This article discusses the procedure for filling out the 4-FSS report for the 3rd quarter of 2021. Let us remind you that as of 2021, control over insurance premiums was transferred to the tax office. Reporting on them is also now submitted to the tax authorities. However, one type of contribution remained “under the control” of the extra-budgetary fund. We are talking about payments for insurance against accidents and occupational diseases, or, as they are often briefly called, “injury” payments. Accordingly, reporting form 4-FSS for these payments still needs to be submitted to the Social Insurance Fund (FSS). Let's look at how to fill out and submit the 4-FSS report for 9 months of 2021 and offer a new 4-FSS form for the 3rd quarter of 2021 for download. The article also provides the deadlines for submitting the 4-FSS report for 9 months of 2021. Let’s say right away that the 4-FSS report has been completed on an accrual basis since the beginning of 2021. Therefore, if necessary, you can familiarize yourself with the sample 4-FSS for 2 quarters. 2021 .

Legal grounds for filling out form 4-fss

The obligation to submit Form 4-FSS is established in clause 1 of Art.

24 of the Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance...”. All legal entities and individuals using the services of insured persons must submit a report, i.e. employees who are subject to social insurance. The insured persons include (Clause 1, Article 5 of Law No. 125-FZ):

- Employees with whom an employment contract has been concluded.

- Individuals involved in labor as part of the execution of a sentence imposed by a court.

- Individuals with whom civil law (copyright) contracts have been concluded. In the latter case, the performer is the insured person, if this is provided for by the terms of the contract.

The 4-FSS report form for 9 months of 2021 and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381. The latest changes that are relevant today were made by Order of the FSS of the Russian Federation dated June 7, 2017 No. 275.

The procedure for submitting the report is established by Art. 24 of Law No. 125-FZ.

The form of its submission depends on the number of insured persons. If it exceeds 25 people, then the report must be submitted only electronically.

Small organizations with up to 25 employees can submit the form on paper.

In “paper” form, 4-FSS for is submitted before the 20th of the month following the reporting period, and the electronic version of this report must be submitted no later than the 25th. Those. the 4-FSS report for 9 months of 2021 must be submitted by October 22, 2018 “on paper” (since October 20 is a day off) and by October 25, 2018 – in electronic form.

How to fill out the form

The 4-FSS report for the 1st quarter is submitted electronically or in paper form. To fill out, you must use the form valid on the date of filling out the calculation.

IMPORTANT!

Only organizations (including those created, reorganized) whose average number of individuals for the previous year did not exceed 25 people have the right to provide a report on paper.

Let's point out some rules on how to fill out the 4-FSS report in 2021:

- If there are no indicators, dashes are entered in the fields.

- Cost indicators are indicated in rubles and kopecks.

- All sheets must contain a registration code and a subordination code. Continuous numbering is indicated only on completed pages.

- Errors may not be corrected by correction or similar means. The erroneous value is crossed out, the correct value is entered, certified with a signature and seal indicating the date of correction.

Organizations interacting with the Fund through the direct payment system fill out the calculation taking into account the requirements set out in the appendix to the order of the Social Insurance Fund No. 114 dated March 28, 2017.

What if the organization does not operate?

“Zero” 4-FSS for the 3rd quarter of 2021 must be submitted, even if the organization did not operate during the reporting period (from January to September 2021 inclusive). There are no exceptions for such cases in the current legislation. In the “zero” calculation using Form 4-FSS, fill out only the title page and tables 1, 2, 5.

Reflect payments under civil contracts in Table 1 of Form 4-FSS only when contributions were accrued in favor of individual performers. Charge contributions for injuries if such an obligation is provided for in the contract. When there is no such condition in the contract or service agreement, do not charge contributions and do not reflect payments in Table 1 of Form 4-FSS.

Where to take 4-FSS for 9 months of 2021

If the organization does not have separate divisions, then the calculation of 4-FSS for the 3rd quarter. 2021, submit it to the territorial office of the FSS at its location (clause 1 of article 24 of the Law of July 24, 1998 No. 125-FZ). This is the place of registration of the organization.

If there are separate units, then Form 4-FSS must be submitted in the following order. Submit the calculation to the territorial office of the Social Insurance Fund at the location of the separate unit, if such a unit has a current (personal) account and independently pays salaries to employees. In Form 4-FSS, indicate the address and checkpoint of the separate unit.

Filling example

Let's assume that payments to individuals for the period amounted to 90,000 rubles. (monthly 30,000 rubles). The insurance rate is 0.2%.

IMPORTANT!

4-FSS reporting should be completed on an accrual basis from the beginning of the reporting period, that is, the year. Consequently, policyholders submit this report to Social Insurance only four times a year: at the end of the previous year, for the 1st quarter, for the 1st half of the year, for 9 months of the current year.

Completed form 4-FSS for the 1st quarter of 2021

The 4-FSS calculation is submitted not only to the territorial social insurance body, but also to Rosstat - as part of mandatory reporting on labor protection (1-T (working conditions), 7-injuries, 4-FSS). Here is what needs to be reflected on labor protection in reporting to Rosstat in Form 4-FSS for the 1st quarter of 2021:

How to fill out 4-FSS for 9 months of 2021

The form consists of a title page and several tables, each of which contains a separate block of information.

As part of the 4-FSS report for the 3rd quarter of 2021, only the main sheets containing general information about the payer, insurance premiums and labor protection measures are required to be completed:

- Title page.

- Table 1 containing the calculation of the base for calculating contributions.

- Table 2, which reflects the status of settlements with the Social Insurance Fund division.

- Table 5, including information on the special assessment of working conditions and medical examinations.

The remaining tables apply only if the policyholder has the data to fill them out:

- Table 1.1 is used if the policyholder temporarily sends its employees to work for another legal entity or individual entrepreneur.

- Table 3 contains information on compulsory insurance costs (for example, sick pay for industrial accidents).

- Table 4 reflects information on the number of accidents and occupational diseases.

Using the same principle, we will consider the order of filling out the report - first all the “mandatory” sheets, and then the “additional” sheets.

How is the 4-FSS zero report submitted in 2021?

In the absence of actual activity of the company, the form of the 4-FSS report for the 2nd quarter of 2021 or any other reporting periods is practically the same as in the presence of insurance premiums. How to make a 4-FSS report for 2021, you can consult with professionals or use the appropriate program, the algorithm of which includes the procedure for generating zero reporting.

As a sample, you can download the 4-FSS zero report for 2021 with the fields filled in for example. But at the same time, it is imperative to make sure that the example of filling out the 4-FSS report for 2021 complies with current legal requirements. An example of a zero report 4-FSS 2021 makes it possible to draw up your report as soon as possible if the entrepreneur is almost overdue for its submission.

Title page 4-FSS

This section 4-FSS includes general information about the policyholder and the form itself.

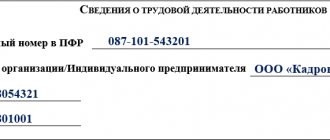

Registration number: this is the identifier of the policyholder, which is assigned when registering with the Social Insurance Fund office

Subordination code: shows in which division of the Social Insurance Fund the policyholder is currently registered

Adjustment number: indicates whether the report is original or has already been amended. The first version of the report contains the code “000” in this field, the subsequent ones – respectively “001”, “002”, etc. If after submission of the report the form was changed, then the corrected report is provided in the format relevant for the period for which the error was identified

Field “Reporting period”: serves simultaneously to fill in information about the period for which the report is submitted and for information about applications for the allocation of funds for payment of insurance compensation. When filing a report “normally,” the period is entered in the two left cells: nine months – “09” (from January to September 2021). If the policyholder applies to receive funds, then only the two right-hand cells of the field are filled in. They record the number of requests - from 01 to 10.

Field “Calendar year”: enter the year to which the reporting period relates, in four-digit format. Those. in this case – 2018.

Field “Cessation of activity”: is filled in only if the policyholder is in the process of liquidation and the report is submitted in accordance with clause 15 of Article 22.1 of Law No. 125-FZ. Then the letter “L” is entered in the field. If the policyholder operates and provides reporting in the current mode, then this field is not filled in

Field “Full name/full name”: for a legal entity, indicate the name of the organization (separate division, branch of a foreign organization) in accordance with the constituent documents. For an individual – full name of the entrepreneur or other policyholder in accordance with the identity document. Full name is indicated without abbreviation (patronymic - if available).

Fields “TIN” and “KPP”: the corresponding codes are entered for a legal entity or individual in accordance with the tax registration certificate. The TIN of an individual contains 12 characters, and of a legal entity - 10, so for an organization, zeros should be entered in the first two cells. The “Checkpoint” field is filled in only for legal entities and their separate divisions.

Fields “OGRN/ORGNIP”: indicate the main state registration number of a legal entity or individual entrepreneur in accordance with the state registration certificate. The legal entity number contains two digits less than that of an individual entrepreneur. Therefore, for the organization, the first two cells of the field, similar to the TIN, will contain zeros.

Field “OKVED code”: indicates the code of the type of economic activity according to the classifier OK 029-2014 (NACE Rev. 2), taking into account the assignment of this type to the corresponding class of professional risk (Resolution of the Government of the Russian Federation dated December 1, 2005 No. 713). Starting from the second year of activity, the policyholder indicates a code confirmed by the Federal Social Insurance Fund of the Russian Federation (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

Field “Budgetary organization”: filled in by policyholders receiving funding from the budget, in accordance with the source:

– federal budget – “1”;

– budget of a constituent entity of the Russian Federation – “2”;

– municipal budget – “3”;

– mixed financing – “4”

Field “Contact telephone number”: indicates the telephone number for contacting the policyholder, his representative or legal successor, depending on who exactly submits the report

Fields “Average number of employees”, “Number of working disabled people” and “Number of employees engaged in work with harmful or hazardous production factors”: indicate the corresponding indicators calculated in accordance with Rosstat order No. 772 dated November 22, 2015.

Fields “Calculation provided on” and “With supporting documents and their copies attached”: indicate the number of sheets of the report itself and supporting documents (if any), respectively.

The field “I confirm the accuracy and completeness of the information” is indicated:

– category of the person who provided the report; this may be the policyholder himself (1), his representative (2) or a legal successor (3);

– full name of the head of the enterprise, individual entrepreneur, individual or representative of the policyholder;

– signature, date and seal (if available);

– if the report is submitted by a representative, then the details of the document confirming his authority are indicated.

The field “To be filled in by a fund employee” is indicated:

– method of delivery (1 – in person on paper, 2 – by mail);

– number of sheets of the report itself and appendices;

– date of acceptance, full name and signature of the Social Insurance Fund employee.

Table 1: calculation of the base for calculating contributions for 9 months of 2018

Table 1 is called “Calculation of the base for calculating insurance premiums.” It contains information on payments in favor of individuals, subject to contributions and on the insurance tariff, taking into account premiums and discounts (for the period from January to September 2021).

- Line 1 indicates all amounts of payments to employees under labor, civil or copyright contracts in accordance with Art. 20.1 of Law No. 125-FZ. Information is entered on a cumulative basis from the beginning of the reporting period (column 2) and for each of the last three reporting months, i.e. in this case – for July-September 2021. (columns 4-6). The data in lines 2 – 3, discussed below, is filled in similarly.

- Line 2 contains information about the amounts of payments that are not subject to contributions (Article 20.2 of Law No. 125-FZ). This could be benefits, financial assistance, compensation for travel costs, etc.

- Line 3 reflects the basis for calculating contributions and is the difference between the corresponding indicators in lines 1 and 2.

- In line 4, payments in favor of working disabled people are allocated from the total amount.

- Line 5 indicates the insurance rate. It is determined individually, depending on the class of professional risk of the insured.

- Lines 6 and 7 contain information about discounts and surcharges to the insurance rate, which are established in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 No. 524.

- Line 8 contains the date of the order of the territorial body of the Social Insurance Fund to establish a surcharge on the tariff.

- Line 9 indicates the final tariff taking into account all discounts and surcharges. All tariff data is shown as a percentage with two decimal places.

Changes to 4-FSS in 2021

In connection with the transition to direct financing of payments to employees from the Social Insurance Fund, the FSS published a draft departmental order “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases (Form 4-FSS) and its Procedure filling". In 2021, a new reporting form will be introduced to the Social Insurance Fund: for the 1st quarter of 2021 we will report in the old way, but for the half-year reporting we will have to fill out an updated document.

Tables containing data on expenses incurred by the policyholder from insurance premiums have been removed from the updated form 4-FSS. Instead, the report included a table with information about stand-alone classification units for those policyholders who have them. In the table “Calculation of amounts of insurance premiums” the line “Calculated insurance premiums” has been added, and the line “Date of establishment of the premium” has been removed.

A separate table of information has been updated for calculating insurance premiums for organizations that provide outsourcing personnel. It has new columns to indicate:

- checkpoint of the receiving organization;

- the number of disabled people among temporarily assigned workers;

- information about discounts and surcharges to the insurance rate.

IMPORTANT!

As soon as the updates come into force, a new form 4-FSS will appear on the official website of the FSS portal, in the financial reporting section.

Table 2: settlements with the Social Insurance Fund for 9 months of 2021

Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” reflects information about settlements between the insured and the division of the Federal Social Insurance Fund of the Russian Federation.

- Line 1 contains the current debt of the policyholder for contributions at the beginning of the reporting period, i.e. as of 01/01/2018. It must correspond to the indicator in line 19 of table 2 of the report for 2017.

- Line 1.1 is used to reflect the debt at the beginning of the period if the report is filled out by the legal successor of the reorganized policyholder or the “parent” company of the liquidated separate division.

- Line 2 contains the amounts of accrued contributions. Contributions are shown separately on a cumulative basis from the beginning of the period and for the last three months (July - September) on a monthly basis.

- If during the reporting period the FSS division carried out on-site or desk inspections of the policyholder, then their results are reflected in the following lines:

– in line 3 – the amount of additionally accrued contributions;

– in line 4 – the amounts of expenses not accepted for offset for past periods.

- Line 5 indicates the premiums independently accrued by the policyholder for past periods.

- Line 6 shows the amount of reimbursement of the policyholder's expenses received from the Social Insurance Fund branch.

- Line 7 reflects the amounts received from the Federal Social Insurance Fund of the Russian Federation as part of the return of overpaid or collected contributions.

- Line 8 contains the checksum of the indicators of lines 1 to 7.

- Lines 9 – 11 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the end of the period – 09/30/2018, namely:

– line 9 – total amount;

– line 10 – incl. due to excess costs;

– line 11 – incl. due to overpayment.

- Lines 12 -14 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the beginning of the period - 01/01/2018, namely:

– line 12 – the total amount, its indicator must correspond to line 9 of the report for 2021;

– line 13 – incl. due to excess costs;

– line 14 – incl. due to overpayment.

- Line 14.1 contains information about the debt of the fund division to the reorganized policyholder or the liquidated separate division.

- Line 15 reflects the enterprise's expenses related to insurance against accidents and occupational diseases. Amounts are indicated for the entire reporting period and for July-September on a monthly basis.

- Line 16 contains information about insurance premiums actually paid. They are also shown for the period as a whole and monthly for the last three months. Information for July-September must contain payment dates and payment order numbers.

- Line 17 reflects information about the written off debt of the policyholder (in accordance with Part 1 of Article 26.10 of Law No. 125-FZ or other federal regulations).

- Line 18, similar to line 8, is a control line. It contains the sum of the indicators of lines 12, 14.1, 15, 16, 17.

- Line 19 indicates the debt owed by the policyholder at the end of the reporting period – September 30, 2018. If there is arrears, it is highlighted in line 20.

What kind of report is this

We are talking about form 4-FSS, which reflects not only the calculation of insurance premiums in case of injury, but also data on accident benefits, medical examinations of employees and special assessment of workplaces. Reporting to the Social Insurance Fund for the 4th quarter of 2021 must be submitted on a new form, taking into account the adopted changes. The calculation and procedure for filling out Form 4-FSS with an example and explanations are approved in Appendix No. 1 to FSS Order No. 381 dated September 26, 2016.

IMPORTANT!

Previous changes were made in 2021 by order of the Social Insurance Fund No. 275 dated 06/07/2017 - officials reorganized the rules for accepting documents.

The new form is posted on the Internet. In the “Information for Employers” section, you can download and fill out 4-FSS on the FSS portal - all policyholders have the right to use this option.

Form 4-FSS for the 1st quarter of 2021 contains mandatory and additional sheets. Mandatory sheets are filled out for all insured persons, and additional sheets are filled out only if data is available. Mandatory sheets include the title page, tables 1, 2 and 5. Additional sheets include tables 1.1 and 4.

IMPORTANT!

From 01/01/2021, policyholders do not fill out table 3 and line 15 of table 2 of the 4-FSS calculation (FSS letter No. 02-09-11/05-03-5777 dated 03/09/2021).

The essence of the form to be filled out has not changed compared to previous reporting periods, but some new values have been added. A new code field “Budgetary Organization” appeared on the title page. In it, public sector organizations must indicate the source of funding.

New rows have been added to Table 2:

- line 1.1 “Debt owed by a reorganized policyholder and (or) a separate division of a legal entity deregistered”;

- line 14.1 “Debt of the territorial body of the Fund to the policyholder and (or) a separate division of a legal entity deregistered.”

These lines are “mirror” - the value is shown depending on who owns the debt. The line reflects the amount of transferred debt from a reorganized insurer or a separate division deregistered.

ConsultantPlus experts discussed how to fill out the 4-FSS for the 1st quarter of 2021. Use these instructions for free.

Table 5: Special Assessment Information

- Line 1 of Table 5 “Information on the special assessment of working conditions and medical examinations” indicates information on the carried out special assessment of working conditions (SOUT):

- Column 3 indicates the total number of jobs of the policyholder

- Column 4 shows the number of jobs in respect of which a special assessment was carried out at the beginning of 2021.

- Columns 5 and 6 from the column 4 indicator indicate the number of assessed workplaces with harmful and dangerous working conditions (hazard classes 3 and 4).

If at the beginning of the year the validity period of the previously conducted certification of workplaces has not expired (Article 27 of the Law of December 28, 2013 No. 426-FZ “On SOUT”), then line 1 is filled in based on the results of the certification. If neither a special assessment nor certification was carried out, then zeros are entered in the corresponding columns.

Line 2 provides information about mandatory medical examinations of workers who work in harmful or dangerous conditions.

- Column 7 indicates the total number of such employees subject to medical examination at the beginning of the year.

- Column 8 reflects the number of employees who actually underwent medical examinations at the beginning of the year.

Information about medical examinations is entered in accordance with clauses 42, 43 of the Procedure approved by order of the Ministry of Health and Social Development dated April 12, 2011 No. 302n.

Table 1.1: Information on agency personnel

Table 1.1 “Information necessary for calculating contributions by policyholders specified in clause 2.1 of Art. 22 of Law No. 125-FZ” is the first of the “optional” parts of the report. It is filled out only by those policyholders who temporarily send their employees to work for another legal entity or individual entrepreneur.

Each row of the table corresponds to one enterprise (IE) to which the employees are sent

- Columns 2,3,4 contain, respectively, the number in the Social Insurance Fund, INN and OKVED of the receiving entity.

- Column 5 indicates the total number of temporarily assigned workers.

- Columns 6 – 13 contain the basis for calculating insurance premiums, i.e. payments in favor of these employees. Amounts are shown for the entire reporting period and separately - monthly for July-September. From each indicator, the amount of payments in favor of disabled people is allocated.

- Columns 14 and 15 indicate the size of the insurance tariff of the receiving entity, excluding and taking into account discounts (surcharges).

Table 3: costs of compulsory social insurance

This part of the report is completed by those policyholders who independently pay expenses for insurance against accidents and occupational diseases.

- Columns 3 and 4 indicate, respectively, the number of paid days (where applicable) and the payment amount. The rows of the table reflect the types of expenses:

- On lines 1 and 4 - temporary disability benefits due to industrial accidents and occupational diseases.

- Lines 2, 3, 5, 6 from lines 1 and 4 allocate payments to external part-time workers and victims in another organization.

- Line 7 indicates the costs of paying for additional leave for spa treatment.

- Line 8 from line 7 allocates the cost of vacation pay to employees injured in another organization

- Line 9 reflects the financing of preventive measures to reduce injuries and occupational diseases in accordance with the Rules approved by Order of the Ministry of Labor dated December 10, 2012 No. 580n.

- Line 10 summarizes all types of expenses. It represents the sum of the lines 1,4,7,9.

- Line 11 for reference reflects the amounts of benefits accrued but not paid as of the reporting date. Benefits accrued for the last month (September 2021), if the payment period for them has not yet expired, are not included in this line.

Table 4: number of victims in connection with insured events

This table is filled out only by those policyholders who had industrial accidents or were diagnosed with occupational diseases in 2018.

- On line 1, data on the total number of accidents is filled out on the basis of acts in form N-1 (Resolution of the Ministry of Labor dated October 24, 2002 No. 73)

- Line 2 identifies fatal accidents.

- Line 3 reflects information about registered cases of occupational diseases (Resolution of the Government of the Russian Federation of December 15, 2000 No. 967).

- For period 4, the total number of victims is indicated, i.e. The indicators of lines 1 and 3 are summed up.

- Line 5 identifies the number of victims in cases that resulted only in temporary disability.

Accidents and occupational diseases are included in the reporting period based on the date of the examination to verify these facts.

Possible fines

Fines for violations when submitting the 4-FSS report for 9 months of 2018 are established by Art. 26.30 of Law No. 125-FZ.

Failure to submit a report for the 3rd quarter of 2021 is punishable by a fine of 5% of the amount of insurance premiums for the last three reporting months for each full or partial month of delay. The minimum fine is 1000 rubles, the maximum is 30% of the specified amount of contributions.

Also, the policyholder may be fined for submitting a report “on paper” if he is required to submit the form electronically. In this case, the fine will be 200 rubles.

In addition, an additional administrative fine in the amount of 300 to 500 rubles may be imposed on responsible officials. (Article 15.33 of the Administrative Code).

But in this case, the regulatory authorities do not have legal grounds for blocking taxpayer accounts. Form 4-FSS is not a tax return, therefore the provisions of paragraph 3 of Art. 76 of the Tax Code of the Russian Federation do not apply to it. This position is set out in the letter of the Ministry of Finance of the Russian Federation dated 04/21/2017 N 03-02-07/2/24123.

Fine for violating the deadline for submitting Form 4-FSS

The fine for violating the deadlines for submitting 4-FSS is provided for by Federal Law No. 125-FZ of July 24, 1998.

So, if the policyholder does not report to the fund on time, then he faces a fine of 5 percent of the amount of injury premiums accrued for payment for each full or partial month of delay. The maximum fine is 30 percent of the calculated amount of contributions, the minimum is 1 thousand rubles. For failure to comply with the method of submitting the form electronically, a sanction has also been established - 200 rubles.

In addition, there is administrative liability for violating the deadline for submitting the form: the official can be fined in the amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

FEDERAL LAW No. 125-FZ dated July 24, 1998 (as amended on July 29, 2017) “On compulsory social insurance against industrial accidents and occupational diseases”

Conclusion

The 4-FSS report for 9 months of 2021 contains information on accrued and paid insurance premiums for injuries, as well as additional information related to labor protection at the enterprise. The title page and tables 1,2,5 are required to be completed. AA The remaining sections of the form are completed if data is available. The presentation format and delivery procedure depend on the number of insured persons. Penalties are provided for violation of reporting regulations.

Source: buhguru.com

Occupational safety and health courses in Moscow and other regions of Russia

Report 4-FSS for 9 months of 2021: due date and example of completion

22.10.2018 09:44

How is Form 4-FSS reporting prepared in 2021?

Forms for manually compiling a report to the Social Insurance Fund in the new format can be found both on the website of the insurance service itself and in the documentation set of the legal systems ConsultantPlus or Garant. In this case, you need to make sure that the current version of the programs is used. Otherwise, there is a risk that the 4-FSS report for the 1st quarter of 2021 will be compiled incorrectly. And for this, administrative liability is provided in the form of a fine for incorrectly submitted data.

The 4-FSS 2021 report is filled out as follows:

- the title page consists of the following data: company registration number, subordination code, adjustment number, full name of the company, policyholder code, telephone number, number of sheets with calculations;

- the calculation includes 6 tables filled out in accordance with the availability of data on accrued and paid insurance premiums.

You can fill out the form on a computer or on paper using a ballpoint pen in block letters. If any of the indicators is missing, then a dash is placed in this column. It is forbidden to use a corrector, errors must be carefully crossed out, and only then write the correct value (legibly). To avoid any rework, just download the new 4-FSS report for 2021, filled with demo data as an example.