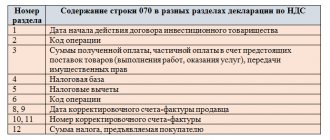

VAT declaration, which implies the basic requirements

According to tax legislation on the territory of the Russian Federation, VAT rates are 18%, generally, 10% for children's and medical goods and 0% for exports.

All VAT taxpayers pay tax based on the results of each quarter, but are required to make advance payments either quarterly or monthly. The deadline for payment according to the declaration is the 25th day of the month following the month after the end of the quarter.

As with any report, the declaration is no exception; some errors may be made.

INTRODUCTION

Classifier of errors in format-logical control of tax and accounting reporting files of the Federal Tax Service of Russia (error classifier - KOFO), approved by Order of the Federal Tax Service of Russia dated 01.01.2001 No. MM-3-6 / [email protected] , is an integral part of the system of classification and coding of technical and economic information and developed by the State Scientific Research Center of the Federal Tax Service of Russia in accordance with the Regulations “On a unified system of classification and coding of technical, economic and social information of the Ministry of Taxes of Russia” (Order of the Ministry of Taxes of Russia)

based on the following legislative acts and regulations:

Order of the Ministry of Finance of the Russian Federation dated 01.01.2001 No. 9n “On approval of the Administrative Regulations of the Federal Tax Service for the performance of the state function of free informing (including in writing) taxpayers, payers of fees and tax agents about current taxes and fees, tax legislation and fees and normative legal acts adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and obligations of taxpayers, payers of fees and tax agents, the powers of tax authorities and their officials, as well as the provision of tax return forms (calculations) and explanation the order of filling them out";

Format of the notification on clarification of the tax return (calculation) (Version 5.01) Part LXXXVII. Order of the Federal Tax Service of Russia dated January 1, 2001 No. MM-3-6/ [email protected]

Order of the Federal Tax Service of Russia dated 01.01.2001 No. MM-7-6/*****@*** “On approval of Methodological recommendations for organizing electronic document management when submitting tax returns (calculations) in electronic form via telecommunication channels”

Order of the Federal Tax Service of Russia dated January 1, 2001 No. MM-7-6/ [email protected] “On approval of the Unified format of a transport container for information interaction with the reception complexes of tax authorities via telecommunication channels using an electronic digital signature”

Order of the Federal Tax Service of Russia dated January 1, 2001 No. MM-7-6/*****@*** “On approval of the Unified format of a transport container for information interaction with the receiving complexes of tax authorities via telecommunication channels using an electronic digital signature”

How to find out about errors in the declaration

The main requirement of the tax inspectorate is to connect all legal entities and entrepreneurs to electronic communication channels. Through them, all kinds of messages are received from the tax inspectorate, and if any errors are detected in the reports, they can send requests for clarification, as well as demands for payment of penalties and fines.

Important! When sending a declaration, you may not even suspect that there is an error or inaccuracy in it, since it may not be only your fault.

This is possible when the counterparty with whom you collaborated and issued the invoice did not reflect it in its sales book. Because of this, you will have to give explanations to the regulatory authority and prove the legality of the transaction, otherwise you may not be credited with this VAT deduction. Let's ask ourselves, how can you find out that the client did not accept your invoice? The tax office is not asleep and will send requests for clarification with the specified error code. There are only four such codes.

Error No. 1. Incorrect reporting period code

All the confusion arises due to the fact that some organizations submit forms monthly, while other companies submit forms quarterly. But if the code is incorrect, tax authorities do not have the right to impose fines for failure to submit reports. Judges are on the side of taxpayers: ruling of the Supreme Arbitration Court of the Russian Federation dated November 11, 2010 No. VAS-14602/10. Inspectors may require clarification to make changes to the declaration in their database. If the reporting period has not yet expired, you must send it again with the correct code. Otherwise, you need to send a letter explaining that the form with the incorrect code is considered submitted.

Code 000000001: there are deductions, but no accrual

The first error indicates that the tax office discovered discrepancies with the buyer’s purchase book and the supplier’s sales book.

The reason for this may be:

- Dishonesty of the buyer, who either did not provide his VAT return or indicated an invoice with a different number that does not match yours.

- The seller’s dishonesty: instead of actual sales, he reflected zero values in the declaration.

- Buyer's carelessness: mistakes were made when filling out the purchase book.

- If the buyer has registered an invoice with an error in the purchase book, provide an explanation with updated data

- The supplier, in turn, made a mistake in the sales book - if the request came to the buyer, inform the tax authorities that everything is correct with you

- The supplier for some reason did not charge VAT - everything is fine, then provide supporting documents that there was a transaction and you have signed documents

- The supplier forgot to indicate the invoice - here you will have to submit an updated declaration to the supplier, and show the buyer that he has everything reflected

Important! As a rule, this error occurs if you are caught in the network of one-day companies that do not provide reports or submit zero reports, and then disappear.

CLASSIFIER STRUCTURE

The error classifier is a list of names of classification objects and their corresponding code designations.

The classifier information is presented in one table.

Each row of the table consists of an error code and an error name.

The classifier table uses a hierarchical classification method and a sequential coding method.

COFO code structure:

KKK – class of errors (attribute reflecting the generality of the content of a subset of errors),

PRR - subclass of errors (

a sign reflecting the commonality of a subset of errors in a class of errors),

AAAA is the registration number of the error within the subclass.

010 – violation of the established procedure for submitting tax and accounting reports;

020 – the file name does not meet the established requirements;

030 – errors detected during format control;

040 – errors detected during logical control;

050 - errors detected when checking using reference books.

060 - errors detected when providing information services to taxpayers in the “ION” offline mode

The file name for loading the table into ASVK is KOFO. TXT.

Table rows are identified by the KOD (Classification Code) field.

The composition and formats of the fields of the KOFO table of the Directory are given in Table 2.1:

Composition and field formats of the

KOFO Directory

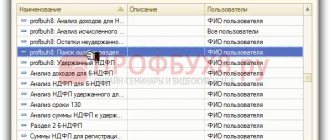

The New Year holidays have ended and reporting period has begun. The accountants have finally gotten into a working mood and are starting to work their magic on 1C to prepare the necessary reports.

Today Scloud will talk about the most common errors in income tax returns. Go.

Code 000000002: what is the error

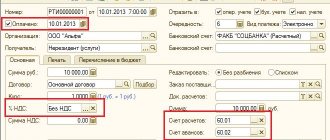

Here we are talking about the fact that discrepancies were discovered in the company’s own report; the data is repeated in the sales book and in the purchase book. In practice, there is a situation when the tax is first calculated and then deducted.

Otrada LLC is a supplier that received an advance payment from Lexus LLC (buyer), the accountant charged VAT on this amount. When shipping the products, the supplier took into account the deduction of accrued advance VAT.

Error number 2 can occur when there is a deduction in the declaration, but the tax is not charged on it. If Otrada LLC receives a demand from the Federal Tax Service, then:

- will check whether the advance invoice is registered in the sales ledger;

- Having identified an advance invoice not reflected in the sales book, he draws up an additional list for the sales book (for the period of receiving the advance payment), pays additional tax and penalties, and also submits an updated declaration.

If advance VAT is calculated and deducted, but makes errors in the sales and purchases book, it will also receive error code 2.

What other information is reflected by codes in the income tax return?

In the income tax return (approved by Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected] ), the following information is subject to coding:

- name of the inspectorate to which the declaration is submitted. For example, if you submit reports to the Federal Tax Service of Russia No. 14 in Moscow, then the code “7714” is entered in the declaration;

- information about your affiliation with a specific inspection. Let's say your company, not being the largest taxpayer, submits an income tax return at the place of registration of the organization itself. In this case, you need to enter code “214” (“At the location of the Russian organization that is not the largest taxpayer”). And if, for example, you submit a declaration at the place of registration of your separate division, then the code “220” (“At the location of the separate division of the Russian organization”);

- data on reorganization/liquidation. For example, if the declaration is submitted by a company that is completing its activities, then “0” (“Liquidation”) is entered in the corresponding cell of the title page of the declaration;

- information about who signs the declaration: the payer himself (code “1”) or his representative (code “2”).

Actions of the taxpayer upon receipt of a request with an error

| Action 1 | Act 2 | Act 3 |

| 1.Send confirmation of receipt of the request to the tax office | Double-check all the data in the declaration, namely registration data, then the purchase and sales book, all invoices, their numbers and dates | 1. Provide a corrective declaration with correct data if it led to an understatement of tax 2. Or provide an explanation of the error made if the tax was not underestimated for this reason |

Deadlines for correcting errors in the declaration

1.If you receive a request, it must be confirmed and sent within six days

- Five days are given to provide a response in an explanation or an adjusted declaration.

3. The tax office gives ten days to prepare documents

The period is counted from the actual day of delivery, that is, when you sent an electronic confirmation of receipt.

In different situations you have to act differently. In order to understand the need to provide an updated declaration, you must independently analyze the indicators of lines 040 and 050; if you find that the primary report led to an understatement of the tax amount, then you must submit an adjustment. If the error did not affect the tax amount, provide an explanation, or if you could not detect the error yourself.

Period code in the income tax return

This code (Appendix No. 1 to the Procedure, approved by Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3 / [email protected] ) allows tax authorities to determine for what specific period the payer submitted the declaration. Moreover, different codes are provided for ordinary organizations and responsible participants in a consolidated group of taxpayers (hereinafter referred to as the CTG).

| Tax/reporting period | Period code |

| For organizations (not KGN) submitting reports quarterly | |

| I quarter | 21 |

| Half year | 31 |

| 9 months | 33 |

| Year | 34 |

| For organizations (not KGN) submitting reports monthly | |

| One month | 35 |

| Two month | 36 |

| Three months | 37 |

| Four months | 38 |

| Five months | 39 |

| Six months | 40 |

| Seven months | 41 |

| Eight months | 42 |

| Nine month | 43 |

| Ten months | 44 |

| Eleven months | 45 |

| Year | 46 |

| For organizations that are responsible participants of the Group of Companies, submitting reports quarterly | |

| I quarter | 13 |

| Half year | 14 |

| 9 months | 15 |

| Year | 16 |

| For organizations that are responsible participants of the CGN, submitting reports on a monthly basis | |

| One month | 57 |

| Two month | 58 |

| Three months | 59 |

| Four months | 60 |

| Five months | 61 |

| Six months | 62 |

| Seven months | 63 |

| Eight months | 64 |

| Nine month | 65 |

| Ten months | 66 |

| Eleven months | 67 |

| Year | 68 |

Responsibility for late filing of a declaration

To ensure that the tax inspectorate does not assess a fine for late payment of VAT tax and submission of a declaration, it is necessary to comply with the deadlines for payment of VAT tax adopted by the Tax Code of the Russian Federation. But if this happens and the tax is not transferred on time, then you will have to pay a fine of 20% of the tax amount.

If circumstances are discovered in which the report and payment are not listed on purpose, the company may be fined 40%

And also transactions on the current account may be suspended, it will be impossible to pay anything except taxes.