Has a new form 4-FSS “for injuries” been introduced? When and what changes were made to the form last? Who should submit the form and when? Where to submit the report? What should the Form 4 of the Social Insurance Fund be for the 3rd quarter of 2021? You can download the new form for free using the links in this material.

Which form should I use?

Relevant for submitting calculations for the 1st quarter of 2021 is the form, the latest edition of which was approved by order of the Federal Social Insurance Fund of the Russian Federation dated June 7, 2021 No. 275 “On amendments to appendices No. 1 and No. 2 to the order of the Social Insurance Fund of the Russian Federation dated September 26, 2021 No. 381 “On approval of the calculation form for accrued and paid insurance contributions for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out.” The report on this form has been submitted since last year, so the “new” form can be called very conditionally.

Who submits the 4-FSS calculation for the 3rd quarter

All employers with hired employees with whom labor relations have been formalized must submit 4-FSS calculations for the 3rd quarter. Such business entities include not only legal entities, but also individual entrepreneurs if they have hired personnel.

If the employer has employees working under a civil contract, then they do not need to be included in the 4-FSS calculation. This point is connected with the fact that insurance premiums “for injuries” are not charged on payments under GPC agreements, and therefore information on payments is not included in the calculation.

Attention! If the GPC agreement includes a condition that the employer charges and pays insurance premiums “for injuries,” then the information on the GPC agreement must be reflected in the 4-FSS calculation.

FSS specialists often try to reclassify relations under a GPC agreement as labor relations, proving that the person works as usual, like everyone else. If they prove this, then they charge additional insurance premiums “for injuries.”

To fill out the 4-FSS calculation without errors, use the 1C: Reporting service. Through it, you can not only generate various reports, but also directly send documents to the tax office without downloading. There is no need to personally visit the offices of the Federal Tax Service and funds, no need to send letters by Russian Post. The service saves your time and also allows you to check whether the reports are filled out correctly. Call our specialists and we will help you with the connection.

table 2

This section of the report includes the calculation of the contributions payable:

- Page 1 reflects the employer’s debt on contributions as of 01/01/2018. This value can be taken from page 19 of the table. 2 forms 4-FSS for 2021. In all 4 reports this value remains unchanged.

- Page 1.1 is filled out in the case when the report is submitted by the legal successor or the data is presented according to a separate entity that has already been deregistered.

- Page 2 reflects a lot of data, but they are all mathematically related. The total amount in the 3rd column is obtained by adding the lines “At the beginning of the reporting period” and “For the last three months”, which in turn will be the sum of the next three lines - 1, 2 and 3 months.

- Page 3 shows whether contributions were accrued as a result of the audit.

- Page 4 reflects the amount not accepted by the Social Insurance Fund for offset.

- Page 5 shows the amounts additionally accrued by the policyholder independently for past periods.

- Page 6 reflects the amount of reimbursement of the policyholder’s expenses received from the Fund.

- Page 7 shows the return of overpaid or collected contributions.

- Page 8 shows the total of pages 1 to 7.

- Page 9-11 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the end of the period:

- page 9 - total amount;

- p. 10 – including due to excess costs;

- p.11 – including due to overpayment.

- Pages 12-14 reflect the amount of debt owed to the division of the Federal Social Insurance Fund of the Russian Federation at the beginning of the period:

- p. 12 - the total amount, its indicator must correspond to p. 9 of the 4-FSS report for 2021.

- p.13 – including due to excess costs;

- page 14 – including due to overpayment.

- Page 14.1 contains information about the debt of a fund division to a successor or a liquidated separate division.

- Page 15 reflects the company's expenses related to insurance of personal insurance and occupational diseases. Amounts are indicated for the entire reporting period and for 3 months of the reporting period.

- Page 16 contains information about insurance premiums actually paid. They are also shown for the period as a whole and monthly for the last three months; payment dates and payment order numbers are also indicated.

- Page 17 reflects information about the written off debt of the policyholder.

- Page 18, similar to page 8, is a control. It contains the sum of the values on pages 12 to 17.

- Page 19 reflects the debt owed by the policyholder at the end of the reporting period. The arrears (if any) are highlighted on page 20.

How to submit the 4-FSS calculation for the 3rd quarter

Employers submit 4-FSS calculations for the 3rd quarter to the Social Insurance Fund according to the legal address of the legal entity or the residence address of the individual entrepreneur. If a separate division is placed on a separate balance sheet, has its own employees and pays them for their work independently, it submits payments at the place of its registration to the Social Insurance Fund.

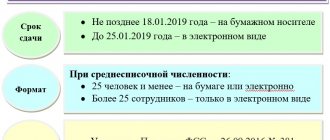

The calculation must be submitted electronically if the average number of employees is more than 25 people in 2021. If this condition is not met, the employer has the right to submit the 4-FSS calculation on paper.

Separately, it is necessary to note employers registered in 2020. In this case, information on individuals who received salaries in 2021 is taken into account when calculating the average number of employees.

Important! If an employer violates the rules for submitting 4-FSS calculations, namely, submits reports on paper instead of electronic format, he will be fined.

Title page

Contains information about the organization:

- Employer registration number is a 10-digit code that is assigned upon registration with the Social Insurance Fund.

- Subordination code is a 5-digit code that determines in which department of the fund the employer is registered.

- Correction number - the value “000” is entered if this is the original report. In other cases, the correction number is indicated.

- Reporting period - contains 2 values, written through “/”. The first 2 boxes indicate the reporting period (for 9 months - “09”). The second windows are filled in in case of applying for a refund (acceptable values 01–10).

- Calendar year is 2021.

- Termination of activity - can be skipped. The permissible value “L” is entered only in a situation of liquidation of the enterprise.

- Full name/full name - contains information about the full name of the organization, as indicated in the constituent documents, the full name is also indicated in full, as stated in the passport.

- TIN - indicates the employer code issued by the Federal Tax Service. Legal entities enter “00” in the first two fields.

- Checkpoint - placed only in cases where the policyholder is a legal entity.

- OGRN (ORGNIP) - the number from the state registration certificate is indicated, legal entities enter the value “00” in the first two boxes.

- OKVED code - indicate the code that corresponds to the type of economic activity of the enterprise. Based on OKVED, the organization is assigned a profrisk class. Every year it is necessary to confirm OKVED in the FSS.

- Budgetary organization - only those employers who receive support from the state indicate the value here. These values show where the money came from (federal budget - “1”; budget of a constituent entity of the Russian Federation - “2”, municipal budget - “3”, several sources of income - “4”).

- Contact phone number - as a rule, indicate the number of the person responsible for submitting the report.

- The fields “Average number of employees”, “Number of working disabled people”, “Number of employees engaged in work with harmful or hazardous production factors” - contain the specified values, calculated in accordance with the requirements of Rosstat.

- Calculation provided on - this field is filled in after the entire report is completed and shows its total volume.

- With supporting documents and their copies attached, to be completed if the report is supplemented with other documents.

- I confirm the accuracy and completeness of the information - a value is entered that corresponds to the attribute of the person donating (“1” - personally, “2” - representative, “3” - legal successor).

- Full name - indicate the full name of the director or responsible person, he also puts his signature in the column below.

- Date—the current date for submitting the report is entered.

- A document confirming the authority of the representative is filled out only if the value “2” is entered in paragraph 17.

- The employer does not use the “To be filled in by fund employee” field. It is for service marks of FSS employees.

Responsibility for failure to submit 4-FSS calculations for the 3rd quarter

If the deadline for submitting the 4-FSS calculation for the 3rd quarter is violated, liability is provided in accordance with Art. 26.30 of the Federal Law of July 24, 1998 No. 125-FZ, namely a fine of 5% of the amount of insurance premiums calculated for each full and partial month from the date established by law for submitting the calculation. In this case, the minimum fine is 1,000 rubles, and the maximum is 30% of the amount of insurance premiums.

In addition, the same article of the law also establishes a fine of 200 rubles if the employer violates the reporting format - paper instead of electronic.

Penalties are also provided for employer officials - on the basis of Part 2 of Art. 15.33 of the Code of Administrative Offenses of the Russian Federation, their size is 300-500 rubles.

Nuances of 4-FSS in 2021

The coronavirus year did not cause any special changes in the rules for filling out 4-FSS.

The issue that concerns many employers is related to compensation from the Social Insurance Fund for expenses related to the prevention of coronavirus.

We talked about this in detail here “Personal protective equipment against COVID-19 and not only from 08/04/2020 will be paid for by the Social Insurance Fund.”

Is it necessary to reflect the amount of expected compensation in 4-FSS? The answer is no . Payment of compensation for the prevention of coronavirus from the Social Insurance Fund is of a declarative nature. And the maximum amount of compensation is tied to the amount of contributions paid in 2021. Therefore, no data related to compensation will be included in 4-FSS for 9 months of 2021.

How to fill out the 4-FSS calculation for the 3rd quarter

To fill out the 4-FSS calculation for the 3rd quarter, you must use the form approved by FSS Order No. 381 dated September 26, 2016 (as amended on June 7, 2017).

The report contains the following sections:

- title page - information about the employer, reporting period, average number of employees is indicated;

- table 1 - the calculation of the base subject to insurance premiums is carried out;

- table 1.1 - filled in with information on employees sent to another employer for temporary work;

- table 2 - calculation of insurance premiums “for injuries” is carried out;

- table 3 - filled in with information on expenses incurred by the Social Insurance Fund (sick leave benefits due to accidents or occupational diseases, payment for vacations for sanatorium treatment due to injuries, costs for the prevention of occupational diseases and injuries);

- table 4 - information is entered on employees who suffered from accidents or have occupational diseases;

- Table 5 - information about special assessments and medical examinations is indicated.

Important! If the employer does not operate in the reporting period and does not make any payments to employees, he submits a zero calculation in Form 4-FSS. In this case, the report includes a title page, tables 1, 2, 5, and dashes are added in the columns.

How to submit RSV for direct payments

Submit calculations for insurance premiums using the same form on which you reported for 2021. It was approved by order of the Federal Tax Service dated September 18, 2019 N ММВ-7-11/ [email protected]

Everyone who joined direct payments from January 1, 2021 must take into account several important changes in the calculation for the first quarter. They will affect the order in which Annexes 2, 3 and 4 are completed.

How to work on direct payments from January 1, 2021

How to fill out the RSV according to the new rules

No one needs to fill out Appendices 3 and 4 anymore, since they decipher the expenses of organizations to pay benefits to employees, which are now immediately paid by the Social Insurance Fund.

With Appendix 2 to Section 1, everything is a little more complicated. It indicates the amount of contributions to VNiM. The features of direct payments are as follows:

- line 002 contains the sign “1” for direct payments;

- no need to fill out line 070 “Expenses incurred for payment of insurance coverage”;

- line 080 “Reimbursed by the Social Insurance Fund for expenses for payment of insurance coverage” is filled in only if the employer received compensation for the periods before the transition to direct payments;

- in line 090 “Amount of insurance premiums payable” only sign “1” is indicated, since sign “2” is entered when expenses exceed the calculated insurance premiums - this is not possible with direct payments.

Fill out, check and submit the RSV via the Internet

Filling example . The company has 5 employees. In the first quarter of 2021, accrued contributions to VNiM amounted to 10,875 rubles. Including for January, February and March 3,625 rubles each.

In January, the Social Insurance Fund reimbursed expenses for December sick leave in the amount of 1,200 rubles.

Appendix 2 will be completed as follows:

Sample RSV for the 1st quarter of 2021 on direct payments. Abridged Appendix 2

What benefits should be reflected in the RSV?

From 2021, the DAM takes into account only those benefits that the employer himself paid to employees. Previously, in the amount of payments we indicated all sick leave, maternity leave, child care benefits, etc. Now only sick leave for the first three days of an employee’s illness and additional days off to care for a disabled child remain.

They are included in the amount of payments and other remuneration accrued in favor of the employee. In the RSV these are lines 030 of subsections 1.1 and 1.2, line 020 of Appendix 2 and lines 140 of subsections 3.2.

Sick leave for the first three days of illness is not subject to contributions, so they are included in the amounts not subject to taxation under Art. 422 of the Tax Code of the Russian Federation. These are lines 040 of subsections 1.1 and 1.2 and line 030 of Appendix 2. Payment of additional exit fees is subject to payment and therefore is reflected in lines 050 of subsections 1.1 and 1.2 and Appendix 2, as well as in lines 150 of subsections 3.2.

Funeral benefits are also paid by the employer, and the Social Insurance Fund will compensate them later. There is no need to show them in the calculation.

How to prepare the 4-FSS calculation for the 3rd quarter

Before generating the 4-FSS calculation for the 3rd quarter, it is necessary to calculate salaries for all months of the reporting period. Based on the “Payroll” document, not only the wages for each employee will be calculated, but also the amount of insurance premiums “for injuries”.

Calculation of 4-FSS in 1C: Accounting

After this, you can generate a 4-FSS calculation in 1C: Accounting 8.3 - in the “Reports” tab through the “Regulated Reports” hyperlink.

In the window that opens, create a new report using the “Create” button, then select the “FSS” folder and then the “4-FSS” reporting.

The document has a “Fill” button, when clicked, it is filled in automatically based on the information available in the program.

Table 1

Here is a summary of data on all types of employee benefits and contribution rates:

- Page 1 includes 4 informative columns about the amounts of payments to individuals. Column 3 shows the entire amount since the beginning of the year, and columns 4-6 show the amounts paid in each month of the reporting period.

- Page 2 includes data by which page 1 can be reduced (benefits, financial assistance, compensation for travel costs, etc.).

- Page 3 contains the final information for calculating contributions, it is obtained by subtracting the data on page 2 from the data on page 1.

- Page 4 contains data on payments in favor of disabled people working at the enterprise.

- Page 5 to 9 contain information about the applicable tariff, discounts and surcharges, and allow you to calculate the total value. If all fields of the form are filled out, then page 9 = page 5 – page 6 + page 7. If page 7 is filled out, then on page 8 you must indicate the date from which this surcharge is applied. All values are indicated with two decimal places.

Table 3

This part of the report is filled out by those policyholders who independently incur expenses for insurance against accidents and occupational diseases. Columns 3 and 4 reflect the number of paid days (where applicable) and the payment amount. Types of expenses are listed by line:

- Page 1 and 4 - payments of benefits for temporary disability in connection with emergency situations at work and occupational diseases.

- On pages 2, 3, 5, 6 from lines 1 and 4, payments are allocated to external part-time workers and victims in another organization.

- Page 7 reflects the costs of paying for additional admission for sanatorium-resort treatment.

- On page 8 from page 7, the costs of vacation pay for employees who suffered in another organization are allocated.

- Page 9 reflects payment for preventive measures to reduce injuries and occupational diseases.

- Page 10 summarizes all types of expenses. It is the sum of pages 1, 4, 7, 9.

- Page 11 provides information about benefits not paid as of the reporting date. If at the time of filing the benefit report the payment period has not yet expired, then they are not included in this line.

Possibility of automating filling out form 4-FSS

To make submitting reports to the federal social insurance service as easy as possible, individual entrepreneurs and organizations use software that can automatically create the necessary documents. Thanks to this approach, for the 9 months of 2021 the 4-FSS report can be submitted as easily as an annual or quarterly one. It is quite enough to enter the initial data in a timely manner and ensure the transfer of the finished document to the supervisory authority.

You can use a program developed by the insurance service itself; you can download it on the FSS website. There are local and network versions, which allow you to automate one or more jobs if desired. If you have questions about how to fill out the 4-FSS report for 2021, you should seek advice from a qualified specialist. If there are none on staff, it is recommended to seek the help of an outsourced accountant.

Table 5

This section of the report contains two lines that reflect data on workplace certification and medical examinations.

Column 3 of line 1 indicates the total number of jobs at the enterprise for which certification must be carried out, and in gr. 4 - the number of places in respect of which it was carried out. In gr. 5 and 6 information is entered if, based on the results of certification, workplaces were classified as hazard classes 3 and 4.

If workplace certification is a mandatory procedure for all enterprises, then medical examinations should be carried out only for some professions. If there are none, dashes are placed in the columns.

Otherwise, in gr. 7 indicates the number of employees for whom a medical examination is mandatory, and in gr. 8 — information about employees who have undergone a medical examination is entered.

Table 4

This sheet is filled out only by those enterprises where accidents occurred or occupational diseases were discovered during the reporting period:

- On page 1 information about the total number of NS is entered. This value must coincide with form N-1 (approved by Resolution of the Ministry of Labor dated October 24, 2002 No. 73).

- On page 2, fatal accidents are listed.

- On page 3, data on recorded cases of occupational diseases is entered.

- On page 4 enter the sum of page 1 and page 3.

- On page 5, data is entered on cases that resulted in only temporary disability.

NS are taken into account in the reporting period when the examination was carried out.