Who submits the report

Rosstat collects information on the number and wages of employees in various reports. In form No. 1, respondents distribute the number of employees on the payroll by salary level. The sample is based on April accruals.

Interval accrual values are constantly adjusted due to changes in the minimum wage. From 01/01/2021, the minimum wage was increased to 12,792 rubles: Rosstat updated Form No. 1 and differentiation by the amount of accrued wages. The form and procedure for filling out in 2021 were approved by Rosstat Order No. 37 dated January 27, 2021.

Order No. 37 explains who submits statistical form No. 1 - all organizations (from among medium and large ones) regardless of the organizational and legal form, type of ownership, type of economic activity.

IMPORTANT!

Small businesses do not submit information according to statistical form No. 1.

Institutions included in the sample are required to report to the territorial statistics office at their location. Separate divisions, branches and representative offices submit information to the Rosstat department at the address of actual economic activity.

Legislative framework of the Russian Federation

not valid Edition from 01.01.1970

detailed information

| Name of document | ORDER of Rosstat dated January 14, 2011 N 2 “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR THE ORGANIZATION BY THE MINISTRY OF INDUSTRIAL TRADE OF THE RUSSIAN PILOT FEDERAL STATISTICAL OBSERVATION OF COSTS AND PRICES FOR MILITARY PRODUCTS” |

| Document type | order, instructions |

| Receiving authority | Rosstat |

| Document Number | 2 |

| Acceptance date | 01.01.1970 |

| Revision date | 01.01.1970 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | It does not work |

| Publication |

|

| Navigator | Notes |

ORDER of Rosstat dated January 14, 2011 N 2 “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR THE ORGANIZATION BY THE MINISTRY OF INDUSTRIAL TRADE OF THE RUSSIAN PILOT FEDERAL STATISTICAL OBSERVATION OF COSTS AND PRICES FOR MILITARY PRODUCTS”

Instructions for filling out form N 1-SR

1. Federal statistical observation form No. 1-SR “Information on the cost and profitability of military (defense) products” is provided by:

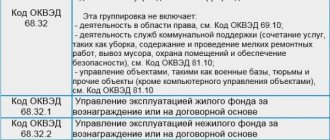

The Ministry of Industry and Trade of the Russian Federation - legal entities (hereinafter referred to as organizations) according to the list established by the Ministry of Industry and Trade of Russia, the main type of activity of which belongs to section D of the All-Russian Classifier of Types of Economic Activities (OKVED) “Manufacturing industries”, engaged in the production and supply of military (defense) products (works, services);

Federal Space Agency - legal entities engaged in the production of rocket and space technology, according to the list determined by Roscosmos.

Primary statistical data in form N 1-SR are provided according to the list of product ranges agreed with the Military-Industrial Commission under the Government of the Russian Federation.

2. The form is provided in accordance with these instructions, as well as in compliance with the requirements of the Law of the Russian Federation of July 21, 1993 N 5485-1 “On State Secrets” (as amended by the Federal Law of December 1, 2007 N 294-FZ) (Section V. Disposal of information constituting state secrets) - through units for the protection of state secrets.

3. If a legal entity has territorially separate divisions engaged in the production of military (defense) products (works, services), the form is filled out both for each such separate division and for a legal entity without these separate divisions.

4. The head of a legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

5. Information is provided within the time frame and to the addresses indicated on the form.

In the address part of the form, in accordance with the constituent documents registered in the prescribed manner, the full name of the reporting organization is indicated, and then in brackets - the short name (abbreviation).

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code.

If the actual address does not coincide with the legal address, then the actual postal address is also indicated.

The reporting organization enters the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) in the code part of the form on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations by the territorial bodies of Rosstat.

6. The form is presented to the Ministry of Industry and Trade of Russia as an accrual total with a six-month periodicity (January - June, January - December), to Roscosmos - on a quarterly accrual basis (January - March, January - June, January - September, January - December). The form containing information on a separate division of a legal entity indicates the name of the separate division and the legal entity to which it belongs. For territorially separate divisions of a legal entity, an identification number is indicated, which is established by the territorial body of Rosstat at the location of the territorially separate division.

7. When filling out the form for federal statistical monitoring of military products N 1-SR, you should be guided by the following definitions:

military (defense) products (works, services) - ready for delivery at actual prices, completed in production and accepted by the customer, mass-produced weapons and military equipment, components and materials, developed on the basis of technical specifications of government customers and (or) produced according to technical documentation (technical specifications) agreed with government customers, including dual-use products intended for defense needs, work performed in-house and services provided (hereinafter referred to as military (defense) products);

dual-use products - products (work, services) intended for delivery both for civil production and the needs of the country's defense with uniform requirements, manufactured according to approved (agreed with government customers) documentation;

products intended for delivery to the domestic market - military (defense) products intended for sale within the state;

products intended for export - products intended for export from the customs territory of the Russian Federation without the obligation to re-import;

products with a long production cycle - products whose technological production cycle is more than one year;

the actual price of the product in relation to products intended for sale on the domestic market is the contract price of the product (excluding VAT, excise taxes and similar mandatory payments) in the period for which the data is provided, established in the price protocol attached to the government contract (contract);

the actual price for products supplied for export is the contract price, recalculated at the ruble exchange rate quoted by the Central Bank of the Russian Federation on the date of product release.

8. Section 1 of the form “Indicators of cost and profitability of military (defense) products” is filled out on lines 01 29.

In this section, the data for the corresponding period of the previous year presented in the form for the reporting period must coincide with similar data in the form provided for the same period last year, except in cases of reorganization of a legal entity, changes in the methodology for generating indicators or clarification of data for the previous year, caused by objective reasons. All cases of discrepancies in data for the same periods, but presented in different forms, must be explained in the explanation of the form. If in the reporting period there was a reorganization, change in the structure of the legal entity or the methodology for calculating indicators, then in the form the data for the corresponding period of the previous year are given based on the new structure of the legal entity or methodology adopted in the reporting period.

Data in column 1 = column 2 + column 3, in column 4 = column 5 + column 6.

Line 01 reflects the volume of output of military (defense) products, in actual prices without value added tax, excise tax and similar mandatory payments (without internal turnover) for the reporting period.

Line 02 reflects the actual cost of production of military (defense) products. Line 02 = sum of lines 27 and 28.

Lines 03 26 reflect the actual costs of production of military (defense) products, according to costing items in accordance with the Procedure for determining the composition of costs for the production of defense products supplied under the state defense order, approved by Order of the Ministry of Industry and Energy of Russia dated August 23, 2006 N 200, and the accounting policies adopted by the organization.

Line 03 reflects the total cost of materials. Line 03 = sum of lines 04 13.

Line 14 reflects the total cost of paying the main production workers. Line 14 = sum of lines 15 and 16.

Line 17 reflects the costs of paying insurance premiums for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases.

Line 18 reflects the total cost of preparation and development of production. Line 18 = sum of lines 19 and 20.

Line 26 reflects losses from marriage. Defects in production are considered to be semi-finished products, parts, assemblies and work that do not meet the established technical conditions or standards in quality and cannot be used for their intended purpose.

Line 27 reflects the total production cost. Line 27 = sum of lines 03, 14, 17, 18, 21 26.

Line 28 reflects non-production costs in accordance with the terms of the government contract (contract).

Line 29 reflects the profitability of manufactured military (defense) products.

| Line 29 = | line 01 - line 02 | x 100 | . |

| line 02 |

9. Section II of the form “Indicators of cost and profitability of manufactured military (defense) products” is filled out for each military (defense) product included in the nomenclature list agreed with the Military-Industrial Commission under the Government of the Russian Federation.

In the lines “Name of product” and “Brand, type, modification”, “Serial number of product (batch of products)” the official designation provided for in the technical documentation (technical conditions) is indicated.

The line “Product code according to OKPD” indicates the nine-digit product code according to the All-Russian Classifier of Products by Type of Economic Activity OK 034-2007 (OKPD).

In the line “State customer (customer)” and “Code of state customer (customer)” the following is indicated:

for state contracts with a state customer for final products - the official name and five-digit code for the state customer of the All-Russian Classifier of Public Power and Management Bodies OK 006-93 (OKOGU);

for other contracts (agreements) for components, purchased semi-finished products, works, services - the official name and eight-digit code of the customer (enterprise, organization) according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

In the line “Number of the state contract (contract)” and “Date of conclusion of the contract” the details of the contractual documents drawn up between the state customer and the main contractor, the main contractor and the contractor or the contractor and the co-executor are indicated.

The line “Calculation unit” indicates the calculation unit corresponding to the natural measurement adopted for a given type of product in standards or technical specifications (pieces, sets, etc.).

Line 30, columns 1, 3 shows the number of actually manufactured products (pieces, sets, etc.).

Columns 1, 3 on lines 31 60 indicate actual cost indicators for costing items, product output and profitability for the entire output of a specific type of product (product, base product, group of similar products, set, unit, part, etc.).

Columns 2, 4 on lines 31 54 reflect the actual costs of producing a unit of a specific type of product (product, basic product, group of similar products, set, unit, part, etc.) broken down by costing items in accordance with the Procedure for determining the composition of costs for the production of defense products supplied under the state defense order, its price and profitability. Moreover, if more than one product is produced in the reporting period, the indicators of itemized actual costs, production and total cost, as well as profitability are indicated per unit as a weighted average, with the exception of products with a production cycle of more than one year.

In columns 1, 2, 3 and 4:

Line 31 reflects the total cost of materials. Line 31 = sum of lines 32 41.

Line 42 reflects the total cost of paying the main production workers. Line 42 = sum of lines 43 and 44.

Line 45 reflects mandatory insurance premiums in the same way as line 17.

Line 46 reflects the total cost of preparation and development of production. Line 46 = sum of lines 47 and 48.

Line 54 reflects losses from marriage in the same way as line 26.

Line 55 reflects the total production cost. Line 55 = sum of lines 31, 42, 45, 46, 49 54.

Line 57 reflects the final value of the actual full cost of the product, including both production and non-production costs. Line 57 = sum of lines 55 and 56.

On line 58, only columns 2 and 4 are filled in.

On line 59, only columns 1 and 3 are filled in, which reflect the production volumes of the product.

Line 60 reflects:

Profitability of issue according to columns 1, 3

| Line 60 = | line 59 - line 57 | x 100 | . |

| line 57 |

Product profitability according to columns 2, 4

| Line 60 = | line 58 - line 57 | x 100 | . |

| line 57 |

On line 61, only columns 2 and 4 are filled in, which reflect the actual labor intensity.

Line 62 in columns 1 and 3 shows the share of production volume of a specific item in the total volume of finished military (defense) products at actual prices, completed production and accepted by the state customer in accordance with established standards and technical conditions.

| Line 62 = | line 59 | x 100 | . |

| line 01 |

10. If in the reporting period two or more products with a production cycle of more than one year are delivered, then reporting information is presented for each of such products on separate sheets in the context of indicators in column 2.

Columns 3 and 4 of Section II for products with a long production cycle are filled out only if there are products delivered in the corresponding reporting period of the previous year.

What are the deadlines and procedure for delivery?

Respondents provide information on the distribution of the number of employees by salary level only if they were included in the department’s sample. Rosstat determines accountable persons selectively, once every two years. Information is provided in the context of one month - April. The deadline for submitting the report is May 20.

IMPORTANT!

In 2021, all reporting to statistics is submitted only in electronic form (500-FZ dated December 30, 2020). The responsible executor signs the statistical form with an electronic digital signature and sends the electronic file to the territorial department of the statistical agency.

ConsultantPlus experts looked at what reports a HR officer should submit during 2021. Use this information for free.

How to fill out a report

Statistical form No. 1 consists of a title page, a summary table and a certificate.

Step-by-step instructions for filling out statistical form No. 1 with illustrations:

Step 1. Fill out the title page. On the title page we indicate the name of the respondent organization, its postal address and OKPO.

Step 2. Enter information into the table. In the tabular section, the number of employees is compared with salary accruals. The first column shows interval values from the minimum wage to the maximum possible salary (the maximum is not limited). The second column contains the line numbering. In the third column we indicate the number of employees who received wages in a given interval, and in the fourth column we indicate the total accrual amount for these employees in rubles. All accruals are indicated before deduction of personal income tax.

Step 3. Generate reference information. In the certificate, we highlight employees who received a salary in the amount of the minimum wage and who worked for less than a full month. Then we indicate the average number of employees as of March 31, 2021 and for April 2021. In the last lines we reflect the total wage fund (taking into account part-time workers and civil servants) and the average payroll.

IMPORTANT!

Table of statistical form No. 1 reflects information only on employees from the average payroll of the organization. External part-time workers, employees under civil contracts, employees on maternity leave and a number of other categories are not included in the payroll (clause 5 of the instructions for filling out statistical form No. 1 from Order No. 37).

The report is signed by the manager or specialist responsible for submitting information. The date, contact phone number and email address must be indicated.

Who takes 1-KSR and when?

Form 1-KSR reports to individuals and legal entities that provide individuals with places to stay - hotels, hostels, motels. This also includes special SSRs - sanatorium-resort organizations, tourist centers, cruise and pleasure ships, railway sleeping cars, etc.

The form is submitted quarterly and at the end of the year. For the quarterly form, the deadline is until the 20th day of the month following the reporting quarter. For annual - until March 15 of the year following the reporting year.

The form is submitted in paper or electronic form. If there are separate divisions, report separately for the branch and the parent organization.

For missing the deadline, a fine is provided under Article 13.19 of the Code of Administrative Offenses of the Russian Federation in the amount of 20–70 thousand rubles for a company and 10–20 thousand rubles for an official.