Filling out part 2 of form 6-NDFL still causes difficulties for users. Tax Accounting Register and specialized reports for Personal Income Tax cannot always help in finding errors, since not all the data stored in the Register of Taxpayer Calculations with the Budget for Personal Income Tax .

After reading this article, you:

- learn how to use the Universal Report to check the correctness of filling out Part 2 of Form 6-NDFL and determine what actions need to be taken so that the data in the report is reflected correctly;

- receive a link to the ready-made setup Checking the completion of Part 2 of 6-NDFL for use in your program.

Possible errors when calculating personal income tax in the 1C 8.2 ZUP 2.5 program

Let's look at ZUP 2.5 in the 1C program using the example of the “Vacation” document. Vacation pay was accrued, which was initially planned to be paid on 01/29/2016. In fact, payment is made on 01/28/2016. Therefore, we change the date of payment of income in the vacation accrual document to 01/28/2016. This date falls into the income register.

The tax accounting register 1C 8.2 includes the date from the personal income tax tabular section, which we see on the “Payment” tab of the document “Accrual of vacation for employees of organizations.” The date here has not changed, but remains 01/29/2016.

In order for this date to also change, we need to either recalculate the document completely or recalculate only the personal income tax. If recalculation is undesirable or impossible for some reason, the date can be adjusted manually.

Let's simulate a situation where we have a discrepancy in the dates of receipt of income and post the document. Now we will show what mistakes this is fraught with in the future.

We look at the registers to see if there is a discrepancy. Our income register includes the date 01/28/2016.

It was entered into the tax register on 01/29/2016.

Then we pay vacation pay. We submit the document for payment. We look at its movement through the tax accounting register, which records the actual tax withheld. The date of receipt of income is recorded here as 01/29/2016 from the tax register.

In form 6-NDFL, this situation will look like this: the date of actual receipt of income (line 100) is 01/29/2016, and the date of tax withholding (line 110) is 01/28/2016. It turned out that we withheld the tax earlier than accrued income, whereas for income in the form of vacation payments, these two dates (the date of receipt of income and the date of tax withholding) must coincide.

But that's not all! When calculating salaries, the 1C program tries to correct personal income tax and bring it into compliance. Therefore, it reverses the tax from the date of receipt of income on January 29, 2016 and charges the same amount as of January 28, 2016.

Further, when paying wages, the withheld tax is recorded in exactly the same way. One line in the personal income tax with a “minus” from 01/29/2016, and the second line with a “plus” from 01/28/2016.

In 6-NDFL, two more groups of lines are added from 100 to 140. In one, everything is reversed, and in the other, everything is accrued anew.

To prevent this situation from arising, carefully monitor the date of receipt of income, which will be recorded in the Income Register, and the date of receipt of income, which will be recorded in the Tax Register. They must match.

Elimination of errors in the 6-NDFL report

Calculation of 6-NDFL is a mandatory type of declaration that all legal entities must submit. Errors in this report may result in severe financial penalties. However, no one is immune from mistakes; misfires occur in the work of even an experienced accountant. In this article we will look at how to eliminate errors in the 6-NDFL report.

In order to find errors in the 6-NDFL report as quickly and easily as possible, we need to resort to using the “Checking Section 2 “6-NDFL”” report.

To fill out 6-NDFL, the key point is the tax payment deadline. Only based on it, the program either fills in information for the current quarter or not.

At an enterprise, in addition to working employees, there are also those who are on vacation, on sick leave, receiving financial assistance, etc. For all these accruals, tax payment deadlines vary.

Let's understand it with an example. In June, the employee was on sick leave. We decide to pay the sick leave along with the salary (which was accrued on June 30, 2018) on the fifth day of the next month (Fig. 1).

When creating a statement to a bank or cash desk, be sure to check the method of payment of wages in the employee’s card - it may differ. Click the “Pay” button – “Monthly salary” to fill out the document (Fig. 2, 3).

The date of creation of the statement must be identical to that indicated in the intersettlement documents (if the amounts for them are paid along with the salary). Personal income tax for transfer is filled in automatically.

In July, we will also accrue temporary disability benefits to the employee, but we will pay it in the same month (unlike the previous option) (Fig. 4).

We send another employee on vacation for 14 calendar days (Fig. 5).

We will create a separate statement for the cash register for him, with the type of payment “Vacation” (Fig. 6).

And in August we will accrue financial assistance to the employee in connection with the birth of a child, which will be paid in September (Fig. 7).

Of course, we will fill out the document “Calculation of salaries and contributions” for employees every month.

Let’s move on to the report “Check of Section 2 “6-NDFL””. We turn on the extended version of the report and go to the “Structure” tab (Fig. 8).

We add two additional fields “Document basis” and “Registrar”, check the box “By employee”. Please note how the report columns are named: “Date of receipt of income”, “Term of transfer”, “Date of tax withholding”, “Withheld”, “Amount of income received” (Fig. 9).

This table truly contains all the necessary details for verification. This report is also convenient because you can open and edit documents from it.

- The first accrual in our example is vacation pay, which was paid on July 4 (Fig. 10).

According to this type of accrual, the date of receipt of income is equal to the date of payment. The deadline for transferring personal income tax on vacation is the end of the month in which it was paid (which means it is 07/31/18). The date of tax withholding for all types of accruals is indicated by the date of creation of the payment statement.

- Further on the report we see the salary calculation for June (Fig. 11).

The June document comes up later than the July one, because it was paid later - on the fifth of July. Please note that in the “Tax payment deadline” column the day following the payment date is indicated, and in the “Date of receipt of income” column – the end of the month.

- Let's check the dates of sick leave accrued in June, but paid on July 5 (Fig. 12).

The deadline for transferring tax for temporary disability benefits is the last day of the month in which it was paid (identical to vacations).

- Sick leave with accrued and paid funds on July 31 (Fig. 13).

All three dates (date of receipt of income, date of tax withholding, deadline for transferring tax) will be equal!

- It remains to deal with the financial assistance to the employee, which was accrued in August and paid on September 5 (Fig. 14).

This accrual is recognized as another type of income, which means the transfer period for it is the day following the payment date. According to the conditions of our example, this is the sixth of September. Of course, if this day were a day off, it would be moved to the first working day.

- If we check the accrued wages for August in the report, we will not see the withheld personal income tax (Fig. 15).

This is incorrect, because the salary was paid, the statement was entered into the program. Let’s open it and see that in the column “Personal income tax to be transferred” the amounts are not indicated (Fig. 16).

Error. Click “Update Tax”. Let's repost the document and reformat the report. Personal income tax is withheld.

Now you need to check the completion of the second section of the “6-NDFL” report (Fig. 17, 18).

Everything is filled out in accordance with our data on the verification report.

In this article, we looked at how to eliminate errors in the 6-NDFL report. We hope you found our material useful. If you have any other questions about 1C, you can contact our dedicated 1C Consultation Line. We work 7 days a week from 9:00 to 21:00. We process more than 5 thousand requests per month. The first consultation is completely free!

Possible errors when calculating personal income tax in the 1C 8.3 ZUP 3.0 program.

In the 1C ZUP 3.0 program, the date of receipt of income is also taken into account in two registers: the Income Accounting Register and the Tax Accounting Register. For example, consider the document “Vacation”. The Income Accounting Register contains the date of payment from the main form of the document.

And in the Tax Registration Register - the date from the form “More details about the calculation of personal income tax”.

These two dates must match. But if we change the date in the main form of the document, the date automatically changes in the “More details about personal income tax calculation” form. It’s easier here, the ZUP 3.0 program. she guarantees us that these dates will coincide.

The only thing is that in the current release of the 1C program there is an error for the “Sick Leave” document. If it is paid with a salary, and we change the date of payment, then in this case the date of receipt of income in the form “More details about calculating personal income tax” does not itself change.

Here you need to recalculate, or change the date in the “More details about personal income tax calculation” form manually.

For all other cases, the personal income tax accounting date should change automatically upon the payment date. But just in case, check this moment, make sure the dates match.

Failure to comply with the explanations of the Federal Tax Service when filling out 6-NDFL

Often, in line 070 “Amount of withheld tax” of section 1 of the calculation, accountants reflect the amount of tax that will be withheld only in the next reporting period (for example, wages for March were paid in April, wages for June were paid in July, etc.). Meanwhile, the Federal Tax Service has explained more than once: if a salary that relates to one quarter is paid in the next, then “0” is entered in line 070 for the corresponding period. (See, for example, letters of the Federal Tax Service of Russia dated 01.08.16 No. BS-4-11/ [email protected] , dated 01.07.16 No. BS-4-11/ [email protected] - “After payment of wages for the previous period and, Accordingly, there is no need to submit an updated calculation of 6-NDFL with completed line 070").

In addition, tax agents often make mistakes when reflecting sick leave benefits in section 1 of the 6-NDFL calculation. Federal Tax Service specialists remind that if a benefit relates to one reporting period (for example, a benefit for sick days in September), and is paid in another (for example, in October), then the amount of accrued income must be reflected in the period of payment of such benefit, and not in the period accruals. Also see “The Federal Tax Service reminded how to fill out 6-NDFL if the accrual and payment of sick leave benefits occur in different periods.”

Some accountants in line 100 “Date of actual receipt of income” mistakenly indicate the date of salary transfer, while the date of actual receipt of income in the form of wages is recognized as the last day of the month for which the taxpayer was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation) .

Possible errors when calculating personal income tax in the 1C 8.3 Accounting 3.0 program

As for the 1C Accounting 3.0 program, there are also two inter-account documents “Sick Leave” and “Vacation”. There is also a payment date here, and if this date changes, everything changes automatically. The date of receipt of income for personal income tax also changes automatically. But, just in case, check.

Possible errors when calculating personal income tax

Also, when calculating personal income tax, we must pay attention to the tax accrual date. This is relevant for programs of the third version. The tax accrual date must be strictly before the tax withholding date. If at the time of withholding the tax, the tax itself has not been accrued, then, in fact, there is nothing to withhold.

Important! Track in the 1C program: the dates of intersettlement documents are the date of tax accrual; if at the time of payment the tax is not accrued, it will not be withheld.

This is especially true for non-salary income, since the date of the document is fixed as the tax accrual date. Thus, in the third version, the date of the “Vacation” document, the date of the “Sick Leave” document and other documents are also important.

What went wrong?

1C, like any program, has a certain data generation algorithm. Within the framework of personal income tax, it is based on salary payments twice a month and the generation of documents in the following order:

1. Statement for advance payment

2. Advance payment

3. Payroll

4. Statement for payment

5. Payment of wages

6. Payment of personal income tax

If the order of documents was different, or the employee was given not only a salary, but also sick leave, vacation or bonus, then personal income tax may be incorrectly distributed among employees when generating documents: “Payment Statement” and “Write-off from the current account” (payment of personal income tax). So the accountant can see zeros in the statement.

This leads to incorrect completion of the 6-NDFL report.

Possible errors in interpayment documents using the example of 1C 8.3 ZUP 3.0

Using the example of the 1C ZUP 3.0 program in the “Vacation” document, the planned payment date is 01/28/2016, but we will set the document date to 01/30/2016, that is, later than the planned payment date. Let's see it through.

Our Tax Registration Register entry was created as of January 30, 2016.

If we pay vacation pay earlier than the document date - January 28, 2016, as planned, we fill out the statement, we see that the withheld personal income tax is not filled out. As of January 28, 2016, there is no calculated tax. Accordingly, when conducting such a statement, personal income tax withheld is not registered.

If everything is fine with the document date and it is earlier than the planned payment date:

Then when you fill out the form, everything will be fine, the tax will be determined. When conducting the Statement, it is recorded as withheld tax.

Possible errors in interpayment documents using the example of 1C Accounting 3.0

In the 1C Accounting 3.0 program everything is the same. The date of the document is important. Let's look at the example of the “Vacation” document. The planned payment date is 01/28/2016, and we will deliberately set the date of the document later, for example, 01/30/2016. We will post the document.

The calculated tax was registered as of 01/30/2016.

After the payment is made, and not in the Statement, namely the “Cash Withdrawal” payment or debiting from the current account earlier than the date of the “Vacation” document, the withheld tax is not registered, is not determined and is not recorded in the Register.

Therefore, the date of the document is important; if we set it to 01/28/2016 and reschedule the cash issuance, then a record for the withheld personal income tax has been created, everything has been included in the Register and will then be included in form 6-NDFL.

Be careful ! In the 1C Accounting 3.0 program, this is especially important, because the personal income tax withheld is not displayed in the Sheet, that is, we do not observe or see errors in the on-screen form itself. But if you look at the Register, you can track such a moment. Therefore, in the 1C Accounting 3.0 program, when paying salaries, look and check how the personal income tax withheld was recorded, see the movement in the Register “Calculations of taxpayers with the budget for personal income tax.”

Setting up a Universal Report

The universal report in the program is located in the Reports - Standard reports - Universal report section.

Filling out the report header

In the header of the report please indicate:

- Period —the period for compiling the report;

- Accumulation register - type of data source;

- Taxpayers' settlements with the budget for personal income tax - the name of the register in which the data of taxpayers' settlements for personal income tax is stored;

- Basic data - register data Calculations of taxpayers with the budget for personal income tax .

Setting up the report

Open the report settings using the Settings . Select View - Advanced .

The extended report view allows you to work with special tabs:

- Selections;

- Fields and sorting;

- Decor;

- Structure.

This helps you customize the report as flexibly as possible to suit your conditions.

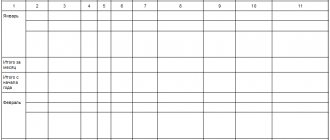

For the report Checking the completion of Part 2 6-NDFL, fill in the tabs:

- Selections;

- Fields and sorting;

- Structure.

Tackles tab

On the Screenings Add screening button to indicate the period of income generation, for example, for 1 quarter. 2021:

- 1st line: Field - Date of receipt of income , Condition - Greater than or equal to , Value - 01/01/2019 .

- Field - Date of receipt of income , Condition - Less than , Value - 04/01/2019 .

- Field - Payment deadline , Condition - Not equal , Value - not filled in.

Click the Show and select the Show In report header .

Qualifications tab looks like this:

If the database keeps records for several organizations, you can add a 4th selection line:

- Field - Organization , Condition - Equal to , Value - organization for which the data is being checked. PDF

Fields and sorting tab

On the Fields and Sorting , in addition to the default indicators, use the Add to set the following indicators:

- Registrar;

- Take into account paid income in 6-NDFL;

- Transfer deadline;

- Payment deadline;

- Amount of income paid.

Use the up and down arrows to arrange the fields in order. For a more compact report form, leave the checkboxes only on the following indicators:

- Type of income;

- Resident tax rate;

- Registrar;

- Take into account paid income in 6-NDFL;

- Transfer deadline;

- Payment deadline;

- Amount of income paid;

- Sum.

In the Sorting Add button to specify the data ordering system in the report:

- Date of receipt of income - Ascending ;

- Individual - Ascending . _

Structure tab

The initial report structure contains only detailed records. To build your own report structure, remove the default setting by clicking the Delete .

Click the Add to set the fields to be grouped, as shown in the figure.

Possible errors in interpayment documents using the example of 1C 8.2 ZUP 2.5

As for the 1C ZUP 2.5 program, in the current release the date of the document, for example, “Vacation”, does not in any way affect the calculation of withheld personal income tax. For example, let’s take a vacation accrual with a planned payment date of 01/28/2016 and change the document date to 01/30/2016. After that, we will repost the Salary Payment Sheet. Let's see the movement according to the Registers.

The program 1C ZUP 2.5 personal income tax withheld saw and registered it. Therefore, document dates are not so important here.

But such a mechanism, when the program tries to withhold everything accrued as of the end of the month, which is used in the 1C 8.2 ZUP 2.5 program, has its drawbacks and leads to other problems, which we will consider in the next question, when we talk about personal income tax withheld.

Give your rating to this article: (

3 ratings, average: 4.67 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Generating a report

By clicking the Generate , the report will be built according to the form specified by the settings.

This is the most detailed report for checking the 2nd part of form 6-NDFL:

- line 100 - column Date of receipt of income ;

- line 110 - date of the Recorder ;

- line 120 - column Deadline for payment ;

- line 130 - the sum of the data in the column Amount of income paid ;

Unfortunately, the program does not automatically summarize the amount of paid income. You can get the total amount by holding down the CTRL and using the mouse to mark the required report amounts. Or, click on the first amount, press the SHIFT and select the last amount - the total will appear in the ∑ of the report. PDF

- line 140 - personal income tax amount .

As can be seen from the report:

- the amount of vacation pay paid to S.B. Petrova is not shown. because of the column:

- Take into account paid income in 6- NDFL

- No. Cancel posting of the holiday pay document to S.B. Petrova in order to delete the current entry in the register. If you do not cancel the posting, the data may not be updated the next time the document is posted. After canceling the posting, post the document again and check using the Dt/Kt that the column value is:

Take into account paid income in 6-NDFL - Yes . PDF

- Deadline for payment of personal income tax Kalinina S.V. — 04/01/2019, since 03/31/2019 is a non-working day. PDF This data will already be included in Form 6-NDFL for the first half of 2021.

After correcting the data according to Petrova S.B. generate a report in the Universal report .

Section 2 of form 6-NDFL is now filled out correctly. PDF

Based on the data in the reviewed report, it is easy to find the reason why personal income tax is filled out incorrectly in section 2 of form 6-NDFL, and determine what needs to be done to correct the situation.

To avoid having to configure the report again each time, BukhExpert8 advises saving the settings in 1C by clicking the Save report option .

After entering the name of the setting, for example, Checking the completion of Part 2 of 6-NDFL , you do not have to set up the report again each time. Select settings button to access the saved setting.

Settings can be downloaded or sent by mail. More details:

- How to send settings by email

- How to upload and download settings

The Universal report settings can be downloaded to other computers and databases by clicking MORE - Other - Change report option. To do this, in the settings form that opens, select the Load settings : the MORE button - Load settings.

See also:

- Accountant Assistant - Universal Report

- Register Calculations of taxpayers with the budget for personal income tax

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- A universal report for checking labor costs in the income and expense ledger. The income and expense ledger is an important tax register used...

- A universal report for checking the cost of goods sold in the book of income and expenses When working on the simplified tax system, it is not always clear why some expenses...

- A universal report for checking the payment of wages. There are often situations when an accountant, having made adjustments to the payment of wages...

- Universal report for checking inclusion in expenses under the simplified tax system. Is a universal report suitable for checking inclusion in expenses for...