In the summer of 2021, namely from July 1, the next wave of Russian business representatives should switch to online cash registers. This time, the obligation to install a new type of cash registers affects individual entrepreneurs who work under the so-called “imputation” and under the patent system.

In addition, the State Duma is considering a bill that may completely free individual entrepreneurs from the need to spend money on new cash registers. Online cash registers for UTII in 2021, changes, latest news, who should switch to online cash registers from July 1, 2021, whether State Duma deputies adopted a new law that exempts at least some individual entrepreneurs from online cash registers - more on all this below.

The law allows deferment, but not for everyone and not for everything.

Federal Law No. 54 talks about the procedure for introducing a new type of cash register for all entrepreneurs, regardless of the taxation system. For most, innovations have become relevant since the spring of 2021.

Businessmen who chose UTII taxation, according to the text of this legislative act, received a deferment for installing online cash registers until July 1, 2021. The reason for this special treatment is that such entrepreneurs were not required to use cash register equipment to make payments to clients. Instead, the buyer could, at his request, receive a sales receipt or a strict reporting form, which should be ensured before the onset of “hour X”, when cash registers become inevitable.

NOTE! From July 1, 2021, online cash registers for payments are a mandatory requirement for all entrepreneurs, including UTII and patent payers.

There are legally justified exceptions to the application of this article of the law:

- the ability to trade and provide services without a cash register (for certain types of activities on UTII);

- mandatory transition to new cash register systems for businessmen on UTII earlier than July 1, 2021 (from March 31, 2021).

Do I need a cash register for UTII?

This question is asked by many entrepreneurs, because tax is calculated at a fixed rate, derived using a special formula. At the same time, LLCs and individual entrepreneurs do not report the amount of revenue from the sale of their products or services.

However, the government considered that the introduction of cash registers for individual entrepreneurs on UTII, as well as for organizations on UTII, will help protect the interests of consumers who require confirmation of the fact of sale. Let us remind you that the buyer can receive not only a paper, but also an electronic version of the check in the form of an SMS or email message, if he so desires.

Which UTII payers will not need an online cash register?

The law allows you to do without CCP when carrying out certain strictly defined types of activities listed in Art. 2 Federal Law No. 54:

- sale of press in kiosks (besides the press, there may be other goods, but printed publications should be more than half of the total trade assortment);

- sale of coupons in the transport salon;

- securities trading;

- shoe repair services;

- catering points in educational institutions operating during school hours;

- retail trade from non-stationary places (except for a number of non-food products included in a special list);

- sale of ice cream and soft non-alcoholic drinks in non-stationary conditions;

- trade "on the street";

- sale of seasonal vegetables and fruits (so-called “disruptions”);

- sale of goods from tanks (milk, live fish, kvass, etc.);

- acceptance of glass containers and/or waste paper (but not scrap metal!);

- services for cutting, plowing, digging;

- services of nurses and nannies;

- heavy lifting services;

- sale of handmade products;

- renting your own real estate (IP);

- work in pharmacies located in remote areas without the Internet (from the list approved by the Decree of the Government of the Russian Federation).

FOR YOUR INFORMATION! Even with the listed activities, if the range of goods contains excise goods, an online cash register must be installed!

Responsibility for violation of the law on cash register equipment

For individual entrepreneurs on UTII, sanctions for non-compliance with the requirements for cash mechanisms are indicated in Art. 14.5 of the Code of Administrative Violations of the Russian Federation.

If payments by an individual entrepreneur are made without using a cash register, the fine will be from 25% to 50% of the amount of settlements carried out “by the cash register”. The minimum amount of such a penalty is not less than 10 thousand rubles. Legal entities in a similar situation will be charged from 75% to 100% of payments made “bypass the cash register” (but not less than 30 thousand rubles).

Installation of a cash register model that is not included in the official register, lack of registration with the Federal Tax Service, as well as failure (or delay) to submit documents and information on cash registers to the tax service entails a warning or an administrative fine:

- from one and a half to three thousand rubles - for individual entrepreneurs;

- from five to ten thousand rubles - for legal entities.

How to find out whether an online cash register will be needed and when?

After the release of the new version of Federal Law No. 54, all subjects of legal relations, based on the need for them, online cash registers can be divided into 4 groups, each of which is subject to the obligation to introduce an innovation within a certain period. These data are shown in Table 1.

Table 1

Responsibilities and deadlines for establishing online cash registers for different categories of individual entrepreneurs

| № | IP group | Legislative justification | Position on online cash registers |

| 1. | Entrepreneurs who are not required to use cash registers at all | According to both versions of the law | There is no need to enter online cash registers, no changes will occur. |

| 2. | Individual entrepreneurs had to use CCP according to the old version, but this is not required according to the new one | Clauses 3 and 4 of Art. 2 of this Federal Law in the old version dated March 8, 2015. Clauses 2, 3 and 7 of Art. 2 of this Federal Law, as amended on July 3, 2021. | The old-style cash registers are used until July 1, 2021, and then are abolished. |

| 3. | Entrepreneurs who needed CCP before, it remains mandatory now | Until July 1, 2017, you can continue to use the old cash register, even if it is not an online version. Then only online checkout is allowed. After February 2021, only new types of cash registers can be registered. | |

| 4. | Individual entrepreneurs who previously did not need cash registers, but now will need them | They may not use cash registers until July 2021, then register and use online cash registers. |

How to choose among the variety of cash registers

Now let’s get down to the most interesting question – which model is better to take. We advise you to pay attention to several parameters:

- Autonomy. If the work of your individual entrepreneur involves traveling or delivery, then it is critical to choose the right device. He must provide the courier with a cash register with a battery for a certain period of time.

- Display size, presence and number of buttons. A simple one in appearance is suitable for a small assortment, while a screen with a large touch diagonal is larger for large stores, restaurants and other establishments.

- Print speed. An important factor if queues often form. The faster the document is printed, the less people will accumulate in the room. The presence of an auto-cut also has a positive effect on the quality of customer service.

- Width of receipt tape. If most of the titles in the assortment are long, then you should choose a printer that will fit more into one line.

- Internet connection. You can choose among those that work via a SIM card, cable or wi-fi. If the connection does not work well indoors, it is better to use a SIM card.

- Dimensions. Here it is worth considering the place where the device will be located after purchase. Some are quite bulky. For courier delivery, we recommend looking for a more compact option.

Among the popular models:

- Atol Sigma 7. Check 57 mm. The display is touchscreen, occupies 7 inches. Can be used for goods with markings and EGAIS.

- Evotor 7.2. Directories, cloud database, integration with various commodity accounting systems.

- Atol Sigma 10. Screen 10 inches. Prints at a speed of 100 mm/sec. There is an auto-cut. Supports all possible methods of connecting to the Internet.

We looked at how to choose an online cash register for UTII payers in retail trade, took into account the nuances and provided a list of those who currently have the right not to change anything in their work. We remind you that there are no sanctions if you prepare in advance, and for being late, serious fines can be imposed, including restriction of activities for a period of 3 months. We advise you to start rebuilding at least 30 days in advance in order to have time to complete all operations and comply with the law now.

Number of impressions: 873

Documents for a client without an online cash register

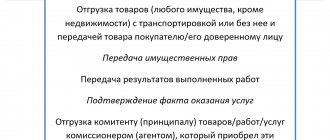

Instead of a check, you need to issue the client a strict reporting form (SSR). When the time comes for everyone to install online cash registers, entrepreneurs included in the list of exceptions will have to use a new type of strict reporting forms generated by a special automated device, which, like the new cash registers, will be equipped with fiscal memory.

And from February 1, 2021, in such a BSO it will be necessary to fully indicate the name of the product sold or service provided.

Choosing a cash register for a small business

Cash registers for non-stationary trade

This type is suitable not only for couriers, but also for small retail outlets (boutiques, coffee shops, islands). There are models suitable for catering with the sale of alcohol without labeling. In this case, the following condition must be met: the cash register must be compatible with the product accounting service that sends documentation to EGAIS.

Cash desks for stationary trade

These are mainly the following types of devices:

- POS terminal, tablet or laptop with a receipt printer.

- Monoblock with built-in screen and receipt printer.

This type of equipment is suitable for retail trade and catering with medium and high customer flows. Cash registers can be used for the sale of alcoholic beverages if they are connected to a commodity accounting system that sends documentation to EGAIS , as the Kontur.Market service does.

Early transition of UTII to online cash registers

There is a special legislative incident that will require businessmen on UTII to support the innovation of using online cash registers before the stated deadline of July 1, 2021.

The fact is that the adopted amendments to Federal Law No. 54 turned out to be in one point in conflict with Federal Law No. 171, which regulates the trade in alcohol-containing products. From March 31, 2021, some edited articles become valid, namely paragraph 10 of Art. 16, according to which the sale of alcohol must necessarily be carried out through an online cash register, even if the sale occurs through public catering (previously, the form of sale determined the mandatory use of cash register systems).

Since the legislative principle of priority of special legislative norms over general ones applies, the requirements of Federal Law No. 171 prevail over the relaxations provided in the amendments to Federal Law No. 54.

Hence the obligation for entrepreneurs on UTII engaged in trade in all types of alcoholic and low-alcohol products to switch to online cash registers from March 31, 2021. These drinks, in addition to strong alcohol, even include those types that previously did not require accounting by cash register when sold through public catering:

- beer;

- beer-based drinks;

- mead;

- cider;

- Poiret, etc.

If an entrepreneur has an old-style cash register on UTII (with an EKLZ tape), he can use it before the generally established deadline, taking into account the one-year deferment, that is, until July 1, 2021, then a new device will still be required.

IMPORTANT! This responsibility cannot be ignored even in connection with the location of a point of sale of alcohol in a remote area where there is no Internet. It’s just that in such a difficult situation there will be no immediate transfer of data to the INFS (they will have to be handed over directly) and the ability to send a check to the client by email (it will be issued exclusively in paper form). But this does not cancel the legal requirement for new cash register equipment.

Right to deduction

It is important that the use of cash registers for UTII gives the right to a deduction for the purchased cash register. The maximum amount is no more than 18,000 rubles. Such a reduction in imputed tax is permissible in addition to insurance premiums made by individual entrepreneurs and payment of sick leave benefits for the first 3 days.

The 50% limit on reduction does not need to be observed (letter of the Ministry of Finance dated April 20, 2018 No. 03-11-11/26722).

Also see “Reducing UTII for insurance premiums in 2021 for individual entrepreneurs.”

Sale of non-food products on UTII

In 2021, the government was actively working to amend the list of non-food products that cannot be traded without using online cash registers, no matter what the conditions of sale. These amendments apply to all businessmen, including those working under the UTII system. It is mandatory to use a “smart” cash register when selling:

- carpets and carpet products;

- underwear;

- hosiery products;

- handkerchiefs;

- leather products (except for leather parts sold separately and leggings);

- wooden and cork products (except cutlery and utensils);

- wicker goods (except baskets);

- chemical substances;

- medicines and medical products;

- rubber and plastic items;

- electrical, computer, optical equipment;

- Vehicle;

- sporting goods;

- musical instruments.

How to combine UTII and simplified tax system?

The deferment for entrepreneurs paying taxes under 2 preferential systems at once will not apply. They, like everyone else, must start using online cash registers from July 1, 2021 in all types of activities where the simplified tax system is applied. But in those objects for which taxes are paid according to the UTII system, the installation of cash register systems can be expected until 2021.

ADVICE FOR BUSINESSmen! If any doubts arise regarding the procedure for using and the beginning of the service life of cash register equipment with a fiscal drive and online data transfer, you need to contact the tax authority that registered the purchased cash register for clarification. By receiving official written explanations, you can protect yourself from unexpected fines.

Fines for working without a cash register

If you work without a cash register, the tax office will issue a fine. The amount of the fine depends on the situation:

- the first sale without a cash register for any amount - from one-fourth to half of the purchase price. But not less than 10,000 rubles;

- repeated violation in the amount of up to one million rubles - a fine of up to half the purchase price and not less than 10,000 rubles;

- repeated violation amounting to more than a million rubles - the entrepreneur will be prohibited from engaging in activities for 90 days;

- the entrepreneur did not provide the buyer with a cash receipt in electronic or paper form - 2000 rubles.

An individual entrepreneur will receive a fine of 1,500–3,000 rubles for a violation if:

- the equipment is not registered;

- no fiscal storage;

- The cash register does not print receipts;

- there is no QR code on the receipt;

- the entrepreneur did not provide accounting documents to the tax office.