The list of documents for registration of individual entrepreneurs has not changed for quite some time, since it is enshrined in law and must be submitted by any person wishing to obtain the status of an individual entrepreneur. To obtain individual entrepreneur status, you will need to submit the following package of documents:

- application for state registration of an individual as an individual entrepreneur (in form P21001);

- receipt of payment of the state fee for registration of individual entrepreneurs;

- if necessary, switch to a simplified taxation system - a corresponding application for switching to the simplified tax system (according to form No. 26.2-1);

- a copy of your identity document (passport).

Knowing what documents are needed to open an individual entrepreneur, you will not encounter unpleasant surprises and bureaucratic delays. Let's consider each of the listed documents in more detail.

Why is it better to register an individual entrepreneur?

- This will allow you to conduct legally legal business activities without creating a legal entity.

- Only a registered entrepreneur can work by bank transfer and officially transfer money to other companies.

- IP allows you to create your own trademark in the future.

- Like any commercial organization, an individual entrepreneur can become an employer and hire workers under an employment contract

- By law, your official status must mean that the state will assist you and ensure the protection of your rights...

Requirements for individual entrepreneurs

- Individual entrepreneurs are required to submit reporting declarations

- An entrepreneur is required to pay taxes

- The individual entrepreneur is obligated to meet qualification requirements

- After registration, the entrepreneur is responsible for the property

Instructions for registering individual entrepreneurs

Step No. 1 Collect the required documents

The package of documents includes

- Your passport

- TIN

- Receipt. You can pay the state fee at any bank

Step No. 2. Decide on OKVED codes

To understand in more detail what this encoding is, you can refer to the special article on our website.

The all-Russian classifier of types of economic activity seems to be something complicated and incomprehensible just by its name. It's easy to understand. It consists of several numbers, which have their own designation and structure:

- 11.1 - subclass

- 11.11 - group;

- 11.11.1—subgroup;

- 11.11.11 - view.

To make it clearer, here are a few examples:

15.8 as a subclass, for example, denotes the type of activity - food production.

15.84 already specifies this type - production of cocoa, chocolate and sugary confectionery products

15.84.1 - an even more specific type - production of cocoa only. Or 15.84.2 - chocolate and sugary confectionery products.

You can choose more than one type of commercial activity. But choose wisely. Keep in mind that the first code you specify will be considered the main one. And some indicators of your interaction with government agencies will depend on it. Thus, it determines the amount of insurance premiums that will need to be paid to extra-budgetary funds.

As for insurance payments, for you they will at least be a guarantee of receiving compensation for sick leave and maternity leave.

But let's return to OKVED. The codes that you specify during registration will become the basis for the specifics of your business. Activities outside of these codes will be considered unauthorized for you. Of course, no one will forbid expanding the list in the future. But remember that you can choose your activity code for free only the first time. All subsequent changes are paid according to the tariffs of the tax department.

It is considered unnecessary to indicate the most specific types, as we showed in the example. Because it greatly narrows your options. Focus on four numbers.

Note: an updated version of the OKVED register (OKVED-2) is currently in effect. To avoid any difficulties, you can use the registry version comparison table.

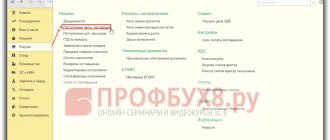

Step No. 3. Submit an application to the tax office

The Inspectorate of the Federal Tax Service (IFTS) is the place where you will take the collected documents. There are several options. You either take care of everything yourself. Or you appoint a trusted person who does this for you. But in this case, do not forget about the need to have everything certified by a notary.

The application to the tax office itself consists of five pages. If you need to find a form for this application, look for form P21001.

The form contains your full name, contacts including telephone and email, passport information, pre-selected OKVED codes, as well as your Taxpayer Identification Number (TIN). You should also take full responsibility for filling out the application. The rigor of the form implies the absence of errors and block letters.

You can fill it out yourself, or you can pay the tax office for the service (officially). If you have never done anything like this before, we recommend using the second option. This will save a significant amount of time and nerves. And the fee you will be charged is not critical.

Step No. 4. Choose a tax system

After registration, you have up to thirty days to submit an application for a certain regime for collecting taxes from your individual entrepreneur. But it’s better to decide right away. Here are the possible options for individual entrepreneurs:

Simplified taxation system (STS)

Or, as they call it differently, “simplified”. As the name suggests, this system is attractive because it simplifies the main responsibilities of an entrepreneur. First of all, we are talking about individual entrepreneur reporting.

Using the simplified tax system, a businessman pays a single tax instead of several tax levies (VAT, income tax and property tax).

There are two options.

- simplified tax system with a rate of 6 percent. Then the tax is imposed on all income.

- simplified tax system with a rate of 15 percent. Then the tax goes to the difference “income minus expenses”.

And don’t let it seem that six is always more profitable than fifteen. In some situations, paying for the difference is much more interesting than giving away a portion of the company's total income.

Unified Agricultural Sciences. Unified agricultural tax

As the name implies, it is necessary for those individual entrepreneurs who are engaged in the production of agricultural products. It also does not burden the entrepreneur with property taxes and VAT with personal income tax.

UTII. A single tax on imputed income

In the system of this taxation, the main factors are the physical indicators of individual entrepreneurs. That is, the area of sales floors, the number of employees on staff, the number of sales points, and so on.

Based on these indicators, the approximate probable income is established, which is subject to the tax itself.

PSN. Patent tax system

Until 2013, patents were issued under the simplified tax system. Since 2013, it has been separated into a separate system, which the entrepreneur has the right to choose. The main thing here is that the individual entrepreneur complies with the restrictions on the number of employees (no more than 15) and other indicators.

A patent is granted for a period of one month to one year at the discretion of the business owner. Involves engaging in one type of activity. (The other will need a different patent). There is no reporting under this system, but the individual entrepreneur maintains his own income book and provides it upon request of the audit.

The cost of a patent is regulated regionally and depends on the type of activity and period.

When you have submitted an application for registration of an individual entrepreneur and all the required documents for consideration, it will be better if you take a receipt stating that these documents were accepted from you. It also indicates the date when you are issued documents with permission to operate as an individual entrepreneur.

Selecting OKVED code

The first stage of the procedure under consideration is the selection of OKVED codes for individual entrepreneurs in 2021. It is carried out on the basis of a code directory in force since the beginning of 2017, which is called OKVED-2. When choosing OKVED codes for individual entrepreneurs, you must follow several simple recommendations:

- the number of selected types of activities is not limited, which allows you to indicate any number of them in the registration documents;

- the code affects the amount of insurance premiums (if they are required to be calculated and paid);

- licensing requirements for certain types of activities are regulated at the level of federal and regional legislation;

- It is allowed to add new and delete old OKVED codes in the course of business activities, for which it is enough to submit a corresponding application to the Federal Tax Service and make changes to the registration documentation.

What documents does an individual entrepreneur receive after registering the right to operate?

After submitting the documentation, it will take about five days before the license is issued. As already written above, the time will be indicated on the receipt that you can take when submitting. The set of documents you receive includes:

- Certificate. This is what guarantees your status as an individual entrepreneur. (OGRNIP)

- Certificate of registration with the Federal Tax Service.

- Extract from the Unified State Register of Individual Entrepreneurs

You can conduct business anywhere, but you must submit documents at your place of registration. You will also need to submit reports there.

It is not necessary to submit documents in person.

What is meant by constituent documents

Constituent documents are information that is reflected in a certain form, approved by law and is a legal basis for recognizing the legal status and activities carried out.

A detailed explanation of this concept is given in the text of Art. 52 of the Civil Code of the Russian Federation, but a specific definition of the term is not given here, and the basics for the formation of constituent documents are designed for legal entities.

For legal entities, the constituent ones are:

- charters (for the absolute majority),

- constituent agreements (for business partnerships),

- federal laws (for state corporations).

In practice, the constituent documents of an individual entrepreneur mean papers indicating the registration of an individual entrepreneur and confirming his legal capacity. But from a legal point of view, calling them constituent documents is still incorrect, because the list of constituent documentation is limited and an individual entrepreneur should not create any of these documents.

The basics of forming constituent documents are designed for legal entities, and not for individual entrepreneurs

Other ways to register an individual entrepreneur

Registration through the MFC (multifunctional center)

This structure is called the “municipal center for the provision of state and municipal services.”

Such centers were created in order to reduce the burden on other departments. Therefore, they offer the same services as the tax office. The list of documentation that you provide to the MFC remains unchanged. You will also need to create a package of papers and find out where the MFC is located in your city.

Registration through the public services portal

This is an official resource on the Internet that allows you to carry out various operations, including registration ones, without leaving your home.

Positive aspects of registering through the portal:

- No queues

- Easy to find information and forms on one site

- There are also instructions there with a step-by-step explanation of your next steps.

- Pay only standard state fees

Negative sides:

- The process of confirming your identity is quite complex and lengthy (we are talking about obtaining a full-fledged account on the portal, which will allow you to register).

- The work of the resource does not always operate in accordance with the regulations. It happens that applications via the Internet are lost in the structure of the tax service

- Limitation of the authorization session. If you fill out electronic forms for a long time, you will simply be “kicked out” of the system without saving the result and will simply have to fill out everything again.

- There are connection failures with the server.

Instructions for registration through government services

- We go to the portal through any device. Theoretically, you can register even from a suitable phone.

- Register in your personal account. There are several stages of registration. Just creating an account will not give you the features you need. Therefore, you will also need to enter an activation code (either sent by email or issued at a Rostelecom branch). Such a code is not given immediately. It takes up to two weeks to generate and receive it. Then you will need to confirm your identity. There is another option - buy an “electronic signature” (about 2-3 thousand rubles for one year). If you have an electronic signature, you will be able to go through the registration steps faster.

- Select the section “, then “Federal Tax Service”. At the end it opens. We read what is required.

- We fill out the application using form P21001. We fill out with utmost precision and care.

- We submit other documents electronically (passport, duty payment receipt, application form). To do this, you will need to scan everything and transfer it to a computer.

- We attach documents to the application in the form of one archive. These documents can be certified either with your electronic signature, which you could previously purchase, or notarized before scanning. We wait.

- Within a few days, a notification from the tax service arrives at the specified mailing address. Then you will need to take all the documents and go to the FSN office to pick up the completed registration papers.

How to register an individual entrepreneur through the FSN website

As in the first case, you will need to perform a few simple steps:

- Go to the official website of the tax service.

- Select the “Individual Entrepreneur” menu, then “Registration of an individual entrepreneur.”

- Find the subsection “Life situations” and select the item “I want to apply for registration of an individual entrepreneur.”

- There you will find instructions on the further procedure, and the entire volume of documents that will be needed for completion. Now find point number 3 and select the “remotely” section.

- Click on the “Submit Documents” button. There are two of them. One is to submit electronically, the other is to fill out an application on form P21001. We click on both. Further - according to the described regulations. Hints will pop up right on the pages. We remind you that in case of electronic submission of documents, you will need scanned and certified copies of them.

Registration of individual entrepreneur by mail

The Federal Tax Service makes it possible to send all documents required for the registration procedure by registered mail. It is important that it has a declared value and an inventory of the investment.

Completion

Certificates and notifications have been received. Now you need to start registering with the Pension Fund. This process is also handled by the tax service itself. Having registered an entrepreneur, she sends all the necessary information about him to the Pension Fund of the Russian Federation, where he is further registered. After a certain period of time, the individual entrepreneur receives a notification by mail that he has been registered with these authorities. If the notification does not arrive to the applicant for a long time, then he must independently submit the necessary documents to the local authority of the Pension Fund of the Russian Federation.

Remember that it is prohibited to engage in entrepreneurial activity without registration with the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund on the territory of the Russian Federation. Moreover, if you are not interested in hiring employees and work alone, then these services register you automatically, and there is no need to make any additional fees. If you have hired employees, you must register yourself as an employer and register your employees. You are required to pay insurance premiums for yourself and your employees.

To reduce your time, you can order ready-made receipts with your details for each month or for a year at once. The last option is the most convenient. You just need to pay the entire amount of the annual fee before the end of the year, and better - no later than ten days before its end. Also, many entrepreneurs prefer to make insurance payments through a current account. This method has become one of the most popular.

Registration changes for 2021

There were no changes in the basis of actions when submitting documents. But penalties for violations of regulations have become more serious.

If there are doubts about the authenticity of the documents you provided, registration may be stopped for up to one month.

Registration may now not be approved if you have already been found to have violated the law in commercial activities.

The fine for incorrect information that you try to provide to the tax office to register an individual entrepreneur is up to 10 thousand for the first time.

You are responsible if dummies are used. By the way, just one statement from such a dummy director will be enough in this case.

Payment of state duty

Applicants submitting documents for opening an individual entrepreneur in 2021 in electronic format are exempt from paying state fees. When submitting documentation in a different way, the future individual entrepreneur will have to pay 800 rubles.

The easiest way to make a payment is by receipt. To obtain it you must perform the following steps:

- go to https://service.nalog.ru/payment/index.html;

- select a suitable payment purpose;

- send the generated document for printing.

If you want to save additional money on state fees, it is advisable to pay through the State Services portal. In this case, the payment amount is reduced by 30%.

Bottom line

As you can see, you don’t have to take many actions in order to obtain the official right to be called an individual entrepreneur. However, each action has its own nuances. And the whole process must be treated with complete seriousness and responsibility, find out information in advance, and in some cases, hurry.

However, if you familiarize yourself with the entire procedure, you will be able to implement your plans without any problems in practice. And then you will be able to fully enjoy the difficult activity that you have chosen in the form of your own business.

Understand your current account

Having a current account is not a prerequisite for an individual entrepreneur. If the type of activity involves the provision of services to the public and cash payments to clients and suppliers, then there is no need to have a bank current account.

The profitability of the enterprise will be carried out according to the Book of Income and Expenses. And all tax payments can be made by an individual entrepreneur through a Sberbank branch. If settlements with counterparties occur in a non-cash manner, then opening a current account becomes a prerequisite for successful work.

When deciding to open a current account, it will be much more convenient for an entrepreneur to pay with counterparties, landlords of premises, suppliers of materials and a number of services, and mutual settlements between business entities in the amount of over 100 thousand rubles should pass only through a current account. This is stated in the Directive of the Bank of Russia dated October 7, 2013 N 3073-U “On cash payments.”

The exception is settlements between entrepreneurs and ordinary citizens who are not individual entrepreneurs. In addition, it is more convenient to pay taxes and contributions through a current account, and it is much easier to store large sums of money.