What is the reporting form?

Report form P (services) – statistical, OKUD code 0609707. The statistical report form was approved by Rosstat in its order No. 564 of 08/31/2017. Already in December 2021, changes were made to the order.

If a company is engaged in providing services to the population on a commercial basis, then such a report must be submitted to the local statistics office.

Report P (services) should not be confused with form 1-service, which is annual.

The difference between the two forms is that 1-services are compiled once, at the end of the year, and P (services) - every month or quarter.

Both report forms were approved by one order and are forms that companies fill out as part of federal statistical monitoring.

Purpose and sample

The report refers to documents for statistical purposes. It is submitted every month to the local Rosstat office. Moreover, the deadline for submission is set on the 4th day of the month closest to the reporting month. However, if the 4th falls on a weekend or holiday, it is due on the next business day.

The document is intended to track the dynamics of economic indicators, the number of goods and services that were created by the enterprise itself. Consists of a title page, as well as 5 mandatory sections (the form is unified and mandatory for use by all organizations):

- General indicators of the company's economic development.

- The number of goods and services that were created (produced) directly by the enterprise. The classification is given in accordance with the types of activities.

- Sale of goods and provision of services - wholesale and retail.

- Indicators for cargo transportation, freight turnover indicators (for vehicles only).

- Indicators for production volumes, as well as shipment of goods, dividing them into types (services are also taken into account).

NOTE. Starting from the January 2021 report, a new form of Form P-1 is used. It is given below.

Who passes and who doesn't pass

The following organizations are exempt from submitting this reporting document:

- small businesses – i.e. all small businesses (annual revenue less than 800 million rubles, total number of employees less than 100 people);

- Insurance companies;

- banks;

- companies with a maximum of 15 employees, including freelancers working as external part-time workers.

All other companies submit a report. In this case, the purpose and nature of their activities do not matter - for example, non-profit organizations (public, religious associations) are also required to submit a reporting document to the local branch of Rosstat.

It can be provided either by mail or electronically. It is advisable to keep a backup copy of the document, and in the case of a postal item, send it by registered mail with return receipt requested.

Who should submit reports?

To ensure that the information in the reports is indicated correctly, Rosstat has compiled instructions for filling them out.

Among other things, such instructions contain information about who should submit these forms.

Such reporting is submitted by all legal entities, with the exception of those belonging to small businesses. That is, medium and large enterprises are required to report to the statistics body.

Another feature is that if the entity that provides the service receives funds directly from the buyer, then the service provider is obliged to submit a report to the statistics body.

In the case where the consumer is an individual and the employer pays for him, the employer company fills out a report on the service provided to the employee. In this case, such obligation is removed from the service provider.

It is also worth noting that except for small businesses, that is, small businesses, such reporting forms are not submitted by housing and housing construction cooperatives, as well as homeowners’ associations.

Saving templates

To fill out and submit statistical reporting to TOGS in electronic form, you first need to obtain templates - a package of electronic versions of forms.

- Download the template file that needs to be connected to the program. To download the template, go to the Rosstat website, then find the desired template in the list and click on the Download link in the XML template column.

- The templates are in the archive, you first need to unzip the xml

- In the “Filling out statistical reporting forms” program, click on the Load templates from file button or click File-Load templates from file

- A window will appear with information about the downloaded templates. Click Close

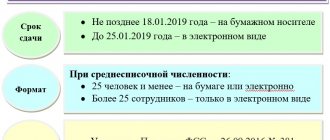

Deadlines for submitting the statistical form

Despite the fact that both report forms are very similar to each other, the deadline for submitting them to the statistics body is different.

| Report form name | Deadline for submitting the report to the statistics body | |

| Form P (services) | Number of employees no more than 15 people | The report is provided on a quarterly basis, no later than the 15th day of the month following the reporting quarter |

| Number of employees more than 15 people | The report is submitted monthly, by the 4th of the month | |

| Form 1-services | The deadline for submitting the report to the statistics department does not depend on the number of employees | The form is submitted once a year, before March 1 |

It must be borne in mind that the number of company employees is determined based on the results of the past year. That is, if at the end of 2021 the number of employees of the organization was 17 people, then a report on Form P (service) must be submitted every month.

It is difficult to miss the due date for service 1; the report is submitted only once a year.

For what period is Form No. P (services) submitted in 2021?

Organizations whose average number of employees in 2018 exceeded 15 people (not related to small businesses) provide the form monthly in 2021. In this case, the report contains information for both the reporting (column 4) and the previous (column 5) months.

Organizations whose average number of employees for 2018 was 15 people or less (not related to small businesses) draw up the form quarterly, but on an accrual basis from the beginning of the year (column 4). And column 5 is not filled in at all.

What does the report form include?

Both report forms are extremely easy to fill out.

The forms consist of only two parts - a title page and one section, which is presented in the form of a table. The indicators that need to be filled out in the tabular section are identical in both forms. The only difference is the period for which the information is provided.

Such reports can be drawn up by the director himself, an accountant or a person appointed by order of the director to perform such duties.

After the tabular part, the position of such person is indicated, a signature is affixed, and a transcript of the signature is given. In addition, you must provide a contact phone number and/or email address. If questions arise or errors are found in the form, employees of the statistics agency will contact the responsible person. Also on the last sheet of the form is the date when the report was submitted to the statistics agency.

Filling out information about the organization

To fill out information about the organization in the program, do the following:

- First, download the template file that you need to connect to the program.

- Open the program (Start - Programs - Filling out statistical reporting forms) or run the program through the Filling out statistical reporting forms

- In the program that opens, click Organizations, click the Create organization button or click Operations - Organizations - Create organization

- A form will open for you to fill out your organization details; carefully fill in all the data. Then click Save

.

Attention! The OKPO code cannot be changed after the organization is created!

Filling out the cover page of the form

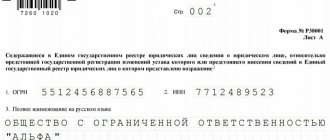

Filling out the cover pages of reports submitted to statistics does not differ in variety. The form of the first page of the form contains all the basic information about the report itself and the organization and is identical to any reporting form submitted to the Rosstat office.

You can select several blocks of the report title page:

- The top of the title page contains general reference information. The first block contains information about the name of the reporting form and the period for which it is submitted.

- The next block of information concerns information about who should submit this report and in what time frame this must be done. Next to it, on the right, is the name of the form and what document was used to put the report into effect. In addition, the period for which the report is filled out and submitted is indicated.

- Information about the company is a separate block of information. Here you indicate the name of the organization (full or short), the address where correspondence can be sent, the OKPO code, which is the main identifier of the organization in the statistical accounting system. In addition, the same block indicates the OKUD code for a specific report form

Instructions for filling

Before you start drawing up the document, you should take into account that the data entered into it should reflect the situation only for a specific enterprise. That is, if a company has several branches in different regions, then each such separate division provides its own document to the local branch of Rosstat.

Title page

When preparing the title page, you should adhere to the general rules provided for in such cases:

- The name of the company is indicated exactly as it is given in the constituent documents (full), and an abbreviated one is written next to it in brackets.

- The code is entered in accordance with the accepted OKPO classification.

- The postal address must indicate the legal address; You must also provide your postal code.

Section 1

Each section provides data with or without VAT. In this case, all information must be provided without VAT. You also need to consider the following rules:

- Line 1 does not take into account income that was received as a result of the sale of the company's fixed assets, inventories, currency, shares and other securities, as well as intangible assets.

- Lines 3 to 5 are filled in only if reporting is submitted for the months, the last in the quarter: for the 1st quarter this is March, for the 2nd - June, for the 3rd - September and for the 4th - December.

- In line 5, only the balances of purchased goods should be taken into account.

Section 2

In this section, the information is taken without VAT. Recommendations for filling out the following:

- In fact, the entire section clarifies and details the information of 1 line of 1 section - i.e. provides data on goods and/or services produced and/or provided by the organization itself.

- In the table, the total number of lines to be filled in must be equal to the number of codes according to the OKVED system.

- Accordingly, the entire amount in the lines must exactly correspond to the amount given in line 1.

Section 3

Here all data is calculated and filled in excluding VAT. In this case, they are guided by the following rules:

- Line 22 takes into account only the revenue that was received from goods sold directly to private citizens for their personal needs.

- In this case, when analyzing and calculating the data in line 22, you should exclude all goods that:

- were received by employees of the enterprise as part of their wages;

- which during operation broke down completely or partially before the expiration of the warranty period;

- all immovable objects, regardless of their purpose;

- travel tickets and coupons that allow you to use any type of transport;

- lottery tickets;

- cards that are intended to pay for telephone and other communication services.

- In lines 23, 24 and 25, the data is given in accordance with the name of the column.

- In line 26, you should note only the revenue that was received from the sale of goods to other companies and/or individual entrepreneurs. Thus, any goods that were sold to private citizens are not counted in this column.

- In line 27, you should take into account only the revenue that was received from the sale of such goods to private citizens: culinary products, as well as goods that have not undergone culinary processing.

- In line 28 you need to enter the entire amount of income that was received as a result of providing services to private citizens.

NOTE. If a company fills out line 28, it must also submit Appendix 3 to the reporting form P-1 in question.

Section 4

Here you need to enter all the information that relates to the transportation of goods exclusively by road:

- Data on lines 29 and 30 are taken into account in tons.

- Data on lines 31 and 32 are in tonne-kilometers.

Section 5

Here is information about products that were produced and shipped at the expense of the enterprise’s own resources. In this case, the data should be organized according to types. The entire list of these types is established by Rosstat - separately for goods and separately for services. All codes (50, 70, 80) can be set independently based on the types of products produced and/or shipped.

NOTE. In line 90, which follows at the end of the table, it is necessary to provide information about the electricity consumed by the enterprise for the entire quarter. Accordingly, these data are entered not monthly, but quarterly, i.e. reports only cover the most recent quarterly months: March, June, September and December.

Filling out the tabular section of the report

As mentioned above, both reports have only one section, which is presented in table form.

The table contains several columns:

- Types of services provided

- Line number to fill in

- OKPD2 code

- For what period are data presented?

The report must contain the total cost of services provided to the population, their breakdown for a specific type of service, as well as the cost of other paid services provided by the organization.

It is worth considering that the 1-service report contains one column less than P (services). The fact is that the 1-service form is annual and the information in it is indicated based on the results of the past year. Form P (services) takes into account information for the current period and for the previous month.

The list of services that the organization can provide to the population is quite extensive. This can be either hairdressing services or rental services. A list of all types of activities for which services can be provided is written directly in the report itself.

Forms are filled out in thousands of rubles, with one decimal place.

At the end of the form, you must put the signature of the performer and, at a minimum, indicate the contact telephone number and date of submission.

Who submits Form P (services)?

Check on the Rosstat website whether you need to submit certain forms. As for Form P, more precisely, “Information on the volume of paid services to the population by type,” it is submitted only by legal entities. Moreover, small businesses are exempt from this obligation. For individual entrepreneurs there is form 1-IP (services).

In general, Form P (services) is submitted under the following conditions:

- you provide services to the public and sell them directly: you accept orders and payment from the buyer of the service;

- you are an employer and are paying for a service that someone provided to your employee (for example, training or a travel package);

- you are an intermediary, and the service is provided through you;

- you are a resource supply company, and then you will have to submit Form P (services) even when concluding contracts for the provision of utility services with management companies.

If your company has separate divisions, then submit Form P (services) for the legal entity as a whole and separately for each separate division.

Comments

Mikhail 04/22/2016 at 1:00 pm # Reply

Citizens, be vigilant when submitting Form 1-IP “Information on the activities of an individual entrepreneur.” On March 1, 2021, I submitted a report to the office “Kurganstat, Territorial body of the Federal State Statistics Service for the Kurgan Region” 640020 Kurgan, st. M. Gorky, 40 04/22/2016 They sent me a document stating that the report had not been submitted and I was facing a fine. I called this office, the woman answered, did not introduce herself, but spoke politely, said that I really did not submit the report, I asked why you have such a frivolous organization where they lose documents, to which the answer was received that the organization is serious, justifying this by the fact that they can issue fines. I dictated the form data to her over the phone, I don’t know if she will be fined or not? So when citizens hand in reports to this office, ask them to provide a paper with a seal that they have accepted them. If there is no seal, then ask for an identification from the employee who accepts the report from you, rewrite the identification data and demand the date and signature on a copy of the document... Don’t step on a rake, after all, it’s 10,000 rubles. they don’t lie on the road - and this office in Kurgan is definitely not serious and irresponsible people work there.

ostapx1 04/22/2016 at 01:35 pm # Reply

Thanks for the warning. Unfortunately, this is possible in any regulatory body. That is why it is very important, when submitting reports, to do what you wrote in the last paragraph.

Sections 3 and 4

The table in section number three contains information on the consumption of various feeds for feeding animals and poultry, as well as on the amount of cereal crops processed for these purposes.

Next comes the fourth section, which contains data on the export of produced agricultural goods (cereals and livestock products), including outside the country. If the goods were not shipped during the reporting period, this part of the document does not need to be filled out.

In what structure is the document presented and where can I download its form?

The main form of the report consistently reflects:

Don't know your rights?

- Section 1 contains general economic indicators.

In particular, revenue:

- for shipped goods;

- for resold goods;

- on remaining goods.

- Section 2 contains revenue detailed by type of economic activity.

- Section 3 contains data on wholesale and retail sales of services provided in the catering segment.

- Section 4 contains data on transport services provided.

- Section 5 contains detailed information on released goods (using classification by OKPD codes) and balances.

Appendix No. 2 reflects information about the core products for the reporting business entity.

In particular:

- Defense products at fixed and actual prices, which:

- supplied to the domestic market;

- exported.

- Civilian products produced by a defense enterprise - for reference.

Appendix No. 2 also shows the average number of personnel at a defense enterprise and the number of man-hours worked during the reporting period (separately in departments producing civilian products). Such information is not indicated in the main report.

You can download the P-1 form valid for 2021 from us - via the link.

Form No. P-1 is submitted by all legal entities larger than small enterprises with a staff of more than 15 people, which includes contractors and part-time workers. The document reflects information about released goods and services. Defense enterprises also fill out Appendix No. 2 to the report. In addition to production indicators, it contains data on the staff of the business entity and the work performed in man-hours.

Statistical reporting form P-1 is a monthly reporting form for business entities. The document is submitted to Rosstat in paper or electronic form. The report must be submitted no later than the 4th working day after the end of the month for which the data is provided. The obligation to submit this report applies to all legal entities using hired labor with a staff size of 15 or more people (all employees are taken into account, including those registered under GPC agreements or part-time employees). Holders of mining licenses report regardless of the number of employees. The group of exceptions includes enterprises related to small businesses and financial and credit structures (banks, insurance companies) - they do not need to submit a report.

This might also be useful:

- New form SZV-M “Information about insured persons”

- New form 6-NDFL 2021

- New RSV form 2021

- Payment of 1% on income over 300,000 rubles

- Property tax for organizations and individuals

- Form and rules for filling out form 4-FSS

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Basis for drawing up a report on services provided

The most popular agreement in the civil law sphere is a contract for the provision of paid services.

Today, the range of services provided is very wide (medical, legal, accounting, consulting, advertising, etc.).

A report on services provided is needed to describe the essence of the work provided by the contractor, their cost and record the very fact of their provision. This document is one of the proofs of the reality of the transaction.

The law of the Russian Federation does not contain requirements for the mandatory preparation of a report, therefore this document is drawn up by agreement between the customer and the contractor.

Example

A ready-made example of a reporting document is presented below.

Federal statistical observation form No. P-1 “Information on the production and shipment of goods and services” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership that produce goods and services for sale to other legal entities and individuals (except for entities small businesses, banks, insurance and other financial and credit organizations, as well as legal entities whose average number of employees does not exceed 15 people, including part-time workers and civil contracts that are not small businesses).

Legal entities submit the specified form of federal statistical observation to the territorial body of Rosstat at their location. If a legal entity has separate divisions, this form is filled out both for each separate division and for a legal entity without these separate divisions.

The completed forms are submitted by the legal entity to the territorial bodies of Rosstat at the location of the corresponding separate division (for a separate division) and at the location of the legal entity (without separate divisions) within the established time limits. In the event that a legal entity (its separate division) does not carry out activities at its location, the form is provided at the place where it actually carries out activities.

The head of a legal entity appoints officials authorized to provide statistical information on behalf of the legal entity (including in separate divisions).

Temporarily non-operating organizations where goods and services were produced during part of the reporting period are provided with a federal statistical observation form on a general basis indicating the time since when they have not been operating.

Subsidiaries and dependent business companies provide the federal statistical observation form No. P-1 on a general basis in accordance with paragraph 2 of these Instructions. The main business company or partnership that has subsidiaries or dependent companies does not include information on subsidiaries and dependent companies in the federal statistical observation form.

Organizations that carry out trust management of an enterprise as a whole property complex draw up and provide reports on the activities of the enterprise that is in their trust management.

Organizations carrying out trust management of individual property objects provide the founders of the management with the necessary information about their property. The management founders draw up their reports taking into account information received from the trustee.

At the same time, organizations carrying out trust management draw up and provide reports on the activities of the property complex in their ownership.

Associations of legal entities (associations and unions) in the specified forms reflect data only on activities recorded on the balance sheet of the association, and do not include data on legal entities that are members of this association.

The address part of the form indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets. On the form containing information on a separate division of a legal entity, the name of the separate division and the legal entity to which it belongs is indicated (for example: Branch No. 19 of Krasny Tekstilshchik CJSC).

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code; if the actual address does not coincide with the legal address, then the actual postal address is also indicated. For separate divisions that do not have a legal address, a postal address with a postal code is indicated. A legal entity enters the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) in the code part of the form on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations by the territorial bodies of Rosstat.

For territorially separate subdivisions of a legal entity, an identification number is indicated, which is established by the territorial body of Rosstat at the location of the territorially separate subdivision.

Data for the corresponding period of last year, provided in the form of federal statistical observation for the reporting period, must coincide with the data of the form provided for the same period last year, except in cases of reorganization of a legal entity, change in the methodology for generating indicators, or clarification of data for last year. All cases of discrepancies in data for the same periods, but given in different forms, must be explained in the legend to the form.

If in the reporting year there was a reorganization, change in the structure of a legal entity or a change in methodology, then in the form of federal statistical observation, data for the reporting period, as well as for the corresponding period of the previous year, are given based on the new structure of the legal entity or methodology adopted in the reporting period.

According to form No. P-1

legal entities that are not small businesses, the average number of employees of which exceeds 15 people (including those working under civil contracts and part-time work), submit information monthly under sections 1 (except for lines 03, 04, 05), 2, 3, 4 for the reporting month, the previous month and the corresponding month of the previous year, for section 5 - for the reporting month; quarterly - according to lines 03, 04, 05 of section 1 - as of the end of the reporting period and the corresponding period of the previous year.

Organizations applying the simplified taxation system that are not small businesses provide form No. P-1 on a general basis.

In the case of carrying out activities on the basis of a simple partnership agreement (joint activity agreement), goods and services produced by the partners as a result of their joint activities, when each partner fills out the statistical observation form No. P-1, are distributed among the partners in proportion to the value of their contributions to the common cause, unless otherwise provided by the simple partnership agreement or other agreement of the partners. If these goods and services cannot be distributed among partners (for example, large equipment, etc.), then information on them is shown on a separate statistical observation form by the partner who is entrusted with keeping records of common property.

Organizations carrying out construction activities on the territory of two or more regions, including on separate forms of Form No. P-1, provide information on the actual location of the construction site. At the same time, on each report form it is written: “including in the territory of ________________ (its name is given, indicating the city and district).

In accordance with the Decree of the Government of the Russian Federation of November 10, 2003. No. 677 “On all-Russian classifiers of technical, economic and social information in the socio-economic field” (clause 9), assignment of codes to classification objects (types of products) by economic entities (enterprises and organizations) must be carried out independently and bear responsibility for incorrect their appropriation and application.

Who is taking the statistical form P-1 in 2021?

Form P-1 statistics is submitted to Rosstat monthly (on the 4th working day after the reporting month) by legal entities larger than small enterprises with a staff (which includes contractors and part-time workers) of more than 15 people, carrying out all types of activities except the provision of:

- banking and other credit and financial services;

- insurance services.

Nonprofit organizations only submit the form if they provide goods and services to outside parties.

Please note that there is a report on Appendix No. 2 to Form No. P-1. It is due in the same time frame as the main form. It is filled out by enterprises with more than 15 employees operating in the defense industry within the framework of:

- mining and manufacturing industries;

- production and supply of electricity, gas, steam.

In the report - if we talk about the main statistical form P-1 - it is necessary to reflect the following indicators:

- For the reporting month preceding it and the corresponding month last year:

- for all lines of section 1, except lines 03, 04 and 05;

- for all lines of sections 2, 3 and 4.

- Only for the reporting month - for all lines of section 5.

- For the quarter (as of the end of the quarter) and the corresponding period last year - on lines 03, 04 and 05 in section 1.

Let's take a closer look at what information is reflected in the specified sections of the main report form and Appendix No. 2.

Why is Form No. 1-IP necessary?

Form 1-entrepreneur 2021 was introduced by Rosstat for statistical monitoring of the activities of small and medium-sized businesses. This form is relevant for submitting the 1-P entrepreneur report for 2021 in 2021. The previous continuous survey of individual entrepreneurs was conducted in 2021 (based on the results of 2015).

In 2021, only those representatives of small and medium-sized businesses who were included in the list approved by Rosstat submitted the 1-P entrepreneur report. This is the so-called selective observation, in contrast to the continuous observation carried out by Rosstat in 2021 based on the results of 2015. The following continuous observation, i.e. Submission of the 1-P entrepreneur report will be mandatory for all small and medium-sized enterprises, including individual entrepreneurs, in 2021, based on the results of 2021.

Rosstat carries out selective observation annually. Typically, territorial authorities independently notify individual entrepreneurs by sending them in writing the forms of reports required for submission. But the human factor can interfere with this, so in order to find out whether you need to submit a report for 2021, go to the Rosstat website and fill out the form. If you are included in the list of selective reporting, this service will give you the report form necessary for submission to Rosstat.

Based on Art. 2 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”, such statistical observations are carried out once every five years to develop a realistic policy of the Russian Federation in relation to SMEs.

It should be noted that the information provided by the individual entrepreneur must be based on real facts, and not just on data submitted to the Federal Tax Service. Rosstat guarantees complete confidentiality of information and information. The transfer of data to tax authorities, according to Rosstat management, is excluded.

Information received by Rosstat on the state of small and medium-sized businesses in 2021 will be used to generate official statistics. The observation results will be available on the Rosstat website - www.gks.ru