Explanations to the Balance Sheet and explanations to the Statement of Financial Results are included in the annual financial statements (Part 1, Article 14 of Law No. 402-FZ dated December 6, 2011, Clause 4 of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n ).

As a rule, the information in the Explanations deciphers the numerical indicators of the Balance Sheet or the Statement of Financial Results. This follows from the provisions of paragraph 24 of PBU 4/99.

The Explanations also disclose information about the organization's accounting policies, as well as additional information. One that is not in the Balance Sheet and the Income Statement, but without it it will be difficult for users to assess the real financial position of the organization, the financial results of its activities and cash flows for the reporting period.

Who is obliged to draw up

Filling out the notes to the balance sheet is mandatory for all organizations that maintain accounting. An exception is organizations that have the right to use simplified forms of accounting and reporting. For example, these are small enterprises that are not subject to mandatory audit, as well as most non-profit organizations (clause 6 of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, parts 4 and 5 of Article 6 of Law dated December 6, 2011 No. 402 -FZ).

This is the general procedure for filling out the notes to the balance sheet. However, there are situations when small businesses must draw up explanations. For example, if an organization makes changes to its accounting policies. In this case, the relevant information must be provided in additional information as part of the explanations.

Explanatory note to the annual financial statements

In accordance with paragraph 1 of Article 13 of Law No. 129-FZ “On Accounting”, organizations are required to prepare financial statements based on synthetic and analytical accounting data.

Please note: In accordance with paragraph 3 of Article 4 of Law No. 129-FZ, organizations that have switched to the simplified tax system are exempt from the obligation to maintain accounting records. At the same time, organizations using the simplified taxation system must keep records of fixed assets and intangible assets in accordance with current legislation.

In accordance with clause 28 of PBU 4/99 “Accounting statements of an organization”, Explanations to the balance sheet and profit and loss statement disclose information in the form of separate reporting forms and in the form of an explanatory note .

The explanatory note is included in the financial statements in accordance with paragraph 2 of Article 13 of Law 129-FZ, along with the balance sheet and other forms of financial statements.

The explanatory note to the annual financial statements must contain essential information:

- about the organization,

- her financial situation,

- comparability of data for the reporting and preceding years,

- valuation methods and significant items of financial statements.

The explanatory note must report facts of non-application of accounting rules in cases where they do not allow a reliable reflection of the property status and financial results of the organization, with appropriate justification.

Otherwise, non-application of accounting rules is considered as evasion of their implementation and is recognized as a violation of the legislation of the Russian Federation on accounting.

In the explanatory note to the financial statements, the organization announces changes in its accounting policies for the next reporting year (Clause 4, Article 13 of Law 129-FZ “On Accounting”).

An organization may also provide additional information accompanying the financial statements if it considers it useful for interested users when making economic decisions (clause 39 of PBU 4/99).

It reveals:

- dynamics of the most important economic and financial indicators of the organization’s activities over a number of years;

- planned development of the organization;

- expected capital and long-term financial investments;

- policy regarding borrowings, risk management;

- activities of the organization in the field of research and development work;

- environmental protection measures;

- other information.

Additional information, if necessary, can be presented in the form of analytical tables, graphs and diagrams.

Guided by the requirements of Law No. 129-FZ and the provisions of the current PBUs, we will draw up an approximate Explanatory Note to the balance sheet of the small organization Romashka LLC for 2011.

EXPLANATORY NOTE

to the annual balance sheet for 2011 LLC

1. Basic information about the organization.

Limited liability company, legal and actual address: 117437, Moscow, Profsoyuznaya st., building No. 110, building B.

Date of state registration: July 20, 2007.

OGRN: 1012357987234.

INN: 7723123702.

Checkpoint: 772301001.

Registered with the Federal Tax Service of Russia No. 23 for Moscow on July 20, 2007. Certificate 77 No. 005555155.

The Company's financial statements are prepared on the basis of the accounting and reporting rules in force in the Russian Federation.

The number of employees at the end of the reporting period was 55 people.

In 2011, there was an increase in the authorized capital due to retained earnings from previous years in accordance with Minutes No. 1U dated April 11, 2011 in the amount of 3,000,000 . The size of the authorized capital of the Company as of December 31, 2011. is 3,100,000 rubles.

The main activities of the Company are the production and wholesale of hosiery.

Production and financial activities were carried out by the Company throughout the entire period of 2011 and were aimed at generating income in the reporting and subsequent periods.

The level of materiality established by the Company in its accounting policy for accounting purposes is 15% of the corresponding item in the financial statements.

2. Revenue (income) from sales

Revenue from the performance of work, provision of services, sale of products with a long manufacturing cycle is recognized as the work, service, and product are ready (clause 13 of PBU 9/99 “Organizational Income”).

Income from sales in 2011 amounted to 2,000,000 . (without VAT):

Sales income for previous reporting periods amounted to (excluding VAT):

- 2010 – 1,700,000 rubles;

- 2009 – RUB 1,500,000

- 2008 – 1,200,000 rubles;

- 2007 – 800,000 rubles.

Analysis of the above indicators indicates a positive dynamics in the development of the financial and economic activities of the enterprise.

3. Costs associated with sales

Administrative expenses, accounted for in the debit of account 26 “General business expenses”, at the end of the reporting period are not distributed among the objects of calculation and, as conditionally constants, are written off directly to the debit of account 90 “Sales of products (works, services)” with distribution between product groups in proportion to the specific weight of sales proceeds.

Selling and administrative expenses are recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities (clause 9 of PBU 10/99 “Expenses of the organization”).

Costs associated with sales in 2011 amounted to 1,000,000 . (without VAT):

For tax accounting purposes, the amount of expenses associated with the sale amounted to 970,000 rubles.

The difference that has arisen in accounting for production and administrative expenses for accounting and tax accounting purposes arose in connection with the use of PBUs for determining expenses in accounting and the provisions of the Tax Code for accounting for expenses for tax purposes.

The amount of the difference between BU and NU is 30,000 rubles. arose from a temporary difference of 20,000 rubles. and permanent differences in the amount of 10,000 rubles. in the following way:

1. Temporary difference in the amount of 20,000 rubles. formed due to differences in accounting for depreciation of fixed assets for tax and accounting purposes.

2. Permanent differences in the amount of 10,000 rubles. (5,000 + 5,000) consist of expenses not accepted for NU purposes, namely:

- 5 000 rub. depreciation of fixed assets is not accepted for NU purposes;

- 5 000 rub. health insurance costs in excess of norms.

Costs associated with sales for previous reporting periods amounted to (excluding VAT):

- 2010 – 900,000 rubles;

- 2009 – 800,000 rubles;

- 2008 – 700,000 rubles;

- 2007 – 600,000 rubles.

Analysis of the above indicators indicates the optimization of costs associated with sales, which has a positive effect on the economic activity of the enterprise.

4. Financial result obtained from main activities

The financial result obtained from the main activities in 2011 amounted to 1,000,000 . ( 2,000,000 - 1,000,000 ).

For tax accounting purposes, the amount of profit from sales amounted to 1,030,000 . ( 2,000,000 – 970,000 ).

In addition, the main type of activity does not reflect the results of the sale of a large batch of finished products, due to the delay in the transfer of the batch of goods to the buyer LLC “BUTTERUTCH” and the signing of the TORG-12 consignment note.

The sale of goods took place in the 1st quarter of 2012. All work on production of products was completed in the 4th quarter of 2011.

Finished products are reflected in account 43 “Finished products” in the amount of actual costs for their production - 200,000 rubles.

The amount of revenue from the sale of this batch of own-produced products is 470,000 rubles.

The amount of profit received (before tax) for this project will be 270,000 rubles.

5. Other income

The amount of other income in 2011 amounted to 150,000 rubles.

For tax accounting purposes, the amount of other income was 100,000 rubles.

The difference that has arisen in accounting for other income for accounting and tax accounting purposes arose in connection with the application of PBU to determine the amount of other income in accounting and the provisions of the Tax Code for accounting for income for tax purposes.

The amount of the difference between BU and NU is 50,000 rubles. represents a constant difference, which consists of the amount of the contribution of the founder owning 100% of the shares in the LLC.

6. Other expenses

The amount of other expenses in 2011 amounted to 350,000 rubles.

For tax accounting purposes, the amount of other income amounted to 185,000 rubles.

The difference that arose in accounting for other expenses for accounting and tax accounting purposes arose in connection with the application of PBU to determine the amount of other expenses in accounting and the provisions of the Tax Code for accounting for expenses for tax purposes.

The amount of the difference between BU and NU is 165,000 rubles. represents a constant difference, which is made up of the following expenses that are not accepted for NU purposes:

- 10 000 rub. interest on loans (including bills of exchange) exceeding the maximum amount accepted for tax purposes in accordance with Article 269 of the Tax Code;

- 50 000 rub. expenses of previous tax periods that are not taken into account in the current tax period;

- 60 000 rub. bonuses from net profit and financial assistance to employees of the organization;

- 40 000 rub. fines and penalties according to the on-site inspection report of the Pension Fund and the Social Insurance Fund dated September 27, 2011 No. 547;

- 5 000 rub. other expenses (including depreciation of non-production assets, purchase of drinking water and other expenses not taken into account for NU purposes).

During 2011, the Company took into account as other expenses expenses in the form of interest on a long-term bank loan in the amount of 150,000 .

This loan was provided to the Company by Bank Vozrozhdenie to replenish working capital, in accordance with the loan agreement dated November 15, 2011. No. 2342/2.

The loan amount, according to the agreement, is 1,000,000 rubles. and was fully received by the Company in November 2011.

The repayment period for the principal amount of the debt under the loan agreement is November 15, 2014. Interest is repaid monthly.

7. Income tax calculations

The Company forms in accounting and discloses in the financial statements information on calculations for corporate income tax in accordance with the requirements of PBU 18/02 “Accounting for calculations for corporate income tax”.

Profit for income tax purposes in accordance with tax register data and tax return data amounted to 945,000 .

The income tax rate in 2011 was 20%. The amount of accrued income tax according to the tax return for 2011 amounted to 189,000 rubles.

The amount of accounting profit according to the accounting registers amounted to 800,000 rubles.

The amount of the conditional expense reflected in the accounting records as the debit of account 99.02.1 “Conditional income tax expense” amounted to 160,000 rubles. (800,000*20%).

The amount of deferred tax assets (hereinafter referred to as DTA) at the beginning of 2011 was 16,000 rubles. During 2011, there was an increase in OTA in the amount of 4,000 rubles. due to the occurrence of a temporary difference (in terms of depreciation of fixed assets) in the amount of 20,000 rubles. (20,000*20% = 4,000).

10,000 in 2011 . PNA arose due to the constant difference in the amount of the contribution of the founder owning 100% of the shares in the LLC in the management company of the Company in the accounting records in the amount of 50,000 rubles.

35,000 in 2011 . PNO arose due to permanent differences in the amount of 175,000 rubles. ((10,000 + 165,000)*20% = 35,000).

The current corporate income tax calculated in accordance with the provisions of PBU 18/02 is 189,000 rubles. ( 160,000 + 4,000 + 35,000 – 10,000 )* and corresponds to the tax return data for 2011.

*Current corporate income tax = conditional expense + Accrued IT + PNA – PNA.

8. Financial result of economic activities

The financial result obtained in 2011 amounted to 615,000 rubles. ( 800,000 - 189,000 + 4,000 ).

The financial result of the enterprise in 2011 was affected by the expenses incurred and written off to the financial result:

- managerial,

- commercial,

- others,

related to the sale of a large batch of finished products produced in the 4th quarter of 2011 and sold in the 1st quarter of 2012.

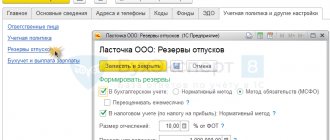

9. Information about the organization’s accounting policies

The regulations on the accounting policies applied by the Company are drawn up in accordance with the provisions of Federal Law No. 129-FZ of November 21, 1996. “On Accounting” and the requirements of PBU 1/2008 “Accounting Policy of the Organization” and other current provisions, guidelines, instructions.

The Company's accounting policy was approved by Order No. 1UP dated December 30, 2010.

The initial cost of the Company's fixed assets is repaid:

- linear method according to depreciation rates established depending on the useful life of the fixed assets in accordance with the Classification of fixed assets, approved by the Decree of the Government of the Russian Federation dated 01.01.2002. No. 1.

In case of acquisition of used fixed assets, the useful life of this property is determined as follows:

- the useful life is reduced by the number of years (months) of operation of this property by the previous owner.

Assets in respect of which the conditions are met that serve as the basis for their acceptance for accounting as fixed assets, costing no more than 40,000 rubles per unit, are reflected in accounting and reporting:

- as part of inventories and are written off as expenses as they are put into operation.

The Company does not create a reserve for OS repairs.

Costs for repair of fixed assets:

- are included in the cost of products (works, services) of the reporting period.

OS inventory is performed:

- 1 time every 3 years.

The valuation of inventories upon disposal is carried out based on the weighted average cost of acquisition/procurement of a group of inventories.

The Company creates a reserve to reduce the cost of inventories at the expense of financial results.

The reserve for reducing the cost of inventories is formed:

- by the amount of the difference between the current market value and the actual cost, if the latter is higher than the current market value.

- Amount of reserve in the absence of asset movement:

- during the year – 50% of book value,

- over a year – 100% of book value.

The cost of special equipment is paid:

- in a linear way.

The cost of special clothing , the service life of which, according to the issuance standards, does not exceed 12 months, at the time of transfer (vacation) to the organization’s employees

- written off at a time.

In the reporting year, the enterprise creates reserves for doubtful debts for settlements with other organizations and citizens for products, goods, works and services, attributing the amounts of reserves to the financial results of the organization (clause 70 of the Regulations on Accounting and Reporting).

The amount of the reserve for doubtful debts is:

- 100%, if a court decision is made not in favor of the Company, or on bankruptcy/liquidation of the debtor.

- 100%, if all attempts made to find the debtor were unsuccessful.

- 50% if pre-trial settlement could not be avoided and the case was sent to court.

- 50% if the debt is overdue for more than 3 months and the debtor does not sign the reconciliation report/does not agree with the amount of the debt.

- 30% if the debt is overdue for more than 3 months and the debtor has signed a reconciliation report and agrees with the amount of the debt.

Revenue from the performance of work, provision of services, sale of products with a long manufacturing cycle is recognized:

- as work, services, products are ready (clause 13 of PBU 9/99).

Production costs are accumulated on account 20 “Main production” with analytical accounting by types of items, types of production costs, and departments.

Work in progress is taken into account:

- on account 20 “Main production” in the amount of the actual cost. Account 21 “Semi-finished products of own production” does not apply.

Direct costs associated with the production and sale of goods of own production, as well as the performance of work and provision of services include :

- The actual cost of raw materials, materials used in the production of goods (performance of work, provision of services) and forming their basis, or being a necessary component in the production of goods (performance of work, provision of services);

- Cost of finished products used in production;

- General production expenses.

General production costs are accumulated on account 25 “General production expenses” and at the end of the month are written off to account 20 “Main production” with the distribution of costs by type of item.

General production expenses associated with the production and sale of goods of own production, as well as the performance of work and provision of services include :

- The actual cost of raw materials and supplies used for general production purposes;

- Depreciation charges for fixed assets for production and general production purposes;

- Depreciation charges for intangible assets for industrial and general production purposes;

- Cost of purchased goods and finished products used in production;

- Expenses for work and services of third-party organizations of a production and general production nature;

- Expenses for remuneration of key production personnel with deductions for insurance premiums;

- Deferred expenses in the part related to general production expenses.

The distribution of general production expenses accounted for in the debit of account 25 “General production expenses” is carried out proportionally:

- revenue from sales of products (works, services).

Administrative expenses , recorded in the debit of account 26 “General business expenses”, at the end of the reporting period

- are not distributed among the objects of calculation and, as conditional constants, are written off directly to the debit of account 90 “Sales of products (works, services)” with distribution between product groups in proportion to the share of revenue from sales.

Selling and administrative expenses are recognized in the cost of products, goods, works, services sold:

- fully in the reporting year they are recognized as expenses for ordinary activities (clause 9 of PBU 10/99).

The cost of purchased goods in accounting is formed:

- based on the costs of their acquisition. Transport costs for the delivery of goods are accounted for separately on account 44 “Sales expenses”.

When disposing of financial investments , they are assessed at the initial cost of each accounting unit of financial investments.

Costs incurred by the organization in the reporting period, but relating to the following reporting periods , are reflected in the balance sheet:

- in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type (clause 65 of the Regulations on Accounting and Reporting).

Costs that were previously taken into account by the organization as deferred expenses and reflected in account 97 are not transferred to the accounting registers.

In the balance sheet, these costs are reflected in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type. Non-exclusive rights to software products and other similar intangible objects that are not intangible assets according to PBU 14/2007:

- are taken into account in account 97 “Deferred expenses” and are written off as expenses on a monthly basis in equal shares during the term of the contract (clause 39 of PBU 14/2007).

In the balance sheet, these costs are reflected in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type.

Reserves for future expenses for the payment of vacation pay are recognized as an estimated liability and reflected in the account for reserves for future expenses. The amount of the estimated liability is included in other expenses. The amount of the estimated liability is determined based on the entire amount of vacation pay due but not taken off by employees as of the reporting date (clauses 17, 18, 19 of PBU “Estimated Liabilities, Contingent Liabilities and Contingent Assets”).

Reserves for upcoming expenses and payments in 2011, the creation of which is not mandatory in accordance with current legislation, are not created.

Loans and credits received are accounted for as short-term or long-term borrowed funds, in accordance with the terms of the agreement, namely:

- With a repayment period not exceeding 12 months, loans and credits are taken into account as part of short-term debt on loans and borrowings;

- With a repayment period exceeding 12 months - as part of long-term debt on loans and borrowings.

The transfer of long-term accounts payable for loans and credits received into short-term accounts payable is not carried out.

Accrued interest and (or) discount on bonds are reflected as follows:

- other expenses in those reporting periods to which these accruals relate.

CEO

Fomin Ivan Vladimirovich __________________ (signature)

Chief Accountant

Ivanova Elena Sergeevna __________________ (signature)

Document form

Explanations can be made in text and (or) tabular form. They are usually presented in table form. You can decide what to include in such a table yourself, taking into account Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010 (clause 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010).

If you are filling out such Explanations for the statistics department or tax office, then after the column “Name of the indicator”, additionally enter the column “Code” into the tables. Enter line codes in accordance with Appendix 4 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. This procedure follows from paragraph 5 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Main sections

Explanations to the Balance Sheet and Explanations to the Statement of Financial Results include the following sections:

- intangible assets and R&D expenses;

- fixed assets;

- financial investments;

- stocks;

- accounts receivable and accounts payable;

- production costs;

- estimated liabilities;

- securing obligations;

- government assistance.

Fill in the section indicators based on the data for the reporting and previous periods (clause 35 of the Regulations approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

What is Form 5 of financial statements: sample filling, standard form, sample design

When submitting an annual report, all enterprises are required to provide additional annexes to the balance sheet, including Form 5 (Explanations to the Balance Sheet), which displays information about the capital, property and liabilities of the enterprise displayed in the balance sheet.

What is Form 5 of financial statements

This appendix provides more detailed and detailed information on individual sections of the balance sheet, including reflecting the reasons and methods of occurrence of the amounts in the accounting report, justifying its sections and paragraphs (Order of the Ministry of Finance No. 66n dated July 2, 2010).

All enterprises engaged in entrepreneurial activities are required to provide Appendix 5 to the balance sheet, except for small businesses that use a simplified taxation system.

They fill out the form only when necessary, when additional information is required on sections of the balance sheet.

Form 5 involves filling out tables for various groups of enterprise assets according to their financial affiliation. When filling out some lines of the application, you must use codes approved by the joint order of the Ministry of Finance of the Russian Federation No. 102n and the State Statistics Committee of the Russian Federation No. 475 dated November 14, 2003. For the remaining lines, the codes are approved by the enterprises themselves.

Structure

Form 5 consists of several sections, which have their own characteristics when filling out. The number of completed tabular blocks in the Form 5 appendix must correspond to the amount of information on the lines of the balance sheet. When drawing up a balance sheet, it contains references to specific explanatory documents on individual items.

Intangible assets

The first section “Intangible assets” consists of two tables:

- The first contains detailed information on different types of assets.

- The second reflects the features and amounts of depreciation at the beginning and end of the year.

Lines 010 – 015 must be filled out if there is a patent for any type of activity, while line 010 reflects the cost of the right, the remaining lines contain more detailed information on this right.

Line 030 “Business reputation”. To be filled in if the enterprise was privatized as a result of a won tender, and the paid price turned out to be higher than the one originally established for this lot. The difference between these amounts is entered in the line.

Section "Intangible assets"

Fixed assets

The “Fixed Assets” section also contains two tables:

Data is recorded on real estate objects actually in operation, including in the absence of ownership rights to some of them.

Section "Fixed assets"

Other sections

The “Movement of Borrowed Funds” section displays the amount of cash of the enterprise, the routes of its movement, loans received and the timing of their repayment.

Inventory pledged

The section “Receivables and payables” contains all information on short-term and long-term receivables and payables of the enterprise for a period of more than a year, as well as on the movement of bills issued, received and overdue.

Debt section

Chapter “Depreciable property”. Information about wear-and-tear, intangible assets of the enterprise, its fixed assets and low-value assets is reflected.

Production costs

The section “Making investments” contains detailed accounting of property transferred to other enterprises (individuals or legal entities) for the purpose of making a profit.

Security for obligations

In addition, the form includes a section “Public Investments”, in which funds allocated from the state budget on a repayable or gratuitous basis should be reflected.

State aid

Forms and samples

A special form is used to fill out the form. The absence of such a form, as well as errors in the entered information, can lead to a significant distortion of the enterprise’s reporting, which will make it impossible to display the real picture of financial activities and financial results.

The form was approved by order of the Ministry of Finance of the Russian Federation No. 67n dated July 22, 2003. But the enterprise has the right to develop such a form itself, taking into account the basic requirements for it according to PBU 4/99. you can do it with us for free.

Sample form Appendix Form 5 of financial statements

The basis for entering information is all primary accounting documents of the enterprise. In addition to detailing the various balance sheet items, Form 5 gives a more complete and understandable picture of the organization’s financial position.

Is it possible to do without form 5

Appendix Form 5 is a clarifying document, the need for which has been confirmed by practice: some time ago it was replaced by an explanatory note, which led to confusion, since the format of the explanatory note did not fit into the general format of the financial statements. Therefore, this application was reintroduced and became a necessary component of accounting forms. That is, the inextricable connection between balance and applications to it has been proven by practice.

Paper forms of accounting statements, fraud on the Internet, the use of UTII - you will find all this in the video below:

Source: https://uriston.com/kommercheskoe-pravo/buhgalteriya/otchetnost/5-forma.html

Intangible assets and R&D expenses

In this section, disclose information on the following lines of the Balance Sheet:

- line 1110 “Intangible assets”;

- line 1120 “Results of research and development”;

- line 1190 “Other non-current assets”.

The section “Intangible assets and R&D expenses” consists of five tables.

In Table 1.1 “Availability and movement of intangible assets”, disclose information on the original cost and accumulated depreciation (at the end and at the beginning of the period), receipts and disposals for the period, the results of revaluation, as well as information on the value of intangible assets subject to impairment in the reporting year , the amount of impairment loss recognized. Reflect the data both in general for all intangible assets and in the context of their individual types (paragraph 2, 3, 6, 8, paragraph 41 of PBU 14/2007, paragraph 35 of PBU 4/99).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

When revaluing, in the column “Original cost” the current market value or current (replacement) value is given (Note 3 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.2 “Initial cost of intangible assets created by the organization itself,” disclose information on intangible assets that the organization created independently (paragraph 11, clause 41 of PBU 14/2007). Indicate the data as of the reporting date, the previous year and the year that precedes the previous one (notes 2, 4 and 5 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.3 “Intangible assets with fully amortized cost”, indicate the name and initial cost of those tangible assets whose cost is fully depreciated, but the organization continues to use them (paragraph 9 of clause 41 of PBU 14/2007). Indicate the data as of the reporting date, the previous year and the year that precedes the previous one (notes 2, 4 and 5 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.4 “Availability and movement of R&D results”, indicate information on the amount of R&D expenses (clause 16 of PBU 17/02).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.5 “Unfinished and unregistered R&D and unfinished transactions for the acquisition of intangible assets,” write down the amount of costs both in general and by type for the reporting and previous year according to:

- unfinished research and development (balance at the beginning of the year, amount of expenses for the year, amount of written-off costs that did not give a positive result, amount of expenses accepted for accounting, balance at the end of the year);

- unfinished transactions for the acquisition of intangible assets (balance at the beginning of the year, amount of expenses for the year, amount of written-off costs that did not give a positive result, amount of expenses accepted for accounting, balance at the end of the year).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

Accounting statements: fill out form 2, form 4 and form 5

Templates and forms Accounting reporting is an inevitable task for any accountant. Let's consider the features of preparing accounting reports for non-profit organizations. We will attach current forms and samples to fill out.

March 19, 2021 Evdokimova Natalya

The current forms of accounting reports for non-profit organizations are approved by Order of the Ministry of Finance of Russia No. 66n.

We reviewed the full list of reporting documentation in the article “Composition of financial statements 2021”.

Report on financial results of activities - form No. 2

The current form is OKUD 0710002, the tabular part reveals indicators of income, expenses from business or other activities, as well as the results of the financial activities of the institution.

NPOs are required to submit this report if:

- During the reporting period, the organization received its own income from the sale of work and services, and the sale of goods.

- The amount of income received from business activities is significant in relation to total income.

- Reflection of income in the report on the intended use of funds is not enough to fully disclose information about the implementation of activities.

- The lack of information prevents a real assessment of the organization's financial condition.

Accounting according to f. No. 2 consists of the title part, which indicates the details of the economic entity: name of the non-profit organization, type of activity, legal form of ownership, TIN. The tabular part of the document contains:

- name of the indicator;

- line code for each item;

- numerical expression of the indicator for the reporting period;

- the same figure for the previous period.

Some lines of the tabular section are subject to additional decoding in the explanatory note to the report. Due to the disclosure of information for the reporting and previous periods, inconsistencies may arise that need to be corrected.

Cash flow statement - form No. 4

Most non-profit organizations have the right to conduct accounting in a simplified way. The issue of the procedure and composition of simplified reporting is discussed in the topic: “We submit reports according to a simplified scheme.” In case of insignificant cash flows or their complete absence, the organization has the right not to provide document OKUD 0710004.

The report contains information on the annual movement of financial flows in terms of receipts, expenditures, lending, invested activities and other areas of the company.

Disclosure of indicators should be carried out taking into account balances at the beginning and end of the calendar year in the currency of the Russian Federation (rubles).

If a non-profit enterprise makes payments in foreign currency, then the report indicators are subject to conversion (recalculation) into rubles at the exchange rate on the date of preparation of the financial statements.

https://www.youtube.com/watch?v=wkdOEdv2Ips

The report does not include the following types of cash flow amounts:

- investments of funds related to investing in government securities, bills, shares and other cash equivalents;

- cash receipts from the repayment of cash equivalents excluding interest and payments accrued during the period of use;

- currency exchange transactions without taking into account exchange rate differences (profit or loss);

- transactions for the exchange of cash equivalents without taking into account gains and losses during the exchange;

- transfer of funds of the organization between its current accounts;

- write-off operations to receive cash from the company’s current account;

- other similar cash flows.

A detailed filling algorithm is presented in the Regulations on BU 23/2011 (Order of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 11n). The text is posted on the official website of the Ministry of Finance.

| Form 4 financial statements |

| forms 4 |

Fixed assets

In this section, disclose information on the following lines of the Balance Sheet:

- line 1150 “Fixed assets”;

- line 1160 “Profitable investments in material assets”;

- line 1190 “Other non-current assets”.

The “Fixed Assets” section of the Explanations contains four tables.

In Table 2.1 “Availability and movement of fixed assets”, reflect information on the initial cost and accumulated depreciation of fixed assets (at the beginning and end of the reporting year and the previous year), as well as information on the receipt (disposal) of fixed assets, revaluation and accrued depreciation for the reporting period. period and previous year (clause 32 of PBU 6/01). Disclose the information by groups of fixed assets (paragraph 3, clause 27 of PBU 4/99, clause 32 of PBU 6/01). The cost of objects that are taken into account as part of fixed assets and as part of profitable investments in material assets should be reflected separately.

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In table 2.2 “Unfinished capital investments”, provide information on the value of unfinished capital investments (at the beginning and end of the reporting year and the previous year), as well as its changes for the reporting period and the previous year (excluding costs for future intangible assets and R&D ).

In table 2.3 “Changes in the value of fixed assets as a result of completion, additional equipment, reconstruction and partial liquidation”, disclose information about the increase (decrease) in the value of fixed assets as a result of their partial liquidation or completion, additional equipment or reconstruction (paragraph 5 of paragraph 32 of PBU 6 /01).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 2.4 “Other use of fixed assets”, reflect information on fixed assets that:

- leased, it does not matter whether they are listed on the balance sheet or not;

- rented, it does not matter whether they are listed on the balance sheet or not;

- are real estate objects, and they have begun to be used, although they are under state registration;

- transferred to conservation;

- used in a different capacity (for example, they are objects of collateral, etc.).

Reflect the information as of December 31 of the reporting year, as of December 31 of the previous year and as of December 31 of the year before.

Form 5 - Appendix to the Balance Sheet

An important and additional appendix to the balance sheet is Form No. 5, which details the sections of the balance sheet. This type of documentation is clarifying in nature. Previously, they tried to cancel this document, but then they returned it because there was confusion in the data.

Form 5 of financial statements and its sample

Explanations to the balance sheet and financial results statement - this is form No. 5 and its purpose is to detail the reflected indicators and enter clarifying information.

The official Form No. 5 can be downloaded here.

An up-to-date example of filling out the Explanations to the Balance Sheet and the Statement of Financial Results can be downloaded here in pdf format.

The following entities may not fill out Form No. 5 of the financial statements:

- small business, the audit of which cannot but be carried out;

- non-profit organizations;

- public organizations that are not engaged in commercial activities.

Thus, you can see a clearer picture of the state of finances of a particular organization, since all data in the explanations is divided into types and groups according to financial affiliation.

Appendix 5 to the balance sheet: structure and filling procedure

Let's take a closer look at the groups into which financial indicators are divided.

Section on intangible assets

The section “Intangible assets” is clarifying information on the balance sheet, recorded in line 110. Intangible assets are registered at their original cost. The data is reflected according to the principle:

Cost of intangible assets at the beginning of the reporting period + receipt - disposal = cost of intangible assets at the end of the reporting period

In Form 5, amounts reflecting retired intangible assets are written with parentheses. This block also describes the amounts for depreciation of intangible assets at the beginning and end of the reporting year. There are also lines for types of intangible assets:

Section "Fixed assets"

This section details all information relating to the movement of fixed assets and their availability, and deciphers line 120 of the balance sheet.

The data presented in analytical accounting for accounts 01 and 02, where fixed assets and their depreciation are registered, are needed to reflect the indicators of this block.

Indicators for fixed assets are filled in at cost, called initial or replacement.

Get 267 video lessons on 1C for free:

The tables also reflect changes in the indicated value of fixed assets that were reconstructed, completed or liquidated. Figures for retired OS are written with parentheses. OS taking into account depreciation is also deciphered in a separate table in this section:

Section on financial investment amounts

This section details the amounts on lines 140 and 250 of Form No. 1. Indicators for investments of short-term and long-term funds are reflected here, their types are described and separated into groups. Also subject to submission are financial investments that have the status of “pledged” and for which there has been a transfer to other persons:

Conventionally, the following groups of financial investments can be distinguished:

- investing in funds that form the authorized capitals of other organizations;

- state and municipal securities;

- securities of other enterprises, which also includes debt securities (bonds, bills);

- loans issued;

- deposits and others.

Section “Securing Obligations”

This section details information regarding the information specified in the Certificate of Availability of Valuables that is presented on off-balance sheet accounts. Separately indicate information on collateral that was issued and received at the beginning and end of the reporting year:

Section "Production costs"

This block clarifies information on costs and expenses associated with the production process, as well as any changes in balances relating to work in progress, deferred costs and deferred inventories.

General information about the enterprise is indicated, but turnover within the enterprise is not taken into account. It may include expenses related to the transfer of goods, products or work and services that relate to the enterprise’s own goals:

Section "State aid"

This section applies to enterprises that received government assistance during the reporting period. These include subventions, subsidies, government loans, as well as other assets of the enterprise - land plots, natural resources, other real estate:

Debt section

This section provides clarification of lines 230 and 240 of the asset and lines 510, 520, 610, 620, 630 and 660 of the liability of the balance sheet, which include the amounts of the enterprise's debt to creditors and debt of debtors. All debt figures that have short-term and long-term status are recorded. They are divided by type at the beginning and end of the reporting year:

Source: https://BuhSpravka46.ru/nalogi/buhgalterskaya-otchetnost/forma-5-prilozhenie-k-buhgalterskomu-balansu.html

Financial investments

In this section, disclose information on the following lines of the Balance Sheet:

- line 1170 “Financial investments”;

- line 1240 “Financial investments (except for cash equivalents).”

This section of the Notes to the Balance Sheet consists of two tables.

In table 3.1 “Availability and movement of financial investments”, disclose information about the initial cost (at the beginning and at the end of the period) of long-term and short-term financial investments, as well as their changes during the period (receipt, disposal, interest accrual) (clause 41 of PBU 19 /02). Disclose information by type of financial investment (clause 42 of PBU 19/02).

In table 3.2 “Other use of financial investments”, indicate information on financial investments that are pledged and transferred to third parties (except for sale), as well as on their other use as of the end of the period (paragraphs 7 and 8 of clause 42 of PBU 19 /02).

Reserves

This section discloses information on line 1210 “Inventories” of the Balance Sheet.

The section includes two tables, information in which must be reflected by type of inventory (clause 23 of PBU 5/01).

In table 4.1 “Availability and movement of inventories”, indicate the cost and the amount of the reserve for reduction in value (at the beginning and at the end of the period), as well as changes during the period (clause 27 of PBU 5/01). In table 4.2 “Inventories as collateral”, indicate unpaid inventories and inventories as collateral under the contract (as of the reporting date) (clause 27 of PBU 5/01).

Accounts receivable and payable

In this section, disclose information on the following lines of the Balance Sheet:

- line 1230 “Accounts receivable”;

- line 1410 “Borrowed funds”;

- line 1450 “Other obligations”;

- line 1510 “Borrowed funds”;

- line 1520 “Accounts payable.”

The section consists of two tables for information on accounts receivable and two for accounts payable.

In table 5.1 “Availability and movement of accounts receivable” for long-term and short-term accounts receivable by their types, indicate information on the availability of accounts receivable at the beginning and end of the period, its changes during the period (receipt, disposal), as well as information on the reserve for doubtful debts

In the column “At the beginning of the year”, reflect in aggregate the debit balance of accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 as of January 1 of the reporting year.

In the “At the end of the period” column, indicate the balance of accounts receivable as of the end of the reporting year.

In the “Changes during the period” column, reflect the receipt and disposal of debts, as well as the transfer of debt from long-term to short-term.

Indicate the amounts of receivables in full according to the terms of the contracts (i.e., without taking into account the reserve for doubtful debts created for it) (clause 35 of PBU 4/99).

In Table 5.2, Overdue Receivables, disclose information on overdue receivables (that is, debts that have expired) as of the reporting date and as of December 31 of the previous two years. Indicate the amounts of debt by type in two estimates: according to the terms of the contracts (i.e., in full) and in the balance sheet estimate (i.e., minus the reserve for doubtful debts created for it).

An example of how to prepare explanations for the Balance Sheet and the Statement of Financial Results regarding accounts receivable

Before preparing the annual financial statements, the accountant of Alpha LLC carried out an inventory of accounts receivable.

Data for 2015

On the debit of account 62:

- 400,000 rub. – debt for goods shipped to Delta on December 27, 2014 under supply contract No. 125 dated December 20, 2014 (payment due until February 1, 2021) – current, short-term debt;

- 50,000 rub. – debt for goods shipped to Gamma on May 21, 2015 under supply contract dated May 16, 2015 No. 86 (payment due until June 1, 2015); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 50,000 rub. – debt for goods shipped to Omega on April 5, 2015 under supply contract dated March 31, 2015 No. 67 (payment due until June 1, 2015); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 100,000 rub. – debt for goods shipped to Beta on October 10, 2015 under supply contract No. 95 dated October 1, 2015 (payment period until December 31, 2015) – the debt is overdue, short-term, a reserve for doubtful debts was not created.

On the credit of account 62:

- 50,000 rub. – the debt for goods shipped to Gamma on May 21, 2012 under the supply agreement dated May 16, 2015 No. 86 was repaid;

- On June 29, 2015, Gamma paid the debt in full. The provision for doubtful debts was restored in the amount of RUB 50,000;

- 50,000 rubles – the debt for goods shipped to Omega on April 5, 2015 under the supply agreement dated March 31, 2015 No. 67 was written off from the reserve for doubtful debts.

“Alpha” carried out claims work and tried to collect the debt from “Omega” in court. It was not possible to collect the debt. On November 6, 2015, Omega was declared bankrupt by a court decision. As a result, this receivable was recognized as uncollectible and was written off in December 2015 against the provision for doubtful debts;

- 100,000 rub. – the debt for goods shipped to Beta on October 10, 2015 under the supply agreement dated October 1, 2015 No. 95 was repaid;

- On February 1, 2015, Beta paid the debt in full.

On the debit of account 76:

- 1,000,000 rub. – debt under the interest-free loan agreement dated July 19, 2015 No. 1 with A.S. Kondratyev (loan issued on July 19, 2015 for a period until July 18, 2021, repaid in a lump sum in full upon expiration of the contract) – current, long-term debt.

On the debit of account 60:

- RUB 1,500,000 – an advance payment was transferred under the supply agreement No. 55 dated December 22, 2015 with Hermes (delivery period of goods until January 20, 2021) – the debt is current, short-term.

There are no other types of receivables.

On the debit of account 63:

- 50,000 rub. – the reserve for Gamma’s debt under the supply agreement dated May 16, 2015 No. 86 was restored;

- 50,000 rub. – Omega’s debt under the supply agreement dated March 31, 2015 No. 67 was written off from the reserve.

Total as of December 31, 2015:

- accounts receivable accounted for under contracts – RUB 2,900,000, including:

- 400,000 rub. – customer debt (short-term);

- RUB 1,500,000 – debt of suppliers (short-term);

- 1,000,000 rub. – debt on interest-free loans issued (long-term);

- amount of reserve for doubtful debts – 0 rub.;

- balance sheet data on line 1230 “Accounts receivable” – RUB 2,900,000. (RUB 400,000 + RUB 1,500,000 + RUB 1,000,000).

Data for 2014

On the debit of account 62:

- 50,000 rub. – debt for goods shipped to Gamma on May 21, 2014 under supply contract dated May 16, 2014 No. 86 (payment due until June 1, 2014); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 50,000 rub. – debt for goods shipped to Omega on April 5, 2014 under supply contract dated March 31, 2014 No. 67 (payment due until June 1, 2014); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 100,000 rub. – debt for goods shipped to Beta on October 10, 2014 under supply contract No. 95 dated October 1, 2014 (payment period until December 31, 2014) – the debt is overdue, short-term, a reserve for doubtful debts was not created.

There were no other types of receivables.

On the credit of account 63:

- 50,000 rub. – a reserve for doubtful debts was created in relation to Gamma’s debt under the supply agreement dated May 16, 2014 No. 86.

Total as of December 31, 2014:

- accounts receivable accounted for under contracts – RUB 200,000. (customer debt, short-term), including overdue – RUB 200,000. (book value – 100,000 rubles);

- amount of reserve for doubtful debts – 100,000 rubles;

- balance sheet data on line 1230 “Accounts receivable” – 100,000 rubles. (200,000 rub. – 100,000 rub.).

Data for 2013

On the debit of account 62:

- 50,000 rub. – debt for goods shipped to Gamma on May 21, 2013 under supply contract No. 86 dated May 16, 2013 (payment due until June 1, 2013) – the debt is overdue, short-term, a reserve for doubtful debts was not created;

- 50,000 rub. – debt for goods shipped to Omega on April 5, 2013 under supply contract dated March 31, 2013 No. 67 (payment due until June 1, 2013); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve has been created for doubtful debts.

According to the terms of the agreements with Omega and Gamma, interest is not provided for late payments.

There were no other types of receivables.

On the credit of account 63:

- 50,000 rub. – a reserve for doubtful debts was created in relation to Omega’s debt under the supply agreement dated March 31, 2013 No. 67.

Total as of December 31, 2013:

- accounts receivable accounted for under contracts - 100,000 rubles. (customer debt, short-term), including overdue – RUB 100,000. (book value – 50,000 rubles);

- the amount of reserve for doubtful debts is 50,000 rubles;

- balance sheet data on line 1230 “Accounts receivable” – 50,000 rubles. (100,000 rub. – 50,000 rub.).

Based on these indicators, the accountant deciphered the data in the section “Accounts receivable and payable” of the Explanations to the Balance Sheet and the Statement of Financial Results.

Fill out Table 5.3 “Availability and movement of accounts payable” separately for long-term and short-term accounts payable by their types. Disclose information on debt balances at the beginning and at the end of the period, changes during the period (receipt, disposal) with the distribution of amounts of accounts payable arising within the framework of business activities and from accrued interest and fines (paragraph 10, paragraph 27 of PBU 4/99, p 2 and 17 PBU 15/2008).

In the column “At the beginning of the year”, reflect in aggregate the credit balance of accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 as of January 1 of the reporting year.

In the “At the end of the period” column, indicate the balance of accounts payable as of the end of the reporting year.

In the “Changes during the period” column, reflect the receipt and disposal of debts, as well as the transfer of debt from long-term to short-term.

In table 5.4 “Overdue accounts payable,” disclose information on the balances at the end of the reporting period and as of December 31 of the previous two years of overdue accounts payable (i.e., debt that has expired) by type.

GLAVBUKH-INFO

In the balance sheet, the organization reflects advances received minus VAT paid on such advances to the budget. How to reflect advances received in section 5 “Accounts receivable and payable” of the explanations to the balance sheet and income statement for 2015 - including VAT or excluding VAT? Explanations to the balance sheet and financial results statement must contain information about VAT payable (paid) on amounts of payment, partial payment on account of the organization's upcoming deliveries of goods (performance of work, provision of services). Justification for the position: In accordance with part 1 of Art. 14 of Federal Law dated December 6, 2011 N 402-FZ, annual accounting (financial) statements (except for cases established by this Federal Law) consist of a balance sheet, a statement of financial results and appendices thereto. The rules for the formation, composition and content of financial statements are established in PBU 4/99 “Accounting statements of an organization” (hereinafter referred to as PBU 4/99). The reporting forms were approved by Order of the Ministry of Finance of Russia dated 07/02/2010 N 66n “On the forms of financial reporting of organizations” (hereinafter referred to as Order N 66n). We note that the issue of the procedure for reflecting amounts in the balance sheet regarding advances received is not regulated by accounting regulations. From the clarifications of the Ministry of Finance of Russia given in the section “Assessment of debt on paid (received) advances (prepayment)” recommendations to audit organizations, individual auditors, auditors for conducting an audit of the annual financial statements of organizations for 2012, sent by letter dated 01/09/2013 N 07- 02-18/01, it follows that when an organization receives payment, partial payment for the upcoming deliveries of goods by this organization (performance of work, provision of services), accounts payable are reflected in the liabilities side of the balance sheet on line 1520 “Accounts payable” minus the amount of VAT subject to payment (paid) to the budget. In addition, if data on accounts payable for purchased goods (work, services) are significant, they must be reflected in the balance sheet separately from the amounts of prepayment received (see the section “Disclosure of information on advances received (prepayment)” of recommendations for audit organizations, individual auditors, auditors to conduct an audit of the annual financial statements of organizations for 2011, sent by letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01). A similar norm is provided for in clause 11 of PBU 4/99. From paragraph 4 of Order No. 66n it follows that explanations to the balance sheet and financial performance statement (hereinafter referred to as the Explanations) are drawn up in tabular and (or) text form and the content of the explanations drawn up in tabular form is determined by organizations independently, taking into account Appendix No. 3 to Order No. 66n. To decipher receivables and payables, Appendix No. 3 to Order No. 66n provides Section 5 “Receivables and Payables”. Section 5 consists of four tables. Information on the presence and movement of accounts payable is given in table 5.3 of section 5. In accordance with paragraph 35 of PBU 4/99, the balance sheet must include numerical indicators in the net estimate, i.e. minus regulatory values that must be disclosed in the Explanations. Therefore, in contrast to the balance sheet, where the debt on advances received is shown minus VAT, when filling out section 5 it is necessary to show the full amount of accounts payable. In fairness, it should be noted that the amount of VAT payable on advances received does not fully correspond to the concept of regulatory values, such as, for example, reserves created for doubtful debts in relation to receivables. However, in our opinion, the reflection in the Explanations of accounts payable on advances received excluding VAT may lead to a misconception among users about the actual amount of accounts payable. Based on this, we believe that the Explanations should contain information about VAT payable (paid) on amounts of payment, partial payment on account of the organization's upcoming deliveries of goods (performance of work, provision of services). We believe that, to complete the picture, Table 5.3 of Section 5 can be supplemented with columns (balance at the beginning of the year, receipts, withdrawals, balance at the end of the year), in which you can indicate the amount of such tax. Let us recall that in accordance with paragraph 4 of Order No. 66n, the content of the Explanations is determined by organizations independently, taking into account Appendix No. 3 to Order No. 66n. Consequently, the organization, based on Appendix No. 3 to Order No. 66n, can independently determine the data that it will reflect in the Explanations. For your information: Many auditors and accountants do not agree with the position of representatives of the financial department, recommended by letter dated 01/09/2013 N 07-02-18/01, regarding the reflection of advances received in the balance sheet and believe that accounts payable should be reflected in full in the liabilities side of the balance sheet, and VAT payable (paid) to the budget on such advances should be reflected in the balance sheet asset*(1).Prepared answer:

professional accountant Bashkirova Iraida Quality control of response: professional accountant Rodyushkin Sergey March 28, 2016

| Next > |

Production costs

The “Production Costs” section is presented in one table, which discloses information on the following lines of the Income Statement:

- line 2120 “Cost of sales”;

- line 2210 “Business expenses”;

- line 2220 “Administrative expenses”.

In the table “Production costs”, disclose information about the composition of costs in the context of their elements (paragraph 12, paragraph 27 of PBU 4/99, paragraph 2, paragraph 22 and paragraph 8 of PBU 10/99). Indicate the cost amounts for two periods: the reporting period and the previous period.

State aid

The section consists of one table, which reveals information on the following lines of the Balance Sheet:

- line 1410 “Borrowed funds”;

- line 1510 “Borrowed funds”;

- line 1530 “Deferred income”.

In the table, disclose information on received budget funds and loans for the reporting year and for the previous year (paragraph 1, clause 22 of PBU 13/2000). Disclose the amounts of budget loans in terms of their intended purpose (paragraph 2, clause 22 of PBU 13/2000).