is not an independent and self-sufficient document. It refers to the primary documentation of the company and requires a basis for its preparation. In this case, it is a request for the release of goods from the warehouse, issued in the company’s accounting department.

What is the document for?

An invoice for goods release is drawn up in cases where material assets are shipped from a warehouse. It is drawn up in the following cases:

- The goods are transferred within the organization (for example, from a warehouse to production).

- The transfer occurs to a third-party consignee (for example, a buyer under a supply agreement). This method is used if there is an appropriate agreement between enterprises providing for the use of this form of documentation.

Is it possible to pay for food?

The most widely used invoices for goods release are in the field of food production or catering. As a matter of fact, usually an invoice of this type is understood as one that is drawn up in the OP-4 form and concerns the transfer of raw materials from storage to the kitchen or from the kitchen to distribution, to buffets, etc.

Attention: For dispensing, form OP-4 is used in cases where the distribution area and the kitchen or workshop itself are separated from each other, and it is necessary to reflect the movement of goods in the internal documentation of the enterprise.

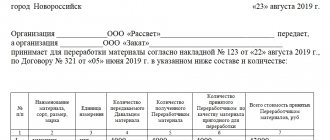

How is it processed?

If we are talking about the form of the invoice for the release of goods, then the OP-4 form is used (OKUD number 0330504), approved by Decree of the State Statistics Committee of the Russian Federation No. 132 of 1998. Due to the fact that the Federal Law “On Accounting” came into force on January 1, 2013, this unified form is no longer mandatory.

Each enterprise now has the right to prepare and approve its own forms of primary documentation. The only exception is cases when some form was separately approved by government agencies on the basis of federal laws - however, OP-4 does not apply to these cases.

Despite the right to independently introduce forms for the “primary”, most enterprises still actively use the old unified forms. They are convenient, employees are accustomed to filling them out correctly - and additional information, which can be reflected in independently developed forms, is not always required.

However, if the management of the organization decides to introduce its own forms for the invoice for the release of goods, such a document must necessarily contain the following information:

- Company name.

- The structural unit in which the movement of goods occurs.

- Name of transferred material assets, quantity and price.

- Basis for transfer. Usually this is a requirement drawn up in form No. OP-3 or similar.

- Signatures of financially responsible persons making the vacation.

Important: In cases where we are talking about the transfer of food products, the time of drawing up the document is also an important point. As a rule, such goods are perishable, and sanitary standards limit the time when they can be transferred.

Is it necessary to put a stamp on the invoice?

According to the rules of business document flow, organizations exchanging documents certify their signatures with company seals.

If internal rules provide for the affixing of stamps to documents, then the stamp is affixed even if the movement of commodities is carried out within the same enterprise. Although it is worth noting, at the moment legal entities have the right to conduct their activities without the use of seals and stamps. In addition, the M-15 form does not specifically provide for stamping. This suggests that such an invoice will be valid even in the absence of imprints.

Shelf life

This invoice refers to primary documentation. Accordingly, its shelf life is at least five years. This period begins after the end of the reporting year. After the expiration of the five-year period, this invoice may be destroyed.

Registration of OP-4

When using an invoice drawn up in the OP-4 form or similar, the following rules should be followed.

Who should do the compilation?

The preparation of the invoice is carried out by a person whose responsibilities include this in accordance with the staffing table and job descriptions in force at the enterprise.

Such persons may be:

- Accounting employee.

- Storekeeper.

- Head of production department, etc.

Number of copies

When using the OP-4 form, the document must be made in at least 2 copies:

- The first is transferred to the person who received the goods and is now financially responsible for it.

- The second remains with the warehouse or storeroom manager. Later, it, together with the commodity report, is transferred to the accounting department of the enterprise.

If necessary, depending on the current accounting policy, additional copies may be produced at the enterprise.

How to fix errors

The document is a reporting document, so you need to be very careful in its preparation and execution. You should strive to avoid mistakes, but if any are made, you must carefully correct them by crossing out incorrect information and entering correct information. Next to the correction, you must put the signatures of the persons responsible for drawing up the invoice with the inscription “Believe the corrected one.” However, if possible, it is better not to correct errors, but to compose a new version.

Filling out the front side of the OP-4 form

- First, indicate the name of the enterprise and the structural unit that is issuing the document.

- Then, on the right, in the column with codes, the codes of various classifiers are entered (if necessary).

- Below, in the appropriate cells, enter the document number , as well as the date of its preparation.

- After this, you need to provide a link to the basis: the number of the request for the release of goods is written here, and next to it is entered the exact time of transfer of the products (hours and minutes) - this is due to the fact that food products are perishable goods.

- Then the surname, name, patronymic of the materially responsible person , i.e. the employee who directly picks up products from the pantry.

- Next comes the main part, presented in the form of a table. Information is entered here

- about the name of the product (i.e. specific types of food products are written),

their unit of measurement (kilograms, liters, etc.),

- the quantity of products requested according to the invoice and actually released,

- price per unit of goods

- and the total amount.

The “Total” line summarizes the information entered above.

Filling out the reverse side of the OP-4 form

On the reverse side of the document there is a continuation of the table.

- After entering into it a complete list of products received from the warehouse, the results of general indicators on the quantity supplied and the cost of goods are summed up.

- Below, in words, again, the total amount of the invoice is entered and the signatures of all employees involved in the process are placed, indicating their positions, surnames and initials.

- The document must also be certified by the signatures of the production manager and the head of the company. All autographs must be transcribed.

- https://assistentus.ru/forma/rashodnaya-nakladnaya/

- https://welena.ru/sovety/forma-m-5-obrazec-zapolneniya-oformlenie-i-zapolnenie-nakladnoi-na.html

- https://assistentus.ru/forma/m-15-nakladnaya-na-otpusk-materialov-na-storonu/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_m15_blank_i_obrazec/

- https://1atc.ru/nakladnaya-na-otpusk-tovara/

- https://assistentus.ru/forma/op-4-nakladnaya-na-otpusk-tovara/

Sources

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample. Statement No. 15 ", as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |