- from short-term financial investments (account 58 minus the reserve for impairment formed on account 59);

- debit balances on settlement accounts (60, 62, 68, 69, 70, 76, etc.)

- Capital and reserves. These are authorized, additional, reserve capital and retained profit or uncovered loss (accounts 80, 82, 83, 84).

- Long-term borrowed funds (with a repayment period of more than 12 months - account 67).

- Other long-term liabilities (credit balances on accounts 60, 62, 68, 69, 76 (in terms of long-term accounts payable).

- Short-term borrowed funds (with a repayment period of less than 12 months - account 66).

- Accounts payable (credit balances on accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 (in terms of short-term “creditor”).

- Other short-term liabilities.

The passive includes lines such as:

Just like in a regular balance sheet, the abbreviated one provides information for 3 years: the reporting year, the previous one and the one preceding the previous one. That is, in the balance sheet for 2021 you need to show the balances as of 12/31/2020, 12/31/2020 and 12/31/2020.

As you know, balance lines are encoded. Their codes are contained in Appendix No. 4 to Order No. 66n. The simplified balance sheet contains aggregated indicators that include several indicators (without detail), so the line code in it must be indicated by the indicator that has the largest share in the aggregated indicator (clause 5 of Order No. 66n).

Please note that only the head of the organization signs the balance sheet; the signature of the chief accountant is not required.

Report on the financial results of a small enterprise for 2021 – 2020

Today we will consider the topic: “report on the financial results of a small enterprise for 2021 - 2021” and will analyze it based on examples. You can ask all questions in the comments to the article.

How to draw up a balance sheet for small businesses

| Video (click to play). |

Balance Sheet Forms

and the Report on the financial results of small businesses were put into effect by order of the Ministry of Finance of Russia No. 113n dated August 17, 2012. Based on the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n “On the forms of financial statements of organizations.”

According to order No. 66n. Small business organizations prepare financial statements according to the following simplified system:

a) in the Balance Sheet and the Statement of Financial Results of a small enterprise. Indicators only for groups of articles are included (without detailed indicators for articles);

b) in the Appendices to the balance sheet and the Statement of Financial Results of a small enterprise, only the most important information is provided. Without knowledge of which it is impossible to assess the financial position of an organization or the financial results of its activities.

In your work you must also be guided by the Chart of Accounts. Provisions of the Tax Code of the Russian Federation and data from tax registers of the organization.

Before you draw up a balance, check:

Below is a detailed example of filling out the balance sheet and financial performance statement of a small enterprise. Balances and turnovers, which accounts are used to make up the Balance Sheet. And a report on financial results for small businesses (Form KND 0710098).

The company is located on the simplified taxation system (USN-D) 6% and is engaged in appraisal services. Intangible, financial and other non-current assets. There are also no financial or other current assets in the organization. The accounting policy stipulates that revenue is determined as money is received from customers. Expenses are recognized as they are paid and reduce the financial result of the current period. (clause 7 PBU 1/2008, clause 12 PBU 9/99, clauses 18 and 19 PBU 10/99).

Information disclosure service: financial statements, balance sheets. And all other forms are free.

Example REPORT on FINANCIAL RESULTS of a small enterprise

According to the law on accounting, the financial statements include precisely the statement of financial results (clause 1, article 4 of Law No. 402-FZ).

Line 2110 “Revenue, minus VAT, excise taxes.” It is calculated as the difference between the turnover on the Credit account 90.1 and the sum of the turnover on the Debit account 90.3,90.4,90.5.

Line 2120 “Expenses for ordinary activities.” Amount of turnover on Account Debit 90.2.

No video.

| Video (click to play). |

Line 2330 “Interest payable.” Turnover on Debit account 91 in terms of interest expenses.

Line 2340 “Other income”. Calculated based on the Turnover on Account Credit 91.

Line 2350 “Other expenses”. Calculated based on the Turnover in the Debit of account 91, all other expenses are indicated except for Interest payable (they are reflected on line 2330)

Line 2460 “Profit tax (income)”. The amount of income tax indicated in account 68 is indicated. For organizations using the simplified tax system, you need to indicate the simplified tax here. Because this line reflects not only income taxes, but also taxes on income. And the simplified single tax is just that.

Line 2400 Net profit = Revenue – Expenses for ordinary activities + Interest payable + Other income – Other expenses + (-) Income tax.

Table: Procedure for filling out the Financial Results Report by a small enterprise

EXAMPLE OF BALANCE SHEET of a company using the simplified tax system, How to draw up a balance sheet for a small enterprise

Line 1150 “Tangible non-current assets”. The line is calculated as the difference between the Balance at the end of the period for the Debit of account 01 and the Balance at the end of the period for the Credit of account 02.

Line 1170 “Intangible, financial and other non-current assets.” The line is calculated as the difference between the Amount of balances at the end of the period for Debit accounts 03,04,09,58. And the amount of balances at the end of the period for the Credit of accounts is 05.59.

Line 1210 “Inventories”. The line is calculated as the difference between the Amount of balances at the end of the period for Debit accounts 10,11,15,16.1,20,21,23,25,26,29,41,43,44,45,46,97. And Amounts of balances at the end of the period for Credit accounts 14, 16.1,16.2,42.

Line 1250 “Cash and cash equivalents.” The line is calculated as the sum of the Balances at the end of the period for the Debit accounts 50,51,52,55,57.

Line 1260 “Financial and other current assets”.

Line 1260 is calculated as the Sum of balances at the end of the period for Debit accounts 19,60,62,66,67,68,69,70,71,73,75,76,79,86,94 minus Balance for Credit account 63.

Line 1310 “Capital and reserves”. The line is calculated as the Sum of balances at the end of the period for Account Credit 80,82,83,84 minus Account Credit Balance 81.

Line 1410 “Long-term borrowed funds.” The line is calculated as the Balance at the end of the period for Account Credit 67.

Line 1450 “Other long-term liabilities”. The line is calculated as the sum of the balances at the end of the period for the Credit of accounts 75.77.

Line 1510 “Short-term borrowed funds.” The line is equal to the Balance at the end of the period for the Credit of account 66.

Line 1520 “Accounts payable”. The line is calculated as the sum of the balances at the end of the period for Credit accounts 60,62,68,69,70,71,73,75,76.

Line 1550 “Other short-term liabilities”. The line is calculated as the sum of the balances at the end of the period for the Credit of accounts 96.98.

Table: Procedure for filling out the Balance Sheet for a small enterprise

Table: Procedure for filling out the Balance Sheet in full

Filling out accounting (financial) reporting forms by small businesses and non-profit organizations using the new KND form 0710096

New form

accounting statements (KND 0710096) combined the two previous forms, including the balance sheet of a small enterprise. Simplified financial statements of small businesses (KND 0710098). And financial statements of socially oriented non-profit organizations (KND 0710097). It also includes additional appendices “Statement of Changes in Capital” and “Statement of Cash Flows”.

Annual financial statements – 2015, VIDEO from the seminar

Changes that affected the formation of accounting reports for 2021. Mandatory audit of annual accounting (financial) statements. Frequent violations when assessing balance sheet items and reflecting financial results. Drawing up a balance sheet. Explanations in the financial statements. Information accompanying financial statements.

The relationship between the indicators of the Balance Sheet and the Statement of Financial Results of a small business entity

Receive financial statements of any enterprise using TIN

Disclosure service: financial statements, balance sheets and all other forms for free.

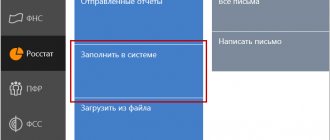

Federal Tax Service, Pension Fund of Russia, Social Insurance Fund, Rosstat, RAR, RPN. The service does not require installation or updating - reporting forms are always up to date, and the built-in check will ensure that the report is submitted the first time. Send reports to the Federal Tax Service directly from 1C!

Can or should you report?

The opinion that reports need not be submitted to Rosstat is deeply mistaken. For ignoring the requirement to send or incorrect information in the reporting, you face a fine under Article 13.19 of the Code of Administrative Offenses of the Russian Federation, namely:

- from ten to twenty thousand rubles will be paid by an individual entrepreneur, as well as an “official” - the director of the company;

- from twenty to seventy thousand rubles will have to be paid to the organization itself.

For repeated violations, fines increase. An official can pay 30-50 thousand rubles, a legal entity - 100-150 thousand rubles.

Advice

If you are not sure whether you need to report or submit one form or another, it would not hurt to make additional inquiries at the local Rosstat office. Even if you do not have the type of activity for which the department has requested a report, it is better not to ignore the request, but at least send a letter with an explanation.

Procedure for filling out the financial results report 2021

poryadok_zapolneniya_otcheta_o_finansovyh_rezultatah_2020.jpg

The financial results statement (FRS) is the second most important report after the balance sheet. With the approach of the time for the formation and submission of annual reports, the issue of correct execution of the financial financial statements becomes relevant. Let us recall the procedure for filling out the financial results report for 2021 and the criteria for checking the entered values.

The OFR is filled out in accordance with the form approved by the order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010, and periodically updated on the basis of relevant orders. For the reporting package for 2021, the document should be prepared on the form as amended by Order No. 41n dated 03/06/2020. You can download the 2021 financial results report below or from the Federal Tax Service.

FIR for 2021 (like the financial results report for 2021) is a familiar form that has two sections: the first provides general information about the company, the second contains a lined table containing:

explanations (the number of the corresponding explanation to the reporting is indicated);

string ciphers (codes);

the value of the indicator for the reporting and previous periods in comparable units.

The report informs the user from what sources the company's income is generated, and what expenses are taken into account when calculating net profit (NP).

Line codes for the financial results report 2021: decoding, content and formation

When preparing a report, take into account the following basic rules:

income/costs are indicated in detail;

the subtrahend/negative value is enclosed in parentheses;

empty lines are crossed out.

Fill out the report based on the data of the general balance sheet (STB) and detailed turnover for accounts 90, 91, 99.

The line codes of the latest current report have not changed compared to previous versions of the form, and the values in them are formed taking into account the same criteria:

How to submit financial statements in 2021 and what’s new in them are some of the most frequently asked questions at the end of the year. The excitement of accountants can be understood, because recently amendments were made to the Law “On Accounting” and they relate specifically to financial statements. However, there is absolutely nothing to worry about yet.

You can read about the composition of accounting statements and methods of presenting them in other materials on our website.

Will new accounting forms be introduced in 2020?

The latest changes to the Order of the Ministry of Finance, which approved the forms of financial statements, were made in March 2021 (Order of the Ministry of Finance dated March 6, 2020 N 41n). And it is impossible to say that because of this the forms have changed significantly. Most of the amendments were of a technical nature, and the rest are significant only for public sector organizations and non-profit organizations (Information message of the Ministry of Finance dated May 28, 2020 N IS-accounting-11).

So most companies will need to prepare accounting reports for 2021 in the usual form.

As they say, people are shouting about the new reporting procedure at every corner. However, we hasten to assure you that according to the new rules, it will be necessary to submit accounting reports only from 2021. And in 2021, it must be submitted as before - to the Federal Tax Service and the Rosstat body within the same deadline. That is, no later than 04/01/2020, because 03/31/2020 is Sunday (clause 5, clause 1, article 23, clause 7, article 6.1 of the Tax Code of the Russian Federation, part 1,2, article 18 of the Law of December 6, 2011 N 402-FZ).

From 2021, financial statements will need to be submitted only to the tax office, and in electronic form through an electronic document management operator, signed with an electronic signature. Only small businesses and only for 2020 will be able to submit reports either on paper or in electronic form of their choice (clause 1, clause 4, article 2, clause 2, article 2 of the Law of November 28, 2020 N 444-FZ) . The deadlines for submitting reports will remain the same.

The obligation of organizations to submit a copy of their accounting records to the territorial branch of the State Statistics Committee will be cancelled. But there are rare exceptions. For example, companies whose annual financial statements contain information classified as state secrets will still have to submit it to the statistics authority (clause 4 of article 1 of Law dated November 28, 2020 N 444-FZ).

The formats of electronic documents - accounting records and auditor's report - must be approved by the Federal Tax Service. It will also be responsible for maintaining the state information resource for accounting (financial) reporting. As the name implies, this will be a large database containing information from the accounting records of all reporting organizations.

Information from this resource can be obtained for a fee. In what cases and how much it will be, the Government of the Russian Federation must determine.

We follow the form

Pay attention to the statistical reporting forms themselves, unless they were sent to you along with a request from the department.

The department periodically makes certain changes to the forms, and not only of a technical nature. Thus, already in May 2021, when submitting reports for 2021, a new form No. 1 (labor force) “Information on the composition of the organization’s labor costs” will begin to be used (approved by Rosstat order No. 839 dated December 18, 2017).

Another example - from January 1, 2021, form P-4 “Information on the number and wages of employees” is filled out according to new rules (approved by Rosstat order No. 772 dated November 22, 2017). For example, the average payroll now needs to include those who are on parental leave while working part-time or at home while maintaining their right to benefits.

Tatyana Evdokimova, expert of the Kontur.Accounting at SKB Kontur

Is it necessary to submit accounting reports for 2021 to Rosstat in 2021: new law

2020 and 2021 are turning points for the state system of collecting annual accounting (financial) statements of enterprises and individual entrepreneurs, who are required by law to keep accounting records and create appropriate accounting records. We'll tell you what the authorities decided and whether there is an obligation to submit accounting reports to statistics for 2020 in 2021.

The Federal Law “On Amendments to the Federal Law “On Accounting” set out in a new version its Articles 13 and 18. According to them, from 2020, the submission of a mandatory copy of annual financial statements to the territorial body of Rosstat has been canceled.

Since all accountants are accustomed to submitting a copy of their accounting reports to Rosstat, many naturally asked the question: what to do with reporting for 2021 in 2020? What does the new law say?

So: in 2021, the previous procedure for submitting financial statements to statistics is still in effect. Accordingly, he will be the last one for whom this obligation must be fulfilled.

According to the new law, from January 1, 2021, the federal executive body for the generation of official statistical information on social, economic, demographic, environmental and other social processes in Russia (Rosstat) will stop collecting legal copies of reports, including revised ones, as well as audit reports about it for the reporting period of 2021 and reporting periods expired before 01/01/2020.

Let us remind you that a mandatory copy of the annual financial statements must be submitted to the territorial statistics body no later than 3 months after the end of the reporting period, that is, 2021 (Parts 1 and 2 of Article 18 of the Law of December 6, 2011 No. 402-FZ).

Thus, before April 1, 2021 inclusive (this will be Monday), you need to have time to send the accounting results for 2021 to statistics for the last time.

According to Rosstat, 79% of small enterprises submitted accounting (financial) statements for 2016 to state statistics bodies in electronic form.

The transition to submitting only electronic accounting reports to the tax office costs about 850 rubles annually if submitted through an authorized representative (including entering data from paper into electronic form and sending it to the Federal Tax Service in the established format). These costs are fully compensated by the cancellation of submission of accounting reports to Rosstat.

Please note that data from the counterparty’s annual reports for 2014–2020, submitted by it before 01/01/2020, will still have to be requested from Rosstat, and not from the tax office.

Please keep in mind that the abolition of the obligation to submit a copy of accounting records to Rosstat from 2021 does not apply to:

Who will have to report to Rosstat

What reports are to be sent and when, Rosstat reports. Typically, a letter from the department with the form of the required report and instructions for filling out is sent by mail. For an individual entrepreneur, the shipment arrives at the registration address, and for a legal entity - at the place of registration of the company.

Advice

Be careful: regardless of whether your company is a small business, be sure to send an annual balance sheet to Rosstat. The deadlines must be met by the end of March of the year following the reporting year.

Small businesses in 2021 - which companies fall into this category

So, in accordance with Decree of the Government of the Russian Federation dated April 4, 2016 N 265, not only sales revenue is taken into account, but all tax accounting income.

Let's figure out which organizations and individual entrepreneurs in 2021 fit the definition of a small business.

Main criteria for defining a small business 2020

From August 1, 2021, the calculation of the maximum amount of income for the past year includes not just all cash receipts, but all income according to the tax return. We present the criteria in table form:

Share of participation of other persons in the capital

The share of participation of state entities (RF, constituent entities of the Russian Federation, municipalities), public and religious organizations and foundations is no more than 25% in total.

The share of participation of ordinary legal entities (including foreign ones) is no more than 49% in total.

The share of participation of legal entities that are themselves small and medium-sized businesses is not limited.

The number of employees in 2021 is determined based on the average number of employees, a report on which is submitted annually to the tax office.

As for shares in the authorized capital, Federal Law No. 209 of July 24, 2007 provides for exceptions. Limits do not apply to:

From August 1, 2021, a unified register of small and medium-sized enterprises (SMEs) was created. It is formed by the Tax Service independently based on the reporting of small businesses:

In order to be included in the register, managers of small companies and entrepreneurs do not need to do anything. Access to the register of SMEs can be obtained on a special page of the Federal Tax Service website. In order to check whether information about your business is in the unified register of SMEs, just enter the INN, OGRN, OGRNIP, company name or full name of the individual entrepreneur (one or the other) in the search bar.

By voluntary application, you can supplement the information: inform about your products, concluded contracts, participation in partnership programs.

If the information about your small or medium business is not in the register or is incorrect, apply for verification with the correct information.

Organizations and entrepreneurs whose information is not in the register will be deprived of the opportunity to use the benefits provided for SMEs.

Small companies and individual entrepreneurs that fall under the listed criteria will enjoy certain benefits in 2020.

We wrote about how to draw up an employment contract for micro-enterprises in a separate article.

For such enterprises, shortened inspection periods apply. Any regulatory authority can inspect a small business entity for no longer than 50 hours per year. And for micro-enterprises the maximum period is 15 hours per year.

For 2 years (from January 1, 2021 to December 31, 2020), the “kids” were provided with supervisory holidays. This benefit for small companies and individual entrepreneurs was established by Federal Law No. 246-FZ dated July 13, 2015. But this only applied to scheduled inspections. If a complaint is received from a consumer or government agencies have information about a company violating the law, inspectors will come with an audit.

The validity period of the “supervisory holidays” established by Federal Law No. 246-FZ, which expired at the end of 2021, was extended for 2021 and 2021 by Federal Law No. 480-FZ of December 25, 2020, it was published on the official portal of legal documentation. However, it must be borne in mind that supervisory holidays do not apply to inspections carried out using the risk-based control method, and this method is used by such departments as the Federal Tax Service, the Ministry of Emergency Situations, the Federal Antimonopoly Service, Rosprirodnadzor, Rosalkogolregulirovanie and Rospotrebnadzor. From this we can conclude that small businesses are not exempt from inspections by these departments.

In addition, there will be no supervisory holidays for those enterprises that are engaged in licensed activities - these are:

and many others (a full list of 52 points is given in Article 12 of the Federal Law of May 4, 2011 N 99-FZ “On licensing of certain types of activities”).

Small businesses do not require status confirmation

Such an enterprise does not need to be separately registered and receive confirmation that your company is one. The status is also saved automatically in the future. It is enough that the company or entrepreneur meets the listed conditions. Moreover, even if within one or two years you exceed the established limits, the status of the enterprise will remain. A change in status occurs only when the maximum indicators for the number of employees, the amount of income or shares in capital are not observed for three consecutive calendar years (Part 4 of Article 4 of Federal Law No. 209). In the register, as mentioned above, the first status changes will occur only in 2021. However, for new organizations and individual entrepreneurs, new criteria and registration procedures in the register apply.

From January 1, 2021, the deposit insurance rule applies to small businesses. But in order to have the right to demand compensation for deposits, the enterprise must be included in the register of small and medium-sized businesses. This is stated in Federal Law No. 322-FZ dated August 3, 2020.

The deadline for submitting reports as part of continuous monitoring is 2021

Currently, information on small and medium-sized businesses is being collected based on the results for 2021.

The deadline for submitting information is April 1, 2021.

In 2021, small businesses must report to Rosstat on their activities

Preliminary results of the continuous observation will be published in December 2021, and final results in June 2022.

Reporting for 2021 is presented using new forms, approved. by order of Rosstat dated August 17, 2020 No. 469.

The procedure for filling out the financial results report in a simplified form for 2021

Criteria for classifying firms as small businesses

For medium-sized businesses, criteria 1 and 2 are the same as for small and micro enterprises, while the average number of employees should not exceed 250 people, and income from business activities should not exceed 2 billion rubles.

In this case, such an organization must be included by the Federal Tax Service in the register of small and medium-sized businesses posted on its official website (part 1, paragraph “a”, paragraph 1, paragraphs 2, 3, part 1.1, part 3 of Art. 4, Article 4.1 of Law No. 209-FZ, clause 1 of the Decree of the Government of the Russian Federation of April 4, 2016 No. 265).

Therefore, small businesses can submit financial statements in a simplified manner, namely:

Thus, when preparing simplified financial statements, you do not need to fill out and submit appendices to the statements to the Federal Tax Service, i.e.:

However, if the organization believes that the information from these forms is necessary for reporting users, then the organization can fill them out (clause 26 of the Ministry of Finance Information No. PZ-3/2016).

The procedure for filling out a statement of financial results in a simplified form

Data must be reflected for the reporting year and the previous year.

Expenses and losses are shown in brackets.

Revenue, as always, must be reflected net of VAT and excise taxes, and expenses for ordinary activities include cost of sales, selling and administrative expenses.

Line codes are indicated in a self-added column for the indicator that has the largest share in the aggregated indicator (clause 5 of Order No. 66n). The codes are taken from Appendix No. 4 to Order No. 66n.

Let's list what is included in the consolidated items of the simplified statement of financial results.

So, the first indicator in a simplified report is the same as in a document drawn up in a general form. This is revenue.

Next comes the line “Expenses for ordinary activities.” It contains a total reflection of three indicators: cost of sales, commercial and administrative expenses.

The next three lines are also taken from the general form report. These are “Interest payable”, “Other income”, “Other expenses”.

The penultimate indicator “Taxes on profit (income)” is to reflect the results of taxation. In particular, the tax paid under the simplified tax system is indicated here.

And the last indicator is net profit (loss).

The line of the same name is also in the general form report.

To calculate the final value, you need to sum all the previous lines.

Let's take as an example

Commonly used line codes for a balance sheet compiled in a simplified form:

Forms of continuous statistical observation 2021

The system of statistical indicators of continuous observation will be placed in the following forms of federal statistical observation:

- Form N MP-SP “Information on the main performance indicators of a small enterprise for 2021”;

- Form N 1-entrepreneur “Information on the activities of an individual entrepreneur for 2021”

You can submit reports in the following ways:

- personally to the statistics departments at the place of registration of the organization or individual entrepreneur. The reporting is considered submitted on the day of its actual transmission to the statistical authorities;

- by mail . The reporting is considered submitted on the day of mailing;

- in electronic form via TKS . The reporting is considered submitted on the day the report is sent.

We will submit annual accounting reports for 2021 according to new rules

First of all, the submission of financial statements to Rosstat will be cancelled. It will need to be sent only to the tax office, which will maintain the state information resource for reporting, including providing information from it to interested parties (a fee will be charged for this).

In addition, starting with the report for 2021, it will be necessary to submit reports only in electronic form using the TKS. But a slight delay is planned for SMP: they will have to start reporting electronically only with reporting for 2021.

The corresponding amendments are already under consideration in the State Duma. If adopted, the law will come into force on 01/01/2020.

Find out what kind of financial statements newly created organizations submit here.

Small business organizations that use the simplified taxation system maintain simplified accounting and submit a simplified balance sheet. A distinctive feature of such a balance sheet is the reflection of financial data in a more comprehensive manner: each line contains data for a whole group of items. Values are rounded and indicated in thousand or million rubles. The simplified balance sheet for the simplified tax system contains two sections: assets and liabilities. The asset contains data about the company's property, as well as its composition and value. And the liability is about the sources through which the property was acquired. One of the main conditions is the equality of assets and liabilities of the balance sheet. In this article we will look at the procedure for filling out a simplified balance sheet.

Some companies have the right to conduct their accounting in a simplified form and generate simplified financial statements. These include the following organizations:

Important! Small businesses have the right to choose the form for preparing financial statements independently. They have the right to submit reports using generally accepted forms for ordinary companies and simplified ones. Based on this, the composition of the financial statements will be determined.

For small enterprises, special simplified reporting forms have been approved, which are given in Appendix 5 of Order of the Ministry of Finance of Russia No. 66n dated July 2, 2010. Simplified financial statements include the following:

Important! If enterprises need to indicate any additional information, and the simplified reporting forms do not contain the necessary columns, then they have the right to use general reporting forms.

Thus, representatives of small businesses have the right to decide independently which forms to submit financial statements. The main thing is that the decision they make is reflected in their accounting policies.

When filling out simplified reporting forms, you should be guided by the following regulatory documents:

The annual balance sheet must contain information on the assets and liabilities that the company has as of the closing date of the reporting year, that is, December 31. Additionally, information for previous periods is entered into the balance sheet, that is, as of December 31 of the previous year and as of December 31 of the year before. For example, a balance sheet prepared by an enterprise for 2021 will need to contain data as of December 31, 2021, December 31, 2021, and December 31, 2021.

The financial results report at the end of the year must contain information on income and expenses that were recognized in the organization’s accounting in the reporting year and the previous year.

Last year's data is taken from last year's reports. And for the current year’s indicators, information is taken from sources such as:

If there is no data to fill out any balance line, it does not need to be filled in, but a dash is placed. The line code that is indicated in the simplified balance sheet can be found in Appendix 4 to Order of the Ministry of Finance 66n. But stocks with aggregated indicators for a simplified balance sheet are not provided for in this Appendix. Therefore, codes should be determined according to indicators that have a greater share in the aggregated indicator. For example, the line “Tangible non-current assets” goes under code 1150, which in the general form of the balance sheet corresponds to the line “Fixed assets” (

What needs to be taken

It is easy to find out what forms of statistical reporting a company needs to submit on the Rosstat website. To do this, go to the address and enter your company data (OKPO, OGRN, INN). After clicking on the “List of Forms” button, a file will be downloaded with a list of statistical reporting forms that must be submitted to Rosstat, as well as the deadlines for submitting reports:

Advice The list of reports for small companies may change annually, it all depends on the sample formed by the statistics body. So at the beginning of the year, be sure to check what reports you may have to fill out.

For example, the table shows that the company to which the request was sent must submit information on the number and wages of employees to Rosstat at the end of the year by January 20, and send a form with basic information about the organization’s activities by April 1.

Conditions for obtaining the status of small and medium-sized businesses and reporting composition

The conditions for obtaining the status of small and medium-sized businesses (SMEs) are established by the Law “On the Development of Small and Medium Enterprises” dated July 24, 2007 No. 209-FZ.

An enterprise can be classified as an SME if it meets the following requirements:

Please note that the limits of permissible revenue are periodically reviewed by the Government of the Russian Federation. At the time of writing, they are within the amounts indicated in the table.

IMPORTANT! SME status can be lost if the first two requirements for the number of employees and revenue are violated for 3 years in a row. This will also happen when the share of participation of legal entities is above 49%.

The composition of the reporting of small and medium-sized businesses is influenced by several factors:

- taxation system (TSS);

- type of activity (for example, the need to submit reports for small and medium-sized businesses on waste arises if organizations and individual entrepreneurs generate waste in the course of their activities);

- presence or absence of employees;

- requirements for the presentation of statistical reporting, etc.

Our specialists have compiled a detailed list of forms that small and medium-sized enterprises and individual entrepreneurs must report on.

| Reporting on taxes and contributions | ||||||

| SNO | Document's name | Periodicity | Document code | Who rents | Where to take it | For details, see the article: |

| BASIC | Tax return for value added tax | Quarterly | KND 1151001 | Organizations and individual entrepreneurs | To the tax office | “VAT return for 2017-2018 - form and sample” |

| BASIC | Tax return for corporate income tax | Quarterly/monthly (optional) | KND 1151006 | Organizations | To the tax office | “Tax return for income tax for 2017-2018” |

| BASIC | Tax return for corporate property tax | Once a year | KND 1152026 | Organizations that have property recognized as an object of taxation | To the tax office | “Tax return for corporate property tax” |

| BASIC | Tax return for personal income tax (form 3-NDFL) | Once a year | KND 1151020 | IP | To the tax office | “Tax return 3-NDFL in 2017-2018 - how to fill out? » |

| BASIC | Single simplified (tax) return - an alternative to submitting zero returns for income tax and VAT | Quarterly | KND 1151085 | Organizations, individual entrepreneurs on OSNO, if they do not conduct activities with the movement of funds through a current account (cash office) and do not have objects of taxation | To the tax office | “Unified simplified tax return - sample 2021” |

| UTII | Tax return for single tax on imputed income for certain types of activities | Quarterly | KND 1152016 | Organizations and individual entrepreneurs | To the tax office | “How to fill out the UTII declaration for the 4th quarter of 2021? » |

| Unified agricultural tax | Tax return for the unified agricultural tax | Once a year | KND 1151059 | Organizations and individual entrepreneurs | To the tax office | "ESKHN" |

| simplified tax system | Tax return for tax paid in connection with the application of the simplified taxation system | Once a year | KND 1152017 | Organizations and individual entrepreneurs | To the tax office | “Declaration form for the simplified tax system for 2017-2018” |

| simplified tax system | Single simplified (tax) return - an alternative to submitting a zero tax return under the simplified tax system | Once a year | KND 1151085 | Organizations, individual entrepreneurs, if they do not carry out activities with the movement of funds through a current account (cash office) and do not have objects of taxation | To the tax office | “Unified simplified tax return - sample 2021” |

| All NO systems | Tax return for transport tax | Once a year | KND 1152004 | Organizations for which vehicles are registered and recognized as objects of taxation | To the tax office | “Tax return for transport tax in 2017-2018” |

| All NO systems | Tax return for land tax | Once a year | KND 1153005 | Organizations owning land plots recognized as an object of taxation | To the tax office | "Land Tax Declaration" |

| All NO systems | Tax return for water tax | Quarterly | KND 1151072 | Organizations and individual entrepreneurs using water bodies subject to licensing | To the tax office | “Water tax in 2017-2018 - terms and payment procedure, rates” |

| All NO systems | Calculation of personal income tax amounts calculated and withheld by the tax agent | Quarterly | Form 6-NDFL (KND 1151099) | Tax agents - organizations and individual entrepreneurs with employees | To the tax office | "Calculation of 6-NDFL" |

| All NO systems | Certificate of income of an individual | Once a year | Form 2-NDFL (KND 1151078) | Tax agents - organizations and individual entrepreneurs with employees | To the tax office | “Certificate 2-NDFL in 2017-2018 (form and sample)” |

| All NO systems | Information on the average number of employees for the previous calendar year | Once a year | KND 1110018 | Organizations and individual entrepreneurs with employees | To the tax office | “We provide information on the average number of employees” |

| All NO systems | Unified calculation of insurance premiums (ERSV) | Quarterly | KND 1151111 | Organizations and individual entrepreneurs with employees | To the tax office | “Unified calculation of insurance premiums” |

| All NO systems | Information about the insurance experience of the insured persons | Once a year | Form SZV-STAZH | Organizations and individual entrepreneurs with employees | To the Pension Fund | “How to fill out the SZV-STAGE form for 2021 for submission in 2018?” |

| All NO systems | Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records | Once a year | Form EDV-1, attachment to SZV-STAZH | Organizations and individual entrepreneurs with employees | To the Pension Fund | “How to fill out and submit reports to the Pension Fund for the year?” |

| All NO systems | Information about the insured persons | Monthly until the 15th | Form SZV-M | Organizations and individual entrepreneurs with employees | To the Pension Fund | "SZV-M, SZV-STAZH" |

| All NO systems | Register of insured persons for whom additional insurance contributions for funded pension have been transferred and employer contributions have been paid | Quarterly | Form DSV-3 | Organizations and individual entrepreneurs with employees. Applies only to insurance premiums within the framework of voluntary insurance | To the Pension Fund | “What are the deadlines for submitting a report on the DSV-3 form in 2021?” |

| All NO systems | Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage | Quarterly | Form 4-FSS | Organizations and individual entrepreneurs with employees | In the FSS | “Form 4-FSS for the year - reporting form and example of completion” |

| All NO systems | Application for confirmation of the main type of economic activity | Once a year | Only organizations. Individual entrepreneurs are not confirmed (clause 10 of the Decree of the Government of the Russian Federation “On approval of the rules for classifying types of economic activities as professional risk” dated December 1, 2005 No. 713) | In the FSS | “Statement on confirmation of the main type of activity” | |

Will they be punished?

Yes, there are fines for those who decide that they do not want to participate in continuous statistical observation and do not submit reports.

The Code of Administrative Offenses has a separate article 13.9, which is called “Failure to provide primary statistical data.” You will be punished in three cases:

- no reporting submitted;

- reporting is submitted untimely;

- The data presented is unreliable.

The amount of the fine is for officials - from 10,000 to 20,000 rubles, for legal entities - from 20,000 to 70,000 rubles.

How to fill out and send the report correctly

Based on the sections of the form, a typical survey takes place. The procedure takes about 10 minutes. What exactly is included in this questionnaire:

- type of company activity

- number of full-time employees

- the amount of revenue from the sale of goods, products, services

- chosen tax system

- availability of fixed capital and attracted investments

- balance number of freight transport units

Errors made when filling out reports must be corrected as follows. In the “paper” form, the incorrect entry must be crossed out and the correct value written on top. If a report with an error is sent electronically, provide a “clarification”.

The report is transmitted in any way you choose:

- On paper . You need to fill out and sign the forms and submit them to the territorial authority by mail or in person.

- Through the Rosstat website . For the report to have legal force, an electronic signature will be required.

- Through EDF operators . This method is suitable if your company already reports via the Internet to the tax office, Social Insurance Fund and Pension Fund.

The form can also be submitted electronically on the State Services portal (here, by order of Rosstat No. 864 of December 30, 2020, the deadline for submitting the form is May 1, 2021 ). To report through government services, companies need a verified account and an electronic signature; individual entrepreneurs need only a verified account.

The necessary forms have already appeared in Kontur.Extern. You need to go to the “Rosstat” section, click “Create new” and select the desired form.