Home / Government procurement

Back

Published: 04/02/2019

Reading time: 4 min

0

733

Since 2007, the Russian Federation has taken a course towards supporting small organizations and individual entrepreneurs. As a legal framework for the benefits provided to these organizations and enterprises, Federal Law No. 209 “On the development of small and medium-sized businesses in the Russian Federation” was adopted on July 24, 2007.

- SMP

- SONO

- Confirmation of the company's compliance with the status of SMP or SONO

- Advantages for SMP and SONO during public procurement

Legislative framework

A small business entity can be a commercial enterprise or an individual entrepreneur with the main goal of making a profit.

Organizations related to small businesses are divided into several categories:

- running a peasant farm;

- agricultural cooperatives;

- production cooperatives;

- economic partnership.

Formations that do not fall under the concept of small business:

- municipal and state societies;

- non-profit societies.

SONO

SONO stands for socially oriented non-profit organization. The definition of a non-profit organization, including its subtype of a socially oriented institution, is given in Federal Law No. 7 of January 12, 1996 “On Non-Profit Organizations”.

According to the legal act, namely Article 2, a non-profit organization as a whole is a legal entity that does not include profit as the main purpose of its activities . That is, the company does not work for the sake of income, although it can carry out entrepreneurial activities (in accordance with Part 2 of Article 24).

A socially oriented organization is aimed at solving social issues and is designed to develop the country's civil society.

SONO does not include political parties, state-owned companies and corporations.

Criteria for assessing an enterprise as small

The main requirements for classifying a business as small are the number of employees and the amount of income.

For small enterprises, the average number of employees should not exceed 100 people. If we are talking about a micro-business, then there should be no more than 15 employees.

The maximum amount of revenue for 1 year, excluding VAT, cannot exceed 800 million rubles, the lower limit is 400 million rubles. If we are talking about a micro-business, then the revenue should be from 60 to 120 million rubles.

The share in the authorized capital of a small enterprise of other organizations that do not fall under this definition should not exceed 49%.

For individual entrepreneurs, the same criteria are used to determine the business category. If an individual entrepreneur does not have employees on staff, then the category of small enterprise is determined only by the amount of revenue. Entrepreneurs who have chosen the patent taxation system are clearly classified as a small enterprise.

A logical question arises: are LLCs classified as small businesses? Yes, they do if they meet the criteria described above.

How to get on the register and how to stay there

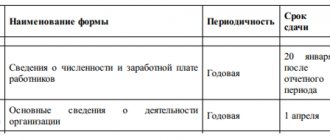

To be included in the list of SMPs, a number of conditions must be simultaneously met. Below are the maximum values for the average number of employees and income; they must be observed in order to be included in the register:

- for medium-sized enterprises: from one hundred to two hundred people / two billion rubles;

- for small businesses: up to one hundred people / eight hundred million rubles;

- for micro-enterprises: up to fifteen people / one hundred and twenty million rubles.

The size of the maximum income and the number of employees is established by the Government of the Russian Federation. There are additional requirements that apply exclusively to business entities and partnerships. The limitation is related to the ownership structure:

- the share of participation of the Russian Federation, its constituent entities and municipalities, as well as foundations, public and religious associations should not exceed 25% of the authorized capital of the LLC (voting shares of the JSC);

- the share of participation of foreign legal entities and (or) legal entities not related to small or medium-sized businesses is no more than 49%.

An alternative condition to the limitation on the share of participation is the innovative nature of the company’s activities. For example, if an organization uses the results of intellectual activity, the exclusive rights to them must belong to the owners - scientific institutions or educational organizations. Another option is that the shares of the joint-stock company are traded on the stock exchange and are classified as part of the high-tech sector of the economy.

The register is formed by the Federal Tax Service on the basis of data from the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs and tax reporting. Information may also come from other departments or be provided by the organization or individual entrepreneur itself. No additional documents or application are required for inclusion in the list. An organization or individual entrepreneur must provide information on the average number of employees and tax reporting for the previous year. If the subject does not comply with the requirement, information about him will be excluded from the list.

Register of subjects

Small businesses include persons included in the Unified Register. You can view the data on the tax service website. All information goes there automatically when registering an enterprise and filing tax reports. After being included in the register, small businesses are no longer required to confirm their status, as previously, when they had to submit financial statements and a report on the average composition.

The following information is freely available:

- name and legal form of the enterprise;

- category, that is, the enterprise is small, medium or micro;

- KVED;

- availability of licenses.

If suddenly there is no information whether the organization belongs to small businesses, or it does not correspond to reality, then such a person must submit an application to the Registry operator so that the data is checked and appropriate changes are made.

If the small business entity itself wishes, other information can be entered into the register, for example, about the products manufactured, whether the enterprise cooperates with government agencies and its contact information.

SMP

The above-mentioned legal act, namely Article 3, determines that small business entities (SMB) include organizations that meet the criteria established by the mentioned law. In addition, information about such entrepreneurs is entered into a unified register.

SSEs include both legal entities, in particular those organized in the form of joint-stock companies and limited liability companies, and individual entrepreneurs.

In order for a company to be included in the SME register, it must meet the requirements established in Article 4 209-FZ:

- According to a certain composition of founders and shareholders for business entities, partnerships, partnerships . First of all, the share of state participation in the capital or management of the company should be no more than 25%, and the share of foreign organizations or organizations that do not belong to the SMP should not exceed 49%. This rule does not apply to a company if it is engaged in high-tech developments, introduces know-how under its own patents, or has received the status of a member of an innovative company.

- The maximum established limit for the number of employees in the company's staff . The legislator has established that a small enterprise means an average number of employees of no more than 100 people inclusive. The list of employees from 101 to 250 people corresponds to a medium-sized enterprise.

- Limit values of the organization's annual income . This gradation is established by Decree of the Government of the Russian Federation dated April 4, 2016 No. 265. For small enterprises, the maximum allowable income level is 800 million rubles. in year. In this case, all types of income are summed up using all tax regimes of the company.

An organization is classified as a small business in accordance with the criterion that is most important. So, if a company has only 50 employees, but at the same time receives an income of 1 billion rubles. per year, then it will not apply to small businesses.

Benefits of MP status

For those who belong to small businesses, certain benefits are provided. The state is thus trying to bring business out of the shadows, reduce the cost of unemployment benefits, create new jobs, and improve the climate for the development of innovation. Naturally, the easiest way to achieve these goals is to simplify the registration procedure, reduce administrative pressure from government bodies and reduce the tax burden.

Preferences for small businesses:

- Preferential taxation. These are special modes, UTII, PSN, simplified tax system or EXSN. Local authorities have the right to set minimum rates. For example, if the simplified tax system at the state level is set at 6%, then local authorities have the right to reduce the tax to 1%. If an individual entrepreneur is registered for the first time, then regional authorities may exempt such person from paying taxes for up to 2 years.

- Financial benefits. At the state level, grants and gratuitous subsidies are provided. Funds can be issued for partial repayment of leasing agreements or for participation in exhibition events. The programs are valid until 2021.

- Administrative relaxations. Such advantages are in the form of a simplified accounting system and cash discipline. While supervisory holidays are provided, the number and frequency of inspections are limited. There is also a state quota of 15% of all orders, that is, MPs fall into this percentage.

This year, additional benefits are provided for micro-enterprises; such individuals can refuse the practice of adopting local documents; for example, there is no need to create internal labor regulations or draw up shift schedules. However, such conditions will have to be included in the employment contract with each employee. If a business loses its microenterprise status, it must create all local documents within 4 months.

Checks

Small and medium-sized businesses include enterprises that are subject to reduced inspection deadlines. Each regulatory authority does not have the right to inspect an individual entrepreneur for more than 50 hours in 12 months. For micro-enterprises, the minimum period is generally no more than 15 hours per year.

Enterprises that fall into the SE category are entitled to tax holidays that are valid until the end of 2021. However, such relaxations apply only to scheduled inspections. If a complaint is received against an entrepreneur with information about a violation of the law, then the inspection authorities will come to such person to clarify the data received.

Responsibility

Do not forget that even those who belong to small businesses are responsible for their unlawful acts. If an entrepreneur or other small enterprise violates the requirements and conditions stipulated by a license or permit to carry out a certain type of activity, then the following liability will follow:

- Issuing a warning and imposing an administrative fine of up to 2 thousand rubles. This measure is provided for citizens.

- The fine for officials is higher - up to 4 thousand rubles.

- For legal entities – up to 40 thousand rubles.

Higher penalties are provided for cases where the violation can be considered gross. Although the legislation does not provide criteria for determining gross misconduct. In fact, such violations should be covered by licensing rules.

Administrative fines are also provided for those individuals who are classified as small businesses but carry out certain activities without permits. The size of the punishment in this case is less, but if such acts continue and can be classified as gross, then this is a different order of numbers. For example, for the absence of a permit for a type of activity that is required to obtain such a document for entrepreneurs, it provides for a fine of up to 20 thousand rubles with suspension of activities for up to 90 days.