No later than May 2, 2021, entrepreneurs submit 3-NDFL to the inspectorate. We have given an example for individual entrepreneurs of filling out a declaration with a sample.

When entrepreneurs file a 3-NDFL declaration

The declaration must be submitted by individual entrepreneurs under the general taxation regime, as well as businessmen under the simplified tax regime if they received an interest-free loan. Then the entrepreneur must report income in the form of material benefits from savings on interest, which is subject to personal income tax, to the 3-NDFL inspectorate (letter of the Ministry of Finance of Russia dated August 7, 2015 No. 03-04-05/45762).

If an individual entrepreneur did not conduct business under the general regime, he still submits 3-NDFL. In this case, the entrepreneur submits a zero declaration to the Federal Tax Service, which includes the title page, sections 1 and 2 (clause 2.1 of the Procedure approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11 / [email protected] ).

When should I report?

Entrepreneurs submit 3-NDFL to the inspectorate at the end of the year. The deadline is April 30 of the next year (clause 1 of Article 229 of the Tax Code of the Russian Federation). You must report for 2021 no later than May 2 (due to holidays, the submission deadline is postponed).

If an individual entrepreneur closes his activities before the end of the calendar year, he is obliged to submit 3-NDFL for an incomplete year to the inspectorate no later than 5 working days from the date of termination of activities (clause 3 of Article 229 of the Tax Code of the Russian Federation).

What are the penalties for being late with 3-NDFL?

For submitting a declaration later than the established deadline, the entrepreneur will be fined, and if the delay is more than 10 working days, the tax authorities will suspend transactions on the bank accounts of this individual entrepreneur.

The amount of the fine under Article 119 of the Tax Code of the Russian Federation is 5 percent of the unpaid amount of tax that must be paid (additionally) according to the declaration. This fine will have to be paid for each full or partial month of delay from the date established for filing the declaration. The total amount of the fine for the entire period of delay cannot be more than 30 percent of the tax amount according to the declaration and less than 1000 rubles.

In addition, for failure to submit (late submission) of a tax return at the request of the tax inspectorate, the court may impose administrative liability on the entrepreneur in the form of a warning or a fine in the amount of 300 rubles or more. up to 500 rub. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

Read about penalties for late statistical reporting.

What form should I use to make a declaration?

Form 3-NDFL was approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/ [email protected]

The declaration includes:

- title page;

- Section 1 “Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget”;

- Section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate”;

- Sheet A “Income from sources in the Russian Federation”;

- sheet B “Income from sources outside the Russian Federation, taxed at the rate”;

- sheet B “Income received from business activities, advocacy and private practice”;

- sheet D “Calculation of the amount of income not subject to taxation”;

- Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate”;

- Sheet D2 “Calculation of property tax deductions for income from the sale of property”;

- sheet E1 “Calculation of standard and social tax deductions”;

- sheet E2 “Calculation of social tax deductions established by subparagraph 4 and subparagraph 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, as well as investment tax deductions established by Article 219.1 of the Tax Code of the Russian Federation”;

- sheet J “Calculation of professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation, as well as tax deductions established by paragraph 2 of subparagraph 2 of paragraph 2 of Article 220 of the Tax Code of the Russian Federation”;

- sheet 3 “Calculation of taxable income from transactions with securities and transactions with derivative financial instruments (DF)”;

- Sheet I “Calculation of taxable income from participation in investment partnerships.”

As part of the declaration in Form 3-NDFL, entrepreneurs are required to submit to the tax office:

- title page;

- section 1;

- section 2;

- sheet B.

The remaining sheets of the declaration are filled out if necessary, that is, if there is data that affects the calculation of personal income tax. This follows from Section II of Order No. ММВ-7-11/671.

By order of the Federal Tax Service of Russia dated November 25, 2015 No. ММВ-7-11/554, changes were made to the 3-NDFL declaration form. True, the form has changed insignificantly. Officials changed only some sheets. Section 2 was updated, in which the base and tax are calculated, as well as sheets B, D2, E1, Z, G, I. The new edition took into account that the limit on deductions for personal income tax increased from 280 thousand to 350 thousand rubles. The barcodes have also been changed.

3-NDFL in xls

The program for filling out the 3-NDFL declaration can also be downloaded from the Federal Tax Service website. However, for now there is a program for filling out the declaration based on the results of 2015. But in 2021 there will be a form for 2016:

In what form should I report?

The tax return can be submitted to the inspectorate (clauses 3 and 4 of Article 80 of the Tax Code of the Russian Federation):

- on paper (in person, through an authorized representative or by mail);

- in electronic form via telecommunication channels or through the taxpayer’s personal account.

How to fill out a declaration

The text fields of the declaration are filled with capital printed characters. If any field is not filled in, you need to put a dash - draw a straight line in the middle along the entire length of the field (i.e. cross out the entire line). When an indicator is less than the number of cells allocated for it, dashes are placed in the unfilled cells on the right side of the field.

The procedure for filling out a declaration on a computer (with subsequent printing) has some features:

- Numeric values are aligned to the right. This means that empty cells, if any, should remain on the left;

- There is no need to put dashes in empty cells;

- Only Courier New font with a height of 16–18 points can be used.

Where to report the trade fee

The amount of the trade fee that you paid and can be credited under paragraph 5 of Article 225 of the Tax Code of the Russian Federation is reflected on line 091 of section 2 of the declaration (clause 5.11 of the Procedure).

To determine personal income tax at the end of the year, reduce the calculated tax by the trade fee, and then by advance payments for personal income tax. It will not be possible to return a trade fee that is greater than the personal income tax amount. This procedure is specified in the letter of the Ministry of Finance of Russia dated September 12, 2021 No. 03-04-07/53154.

Look at where to show the trading fee in the income and expense ledger.

On the title page of the declaration, indicate:

- TIN;

- adjustment number (for the primary declaration “0—”, when submitting an updated declaration, the adjustment number “1—” (“2—”, etc.) is indicated);

- Full name of the entrepreneur, without abbreviations, in accordance with the identity document. For foreign individuals it is allowed to use letters of the Latin alphabet;

- tax period code – “34”;

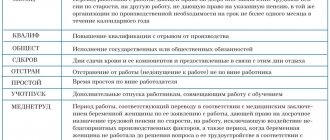

- taxpayer category code according to Appendix 1 to Procedure No. ММВ-7-11/671. Look at the codes in the table:

| Code | Meaning |

| 720 | an individual registered as an individual entrepreneur |

| 730 | a notary engaged in private practice, and other persons engaged in private practice in accordance with the procedure established by current legislation |

| 740 | lawyer who established a law office |

| 750 | arbitration manager |

| 760 | another individual declaring income in accordance with Articles 227.1 and 228 of the Code, as well as for the purpose of obtaining tax deductions in accordance with Articles 218-221 of the Code or for another purpose |

| 770 | an individual registered as an individual entrepreneur and who is the head of a peasant (farm) enterprise |

The title page must contain the date of completion and the signature of the entrepreneur or his representative.

In section 1 you need to indicate:

- OKTMO codes;

- KBK for personal income tax.

The declaration is filled out in rubles and kopecks. Only the amount of personal income tax is calculated in full rubles. That is, the tax amount is less than 50 kopecks. discarded, and the tax amount is 50 kopecks. and more are rounded up to the full ruble.

How to reflect the return of an advance payment to a buyer or customer in the 3-NDFL declaration

Situation 1: the advance was returned in the same year in which it was received, or at the beginning of the next year, but before submitting 3-NDFL

Simply do not reflect the advance in the declaration. The deal was terminated, there was no sale, the advance was returned, which means that at the end of the year there is no taxable income.

Situation 2: the advance was returned after filing a declaration for the year in which the money was received

Submit an updated declaration for the year in which the advance was taken into account in income. Make adjustments to sheet B, excluding the advance amount from income. It is impossible to reflect the returned advance as expenses - Chapter 23 of the Tax Code of the Russian Federation does not provide for this.

Published 09/29/20

In this section we will provide examples of filling out the 3-NDFL declaration for 2021 for various situations when selling real estate. All sample forms are available for download in .pdf format.

You can also fill out the 3-NDFL declaration directly on our website in 15-20 minutes by answering simple questions: Fill out 3-NDFL online.

Technical errors

First on the list is the incorrect attribution of deductions to a particular tax period. Let’s say a citizen paid for medicines in 2014, and in his declaration he asks for a deduction for 2015. This mistake comes from a basic ignorance of the laws. After all, the tax benefit is provided precisely for the year in which the applicant paid for education, medical care or other services.

In second place in the “anti-rating” of errors are violations of the “adjustment number”. Shortcomings of this kind are present in all regions. They are made by people who are filling out and submitting a declaration on their own for the first time. Most often, applicants incorrectly indicate the “adjustment number.” They write the number 1 in this column, although according to the rules they should put 0. “Zero option” is the declaration filed for the first time for the reporting year. If the Federal Tax Service does not accept it and forces you to redo it, then the number 1 is indicated in the column and so on until the tax authority accepts the documents.

The following error is related to the indication of the OKTMO code. There are also some nuances here. When a declaration is filled out in connection with an additional payment to the budget, the citizen must indicate OKTMO at the place of his registration, and if 3-NDFL is submitted to return money from the state, then the applicant indicates the OKTMO code at the location of his employer or other source of payments.

Further, when filing a declaration, applicants often do not fill out the sheets provided for one or another deduction. For example, to receive a deduction for the purchase of residential premises, you need to fill out sheet D1, for social and investment deductions - sheets E1 and E2, etc. If a person fills out a declaration using a program from the Federal Tax Service website, then, as a rule, no problems arise . The program will not allow you to move to the next level if he does not enter information into the appropriate sheet. But when the applicant does this himself in Word or Excell, then he commits such violations.

And finally, providing tax deductions is impossible without the appropriate documents. Costs for treatment, training, insurance or purchase of property must be confirmed by contracts, invoices, receipts, and payment orders. However, many applicants do not attach them to the declaration and are denied preferences. Surprisingly, such errors are found everywhere.

Main mistakes when filling out a goods declaration

The Ural Customs Administration held a webinar for participants in foreign economic activity, dedicated to errors when filling out the DT. We present to your attention the report and presentation of the First Deputy Head of the Ural Electronic Customs, Vladimir Aleksandrovich Zyabko.

“The quality of filling out the declaration and the efficiency of information exchange within the framework of electronic declaration directly determine the timing of customs operations.

The first thing I want to draw your attention to is the timeliness of responses to requests received as part of the electronic declaration.

Each submitted declaration of goods is checked by the software product to ensure that the information matches the information specified in previously registered declarations. If a match is found, your system is automatically sent an email asking for possible duplicate information. If the response that this is not a duplicate of a previously registered declaration is sent within 10 minutes, such a declaration is subject to verification of compliance with automatic registration algorithms. After successful verification of the declaration, a reference number is automatically assigned, and it begins to undergo control for compliance with the automatic release algorithms.

If the 10 minute timeout is violated, the declaration goes into manual registration mode. Thus, for foreign trade participants who are classified as low-risk, a timely response to a request for duplication will allow them to qualify for auto-issue.

The average auto-registration time is less than 1 minute, the average auto-release time is 2-3 minutes. For comparison: the average time for “manual” registration is 25 minutes. Taking into account these figures, you can calculate the economic component of a timely response to one message for your company. Over the 7 months of this year, 1,646 declarations for goods did not undergo auto-registration due to a late response to a request for duplication of information.

Another important aspect of interaction between customs authorities and foreign trade participants, which allows reducing the time required for customs operations, is a timely response to the Notification of the need to provide goods to the customs authority upon export. The specification for the interaction of electronic systems stipulates that the EDC can send information about the need for customs inspection to the post of actual control only after receiving the declarant’s response to the Notification of the need to provide goods to the customs authority. This means that the later you respond, the later the customs inspection (inspection) will be scheduled and the later the actual control will begin. Taken together, this leads to an increase in the period for issuing the declaration.

This year, for 59 declarations of 33 participants in foreign economic activity, responses to the Notification of the need to provide goods were sent to the customs authority after 1 hour, and the interests of 15 participants in foreign economic activity were represented by customs representatives. Of greatest concern is the fact that in 43 cases the response took 7 hours or more. These facts lead to an increase in deadlines, which is directly associated with certain costs for your enterprise.

On July 1, 2021, a new album of formats for an electronic copy of the goods declaration came into force, which implements the requirements of the Decision of the Board of the Eurasian Economic Commission No. 53 of April 2, 2021 “On the classifier of types of identification documents.” The classifier includes the most complete list of types of identity documents, formed based on the results of an analysis of the legislation of the member states of the Eurasian Economic Union. In accordance with the Classifier, if a passport of a Russian citizen is used as an identification document, in column 54 of the declaration in field G5451 “Identity document type code”, the document code “RU01001” is indicated. To do this, you need to update your software product to the version of interaction with customs authorities - version number 5.14.3/3.3.22 and update the directory of identification documents in the reference data of your program. Note "Alta-Soft": Implemented in "Alta GTD", starting with version 2.0.241.23 dated 07/11/2019.

However, until now, some participants in foreign trade activities indicate a non-existent identification document code in column 54 of the declaration. In July, 1,714 declarations for goods were submitted indicating a document code that was not valid on the day the declaration was submitted. Moreover, every 5th violation of the rules for filling out a goods declaration was committed by customs representatives. In August, these violations continue to be identified, and almost 14% of defects are allowed by customs representatives. We strongly recommend updating your software products to the required version of interaction. Also update the directory of identification documents and correct the templates that your specialists use to fill out column 54 of the goods declaration.

I draw your attention to individual paragraphs of the Instructions on the procedure for filling out a declaration for goods, approved by the Decision of the Board of the Eurasian Economic Commission No. 39 of April 26, 2012 “On introducing amendments and additions to the Instructions on the procedure for filling out a declaration for goods, approved by the Decision of the Commission of the Customs Union of May 20 2010 No. 257." This Instruction provides for the indication in column 44 of information about the transit declaration under the document type code 09013 or the TIR Carnet under the document type code 02024. This requirement must be fulfilled if the customs authority specified in column 29 differs from the customs authority specified in column 30 of the declaration.

When making a preliminary declaration, it is allowed to enter information about the transit declaration under the document type code 09013 or the TIR Carnet under the document type code 02024 after the goods arrive at the place of delivery. The presence of this information in the declaration increases the likelihood of successful completion of the automatic registration algorithm.

It is also necessary to pay attention to the correct completion of column 21 of the declaration of goods in the case where the declared goods, before being placed under the declared customs procedure, were transported through the customs territory of the Union in accordance with the customs procedure of customs transit. Only the total number of vehicles is indicated.

The Federal Customs Service is systematically working to automate the processes of customs operations. Since July 1, the process of exchanging messages between the EDC and actual control posts based on preliminary declarations has been automated.

I will give a description of the algorithm for performing customs operations with a preliminary customs declaration:

If no changes are required, or the sent changes are accepted by the official, then requests to check the availability of goods are automatically generated. The check is carried out using the software package “Accounting and control of goods at the warehouse”, the automated system “Control over the transit of goods” and the automated system “Checkpoint”. Until responses to requests are received, in the CED the preliminary declaration is at the “PDD with notification of inspection” stage and is not available for processing by the inspector.

When feedback is received, the goods are considered to have arrived if the following response is received in response to at least one of the previously sent requests: the goods have been accepted for temporary storage, transit is closed, the goods have arrived.

If a note about the need to make changes to the preliminary declaration is placed in the notification of the arrival of goods, such changes must be associated with this notification. It may be that your program requires a “tick” to be checked when submitting an amended goods declaration to customs to be linked to the arrival notification.

Next, I will move directly to the requirements for filling out a goods declaration .

First, I will focus on compliance with the requirements for filling out declarations that contain goods classified as intellectual property .

In gr. 31 indicates the exact name of the product, information about the manufacturer, brands, models, articles.

In field G31_12 information about the trademark, objects of copyright and related rights is entered. For trademarks that do not have a verbal designation (figurative, three-dimensional, combined), it is recommended to indicate “Trademark No...” with the registration number entered in the register of the Federal Service for Intellectual Property (Rospatent) and (or) the International Bureau of the World Intellectual Property Organization (WIPO) ).

In the G31Place field you must indicate the name of the place of origin of the product.

The IPOREGNUM field contains information about all registration numbers of intellectual property objects in the Customs Register.

When filling out column 33:

- in field G332, when declaring goods containing intellectual property objects included in the TROIS, the letter “I” is indicated. Moreover, if the product does not belong to the class of the International Classification of Goods and Services (International Classification of Goods and Services) in respect of which the trademark is registered, field G332 is not filled in.

When filling out column 44:

- if goods are moved by the copyright holder or persons authorized to import goods, the document type code “03021” is indicated - information about the document number - the license agreement and other agreements indicating the transfer of exclusive rights.

- if goods are moved by the declarant without transfer of exclusive rights, but with the consent of the copyright holder (information letter), the document type code “03022” and the details of the letter are indicated.

Under these document type codes, you cannot indicate information about letters from the Federal Customs Service of Russia on the inclusion of a trademark in TROIS (the letters also indicate licensees and authorized importers), since these letters do not constitute the consent of the copyright holder to introduce goods containing intellectual property into civil circulation.

Next, a few words about filling out the declaration columns while observing prohibitions and restrictions.

In case of exemption from compliance with prohibitions and restrictions, the grounds are indicated in column 37, for example, when importing goods as samples (061), the declarant is exempt from compliance with prohibitions and restrictions. In this case, in column 33 it is necessary to enter the letter “C” - free from the use of prohibitions and restrictions.

If quantitative or cost restrictions are established in relation to the declared goods, column 39 “Quota” must be filled in, which indicates information about the balance of the allocated quota in the units of measurement specified in the license, taking into account that the declared goods are not taken into account when determining the balance of the quota.

When filling out column 44:

- if a letter from FSTEC is used as a permit document regarding the consideration of an application from a foreign trade participant regarding the import/export of products, it must be indicated under the code “01999”;

- under the document type code “01154”, only FSTEC conclusions drawn up in the form approved by Decree of the Government of the Russian Federation dated June 21, 2021 No. 565 “On the procedure for identifying controlled goods and technologies, the form of the identification conclusion and the rules for filling it out” are indicated.

Typical errors in filling out declarations made by participants in foreign trade activities in the area of currency control :

- The number and/or date of the contract in section 3 of the Unique Contract Number (hereinafter referred to as the UNC) does not correspond to the number and/or date of the contract specified in column 44 of the DT under the code “03011”.

- The contract currency code specified in section 3 of the Tax Code does not correspond to the currency code reflected in column 22 of the DT.

- When indicating in column 24 of the DT the transaction nature code “058” (gratuitous transaction). In column 44 of the DT, under the document type code “03031”, information about the UNK is erroneously indicated.

- When indicating in column 44 DT under the document type code “03031” information about the UNK. In column 24 of the DT, the transaction feature code “06” is indicated incorrectly. The correct code is "00".

- Column 44 of the DT under the codes “03999” and “10023” incorrectly indicates Instruction of the Central Bank of Russia No. 181-I dated 08/16/2017

- Column 24 of the DT incorrectly indicates the transaction feature code “06” when the transaction nature code is “058” (gratuitous transaction). The correct transaction feature code is “00”.

- Column 22 and column 42 of the DT are filled in incorrectly. For gratuitous deliveries (transaction nature codes “028”, “040”, “058”), column 42 and column 22 of the DT are not filled in.

- The contract currency specified in section 3 of the Tax Code does not correspond to the contract currency reflected in column 22 of the DT.

- In the first subsection of column 22 DT there is no letter currency code. Column 23 of the DT does not indicate the exchange rate.

In accordance with the Regulations on the procedure for transmitting information about registered declarations electronically to the Central Bank and authorized banks (Resolution of the Government of the Russian Federation of December 28, 2012 No. 1459), customs authorities no later than three working days from the day following the date of release (conditional release) of goods , ensure the sending to the bank of information about declarations, which indicate a unique contract number, transferred in the prescribed manner by this authorized bank to the Federal Customs Service.

In cases where information about the unique contract number in column 44 under the code “03031” is missing, or when information in columns 9, 22, 24, 40, 44 is not filled out correctly, and also does not correspond to the information specified in the Criminal Code, information about such registered declarations are not received by authorized banks.

The most typical errors in filling out a declaration for goods under customs duties are associated with column 47.

When exporting goods that are not subject to export customs duties, foreign trade participants do not fill out column 47, leaving it blank, or indicate the wrong method of payment.

A detailed description of the features of filling out individual columns of the declaration for goods, including 36, 44, 47, when declaring goods with exemption from customs duties for customs operations placed under the customs export procedure, is given in the letter of the Federal Customs Service of Russia dated September 7, 2021 No. 01 -11/57109 “On exemption from payment of customs duties for customs operations of goods placed under the customs export procedure.”

When declaring goods using a VAT rate of 10% (children's, food products, medical products and medicines), the error is that column 47 is filled in with two lines - the main and additional, indicating the incorrect method of payment (UN - conditionally accrued, UM - reduced payments).

In accordance with subparagraph 45 of paragraph 15 of the Instructions on the procedure for filling out a declaration for goods (Decision of the Customs Union No. 257 dated May 20, 2010), if in relation to declared goods the tax is calculated and paid before the release of goods at a reduced rate, the calculation is made in one (main) line and in in the “SP” column the code “IP (calculated and paid)” is indicated.

Additionally, I draw the attention of declarants and customs representatives to the procedure for writing off customs payments using unified personal accounts (UPA). Accounting for cash balances on the payer’s personal account in the ELS resource is carried out in the amount of the total cash balance according to the budget classification code in accordance with the organization’s tax identification number, without detailing payment documents. At the same time, as an order for the use of funds and their debiting from the personal account (according to the declaration in which the calculation (accrual) of customs duties was made (column 47 DT)), the customs authorities consider the indication in column “B” - the TIN of the declarant (payer) ) or TIN of the customs representative for each type of payment.

There are cases when, when submitting a declaration, the payer’s TIN is not indicated in column “B”, or is not indicated for all types of payments. In such a situation, the request to write off customs duties is formed incorrectly, which makes it impossible to carry out operations to write off funds before the release of goods. After the release of goods, the elimination of such violations is preceded by customs control with the drawing up of a document and information verification report, based on the results of which the declarant is sent a decision to make changes (additions) to the information stated in the declaration, which also leads to the expenditure of additional resources both on the part of the customs authorities, as well as declarants and customs representatives. Therefore, I would like to once again draw your attention to the fact that incorrect filling out of declaration fields and their subsequent adjustment leads to an increase in the time it takes to make a decision on the release of goods.

When declaring information about customs value, I draw attention to the correctness of filling out the first subsection of column 43 of the declaration. A typical mistake is to indicate code 1 (unit), that is, the method of determining the value of a transaction with imported goods (Article 39 of the Code), while the customs value is determined using methods 2 to 6 (Articles 41-45 of the Code).

On July 1, the Decision of the Board of the Eurasian Economic Commission dated October 16, 2018 No. 160, which approved the DTS-1 and DTS-2 forms, the procedure and cases for filling them out, came into force.

I would like to draw your attention to the fact that the Decision of the Customs Union Commission dated September 20, 2010 No. 376 “On the procedures for declaring, monitoring and adjusting the customs value of goods,” which we have been guided by for 7.5 years, has lost force.

The declaration of customs value is an integral part of the declaration for goods, and compliance with the procedure for filling it out is also controlled by the customs authorities. In accordance with paragraph 4 of Article 45 of the Customs Code, as well as paragraph 48 of the Procedure for filling out the declaration of customs value (Decision of the EEC Board of October 16, 2018 No. 160), column 7 in DTS-2 must be filled out. The reasons why previous methods for determining customs value are not applicable must be indicated. In accordance with paragraph 47 of the Procedure for filling out the DTS in column 8 in DTS-2, the names and details of the main documents submitted in support of the provided information on customs value must be indicated.

Clause 29 of the Procedure for filling out the DTS, in column 17 of the DTS-1, it is necessary to indicate the place (geographical point) of arrival of goods into the customs territory of the Union, or the destination of the goods in the customs territory of the Union, the costs to which, in accordance with the terms of delivery, are paid by the buyer separately, and must be included in the customs value.

A typical mistake is the coincidence of the place (geographical point) of arrival of goods with the place of departure of the goods on the territory of the country of export, or instead of the specific place of arrival of goods, simply the words are indicated - border of the Russian Federation, border of the Customs Union, Russia.

A few words about adjusting the goods declaration .

I draw your attention to compliance with the requirements of paragraph 10 of the Procedure for filling out adjustments to the declaration of goods, approved by the Decision of the Board of the Eurasian Economic Commission dated December 10, 2013 No. 289. It regulates the completion of the sixth element of column 45a “Change and (or) addition of information specified in the DT regarding the customs value of goods.” For example, when changing the customs value according to the price information of the customs authority in the KDT, declarants indicate code “0” - there are no changes (additions) - this is incorrect. It is necessary to indicate code “3” - errors in choosing the method for determining the customs value and (or) the basis for calculating the customs value of goods, including when simultaneously identifying technical errors or errors in relation to additional charges (deductions). The same paragraph provides that in the first subsection of column 45 of the KDT the amount of the customs value of the goods is indicated, taking into account the changes made, and in the second subsection - the initial information on the customs value.

A common mistake is to indicate the same values in both subsections of column 45 of the KDT.

In preparation for the webinar, the Department received questions from foreign trade participants. They were more concerned with the control of customs values, compliance with prohibitions and restrictions, specifically the timing of the release of goods, and requests for additional documents as part of the verification of the declaration.

In fact, each of these areas can become the topic of a separate webinar. We have selected only those questions that relate to the topic of today's event. Stylistics, spelling and punctuation have been preserved.

Question: In case of export of goods subject to export duty outside the customs territory of the Customs Union (Republic of Uzbekistan), if the price of the goods is indicated in dollars, should the customs value of the goods in rubles be indicated in column 45 (12)? In what cases should the customs value of the goods be indicated during export?

Answer: In accordance with the Instructions on the procedure for filling out a declaration for goods (Decision of the Board of the EEC No. 39 of April 26, 2012 “On introducing amendments and additions to the Instructions on the procedure for filling out a declaration for goods, approved by the Decision of the Customs Union Commission of May 20, 2010 No. 257 ") in the Republic of Armenia, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation, columns 12, 43 and 45 of the declaration are not filled out if customs duties and taxes are not established for the exported goods, calculated on the basis of their customs value.

Based on paragraph 8 of Article 38 of the Customs Code, the customs value of goods is determined in the currency of the Union member state in which, in accordance with Article 61 and paragraph 7 of Article 74 of the Code, customs duties, taxes, special, anti-dumping, and countervailing duties are payable.

In accordance with the Instructions, column 45 indicates in digital symbols the customs value of the declared goods in the currency of the Union member state to whose customs authority the declaration is submitted.

Question: Filling out column 33 subsection sign of non-tariff regulation.

- Filling out column 31 of the descriptive part of the cargo packages, namely whether it is necessary to write down the description of the consumer packaging (primary packaging of the goods) and packaging of the packages, if there is information in coded form in the 31st column.

- Filling out column 54, which document is the main document for document code 11003 (charter, decision)?

- Filling out the 18th, 19th, 21st, 25th column.

Answer: In accordance with paragraph 1 of Article 106 of the EAEU Labor Code, information about the product, in particular, includes a description of the packaging. Unfortunately, the classifier of types of cargo, packaging and packaging materials, used to indicate information under number 2 in column 31 of the declaration, does not contain a division of packaging depending on its volume. In this regard, it is necessary to provide a description of consumer packaging (primary packaging) under number 1 in column 31 of the goods declaration.

The document specified in column 54 of the declaration with code 11003 confirms the authority of the person who compiled and submitted the declaration on behalf of the declarant. In your question, unfortunately, you did not indicate the position of this person.

If we are talking about the director, then when choosing the documents you have indicated, preference is given to the Decision of the General Meeting of Participants of the company. The charter of an enterprise usually prescribes the procedure for appointing a manager (general director, director) and does not indicate a specific person, his last name, first name, patronymic. This information is provided in full in the decision.

The procedure for filling out columns 18, 19, 21, 25 is provided for by the Instructions on the procedure for filling out a declaration for goods (Decision of the Board of the Eurasian Economic Commission No. 39 of April 26, 2012 “On introducing amendments and additions to the Instructions on the procedure for filling out a declaration for goods, approved by the Decision of the Customs Commission Union of May 20, 2010 No. 257"), depending on the type of transport, direction of movement and application of customs procedures preceding declaration.

The procedure for filling out the data columns is partially discussed in the main part of the report. To accurately answer this question, more specific information about your situation is needed.

Question: We are interested in CMR. We fill it out under code 02015 without placing it in the archive. But sometimes the inspector may request this document in more detail. The CMR is in English and it is not possible to fill it out in the program in the same way as the original. If you attach it as a free-form document, we can only do so without the seal of Rosselkhoznadzor, because the seal is placed much later. What is the right thing for us to do?

Answer: In accordance with paragraph 1 of Article 108 of the Customs Code, documents confirming the information stated in the declaration of goods, in particular, include transport (transportation) documents. The instructions on the procedure for filling out a declaration for goods (Decision of the Board of the Eurasian Economic Commission No. 39 of April 26, 2012 “On introducing amendments and additions to the Instruction on the procedure for filling out a declaration for goods, approved by the Decision of the Commission of the Customs Union of May 20, 2010 No. 257”) provide indication in column 44 of the number (registration numbers) and date (if dates are available) of transport (shipment) documents under which international transportation will be carried out.

Based on paragraph 7 of Article 80 of the Customs Code, in order to carry out customs operations, customs authorities may be presented with documents drawn up in the official languages of the Union member states or in foreign languages. The customs authority has the right to require the translation of documents drawn up in a language that is not the official language of a member state of the Union.

The documents required to carry out customs operations are submitted to the customs authority in a formalized form. They must be filled out in accordance with the requirements of the Album of formats for electronic forms of documents intended for organizing the interaction of customs authorities with automated systems of foreign trade participants.

If the customs authority needs to confirm that a foreign trade participant has passed the control forms used by federal executive authorities, the inspector requests the necessary documents in the form of scanned images.

Question:

- IM 40 procedure: is it correct to fill out the gr. 18 and gr. 21 as follows: gr. 18 – 2: A671EA67/AK489267; gr. 21 – 1

- Procedure IM 40: is it necessary in gr. 31 fill out the characteristics of a product group (table), even if there is one type of product in product 1 DT?

- Procedure IM 40: is it necessary in gr. 44 attach the statutory documents of the organization? If yes, which ones exactly? And with what document attribute (0 or 2)?

Answer: The given example of filling out columns 18 and 21 refers to the case when the declaration was preceded by the movement of goods through the customs procedure of customs transit.

The format and structure of the electronic copy of the declaration establishes the fields and the list of information that must be indicated in these fields. When filling out the fields of the declaration, you must be guided by these requirements. That is, you need to fill out a table with the characteristics of the product.

When declaring customs in electronic form, documents confirming the authority of the person submitting the customs declaration do not need to be submitted. Such documents include:

- constituent documents of the organization;

- documents confirming the fact of making an entry about a legal entity in the Unified State Register of Legal Entities;

- certificate of registration with the tax authority;

- identification document of the employee of the organization who will submit the declaration;

- other documents - the employee’s power of attorney to perform actions on behalf of the organization, the employee’s employment contract, can be submitted only once and not submitted when submitting subsequent declarations.

Let me conclude today's event with this.

I hope the materials presented will help you in your work and, perhaps, speed up the process of issuing declarations. If you have not received an answer to your question or have any questions on this topic, or if you have a proposal to hold a webinar on other topics, please send information to the email address.” Presentation

Inclusion of maternity capital and budget funds in expenses

The inclusion of maternity capital in expenses is considered a significant violation. Young people under the age of 30 make similar mistakes. Using capital when buying an apartment (or when paying interest), they do not hesitate to include it in their expenses, but this is wrong. Maternity capital is not the applicant’s personal income, but is provided to him by the state. The person does not earn this money and does not inherit it. Consequently, these funds cannot be considered income in the literal sense of the word, therefore, including maternity capital in expenses to obtain deductions is a gross violation of the rules for filling out 3-NDFL.

By the way, educational expenses paid from maternity capital are also not taken into account when determining the tax deduction. An attempt to take these amounts into account in 3-NDFL to obtain tax preferences is also considered a violation.

The exact same rule applies to other amounts received from the budgets of the Russian Federation and its constituent entities. Thus, applicants do not have the right to include in expenses funds received under the “Providing Housing for Young Families” program, as well as various types of subsidies to government employees and the military for the purchase of apartments.

What to do if an error appears in 3 personal income tax

As soon as you see a refusal for some documents in the statuses, you can do the following:

- Contact the tax office at your address by calling or writing by email. You should cover all the details associated with the refusal. And also be prepared to provide documents confirming your identity. Ask if your declaration has been received and if the answer is yes, you can rest assured;

- On the contact page https://www.nalog.ru/rn77/apply_fts/ you can find out all the addresses of tax authorities. You can use the official pages of social networks to get help on your issue: , https://vk.com/nalog__ru, https://twitter.com/nalog__ru. Write a message in the group and they will certainly answer you;

- On the page of the official website of the tax service, you can find detailed instructions for filling out the declaration. Make sure you do it correctly;

- You can also write a complaint electronically in your personal account on the website nalog.ru. At the same time, you can add your contacts so that they can quickly contact you to solve the problem. In this form you can add screenshots from the report window and other documents.

Do you know what to do if error code 0000000002 appears. The declaration (calculation) contains errors and is not accepted for processing?

Exceeding the maximum amount of deductions

The Federal Tax Service does not provide deductions when their amount exceeds the maximum allowable amount established by law. Such declarations are subject to adjustment. Thus, the maximum amount of social tax deductions (excluding expenses for expensive treatment) cannot exceed 120,000 rubles, and the cost of educating 1 child (for the purpose of filing a deduction) cannot exceed 50,000 rubles. As for property deductions, there are restrictions on them too. Thus, the maximum amount of property deduction for the purchase of housing is 2,000,000 rubles, and the deduction for the cost of paying interest on targeted loans for the purchase of residential premises should not exceed 3,000,000 rubles.

However, applicants often submit documents in which these amounts are clearly inflated.

Efficiency of contacts for communication with tax support

Not all methods of contacting tax technical support are equally effective in eliminating errors in the sequence of providing information 3 personal income tax. So that you do not waste time, you need to describe the existing experience of other users. The most effective way to communicate is by telephone. The operator will listen to you and, at your request, check the database on his computer. At the same time, you can immediately determine whether you should change anything in your report. When you call, you will need to provide your passport details and TIN.

The technical support form on the website most often does not receive answers. Apparently this is due to the number of requests. And since the answers are not generated automatically, but are created by employees, they simply do not have enough time for this. Although previously you could do it within 3 days. Creating a complaint through your personal account is ineffective because you can expect a response within a month. And your declaration with an error in the sequence of providing information 3 personal income tax with an unknown reason for refusal cannot be postponed to such lines.

An attempt to obtain deductions for transactions with related parties

Many Russians buy housing from their relatives: brothers, sisters, fathers, mothers or children. Some of these transactions are made simply for show, but there are also real contracts. However, the law categorically prohibits the provision of property deductions for transactions concluded between interdependent persons (relatives). Accordingly, the cost of paying interest on loans received from related parties for the purchase of housing cannot be included in the declaration. It is also worth noting that, along with relatives, the Tax Code of the Russian Federation classifies the applicant’s employers as interdependent persons, as well as companies that he owns (or in which he has a share).

Trying to recoup costs for part-time or evening studies

Also a widespread mistake. It is mainly found in regions and rural areas. People are trying to get a deduction for the education of their children (as well as a brother or sister) through correspondence or evening classes. However, in order to receive benefits, it is necessary that children (or wards) study only full-time. According to legislators, correspondence (evening) education implies that the student can work part-time or do business, and therefore the state does not provide tax preferences in this case.

Why does an error appear on the website nalog.ru

Many users, when creating 3 personal income taxes, encountered the message “Error in the sequence of providing information for 3 personal income taxes.” The reasons may actually be different. And in this situation, it becomes more difficult to determine the true one because the nalog.ru website has internal problems. This started on May 9, 2021. And it continues to this day. Numerous complaints and requests to support regarding failures of the personal account led to nothing.

You will not receive clear explanations for this error even from tax officials. If the status “Declaration registered” appears in the report in your case, it is quite possible that it was completed and reached over the network in the correct form. In this case, on your side (in the browser) the status will still display that the documents were rejected. It is possible that you actually made mistakes in the declaration.

You may also find this article useful: error code: 0400400017 in the calculation of insurance premiums - how to fix it?

Brief conclusions

A large number of errors in declarations does not mean that applicants make them intentionally. As a rule, all violations occur due to ignorance of the laws and lack of experience. After all, many Russians submit 3-NDFL for the first time. Subsequently, they no longer make such mistakes. That is why, to fill out the declaration, it is recommended to use the “PC Declaration” program, which is located on the website of the Federal Tax Service of the Russian Federation, or seek help from specialists. They will help you quickly and correctly fill out 3-NDFL and submit it to the Federal Tax Service within the deadlines established by law.

What is this declaration and who fills it out?

3-NDFL declaration is a form of documentation with which an individual can report on his own income. Most often, the declaration is filled out by those individuals who receive financial income from abroad. Or they receive income from the sale of movable and immovable property. In practice, the 3-NDFL declaration is also submitted by notaries, individual entrepreneurs, commercial agents, and lawyers to maintain legal reporting in a unified taxation system.

The declaration is submitted in a single established (unified) form once a year and no later than April 30 following the reporting period. The personal income tax report can be submitted to the tax office at the place of actual residence. To facilitate the process of filing a declaration, individuals use their personal account on the website https://www.nalog.ru/. There are several points by which the reason for refusal to accept a declaration is determined:

- The declaration does not contain the signature of the payer;

- If there are no documents confirming the identity of the person submitting the declaration. Or if a person refuses to present them;

- There is no personal information in the corresponding fields about the person submitting the declaration in the declaration itself;

- If the declaration is not submitted at the place where the payer was registered;

- Ignoring form fields to fill out.