The concept of cash discipline

The rules for conducting cash transactions in an organization are enshrined in the instructions of the Central Bank of Russia No. 3210-U.

The regulatory document provides for the procedure for handling cash in an institution. For any deviation from the established requirements, liability is provided for violation of the procedure for conducting cash transactions. But this is not the only standard for working with cash. All organizations and individual entrepreneurs that accept cash payment for services and work provided or goods sold from individuals are required to use online cash registers. It is prohibited to work without a new generation cash register (Law No. 54-FZ and Law No. 290-FZ). If a company or merchant carries out a transaction “bypassing the cash register”, then fines cannot be avoided.

The key rules for organizing work with cash transactions are in the article New in cash discipline: how to avoid fines.”

Tax control over the completeness of revenue accounting

Checking the completeness of cash receipts accounting

The procedure for tax authorities to exercise control and supervision over the completeness of accounting for cash proceeds in organizations and individual entrepreneurs is established by the Administrative Regulations “exercise by the Federal Tax Service of the state function of exercising control and supervision over the completeness of accounting for cash proceeds in organizations and individual entrepreneurs (approved by the Order Ministry of Finance of the Russian Federation dated October 17, 2011 No. 133n).

The objects inspected under this regulation include organizations (with the exception of credit institutions) and individual entrepreneurs carrying out cash payments and (or) payments using payment cards or their authorized representatives.

Based on the results of the inspection, a report is drawn up to verify the completeness of accounting for cash proceeds, and if an offense is detected, proceedings are initiated for an administrative offense in accordance with the Code of Administrative Offenses of the Russian Federation.

Check period

The audit period in each specific case is set by the head (deputy head) of the tax inspectorate. In this case, the total period of the inspection cannot exceed 20 working days from the date of presentation of the order to the inspected object.

Verification steps

The verification procedure consists of the following stages (section III of the regulations):

1. The head (deputy head) of the tax inspectorate makes a decision to conduct an audit.

2. Tax inspectors present an order to conduct an audit and official identification.

3. Within 2 working days from the date of presentation of the order:

a) the subject being inspected puts his signature, position and date on the submitted order;

b) if the inspected object is not present, or he refuses to sign the order, then the tax inspectors make a note about this in the order;

4. Within 1 working day from the moment of presentation of the order to the inspected object:

a) the inspected object upon request presents originals or duly certified copies of documents necessary for control (the list of documents is in paragraphs 28 and 29 of the regulations). At the same time, the requirement for notarized copies is unlawful (clause 30 of the regulations);

b) tax inspectors review the submitted documents related to payments in cash and payment cards:

— on the acquisition, registration, commissioning and use of cash registers;

— for the production, acceptance, accounting, storage, issuance, inventory and destruction of strict reporting forms (if the inspected object receives revenue using BSO);

— documents related to the issuance of sales receipts, receipts or other documents confirming the receipt of funds for the relevant goods, work, service (if the inspected object is a UTII payer);

c) tax inspectors review the submitted documents used to formalize cash transactions;

d) the inspection report records the fact of consideration of documents.

5. Within no more than 20 working days from the date of presentation of the order to the inspected object:

a) the scope and composition of control actions are determined, as well as the methods, forms and means of carrying out such control actions (list of control actions - clause 35 of the regulations);

b) the completeness of accounting for cash proceeds is checked (methods of verification - clauses 36 - 41 of the regulations);

c) facts of incomplete (full) accounting of cash proceeds are established (identified, recorded);

d) the inspection report records the result of checking the completeness of revenue accounting.

6. Within no more than 20 working days from the date of presentation of the order to the inspected object:

a) an inspection report is drawn up in 2 copies (requirements for the execution of the report and its details - clauses 46-48 of the regulations);

b) in case of violations, written explanations (comments, objections) are accepted from the taxpayer, and a record is made about this in the report;

c) the inspection report is signed; if the taxpayer evades signing, then this fact is reflected in the act and the act is sent by registered mail to the location (place of residence) of the inspected object;

d) one copy of the act is transferred to the inspected object;

e) when facts of violations of the law are revealed, proceedings on an administrative offense are initiated and carried out in the manner established by the Code of Administrative Offenses of the Russian Federation.

Rights of tax inspectors during an audit

When exercising control, tax inspectors have the right (clause 7 of the regulations):

1) unhindered access:

— to the cash register equipment of the inspected object;

— stored used control tapes;

— fiscal memory drives and software and hardware that provide non-correctable registration and non-volatile long-term storage of information in cash register equipment;

— automated systems that generate strict reporting forms and documents on these forms, equivalent to cash receipts;

2) request for inspection documentation from the inspected object related to the use of cash register equipment and accounting of funds;

3) conduct a check of the cash register and the actual availability of strict reporting forms;

4) receive information from automated systems about issued documents;

5) receive the necessary explanations, certificates and information on issues arising during control;

6) receive passwords for cash register equipment necessary for taking reports of fiscal memory and control tape readings;

7) interact with the internal affairs bodies of the Russian Federation;

bring to administrative responsibility the objects of control in the cases and in the manner established by the Code of Administrative Offenses of the Russian Federation.

bring to administrative responsibility the objects of control in the cases and in the manner established by the Code of Administrative Offenses of the Russian Federation.

Responsibilities of the inspected object

The inspected objects in respect of which the inspection is carried out are obliged (clause 10 of the regulations):

1) provide tax inspectors with unhindered access to:

— to cash register equipment;

— documentation related to the acquisition and registration, commissioning and use of cash register equipment;

— automated systems that generate strict reporting forms and documents on these forms, equivalent to cash receipts;

2) provide information about strict reporting forms generated by automated systems, filling out forms and issuing documents equivalent to cash receipts by an automated system (information from automated systems about documents issued);

3) provide the necessary explanations, certificates and information on issues arising during the inspection;

4) provide information to the tax inspectorate upon request in the manner prescribed by federal laws.

Documents that may be requested from the inspected object

During the inspection, the following documents are requested (clauses 28, 29 of the regulations):

1. When making payments using cash register:

a) documents related to the acquisition and registration, commissioning and use of cash register equipment;

b) cashier-operator’s journal;

c) an act on the return of funds to buyers (clients) for unused cash receipts;

d) a journal for recording the readings of summing cash and control counters of cash register machines operating without a cashier-operator;

e) printouts of reports from the fiscal memory of cash register equipment and used fiscal memory drives;

f) control tapes of cash register equipment on paper and (or) printouts of the control tape made on electronic media;

g) incoming and outgoing cash orders;

h) a journal for registering incoming and outgoing cash documents;

i) advance reports;

j) cash book;

k) certificate-report of the cashier-operator;

l) information about the meter readings of cash register machines and the organization’s revenue.

2. When using strict reporting forms (instead of cash register checks):

a) documents related to the production, acceptance, accounting, storage, issuance, inventory and destruction of strict reporting forms;

a) strict reporting forms, copies of strict reporting forms, document counterfoils;

b) information from the automated system about issued documents:

— about strict reporting forms generated by automated systems;

— filling out forms;

— issuance by an automated system of documents equivalent to cash receipts;

c) act of acceptance of strict reporting forms;

d) a book of records of strict reporting forms;

e) act on writing off strict reporting forms.

3. If the taxpayer does not have a cash register for UTII:

a) documents related to the issuance of sales receipts, receipts or other documents confirming the receipt of funds for the relevant product (work, service).

4. Other documents:

a) a book of accounting of income and expenses and business transactions of an individual entrepreneur;

b) a book of accounting of income and expenses of organizations and individual entrepreneurs using a simplified taxation system;

c) a book of income accounting for individual entrepreneurs using a simplified taxation system based on a patent;

d) book of income and expenses of individual entrepreneurs applying the taxation system for agricultural producers (unified agricultural tax);

e) administrative document on the established cash balance limit;

f) other primary accounting documents and accounting registers necessary for verification.

Control actions

Composition and methods of control actions (clause 35 of the regulations):

1) documentary study of financial and business transactions for the audited period:

— analysis and assessment of information obtained from the requested documents;

2) actual study of financial and business transactions for the audited period:

a) inspection;

b) inventory, including:

— mandatory check of cash in the cash drawer of cash register equipment by removing the balance (recounting) of cash, taking into account the funds given to the cashier before the start of the work shift as small change. Based on the results of the inventory, an act on checking the cash in the cash drawer of cash register equipment is drawn up in two copies. Before the start of the inventory, the act contains a receipt from the cashier stating that there is no (or is) the cashier’s personal money in the cash register cash drawer, and all cash documents that were not transferred to the accounting department (administrator, senior cashier) were provided by the inspector (clause 36 of the regulations);

— checking the actual availability of strict reporting forms (by type of form, taking into account the initial and final forms of documents), based on the results of which an act of verifying the actual availability of strict reporting forms is drawn up in two copies;

— checking the availability of UTII payers who do not use cash registers, sales receipts, receipts or other documents confirming the receipt of funds for the relevant product (work, service);

c) observation, recount;

d) examination: in cases requiring the use of scientific, technical or other special knowledge, experts (expert organizations) are invited to participate in the verification;

e) checking compliance:

— requirements for cash register equipment, procedures and conditions for its use;

— the procedure and conditions for the use of strict reporting forms;

— requirements for automated systems for generating strict reporting forms and filling out relevant documents, the procedure and conditions for their use;

— the procedure and conditions for issuing sales receipts, receipts and other documents confirming the receipt of funds for the relevant product (work, service);

3) receiving from the inspected object the necessary written explanations, certificates and information on issues arising during the inspection , documents and certified copies of documents;

4) ways of studying:

- in a continuous way - in relation to the entire set of financial and business transactions;

- (or) in a selective way - in relation to part of financial and business transactions.

Determining the completeness of revenue accounting

The procedure for determining the completeness of accounting for cash proceeds is established in paragraphs. 37-41 regulations.

1. When using CCT:

a) compare the amounts of cash in the cash drawer of the cash register at the time of the inventory with the data reflected:

- in the fiscal report,

— control tape of cash register equipment,

— entries in the cashier-operator’s journal;

b) entries in the cashier-operator's journal are compared with cash receipt orders, cash reports and data from the cash book, book of income and expenses;

c) on the control tape, the presence of all serial numbers of cash receipts is checked, the numbers and amounts of cash receipts printed on the control tape are checked with the numbers and amounts of available cash receipts (if any);

d) the number of return facts is checked, as well as the amount of money returned to buyers (clients) using unused cash receipts.

2. When using strictly reporting forms:

a) determine the number of strict reporting forms used for the audited period on the basis of a book of records of document forms, acts of acceptance of strict reporting forms and acts of inventory of strict reporting forms;

b) compared with the actual number of copies of forms used

strict reporting (document spines) stored by the inspected object;

c) the amount of cash revenue reflected in the accounting of the inspected object is compared with the amounts reflected in copies of the used strict reporting forms (document spines) stored by the inspected object.

Checking act

The requirements for the inspection report are established by paragraphs 47 and 48 of the regulations:

1) the act must be drawn up on paper, in Russian and have continuous page numbering;

2) blots, erasures and other corrections are not allowed, with the exception of corrections agreed upon and certified by the signatures of a tax inspector specialist and the object being inspected;

3) the inspection report indicates:

— date of drawing up the act by the tax inspector;

— full name or last name, first name, patronymic (if any) of the inspected object, its tax identification number and checkpoint;

- last names, first names, patronymics (if any) of the tax inspectors who conducted the audit, their positions, indicating the name of the inspection;

— date and number of the order to conduct the inspection;

— a list of documents received by the tax inspectorate during the audit;

— the period for which the inspection was carried out;

— start and end dates of the inspection;

— address of the location or place of residence of the inspected object;

— documented facts of violations identified during

checks, or a record of the absence of such.

The description of the violations must indicate the provisions of the regulatory legal acts that were violated.

Rights of the object being checked

Persons undergoing an inspection have the right (clause 9 of the regulations):

1) be directly present during the inspection, give explanations on issues related to the subject of the inspection;

2) receive from tax inspectors information that relates to the subject of the audit and the provision of which is provided for by the Administrative Regulations;

3) get acquainted with the results of the audit and indicate in the audit report about your familiarization with the results of the audit, agreement or disagreement with them, as well as the actions (inaction) of tax inspectors;

4) appeal against the actions (inaction) of tax inspectors that entailed a violation of the rights of the inspected object during the inspection, in pre-trial (extrajudicial) and (or) judicial proceedings in accordance with the legislation of the Russian Federation.

Administrative responsibility

Administrative liability for violations in handling cash is established by Art. 15.1 Code of Administrative Offenses of the Russian Federation.

According to paragraph 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, offenses when working with cash and conducting cash transactions include:

1. Carrying out cash settlements with other organizations in excess of the established amounts.

The maximum amount of cash payments in the Russian Federation between legal entities, between a legal entity and a citizen carrying out business activities without forming a legal entity, between individual entrepreneurs related to their business activities, within the framework of one agreement concluded between these persons, can be made in the amount , not exceeding 100 thousand rubles. This limitation is established by Directive of the Central Bank of the Russian Federation dated June 20, 2007 No. 1843-U.

2. Non-receipt (incomplete receipt) of cash to the cash desk.

3. Failure to comply with the procedure for storing available funds.

According to clause 1.4 of the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation (approved by the Bank of Russia on October 12, 2011 No. 373-P), a legal entity or individual entrepreneur is required to keep cash in excess of the established limit in bank accounts cash balance (free cash).

Cash within the established limit can be kept in the cash desk of an organization (individual entrepreneur). At the same time, measures to ensure the safety of cash during cash transactions, their storage and transportation are determined by a legal entity or individual entrepreneur independently in a local administrative document (based on clause 1.11 of Regulation No. 373-P).

4. Accumulation of cash in the cash register in excess of established limits.

To conduct cash transactions, a legal entity or individual entrepreneur establishes the maximum allowable amount of cash that can be stored in the place for conducting cash transactions determined by the head of the legal entity, individual entrepreneur, after displaying in the cash book (Form No. KO-4) the amount of cash balance at the end of the working day (cash balance limit).

A legal entity or individual entrepreneur issues an administrative document regarding the established cash balance limit, which is stored in the manner determined by the head of the legal entity, individual entrepreneur or other authorized person.

A legal entity or individual entrepreneur determines the cash balance limit in accordance with the appendix to Regulation No. 373-P.

The above offenses entail the imposition of an administrative fine:

a) for officials in the amount of four thousand to five thousand rubles;

b) for legal entities - from forty thousand to fifty thousand rubles.

Procedure for organizing a cash register

To comply with established standards, an institution needs to complete five key steps:

- Appoint a responsible employee for conducting cash transactions. Familiarize the employee with the provisions of instructions No. 3210-U and Law No. 54-FZ in the latest edition against signature.

- Ensure the safety of the cash register and documentation. It is necessary to equip the office with a safe in which to store money, orders, cash books and a checkbook.

- Set a limit on the cash balance in the cash register. This amount is calculated by calculation, based on receipts or departures from the cash register. Do not exceed the limit at the end of a work shift or day, otherwise penalties for violation of cash discipline are guaranteed. Deposit the surplus into the company's bank account. On paydays the balance may be greater than the limit.

- Record all transactions using special cash documents. For incoming transactions, write out an incoming order, and for expenses, write out an outgoing order. Record transactions in the cash book. If you accept cash payment for goods, work, services, use online cash register.

- Spend proceeds only for permitted purposes. The list of approved expenses is given in the instructions of the Bank of Russia dated October 7, 2013 No. 3073-U.

What violations are allowed

Controlled organizations are required to understand and understand what cash violations are fined for, and under what conditions penalties are unacceptable. In total, there are five categories of offenses for which administrative liability is provided:

| The essence of the offense | Explanations |

| For cash payments over the limit | If the organization has paid in cash in the amount of more than 100,000 rubles within the framework of one contract. |

| Misuse of cash proceeds | If the company spent cash proceeds for purposes not provided for by instructions No. 3073-U. For example, paid wages or transferred insurance premiums. |

| Exceeding cash limit | If at the end of the working day there is more money left in the organization’s cash register than the approved balance limit. With the exception of days of payment of salaries, benefits and scholarships. |

| Non-receipt of cash proceeds | If the proceeds received at the cash desk are not capitalized in the prescribed manner. That is, cash documentation (PKO, fiscal receipt or BSO) has not been drawn up. |

| Violation of the procedure for maintaining an online cash register | If the company deviates from the rules for maintaining online cash registers according to Law No. 54-FZ. For example, I did not capitalize a purchase through an online cash register. |

IMPORTANT!

The imposition of administrative liability measures provides for a statute of limitations for violations of cash discipline - only two months from the date of the offense. For example, the cash balance limit was exceeded on 01/10/2019. The institution will be punished only if the misconduct is revealed before March 10, 2019. It is unlawful to apply penalties later.

The exception is ongoing crimes. This is a category of offenses in terms of violations of the provisions of Law No. 54-FZ. For example, if an organization does not switch to an online cash register for a long time.

Arbitration practice. Responsibility for non-receipt of revenue

Situation

The tax inspectorate conducted an audit of the organization's compliance with the rules for using cash registers, as a result of which it was established that it did not capitalize part of the proceeds.

This conclusion was made on the basis that the amounts indicated in the cash book and recorded in the fiscal memory of the cash register (control tapes) did not match. For this, the organization was fined in accordance with paragraph 9 of Decree of the President of the Russian Federation dated May 23, 1994 No. 1006 (hereinafter referred to as Decree No. 1006). The amount of the sanction is equal to three times the amount of revenue not received at the cash desk. The company refused to pay the fine voluntarily. Therefore, the tax inspectorate filed a lawsuit to collect it. The court of first instance rejected the claim. He pointed out that the tax inspectorate did not provide sufficient evidence of the fact that the organization did not receive funds to the cash desk. The case was not considered by the appellate court. The tax inspectorate filed a cassation appeal. In it, she asked to satisfy the claim in full, citing the incorrect application of substantive law by the court of first instance. Decision

The Federal Antimonopoly Service of the North-Western District reviewed the case materials and in its resolution dated February 27, 2002 No. 5641 stated the following. Information about all amounts received by the organization's cash desk must be reflected in the cash book. This follows from Article 34 of the Federal Law of December 2, 1990 No. 394-1 “On the Central Bank of the Russian Federation (Bank of Russia)” and paragraph 22 of the Procedure for Conducting Cash Operations in the Russian Federation, which was approved by the decision of the Board of Directors of the Bank of Russia No. 40 of September 22, 1993. However, the verifiable the organization violated these rules. She did not take into account in the cash book the cash receipts, the receipt of which was recorded by the fiscal memory of the cash register and cash receipt orders. Responsibility for such an offense is provided for in paragraph 9 of Decree No. 1006. The organization is subject to a fine of three times the amount not received. In this case, the argument of unintentional errors cannot be taken into account. Let us recall that in accordance with Article 12 of the Code of Administrative Offenses of the RSFSR, an administrative offense can also be committed through negligence. The cassation court noted that the tax inspectorate did not violate the procedure for bringing an organization to administrative responsibility. The amount of the fine is determined in accordance with the data of cash receipt orders, cash receipts and the cash book and is not disputed by the violating enterprise. The decision to hold the organization accountable was made within two months from the date of the offense. Based on the above, the Federal Antimonopoly Service of the North-Western District satisfied the cassation appeal of the tax inspectorate. The decision of the court of first instance was overturned.

Adviсe

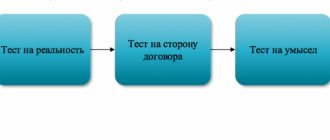

Let us note that inspectors of operational control departments, who check organizations’ compliance with the rules for using cash registers, have recently focused specifically on checking the completeness of receipt of revenue to the cash register. In fact, now failure to reflect it is the only basis on which a fine can be imposed on an organization. Let us recall that fines for non-use of cash registers were imposed in accordance with Article 7 of the Law of the Russian Federation dated June 18, 1993 No. 5215-1 “On the use of cash registers when making cash settlements with the population.” However, at the end of last year they were removed from this article by Federal Law of December 30, 2001 No. 196-FZ. Checks for the completeness of receipt of revenue are usually carried out according to the following algorithm. 1. Complete fiscal reports are taken from the cash register for the period under review (month, quarter, etc.). 2. The data from these reports is verified with the cashier-operator’s journals, cash receipt orders, Z-reports (KKM reports for each day of work) and the organization’s cash book. 3. The correctness of registration of returns and erroneously entered amounts is checked. During the audit, discrepancies may be discovered (for example, more entries have been entered into the cash register than have been recorded in the cash book) and undocumented returns or erroneously entered amounts. In this case, the inspectors draw up an act and protocol on the administrative violation. To avoid such troubles, the accountant must carefully ensure that all amounts from Z-reports for all cash registers for each day of work are reflected in the cash receipt orders and the cash book. In addition, returns and erroneously entered amounts should be processed correctly. To do this, you need to draw up an act in the KM-3 form, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The act is drawn up in one copy. It is signed by members of the commission, which usually includes the head of the department (section), senior cashier, and cashier-operator. Checks that are returned by buyers (wrongly punched) must be canceled, pasted on a piece of paper and, together with the act, submitted to the accounting department. Amounts paid on returned checks are recorded in the cashier's journal. They reduce the revenue for the corresponding day. Let us note that not only the organization, but also its manager can be fined for not posting revenue to the cash register. In accordance with paragraph 9 of Decree No. 1006, he will have to pay 5,000 rubles.

M.V. Skorokhodov, expert of AG "RADA"

Types of penalties for violations

For violations of cash discipline, the violator will face administrative liability. Part 1 art. 15.1 of the Code of Administrative Offenses of the Russian Federation and letter of the Federal Tax Service dated 07/09/2014 No. ED-4-2/13338 provide for the following types of penalties:

- warning;

- a fine against the responsible employee (manager or other employee of the organization);

- fine against the offending company.

With regard to offenses in terms of compliance with law 54-FZ (Article 14.5 of the Code of Administrative Offenses of the Russian Federation), the penalties are as follows:

- warning;

- fine on the responsible person;

- fine for the organization;

- disqualification of an official;

- suspension of company activities (up to 90 days).

Responsibility for violation of the procedure for issuing money on account

Settlements with accountable persons for advances issued to them are classified as cash transactions. According to clause 4.4 of Regulation No. 373-P, funds are issued to the employee against a cash receipt order based on the employee’s application, drawn up in any form and containing the manager’s handwritten inscription about the amount of cash and the period for which the cash is issued, the manager’s signature and date. The accountable person is obliged to submit an advance report and documents confirming the expenses incurred within a period not exceeding three working days after the expiration date for which cash was issued on account, or from the date of return to work.

Violation of the procedure for working with cash and the procedure for conducting cash transactions entails administrative liability established by Part 1 of Art. 15.1 Code of Administrative Offenses of the Russian Federation. This article provides for the imposition of an administrative fine on officials in the amount of 4,000 to 5,000 rubles, on legal entities - from 40,000 to 50,000 rubles. in cases:

— making cash settlements with other organizations in excess of the established amounts;

— non-receipt (incomplete receipt) of cash to the cash desk;

— failure to comply with the procedure for storing available funds;

— accumulation of cash in the cash register in excess of established limits.

Thus, issuing funds to an accountable person who has not reported on a previous advance is not an administrative offense.

If the issuance of funds on account to certain employees who have not reported for previous advances is systematic, then this may be considered by the tax authorities as an artificial concealment of the “over-limit” of the cash balance, which entails administrative liability under Part 1 of Art. 15.1 Code of Administrative Offenses of the Russian Federation. In this case, the absence of an administrative offense will have to be proven in court.

In the case considered by the Federal Antimonopoly Service of the Far Eastern District, the basis for bringing the company to administrative liability was the systematic issuance to the head of the company of funds from the cash desk of the enterprise for reporting without operational necessity with their subsequent return to the enterprise's cash desk, which was qualified by the tax authority as evasion of depositing cash in excess of established limits to the bank.

As the court indicated in its ruling dated July 16, 2010 No. F03-4472/2010, the norm of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, as a mandatory element of the offense, provides for the status of “free funds” for these funds. The funds retain their corresponding status until they are issued for reporting to an authorized person for business and operating expenses.

In addition, the funds received for reporting to the official were subsequently handed over to the enterprise's cash desk for settlements with employees (wages) and for delivery to the bank. In this regard, the court considered the inspector’s argument that the company had executed cash transactions in order to evade depositing cash in excess of established limits to the bank as unsupported by the case materials.

According to the court, a business transaction consisting of issuing cash on account to a financially responsible person for business and operating expenses, who has not submitted a report on the advance previously issued to him, violates the procedure for issuing cash, and not the procedure for conducting cash transactions, expressed in the accumulation of cash in the cash register in excess of established limits. Administrative liability is not provided for violation of the procedure for issuing funds on account.

Similar court decisions were made by the FAS of the West Siberian District dated 02/05/2009 No. F04-491/2009, FAS of the Volga District dated 12/23/2008 No. A12-14717/2008.

At the same time, the Ninth Arbitration Court of Appeal, in its decision dated March 6, 2013 No. 09AP-2451/2013, considered the administrative punishment under Part 1 of Art. 15 of the Code of Administrative Offenses of the Russian Federation for an offense expressed in the issuance of funds on account of cash receipts without written statements from accountable persons, as well as to employees who did not account for funds previously received on account.

Fines and punishments for violations of cash discipline

Let us present in the form of a table what fines are provided for violation of cash discipline. In accordance with Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, violators will be punished:

| The essence of the offense | Fines for officials and individual entrepreneurs | Fines for legal entities | Fines for emergency services |

| For violations of cash discipline (instructions 3210-U): | |||

| From 4000 to 5000 rubles. | From 40,000 to 50,000 rubles. | For a first-time violation - a warning. For a repeated offense - a fine, depending on the legal status of the emergency service. |

| Violation of the procedure for maintaining online cash registers (Law No. 54-FZ): | |||

| Acceptance of cash proceeds via online cash register. | From 25% to 50% of the settlement amount without cash register, but not less than 10,000 rubles. | From 75% to 100% of the settlement amount without cash register, but not less than RUB 30,000. | The fine may be replaced with a warning if the offense is detected for the first time. |

| Repeated non-use of cash registers if the amount of revenue transferred past the cash register was 1 million or more. | Disqualification of an official from one to two years. For individual entrepreneurs - suspension of activities for up to 90 days. | Suspension of the organization's activities for up to 90 days. | Suspension of activities for up to 920 days. |

| The online cash register does not meet the established requirements or the procedure for using the cash register is violated. | Warning or fine from 1500 to 3000 rubles. | Warning or fine from 5,000 to 10,000 rubles. | Warning or fine. |

| Documents related to the use of cash registers were not provided to the Federal Tax Service upon request. | |||

| The receipt or BSO was not issued to the buyer. | A warning or an administrative fine in the amount of RUB 2,000. | A warning or an administrative fine in the amount of RUB 10,000. | A warning or an administrative fine in the amount of RUB 10,000. |

How to prove the illegality of a fine when accused of not posting cash to the cash register?

Tax authorities often conduct checks of cash discipline and discover violations of the procedure for conducting cash transactions, for example, when an enterprise has separate structural divisions (stores), but does not maintain cash books in them, as required by the procedure for conducting cash transactions updated in 2014, or when systematic issuance of money from the cash register on account without complying with the condition of full repayment of funds previously received on account. The results of such an audit often result in accusations of (1) non-compliance with the procedure for storing available funds and (2) non-receipt (incomplete receipt) of cash to the cash desk and corresponding penalties under Article 15.1 of the Code of Administrative Offenses of the Russian Federation. But are such accusations always justified... and how can one try to prove the unlawfulness of an administrative fine in this case? — General Director of Auditorskaya LLC Nikolay Nekrasov will talk about this.

In accordance with Article 1.6 of the Code of Administrative Offenses of the Russian Federation, a person brought to administrative responsibility cannot be subjected to administrative punishment except on the grounds and in the manner established by law. According to Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation, violation of the procedure for working with cash and the procedure for conducting cash transactions, expressed in:

- in making cash payments with other organizations in excess of the established amounts;

- in non-receipt (incomplete receipt) of cash to the cash desk;

- failure to comply with the procedure for storing available funds;

- in the accumulation of cash in the cash register in excess of established limits.

Thus, the legislator has clearly defined a list of specific cases (based on the disposition of the norm, there are only four of them, since the list is closed), when violation of the procedure for working with cash and the procedure for conducting cash transactions is recognized as an administrative offense, for which administrative punishment is provided in the form of a fine for official in the amount of 4,000 rubles.

up to 5,000 rubles, for a legal entity - from 40,000 rubles. up to 50,000 rub. Consequently, NOT ANY of all possible violations of the procedure for working with cash and the procedure for conducting cash transactions is an administratively punishable act. It is a fact. The procedure for working with cash and the procedure for conducting cash transactions is regulated by the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” (hereinafter referred to as - Instructions No. 3210-U).

Let's look at the first case . The company is charged with an act resulting in non-receipt (incomplete receipt) of funds in the amount of .... thousand rubles, since a separate cash book was not maintained in a separate division of the organization, but a cash book was maintained at the central office of the company. However, in our opinion, the Inspectorate’s statement about the fact of non-receipt by the Company (incomplete receipt) of cash to the Company’s cash desk under such circumstances, in our opinion, does not comply with the provisions of Article 15.1 of the Code of Administrative Offenses of the Russian Federation.

In accordance with subclause 4.6 of clause 4 of the Instructions of the Central Bank of the Russian Federation No. 3210-U, separate divisions transfer to the legal entity a copy of sheet of their cash book 0310004 in the manner established by the legal entity, taking into account the deadline for the legal entity to prepare accounting (financial) statements. Based on this norm, it follows that each territorially separate division of the Company is obliged to maintain its own separate cash book, and, accordingly, draw up cash receipts and debit orders documenting each fact of cash entry into the cash desk of a separate division of the enterprise, and then this data is transferred in the prescribed manner to the head office of the enterprise, to which the consolidated financial statements of the enterprise are prepared, containing data on all facts of cash receipts for the enterprise as a whole.

The inspection found that the Company itself kept records in its cash register of ALL cash received from customers, including, incl. and received through a separate division of the Company. The accounting of received funds was kept by the Company in the cash book of the Company as a whole, but was not recorded in a separate cash book of a separate division of the Company. This, of course, is a violation of the established procedure for conducting cash transactions, regulated by Directive No. 3210-U. Nobody argues with this. The Company’s employees simply did not react to the latest change in the Rules for Conducting Cash Transactions in 2014, although almost two years have passed. This circumstance, of course, does not justify them, however, in our opinion, such a violation of the procedure for conducting cash transactions is not an administratively punishable act, since it is not provided for (not named) in Part 1 of Article 15.1. Code of Administrative Offenses of the Russian Federation.

It is obvious that the posting of funds received by a separate division of the Company (i.e., their accounting) was actually carried out by the Company, but in the parent organization of this Company, which is not refuted by the Inspectorate itself.

The legislation does not establish what is meant by the posting of funds, as well as what is meant by the non-receipt of funds. According to the dictionary of accounting terms (see Big Accounting Dictionary edited by A.N. Azriliyan), capitalization is the reflection in value terms in the asset (accounting) of the corresponding accounts, received material assets, property. Accordingly, non-receipt should be understood as non-reflection (concealment) in value terms in the asset (accounting) of the corresponding accounts, received material assets, property.

Consequently, during the audit, the tax authority revealed that the Company incorrectly entered into the cash book the cash received by a separate division of the enterprise, but no violation was identified, that the Company did not enter this cash .

In our opinion, these are completely different violations of the procedure for conducting cash transactions, and liability under Article 15.1 of the Code of Administrative Offenses of the Russian Federation is provided not for all possible violations of the procedure for conducting cash transactions without exception , but only for those that are directly provided for by this article.

Consequently, in the case under consideration, the Company’s actions do not constitute an offense. However, it should be noted that the existing judicial practice on this topic is very diverse and sometimes court decisions under similar circumstances satisfy the demands of tax authorities to impose an administrative fine. Therefore, you cannot be sure that the court will support the legal position we propose in your case.

Therefore, we recommend, just in case, to point out that if a respected court considers our arguments regarding the lack of corpus delicti in the act to be unconvincing, then it should be taken into account that the violation committed by the Company is minor (see Article 2.9 of the Code of Administrative Offenses of the Russian Federation), since it there is no significant threat to protected social relations. In addition, at the moment this violation has been eliminated by the Company, and by that time, it (the violation) should actually be eliminated by you. You may be lucky and avoid penalties.

Let's look at the second case. The Company is charged with acts involving the systematic issuance of cash from the cash register for reporting to the head of the Company without complying with the condition of full repayment of cash amounts previously received for reporting. At the same time, the accountable person was obliged to draw up and submit advance reports on expenses associated with the organization’s activities, with supporting documents, for the amounts previously issued for reporting. Or return unspent cash to the Company's cash desk and then post it in the cash register. However, the amounts of cash unspent by the accountable person were not systematically entered into the cash register, i.e. The inspection established the fact that cash was not received into the company's cash desk. In addition, the unspent amounts of cash previously issued for reporting were not deposited in the bank into the company's current account, but were reported to the head of the organization. How is the procedure for storing available funds violated?

From the text of the resolution imposing an administrative penalty, it follows that the Inspectorate clearly defined and described all the violations of the procedure for conducting cash transactions that it identified in the inspected Company (we structure them):

- First. Funds were systematically issued from the company's cash desk on account without complying with the condition of full repayment of the amounts of cash previously received on account. And we agree with the Inspectorate that the Company actually committed such a violation of the procedure for conducting cash transactions. But... this violation of the procedure for conducting cash transactions is not mentioned in Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation.

- Second. At the same time, the accountable person, if he did not account for the amounts previously issued to him for reporting, was obliged to return the unspent cash accountable money by him to the cash desk of the Company, and the Company had to capitalize these funds at the cash desk of the Company with the execution of cash receipt orders and making entries in the company's cash book. However, the amounts of cash unspent by the accountable person (director) were not systematically credited to the Company's cash desk.

But on this we do not agree with the Inspectorate, since in our opinion, the Company did not commit any violations of the procedure for conducting cash transactions in the form of non-receipt (incomplete receipt) of cash to the cash desk in this situation, since the head of the organization did not actually transfer unspent funds to the Company’s cash desk. did not hand over and in connection with this, the Company was unable to capitalize funds that were not actually received by the Company’s cash desk.

Consequently, the Company did not commit any violations of the procedure for conducting cash transactions in the form of non-receipt (incomplete receipt) of cash to the cash desk, and therefore no violation of the procedure for storing available funds in this case. In our opinion, only if the accountable person actually handed over unspent accountable amounts to the Company’s cash desk, and the Company did not capitalize them in its cash office, then only then would there be violations of the procedure for conducting cash transactions, named in Part 1 Article 15.1 of the Code of Administrative Offenses of the Russian Federation, expressed in (1) non-receipt (incomplete receipt) of funds and (2) non-compliance with the procedure for storing available funds.

In fact, the funds issued by the Company to the accountable person cannot be free funds of the Company (as they are interpreted by the Inspectorate), since they were issued from the Company's cash desk and are at the disposal of the accountable person, and not the Company, even if they were issued to him in violation of the cash register procedure operations. It is obvious that for the funds actually issued for reporting, a debt of the accountable person to the Company arises, but there is no money issued for reporting at the Company's cash desk at this moment. Consequently, there is not and cannot be a failure to comply with the procedure for storing free cash in the cash register of the enterprise.

In accordance with Instructions No. 3210-U (subclause 6.3 of clause 6), it is established that the issuance of cash on account is carried out subject to full repayment by the accountable person of the debt on the amount of cash previously received on account. Consequently, in the case under consideration, the Company violated the provisions of subclause 6.3 of clause 6 of Instructions 3210-U, since the head of the organization received cash from the Company on account, without accounting for the amount of cash he had previously received on account.

How could the Company violate the procedure for storing free funds in the cash register (as the tax authority believes), if the funds actually issued to the accountable person are not actually in the Company’s cash register? At the same time, the fact of issuing funds for reporting to the director of the company is confirmed by cash receipts, which are drawn up in full accordance with the established rules and are not questioned by the Inspectorate. But the tax authority did not provide evidence confirming the fact that there were funds in the enterprise’s cash desk issued on account.

How, in the opinion of the tax authority, could the Company credit funds to its cash desk that were not actually received from the accountable person, even if the accountable person violated the established procedure by not returning unspent accountable funds to the company? The tax authority did not provide evidence confirming the fact that the accountable person returned to the enterprise's cash desk unspent accountable funds.

For violation of the procedure for issuing funds on account, administrative liability is currently not provided for by the Code of Administrative Offenses of the Russian Federation. A similar position was expressed by the Supreme Court of the Russian Federation in its ruling dated September 30, 2015 in case No. 307-AD15-11670. Consequently, in the case under consideration, there is no corpus delicti in the actions of Enoteka LLC.

However, in case the court considers these arguments regarding the lack of corpus delicti in the act to be unconvincing, then we recommend asking the court to take into account that the violation committed by the Company is minor (see Article 2.9 of the Code of Administrative Offenses of the Russian Federation), since it does not contain a significant threat to protected property. public relations, and this did not lead to serious negative consequences. In addition, by that time this violation must have been eliminated by the Company.

Internal control

Full-time employees of the organization are authorized to conduct internal audits. For example, the chief accountant or the head of the organization has the right to conduct a sudden audit of the cash register.

The procedure for conducting an audit, as well as the list of authorized persons, should be established in the accounting policy of the institution. Or issue a separate order. Please note that a sudden audit of the cash register is carried out by a group of people. That is, a specially created commission.

A check of cash discipline in an organization should also be carried out when changing the cashier (the employee responsible for accepting and issuing cash and processing documents).

External control

External control of the cash register refers to checks and audits of compliance with cash discipline, which are carried out by government bodies, services and departments.

The Federal Tax Service is authorized to control representatives of commercial structures. The Inspectorate develops and approves special plans for on-site tax audits. In accordance with the plans, risks from violations of cash register operations are identified. The Federal Tax Service has the right to conduct an unscheduled audit. Please note that the absence of a company from the Federal Tax Service inspection plan is not a guarantee that inspectors will not come with an audit. The inspectorate is authorized to order unscheduled control in the presence of compelling reasons and even without them.

The budget sector is controlled not only by the Federal Tax Service. Cash desk audits have the right to be carried out by:

- Accounts Chamber;

- the audit department of the financial authority in which the institution is served;

- Ministry of Internal Financial Control;

- Ministry of Finance;

- founder or relevant ministry and department;

- bodies of the prosecutor's office and the investigative committee;

- other representatives of government agencies.

State employees can be checked for violations in cash transactions at least every day, so large is the number of controllers and auditors.

When initiating an external audit of the cash register, the controller is required to provide:

- controller's certificate;

- order of the department that initiated the control event;

- audit plan;

- subject of inspection;

- timing of the control event.

IMPORTANT!

The documents are certified by the signature and seal of the head of the department. If there are not enough papers or signatures or seals are missing, ask for correct documentation. Until then, do not allow the auditor to check.

How violations are recorded

Identified errors, deviations and misconduct are documented in a special act. Otherwise, it is impossible to bring the offender to justice. Check whether all required details are reflected in the report of violations when checking cash transactions. These include:

- name of the document, date of preparation, number;

- name of the controlled organization;

- members of the commission (full name, position) - for internal verification;

- position, full name auditor, name of the department - for an external form of control;

- cashier or other materially responsible person (full name, position);

- a list of valuables in the cash register at the beginning of the audit (this is not only cash, but also stamps, securities, strict reporting forms);

- the amount of cash and the value of other valuables according to accounting data;

- last numbers of incoming and outgoing orders (if available);

- a detailed reflection of the fact and content of the violation.