What to do if you forgot to submit a document for sale?

Often, in the process of documenting transactions, some inconsistencies may occur, documents may not be drawn up or drawn up incorrectly, in such situations it is necessary to take additional actions in order to resolve this situation. Otherwise, tax deductions will not be received, since the main basis for this is a correctly drawn up document.

The transaction must be carried out in accordance with legal regulations . What to do if you forgot to post a document from the supplier in a timely manner?

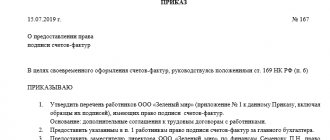

If a discrepancy or absence of an invoice is identified, it is necessary to immediately draw up this document in accordance with the rules and provide it to the buyer within 5 days from the date of its preparation.

The invoice must indicate the exact date of the transaction; in addition, a certificate of completion of work is drawn up, which, together with the invoice, is sent to the customer’s address. This act is also drawn up on the date of the actual transaction. Read more about whether an invoice and a work completion certificate are interchangeable here, and find out more about the rules for issuing a power of attorney for signing invoices and work completion certificates in this material.

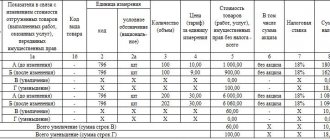

What to do after receiving a request containing error codes

The actions of the taxpayer in such a situation are presented in the figure:

It is important to remember that at each stage there are deadlines, failure to comply with which threatens the taxpayer (VAT tax agent) with fines and, in some cases, blocking of accounts.

The main deadlines are shown in the figure:

Another important point: from what date should these deadlines be counted? You need to focus on this order:

- The period is counted from the next day after the actual delivery of the demand (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

- For a claim received under the TKS, actual delivery is considered to be the day the inspector receives from the taxpayer a receipt for acceptance of the claim, signed by the UKEP (enhanced with a qualified electronic signature) - counting from the date specified in the receipt of acceptance (clauses 12–13 of the Procedure approved by the order Federal Tax Service of the Russian Federation dated 02/17/2011 No. ММВ-7-2/168, Article 19 of the Law “On Electronic Signature” dated 04/06/2011 No. 63-FZ).

Inspectors have a very effective and unfavorable tool for the taxpayer to force him to send a receipt for receipt of the claim on time - blocking the account (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

If it is not registered

Sometimes unplanned situations may occur that need to be corrected. So, if, nevertheless, the invoice arrived on time, but they forgot to register it in accordance with the rules, then this fact cannot be ignored.

If an unregistered invoice is found, it should still be entered into the sales book or purchase book for the period to which it relates. The question also arises in terms of the fact that the next reporting period has arrived and what to do now? How to post a document for the previous period? You can register an invoice even in the upcoming reporting period .

There are no fines or other sanctions for this from the tax authorities. As for the seller in this matter, nothing will happen to him, neither good nor bad, from the fact that he did not exhibit or register this document on time.

As for the buyer, he may be denied VAT deduction. If the document is drawn up correctly and the actual date of the transaction is indicated, the chances that everything will go as expected are quite high.

Read more about the features of registering and storing invoices at an enterprise here.

How to conduct it if it arrives late?

Entrepreneurs who are VAT payers have the right to deduct this tax from the value of acquired property used in business. To implement this deduction, you will need correctly executed invoices from suppliers or contractors.

Any use of materials is permitted only with a hyperlink . If the invoice arrived later, then it must be registered in the reporting period in which the transaction took place.

The main feature that inspectors may not like is the violation of the numbering of documents in the purchase or sales book. But it is worth noting right away that this will not entail any undesirable consequences.

Can the document be accepted next quarter? Options for the development of events if the invoice arrives late :

- It can be accepted retroactively, but in this case the numbering of documents is violated. The buyer has a greater chance of receiving a VAT deduction.

- A document can be registered with the current date, but the deadlines for issuing such invoices are violated. Although there are no sanctions for such violations.

If the document arrived late, then you should try to contact the tax service in order to receive a tax deduction, but no one can give you a 100 percent guarantee that you will receive it.

Accounting press and publications

"Accountant's Advisor", 2007, N 2

INVOICES AND PRIMARY RECEIPTS ARE NOT ACCOUNTED ON TIME.

CAUSES AND CONSEQUENCES

In practice, buyers or customers often need to record invoices and primary documents with earlier dates, when VAT reporting and balance sheets have already been submitted. The accountant must take into account these documents that were received late due to various circumstances. In this regard, should you always submit an updated declaration and fill out additional sheets to the purchase books? Perhaps there is an opportunity to avoid unnecessary hassle and post all the information on these documents in the current period? How risky is this from a liability perspective?

We will try to bring to a common denominator the most common reasons for the late receipt of documents and understand the legal regulations to see if it is possible to resolve situations legally.

Let us immediately make a reservation that this material does not pose the task of taking into account the specifics of export VAT, since a special procedure applies for it and each case should be dealt with separately.

The Tax Code of the Russian Federation provides for mandatory conditions for claiming a deduction for acquisitions: acceptance of an object for accounting for VAT-taxable transactions and the availability of an invoice (clause 1 of Article 169, clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation).

The procedure for calculating tax in accordance with clause 4 of Art. 166 of the Tax Code of the Russian Federation provides that the total amount of tax is calculated based on the results of each tax period in relation to all transactions recognized as an object of taxation in accordance with paragraphs. 1 - 3 p. 1 tbsp. 146 of the Tax Code of the Russian Federation, the moment of determining the tax base of which, established by Art. 167 of the Tax Code of the Russian Federation, refers to the corresponding tax period, taking into account all changes that increase or decrease the tax base in the corresponding tax period.

Based on this rule, which prescribes the procedure for calculating VAT (if all conditions are met), the taxpayer’s right to apply tax deductions for VAT, taking into account all changes, is limited to the framework of the corresponding tax period (month or quarter). The use of a deduction is precisely a change that reduces the tax base in the corresponding tax period, therefore, the inclusion in the current declaration of VAT amounts relating to earlier tax periods is illegal.

Chapter 21 of the Tax Code of the Russian Federation does not contain a ban on the use of deductions in the next period. The deduction procedure is an intermediate link in the VAT calculation chain (one of the actions of the taxpayer), and the permissible period for the return (offset) of overpaid taxes is three years (Section IV of the Tax Code of the Russian Federation “General rules for the fulfillment of the obligation to pay taxes and fees”, clause. 8 Article 78). This is confirmed by the Federal Antimonopoly Service of the West Siberian District in its Resolution dated September 28, 2005 in case No. Ф04-6655/2005-12-14. However, it should be noted that the right to use a deduction for three years does not mean that the payer has the right to violate the procedure for calculating VAT provided for in the Tax Code of the Russian Federation and include in the declaration of the current period the amounts of deductions related to previous tax periods. The requirement to comply with the procedure for submitting updated declarations for the relevant period remains.

The reasons for untimely reflection of information in the declaration can be different, including in the form of an error identified by the taxpayer independently, for example, unaccounted invoices or primary documents were discovered.

In particular, in accordance with paragraph 1 of Art. 54 of the Tax Code of the Russian Federation, if errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods, in the current (reporting) tax period, recalculation of tax liabilities is carried out in the period of the error.

In accordance with the conclusion made in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/07/2005 N 1321/05, a taxpayer who has discovered facts of non-reflection (incomplete reflection) of information in a previously filed declaration has the right to make the necessary changes and additions to the declaration of the tax period to which the transactions relate and payments for them.

If all the conditions for VAT offset in one tax period are met, obtaining a deduction in the next tax period is possible by submitting an updated tax return (Article 81 of the Tax Code of the Russian Federation) for the period when the right to deduction initially arose. According to paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, if a taxpayer discovers in the tax return submitted by him that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of tax payable to the budget, the taxpayer is obliged to make the necessary additions and changes to the tax return.

Within the meaning of Art. 88 of the Tax Code of the Russian Federation, in order to confirm the buyer’s deduction, it is possible to correct the error by submitting a re-issued invoice by the supplier (attention is drawn to this in the Determination of the Constitutional Court of the Russian Federation dated July 12, 2006 N 267-O).

If we use the text of the preamble to the Rules (PP N 914), then the purpose of preparing additional sheets for books is the need to make changes to them. On the other hand, paragraphs 7 and 28 of the Rules talk about correcting errors in invoices of previous tax periods. In terms of the content of the requirements for the preparation of additional sheets, these practically exclusively include supplier errors in invoices - everything is spelled out very clearly here.

However, there is nothing in the Rules regarding errors due to internal reasons in past periods and discovered later, for example related to:

- with accountant errors (when posting purchases from correct invoices to the ledger - any incorrectly indicated amounts that affected the calculation of the tax base);

— with erroneous repetitions of previously entered data on the invoice (extra entry);

- either with the discovery of primary documents relating to the past period;

- with untimely transfer of the primary document by the person responsible for such transfer.

In fact, there may be more reasons for errors. The Rules do not disclose what to do with them, so officials interpret in the explanations that in all cases when updated declarations are needed, additional sheets should be filled out (Letter of the Federal Tax Service of Russia dated September 6, 2006 N MM-6-03 / [email protected] ). A careful accountant is forced to extend the Rules to almost any error.

Reasons for late reporting of deductions

Let's look at the most common reasons for late reflection of deductions:

— existing invoices and primary documents are not taken into account;

— an error was identified in the reflection (posting) of the transaction amount and (or) the purchase book;

— documents from the counterparty were received late;

— corrected documents were received from the counterparty for the previous period;

— there were no taxable turnovers, so the deduction was not claimed (it was non-taxable).

Conditionally generalizing the nature of the reasons, we can identify their dependence on the following factors:

- for internal reasons in the organization;

— for external reasons (due to the fault of suppliers, delivery services, mail);

- due to the lack of clear rules in the Tax Code of the Russian Federation (waiting for a tax base for deductions).

Internal reasons in the organization. What could be the internal reasons in an organization why invoices and primary documents received on time are not taken into account? There can be a lot of such reasons, and they are related to the organization of internal control, for example, compliance with the internal document flow schedule (if it exists at all), irregularity of reconciliations, etc.

For example, unaccounted documents were discovered when reconciling the journal of incoming invoices (or the journal of incoming correspondence) with the purchase book, that is, timely reconciliation of the organization’s internal registers was not established. Or there was a failure in the electronic processing of information from the internal control system.

Another reason may be the untimely reporting of the person responsible for any acquisition for the organization due to various circumstances, as a result of which the documents do not reach the accounting department on time.

Accounting is carried out by a third-party company, which does not timely receive documents from the persons responsible for such transfer.

It may also be that the accountant mistakenly reflected in the accounting figures other than those reflected in the actual documents.

Such reasons lead to the untimely receipt of documents related to the procedure for claiming the right to deduct VAT. In turn, this entails a distortion of the tax base of past periods, for which corrections should be made by submitting updated tax returns (Article 81 of the Tax Code of the Russian Federation), and in addition, filling out additional sheets of purchase books. Moreover, the organization’s working capital is diverted until the clarification period.

Are such demands justified for any of these reasons? In our opinion, yes. It is clear that no one is immune from an error, but it is necessary to correct it and take measures to prevent further occurrences.

Consequences in the example.

Example 1. In December, unaccounted invoices and acts for services rendered, dated April and May 2006, were discovered. What date should VAT be taken into account? Do I need to fill out additional sheets and submit updated declarations?

Solution. In this case, the organization must fill out additional sheets for the purchase books for April and May, as well as submit an updated VAT return for the same months.

Consequences. The tax inspectorate may regard the fact of untimely inclusion of a deduction in the VAT return for December as a tax offense, which led to an overstatement of the amount of deductions in April and May, respectively, to an understatement of the amount of tax payments in December. The fact of distortion of the tax base in two tax periods is obvious. If tax officials identify these amounts as deductible in the December 2006 return, there is a risk that these amounts will be excluded from the deduction totals. However, to receive a deduction for April and May 2006, you will still need to submit an updated declaration.

External reasons for corrections (independent of the organization) are associated with sellers making various corrections to invoices, as well as with the case of their cancellation.

If the failure to include deductible amounts in previously submitted declarations occurred due to late submission of documents from the seller (supplier, customer), post office, courier service, then the organization has every right to claim a deduction only in the current month, since in the absence of these documents from the service provider, the organization was not entitled to claim a deduction. However, to do this, the fact of late receipt of documents must be confirmed.

For example, there is documentary evidence of the late submission of documents by the supplier (there is a line in the incoming correspondence journal with the date of actual receipt of documents by mail or via courier, or an entry in the journal of received invoices).

Tax Code and official clarifications (Letters of the Ministry of Finance of Russia dated June 23, 2004 N 03-03-11/107, dated November 10, 2004 N 03-04-11/200, dated 02/08/2005 N 03-04-11/23, dated 16.06 .2005 N 03-04-11/133, dated 09.30.2005 N 03-04-11/253, Letter of the Ministry of Taxes and Taxes of Russia dated 13.05.2004 N 03-1-08/1191/ [email protected] ) confirm that according to this For this reason, there is no need to submit updated declarations, since until the documents were received by the organization, there was no right to deduction. Consequently, there is no need to compile additional sheets.

Another external reason is the supplier (seller) making corrections to the invoice, for which a deduction has already been declared and there is an entry in the purchase book, but this case leads to a change in the VAT tax base of the previously declared tax period.

There were several opposing opinions on this issue. It would seem that this situation does not depend on the buyer, however, in this case, according to officials (with reference to clause 14 of the Rules approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914), the tax return should be clarified, and therefore an additional sheet for the corresponding period (Letters of the Federal Tax Service of Russia dated 09/06/2006 N MM-6-03/ [email protected] , Ministry of Finance of Russia dated 09/21/2005 N 07-05-06/252).

Another position was that the indicators of the corrected invoice are reflected in the tax return for the current tax period (as of the date of the changes) (Letter of the Ministry of Taxes and Taxes of Russia dated May 13, 2004 N 03-1-08/1191/ [email protected] , FAS Resolution Central District dated February 28, 2005 N A08-11030/03-20).

The law does not contain a prohibition on correcting an invoice by re-issuing the correct one. Making corrections to invoices that did not affect the amount of VAT to be refunded cannot be grounds for refusing such compensation, especially since Art. 169 and other articles of Ch. 21 of the Tax Code of the Russian Federation there is no prohibition on making changes to incorrectly executed invoices or replacing such an invoice with a document drawn up in accordance with current standards (Resolution of the Federal Antimonopoly Service of the North Caucasus Region of March 31, 2004 N F08-1168/2004-459A).

In cases of corrections to invoices, the changes made to the Rules clearly define the mandatory completion of additional sheets and clarification of previously submitted declarations, regardless of the essence of the defect made in them. This once again emphasizes the need to control the content of invoices received.

However, if there is no change in the digital indicators (subclauses 6 to 12 of clause 5 of Article 169 of the Tax Code of the Russian Federation), then one should not forget about the possibility of correcting the invoice for the same period when the deduction was claimed (clause 29 of the Rules), - such a correction will save you from filling out an additional sheet and an updated declaration. You can also agree with the counterparty to replace the invoice if shortcomings are discovered in its design, but the numbers have not changed.

If you receive an incorrectly executed invoice (clauses 5 and 6 of Article 169 of the Tax Code of the Russian Federation), it is better to immediately return it to the supplier for correction without registering it in the purchase book (see clause 14 of the Rules). This way, the accountant will save himself from the hassle of additional sheets and updated declarations.

Disagreements in the interpretation of norms for implementation

VAT deduction in the Tax Code of the Russian Federation

We support the position of payers who claim a deduction upon the occurrence of the relevant mandatory conditions (purchase for taxable transactions, receipt of primary documents on the acceptance of acquisitions and invoices for accounting, and for periods before January 1, 2006 - confirmation of the fact of payment) regardless of the presence or absence taxable base. However, officials are on the defensive to protect another condition arising from the tax calculation procedure - the presence of taxable turnover, although the Tax Code of the Russian Federation does not contain such a condition for exercising the right to deduction.

Judging by official explanations, in the absence of taxable turnover, the payer does not have the right to claim VAT for deduction (in particular, Letters of the Ministry of Finance of Russia dated 02/08/2006 N 03-04-08/35, dated 02/08/2005 N 03-04-11/23, Federal Tax Service of Russia dated November 1, 2004 N 03-1-09/2248/16, Federal Tax Service for Moscow dated November 19, 2004 N 11-11н/74691) - you must wait for the period when the turnover will be subject to VAT.

Well, it would only be necessary to have a sale or an advance payment, but taxable turnover is also needed. What if, in certain tax periods, the organization carries out only VAT-free transactions? What to do with the deduction in this case?

This case is connected not so much with the procedure for timely application of the deduction, but with the lack of clear rules regarding separate accounting.

Guided by the explanations, the payer, having no taxable turnover this month, did not declare the amount to be deducted for acquisitions. At the same time, he assumed that in the next period there would be some kind of tax base (even the most minimal) or an advance payment. However, this did not happen. Instead of the expected taxable transactions, a non-taxable transaction was actually carried out - the cost of shipment amounted to 100% of the non-taxable turnover. According to the rules of separate accounting, the deduction should not be declared this month, and the amount of VAT on acquisitions should be taken into account in the cost of these acquisitions (clause 4 of Article 170 of the Tax Code of the Russian Federation). However, the Tax Code of the Russian Federation does not provide instructions on the future fate of “deferred” deductions.

What to do with the calculated deduction amounts in the previous month? Again, leave them to await taxable turnover? What if next month there will be only non-taxable turnover again? It turns out that this way you can postpone the deduction indefinitely...

Arbitration practice is developing in favor of deduction claims by payers, regardless of the formation of the tax base (FAS Central District dated 05/03/2006 N A09-15939/05-13, dated 04/20/2006 in case N A68-AP-664/11-05; FAS North- Western District dated 09/08/2006 in case N A56-26599/2005, dated 07/17/2006 in case N A56-27459/2005, dated 02/06/2006 N A05-13369/2005-10, dated 06/13/2006 in case N A56- 19189/2005; FAS Moscow District dated August 10, 2006 N KA-A40/6470-06 in case N A40-75611/05-4-343 and many others).

There are two solutions - either include the deduction amounts in costs, or the “deferred” deduction will await taxable turnover. Both of these options turn out to be extremely unprofitable for the payer - in any case, the payer’s finances suffer and working capital is diverted.

If such a case arises, it is better to have the risk of a dispute than to bear the entire VAT on your costs. The only way out is to submit an updated declaration.

Let's present the options with an example.

Example. In November, the amount of VAT on the organization’s acquisitions amounted to 1,000 rubles. Primary documents and invoices are available. There were no taxable transactions. In December, the organization provided a cash loan to another organization in the amount of 100,000 rubles, which is a VAT-free transaction (clause 15, clause 3, article 149 of the Tax Code of the Russian Federation). There were no other operations. VAT on November purchases amounted to RUB 5,000.

Based on legal requirements, in any case, 5,000 rubles. — VAT for December — taken into account in the cost of acquisitions accepted for accounting. How to deal with November deductions when filling out declarations?

1st solution for November deductions. The payer submitted the return for November without claiming a deduction. Deferred VAT deduction for November - 1000 rubles. — according to the tax authorities’ method, it continues to expect taxable turnover and is not reported in December. In this case, 1000 rubles. diverted from circulation by the payer.

In May 2006, the Presidium of the Supreme Arbitration Court of the Russian Federation adopted Resolution No. 14996/05 dated May 3, 2006, which states that “the norms of Chapter 21 of the Code do not establish the dependence of tax deductions on purchased goods (works, services) on the actual calculation of tax for specific transactions, for implementation of which these goods (works, services) were purchased. The sale of goods (work, services) for specific transactions in the same tax period is not, by force of law, a condition for the application of tax deductions.” In future, in similar situations, this conclusion of the high court will inevitably be taken into account.

Consequently, if any arbitration court makes a negative decision in a similar situation, then when the payer appeals to the highest authority of the Supreme Arbitration Court of the Russian Federation, the final decision will be made in his favor.

2nd solution for November deductions. The payer submitted a declaration for November, declaring a deduction of 1000 rubles.

Conclusion. With this option, guided by current legislation and relying on the results of arbitration disputes, the payer of the November declaration may be exposed to risks, but with a fairly higher probability of winning.

If the organization acted according to the first option, then it can be corrected by submitting an updated declaration (and filling out additional sheets) for November, based on the arguments given above.

Thus, if all the conditions for deducting VAT are met in one tax period, the payer has the right to claim a VAT deduction in the next (later) period, without including these deductions in the next (current) declaration, but on the basis of an updated tax return for the corresponding tax period. The moment of exercising the right to deduct VAT refers to the period when such a right arose in accordance with the established deduction procedure, that is, this moment is not automatically transferred. The right to deduction should be used specifically in the corresponding tax period.

The right to a deduction in the next period cannot depend on the payer’s desire to transfer the deduction to the future, but depends on the validity of the reasons why this deduction was not included in the declaration in a timely manner. In this case, the taxpayer retains the right to deduction for three years and can be exercised by submitting an updated declaration for the corresponding tax period in accordance with Art. 81 Tax Code of the Russian Federation.

It remains only to add that liability for incorrect maintenance of purchase books, and therefore for their parts in the form of additional sheets (clause 7 of the Rules), is not provided. FAS NWO, in its Resolution dated June 26, 2006 in case No. A56-41248/2005, rejected the inspector’s argument that the company does not have the right to apply a tax deduction due to the fact that the company made a technical error (misprint) in the purchase book: it indicated an invoice instead of a genuine one non-existent from the same date. The same FAS, in Resolution dated December 5, 2003 N A56-36851/02, came to the conclusion that a violation of the Rules for maintaining journals of received and issued invoices, books of purchases and sales when calculating VAT in terms of maintaining books of purchases and sales and journals registration for them is not a basis for refusal to apply VAT deductions.

However, if errors are discovered that lead to an underestimation of the tax amount, the taxpayer is obliged to make the necessary changes to the tax return (clause 1 of Article 81 of the Tax Code of the Russian Federation). Otherwise (if clarification is not made), such inaction may be regarded as a gross violation of the rules (Article 120 of the Tax Code of the Russian Federation). In this case, incorrectly filling out invoices is actually equivalent to its absence.

The payer must proceed from specific circumstances, given that the invoices are prepared by the supplier, which casts doubt on the inspectors’ conclusions about the taxpayer’s fault. In particular, the Federal Antimonopoly Service NWO, in Resolution No. A56-20715/02 dated January 23, 2003, indicated that the presence of invoices improperly executed by the supplier, which resulted in incorrect reflection of tax amounts in the accounting accounts, does not constitute a tax offense under Art. 120 Tax Code of the Russian Federation.

Embankment

Tax expert

LLC Auditing and Consulting Group "AIS"

Signed for seal

01.02.2007

————

What will happen if there is no paper?

In accordance with Article 168 of the Tax Code, paragraph 3, an invoice must be drawn up within five days from the date of the purchase and sale transaction. If the listing does not occur, then it turns out that the seller is violating the law, although as for sanctions for this violation, they are not provided.

The best option is to detect the discrepancy in the same reporting period. If the absence of a document is discovered later, problems will arise with VAT deductions . The seller will suffer much less here.

For more details about why an invoice is needed for both sellers and buyers, read this material.

What to expect when applying “retroactively”?

If you forgot about the invoice and remembered it in the next quarter, then it is advisable to post the document “backdated” so as not to violate the invoicing procedure. The legislation does not provide for a procedure for dealing with such violations, so management must determine it in the accounting policies of the enterprise. If the document is not received on time, the buyer risks more than the seller.

For backdating registration, the seller only faces a violation of tax laws, for which there are no sanctions. The buyer will have to fight for his right to receive tax deductions, right up to court proceedings.

There are more materials about invoices on our website:

- What is a power of attorney to sign and how to issue it?

- Features of filling out and submitting an invoice for KS-2 and KS-3 and sample documents.

- Who issues the document?

- What is the difference between an invoice and an invoice?

- What is an invoice and an invoice, what is the difference between these documents, and how to fill them out?

- Is it possible to accept a zero invoice?

- What is an invoice and a universal transfer document?

- In what cases and when are invoices and delivery notes issued?

- Is there a stamp on the document?

In case of what errors should an updated VAT return be submitted?

The VAT reporting has been submitted, it seems that you can relax... However, not all accountants can breathe a sigh of relief - some of them will have to make changes to the reporting. This is usually a consequence of the fact that errors were identified in the submitted declaration, or documents from the counterparty relating to previous periods were received late.

In this article we will look at cases when it most often becomes necessary to resort to filing an amended VAT return, as well as how to do this and avoid possible sanctions.

Tax legislation requirements

Based on Article 81 of the Tax Code of Russia, an organization is required to submit an updated declaration only if errors and unreported data discovered after filing reports lead to an underestimation of the tax amount .

If the primary declaration contains unreliable or incomplete information that does not lead to an underestimation of the tax amount, then the taxpayer is not required to submit an “adjustment”, although he has the right to do so.

What threatens a company or entrepreneur who has filed an updated declaration? The mere fact of its presentation does not entail sanctions - it all depends on whether unreliable primary data caused an understatement of tax. If this is the case, then the arrears and penalties should be paid before submitting the “clarification”. In this case, according to paragraph 4 of Article 81 of the Tax Code of the Russian Federation, the taxpayer will be released from liability for incomplete payment of tax.