When is severance pay reflected in the 2-NDFL certificate?

Since the dismissal benefit is material compensation, it has preferential taxation. According to Article 217, paragraph 3, subsection 8 of the Tax Code of the Russian Federation, the amount of compensation upon dismissal is not subject to personal income tax if it does not exceed three times the average monthly salary. For regions of the Far North and territories equivalent to them, this parameter is increased to six times.

All compensation payments exceeding the amounts established by law are subject to personal income tax (NDFL). Accordingly, they need to be reflected in the 2-NDFL report.

According to the Tax Code of the Russian Federation (clause 9 of Article 255), a collective or employment contract must contain a clause on preferential taxation of severance pay.

Federal Tax Service Letter No. BS-4-11/9933 dated May 25, 2017 states that severance pay that does not exceed three times the average monthly salary (six times for workers in the Far North) is not subject to personal income tax, regardless of the reason for the termination of the employment relationship.

Severance pay is paid in the following cases:

- upon liquidation of an enterprise (Article 178 Part 1 of the Labor Code of the Russian Federation);

- upon termination of employment relations due to the employee’s conscription into the ranks of the Armed Forces of the Russian Federation (Article 178, Part 3, Paragraph 3 of the Labor Code of the Russian Federation);

- when staffing is reduced (Article 178 Part 1 of the Labor Code of the Russian Federation);

- if the termination of the employment relationship occurs due to violations of the rules for concluding an employment contract through no fault of the employee (Article 84 Part 1.3 of the Labor Code of the Russian Federation);

- dismissal by agreement of the parties.

If you rely on the rules specified in the law, upon dismissal by agreement or at your own request, the employer may not pay severance pay. But there are certain nuances here too. If the clause on the payment of severance pay upon dismissal at one’s own request or by agreement of the parties is specified in the employment contract, then the employer must pay it.

Last payment

Severance pay is financial assistance provided for by the Labor Code of the Russian Federation, which is paid to those who are fired not for “bad” articles of the normative act (committing an immoral offense, absenteeism, drunkenness in the workplace). All categories of dismissed persons designated in a special Law have the right to receive severance pay, regardless of position, length of service, job function performed, gender and social status. This assistance is also paid to working pensioners, who have equal rights to able-bodied employees.

In addition, depriving pensioners of “compensation” is regarded as discrimination against employees based on age, which, in turn, threatens sanctions from the employer’s administration.

The purpose of paying severance pay is to provide financial support to dismissed employees during the job search period. Also, such assistance can be called material compensation for the loss of a job due to the “indirect fault” of the employer (for example, when staffing is reduced, when it is impossible to move to another locality due to the company changing its location) or incentive assistance to those who are obliged to repay the state a debt by resigning due to reason for the need to undergo urgent military or alternative service.

Who is entitled to severance pay?

Chapter 27 of the Labor Code of the Russian Federation establishes an exhaustive list of categories of dismissed persons who are entitled to payment of severance pay.

These are persons who are forced to terminate their employment relationship with their employer due to:

- The refusal is transferred to another area along with the enterprise when it changes its location;

- Refusal to perform a labor function due to a change in significant working conditions or provisions of the employment contract;

- Inconsistencies between the qualifications and skills of the employee and the position held;

- Inability to perform a job function due to a sharp deterioration in health;

- Reinstatement of the employee in whose place the dismissed person is working;

- Gross violation by the employer of the norms of the current labor legislation (systematic or one-time), the provisions of a collective or labor agreement

- Conscription for compulsory military or alternative service. With these dismissal formulations, the employee receives assistance in the amount of two weeks' average earnings.

- Liquidation, reorganization, bankruptcy of an enterprise. reduction of an employee's position.

In this case, the dismissed person has the right to severance pay equal to average monthly earnings.

A collective and/or employment agreement may contain clauses that provide for an increased amount of severance pay or its payment for a longer period than established by law. When drawing up contractual documentation, it is necessary to take into account the rule in which the position of the parties to the agreement can only be improved in comparison with existing legal norms.

For example, according to the law, upon dismissal due to staff reduction, severance pay is paid in the form of one-time assistance for the month following the date of dismissal. In special cases, the second month (very rarely - the 3rd) after dismissal is paid, provided that the former employee cannot find a job for reasons beyond his control and has registered with the local employment service within 2 weeks from the date of dismissal. The provisions of the collective agreement may extend the term of payments or increase their amount. Reducing the quantity and/or quality of goods provided for by regulations is considered illegal.

Income codes that are always subject to personal income tax

Income code 2000 is wages, including additional payments and allowances (for harmful and dangerous work, for night work or combined work).

Income code 2002 is a bonus for production and similar results that are provided for in employment contracts, collective agreements or legal norms.

Income code 2003 – remunerations paid from the organization’s profits, special-purpose funds or targeted revenues.

Income code 2010 – income from civil contracts, excluding copyright contracts.

Income code 2012 – vacation pay.

Income code 2013 - to compensate for unused vacation.

Income code 2014 - severance pay, compensation payments in the form of average monthly earnings for the period of employment after dismissal, compensation to managers, deputy managers, chief accountants in excess of earnings for 3 or 6 months (regions of the Far North and equivalent areas).

Income code 2300 – sick leave benefit. It is subject to personal income tax, so the amount is included in the certificate. At the same time, maternity and child benefits are not subject to income tax, and they do not need to be indicated in the certificate.

Income code 2301 – fines and penalties paid by the company by court decision for failure to voluntarily satisfy consumer demands.

Income code 2610 - denotes the employee’s material benefit received from savings on interest on loans.

Income code 2001 is remuneration of directors and other similar payments received by members of the organization's management body (board of directors, etc.).

Income code 1400 – an individual’s income from leasing or other use of property (if it is not transport, communications or computer networks).

Income code 2400 – income of an individual from leasing vehicles for transportation, pipelines, power lines and other means of communication, including computer networks.

Income code 2520 – income in kind received in the form of full or partial payment for goods, work, services performed in the interests of the taxpayer.

Code 2530 – remuneration in kind.

Income code 2611 - bad debts written off from the balance sheet..

Income code 1010 – transfer of dividends.

Income code 3020 – interest on bank deposits.

Income code 3023 – income in the form of interest (coupon) received by taxpayers from ruble bonds of domestic organizations issued after January 1, 2017.

Income code 4800 is a “universal” code for other employee income that is not assigned special codes. For example, daily allowances in excess of the tax-free limit, additional sick pay, stipends.

See the full list of income and deduction codes for the 2-NDFL reference.

Vacation compensation code 2021

Income code - vacation pay has an individual 4-digit number - is required for affixing in the 2-NDFL certificate. Let's consider what it can be. Why should vacation time be taken into account separately from basic earnings? The current personal income tax code in 2021 for vacation pay and for its compensation. What accrual period for the vacation pay income code should be in the 2-NDFL certificate? Results Why should vacation be taken into account separately from basic earnings? Vacation payments to an employee are one of the forms of social guarantees provided for in Art. 114 Labor Code of the Russian Federation. But they cannot be considered as wages, since during vacation the employee de facto does not work.

- three times the average monthly salary - for ordinary employers;

- sixfold - in the Far North and equivalent areas

2301 fines and penalties paid by an organization on the basis of a court decision for failure to voluntarily meet consumer requirements in accordance with the Law of the Russian Federation dated 02/07/92 No. 2300-1 2611 bad debt written off in the prescribed manner from the balance sheet of the organization 3021 income in the form of interest (coupon ), received by the taxpayer on the circulating bonds of Russian organizations, denominated in rubles and issued after January 1, 2021 Deductions 619 positive financial result on transactions accounted for in an individual investment account Where the income code is indicated for compensation upon dismissal in 2021 Income codes are needed when filling out a certificate 2-NDFL.

Why do you need a 2-NDFL certificate?

Upon termination of an employment contract, the company is obliged to provide the dismissed employee with official information about accrued income and the tax withheld from it. The data is provided in form 2-NDFL and covers the current calendar year (the form was approved by order of the Federal Tax Service of Russia dated October 30, 2015).

Such a certificate is issued for various purposes, for example:

- to provide a new job at the place of work and calculate personal income tax on an accrual basis;

- receiving tax deductions;

- confirmation of earnings when applying for a bank loan;

- adoption;

- as documentary support in a labor dispute or in litigation.

An employee has the right to request 2-NDFL in several copies.

Certificate 2-NDFL about income

Personal income tax (NDFL) is a deduction that is made from all income of a citizen. It is calculated as a percentage of the funds received; the amount of taxation directly depends on the presence or absence of citizenship of a person. Tax rates also change depending on where the funds originate.

The employer is responsible and accountable only for those deductions that he makes personally from the salaries of his employees. The citizen himself must report for other income and this should be done at least once a year. Individual entrepreneurs who have employees, as well as legal entities, are required to calculate personal income tax on a monthly basis and transfer it to the budget in the prescribed manner. Reporting under 2-NDFL allows tax authorities to monitor the accuracy and completeness of deductions, as well as maintain general records of the income and expenses of employees.

Tax deductions, regardless of the frequency of their payment, always have a general annual accounting, therefore, when moving from one employer to another, it is extremely important to provide information about previously deducted amounts at the new place of work. This procedure allows you to calculate your total annual income and correctly calculate taxes and fees.

Main purpose

Certificate 2-NDFL allows you to provide complete information about how much income was received by an individual at this enterprise, as well as how much money was withheld from him. Employers pay taxes for each person working for them, but an individual can only obtain information about themselves, because this data is confidential. Certificate 2-NDFL allows you to make such an individual selection from the general tax report.

Information about wages received and interest deducted from it can only be obtained from your employer. This document is often requested by employees throughout their employment. It is impossible to do without it when obtaining a loan, applying for subsidies and benefits. This form allows you to prove not only the declared income, but also the fact that the person works and regularly receives certain amounts.

Upon dismissal, a certificate in form 2-NDFL makes it possible to correctly calculate the total amount of income for the current calendar period, and, accordingly, calculate tax deductions. Typically, the form contains information about amounts for the year, but may contain fewer months.

The certificate is filled out using a special template, which must contain:

Name of the legal entity and indication of its banking, tax and payment details

Particular attention is paid to the individual code, which determines under what number the company is registered in the tax register. Passport details of the employee to whom it is issued, including not only his full name and passport number, but also the registration address of the individual. The tax rate applicable to a given employee. Income amounts monthly and total. The total amount of calculations. If during the period under review the hired person had other deductions, then they are also indicated

If during the period under review the hired person had other deductions, then they are also indicated.

Income and deduction codes

When filling out tax forms, a coded system for entering information is used.

This allows you to save space for entered information and systematize data processing. Each type of income and deduction has its own unique code. The full table of accepted codes is quite extensive and allows you to specify any amount, as well as explain why it was charged or withheld.

The most common income codes are:

- Salary – 2530.

- Vacation compensation – 2012.

- Disability benefit – 2300.

- Remuneration for labor – 2000.

- Encouragement awards - 2002.

- One-time financial assistance from the manager - 2762.

Each tax deduction has its own code, which upon dismissal must be entered opposite the amounts calculated from wages.

Rules for document execution

The type of declaration was approved on October 30, 2015. The mandatory requirements when filling out 2nd personal income tax include completing the following fields:

Information about the employer, details. Reductions are allowed only in accordance with the statutory acts

- information about the recipient of the profit - individual. face;

- profit subject to taxation;

- deductions that were applied in the reporting period;

- the amount of profit and personal income tax.

In the information field about the agent, you must indicate complete information about the legal entity.

In the information column about physical the person is told the following:

- Last name, first name, patronymic;

- citizenship and status as a taxpayer;

- place of registration and place of residence;

- passport details.

Profit on which personal income tax is withheld is reflected by month. At the same time, indicate the code of income and tax deductions indicating the amounts. If physical the person had the right to other deductions - social or property, this information is reflected in certificate 2 and indicates that such a right was presented.

The form must be certified by the manager or other authorized person and stamped. The certificate is considered invalid without a stamp.

In relation to the calculation of 2nd personal income tax, the registration procedure applies: corrections are not allowed, if errors are detected, a new form is issued as soon as possible.

For misrepresentation of information or delay in time, administrative sanctions are applied to the tax agent.

Compensation for unused vacation in 2021

All other benefits, including those determined by the collective agreement, are not subject to taxes. What income code should be indicated for vacation pay in the 2-personal income tax certificate? After all, all this can be determined by a collective and labor document, on the basis of which the employer acts. Terms Paid on the day of dismissal in the form of an average monthly salary.

For the second month before the employment period, a similar amount is offered as remuneration. If there is a court ruling or an order from the Labor Exchange, then a similar payment is paid to the previous paragraphs, and for the third month. Payments Citizens who have the following situation receive a two-week benefit:

in connection with the transfer of an employee to another workplace.

Basic principles of design

The procedure for filling out the 2-NDFL certificate was approved by order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Procedure). And by order of the Federal Tax Service of the Russian Federation dated January 17, 2018 No. ММВ-7-11/ [email protected] some changes were made to it.

This article discusses a new form of certificate.

Only data on income that is subject to taxation is provided.

Not taken into account:

- severance pay in the amount of 3 (6 for the Far North) average monthly earnings;

- maternity and child care benefits;

- compensation for damage caused;

- other non-taxable amounts.

Any company also annually, before April 1, submits to its Federal Tax Service information in form 2-NDFL for the past year on the income of its full-time and freelance employees, including dismissed ones (clause 2 of Article 230 of the Tax Code of the Russian Federation).

NOTE:

A certificate for an employee dismissed last year is submitted with the same number under which it was issued on the day of his dismissal. The same rule applies to the date of the certificate.

If it turns out that an individual is a debtor to the budget for income tax, the certificate must be submitted no later than March 1. At the same time, you need to inform the former employee about the identified debt and send him a copy of the certificate (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Payments not specified in the Labor Code of the Russian Federation

The Labor Code of the Russian Federation does not establish such grounds for canceling an employment agreement with an organization as termination of the agreement on the initiative of mutual consent and the employee’s retirement.

There are other cases not specified in the Labor Code. When such situations arise, it is difficult for the employer to classify payments as compensation due to the procedure for taxing these amounts with income tax on preferential terms.

The legislation does not establish grounds for expanding the list of benefits. Article 217 of the Labor Code of the Russian Federation stipulates that partial payment of personal income tax is possible only in the case of payments fixed at the level of federal and local legislation.

A number of charges do not apply to them:

- Severance pay.

- Average monthly salary received while working.

- Compensation payments to dismissed managers, their deputies and chief accountants of the company (at the initiative of the owner of the company’s property or by decision of the competent government agency), if their amount exceeds the SMZ three times (in the Far North - 6 times). This is enshrined in Article 181 of the Labor Code of the Russian Federation.

It turns out that the employer has the right to independently determine the list of grounds for calculating compensation upon cancellation of an employment agreement (both regular and increased amounts). This is possible even in case of dismissal by agreement of the parties (Article 78 of the Labor Code of the Russian Federation).

Certificates upon dismissal upon written request of the employee

Article 84.1 of the Labor Code approves the procedure for dismissal and lists the list of documents that the employer is obliged to issue to the employee on the last day of work.

This type includes:

- Certificate of income of the employee, taking into account severance pay upon dismissal;

- on insurance amounts to the Russian pension fund;

- about your work experience in the company.

Declaration 2 of personal income tax refers to the type of certificates that are issued upon written request. A legal entity cannot deny this right to a former employee, since the indicators in these certificates relate only to the employee and the work, until dismissal, contains private information relating to a specific person.

When issuing a declaration upon written application, the following are taken into account:

- Information is provided only free of charge;

- the declaration is submitted no later than 3 days from the date of registration of the application;

- Not every organization has a personnel employee who will prepare papers on the experience of physical persons. persons in this company. In this case, if the employee quits, the responsibility for issuing falls on the accountant.

Certificates from the Pension Fund contain personalized accounting information. This information is necessary for accumulating contributions at a new workplace.

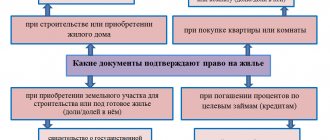

Documents issued upon dismissal

The dismissal procedure is strictly regulated by law. When carrying out this, the main thing is to make a full settlement with the employee and hand over to him all the documents due. In fact, the parties must close mutual claims against each other so as not to subsequently raise documentation to resolve additional issues. Receiving all the required forms in hand allows the dismissed person to save time in the future on additional trips to the former employer to obtain documents that were not previously collected.

When terminating an employment contract with an employee, the employer is obliged to hand over to him:

- A work book with a record of work in this organization.

- Medical record, if available.

- Education documents, provided that their originals were kept by the employer. We are not talking about diplomas, but about certificates of advanced training, certificates of skills acquired in the process of work, and so on.

- A certificate that will allow you to make accruals for sick leave in future work in the event of an employee’s illness.

- When an employee is laid off, he is issued a certificate for the employment center.

At the request of the person being dismissed, he is given:

- Copies of orders for admission and dismissal.

- Certified copies of incentive and transfer forms.

- Certificate of income for the last 12 months in form 2-NDFL.

All papers require proper completion and certification; the employer must adhere to established registration standards.

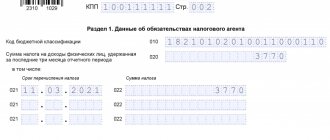

Deadline for submitting 2-NDFL for a dismissed employee

A certificate of income of a dismissed employee is submitted to the tax service along with other certificates issued at the end of the year.

When submitting a certificate to the tax office, the certificate number must remain the same as that which was assigned when issued to the resigning employee.

- 04 next year – for all employee income – status 1;

- 03 next year - for income for which no deduction was made - status 2.

If this period falls on a non-working day, it is shifted to the next working day

For 2021, 2 personal income tax reports are submitted:

- with status 1 – until April 2, 2021

- with status 2 – until March 1, 2021.

Obligation of the employer to issue documents to the employee

Issuing a certificate upon dismissal is not the right, but the obligation of the employer without reminders from the individual. persons about this need. If the certificate is not issued on time, this is done after the employee applies in a short time. This norm is enshrined in Article 62 of the Labor Code.

Upon dismissal of an individual The employer provides a certificate only upon oral request from the employee, who clarifies for what period he needs the calculation. However, if it is provided on time, it is better to support the request with an application for extradition.

The company acts as a tax agent who makes monthly payments to individuals. persons - employees of the organization for the payment of earnings, in addition, accrue, withhold and transfer personal income tax to the treasury.

In practice, situations are not uncommon when, upon dismissal, the 2nd personal income tax report from the last place is not issued on time due to the formation of a debt to the employee, as well as when errors are discovered in the company’s accounting.

After a written application from the employee, the 2nd personal income tax report is issued no later than three days, only if, if this deadline is violated, the individual. the person will contact the labor inspectorate.

The number of report copies is not regulated. If necessary, after dismissal, the employee makes a written request to the head of the company to issue several forms, and he does not have the right to refuse.

Sample of filling out certificate 2-NDFL

Employee Alekseyev Aleksey Alekseevich resigned from company A in April 2021. He asked the accountant to give him a 2-NDFL certificate for the current year before his dismissal.

During the year, A. A. Alekseev received the following income:

- January: salary - 42,000 rubles.

- February: sick leave - 21,000 rubles, salary - 20,000 rubles.

- March: salary - 42,000 rubles.

- April: salary - 23,000 rubles, compensation for vacation - 18,000 rubles, severance pay in excess of the non-taxable part in the amount of 14,000 rubles.

All listed income is taxed at the same tax rate - 13%.

Every month Alekseev A.A. was provided with a standard deduction for the first child (clause 1 of Article 218 of the Tax Code of the Russian Federation). During 2021, the deduction amount was RUB 5,600. (1,400 × 4).

Personal income tax on all income is withheld in a timely manner and transferred to the budget in full in the amount of 22,672 rubles: (42,000 + 21,000 + 20,000 + 42,000 + 23,000 + 18,000 + 14,000 – 5,600) × 13%.

The 2-NDFL certificate can be divided into the following parts: title, space for signature/stamp and 5 sections. Below are explanations for filling them out.

Revenue code

To maintain accounting, you need to understand and correctly draw up reporting documentation, fill out the appropriate declarations, and deal with the posting of company funds. It should be understood that the severance pay income code in the 2-NDFL certificate for redundancy is 2014.

Expert opinion

Irina Vasilyeva

Civil law expert

Only reliable data must be provided to the tax office. For errors and inaccuracies, a fine of 500 rubles may be imposed for each submitted paper.

Dear readers! To solve your problem right now,

get a free consultation

— contact the duty lawyer in the online chat on the right or call:

You won't need to spend yours

time and nerves

— an experienced lawyer will take care of solving all your problems!

What expense type code and KOSGU should be used to make payments upon layoff?

Keeping records of expenses during organization should be in accordance with the orders of the Ministry of Finance of the Russian Federation - No. 65н.

Accounting documents include expenses for severance payments in case of layoffs:

- expense type element - 111;

- in KOSGU the code will be 211 - “Salary”;

- reflection of expenses for the period of employment of a former employee - 321;

- in accounting and reporting, expenses may be indicated under subarticle KOSGU No. 262 “Social assistance benefits to the population.”

Insurance contributions are also not paid from severance pay. It is important that upon dismissal the documents are completed properly. The number of employees should be reduced in accordance with the legislation of the Russian Federation. In this case, it is necessary to prepare a calculation and make all due compensation payments.

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7

, St. Petersburg

+7

, Regions

8800-350-97-52

Vacation compensation upon dismissal in 1s 8.3 accounting

Next, in the “Reflection in accounting” part of the window, indicate:

- Method: the one that suits you for attributing costs.

- If you are a UTII payer, also select the option you need.

Click the “record” button. This is what should happen: Get 267 video lessons on 1C for free: Accrual and calculation of vacation in 1C 8.3 upon dismissal Now let’s move on to the document for calculating vacation pay in 1C Accounting. As I said earlier, you must calculate the amount of compensation manually.

Let's create a new document. Since the employee is resigning, the final payment can also be made in this document. But I still advise you to make separate documents, there will be less confusion.