New declaration on UTII from 2021

Few changes have been made to the declaration form, including:

- barcodes on all pages have changed,

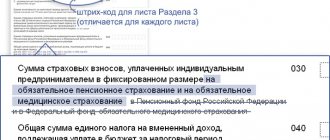

- The calculation of “imputed” tax in section 3 of the UTII declaration for individual entrepreneurs has changed. Now entrepreneurs can reduce the tax by up to 50% on the amount of insurance premiums paid not only for employees, but also for themselves (clause 1, clause 2, article 346.32 of the Tax Code of the Russian Federation).

The changes also affected the Formats for submitting the electronic declaration and the Procedure for filling out the UTII declaration.

The new UTII declaration for the 1st quarter of 2021 must be submitted no later than April 20, 2021. The “old” form was last used for the report for the 4th quarter of 2021. and it can no longer be used.

Those with more than 100 employees submit the declaration electronically; with a smaller average number of employees, you can submit a report on paper.

General reporting rules for imputation

UTII is a special tax regime that occupies a special position among the tax regimes existing in the Russian Federation. He is individual in many ways:

- applicable only to certain types of activities;

- in the procedure of transition to it and leaving it;

- in the absence of dependence of the amount of tax paid on the actual income received;

- in the rules for filing imputed tax reports.

Read more about this special regime in the article “The UTII taxation system: the pros and cons of imputation.”

Tax reporting for imputed tax (or tax return for UTII ) is tied to the tax period. Such a period for imputation is a quarter, i.e. the declaration is submitted to the Federal Tax Service on a quarterly basis, upon its completion. The deadline for this submission is fixed in paragraph 3 of Art. 346.32 of the Tax Code of the Russian Federation and is uniform for the entire territory of Russia: no later than the 20th day of the month following each tax period.

In reality, this period may shift towards its increase, since it is subject to the rule of the Tax Code of the Russian Federation on the transfer of a legally established date that falls on a weekend to the next weekday following this weekend (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

You can submit a declaration to the Federal Tax Service using any of the methods available to the taxpayer:

- electronically via TKS or through the Federal Tax Service website;

- on paper, submitting it in person or sending it by mail to the tax office.

Note! The “imputed” person cannot have zero declarations.

The procedure for filling out the UTII declaration 2021

The composition of the declaration remains the same: a title page and three sections. When filling them out, it is more convenient to adhere to the following sequence - first the data is entered into Section 2, then into Section 3, and lastly Section 1 is filled out. Appendix No. 3 to Order No. MMV-7-3/353 contains a detailed procedure for filling out the UTII-2017 declaration .

The general requirements for filling out an “imputed” declaration are standard:

- Monetary figures are indicated without kopecks, rounded to the nearest ruble;

- All pages are numbered;

- If there is no indicator in the cell, a dash is entered;

- At the top of each page the taxpayer’s INN and KPP are indicated;

- The report should be printed on one side of the sheet only, and do not staple the sheets.

Let's look at how sections of the UTII declaration for the 1st quarter of 2021 are filled out using an example:

IP Vorobyov used UTII for the entire 1st quarter of 2021, engaged in cargo transportation in Yaroslavl (OKVED code 49.41). The fleet includes 3 cars; the staff includes employees in addition to the individual entrepreneur himself. Basic income 6000 rub. per month. Coefficient K1 in 2021 = 1.798, and K2 = 1. In the 1st quarter, Vorobiev paid 5,000 rubles for himself. insurance premiums, and for employees - 12,000 rubles.

Reporting for the 4th quarter 2021

The UTII declaration for the 4th quarter of 2021 must be submitted no later than January 20, 2021. The form of this reporting was approved by order of the Federal Tax Service of Russia dated July 4, 2014 N ММВ-7-3/ [email protected]

Please note: UTII declaration for the 1st quarter of 2021, i.e. during the period from April 1 to April 20, 2021 and beyond, is submitted using the new form, which you will find below.

The UTII declaration for the 4th quarter of 2021 is not much different from the new one, which will take effect after the end of the 1st quarter of 2021, so it can be used as a sample in the future.

The title page of the declaration is filled out by the taxpayer, except for the lower right field. At the top of the page indicate the TIN and KPP of the organization (individual entrepreneurs - only TIN).

In the “Adjustment number” field when submitting the initial declaration, enter “0—“. If updated reporting is subsequently submitted, then depending on the count it will be, indicate “1—”, “2—”, etc.

The tax period in the declaration for each quarter will be different:

- 21 - for 1st quarter;

- 22 - for the 2nd quarter;

- 23 - for the 3rd quarter;

- 24 - for the 4th quarter.

In our case, code 24 is entered. In addition, you must indicate the reporting year to which the tax period relates, i.e. 2021.

Pay special attention to the field “at place of registration (code)”. The fact is that the UTII payer reports to the inspectorate at the place of activity, and not to the registration of an individual entrepreneur or LLC. The place of activity and the place of registration may coincide, then they fall under the jurisdiction of one inspection. If a taxpayer is registered with one inspectorate, but conducts activities under UTII in the territory under the jurisdiction of another Federal Tax Service, then he is registered with two tax authorities.

The registration location code is selected from Appendix No. 3 to the instructions for filling out, in particular:

- 120 - at the place of residence of the individual entrepreneur;

- 214 - at the location of the Russian organization, if it is not one of the largest taxpayers;

- 310 - at the place of business of the Russian organization;

- 320 - at the place of business of the individual entrepreneur.

Next, fill out the usual information for the title page: full name of the taxpayer; activity code according to OKVED, telephone number, number of pages in the reporting.

Section 1 indicates the amount of tax payable to the budget, i.e. already reduced by insurance premiums for individual entrepreneurs and/or employees. At the same time, the form has fields for filling out different OKTMO codes if you conduct activities using UTII in different places.

In section 2, line 010, you must enter the code for the type of business activity in accordance with Appendix No. 5 to the procedure for filling out reports. This is not the same as the OKVED code, for example:

- 01 – household services;

- 02 – veterinary services;

- 03 – transport repair and maintenance services, etc.

Section 2 is filled out for each place of business, so if you have several of them (for example, several retail outlets), but the tax office is the same, then the same number of Section 2 sheets must be completed.

Please note: when conducting activities on UTII in places belonging to different tax inspectorates, the declarations themselves must be different.

Next, in section 2, enter data for calculating the payment using the formula DB * FP * K1 * K2, i.e. it is necessary to indicate the basic profitability, physical indicator, coefficients, regional tax rate, which can be reduced compared to the standard 15%.

Section 3 indicates the calculated tax payment and insurance premiums that were paid for employees and/or individual entrepreneurs for themselves. Based on this information, the payment for payment to the budget is calculated.

Section 2

IP Vorobyov has only one type and address of “imputed” activity, so only one sheet of the section will be filled out. When carrying out several areas of business on UTII, each of them is assigned a separate section 2 of the UTII tax return-2017.

The code in line 010 is selected from Appendix No. 5 to the Filling Out Procedure - type of activity “05”.

In lines 070-090 for each month of the quarter we enter:

- Gr. 2 physical indicator – 3 (number of cars used in “imputed” activities);

- Gr. 3rd number of days of activity on UTII - put a dash, since all months have been fully worked out; when part of the month the activity was carried out in a different mode, you need to indicate the number of days of work on UTII;

- Gr. 4 tax base - with a fully “imputed” month, it is calculated as the product of indicators on lines 040, 050, 060, 070 (080, 090). In our case, the tax base for gr. 4 will be the same in each month of the 1st quarter: 6000 rubles. x 1,798 x 1 x 3 = 32,364 rubles.

When an incomplete month has been worked, the resulting result must additionally be divided by the number of calendar days of the month and multiplied by the days worked.

We get the tax base for the quarter by adding up the base for 3 months - 97,092 rubles. (line 100). Let's multiply it by the rate of 15% and get the tax amount - 14,564 rubles. (line 110).

Where is the imputed tax report?

Where can I file a UTII tax return ? Both of its options required for 2021 (required for the report for the last quarter of 2021 and the form for the updated UTII declaration - 2017 , valid for the periods of 2017) are available for downloading in any of the reference and legal systems and on the Federal Tax Service website.

It is also possible to download the UTII declaration - 2017 on our website.

In addition, on our website you can download the form of this form used for reporting for the periods of 2021, which may be required if there is a need to clarify previously submitted data.

Section 3

Let's calculate deductions and the amount of tax payable:

- In line 005 the sign is “1”, since our individual entrepreneur has employees.

- On lines 020 and 030 we indicate the amount of insurance premiums transferred in the 1st quarter for employees (12,000 rubles) and “for yourself” (5,000 rubles), respectively. Please note that line 030 in the UTII-2017 form can now be filled out by individual entrepreneurs with employees in order to reduce the accrued UTII tax by the amount of fixed contributions.

- Individual entrepreneurs with employees can deduct no more than 50% of the “imputed” tax on line 010: RUB 14,564. x 50% = 7282 rub. Although the amount of contributions paid is 17,000 rubles. (12,000 rubles + 5,000 rubles), but from them we will take only 7,282 rubles to reduce.

- The total amount of UTII payable for IP Vorobyov is 7282 rubles. (line 040).

Results

The imputed tax declaration is submitted quarterly, by the 20th day of the month following the reporting quarter.

Its form, starting with reporting for the periods of 2021, has been changed. The update is mainly related to editorial changes, but there is also an innovation that has changed the procedure for calculating the final tax amount for individual entrepreneurs with employees. Now such individual entrepreneurs can reduce the accrued tax by the amount of payments for insurance premiums made both for employees and for themselves. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Section 1

This indicates how much tax is payable for each OKTMO code. In our case, there is only one code, which means only the first block of lines 010-020 will be filled. Line 020 will be equal to line 040 of section 3 - 7282 rubles.

If OKTMO is more than one, the calculation for each of them is done in proportion to the share in the total tax amount: line 020 = line 040 section 3 * (sum of lines 110 section 2 according to code OKTMO / line 010 section 3).

When adding the tax amounts for all OKTMO codes in section 1, the result should be equal to line 040 of section 3.

OKVED codes

The declaration must explain what the main activities of the organization or individual entrepreneur are. For these purposes, you need to indicate the OKVED code. At the same time, in all declarations submitted from January 1, 2021, it is necessary to indicate codes according to the new OKVED2 classifier. However, if “clarifications” are submitted for periods expiring before 2021, then indicate in them the same codes that were entered in the initial declarations (Letter of the Federal Tax Service of Russia dated November 9, 2016 No. SD-4-3/21206).

How to find out the new OKVED

If you do not know your new OKVED code, use transition keys. You will find them on the website of the Russian Ministry of Economic Development at the link economy.gov.ru. Download the key “OKVED 2001 - OKVED2”. On the contrary, you can see the new code.

Let's give an example of a completed title page of the UTII declaration for the 1st quarter of 2021.

Responsibility

If the UTII declaration for 9 months of 2017 is submitted later than October 20, 2021, then the organization or individual entrepreneur may be fined (Article 119 of the Tax Code of the Russian Federation). Fine – 5% of the UTII amount not paid on time based on the declaration for each full or partial month from the day established for its submission. That is, if the declaration for 9 months of 2017 is submitted, say, one day later and the amount payable under this declaration is 125,600 rubles, then the fine is 6,280 rubles. However, the fine cannot be less than 1000 rubles and should not exceed 30% of the tax amount (Article 119 of the Tax Code of the Russian Federation).

For violation of the deadlines for submitting an “imputed” declaration, administrative liability is also provided for officials (individual entrepreneurs or directors): a warning or a fine of 300 to 500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).