Tax register concept

Information about the purpose and procedure for creating tax accounting registers contained in the code is rather scarce. Thus, a certain amount of useful information about income tax registers is in Art. 313, 314 of the Tax Code of the Russian Federation, there is even less data on VAT, all of them are placed in Art. 169 of the Tax Code of the Russian Federation. Therefore, for a better understanding of the issue of tax registers, it is better to consider these provisions in conjunction with the instructions that are in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

In essence, a register is an accumulation of data contained in accounting documents, calculations, summary tables in paper or electronic form, for the purpose of correct taxation. At the same time, as for any component element of the accounting system, there is a fixed set of rules for it:

- No edits or empty lines.

- Prohibition on entering knowingly false and incorrect data.

Tax register is a set of documents and (or) tables for accumulating, grouping, summing up the information necessary for the correct calculation and transfer of fiscal payments for a given period of time.

The collected figures must be recorded in strict accordance with the classification given in Chapter. 21 Tax Code of the Russian Federation. At the same time, tax accounting does not require double entry; it is enough to simply sum up the monetary value of the transactions included in the tax base. At the same time, the consistency and time certainty of entering data, and the inadmissibility of gaps remain relevant.

The main thing for the payer is to create a procedure for collecting and summarizing information that makes it possible to clearly track the mechanism of formation of the tax base. The basis for creating tax accounting registers for VAT is the documentation used in accounting.

At the same time, there are differences between the accounting and tax accounting systems:

- Accounting statements are drawn up in the form of journals and contain information exclusively about the document with the help of which the fact of economic activity was recorded.

- The tax accounting nomenclature can include information both directly from documents and from existing and generated analytical reports, for example, from accounting cumulative tables, calculations, and registers.

Based on the fact that the qualitative reflection of all transactions that form the tax base is of paramount importance for correct tax accounting, in certain situations they can be replaced by already existing accounting registers. This is possible if the methodology for accumulating data for any type or area of activity is completely identical. Then the information collected in accounting journals and statements will be used to determine the tax base without any additional processing or adjustment.

Based on the above, we can conclude that after reviewing existing reports, analytical tables, and account entries, company specialists themselves must decide on the need to introduce additional tax forms. Such a need arises when it is impossible to correctly fill out tax reporting only on the basis of accounting registers.

Although there are several templates available for internal tax forms, it is expected that they will in any case be implemented in the form of tables on paper or electronic media. At the same time, the creation of registers on a computer in specialized data processing databases predetermines the possibility of printing out the necessary information to create a paper version of its display.

In addition to using the already existing list of mandatory details for standard accounting forms, it is possible to expand it in order to more fully reflect the information necessary for tax calculation. You should ensure that adding new fields does not lead to duplication of entered data. Most often, the need to expand the form or increase the columns of the analytical table arises when there are significant differences between tax accounting and accounting.

All algorithms and procedures for accumulating data for calculating taxes must be reflected in the accounting policies. The responsibility to reliably and completely enter information into the relevant registers rests with specially appointed employees. Most often, these are employees of financial services who sign the documents attached to the reporting. Amendments to tax accounting documents are permitted only to responsible persons in the event of timely detection of errors or inaccuracies. In order to prevent unauthorized employees from making adjustments, it is necessary to restrict access to the specified registers. In case of data correction, there must be a valid reason for this, as well as certification of the correctness of the new entry by the signature of the responsible person.

Rules for creating registers

Most of the requirements for compiling tax registers are formulated in paragraph 4 of Art. 10 of the Law “On Accounting” 06.12.2011 No. 402-FZ. These include:

- indicating the title of the document;

- a clear definition of the time period for which the document records data;

- reflection of the quantitative and cost characteristics of the operation being carried out;

- indication of the names of the facts of economic activity according to the order of their implementation;

- signatures of persons responsible for maintaining the register.

As noted earlier, tax registers are necessary to register, group and accumulate data from various documented sources to form the taxable base. At the same time, the structure of the register should make it possible to understand without much difficulty the procedure for forming a taxable object for the period.

Tax authorities are not given the right to impose any standard accounting forms on companies, so companies are given complete freedom. At the same time, organizations must ensure that all required details are included in the forms used.

In those rare cases when there is an urgent need to make corrections to these tax accounting forms, it is necessary to put the date and signature of the responsible person next to them. If there is a requirement to provide original documents, you must keep copies of each copy.

Although tax legislation is quite democratic regarding the rules for creating registers, their absence is classified as a gross violation of the tax base accounting procedure and may entail a fine in the amount of 10 to 40 thousand rubles.

Tax accounting registers accumulate information about taxable amounts without using double entry, at the same time, the requirements for their registration are similar to those that apply to accounting documents. Thus, all accounting documents that allow you to achieve your goal can be classified as tax accounting registers. It is advisable to use a self-developed form or report form only if the standard accounting version lacks any data.

A company's liability for violation of legislation regarding registers arises only in the absence of those forms specified in its accounting policies. This, in particular, was stated in the resolution of the Federal Antimonopoly Service of the North-Western District dated 10.10.2005 No. A42-7611/04-15. In addition, there is court practice, according to which the payer independently determines not only the structure and list of details of tax accounting forms, but also which of them and how they need to be drawn up.

Key provisions that must be included in the accounting policies

When developing an accounting policy, the company, along with a description of the usual procedures for recording transactions, must include a detailed explanation of the methodology for summarizing and analyzing the constituent elements of the tax base. For VAT, it is advisable to reflect in it the rules for the preparation and registration of invoices, purchase and sales books, the registration journal and other registers used in the company.

In addition to the general points, for VAT it is necessary to take into account a number of nuances:

- The frequency with which invoice sequence numbers are restarted.

- Algorithms for the separate registration of transactions subject to and not subject to VAT.

- The method for calculating the threshold for refusing to maintain separate accounting is the 5% rule. It should be established how the level of expenses will be reported for different categories of transactions.

It is also necessary to develop instructions for implementing separate tax accounting for incoming assets.

The more detailed all the intricacies of VAT tax accounting are described, the easier it will be for the company to defend its point of view in the event of disputes on any issues with the inspectorate.

How to create an accounting policy for VAT

VAT payers must develop accounting and tax accounting policies. How to do this, read our article “VAT Accounting Policies.”

An accounting policy is a document regulating the methods of accounting within an organization. In the VAT plan, be sure to record:

- the procedure for maintaining separate records of transactions subject to and non-taxable with VAT - without this you do not have the right to claim VAT for deduction;

- a list of goods and VAT on which is distributed by calculation method;

- criteria for classifying expenses as taxable and non-taxable activities;

- whether the 5% rule is used or not, which we described in detail in the article “5% VAT Rule in 2021”;

- application of VAT benefits;

- procedure for issuing invoices;

- description of synthetic and analytical VAT accounts;

- forms for VAT calculations;

- the procedure for storing tax documents, and so on.

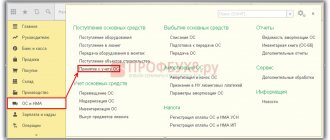

Classification of tax accounting registers for VAT

Mandatory documents that participate in the VAT tax accounting process are:

- Journal for recording invoices.

- Book of purchases.

- Sales book.

They accumulate data on changes in the tax base based on incoming documents and accounting calculations. Thanks to the clear structure of the information stored in them, it is subsequently much easier to draw up a declaration on their basis for the period. In particular, the documents provide for the grouping of facts of economic activity by their types: taxable, non-taxable, and subject to preferential interest.

In the book of purchases and sales, in addition to the registration data of invoices, the amount of tax allocated in them is also indicated. At the same time, they are combined according to the general procedure for collecting tax that applies to a particular transaction. The amounts calculated at the end of the period are the source for the subsequent final tax calculation. It turns out that the purchase book reflects the total amount of VAT to be deducted, and the sales book reflects the amount of tax to be accrued and paid.

The results of the received VAT from the purchase book must be reflected in the declaration in accordance with the provisions of paragraphs 2 and 7 of the rules approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. VAT refundable at all applicable rates is included in field 120 of the declaration put into effect by order of the Federal Tax Service of Russia dated 10/29/2014 No. MMB-7-3/ [email protected] The entire volume of transactions subject to taxation at a 0% rate is reflected in parts 4–6 of the declaration.

The general principles and requirements for maintaining books, both for purchases and sales, are approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. In addition, it states that these registers on paper must be bound and numbered.

How to calculate VAT payable

When selling goods or services, the company always indicates the price including VAT. This is VAT calculated on sales, that is, an “output” tax. But in order to produce goods or provide services, a company could purchase raw materials or pay for work, which was also charged to it with VAT. This is the “input” or “input” VAT paid by the organization or individual entrepreneur.

VAT is a value added tax. Therefore, we do not pay the full amount of “outgoing” tax to the budget, but reduce it by the amount of “incoming” tax. Here's a visual formula:

VAT payable = VAT on sales - “Input VAT” + VAT recovered

Important! VAT on sales may be less than the “input” tax. For example, when exporting goods. We described how to return overpaid tax from the budget in the article “VAT Refund for Legal Entities.”

Sometimes VAT needs to be restored. This means that you return the “input” VAT previously accepted for deduction to the budget. There are various reasons, for example, the right to deduction has disappeared.

We talked more about “input” and “output” VAT in our article.

Based on the formula, tax accounting in a company should be structured in such a way as to record the amounts of “incoming”, “outgoing” and “recovered” VAT.

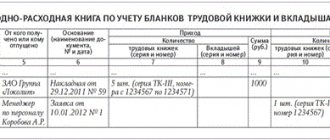

Requirements for registering received and issued invoices

The question of how to create and maintain a journal of incoming/outgoing invoices is also answered in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. For each flow of documents, the book has a separate section, that is, only issued invoices are recorded in one part - invoices, in the other - received from counterparties. The key requirements for its design are as follows:

- Mandatory presence of fields for recording intermediary transactions.

- Availability of a method and place on the form for registering adjusted (corrected) invoices.

- Since January 2015, when concluding an agency agreement or performing the functions of a developer, only invoices for intermediary transactions should be included in the journal. This obligation is assigned both to companies paying VAT and to companies exempt from this on the basis of clause 3.1 of Art. 169 NK.

It is possible to create a magazine on paper and in digital format.

How to keep tax records of sales with VAT

When selling goods or services, you can use different VAT rates: 0%, 10% or 20%. Tax accounting should be structured so that amounts at different rates are taken into account in different analytical accounts.

When selling, you need to issue an invoice with a highlighted rate and VAT amount. Then register it in the sales book. If a company is exempt from paying VAT on the basis of Art. 145 of the Tax Code of the Russian Federation, then issue an invoice without VAT, but record it in the sales book. But if you issue an invoice for a transaction that is exempt from VAT on the basis of Art. 149 of the Tax Code of the Russian Federation, there is no need to register it in the sales book.

To maintain reliable tax records, it is important to follow three rules:

- prices in documents must correspond to market prices;

- the place of sale of goods and services is Russia;

- VAT is charged at the time of shipment or at the time of receipt of the advance payment, whichever comes first.

Conditions for correct compilation of a purchase book

By virtue of clause 3 of Art. 169 of the Tax Code of the Russian Federation, a purchase book must be compiled by all companies purchasing goods, work or services and being VAT payers by law. The basic principles of book design are enshrined in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, which also gives permission for its design in electronic or paper form.

Among the recently emerging responsibilities of the payer related to the accounting register described, the following can be distinguished:

- Entering data on documents for payment of input tax.

- Availability of information on agency agreements in the book.

- Reflection of the assessment of transactions performed in foreign currency.

Currently, the book does not have columns that allow you to separately record the fact of acquisition and the amount of tax at various rates, as well as those exempt from taxation.

The debate about whether or not it is possible to include data in the ledger based on copies of invoices without obtaining the original version is still ongoing. Given the stable position of the Federal Tax Service, which denies any possibility of this, the judicial authorities are not so categorical. In a situation where the counterparty somehow receives the original invoice, the application of a deduction based on a copy may be considered legal. As an example, we can cite the resolution of the Federal Antimonopoly Service of the Moscow District dated 06/05/2014 No. F05-4685/2014.

How to keep tax records of purchases with VAT

When purchasing goods subject to VAT, the supplier will issue you invoices. They must be immediately registered in the purchase book. In this case, it is necessary to keep separate records of “input” VAT for taxable and non-taxable transactions. VAT on transactions involved in taxable activities is recorded on account 19.

In addition, in order to accept VAT as a deduction, it is necessary to ensure compliance with the following conditions:

- you have a properly executed invoice from the supplier;

- the receipt is involved in transactions subject to VAT;

- VAT is transferred to the supplier;

- the received inventory items are capitalized in accounting.

Basic provisions for maintaining a sales book

Issued invoices, including corrected ones, according to Decree of the Government of the Russian Federation No. 1137, must be reflected in the sales book. The same regulatory document regulates the basic rules for its maintenance, and also contains an approved form as an appendix. The digital option for creating a sales book is established in the Federal Tax Service order dated 03/05/2012 No. MMB-7-6/ [email protected]

At the moment, there are a number of features in the preparation of this document that you should pay attention to first:

- Entering the number and date of the document for the transfer of funds.

- The need for a separate indication of intermediary operations.

- Availability of fields for entering currency valuation of transactions.

- When recording an adjustment invoice, it is not the total amount of tax that is indicated, but only the size of the discrepancy with the original version, both upward and downward.

The sales book is also subject to a provision according to which it is prepared not only by companies paying VAT, but also by companies exempt from it. In the situations described in paragraphs 1–5 of Art. 161 of the Tax Code of the Russian Federation, entrepreneurs performing intermediary operations must also maintain the described register, while they may not have the obligation to pay VAT.

A rather interesting situation has developed around the sale of property of insolvent companies. The objects of sale themselves are not subject to tax, but buyers in such transactions act as intermediaries, and therefore they must transfer VAT, albeit to the former owner of the property. This position is set out in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated January 25, 2013 No. 11.

For the procedure for making adjustments to the book, the time to detect inaccuracies and errors is of paramount importance. So, if the need to change data arose before the end of the reporting period, the incorrect ledger line is reversed, recorded with a negative value, and the correct data is entered instead below it. If the period is closed, it is necessary to use special additional pages for correction, which are added to the part of the book related to the time period when the error was made.

The totals of columns 14–19 from the sales book serve as the basis for filling out the VAT return; until 01/01/2014, columns 4 to 9 performed the same function.

Who is the VAT payer?

Most companies and entrepreneurs pay VAT. But there are categories of persons who are exempt from paying this tax:

- Organizations and individual entrepreneurs whose revenue from the sale of goods and services over the last 3 months did not exceed 2 million rubles. They can submit an application to the Federal Tax Service for exemption from VAT.

- Organizations and individual entrepreneurs using special tax regimes, for example, simplified tax system, PSN, unified agricultural tax or tax on professional income.

- Organizations and individual entrepreneurs that meet the requirements of Art. 145 Tax Code of the Russian Federation;

- Organizations and individual entrepreneurs participating in innovation.

At the same time, payers are divided into “internal” - those who pay VAT on the sale of goods, work and - those who pay VAT on the import of goods and services from abroad.

Important! Even exempt companies will have to pay VAT if they issued an invoice with the allocated VAT amount.

Results

Despite the lack of a uniform concept of tax registers in the code, Art. 120 mentions the possibility of applying punishment to the payer in the complete absence of their knowledge. Based on a comprehensive assessment of Art. 169, 313 and 314 of the Tax Code of the Russian Federation in conjunction with Art. 10 of the Federal Law “On Accounting”, it is possible to formulate a list of rules on the basis of which accounting processes in the accounting and tax spheres should be built.

When the existing system of analytical accounts allows you to fully obtain data for tax calculations, there is no need to enter any additional forms: tax accounting will be built on the basis of existing data. It is also possible to enter auxiliary fields into standard forms in order to correctly calculate the tax base.

It is very important to consolidate the list of used registers in the company’s accounting policies, since this can become a decisive argument in a legal dispute. This is due to the fact that inspectorates do not have the right to insist on providing those tax forms that are not enshrined in company policy.

Specifying the topic of tax registers for VAT and being guided by the text of Art. 169 of the Tax Code of the Russian Federation, which states that these are the final forms for registering and grouping primary data, the following options for their practical implementation can be distinguished:

- Journal for recording invoices.

- Book of purchases.

- Sales book.

The entire set of rules, application forms and instructions for preparing these documents are approved in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. Using the information provided therein, the taxpayer has every opportunity to correctly fill out and make the necessary corrections to these documents. It is worth noting that the taxpayer himself is interested in the correct maintenance of registers, since they significantly simplify the process of preparing a VAT return.

Similar articles

- List of accounting registers

- Tax accounting registers: what are they and how to prepare them correctly

- Tax register for 6-NDFL sample

- Development of tax registers for income tax

- Rules for filling out tax accounting registers

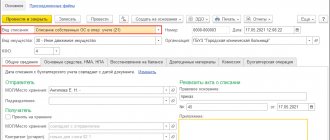

How to account for VAT on advances

An advance is money that you have transferred to a supplier as payment for a future delivery or that you have received from a buyer for an upcoming delivery. For any of these transactions, an invoice must be issued within 5 days.

We record the generated invoice in the purchase or sales book. In this case, “input” or “output” VAT is formed: the tax accepted for deduction will need to be restored after the fact of shipment. Read more in our article “How to recover VAT from advances issued.”

Account for VAT on advances in separate subaccounts of accounting. For advances from customers, open a subaccount to account 62, and for advances to suppliers - to account 60.

Here is an example of the entries that need to be made when receiving an advance from a buyer.

| Debit | Credit | Description |

| 51 | 62.2 | Advance payment received from buyer |

| 76.AB | 68.2 | VAT charged on advance payment |

| 62.1 | 90.1 | Goods sold to the buyer |

| 90.3 | 68.1 | VAT charged on the shipment amount |

| 62.2 | 62.1 | The previously received advance payment from the buyer was offset against payment for shipment. |

| 68.2 | 76.AB | Recovered VAT from advance payment |