The quarterly statistical report in the form ZP-education contains information about the number of employees in the educational institution and the payroll. The unified form and Instructions for filling it out are regulated by Rosstat Order No. 412 dated July 24, 2020 (Appendix No. 9).

The main purpose of the salary-education form is to collect statistical information on indicators of income from the labor activities of personnel. With its help, statistical authorities monitor indicators in a specific period of time. Educational institutions will begin submitting this report using the new form starting with reporting for the 1st quarter of 2021.

Salary education form: who should take it

The statistical report ZP-education in 2021 is required to be provided by state educational institutions, the type of activity code of which corresponds to one of the OKVED codes given in Appendix No. 9 to Order No. 412: these are institutions of preschool, primary, secondary, vocational (secondary and higher), additional education , vocational training, education in the field of culture and sports, etc.

There is no need to provide statistical reporting for separate divisions of legal entities that operate outside the Russian Federation.

You can clarify the need to submit a salary-education form using a special Rosstat service. To obtain the necessary information, the respondent must indicate OKPO, INN or OGRN, and the system will display a list of reports.

When do you need to submit your salary-education report to statistics?

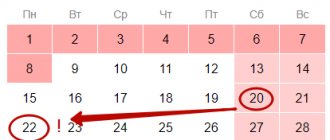

The organization's salary-education report is submitted quarterly. This must be done on the 10th day of the month following the expiration of the reporting period.

If the deadline for submitting a report falls on a weekend or holiday, it is postponed to the first working day following it. Rosstat notes that the priority is to provide statistical reports in electronic form. But the ZP-education form can also be submitted on paper or sent by mail.

Submission of statistical reports is a mandatory procedure. If a business entity does not provide it within the established time frame, it will have to bear administrative responsibility. The amount of penalties is prescribed in 13.19 of the Code of Administrative Offenses of the Russian Federation: up to 70 thousand rubles. for legal entities and up to 20 thousand rubles. for an official. If the violation is repeated, the fines will increase significantly.

HR reporting in 2021: HR calendar

Rosstat approved Order No. 404 dated July 15, 2021, which changes most statistical reporting forms filled out by personnel employees.

Once a year, starting with the report for 2021, you will need to submit updated data using the following forms:

- No. 1-T “Information on the number and wages of employees”;

- No. 1-T (working conditions) “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions”;

- No. 2-GS (ГЗ) “Information on additional professional education of federal state civil servants and state civil servants of the constituent entities of the Russian Federation”;

- No. 2-MS “Information on additional professional education of municipal employees”;

- No. 1-T (GMS) “Information on the number and remuneration of employees of state bodies and local governments by personnel categories.”

Quarterly, starting with the report for the first quarter of 2021, employers will fill out and send updated forms to Rosstat:

- No. P-4 (NZ) “Information on underemployment and movement of workers”;

- No. ZP-education “Information on the number and remuneration of workers in the education sector by categories of personnel”;

- No. ZP-science “Information on the number and remuneration of employees of organizations carrying out scientific research and development, by personnel category”;

- No. ZP-zdrav “Information on the number and remuneration of healthcare workers by categories of personnel”;

- No. ZP-social “Information on the number and remuneration of workers in the social service sector by personnel category”;

- No. ZP-culture “Information on the number and remuneration of cultural workers by categories of personnel.”

Every month in 2021, information is expected from employers using the following forms:

- No. 3-F “Information on overdue wages”;

- No. 1-Z “Labor Force Sample Survey Questionnaire”;

- No. 1-PR “Information on the suspension (strike) and resumption of work of labor collectives”;

- No. P-4 “Information on the number and wages of employees.”

In addition, the order of Rosstat states that a periodic form is being introduced (once every 2 years) - No. 57-T “Information on wages of employees by profession and position.” It will need to be filed for 2021 only for odd-numbered years. Once every 3 years you will have to submit:

- No. 1-GS “Information on the composition of employees holding government positions and positions in the state civil service, by gender, age, length of service in public service, education”;

- No. 1-MS “Information on the composition of employees filling municipal positions and municipal service positions, by gender, age, length of service in municipal service, education.”

There are more monthly reports

The government is actively preparing to transfer work books into electronic format. But in order for the system to work, and for the data to timely and fully enter the Pension Fund, which calculates the length of service of working citizens, employers will be forced to submit detailed information about the work activities of employees.

According to the bill sent to the State Duma, companies will have to report:

- place of work (name of the employer, information about his renaming, the basis for the renaming and data on the corresponding document on the renaming);

- registration number of the organization in the Pension Fund of Russia;

- the work performed by the employee and periods of work, including: date of employment;

- name of position (specialty, profession);

- level of qualification (rank, class, category);

- information about transfers to another job;

- information about dismissal and grounds for termination of the employment contract;

- data of the relevant orders (instructions), decisions or other documents on the basis of which the employment relationship was formalized, amended, or terminated.

In fact, the new report completely duplicates the information that the personnel officer (authorized person) enters into the workers’ work books.

According to officials, information will have to be transmitted monthly, before the 15th day of the month following the reporting month.

Only about dismissals and cases of hiring new employees will have to be reported no later than the working day following the day the corresponding order (instruction) is issued.

Punishments are being prepared for violation of reporting rules. If there is no information about work activity or it is incomplete, the Pension Fund of the Russian Federation will notify the labor inspectorate.

Since the State Tax Inspectorate has the authority not only to check, but also, under certain circumstances, to immediately punish violators, an employer who fails to report will have a hard time. For failure to transfer information to the Pension Fund, in accordance with the proposed amendments to Art. 5.

27 of the Code of Administrative Offenses of the Russian Federation, officials will be given warnings. But if inspectors find other violations, then you may have to pay a fine.

Please note that the new report does not yet have a form. It will be developed by the Pension Fund of Russia immediately after the legislative initiatives come into force.

The Ministry of Labor reports that the reform to transfer work books into electronic format and collect information for their maintenance will start in six months - from 01/01/2020. But the situation may change if deputies do not have time to approve the bills on time or refuse to approve them altogether.

What reports need to be submitted now?

“One-time” HR reports in 2021

Ministry of Internal Affairs

Employers who have entered into or terminated an employment contract (GPC contract) with a foreign citizen are required to notify the migration department of the Ministry of Internal Affairs about this. Notice period: within 3 days from the date of conclusion (termination) of the employment contract. The form of the document that must be sent to law enforcement agencies is established by Order of the Ministry of Internal Affairs of Russia dated January 10, 2018 No. 11.

More information about the procedure for labor relations with citizens of other states can be found in the “Foreign Workers” section.

Military registration and enlistment office

Source: https://clubtk.ru/kalendar-kadrovika-kakie-otchety-sdaem-v-etom-mesyatse

Salary education: instructions for filling out in 2021

Detailed instructions for filling out the ZP-education are given in Appendix No. 9 to Order No. 412. All total indicators must be given on an accrual basis from the beginning of the year in thousand rubles.

Filling out the PO-formation begins with entering data into the title part of the report. Here they indicate:

- reporting period;

- name of the business entity (full and multiple);

- mailing address;

- OKPO code;

- reporting organization type code (from the list given in the Completion Instructions).

If the legal address of the institution does not coincide with the actual one, the actual location (postal address) is indicated in the report.

The table shows the data for the workforce as a whole and for different categories of workers:

- managers;

- heads of departments;

- teaching staff implementing general, preschool and additional education programs;

- teachers;

- industrial training masters;

- teaching staff;

- scientific staff;

- doctors;

- cultural workers;

- social workers;

- other employees (service personnel, accounting, etc.).

According to the instructions, the salary education is then filled in according to the corresponding columns of the table (there are 11 in total):

- In Art. No. 1 indicate the average number of employees excluding external part-time workers, in Art. No. 2 they prescribe indicators only for external part-time workers. The procedure for calculating the average number is given in paragraphs 8-12 of the Instructions for filling out the statistical report.

- In Art. No. 3-5 it is necessary to display information on the payroll for the period. In Art. No. 3 records data on all personnel (external part-time workers are not included), in Art. No. 4 – data on internal part-time workers, in Art. No. 5 – on external ones.

- In Art. No. 6-11 describe data on the wage fund broken down by funding sources: budgetary funds, compulsory medical insurance and funds received from income-generating activities. Art. Nos. 6-8 are reserved for displaying information for the entire team. And in Art. No. 9-11 indicate information on external part-time work.

Recommendations for calculating the salary fund are given in paragraph Instructions for filling out. The specified instructions for salary-education for 2021 should be used when filling out a statistical report, starting from the 1st quarter of 2021.

In the final part you need to indicate the position and full name. person responsible for preparing the report, date of preparation, contact details. The accuracy of the information specified in the form is certified by the signature of the manager or responsible employee.

There are more monthly reports

For separate divisions that do not have a legal address, a postal address with a postal code is indicated.

In accordance with the Decree of the Government of the Republic of Dagestan dated September 19, 2012 No. 316, the sectoral executive authorities of the Republic of Dagestan are identified as responsible for monitoring, quality control and reliability of the information provided. According to form No. ZP-education, such a body is the Ministry of Education and Science of the Republic of Dagestan.

The salaries of those working under a temporary contract increased the most in 2021 - by 124.7%, to $2 thousand. At the same time, the salaries of employees who combine freelancing and full-time work fell and amounted to $1,241. The salaries of independent developers have almost halved - $704 versus $1,450 in 2021.

However, analysts explained that there were too few server administrators among the survey participants for these data to be extrapolated to the entire market.

It is filled out as of the 1st day of each month and submitted to the territorial body of Rosstat at its location on the next day after the reporting date by legal entities (except for small businesses) only if there are overdue wages.

The program was developed jointly with Sberbank-AST JSC. Students who successfully complete the program are issued certificates of the established form.

We are talking about forms that reflect information about the number of employees, their working conditions and wages. Information on wages of employees by profession and position (Form No. 57-T) will need to be submitted by November 29, 2021.

All companies must report personal income tax and insurance contributions to the inspectorate and the Social Insurance Fund. A number of reports must be submitted to the Pension Fund and statistical authorities. Next, we will tell you where and what reports a payroll accountant submits in 2021.

In addition, the order of Rosstat states that a periodic form is being introduced (once every 2 years) - No. 57-T “Information on wages of employees by profession and position.”