2-NDFL during reorganization and liquidation – 2021

The responsibility of companies, as tax agents, is to submit information on the payment of income to staff and other individuals in 2-NDFL certificates. They must be submitted for the past tax period before April 1 of the next year at the place of registration with the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

In situations where a company ceases to exist or is reorganized before the end of the year, forms 2-NDFL should be submitted for the estimated tax period, i.e.

for the time that the enterprise was operating - from the beginning of the year to the date of the termination of the company’s operation in its previous status registered in the state register (clause 3.5 of Article 55 of the Tax Code of the Russian Federation).

The nuances of filling out 2-NDFL certificates in situations related to the termination of activities or reorganization of an enterprise will be discussed in the article.

2-NDFL when changing the status of the company

As a rule, a company ceases to exist after submitting all reports in full, including 2-NDFL certificates for employees.

After all, after the termination of activity, it does not have successors who could report on the data on tax accruals and withholding.

Closing companies, submitting 2-personal income tax until the moment of liquidation, fill out certificates according to the usual algorithm - the name of the company is indicated in the line “tax agent”, and its details - in the appropriate fields provided.

When reorganizing (“reshaping” a company according to a selected criterion and registering it in a new capacity), the range of actions is wider.

If, due to any circumstances, the company did not submit 2-NDFL before changes in status, the legal successor is obliged to report for it. This requirement has been in effect since the beginning of 2021 (clause 5 of Article 230 of the Tax Code).

Therefore, the successor company in this case will submit information on the income of individuals twice:

- as a successor to the tax agent - for the period from the beginning of the year to the date of recorded reorganization;

- as a tax agent - for the time from the beginning of operation of the changed company until the end of the year.

Changes to form 2-NDFL in 2021

To ensure the correct preparation of forms based on the right of succession and their subsequent submission to the Federal Tax Service, the legislator updated the 2-NDFL certificate. Since 2021, changes have been made to it, however, these do not affect the procedure for reflecting income, deductions and taxes.

Two new lines have been added to section 1 “Data about the tax agent”:

- “Reorganization/liquidation form”, where a code corresponding to the type of changes being made is entered:

– 0 – liquidation;

– 1 – transformation;

– 2 – merger;

– 3 – separation;

– 5 – connection;

– 6 – separation with simultaneous joining;

- “TIN/KPP of the reorganized company”

In the 5th section, in the field certifying the signature of the decryption of the signatory, an entry has been entered about the possibility of certifying the certificate by the legal successor. In the “tax agent” field of this section, the successor enters code “1”, and his representative - “2”.

Thus, new form fields are filled out exclusively by assignees. 2-NDFL certificates for the transformed company are submitted by them to the Federal Tax Service at the place of their territorial registration. At the same time, they indicate:

- OKTMO code of the reformed company;

- in the line “tax agent” - its name;

- in the field “TIN/KPP of the reorganized organization” - exactly the TIN/KPP of the reorganized company.

Let's look at filling out the 2-NDFL certificate using examples.

Example 1. Registration of 2-NDFL before liquidation

, operating since 2010, is liquidated on December 1, 2021 and draws up all the necessary documents, incl. 2-NDFL certificates before the specified date. They are filled out according to the traditional scheme, and new lines for successors introduced in 2021 are not filled out.

Example 2. Filling out 2-NDFL by the legal successor during reorganization

The company MIR LLC, located in Chelyabinsk (OKTMO 75712000, INN 7404215894, KPP 740445028) is being transformed by merging with Topol LLC from Yekaterinburg (OKTMO 65701000, INN 6612456456, KPP 661200012) from December 1 2021 This date is recorded in the state register termination of the activities of MIR LLC and the transfer of its assets by right of succession.

2-NDFL information for MIR LLC was not submitted to the Federal Tax Service. Topol LLC will report:

- as the legal successor of the transformed company, filling out 2-NDFL for the period from January 1 to November 30, 2021:

- as a tax agent from December 1 to December 31, 2021:

Source: //spmag.ru/articles/2-ndfl-pri-reorganizacii-i-likvidacii-2021

Declaration of income received by a participant after the liquidation of the company

The rules for taxation of income received by a shareholder (participant, shareholder) of an organization in the event of its liquidation are ambiguous due to the constant changes made to the Tax Code of the Russian Federation. Let's try to understand the indisputable and controversial points.

Tax base (what is considered income): When receiving funds (property) by a shareholder (participant, shareholder) of an organization in the event of its liquidation, the actual value of the share is recognized as income (clause 10, clause 1, article 208, clause 1, article 209) Tax Code RF).

For example, a citizen was a participant in two LLCs - “A” and “B”. Both organizations were liquidated. In “A” he made an initial contribution to the management company in the amount of 15,000 rubles. During liquidation, the actual value of the share was calculated and he received a payment in the amount of 150,000 rubles. In this case, the income (tax base) for further calculation of personal income tax will be 150,000 rubles. In “B” he made an initial contribution to the management company in the amount of 15,000 rubles. And he received money after calculating the actual value of the share - 1,500 rubles. Accordingly, the income (tax base) for calculating personal income tax will be 1,500 rubles.

Tax base (what is considered an expense, what deduction to use):

A) exercise the right to a property deduction provided for in subclause 2 of clause 2 of Article 220 of the Tax Code of the Russian Federation - to reduce income by the amount of actually incurred and documented expenses associated with the payment of the authorized capital. Such expenses include amounts paid as payment to the Criminal Code. And in cases where such payments were made at the expense of loan funds, then the amount of interest paid under the loan agreement (see Letter of the Ministry of Finance of Russia dated November 10, 2015 N 03-04-07/64620). For “A” tax base = 135000 (150000-15000); for “B” tax base = 0 (1500-15000).

Please note that only payment (in cash or property) of the authorized capital is considered an expense. If the value of your share has increased by increasing the authorized capital at the expense of net profit, then the “increase due to net profit” will not be included in the expense.

B) in the event that you do not have documents confirming the costs of acquiring a share, you have the right to take advantage of a property deduction in an amount not exceeding 250,000 rubles, in accordance with paragraph. 2 subparagraph 1 paragraph 2 art. 220 Tax Code of the Russian Federation. For “A” tax base = 0 (150000-250000); for “B” tax base = 0 (1500-250000).

Holding period: There is no minimum holding period for income received as a result of the liquidation of an organization, therefore, regardless of the holding period, income will have to be declared.

We submit the declaration ourselves, because in any case, it becomes necessary to use one of the deductions, and only the tax authority has the right to provide them on the basis of the 3-NDFL declaration. Explanations on this issue are contained in Letter of the Ministry of Finance of Russia dated May 27, 2016 N 03-04-06/30627.

Features of obtaining personal income tax certificate 2 upon liquidation or reorganization of an enterprise

Probably every working person has taken out a 2nd personal income tax certificate at least once in their life.

This is a mandatory account for banks when applying for a loan, the tax office when receiving deductions, and social services when assigning benefits.

The certificate reflects the citizen’s official income and taxes that he paid to the state. As a rule, obtaining a certificate is not a problem, but difficult cases also occur, for example, during the liquidation of an LLC.

Why is a certificate needed and how is it provided?

Certificate 2 of personal income tax contains information about income paid to the employee, tax deductions, as well as taxes withheld and paid to the budget.

The certificate contains details (date of issue and number) and five sections. The first two indicate information about the employee and the tax agent. The third section reflects the tax rate and employee income.

The declaration is issued for one calendar year. Remunerations received by the employee are reflected in the certificate with the assigned income code by month. Section 4 shows general information on tax deductions, section 5 shows general information about income and taxes paid.

As a rule, the following organizations request an income certificate:

- Banks - when applying for a loan;

- tax office - upon receipt of the right to tax deductions and refund of already paid personal income tax;

- social protection - when assigning benefits;

- embassies and consulates of other states - when applying for a visa;

- new employer and other organizations.

Working citizens receive a certificate only from the employer; for this they contact the organization’s accounting department. Official employment in the company is important.

According to the Labor Code, 3 days are allotted for issuing a certificate. An accountant fills out the certificate. The certificate is certified by the signature of the head and the seal of the organization.

Often the need for a certificate arises after dismissal; in this case, a person receives a certificate from his former employer within the time allotted by law - he has no right to refuse to issue a certificate.

Where can I get a personal income tax certificate 2 for an employee if the organization is liquidated?

What to do if the organization no longer exists or a reorganization has occurred. In this case, contact the tax service. The fact is that personal income tax certificate 2 is issued to employees and relates to reporting.

Each organization is required to submit such a report to employees by April 1 of the year following the reporting period. When liquidating a company 2, personal income tax is also submitted to the supervisory authorities.

To obtain a certificate, a citizen applies to the inspectorate at the place of registration of the enterprise. This information is posted on the Federal Tax Service website according to the company’s TIN and is located on the organization’s seal.

A certificate is also issued within 3 days based on the application. The application is drawn up in free form and in two copies. The second copy with the registration mark remains with the citizen.

If a person does not need the certificate itself, but only information on income and taxes, he will find out about this in the following ways:

- From the legal successor, if reorganization has taken place;

- through your personal account on the Federal Tax Service website;

- through a new employer, who will make a corresponding request to the Federal Tax Service and extra-budgetary funds.

For what period do organizations submit information upon liquidation or reorganization?

According to the rules, the tax period is a calendar year, what deadlines are provided for the completion of the enterprise. When a company is closed, the legal entity submits personal income tax reports before liquidation.

There are three options for determining the last tax period, and depend on when the company ceased operations:

- Until the end of the calendar year. In this case, the period is considered to be the time from January 1 to the closing date.

- The opening and closing of the company occurred within one year. In this case, the period is less than 12 months. The beginning is the date of opening of the company, the end is the liquidation.

- Legal entity opened in December of one year and closed at the end of the next year. The tax period in this case does not exceed 13 months and includes the work of the organization.

The requirement to provide reporting also applies to entrepreneurs closing an individual entrepreneur (if he is an employer). There are no separate deadlines for this procedure, so the entrepreneur submits 2 personal income taxes, as is customary, before April 1.

Important! You can close an individual entrepreneur only after submitting reports.

How to submit personal income tax during reorganization.

It is important to take into account the type of changes; the following options are possible:

- "Merge". A number of companies are transformed into one, while the previous legal entities cease to operate. Data must be provided before the date of registration of the new organization.

- "Joining". One company merges with another, but ceases to operate as a separate legal entity. In this situation, only the affiliated company must submit tax information before making the corresponding entry in the Unified State Register of Legal Entities.

- "Separation". A series is created from one organization. Certificates are provided before registering new legal entities.

Information is submitted in the usual manner if the reorganization takes place in the form of a spin-off or transformation, since in this case the work of the enterprise does not stop.

Important! The assignee is not required to submit reports for the reorganized company.

What to pay attention to when applying for 2nd personal income tax

The certificate must be stamped. It is important that the seal is placed in a specially designated place, at the MP mark. The signature of the head of the enterprise or another person authorized to sign such a certificate is written in blue pen with a clear imprint. It is not allowed to cover the signature with a seal.

Personal income tax certificate 2 is issued by the employer; if the company has already been liquidated, the employee will be issued a certificate by the tax office. Tax agents are required to report to the inspectorate. The time frame for obtaining a certificate is the same as for the standard procedure – 3 days.

Source: //ndflexpert.ru/2/2-ndfl-pri-likvidacii-predpriyatiya.html

Review of 2-NDFL during liquidation and reorganization

Income tax levied on the income of individuals is calculated and paid by tax agents, which include enterprises and individual entrepreneurs - in some cases, and by citizens themselves - in others. Based on the results of the reporting tax period, which is a calendar year, agents are required to submit a report to the territorial branch of the Tax Service at the place of registration. 2-NDFL.

The certificate must contain information about all remunerations that the tax agent paid during the reporting period to employees and other individuals. persons, the amount of income withheld from them. According to the general rules, the HD entity is required to submit a certificate before April 1 of the year following the reporting year.

But such a restriction applies only to tax agents; if the taxpayer himself needs, for example, to receive a property deduction, then he has the right to submit a report throughout the year at any time. In other cases, employees require a certificate from employers to submit to various authorities and institutions.

The tax agent is required to submit certificates separately for all employees, as well as a register of these certificates in 2 copies. If the organization did not accrue or pay wages during the reporting period, then the certificate is not submitted.

There is also no requirement to submit a report in cases where the enterprise acquired property or property rights from a citizen or paid remuneration to the individual entrepreneur. The situation changes in relation to entities that have undergone changes in their activities during the calendar year, for example, the enterprise has been reorganized or it has been liquidated.

If reorganization should be understood as some changes in the structure of the enterprise, then liquidation means the complete cessation of activity. In this case, the deadlines for filing 2-NDFL during liquidation and reorganization change.

Main provisions

If an enterprise is liquidated or undergoes reorganization, this means that its latest tax period, for which various reports are required, is changing. This is indicated in the Tax Code, in Art. 55, in paragraph 3. Moreover, this period will depend on the operating time of the enterprise during the year.

Article 55. Representative offices and branches of a legal entity

Legal deadlines

On the issue of providing information on the income of employees, the Federal Tax Service states that the information must be submitted by the storage system itself, which is being liquidated or reorganizing the structure. Tax authorities make their conclusions based on the provisions of the Tax Code, Art. 50, which deals with the succession of newly created legal entities. persons to fulfill the obligation to pay taxes.

In this article and others, the legislator does not impose responsibility for providing information according to f. 2-NDFL for legal successors. According to Art. 216 reporting is submitted for the past period in which the tax agent paid remuneration.

The deadlines for submitting reports can be considered using the example of some situations:

| What is happening to the enterprise | Which period should be considered the last tax period? |

| By the end of the year, reorganization took place or the enterprise ceased operations. | The tax period for filing reports should be considered the period from the beginning of the calendar year until the moment when the reorganization was completed or the enterprise (separate division) ceased its activities. |

| An enterprise was created and liquidated or underwent reorganization during the same calendar year. | The tax period should be considered the period from the moment of establishment of the enterprise until the moment of changes, which is less than 12 months. Situations are possible when small businesses open for 2–3 months in order to carry out a certain type of work or order. |

| The company was registered in December, but the changes occurred in the middle or towards the end of the next calendar year. | The period for the report will be considered the period of operation of the enterprise from the moment of opening until liquidation or reorganization, which should not be more than 13 months. Having opened in December, the enterprise could not calculate and pay wages to employees in the same month, i.e. all payments would fall on the next calendar year. |

The reorganized enterprise still remains an active legal entity, but the liquidated organization ceases to exist as a legal entity. face.

General nuances

In NK, in Art. 226, paragraph 1 states that the tax agent who calculated and withheld personal income tax from the taxpayer is obliged to transfer it to the local budget at the place of registration of the enterprise. But when a Russian organization has separate divisions that are on a separate balance sheet, it is also obliged to pay income taxes to the budget at their location (Article 226, paragraph 7).

The amount of tax that is withheld is calculated based on the income subject to taxation paid to employees or other individuals. persons who have an employment relationship with a separate unit.

Article 226. Peculiarities of tax calculation by tax agents

Thus, at the location of the separate unit, i.e., a certificate according to f. is also submitted to the territorial branch of the National Assembly. 2-NDFL. The main enterprise submits it at the place of its registration.

Form 2-NDFL

Large tax agents report to the tax office according to f. 2-NDFL and 6-NDFL, which are filled out separately for all separate divisions. Until the process of changes at the enterprise is completed, a f. must be submitted in relation to a separate division. 2-NDFL during liquidation and reorganization.

Comparison of shapes

To present information from an enterprise that is undergoing a reorganization process, the change procedure plays an important role. If f. “2-NDFL – liquidation” is submitted according to the general rules, then in case of reorganization of the f. “2-NDFL – reorganization”, taking into account the type of changes and the further procedure of the enterprise.

The general rules for submitting a certificate cannot be applied during reorganization, when there is a division or transformation of an enterprise, as a result of which:

- one or more enterprises are allocated;

- joins one or more enterprises;

- the company ceases to exist after the changes are made.

| Reorganization procedure | Submission deadline f. 2-NDFL |

| Merger. Two or more companies merge to form one large enterprise. As a result, small firms individually go out of business. | Enterprises that are going through the merger process submit a certificate until they become part of a large enterprise and it undergoes state registration. After the merger, the new legal entity submits a report within the established time frame, i.e., based on the results of the year. |

| Joining. One or more enterprises join a larger one, as a result of which they transfer their rights and obligations to it. The joining enterprises cease their HD. | The merging enterprises submit a report until information about the termination of activities is entered in the Unified State Register of Legal Entities for each. The organization to which small firms have joined submits annual reports. |

| Separation. A large enterprise is undergoing a process of division into several small ones. As a result, a large enterprise ceases to exist. | A large dividing enterprise is required to report to the tax authorities before the new organizations register the status of legal entities. In turn, new enterprises will submit certificates according to generally accepted rules. |

But there are also forms of reorganization when, as a result of the changes made, it is not necessary to liquidate the enterprise(s):

- From a large enterprise, one or several small ones are separated, in this case the main organization transfers some of the powers to the newly opened ones. The activities of the main company remain unchanged. Information on f. 2-NDFL, according to the general rules, represents the main enterprise and the spun-off one separately, i.e., based on the results of the reporting year until April 1.

- As a result of the transformation of the company, it can change the form of ownership, for example, an LLC is transformed into a joint-stock company, a cooperative or a partnership. A joint stock company can become an LLC or a cooperative. Due to the fact that the enterprise did not stop its work, the reorganization carried out is not reflected in the reporting deadlines. F. 2-NDFL is submitted according to the general rules.

How 2-NDFL certificates are presented during liquidation and reorganization

Due to the fact that the liquidated enterprise is completing its activities, no one except it can submit a report to the tax office. Therefore, the form is filled out based on information related to the closing enterprise. This must be done before the business closes completely.

In practice, what usually happens is that first the company’s activities are suspended, then for some time the results are summed up, all reports are submitted, and taxes are paid. The final moment during liquidation can be considered the date when the enterprise is deleted from the register of legal entities. This is done by the Tax Service at the request of the enterprise.

When carrying out reorganization, several certificates are submitted to the tax office according to f. 2-NDFL. First, personal income tax is calculated, withheld, transferred and displayed in a certificate for a certain period by the existing company(s), and then by the one(s) that was formed after the changes.

In fact, enterprises submit reports only for the period when they operated and paid income to individuals. Reporting can be submitted in several ways; it depends on the number of employees, the deductions from whose income are indicated in the certificate.

Enterprises can submit f. 2-NDFL:

- on paper in person through your representative (responsible employee);

- by sending by registered mail with an inventory of the papers being sent enclosed in the envelope;

- in electronic form on a disk or flash drive;

- via a communication channel, also in electronic form.

If the number of employees does not exceed 25 people, then it is allowed to submit a report on paper, in other cases only in electronic form. The submitted certificates are accompanied by a register where information about all income indicated in the compiled forms is entered.

If one of the certificates does not pass the inspection by the tax inspector, he will delete it from the register and record the results of the inspection in the protocol. The inspector will give one copy of the protocol and register to the enterprise.

When a report is submitted on removable media, a paper register must be attached to it. Moreover, a separate register is created for each completed file. Based on the results of the inspection, the inspector can accept all files. If errors are detected in one of the files, it will not be accepted.

In the same way, a protocol is drawn up and sent to the enterprise along with the register. Moreover, they can be given to a company representative personally or sent to a postal address. Through a telecommunications channel, send f. 2-NDFL is possible if the enterprise has an electronic signature. After verification, the protocol and register will be sent to the enterprise in the same way.

Other points

If, for example, during the liquidation procedure of an enterprise all employees quit, then a report can be sent to the liquidation commission before submitting the liquidation balance sheet. In exceptional cases, tax agents must report in a different form. 2-NDFL, but submit another reporting form.

This applies to cases, as indicated by the legislator in Art. 226.1, when the enterprise:

- carried out transactions with securities and futures transactions;

- made payments on securities issued by Russian companies.

Such enterprises submit the necessary information to the tax office about the recipients of income, amounts paid, accrued, withheld and transferred personal income tax in the income tax return. Such information is submitted not once a year, but according to the results of each reporting period, which is a quarter, until the 28th of the next month.

Accordingly, if during the calendar year the enterprise carried out such operations, and then at some point was liquidated (reorganized), then the declaration will have to be submitted not at the end of the quarter in which the changes took place, but upon completion of the changes, as the legislator indicates in Art. 230 (clauses 2, 4) and 289.

An example would be a situation where an enterprise is liquidated (makes changes in structure) in April, i.e. in the 2nd quarter, but you do not need to wait until the end of the reporting period to submit a declaration in order to submit it before July 28. This can be done as soon as the process is completed.

Source: //buhuchetpro.ru/2-ndfl-pri-likvidacii-i-reorganizacii/

Liquidation of an LLC in 2021: step-by-step instructions

Liquidation of an LLC is a rather complex and time-consuming process. However, if you adhere to certain rules, you can close the organization yourself, without resorting to the help of third-party specialists.

Before starting this procedure, you need to know that there are alternative

liquidation methods. Perhaps, specifically in your case, it is easier to sell the LLC or change its founders. In such a situation, the organization will continue to exist, but without your participation.

Step-by-step instructions for liquidating an LLC in 2021

An organization can be liquidated voluntarily or by court decision (all cases are listed in Article 61 of the Civil Code of the Russian Federation). This article discusses the voluntary liquidation procedure of an LLC.

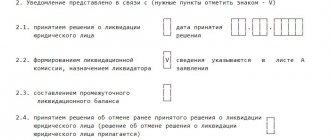

The process of voluntary liquidation of an LLC consists of the following stages:

- Making a decision on liquidation and creating a liquidation commission.

- Notification of the commencement of liquidation of the tax service.

-

of a notice of liquidation in the State Registration Bulletin - Notification of the fact of liquidation to creditors.

- Notifying employees and the employment center about the upcoming dismissal.

- Preparation for a possible on-site inspection from the Federal Tax Service.

- Drawing up and submitting an interim liquidation balance sheet to the Federal Tax Service.

- Settlements on the organization's debts.

- Preparation of liquidation balance sheet and distribution of LLC assets.

- Submission of the final package of documents to the Federal Tax Service.

Let's look at each of the above stages in more detail:

Making a decision on liquidation and creating a liquidation commission

The decision on liquidation is made at the general meeting of LLC participants. It must be adopted unanimously and documented in the form of minutes of the general meeting

participants.

If there is only one participant in the organization, then the decision on liquidation is made individually, after which a decision of the sole founder

.

Next, you need to appoint a liquidation commission (which usually includes the founders, director, chief accountant, lawyer, and other qualified employees) and select its leader.

It is worth noting that the commission may consist of only one person - the liquidator. The passport details of each member of the commission must be included in the decision (protocol) on liquidation.

The commission or liquidator is vested with full powers to manage the affairs of the company. They represent the organization in court and are responsible for all actions committed at the liquidation stage (Article 62 of the Civil Code of the Russian Federation).

note

, starting from March 30, 2015, the functions of the applicant in the liquidation process must be performed by the head of the commission or the liquidator (previously, documents had to be submitted by one of the founders or participants of the LLC).

Notification of the tax service and funds about the beginning of LLC liquidation

Within 3 working days after the decision (protocol) on liquidation is made, the following must be submitted to the Federal Tax Service at the place of registration:

5 working days after submitting the documents, the tax office must make an entry in the Unified State Register of Legal Entities stating that the LLC is in the process of liquidation and give you a copy of the sheet confirming the entry of data into the state register.

note

, funds (PFR and Social Insurance Fund) no longer need to be notified of the fact of LLC closure. This information should be provided to them by the tax office. True, in our country anything can happen, so it is better to check this point with the Federal Tax Service at the place of registration.

Free tax consultation

Publication in the “Bulletin of State Registration”

It is impossible to liquidate an organization with debts to counterparties without settling relations with them, therefore the liquidation commission must publish a message in the media about the planned termination of the LLC’s activities.

The publication in which such information is published is the “Bulletin of State Registration”

. You can place a notice of liquidation through a special form on the official website of the magazine.

Notice of closure of LLC to creditors

In addition to publication in the "Bulletin"

it is necessary to notify your creditors in writing about the start of the liquidation procedure, and also tell about the procedure and deadlines for filing claims and demands on their part (this period must be at least 2 months).

There are no special requirements for the execution of such notices, however, you must have evidence that the creditors were actually aware. They can be registered letters with acknowledgment of delivery or the signatures of the persons receiving the correspondence (in the case of courier delivery).

Notifying employees and the employment center about dismissal

No later than 2 months before the upcoming dismissal, you must notify your employees of this fact. This must be done by means of a special written notice with a note that the dismissal occurs at the initiative of the employer in connection with the cessation of the organization’s activities.

Written notification must also be provided to the employment authorities. For each employee, the position, profession, specialty, qualification requirements, as well as wage conditions are indicated.

The employment center is notified 2 months before dismissal or 3 months if the dismissal is massive (depending on the region and the specifics of the activity, but usually 15 people or more).

Dismissed employees will need to be paid severance pay in the amount of average monthly earnings. They also retain the right to receive a salary for the period of employment (but no more than 2 months from the date of dismissal).

Reporting for employees

After employees have been fired and full settlement has been made with them, you can send reports to the Pension Fund (form SZV-STAZH), Social Insurance Fund (form 4-FSS) and the Federal Tax Service (Unified calculation of insurance premiums). These calculations must be submitted before submitting application P16001.

If the process of liquidation of the LLC coincided with the end of the reporting year, then you first need to submit calculations of SZV-STAZH and 4-FSS for the past year (in the general manner), and then for the period from the beginning of the year until the filing of the liquidation application P16001.

Note

: on the latest reports to the Pension Fund of Russia, the Social Insurance Fund and the Federal Tax Service, do not forget to put a mark on the title pages - “Cessation of activity”.

Within 15 working days from the date of submission of the last report to the Pension Fund, the amount of contributions (additional payments) is paid, if they were accrued.

In addition, from April 2021, a new monthly report was introduced to the Pension Fund for employers in the SZV-M form. This report must be submitted no later than the 15th day of the following month.

For a company in the process of liquidation, in the absence of employees, a zero SZV-M signed by the liquidator is submitted.

Don’t forget about reports in form 2-NDFL and 6-NDFL. Termination of a company's activities does not relieve the duties of a tax agent. Similar to reporting to the Pension Fund and the Social Insurance Fund, 2-NDFL and 6-NDFL are provided for the period from the beginning of the year until the termination of activities, and if the reporting year has ended, then also for the past period.

Preparation for a possible on-site inspection from the Federal Tax Service

After receiving notice of the liquidation of an LLC, tax authorities have the right (but not the obligation) to conduct an on-site audit. Moreover, they can do this regardless of when and for what reason the previous inspection was carried out.

In practice, the tax inspectorate does not always carry out this procedure, and, as a rule, “zero” companies do not check them at all. However, in any case, it is better to prepare for the visit from the Federal Tax Service and put things in order in cash payments and reporting documents in advance.

If the decision on an on-site inspection has already been made, then you can move on to the next stage of liquidation only after the inspection is completed and all issues that arose during its implementation have been resolved.

Drawing up and submitting an interim liquidation balance sheet to the Federal Tax Service

After being published in the "Herald"

the deadline for submitting claims by creditors has expired (at least 2 months), it is necessary to draw up

an interim liquidation balance sheet

.

There are no special rules for its preparation, however, judicial practice recommends drawing up a balance sheet according to the same principles as financial statements (therefore, it is not recommended to solve this problem yourself without having similar experience).

The interim balance must contain:

- information about the organization’s property;

- information on claims made by creditors;

- results of consideration of creditors' claims.

After the document has been drawn up, it must be approved at a meeting of the founders (by the sole founder) and the corresponding protocol (decision) must be drawn up.

Next, you must provide the tax office with:

In addition, many Federal Tax Service Inspectors may additionally require:

Within 5 working days after accepting the documents, the tax office must enter the relevant data into the Unified State Register of Legal Entities and give you a copy of the sheet confirming the entry into the state register.

Filing a tax return

Along with the interim liquidation balance sheet, you can submit a tax return, but on the condition that after drawing up the balance sheet, the organization no longer plans to carry out taxable transactions. If such transactions are possible, submit the declaration with the final liquidation balance.

For LLCs being liquidated, the last reporting year is the period from January 1 to the date of entry of the liquidation in the Unified State Register of Legal Entities. All reporting for the company must be submitted no later than the date of entry on the liquidation of the organization.

Tax returns are submitted in accordance with the chosen tax system, read more on this page.

Calculations for the organization's debts

After the interim balance is approved, the liquidation commission must begin to pay off the organization’s debts.

According to Art. 64 of the Civil Code of the Russian Federation, debts must be paid in the following order:

- Citizens to whom the LLC is liable for causing moral damage or harm to life and health.

- Employees under an employment contract (salary and severance pay) and payment of royalties.

- Calculations for mandatory payments to the budget and extra-budgetary funds (taxes, insurance premiums, fines, etc.).

- Remaining debts to other creditors.

If there are not enough funds to pay off all the debts of the LLC, then the organization must put its property up for public auction. If in this case, the proceeds received from the sale do not cover all the company’s debts, then the liquidation commission will have to apply to the arbitration court for bankruptcy of the legal entity.

If, even before the start of liquidation, you know for sure that the funds and property of the LLC will not be enough to pay off all existing debts, then it is better to immediately contact bankruptcy specialists (since there are many nuances in carrying out this procedure; it is better not to do it yourself).

Preparation of liquidation balance sheet and distribution of LLC assets

As soon as all debts to contractors, employees and the state are repaid, the liquidation commission must draw up a final liquidation balance sheet

, containing information about those assets of the company that remain and must be distributed among the participants.

Note

: if the assets in the final balance sheet turn out to be greater than in the interim balance sheet, the tax office may request clarification and even refuse liquidation. This is done in order to identify unscrupulous liquidators who temporarily withdraw their assets from the LLC in order not to pay debts to creditors.

The final liquidation balance sheet must be approved at the general meeting of participants (by the sole founder) and the corresponding protocol (decision) on approval must be drawn up.

Only after this, the assets remaining after settlements with creditors can be distributed among the founders (participants) in accordance with their shares in the authorized capital of the organization.

Main points of civil law relations

In accordance with Art. Art. 57, 58 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”, a company can be liquidated voluntarily in the manner established by the Civil Code of the Russian Federation, taking into account the requirements of this Federal Law and the company’s charter. Liquidation of a company entails its termination without the transfer of rights and obligations by way of succession to other persons.

The property of the liquidated company remaining after completion of settlements with creditors is distributed by the liquidation commission among the company's participants in the following order:

- first of all, payment to the company participants of the distributed but unpaid part of the profit is carried out;

- secondly, the property of the liquidated company is distributed among the company's participants in proportion to their shares in the authorized capital of the company.