Which depreciation group does the land belong to?

It turns out that in this case the land does not “wear out”, and its book value changes over time only due to improvements and revaluations. As for accounting, in this case the provisions of PBU completely coincide with tax legislation. The position on non-accrual of depreciation on land in accounting is confirmed by PBU 6/01. Leased land: postings If a company leases a plot, then there is no need to charge depreciation on it either. The value of land received for temporary use should be reflected on the balance sheet. Depreciation must be charged only on fixed assets located on the leased site.

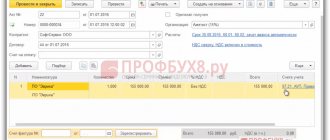

Example. Then all the entered depreciation settings will not matter. But you will have to fill them out, since they are required. Do not forget to indicate the account of the fixed asset itself.

This field is hidden after all the shock absorption settings and is easy to miss. If you maintain management accounting for fixed assets, then the tab for this type of accounting is filled out in the same way. But in tax accounting you need to set the value Cost is not included in expenses.

Tax accounting in the document Acceptance of fixed assets for accounting in 1C UPP and Complex 1.1 That's it - now the document can be posted. Check that the postings for accounting for the construction project have been successfully generated. Answer Land plots are not subject to depreciation, therefore they do not belong to depreciation groups. Rationale The peculiarity of land plots is that their consumer properties do not change over time. In this regard, the law establishes that land plots are not subject to depreciation. This rule is established both for corporate income tax and in accounting (in Russian accounting standards and in IFRS): Corporate income tax: “Land and other natural resources (water, subsoil and other natural resources) are not subject to depreciation... "(Clause 2 of Art.

- home

- Tax accounting

In this article we will look at: depreciation of land in accounting and tax accounting. Let's find out whether it is possible to calculate depreciation of the asphalt pavement. We will answer your questions. Companies acquiring land on a property basis are required to reflect the land on their balance sheet in accordance with the procedure for accounting for fixed assets.

However, among owners who have purchased land, the question often arises: is it necessary to depreciate the cost of land and whether it is possible to reduce the taxable profit of the company in this way. You will find answers to these and many other questions regarding land depreciation in our article. Land as an object of fixed assets In accordance with the provisions of the Tax Code, land plots are recognized as objects of fixed assets.

The basis for reflecting land in the balance sheet can be contracts of purchase and sale, exchange, or gratuitous use.

>Standard service life of trees

Revaluation of land plots

Home > Library > Articles on valuation > Revaluation of cadastral value

Revaluation of cadastral value

Since 2013, a massive revaluation of the cadastral value of real estate and land plots has begun throughout the Russian Federation. At the same time, their new price, determined by the state, often comes as a shock to the owners. It has increased tens and sometimes hundreds of times.

And everything would be fine, but you have to pay tax on this amount, which has also increased several times. Of course, many citizens have a very pressing question about how correctly the new price of their real estate has been calculated by government authorities and whether the tax amount is correct.

And if you are reading this article, then obviously this issue began to worry you too, after receiving a notification with a new tax amount from the tax office.

State revaluation of the cadastral value of land plots and other real estate, according to the Law, occurs once every 5 years. However, this does not mean that next time the valuation of your property will approach the market value and you just need to wait. On the contrary, it's time to act!

What is the right thing to do in this situation?

Revaluation of the cadastral value of a land plot

There is an absolutely legal way to solve your problem, this is to appeal the cadastral value in order to change it downwards and, accordingly, reduce the property tax.

The state has provided a special mechanism for this. There are commissions under Rosreestr of the Russian Federation that you can contact if you think that Rosreestr appraisers have incorrectly established the cadastral value of your property.

According to statistics, in more than 50% of cases the commission makes a positive decision to reduce the incorrectly determined price.

If you were unable to achieve a positive decision in the commission, then there is another way to appeal the cadastral value - by filing a lawsuit.

The most difficult problem is to prove to the commission or court that the value of your property is really overpriced. According to established practice, this is done using an assessment report.

Our company has accumulated solid experience in challenging cadastral valuations in Rosreestr commissions and courts.

We will not only prepare an assessment report for you to submit at the place of request, but will also help collect other documents, prepare a statement of claim and represent your interests in court, if necessary.

From our own experience, we can say that if the report on the revaluation of the cadastral value is completed correctly and there are no complaints about it, then the case is almost always resolved in favor of our client.

Revaluation of the cadastral value of a land plot

The main problem with the state assessment of land plots is that it is carried out on an average basis. Homogeneous areas, located either in the same place or similar to each other according to some set of characteristics, can be assessed equally.

At the same time, price increases, for a number of reasons, usually occur upward and significantly exceed the market value.

A revision of the cadastral price is needed to equalize the market and cadastral values of land - Article 66 of the Land Code says that they should be equal.

You can find additional information in the article reducing the cadastral value of a land plot. In it you will find out if you have grounds for revaluation, what specific steps you need to take and what documents you need to prepare.

Revaluation of cadastral value of real estate and apartments

With city real estate (buildings, apartments, retail premises, etc.) things are even more complicated. Its value is constantly changing depending on the economic situation in the country.

In Moscow, these fluctuations may well be measured in millions of rubles.

In addition, the price of real estate can change quickly if it is located in a part of the city that is actively being built up and improved or, conversely, is falling into decay.

If your property is worth a lot of money, then the tax on it is also not small, and a good option for you to appeal the cadastral value of an apartment or any other real estate would be precisely the period when prices are minimal.

You can find additional information in the article reducing the cadastral value of real estate. In it you will find out if you have grounds for revaluation, what specific steps you need to take and what documents you need to prepare.

If you need a revaluation of the cadastral value of an apartment, land plot or any other real estate, call us and we will help!

Service life of a wooden house

The shelf life of a wooden house also very much depends on the completeness of the research work carried out before the actual construction. If all the properties of soil and ground, groundwater flow, temperature, climate and flora of the land plot are studied in detail, then with a high degree of probability we can say that the service life of a wooden residential building will be long thanks to a high-quality foundation that can withstand heavy weight for a long time. And the foundation, as you know, is the basis of everything.

The predicted service life of a wooden house is the duration of use of housing until the physical wear and tear of the building reaches 40-60%. Subject to maintenance and timely repairs. It is calculated based on the minimum service life of individual non-replaceable (capital) structures. Here and further we consider capital class VI - load-bearing walls made of solid wood. Conventionally, wooden frame “cottages” of economy class and the other extreme - timber made from boards with glue, are not considered in principle.

Standard service life of trees

The criterion for assessing the technical condition of the building as a whole and its structural elements and engineering equipment is physical wear and tear. During many years of operation, structural elements and engineering equipment constantly wear out under the influence of physical, mechanical and chemical factors; Their mechanical and operational qualities decrease, and various malfunctions appear. All this leads to a loss of their original value. Physical wear and tear is the partial or complete loss of building elements of their original technical and operational qualities. Many factors influence the time it takes for a building to reach the maximum permissible physical wear and tear, at which further operation of the building is practically impossible. The maximum physical wear and tear of a building according to the “Regulations on the procedure for resolving issues regarding the demolition of residential buildings during the reconstruction and development of cities,” approved by the USSR State Construction Committee, is 70%. Such buildings are subject to demolition due to dilapidation. The main factors influencing the time it takes for a building to reach the maximum permissible physical wear and tear are: the quality of the building materials used; frequency and quality of repair work; quality of technical operation; quality of design solutions during major repairs; period of non-use of the building; population density.

BP 2.0 Acceptance for accounting of fixed assets (land plot)

Good afternoon. Please tell me. There was 1 large plot of land (accepted for registration, write-off of fixed assets was entered (according to the inventory, this plot was written off). Next, this plot was divided into 5 plots, Registration of the land plot was entered (all data was filled out), then it is necessary to Accept these land plots for accounting (we create a document Acceptance for accounting of fixed assets according to inventory, select the required land plot, on the BU tab we indicate the accounting procedure - Cost is not repaid, method of receipt Other, accounting account 01.01, on the Tax accounting (USN) tab The procedure for including the cost in expenses (USN) - indicate Not include in expenses. But when posting the document, it displays a message. In the field “Procedure for including cost in expenses:” on the “Tax Accounting” tab, the value is set to “Cost is not included in expenses” Posting the document: Acceptance for accounting OS 00000000002 dated 10/29/2014 12 :00:01 (Based on inventory results) The value of the attribute “Cost (amount of expenses of the simplified tax system)” is not filled in! The value of the attribute “Useful life of the simplified tax system, months” is not filled in!” The document is not posted. Please tell me if anyone knows what I'm missing, I seem to have checked all the settings and everything is filled out correctly. Thank you in advance.

Accounting and tax accounting of fixed assets using the simplified tax system: practical lesson

Let's consider the procedure for accounting and tax accounting of an organization's costs associated with the acquisition of real estate, and the procedure for documentation.

Description of the business situation

The organization applies a simplified taxation system with the object of taxation “income minus expenses” from the moment of registration with the tax authorities.

Under the purchase and sale agreement, the organization acquired non-residential premises worth RUB 5,750,000. and 12/100 shares in the right of common shared ownership of a land plot worth 500,000 rubles. The purchase and sale agreement is at the same time an act of acceptance and transfer of real estate (premises and shares in a land plot). With the contract, the seller provided the organization with a technical passport for non-residential premises and a cadastral passport for the land plot.

The agreement provides for the following payment procedure:

— 250,000 rub. on the day of signing the contract (02/27/2014) at the expense of the buyer’s own funds;

— 6,000,000 rub. at the expense of a bank loan no later than the working day following the day of receipt of documents on state registration of real estate objects.

The organization received a long-term loan from the bank for 5 years (2014 – 2021) in the amount of 6,000,000 rubles. at 12.25% per annum. The funds were transferred by the bank on March 12, 2014. Under the terms of the loan agreement, the organization pays the bank a commission for maintaining a loan account - 15,000 rubles. in the first month and 5,000 rubles. in the following months. Under the terms of the loan agreement, the organization entered into a guarantee agreement with a third party. The cost of drawing up a guarantee agreement was 40,800 rubles.

The organization's ownership rights to non-residential premises and a share in a land plot were registered in March 2014. During the state registration of real estate, the organization paid 15,000 rubles. for registering the premises and 15,000 rubles. for registration of a share in a land plot.

Tax accounting of real estate objects

According to paragraphs. 1 clause 1 art. 346.16 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), when determining the object of taxation “income reduced by the amount of expenses,” the taxpayer reduces the income received by expenses for the acquisition of fixed assets. In this case, the procedure for recognizing these expenses is regulated by paragraphs. 3 and 4 tbsp. 346.16, paragraph 2 of Art. 346.17 Tax Code of the Russian Federation:

— expenses are recognized from the moment fixed assets are put into operation;

— during the reporting period, expenses are accepted for the reporting periods in equal shares;

— the cost of fixed assets is accepted at the original cost, determined in the manner established by the legislation on accounting (for taxpayers applying the simplified taxation system from the moment of registration with the tax authorities);

— fixed assets, the rights to which are subject to state registration, are taken into account in expenses from the moment of the documented fact of filing documents for registration of these rights;

— fixed assets for tax purposes include fixed assets that are recognized as depreciable property in accordance with Chapter. 25 Tax Code of the Russian Federation;

— expenses for the acquisition of fixed assets are recognized on the last day of the reporting (tax) period in the amount of amounts paid.

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation with depreciable property for the purposes of Ch. 25 of the Tax Code of the Russian Federation recognizes property that is owned by the taxpayer, used by him to generate income and the value of which is repaid by depreciation. Property with a useful life of more than 12 months and an original cost of more than 40,000 rubles is recognized as depreciable.

At the same time, according to paragraph 2 of Art. 256 of the Tax Code of the Russian Federation, land is not subject to depreciation.

According to clause 8 of the Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01), approved. By order of the Ministry of Finance dated March 30, 2001 No. 26n, the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization’s actual costs for acquisition, construction and production, with the exception of taxes reimbursed from the budget. The actual costs of acquiring fixed assets are, in particular:

- amounts paid to the seller;

— state duty paid in connection with the acquisition of fixed assets;

— other costs directly related to the acquisition of fixed assets.

Conclusion

For tax purposes, expenses for the acquisition of a share in a land plot are not recognized due to the fact that the land plot is not depreciable property.

Note. Expenses for the acquisition of a land plot (share in a land plot) are recognized if it is sold by the taxpayer.

Expenses for the acquisition of non-residential premises are recognized in the amount of its original cost, which is added up as follows:

— price under the purchase and sale agreement – RUB 5,750,000;

— state fee for registering an object – 15,000 rubles;

— fee for the guarantee agreement – 40,800 rubles.

Total initial cost of non-residential premises is RUB 5,805,800.

Note. Payment for a guarantee agreement refers to expenses directly related to the acquisition of a fixed asset, since the condition of payment under a purchase and sale agreement is the attraction of credit funds, and the fundamental condition of the loan agreement is the conclusion of a guarantee agreement.

Based on the terms of the contract, payment of the second part of the contract price is made the next day after state registration of the organization’s right to non-residential premises. Registration was carried out in March 2013. Accordingly, when calculating the tax base, the organization has the right to include in expenses the costs of purchasing non-residential premises in the amount of its original cost in the following order:

— 03/31/2014 – RUB 1,451,450;

— 06/30/2014 – RUB 1,451,450;

— 09/30/2014 – RUB 1,451,450;

— December 31, 2014 — RUB 1,451,450.

These expenses are reflected in Section II of the Book of Income and Expenses of Organizations and Individual Entrepreneurs Applying the Simplified Taxation System, approved. by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n. The amount of expenses specified in section II is transferred to section I on the last date of the month of the corresponding quarter (in the amount of the quarterly amount).

Costs of paying state duty in connection with the acquisition of land

According to paragraphs. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation, when determining the object of taxation “income reduced by the amount of expenses,” the taxpayer reduces the income received by the amount of taxes and fees paid in accordance with the legislation on taxes and fees. In tax accounting, expenses for paying taxes and fees are recognized in the amount actually paid by the taxpayer (clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation).

The letter of the Ministry of Finance of the Russian Federation dated September 6, 2005 No. 03-11-04/2/64 states that, in accordance with clause 10 of Art. 13 of the Tax Code of the Russian Federation, state duty refers to federal taxes and fees.

Conclusion

Due to the fact that, according to the rules of Chapter 26.2 of the Tax Code of the Russian Federation, land plots (shares in them) are not accepted for accounting as fixed assets, then accordingly their initial value for tax purposes is not formed.

Taking into account the fact that the share in the land plot under non-residential premises was acquired for business activities, the organization has the right to include in the expenses the state duty paid upon state registration of the share in the land plot on the date of payment of the state duty.

Loan interest

According to paragraphs. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation, when determining the object of taxation “income reduced by the amount of expenses,” the taxpayer reduces the income received by interest paid for the provision of funds (credits, borrowings) for use. These expenses are taken into account at the time of repayment of debt to the bank by writing off funds from the taxpayer’s current account (clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

At the same time, according to paragraph 2 of Art. 346.16 of the Tax Code of the Russian Federation, these expenses are accepted in the manner prescribed by Art. 269 of the Tax Code of the Russian Federation.

According to clause 1.1 of Art. 269 of the Tax Code of the Russian Federation from 01/01/2011 to 12/31/2014. the maximum amount of interest recognized as an expense for tax purposes is assumed to be equal to the interest rate established by agreement of the parties, but not exceeding the refinancing rate of the Central Bank of the Russian Federation, increased by 1.8 times, when issuing a debt obligation in rubles.

Clause 1 of Art. 269 of the Tax Code of the Russian Federation establishes that in relation to debt obligations that do not contain a condition on changing the interest rate during the entire term of the debt obligation, the refinancing rate of the Central Bank of the Russian Federation in effect on the date of raising funds is accepted.

According to paragraph 1 of Art. 269 of the Tax Code of the Russian Federation (as amended by Law No. 420-FZ dated December 28, 2013) from January 1, 2015, interest on debt obligations will be recognized in the amount of the actual rate established by the agreement.

Conclusion

In 2014, when determining the tax base, an organization has the right to include in expenses the interest actually paid to the bank under the loan agreement, but not more than the maximum amount.

As of the date the organization attracted a loan (03/12/2014), the refinancing rate of the Central Bank of the Russian Federation was set at 8.25% per annum. Accordingly, the maximum interest rate is 14.85% (8.25% x 1.8), which exceeds the interest rate under the agreement (12.25% per annum). Thus, in 2014, the Company has the right to include in expenses the interest actually paid to the bank in full.

In connection with the abolition of the limit from 2015, the Company will also be able to include in expenses for tax purposes the interest paid to the bank on the loan in full.

Interest on the loan is included in expenses on the date of their transfer to the bank.

Loan account servicing costs

According to paragraphs. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation, when determining the object of taxation “income reduced by the amount of expenses,” the taxpayer reduces the income received by expenses associated with payment for services provided by credit institutions.

According to paragraph 3 of Art. 5 of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities”, banking operations include the opening and maintenance of bank accounts for individuals and legal entities.

Conclusion

Expenses for maintaining a loan account are taken into account as expenses for tax purposes on the date of their payment.

Real estate accounting

According to clause 17 of PBU 6/01, the cost of fixed assets is repaid by calculating depreciation over the useful life. In this case, land plots are not subject to depreciation.

According to clause 4 of PBU 6/01, the useful life is the period during which the use of an item of fixed assets brings economic benefits (income) to the organization. The useful life is determined by the organization when accepting the object for accounting (clause 20 of PBU 6/01).

The useful life of an item of fixed assets is determined based on (clause 20 of PBU 6/01):

— the expected period of use of this object in accordance with the expected productivity or capacity;

— expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, and the repair system;

— regulatory and other restrictions on the use of this object (for example, rental period).

Conclusion

To accept acquired real estate for accounting, you must formalize:

- unilateral act of acceptance and transfer of non-residential premises (form No. OS-1a);

— a unilateral act of acceptance and transfer of a share in a land plot (form No. OS-1);

— order from the manager to accept non-residential premises and shares in the land plot for accounting purposes.

The acts and orders should indicate:

- initial cost of non-residential premises - 5,805,800 rubles;

— useful life of non-residential premises;

— the initial cost of the share in the land plot is 515,000 rubles. (price under the purchase and sale agreement is 500,000 rubles and state duty is 15,000 rubles).

Note! For accounting purposes, there is no rule for determining the useful life taking into account the period of actual operation of the fixed asset by the previous owners of PBU 6/01. The organization establishes the useful life of an item of fixed assets independently based on the expected period during which the organization intends to operate the specified fixed asset, as well as taking into account its physical wear and tear. At the same time, the application of the Classification of fixed assets included in depreciation groups for profit tax purposes is not mandatory for accounting purposes (clause 1 of the Decree of the Government of the Russian Federation dated January 1, 2002 No. 1).

Useful life

The useful life of a land plot is not established, since this asset is a non-wearable asset.

In fact, the land can be used indefinitely.

Its value may change as a result of changes and improvements.

In tax accounting for fixed assets, SPI is established in accordance with the depreciation group to which the fixed asset belongs.

However, land plots and other environmental management facilities are not included in any of the existing depreciation groups; therefore, the useful life of land is not established in tax accounting.

Is it necessary to install SPI for buildings and structures?

Depreciation charges in accounting

In accordance with paragraph 17 of PBU 6/01, for fixed assets whose consumer characteristics do not change as they are used, depreciation does not need to be charged.

It also explains that such assets include various environmental management facilities, museum exhibits and collections, as well as land plots.

Consequently, in accounting, depreciation is not charged on land.

It's logical. If an object does not lose its properties, does not wear out and can be used constantly, then there is no point in writing off such an asset through depreciation charges.

There is no direct prohibition on establishing a useful life for land in the PBU.

Theoretically, the owner can set SPI for the site, but there will be no point in it, since this parameter is only necessary to determine depreciation charges, which are not necessary for the land.

Even if a period is set, depreciation on land plots does not need to be calculated in accounting. If there are various objects located on the site, then depreciation in respect of them is calculated in accordance with the generally established procedure.

Leased plots are also not subject to depreciation and are accounted for in off-balance sheet account 001.

Is it calculated in tax accounting?

Tax accounting provisions are completely consistent with accounting ones.

Moreover, the Tax Code of the Russian Federation does not even make it possible to establish a useful life for land, since it does not classify this asset into any depreciation group.

Clause 2 of Article 256 of the Tax Code of the Russian Federation clearly states that depreciation is not charged on land assets.

The same statement is true for all natural resources.

Consultations

Consultations

- Accounting Consulting

- Asset accounting

- Cash

- Depreciation

- Decommissioning of OS

- Short-term financial investments

- Accounts receivable

- Reserves

- fuels and lubricants

- Long-term assets held for sale

- Other current assets

- Real Estate Investments

- Fixed assets

- Buildings, structures

- Earth

- Vehicles

- Biological assets

- Intangible assets

- Deferred tax assets

- Other long-term assets

- Accounting policy

- Accounting for liabilities

- Short-term financial liabilities

- Tax liabilities

- Obligations for other mandatory and voluntary payments

- Short-term accounts payable

- Short-term estimated liabilities

- Other current liabilities

- Long-term financial liabilities

- Long-term accounts payable

- Accounting for capital and reserves

- Authorized capital

- Reserves

- Retained earnings (uncovered loss)

- Total profit (total loss)

- Income accounting

- Income from sales of products and provision of services

- Income from financing

- Other income

- Expense accounting

- Cost of products sold and services provided

- Expenses for sales of products and provision of services

- Administrative expenses

- other expenses

- Accounting for currency transactions

- Accounting for exchange rate differences

- Accounting for deferred taxes

- Application of financial reporting standards

- Questions about 1C

- Questions about IS SONO

- Tax questions

- Corporate income tax (CIT)

- Taxable income

- Advance payments under CIT

- Total annual income

- Non-taxable amount of total annual income

- Adjustment to total annual income

- CIT deductions

- Deductions for fixed assets

- Investment tax preferences

- Adjustment of income and deductions

- Losses

- The procedure for calculating and terms of payment of CIT

- CIT withheld at source of payment

- Tax rates, tax period and tax return (form 100.00, 130.00, 150.00)

- Reduction of taxable income and exemption from CIT for certain categories of taxpayers

- Taxation of organizations in SEZs

- Individual income tax (IIT)

- IIT payers

- Taxation of income of a foreigner who is a resident of the Republic of Kazakhstan

- Taxation of income of non-resident individuals

- Objects of taxation

- Income not subject to taxation

- Tax rates, tax period, payment deadlines

- Income taxed at source of payment

- Application of tax deductions

- Income not taxed at source of payment

- Personal income tax declaration (TNF 200.00, 201.00, 210.00, 220.00, 240.00)

- Features of international taxation

- Taxation of income of non-resident legal entities operating without establishing a permanent establishment in the Republic of Kazakhstan

- Taxation of income of non-resident legal entities operating in the Republic of Kazakhstan through a permanent establishment

- Taxation of income of non-resident individuals

- Application of international treaties

- Taxation of income of residents from foreign economic activity (FEA)

- Value added tax (VAT)

- VAT payers and objects

- Taxable turnover VAT

- Taxable import VAT

- Turnover and imports exempt from VAT

- VAT credit

- Invoice

- Procedure for calculating and paying VAT, TNF 300.00

- Relationships with the budget regarding VAT

- VAT in the Customs Union (CU)

- VAT for non-residents

- Excise taxes

- Royalty

- Taxation of subsoil users

- Bonuses

- Payment for reimbursement of historical costs

- Mineral extraction tax

- Social tax (social tax)

- Social tax payers

- Calculation, payment and presentation of tax reporting for social tax by payers using SNR

- Object of taxation and social tax rates

- The procedure for calculating and paying social tax

- Tax period and social tax return

- Vehicle tax

- Land tax

- Property tax

- Gambling tax

- Flat tax

- Individual entrepreneur in the generally established mode (URM)

- Special tax regimes (STR)

- SNR based on patent

- SNR based on a simplified declaration

- SNR for peasants or farms

- SNR for legal entities - agricultural producers. products, aquaculture products (fish farming) and rural consumption. cooperatives

- Non-tax payments

- Mandatory pension contributions (CPC)

- Mandatory social contributions (social contributions)

- Questions about the customs union

- Labor issues

- Changes to the Tax Code

- Consultations with tax authorities

- Tax administration

- Tax audits

- Procedure for using KKM

- Registration of taxpayers with tax authorities

- Accounting for the fulfillment of tax obligations, obligations for the transfer of social tax benefits, and the payment of social contributions

- Financial assistance, loans

- financial leasing

- Ministry of Labor

- Letters from the Tax Code of the Ministry of Finance of the Republic of Kazakhstan

- Statistical reporting

- November 30 Do obligations arise to pay CIT and submit TNF 101.04 when purchasing an air ticket from a foreign airline?

An employee of a LLP (EUR, VAT payer, resident of the Republic of Kazakhstan) purchased a ticket on the Chocotravel website from a non-resident carrier UZBEKISTAN AIRWAIS in the amount of 61,919 tenge (payment by card) for a business trip to Tashkent on September 27, 2021. Fuss… - November 30 Does an individual entrepreneur have tax obligations in connection with the purchase of a forklift?

An individual registered as an individual entrepreneur (SNR on UD) in 2018 plans to purchase a forklift. What obligations may an individual entrepreneur have in this regard? - November 30 Is a LLP subject to registration as a taxpayer engaged in electronic trading of coupons (QR codes)?

The LLP operates by selling coupons (QR codes) with promotions and discounts to individuals and legal entities using information technology through the Internet platform. Registration of transactions for the sale of coupons (QR codes) is carried out… - November 30 When writing off an old car, do you have an obligation to pay a recycling fee?

The joint-stock company decided to write off the old car due to its unusability and sell it for scrap. You must pay a disposal fee. Are there any fees or duties in the Republic of Kazakhstan for deregistration and disposal of cars, in what regulations? - November 30 Does the CGP for PVC have the right to include the contractual penalty in its income?

KGP at PVC entered into an agreement for the supply of goods under government procurement, the supplier did not deliver the goods on time, and therefore a penalty was withheld according to the agreement. The KGP for RVC must transfer these funds to budget revenue or have the right to leave it in the revenue... - November 30 Does the servicing bank have the right to demand from the LLP a report on the use of cash?

Does the bank have the right to demand from the LLP, which has a current account with this bank, reports on the cash that the LLP withdrew from its account with this bank? - November 29 Can a LLP, a VAT payer, sell goods to a second LLP, a VAT payer, at cost, without paying VAT and CIT?

Can a LLP, a VAT payer, sell goods to a second LLP, a VAT payer, at cost, without paying VAT and CIT? - November 29 How to bring fixed assets into compliance with the state classifier of fixed assets?

A letter came from the State Revenue Office about the need to bring fixed assets into compliance with the state classifier of fixed assets, namely, to revaluate fixed assets. How often is it necessary to revaluate fixed assets and revaluate... - November 29 How to determine turnover for VAT deduction (construction in progress, fixed assets)?

We are building our own base and office, and taking VAT as a credit on invoices. This year we will complete construction and buy this site, put it into operation, there are fixed assets on which depreciation is charged, at the end of the year we want to withdraw from VAT. For turnover… - November 29 Is it possible to add notes to cash receipt orders (RKO) with a pen?

According to the rules for conducting cash transactions, when issuing funds, the basis must be indicated. We have printed RKOs without indicating the reasons. Is it possible to add the basis for issuing funds with a pen? Wouldn't this be considered a...