Travel documents

Proper registration of business trips guarantees the absence of problems with the tax service and compensation for the employee’s expenses for working days spent away from his permanent place of work.

Consultants of the portal 33urista.ru will tell you how to prepare travel documents and much more that you need to know about when an employee travels on business.

By the way, many people think that if your boss sends you on a business trip, then you have to go. In fact, if this is not specified in the employment contract, you are not obligated to go anywhere.

Economic feasibility of travel expenses

In letter No. 03-03-06/3/1456 dated January 15, 2021, the Ministry of Finance recalls that travel expenses are subject to reimbursement if the following conditions are simultaneously met:

- expenses are economically justified;

- expenses incurred are directly related to production (commercial activities);

- there is documentary evidence of costs.

As for the economic justification of travel expenses, the requirement is considered fulfilled provided that the amounts spent by the employee on accommodation do not exceed the market average, and the travel was carried out by economy class transport, taking into account the choice of the optimal route.

As a rule, control over living expenses is carried out through local regulations (Regulations on Business Travel), which fix expense limits (by city, region, employee category).

Travel expenses on a business trip are considered economically justified, provided that the employee got to his destination by the cheapest mode of transport. For example, for an employee who is going on a business trip from Krasnodar to Rostov-on-Don, the cost of travel by rail or bus will be economically justified. If an employee is sent from Krasnodar to Tyumen, then it is advisable to use air transport. Despite the fact that the cost of an air ticket will be higher than the price of a train ticket, the cost of air travel will be considered economically justified taking into account the time spent getting to the destination.

What is considered business travel?

First, let's figure out which business trips are recognized as business trips. These include the profile Regulations approved by the Decree of the Government of the Russian Federation dated October 13, 2008. No. 749, refers to the departures of workers:

- Carried out in pursuance of instructions from management. The employee is sent on a trip on the basis of a written order.їє

- Urgent in nature. The duration of a business trip is 1 or more days, determined by the importance and volume of the work to be done. The start of the trip is the day of departure from the locality, the end is the date of return.

- For the purpose of arriving in another locality located outside the permanent place of work. If the specifics of an employee’s work require constant travel, they are not considered business trips.

The parties must be bound by an employment contract and are referred to as employer and employee. If a person travels on the basis of a service agreement, this is not considered a business trip. Costs incurred will not be reimbursed. Contractual regulation of labor relations is a good way to understand any difficult situation at work.

Can any business trip be considered a business trip?

Not every business trip can be recognized as a business trip

The foundations of state regulation in the field of business trips are laid by the Labor Code - Art. Art. 166–168 contain the main features of a business trip, guarantee the employee the preservation of basic labor benefits, and regulate the main points of payment of expenses. In addition, the rules limiting the circle of persons in respect of whom secondment may be “forced” or even possible are contained in a separate section of the Labor Code - the twelfth (Articles 259, 268). The secondment procedure is described in more detail in Government Decree 749 of October 13, 2008.

So, a business trip is a business trip for an employee. However, not every business trip can be called this term. For example, it would be absolutely contrary to common sense to send an intercity bus driver on a daily business trip, whose work initially involves “cruising” between several populated areas. In the same way, it makes no sense to send an employee to a neighboring street to resolve official issues in another organization. And it would be completely illegal to send an employee to another city during working hours to carry out personal assignments for the manager.

Nevertheless, the law provides absolutely clear criteria for determining a business trip:

- The seconded person must have an employment relationship with the employer (for those working under a civil law agreement, the concept of “business trip” does not exist).

- Departure is carried out by order of the employer (as a general rule - without taking into account the opinion of the employee).

- The purpose of the trip is to perform some official task.

- The departure takes place outside the locality in which the business traveler’s place of work is located.

Place of work

The key concept for business trips is the place of work

A point that raises many questions in the practice of business trips is the determination of the place of work of the business traveler. At first glance, everything is simple - the place of work is easy to establish, literally reducing it to the building of the organization where the workplace is located. Difficulties often arise when an employee:

- permanently works in a branch, and not in the parent organization - in this case, the place of work is the branch, but this condition must be reflected in the employment agreement with the employee (clause 3 of Resolution 749) - the trip is a business trip;

- works in the parent company, and is sent to a branch; in other words, his trip should take place within the same organization, but in different localities. In this case, the territorial attribute is decisive, and the trip will be considered a business trip;

- lives and sets off on a trip from a location other than the one where the permanent place of work is located - in this case, the business trip is still issued, but travel and daily allowances are not paid as a general rule (otherwise can be established by agreement with the management).

Example 1. An LLC employee, citizen Barankin, is registered and lives in the locality N, and works in the locality D, where the LLC branch is located. The company's head office is located in N. The employment agreement with Barankin states that his permanent place of work is a branch. The branch management decided to send Barankin to the head office of the LLC (settlement N, where Barankin lives). The head of the branch must properly formalize Barankin’s business trip - issue an order and issue a certificate. In this case, Barankin’s transportation expenses will not be paid, since he will not be able to present travel documents for traveling from point D to point H and back, and daily allowances will not be paid in accordance with paragraph 11 of Resolution 749 (the employee can freely return home after a working day business trip).

An interesting point is the secondment of remote and home-based workers to the office of the employing company. If we interpret the law literally, their place of work, by definition, is outside the company. If such an employee lives in another locality, he must be sent on a business trip. The hiring company itself issues the certificate, and it also records the arrival and departure from the destination. Travel allowances for such employees are paid in the usual manner.

Traveling work

The traveling nature of the work does not involve business trips

Some categories of professions (drivers, sellers of mobile retail outlets, etc.) presuppose daily travel of the employee between populated areas. The basic working conditions of the above-mentioned professions already take into account those incentives and guarantees that are provided for by the rules on business trips (they may be given an appropriate salary supplement). On the other hand, in order to be sent on a trip due to the traveling nature of the work, there is no need to check whether the employee has any restrictions on business trips. The law directly indicates the inadmissibility of business trips for such workers, as well as for those who work on a rotational basis.

The provision regarding the traveling nature of the work is necessarily included in the employment agreement. The categories of enterprise employees who may be subject to such a regime are determined by the collective agreement, other legal regulations, and industry documents.

Expenses associated with travel and accommodation are compensated by the employer in accordance with Art. 168.1 of the Labor Code either on the basis of supporting documents, or by establishing a salary increase.

How to correctly calculate the time of a business trip?

The business trip begins from the day the employee departs for transport and ends on the date of arrival in his locality. The time spent on the trip is calculated on the basis of travel tickets.

If the transport departs before 24:00, then the departure date is considered to be the current day, from 00:00. - the next day. The arrival time is set in the same way.

In the absence of travel documentation, the period of the business trip is determined on the basis of the memo and waybill. If you have not been paid your wages during your business trip, you can safely go to court.

What travel documents are issued?

Previously, the package of field documentation was completed with a travel certificate, work assignment and work report. This list has changed since 2021.

Now a business trip is accompanied by the following documents:

- By order. It is carried out in a standard form and is an order of the employer.

- An advance report, which is a report on the funds spent with supporting documentation attached.

- A time sheet, where the travel days are marked. During this period, the employee is paid an average salary.

- An official note. This document is provided in case an employee operates personal vehicles during a trip.

Let’s take a closer look at what each paper is needed for and what the consequences of incorrect execution of travel documentation are.

Advance report

For the purchase of travel tickets and hotel reservations, cash is allocated to the employee. When he returns from a trip, he is obliged to draw up an advance report and attach documents sufficiently justifying travel expenses.

According to Article 168 of the Labor Code, the employee is compensated for:

- Round trip travel costs.

- Expenses for renting housing, confirming the person’s residence.

- Daily allowance. This is the name for the additional costs that an employee incurs in connection with his stay in another locality.

- Other expenses made with the knowledge of the organization’s management.

The advance report is submitted within 3 days from the date of arrival of the employee. The accounting department checks it and the attached supporting documents. If there are no comments, the employee’s debt is written off and the costs are compensated.

What are other costs?

These include communications, currency exchange, taxes, commissions, insurance, travel on public transport, cargo transportation, etc. In a word, everything that an employee needs to properly carry out instructions from management.

Reporting documents for business travelers for other expenses: checks, receipts, coupons, policies, tickets.

Funds spent by a posted worker on food, cleaning the apartment, and visiting entertainment venues are not reimbursed.

Business trip documents for accounting: writing off expenses

Upon return, the employee must provide you with an advance report for the business trip and documents confirming the expenses he incurred. The main ones are as follows.

Transport:

- For air travel - an itinerary receipt and a boarding pass with a security clearance stamp. This is ideal. We told you here what to do if there is no boarding pass.

- When traveling by rail - an extract from the automated control system for passenger transportation by rail (control coupon), boarding pass.

- Other public transport - tickets, transport cards, cash register receipts, etc.

- Payment for a taxi on a business trip - a cash register receipt or a receipt in the form of a BSO that meets the requirements of the legislation on cash register systems.

For more details, see: “Reflecting taxi expenses in tax accounting (nuances).”

- Car rental - a lease agreement, a certificate of transfer/return of the car, invoices, cash register receipts and other documents confirming the use of the car to fulfill an official assignment.

- Personal car - service note, waybill or route sheet (to confirm the route), checks, receipts, card extract, etc.

Accommodation:

- For hotel expenses on a business trip, supporting documents will be an invoice from the accommodation facility, cash register receipts, and BSO.

- When living in a rented apartment - a rental/lease agreement valid during the business trip, documents for payment: checks, card statements, receipts (if the lessor is an individual), other documents confirming accommodation (including indirectly).

Documents for other expenses will depend on the type of expenses on a business trip. By the way, they must be agreed upon with the employer. Otherwise, you may not receive a refund.

See also: “What to do if the accountable person has spent his money?”

You do not need to confirm only the daily allowance. They are set as a fixed amount per day of business trip. The size must be specified in the LNA. How to spend them is at the discretion of the employee. For example, they cover food costs.

What to do if meals are included in the price, see here.

How to draw up a memo?

If an employee goes on a business trip by personal transport, no one issues travel tickets for him. In this case, upon arrival at work, he draws up a memo that reflects the travel time (dates of departure and arrival).

Expenses made during a business trip using your own transport, for gasoline, and parking are classified as travel expenses and are reimbursed by the employer. Debt write-off based on one memo ⏤ is not permitted.

There is no standard form for the document, so it is filled out in any form with the obligatory indication of the following: name of the organization, full name and position of the employee, date and place of business trip, information about the vehicle, date and signature of the employee.

Business trip arrangements

Arranging for a business trip involves drawing up a lot of documents

Despite the fact that business trips are only a small and insignificant part of personnel work, their preparation includes several stages at once. And each of these stages presupposes that the personnel officer and accountant have knowledge of many nuances of the law.

The company may establish additional guarantees and travel conditions for its employees if they do not contradict the current law. To do this, it is necessary to develop and approve a local legal regulation - a regulation on business trips.

Registration of a one-day and multi-day business trip is no different, only the procedure for paying expenses differs.

Stage one: preparation and planning

An employee involved in arranging business trips for a company should be aware that not every worker can be sent on a business trip. At the same time, norms with legislative restrictions are “scattered” throughout the Labor Code.

Only if the event is approved by the employee himself are sent:

- mothers of children under three years of age (Article 259);

- single mothers and fathers who have a child under five years old (Article 259);

- workers who have a disabled child (Article 259);

- workers who, for medical reasons, are caring for a sick relative (Article 259);

- fathers raising a child without a mother (Art. 259);

- guardians and trustees of children (Article 264).

There is absolutely no opportunity to go on a business trip (even if the employee really wants it):

- expectant mother (Article 259);

- an employee who has not reached the age of majority (Article 268);

- employee-student, if the job assignment is not related to training (Article 203).

Having analyzed the employee’s candidacy for compliance with the specified criteria and found among them one of those that require consent to travel, this consent should be requested in advance. To do this, a notification is drawn up for the employee about management’s plans to send him on official duty and his rights. On the notification, the employee must personally express his consent or disagreement. It should be understood that the employee’s disagreement in this case cannot lead to any penalties (be it moral, material or disciplinary).

The employee’s consent to a business trip must be recorded in writing.

On the contrary, refusal to send an employee who does not have the above characteristics may be regarded as a culpable failure to comply with the orders of the manager.

Russian legislation does not contain rules requiring an employee to obtain consent for a long business trip. At the same time, labor standards in some CIS countries do not allow assignment on a business trip for more than, for example, thirty days without the employee’s approval.

Duration of business trip

The labor law does not contain any restrictions regarding the duration of business trips. However, this does not mean that the business trip can be endless. Thus, the duration of the trip is calculated based on the expected duration of the task (its complexity, volume, etc.). If the task is completed and the business trip continues, a transfer takes place, which, due to inconsistency in execution and lack of employee consent, will be considered a violation of the law.

A multi-day business trip, in agreement with management and if appropriate, can be arranged with a daily return. In this case, the employee will be paid for all travel documents, but will not be paid daily allowances.

When calculating the duration of a business trip, it is necessary to remember that travel time is also included in the business trip period. The easiest way to track the exact time is by looking at the departure time on your travel documents. Moreover, if the vehicle is sent from a point located outside the city (airport, river or sea port, etc.), the travel period additionally includes the travel time to this point. The same rules apply to determining the time of arrival (end of a business trip).

Example 2. Employee Rykov goes on a business trip on a plane that departs from an airport located outside the city at 1:30 on November 18. To determine the start day of a business trip, it is necessary to subtract three hours from the departure time (during this time you need to arrive at the airport as a general rule), as well as the travel time to the airport. In order to be at the airport at 22:30, Rykov needs to leave the city on a regular bus departing at 21:00. It is from this time that the business trip begins. This means that the start date of the business trip is November 17.

Second stage: paperwork

The procedure for documenting a business trip begins with the actions of the head of the structural unit where the seconded employee works (if there is no boss, then the employee himself can draw up the primary documents). At this stage two documents must be prepared:

- Memo (application) for a business trip addressed to the head of the company. The document indicates the destination, duration of the trip, purpose of the trip, and the need to provide transport. The manager will review the application and forward it to the HR department for execution.

The memorandum is usually drawn up by the head of the department. - A job assignment for an employee is an indication of a specific place, time, action and other necessary conditions (the document is not mandatory; the responsibility for its preparation can be assigned to the head of the department by local company documents).

Business trip assignment - a guide for the employee, a guideline for his future report

Based on the application for a business trip, the personnel service prepares an order and a travel certificate. Both documents are signed by the head of the organization, and the company’s round seal is placed on the certificate.

The travel order is prepared in accordance with the unified form T-9

Upon returning from a business trip, the employee must draw up a report on the execution of the assignment. However, this document is not required if it is not provided for by the company’s local regulations.

The business trip order must contain all the basic information about the business trip - full name. employee, duration of business trip, destination, purpose of referral, etc.

Travel certificate

A travel certificate is a key document for a business trip. It serves as confirmation of arrival and departure from each business trip point. The first mark - about departure from the sending organization - is affixed when issuing the certificate. The travel certificate is presented at the place of travel along with the passport.

The travel certificate is drawn up in accordance with the unified form T-10

The top part of the certificate must contain:

- its registration number;

- information about the administrative document;

- Full name and position of the traveler;

- destination (or points);

- dates and number of days of business trip.

The travel certificate is signed by the head of the company

Travel sheet is a field of identification specifically designated for marks of arrival/departure. The mark in each organization is made by a specially appointed person; he affixes the seal of the structural unit or organization to his signature.

At each destination, the employee must mark the travel document

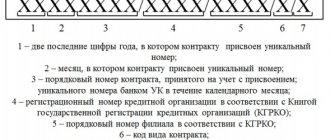

All certificates issued by the company are registered in a special journal. The law does not establish a mandatory form for the journal, however, it is recommended to include in each entry the serial (registration) number, full name and position of the traveler, date of issue, order number, signature on receipt of the travel certificate.

The business trip log should contain license numbers and other important information about all business trips issued by the company

Before leaving, the employee has the right to write an application for an advance payment to pay the planned costs. To determine the exact amount, an estimate of planned expenses can be drawn up. Money is issued on account.

In his application for an advance, the employee must indicate the specific amount of money he will need

In the work time sheet, the business trip day is marked as K or 06.

In the timesheet, business trip days are indicated by the signs: K or 06

Third stage: extension of the tour of duty

If, for some reason, the official assignment was not completed during the originally established period of the business trip, or the employer decided to give the employee an additional assignment at the same point, the business trip can be extended. It should be taken into account that for those categories of employees who cannot be sent on a business trip without their consent, a new additional consent must be requested before extension.

Since the duration of a business trip is not limited by law, consent to its extension is not required from most employees (meaning those not in preferential categories).

After obtaining the employee's consent (if required), the employer must issue an order to extend the trip. It is necessary to make appropriate corrections in the travel certificate; if necessary, add space for additional arrival/departure marks to the travel document.

An order to extend a business trip is drawn up in free form

What to do if the hotel does not provide the required papers?

There are cases when hotels limit themselves to providing invoices without issuing checks and receipts. The law allows business entities that do not use cash register systems to issue strict reporting forms to which the invoice relates. In such a situation, the accounting department cannot refuse to accept this supporting document.

To avoid misunderstandings, call the booked hotel in advance and make sure that it will issue the necessary documentation in sufficient quantities.