In 2021, accountants are offered at least three ways to submit reports to regulatory authorities in order to report with maximum comfort.

In 2021, reporting will be accepted by the Federal Tax Service, Rosstat, as well as extra-budgetary funds. Organizations and individual entrepreneurs are required to submit the following types of reporting:

- the Federal Tax Service will need to submit tax returns, calculations of insurance premiums, as well as a copy of the financial statements for 2017;

- reports are submitted to the Pension Fund of the Russian Federation on forms SZV-M (monthly) and SZV-STAZH for 2017, as well as upon employee retirement;

- calculations of contributions for injuries are submitted to the Social Insurance Fund;

- They submit statistical reports to Rosstat, as well as one copy of the financial statements for 2021.

The legislation allows organizations and individual entrepreneurs to use one of the following reporting methods:

- in electronic form (for example, using the 1C-Reporting service from 1C programs);

- by registered mail via Russian Post;

- personally at a personal reception at the Federal Tax Service inspection, branches of Rosstat, Pension Fund and Social Insurance Fund.

When choosing one or another reporting method, be sure to take into account legal restrictions on submitting documents on paper.

So, if the number of employees of a company exceeds 25 people, it will not be possible to report on paper and it is necessary to submit reports in electronic form. This applies to submitting 2-NDFL

and 6-NDFL (clause 2 of article 230 of the Tax Code of the Russian Federation).

SZV-M and SZV-STAZH must be submitted to the Pension Fund in electronic form if the number of employees is 25 or more people (Clause 2, Article 8 of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting in the mandatory system pension insurance").

In the case of tax returns, it is necessary to pay attention to the average number of employees of the organization for the previous calendar year. If this number exceeds 100 people, declarations need to be submitted only in electronic form (clause 3 of Article 80 of the Tax Code of the Russian Federation). The VAT return is submitted exclusively through the electronic reporting system, regardless of the number of employees of the company (clause 5 of Article 174 of the Tax Code of the Russian Federation).

At the same time, the law provides for fines for non-compliance with the electronic reporting form. For example, failure to comply with the procedure for submitting a tax return in electronic form entails a fine of 200 rubles (Article 119.1 of the Tax Code of the Russian Federation). For failure to comply with the electronic form for submitting reports to the Pension Fund of Russia, a fine of 1000 rubles is provided (Article 17 of the Federal Law of 01.04.1996 No. 27-FZ).

Inventory of attachment

The postal item in which the organization sends financial statements must contain a list of the contents (clause 204 of the Administrative Regulations, approved by Order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n). The procedure for filling out the attachment list depends on the method of sending the letter - registered or valuable. In any case, in order to send a letter with an inventory, you need to bring an open envelope to the post office so that the postal employee can check its contents (subparagraph “a”, paragraph 20 of the Rules, approved by order of the Ministry of Telecom and Mass Communications of Russia dated July 31, 2014 No. 234 ).

If the reporting is sent by a valuable letter, then the inventory of the attachment is filled out according to the form established by the post office (it can be obtained at the post office). List in the inventory for the valuable letter the reporting forms included in it. The investment inventory must be signed on behalf of the organization by a manager or representative who has a power of attorney to submit reports to the tax inspectorate or a branch of Rosstat (Article 185 of the Civil Code of the Russian Federation). For information on the procedure for registering such powers of attorney, see How to submit financial statements in person.

Attention: if you send reports by mail without a list of attachments, the tax office may fine the organization.

The presence of an inventory of the attachment is a mandatory requirement when sending reports by mail (clause 204 of the Administrative Regulations, approved by Order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n). If there is no such document, the reporting is considered unsubmitted. This may serve as a basis for bringing the organization and its employees to tax and administrative liability. The amount of the fine will be:

- 200 rub. for each unsubmitted document - for the organization (clause 1 of Article 126 of the Tax Code of the Russian Federation);

- from 300 to 500 rub. – for officials, for example a manager or chief accountant (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Situation: how to fill out an inventory of the attachment when sending financial statements by registered mail?

There is no standard template for listing mail attachments. Therefore, it can be compiled in any form. It must be filled out in duplicate and signed by the manager and chief accountant. When sending by registered mail, it is necessary for the post office employee to put a stamp on the inventory with the date of receipt of the letter. Typically, postal employees refuse to put a stamp on such a list of attachments, citing the fact that they cannot be responsible for the contents of the envelope. In this case, the organization will not be able to confirm which documents were sent to the tax office (Rosstat branch) with anything other than the signatures of the manager and chief accountant.

This problem can be solved if you send the reports by valuable letter.

SZV-M for April

The SZV-M report is submitted monthly. Employers-insurers need to submit a report for April to the pension fund department by May 15. Submit a report for each employee, including employees on a GPC contract and the director/founder. There were no changes to the Report Form; it was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p.

Important! If you terminated a contract with an employee in April, this must also be included in the report. Employees without salary also need to be reflected in SZV-M. No taxable payments are made in their favor, so such workers are often forgotten. For forgotten employees, the company issues a supplementary SZV-M, and for redundant employees, a canceling one. For late submission of additional reports, a fine of 500 rubles may be imposed for each employee.

If your organization does not have insured persons, then you do not need to submit a report. There are no zero SZV-M reports. You can submit SZV-M in paper form when the number of insured persons of the organization is less than 25. If there are 25 or more, submit only the electronic form.

Property tax calculation

Reporting in May involves submitting payments for advances for the 1st quarter. This year there have been significant changes in terms of payments. On January 1, a new form was introduced, approved by order of the Federal Tax Service dated March 31, 2017 No. ММВ-7-21/ [email protected] The Tax Service revised the procedure for filling out the calculation of advance payments and introduced new tax benefit codes, so the calculation of payments for January-March must be submitted in a new way form.

From January 1, the exemption for movable property received after 2013 inclusive was cancelled. The right to establish this benefit was transferred to the constituent entities of the Russian Federation, but not all regions took advantage of it. We recommend studying regional legal acts before submitting the calculation to the tax office.

Submit a report on advance payments, even if your property has zero value. If it is still listed on the balance sheet, then a zero report form is filled out.

Simplified individual entrepreneur reporting

Individual entrepreneurs using the simplified tax system submit a tax return by May 3. In the declaration, indicate the amount of income for each quarter on an accrual basis, advance payments and insurance premiums. The declaration form is fixed by the order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/ [email protected]

The selected taxation object determines the procedure for filling out the declaration. If this is income, enter the data in sections 1.1, 2.1.1, 2.1.2 (trading fee) and 3, if targeted funding is available. If the difference between income and expenses is taxed, then only sections 1.2, 2.2 and 3 are completed.

An individual entrepreneur who did not receive income in 2021 and does not have data to fill out a declaration submits a document with zero indicators. Both recently registered entrepreneurs and those whose activities are seasonal must submit a zero declaration.

The declaration and attachments can be sent by mail, online, or submitted to the tax office yourself.

Reporting in May 2021

The first quarter of 2021 is over.

Accountants need to prepare reports for the period from January to March. There is quite a lot of it, let’s look at what deadlines and what reports need to be submitted. This year, holidays shifted the deadline for submitting reports for the 1st quarter from April 30 to May 3. Individual entrepreneurs submit a declaration under the simplified tax system for 2017. Accountants need to submit 6-NDFL, RSV and property tax calculations. The income tax return for April and many other documents are submitted. Let's look at everything in more detail.

Postal rules, or What an accountant needs to know about submitting reports by mail

Submitting reports by mail is perhaps one of the most convenient and accessible methods of reporting provided by law. Unlike submitting reports in person, in this case you do not need to waste time going to the tax office, standing in line, and unlike submitting reports via telecommunication channels, you do not need to choose a telecommunications operator, enter into an agreement with him, install the appropriate software, and the costs required to submit reports by mail are significantly less than the costs of submitting reports via telecommunication channels. It would seem that there are continuous advantages. However, in order to send reports by mail, you need to know about the disadvantages of this method, the problems that may be encountered in this case, the claims of the tax authorities, what clarifications the Ministry of Finance gives on this issue and how arbitration practice develops. In addition, the costs of submitting reports by mail should be correctly attributed to expenses, taking into account the “simplified” specifics. This will be discussed in this article.

Reporting methods

According to Art. 80 of the Tax Code of the Russian Federation, a tax return (calculation) can be submitted by the taxpayer (payer of the fee, tax agent) to the tax authority personally or through a representative, sent in the form of a postal item with a description of the attachment, or transmitted via telecommunication channels.

In paragraph 3 of Art. 80 of the Tax Code of the Russian Federation contains exceptions to the general rule. Thus, according to this paragraph, taxpayers whose average number of employees for the previous calendar year exceeds 100 people, as well as newly created (including during reorganization) organizations whose number of employees exceeds the specified limit, submit tax returns (calculations) to the tax authority according to established formats in electronic form, unless a different procedure for presenting information classified as state secret is provided for by the legislation of the Russian Federation.

However, this exception does not apply to “simplified people”. In paragraph 3 of Art. 346.12 of the Tax Code of the Russian Federation lists restrictions on the use by taxpayers of the simplified taxation system. In this list, clause 15 sets a limit on the number of employees. Thus, if during the reporting (tax) period the average number of employees of a simplified organization exceeds 100 people, the simplified organization loses the right to apply this special tax regime.

Thus, “simplified” organizations can choose any of the methods of reporting provided by law.

So, reporting can be sent in the form of a postal item with a list of attachments. Since nothing more is said in the Tax Code of the Russian Federation, taxpayers and tax authorities often interpret some issues of submitting reports by mail differently. Let's look at the most common of them, and also analyze the legislation on these issues and the position of judges.

Does the post office have to be state-owned?

The legal, organizational, economic, financial foundations of activities in the field of postal services in the Russian Federation are regulated by the provisions of the Federal Law of July 17, 1999 No. 176-FZ “On Postal Services” (hereinafter referred to as Law No. 176-FZ ). So, in Art. 3 of this law states that postal services in the Russian Federation are carried out by state unitary enterprises and state postal institutions, as well as other postal operators and are intended to provide postal services to citizens, government bodies of the Russian Federation, government bodies of constituent entities of the Russian Federation, local governments and legal entities.

Article 17 of Law No. 176-FZ establishes that postal operators carry out activities to provide relevant services on the basis of licenses. The need for an organization providing communication services to have a license is also stated in Art. 29 of the same law: the activities of legal entities and individual entrepreneurs in the paid provision of communication services are carried out only on the basis of licenses to carry out activities in the field of provision of communication services. The list of names of communication services included in licenses and the corresponding lists of license conditions are established by the Government of the Russian Federation and are updated annually.

Thus, when sending tax reports by post, the taxpayer has the right to use the services of any licensed postal organization, regardless of its legal form and form of ownership. In addition, in Art. 18 of Law No. 176-FZ states that postal organizations of different organizational and legal forms enjoy equal rights in the provision of public postal services. Judges also take this position, taking the side of the taxpayer (see, for example, Resolution of the FAS TsO dated November 4, 2003 No. A54-105 3/03-C3 ).

Please note : If you are planning to use the services of a postal operator other than a government postal institution, then it is advisable to obtain a copy of the license of this operator.

If the recipient's address is incomplete

It happens that an organization does not know the index of the tax authority to which reporting should be sent, or has indicated it incorrectly. In such cases, tax inspectorates give the following arguments: the taxpayer, by incorrectly indicating the postal address, namely by making an error in indicating the postal code, thereby does not ensure that the tax office receives the tax return.

The relationship between users of postal services and public postal operators when concluding and executing an agreement for the provision of postal services, as well as the rights and obligations of these operators and users, are regulated by the Rules for the provision of postal services , approved by Decree of the Government of the Russian Federation of April 15, 2005 No. 221 (hereinafter referred to as – Rules for the provision of postal services ).

According to these rules, the postal code is a detail of the corresponding post office; an error in its indication or complete absence, if there is a rest of the correct postal address to which the postal correspondence was sent, makes it possible to identify the final direction of the postal item, therefore, in this case, the taxpayer’s obligation to submit the declaration is considered timely fulfilled.

Such reasoning is contained in the Resolution of February 20, 2008 No. A19-1440 6/07-30-F02-30 7/08 , in which the judges of the FAS VSO made a decision in favor of the taxpayer. A similar opinion was expressed by the arbitrators of this district in the Resolution dated January 31, 2008 No. A19-1440 8/07-52-F02-5/08 .

Deadline for submitting reports by mail

Determining the deadline for submitting reports is perhaps one of the most pressing issues, because if it is violated, the organization can be held accountable under Art. 119 Tax Code of the Russian Federation . What is the reporting date when sending it by mail? What documents can be used to prove timely filing of reports?

Report submission date. According to the provisions of paragraph 4 of Art. 80 of the Tax Code of the Russian Federation , when sending a tax return (calculation) by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. Based on Art. 6.1 of the Tax Code of the Russian Federation , an action for which a deadline has been established can be performed before 24 hours of the last day of the deadline. If documents or funds were submitted to the communications organization before 24 hours of the last day of the deadline, then the deadline is not considered missed.

Often, taxpayers and tax authorities argue about what can be considered the date of sending the statements by mail: the date when the taxpayer went to the post office and handed over the letter with the statements, or the date that appears on the stamp on the envelope. This is especially true when reporting takes place in the last hours (and often minutes) of the last day of the reporting deadline, because in this case the taxpayer sends the letter on one day, and the post office processes it the next day.

To illustrate the position of the tax authorities on this issue, one can cite the Letter of the Ministry of Taxes and Taxes of the Russian Federation dated May 13, 2004 No. 03-1-0 8/119 1/ [email protected] , which states that the date of sending a postal item with a list of attachments for the purpose of applying p. .2 tbsp. 80 of the Tax Code of the Russian Federation should be considered the date indicated in the Russian Post stamp. The tax authorities provide the following arguments in support of their position. Clause 25 of the Rules for the provision of postal services establishes that to confirm payment for postal services for sending simple and registered written correspondence provided by federal postal organizations, state postal payment marks are used. The following are used as state postal payment marks:

– postage stamps affixed to written correspondence or printed on postal envelopes and postcards;

–imprints of state postal payment marks applied by franking machines;

– other signs established by the Federal Communications Agency and applied in printing.

Stamps are canceled with a calendar stamp. When canceling postage stamps, the correct payment for postage is checked.

Thus, from the above provisions of the legislation it follows that the forwarding of written correspondence, simple and registered notices is paid for with state postage marks, which, when sent (forwarded), are canceled with a calendar stamp.

However, according to clause 32 of the Rules for the provision of postal services, upon acceptance of a registered postal item or postal order, the sender is issued a receipt. It indicates the type and category of postal item (postal order), the name of the addressee (name of the legal entity), the name of the postal facility of destination, the number of the postal item (postal order). And it is this document that judges accept to confirm that taxpayers have fulfilled their obligations.

In the Resolution of the FAS UO dated 02.06.2005 No. F09-237 1/05-S1 it is noted: at the same time, the postal notification and postal receipt submitted to the case materials for the receipt of a registered letter with dates on postmarks... confirms that the specified declaration was sent by the company to the inspection by registered mail and delivered to the post office... in a timely manner.

The judges of the Federal Antimonopoly Service of the Moscow Region, in Resolution No. KA-A4 0/9406-07 , indicated: the fact that the Company submitted a tax return to the post office... is documented - a postal receipt confirming the receipt of a registered letter. The presence of a calendar stamp on the postal envelope in the situation under consideration does not have legal significance, since the Company’s actions to fulfill its obligation to submit a tax return were completed in a timely manner, within the period established by the Tax Code of the Russian Federation.

If the delay in sending was due to the fault of the telecom operator. It often happens, especially on the last day of reporting, that the telecom operator accepted the postal item from the taxpayer on the last day of the deadline, but processed it only the next day or a few days later due to mail overload. Often in such cases, the tax authorities make claims against the organization, based on the fact that the day of delivery is the day the postmark was affixed to the envelope. Fortunately, the judges are on the side of taxpayers in this matter.

As noted earlier, in accordance with the provisions of Law No. 176-FZ and the Rules for the provision of postal services for a taxpayer, the date of sending a letter is considered the day of delivery of this postal item to the postal operator. According to clause 57 of the Rules for the provision of postal services, for failure to fulfill or improper fulfillment of obligations to provide postal services, postal operators are liable to users of these services, including liability for non-delivery or violation of deadlines for sending postal items.

Thus, users of postal services are not responsible for the failure of the postal operator to fulfill its obligations in a timely manner. Using similar arguments, the judges of the FAS ZSO in decisions dated July 5, 2006 No. F04-415 0/2006 (24268-A81-37) , dated August 10, 2005 No. F04-502 8/2005 (13671-A27-33) , FAS VBO in the Resolution dated 06/15/2005 No. A28-2556 6/2004-100 9/18 , FAS NWO in Resolution dated 07/05/2005 No. A05-255 8/05-12 , dated 03/19/2008 No. A52-121 9/2007 ruled in favor taxpayer.

In this case, the following may be submitted as documents confirming the absence of the taxpayer’s guilt:

– a receipt for the acceptance of registered letters and a certificate from the department... of the post office of the branch of the Federal State Unitary Enterprise "Russian Post" ( Resolution of the Federal Antimonopoly Service of the Russian Federation dated August 28, 2006 No. A19-581 0/06-33-F02-444 8/06-C1 );

– an imprint of the calendar stamp affixed to the postal register ( Resolution of the Federal Antimonopoly Service of the North-West District of August 10, 2005 No. F04-502 8/2005 (13671-A27-33) );

– certificate from the head of the communications department... post office, list of registered letters... ORPTS ( Resolution of the Federal Antimonopoly Service of the Eastern Military District dated June 15, 2005 No. A28-2556 6/2004-100 9/18 ).

Inventory of attachment

Perhaps the greatest number of disputes when submitting reports by mail is caused by the inventory of attachments mentioned by the legislator in Art. 80 Tax Code of the Russian Federation . What is an investment inventory? What should she look like? Does it need to be certified by an organization or a postal worker?

Types of postal items. According to clause 12 of the Rules for the provision of postal services, depending on the method of processing, postal items are divided into the following categories:

-simple. Accepted from the sender without issuing a receipt to him and delivered (handed over) to the addressee (his legal representative) without his receipt;

–registered (registered, declared value, ordinary). They are accepted from the sender with the issuance of a receipt and handed over to the addressee (his legal representative) with his receipt.

Registered mail items can be sent with a description of the attachment, with a notification of delivery and with cash on delivery. The list of types and categories of postal items sent with an inventory of the contents, with a notification of delivery and with cash on delivery, is determined by postal operators.

Postal item with acknowledgment of delivery - a postal item (postal order), upon submission of which the sender instructs the postal operator to inform him or the person specified by him when and to whom the postal item was delivered (postal order was paid).

Postal item with declared value - postal item accepted with an assessment of the value of the attachment determined by the sender. In practice, the amount of value indicated by the organization when sending reports is several rubles for each declaration. When deciding on the amount of value of the letter being sent, it should be taken into account that the amount of responsibility of the telecom operator, which is provided for in clause 57 of the Rules for the provision of postal services . Losses caused during the provision of postal services are compensated by the postal operator in the following amounts:

– in case of loss or deterioration (damage) of a postal item with a declared value - in the amount of the declared value and the amount of the postage fee, with the exception of the fee for the declared value;

– in case of loss or deterioration (damage) of part of the attachment of a postal item with a declared value when sending it with an inventory of the attachment - in the amount of the declared value of the missing or damaged (damaged) part of the attachment, indicated by the sender in the inventory;

– in case of loss or deterioration (damage) of part of the attachment of a postal item with a declared value when sent without an inventory of the attachment - in the amount of part of the declared value of the postal item, determined in proportion to the ratio of the weight of the missing or damaged (damaged) part of the attachment to the weight of the sent attachment (without weight postal envelopes);

– in case of loss or damage (damage) of other registered postal items – in the amount of the postage fee, in the case of loss or damage (damage) of part of their contents – in the amount of the postage fee.

According to the Rules for the provision of postal services , approved by Decree of the Government of the Russian Federation of September 26, 2000 No. 725 [1], depending on the type, category and category of domestic mail and postal orders, the sender makes the following marks on their address side (if they are absent):

– on registered letters (post cards) – “Registered”;

- on letters with a declared value - “With a declared value for ... rub.”, on letters with a declared value with an inventory of the contents, in addition - “With an inventory.”

Despite the fact that this document has lost force, in practice postal workers continue to be guided by it when making these marks.

Form for inventory of attachments and register of correspondence. In addition, the previous Rules for the provision of postal services contained a provision that when an organization sends more than 10 registered/valuable letters at a time, it must submit a list of items to the post office. In practice, this provision continues to be applied by postal employees. The form of this list is given below.

| LLC "Equilibrium" | |||

| List of registered mail submitted to post office No. 647 | |||

| No. | Recipient's name | Address of the recipient | Sender's address |

| … | … | … | … |

| 12 | Inspectorate of the Federal Tax Service of the Russian Federation for the Kanavinsky district of Nizhny Novgorod | 603002, Nizhny Novgorod, st. Sovetskaya, 15 | 603101, Nizhny Novgorod, st. 50 years of Victory, 41 |

| … | … | … | … |

Such a list can also be prepared when submitting a smaller number of letters (or even one letter).

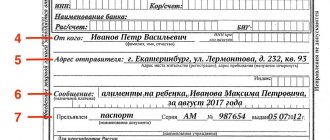

The postal worker will never refuse to stamp this list, and therefore you will not have to worry about the problem of an illegible address on the postal receipt. This list will not replace a receipt, but may help if disputes arise. We will also give an example of filling out an inventory of attachments in a valuable letter, the form of which is offered by postal workers (see page 53).

In addition, since the form of the inventory of the attachment is not established either by the Tax Code of the Russian Federation or by the Rules for the provision of postal services , an organization can draw up an inventory of the attachment in any form.

Claims from tax authorities. The need to have an inventory of the contents can be explained simply: there must be confirmation that the envelope contains reporting and not something else. This opinion was also expressed by the FAS ZSO in Resolution No. F04-807 3/2005 dated December 19, 2005 (16771-A27-15) : the court rightfully did not accept the register of postal items as proper evidence... since it does not contain an inventory of the contents of postal items, due to with which it is impossible to determine what exactly was sent by the taxpayer. Moreover, in our opinion, it is also justified that the inventory of the attachment

taxpayer. Moreover, in our opinion, it is justified that the inventory of the investment

| INVENTORY | INVENTORY | ||||||||||

| investments in | c/p | investments in | c/p | ||||||||

| To whom | Inspectorate of the Federal Tax Service of the Russian Federation for the Kanavinsky district | To whom | Inspectorate of the Federal Tax Service of the Russian Federation for the Kanavinsky district | ||||||||

| Address | 603002, N. Novgorod, st. Sovetskaya, 15 | Address | 603002, N. Novgorod, st. Sovetskaya, 15 | ||||||||

| No. | Name of items | Number of items | Declared value | No. | Name of items | Number of items | Declared value | ||||

| 1 | Tax return for the simplified tax system for the first half of 2006 (on 3 sheets) | 1 PC | 10 rubles | 1 | Tax return for the simplified tax system for the first half of 2006 (on 3 sheets) | 1 PC | 10 rubles - | ||||

| 2 | Calculation of advance payments for insurance premiums for compulsory health insurance for the first half of 2006 (on 5 sheets) | 1 PC | 10 rubles | 2 | Calculation of advance payments for insurance premiums for compulsory health insurance for the first half of 2006 (on 5 sheets) | 1 PC | 10 rubles | ||||

| Total: | 2 pcs | 20 rubles | Total: | 2 pcs | 20 rubles | ||||||

| Sender | Zimina | Sender | Zimina | ||||||||

| signature | signature | ||||||||||

| Checked | Mishkina | Checked | Mishkina | ||||||||

| (position, signature of postal worker) | (position, signature of postal worker) | ||||||||||

| Corrections are not allowed | (imprint of the calendar stamp of the OPS of the place of reception) | Corrections are not allowed | (imprint of the calendar stamp of the OPS of the reception place) | ||||||||

must be drawn up in two copies (one is placed in an envelope, the other remains in the hands of the taxpayer), certified by a postal worker. However, it should be noted that such a requirement is not contained either in the Tax Code of the Russian Federation or in the Rules for the provision of postal services .

In support of our point of view, the following court decisions can be cited: – Resolution of the Federal Antimonopoly Service ZSO dated 08.08.2005 No. F04-752 4/2004 (13691-A27-33) : Tax Code of the Russian Federation, Rules for the provision of postal services... do not contain an explanation of the concept of “inventory of attachments” "and do not provide for affixing a stamp (seal) of the post office on the inventory. However, due to the requirements of Articles 65, 67 and 68 of the Arbitration Procedure Code of the Russian Federation, this does not relieve the taxpayer from the obligation to provide reliable evidence of the contents of the attachment contained in the postal envelope sent to the tax inspectorate. It does not follow from the contents of the receipt and notification of delivery of the postal item that the taxpayer’s registered letter contained the necessary reporting. The organization’s statement that the registered letter sent to the tax office contained an inventory of the attachment, executed and certified by the taxpayer’s seal, cannot be taken into account, since this inventory is not adequate evidence due to the requirements of Article 80 of the Tax Code of the Russian Federation and Article 68 Agroindustrial complex of the Russian Federation;

– Resolution of the Federal Antimonopoly Service dated September 7, 2006 No. A65-2590 7/2005-CA1-32 . In this case, the taxpayer was helped to prove the timely submission of reports by mail by the presence of a receipt and an inventory of the contents in a registered letter, which indicated the declaration being submitted. Moreover, the inventory of the attachment was certified by a postmark with the corresponding date.

However, there are also opposing court decisions. In this case, the judges use the same arguments that neither the Tax Code of the Russian Federation nor the Rules for the provision of postal services contain an explanation of the concept of “inventory of attachments” and do not provide for affixing a stamp (seal) of the post office on the inventory, but come to the opposite conclusions: the absence of an inventory is not a circumstance indicating a failure to submit a tax return ( Resolution of the FAS VSO dated November 30, 2005 No. A33-837 2/05-F02-541 9/05-S1 ).

In practice, the following situation may occur: reporting is sent by mail without an inventory of the contents. The tax authority has received the reports. However, he claims that the organization did not submit reports because there is no inventory of the investment. In the Letter of the Department of Tax Administration for Moscow dated October 12, 2004 No. 11-1 5/65542 you can find the following explanations: a receipt... and a notification of delivery do not confirm the fact that the organization sent a tax return. The organization did not comply with the procedure for sending declarations by post, established by paragraph 2 of Article 80 of the Tax Code of the Russian Federation, namely: there is no inventory of the contents. In such situations, the tax authorities try to hold the organization liable under paragraph 1 of Art. 119 Tax Code of the Russian Federation . However, the courts in this case side with the taxpayer:

– Resolution of the FAS VSO dated November 30, 2005 No. A33-837 2/05-F02-541 9/05-S1 : Article 119 of the Tax Code of the Russian Federation provides for liability for failure to submit a tax return, and it does not follow from its text that when sending a declaration by registered mail by mail, the absence of an inventory of the contents is grounds for holding the taxpayer liable for failure to submit a tax return.

– Resolution of the Federal Antimonopoly Service ZSO dated April 14, 2003 No. F0 4/1733-30 5/ A70-2003 : the absence of an inventory of investments is not grounds for refusal to accept declarations. The tax office had the right to request additional information from the taxpayer.

There are also court decisions in which the following opinion was expressed: the tax authority’s argument about the lack of an inventory of attachments for sent correspondence was rejected, since no evidence was presented to the court that other reporting was presented in the specified mailings (Resolution of the Federal Antimonopoly Service dated November 24, 2005 No. A55- 545 3/2005-44 ).

As can be seen from the above arbitration practice, the courts do not have a unanimous opinion on the issue of the availability of an inventory of contents in a postal item. Therefore, in order to avoid claims from the tax authorities, as well as to protect your rights in court, it is advisable to have on hand a second copy of the list of contents in the mail item, certified by a postal worker.

Accounting for expenses for postal services “simplified”

“Simplified” organizations that have chosen income reduced by the amount of expenses as an object of taxation have the right to take into account, when calculating the single tax paid in connection with the application of the simplified tax system, the expenses specified in Art. 346.16 Tax Code of the Russian Federation . Paragraph 18 of this list lists the organization’s expenses for postal services. Thus, an organization using the simplified tax system can take into account the costs associated with submitting reports by mail.

In addition, it should be remembered that the expenses referred to in Art. 346.16 of the Tax Code of the Russian Federation , must comply with the requirements of Art. 252 of the Tax Code of the Russian Federation , that is, to be economically justified and documented.

of the Rules for the Provision of Postal Services states that upon acceptance of a registered postal item, the sender is issued a receipt. It indicates the type and category of postal item (postal order), the name of the addressee (name of the legal entity), the name of the postal facility of destination, the number of the postal item (postal order).

Order of the Ministry of Finance of the Russian Federation dated December 29, 2000 No. 124n “On approval of strict reporting forms” approved the forms of forms as strict reporting documents that can be used for monetary settlements without the use of cash registers when providing postal services, namely form No. 1 “Receipt for acceptance of postal items” " and form No. 5 "Receipt for accepting various types of fees."

Strict reporting forms approved by the Ministry of Finance are the primary accounting documents used to document business transactions with cash and are equivalent to a cash register receipt.

Consequently, when providing postal services, organizations can use strict reporting forms approved by the Ministry of Finance to account for cash without using cash registers.

In paragraph 3 of Art. 2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards” states that organizations and individual entrepreneurs, due to the specifics of their activities, can make cash payments and (or) settlements using payment cards without the use of cash register systems when selling government postage stamps (postage stamps and other signs applied to postal items) at nominal value, confirming payment for postal services.

Thus, a receipt for receiving postal items will be documentary evidence of the organization’s expenses for postal services.

In conclusion, I would like to note that such a seemingly simple issue as submitting reports by mail is fraught with many nuances and controversial issues. Therefore, first of all, when sending reports by mail, you should receive from the telecom operator through which the reports are sent all documents confirming that they were sent in full and within the time limit established by law, since it is the presence of supporting documents that allows the organization to defend its case. court, and numerous arbitration practices on this issue indicate a significant number of claims from tax authorities and a high probability of meeting them in court.

[1] The document is not currently applicable.

Due date

The reporting submission date is determined by the postmark. Therefore, reporting is considered submitted on time if it is sent before 24 hours of the last day established for its submission. Documents confirming the sending of reports by mail are a postal service receipt confirming the receipt of the letter and a list of attachments certified by the postal service. In order for the post office to issue a receipt, the organization must send the reports by registered or certified mail (clause 31 of the Rules approved by Order of the Ministry of Telecom and Mass Communications of Russia dated July 31, 2014 No. 234).