“Simplified” offers a choice of two options for the object of taxation: “income minus expenses” (USN 15%) and “income” (USN 6%). If, under the “income-expenditure” simplified tax system, the taxpayer needs to not only confirm, but also justify his expenses, then expenses under the simplified tax system of 6% are not taken into account. However, some types of expenses can reduce the amount of tax even with the “income” simplification. In this article we will look at what these expenses are and how they should be taken into account by those who apply the simplified tax system “by income”.

What expenses are taken into account under the simplified tax system of 6%

The tax base of organizations and individual entrepreneurs under the “income” simplified tax system recognizes their income in monetary terms, and the expenses incurred are not taken into account (clause 1 of article 346.18 of the Tax Code of the Russian Federation). But to say that under the simplified tax system for “income” absolutely all costs are not taken into account would be wrong.

So what expenses should be taken into account at the simplified tax rate of 6%? This is stated in paragraph 3.1 of Art. 346.21 of the Tax Code of the Russian Federation - taxes or advances calculated for a quarter, half a year, 9 months and a year can be reduced by the following amounts of expenses:

- insurance premiums (including “for injuries”) transferred from employee benefits,

- sick leave paid by the employer, except for payments related to occupational diseases and accidents,

- contributions under voluntary personal insurance contracts for employees in case of illness.

The listed expenses, which reduce the amount of tax simplified tax system 6%, can reduce the amount of tax or advance payment by no more than 50%. For example, if the tax is calculated in the amount of 2,000 rubles, and the expenses reducing it amounted to 3,000 rubles, then 1,000 rubles can be accepted as a tax reduction. (RUB 2,000 x 50%).

The tax on individual entrepreneur expenses is reduced somewhat differently under the simplified tax system of 6%: entrepreneurs who do not have employees can reduce the tax by the entire amount of fixed insurance premiums paid for themselves. Otherwise, the taxable expenses of an individual entrepreneur are similar to the expenses of an LLC using the simplified tax system of 6%.

It is important to take into account that insurance premiums can be accepted to reduce the “simplified” tax only in the quarter of their payment, and for what period they are accrued does not matter. Expenses accrued but not paid to the budget cannot be deducted.

In addition to the listed expenses, in the part calculated from the trading activities of the simplifier as “income”, the tax can be reduced due to the paid trade tax. Within 5 days from the moment such a taxable object arises, a notice of registration of the tax payer must be submitted to the Federal Tax Service (Clause 8 of Article 346.21 of the Tax Code of the Russian Federation).

Is it possible to include in tax expenses the costs of acquiring material assets by an accountable person on the basis of sales receipts in which a retail buyer or an individual is indicated as a buyer, or the buyer is not indicated at all?

Regardless of the taxation system used (General regime, Unified Agricultural Tax or simplified tax system), tax revenues can be reduced by appropriate expenses, provided that the requirements provided for in Art. 252 of the Tax Code of the Russian Federation, in particular, expenses must be confirmed:

— documents drawn up in accordance with the legislation of the Russian Federation;

— (or) documents drawn up in accordance with business customs applied in the foreign state in whose territory the expenses were incurred;

— (and/or) documents indirectly confirming expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Other requirements:

- expenses must be justified. These are understood as economically justified costs, the assessment of which is expressed in monetary form;

- expenses must be incurred to carry out activities aimed at generating income.

The Plenum of the Supreme Arbitration Court in paragraph 1 of Resolution No. 53 dated October 12, 2006 indicated: the submission by the taxpayer to the tax authority of documents executed properly in order to obtain a tax benefit is the basis for receiving it, except for the situation when the tax authority has proven that the information contained in these documents are incomplete, unreliable or contradictory.

By virtue of Part 1 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, each fact of economic life is subject to registration with a primary accounting document, which must contain the details listed in Part 2, namely:

- Title of the document;

— date of preparation of the document;

— name of the economic entity that compiled the document;

- content of the fact of economic life;

— the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

— the name of the position of the person who completed the transaction, operation and is responsible for its execution, or the name of the position of the person responsible for the execution of the accomplished event (this may be several persons);

— signatures of designated persons indicating their last names and initials or other details necessary for their identification.

As you can see, the name of the buyer is not a mandatory requisite of the primary accounting document, which is also recognized as a sales receipt issued accordingly. (Federal Law No. 402-FZ does not establish specific types of documents that can be used by economic entities as primary accounting documents to confirm the facts of economic life - Letter of the Ministry of Finance of the Russian Federation of 08.25.2017 No. 03-03-06/1/54769.) Therefore, the fact The fact that a retail buyer or an individual is indicated as a buyer in a sales receipt, or the buyer is not indicated at all, does not in itself prevent the inclusion of costs for the acquisition of material assets by an accountable person in tax expenses.

Confirmation of this can be found in arbitration practice. For example, in the Resolution of the FAS VSO dated January 28, 2013 in case No. A78-3770/2012, the following conclusion was made:

The current legislation does not contain special rules for filling out sales receipts. To accept them for accounting, it is necessary that the checks have mandatory details, including the “Name of the buyer” detail. If the required details are available, the sales receipt meets the requirements of the law and performs the functions of a primary accounting document, which means it confirms the expenses of an individual entrepreneur. Thus, the absence of information about the buyer in the sales receipt or the indication of the buyer as a private individual is not grounds for refusal to accept data from primary accounting documents for accounting. The judges also took into account that the list of goods purchased by an individual entrepreneur according to sales receipts, cash receipts, and receipts does not exclude the use of goods by the entrepreneur in production activities. The tax inspectorate did not document this conclusion. The fact of the use of purchased goods in the entrepreneurial activity of an individual entrepreneur was not assessed by the tax inspector.

Therefore, tax expenses can include the costs of acquiring material assets by an accountable person on the basis of sales receipts, in which a retail buyer or an individual is indicated as a buyer, or the buyer is not indicated at all. The main thing is that the sales receipt contains the required details, and the expenses incurred are justified and carried out within the framework of business activities.

Accounting for expenses under the simplified tax system “income” 6%

“Simplified” people are required to keep tax records in the Income and Expense Accounting Book (KUDiR). Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n approved the form and procedure for filling it out.

It depends on the applied taxation object which sections of the KUDiR should be filled out:

- With a simplified tax system of 15%, all sections of the Book are filled out, except for Section IV.

- In the Book of Income and Expenses under the simplified tax system of 6%, Section I in terms of income and Section IV, intended to reflect insurance premiums, hospital benefits and contributions under personal insurance contracts, are filled out, in accordance with clause 3.1 of Art. 346.21 Tax Code of the Russian Federation. Column 5 of Section I also indicates expenses stipulated by the conditions for receiving budget funds to assist unemployed citizens, and expenses from subsidies received from the state for small businesses. You can enter into KUDiR other expenses that do not affect the calculation of tax, with a simplified tax system of 6 percent (accounting for supplier expenses, for example), at your own discretion.

Answer

As an individual, an individual entrepreneur can have a bank account for making personal payments, as well as for receiving and spending funds from business activities. However, it is essentially impossible to use a personal account for business purposes.

But, based on the explanations of officials, we can indirectly conclude that businessmen have the right to use current accounts and personal bank cards in business activities.

An individual entrepreneur can receive documents in the name of an individual. Such expenses can be accepted as expenses, but provided that there is evidence of a direct connection between these expenses and income from business activities.

Does the tax office check tax expenses under the simplified tax system of 6%?

If a simplifier on the simplified tax system of 6% fills out not only the income, but also all the expense sections of the KUDiR, in the event of an audit, tax inspectors will be interested only in income and expenses, on which the amount of tax depends. The Federal Tax Service does not check the remaining expenses of the taxpayer on the simplified tax system for “income”, because they still do not affect the tax base.

Is it necessary to confirm expenses with the simplified tax system of 6%? For expenses that are not important for calculating tax, confirmation is not required (letter of the Ministry of Finance of the Russian Federation dated June 16, 2010 No. 03-11-11/169). As for expenses that reduce tax under the simplified tax system, according to clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation (insurance contributions, sick leave, contributions under personal insurance contracts), then their confirmation is necessary.

So, with a simplified tax system of 6 percent, it is necessary to keep track of expenses in that part of the expenses that affects the tax base. Such expenses are recorded in KUDiR; they must be confirmed and justified.

Registration

In practice, a situation is possible when an individual, before registering him as an individual entrepreneur with the object of taxation “income minus expenses,” incurred expenses related to future business activities. Can they be taken into account when calculating the single tax?

Let's turn to Article 252 of the Tax Code. Paragraph 1 of this article states: expenses must be justified and documented. “Simplers” must comply with these criteria, as stated in paragraph 2 of Article 346.16 of the Tax Code. At the same time, the procedure for accounting for expenses incurred by an entrepreneur on the simplified tax system before his state registration as an individual entrepreneur is not defined by the norms of Chapter 26.2 of the Tax Code.

The Ministry of Finance believes that if an individual incurs expenses before registering as an entrepreneur, then they cannot in any way be related to conducting business activities. Therefore, such expenses cannot be taken into account for tax purposes (letter of the Ministry of Finance of the Russian Federation dated April 10, 2013 No. 03-11-11/142).

In the mentioned letter, financiers examined a situation where a citizen, not yet an entrepreneur, bought a plot of land and building materials for their further use in business. According to officials, the cost of land and building materials cannot be written off as “simplified” expenses. And the fact that the property was intended for business activities does not play any role.

However, in arbitration practice there are decisions in which the courts recognize the right of entrepreneurs to take into account expenses incurred before their state registration as an individual entrepreneur. For example, in the resolution of the Federal Antimonopoly Service of the West Siberian District dated January 25, 2010 in case No. A45-13717/2009, the judges indicated the following. The fact that a businessman uses property acquired at his own expense before starting business activities “does not contradict the current legislation on taxes and fees and cannot deprive the entrepreneur of the right to include controversial costs as expenses associated with the extraction of income, which is subject to taxation in the prescribed manner.” .

But given that controllers have a different opinion on this issue, the legality of writing off such expenses for tax purposes will have to be defended in court.

Officials do not allow expenses for the purchase of a car made before the registration of the entrepreneur to be taken into account in the simplified taxation system. Despite the fact that the machine is used in business activities. And there is no prohibition regarding the cost of maintaining a car. They can be taken into account as part of simplified taxation system expenses, since the car is used in business (letter of the Ministry of Finance of Russia dated February 8, 2021 No. 03-11-11/7503).

Features of accepting expenses in the simplified tax system: accounting, auditing and legal services

Yuri Podporin , Deputy Head of the Special Tax Regimes Department of the Tax, Customs and Tariff Policy Department of the Russian Ministry of Finance, to consider the most controversial situations when preparing reports under the simplified tax system.

.

— Can individual entrepreneurs applying the simplified tax system with the object of taxation in the form of income reduced by the amount of expenses take accounting services into account as expenses? If so, what specific services are we talking about here (accounting, tax accounting, preparation and submission of reports, personnel records management, payroll and taxes, current account maintenance, cash transactions, etc.)?

— In accordance with sub. 15 clause 1 art. 346.16 of the Tax Code of the Russian Federation, when determining the tax base for taxes paid in connection with the application of the simplified tax system, taxpayers, including individual entrepreneurs, can take into account the costs of accounting, auditing and legal services.

It should be borne in mind that, according to paragraph 2 of Art. 4 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, citizens carrying out entrepreneurial activities without forming a legal entity keep records of income and expenses in the manner established by the tax legislation of the Russian Federation.

In addition, clause 3 of the said article of Federal Law No. 129-FZ establishes that organizations and individual entrepreneurs using the simplified taxation system keep records of income and expenses in the manner established by Chapter 26.2 of the Tax Code of the Russian Federation.

In this regard, an individual entrepreneur applying the simplified tax system, on the basis of sub-clause. 15 clause 1 art. 346.16 of the Tax Code of the Russian Federation may take into account the costs of maintaining tax records, preparing tax reports, calculating wages, maintaining a current account, conducting cash transactions, etc.

If an individual entrepreneur, in addition to tax accounting, maintains accounting records, then the costs of maintaining them can also be taken into account for tax purposes.

— Once upon a time, in a letter from the Department of Tax Administration for Moscow dated December 22, 2003 No. 27-08/70659, it was stated that the inclusion in the costs of individual entrepreneurs of the costs of paying for the services of an accountant who maintains tax records for this category of taxpayers is unlawful. Is it so? Indeed, according to this position of the tax authority, it turns out that individual entrepreneurs do not have the right to hire accountants.

— No, this position of the tax inspectorate is illegal. Provisions sub. 15 clause 1 art. 346.16 of the Tax Code of the Russian Federation applies to both organizations and individual entrepreneurs using the simplified tax system. Therefore, when determining the tax base, individual entrepreneurs can take into account the costs of paying for the services of an accountant who maintains tax records for this category of taxpayers.

— For what cost items can an individual entrepreneur applying the simplified tax system with the object of taxation “income minus expenses” take into account expenses associated with the payment of funds to an audit firm for tax consulting, establishment, restoration and maintenance of tax records, preparation of tax calculations and declarations?

— These expenses can be taken into account by an individual entrepreneur applying the simplified tax system on the basis of subclause. 15 clause 1 art. 346.16 Tax Code of the Russian Federation.

In accordance with paragraph 2 of Art. 1 of the Federal Law of December 30, 2008 No. 307-FZ “On Auditing Activities” (hereinafter referred to as Law No. 307-FZ), auditing activities (audit services) mean the activities of conducting an audit and providing services related to the audit, carried out by audit organizations and individual auditors.

The list of audit-related services is established by federal auditing standards (clause 4 of article 1 of the said federal law).

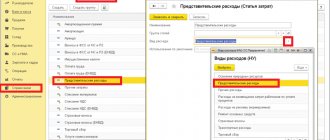

According to clause 4 of the Federal Rules (Standards) of Auditing, approved by Decree of the Government of Russia dated September 23, 2002 No. 696 (Rule (Standard) No. 24), audit-related services include:

- services for tax consulting, automation of accounting and implementation of information technologies;

- services for assessing the value of property, assessing enterprises as property complexes, assessing business risks, conducting marketing research;

- services for training specialists in areas related to auditing, conducting research and experimental work in areas related to auditing, and disseminating their results;

- services for establishing, restoring and maintaining accounting records, preparing financial (accounting) statements, accounting consulting;

- services for analyzing the financial and economic activities of organizations and individual entrepreneurs;

- economic and financial consulting services;

- management consulting services;

- legal consulting services, representation in judicial and tax authorities in tax and customs disputes;

- services for the development and analysis of investment projects, as well as the preparation of business plans.

Main expenses requirements

Expenses accepted under the simplified tax system must meet the following criteria:

- They must be indicated in the list of the Tax Code of the Russian Federation. This list is closed and if the costs incurred are not on it, then income is not adjusted by their amount.

- The level of costs must be economically justified and aimed at making a profit.

- The expenses incurred must correspond to the type of activity.

- All expenses must be documented.

- Payment must be made in full, and the goods and products must be received by the entrepreneur or organization using the simplified tax system.

- To write off an item that was purchased for resale, it must be sold.

Moment of recognition

Receipt of expenses is taken into account under a simplified system:

- from the date of payment to the supplier;

- from the date of acceptance from the supplier of products/provision of services/completion of work;

- the date of shipment of the goods to the final buyer.

Expense criteria

All costs that accompany running a business must be justified: correspond to the direction of the businessman’s activities and be carried out with the aim of making a profit.

That is, if an entrepreneur is engaged in the production of software, then buying a tractor or combine does not quite fit into the concept of his work. During the audit, the tax inspector carefully examines all costs that are taken into account in calculating payments to the budget for justification and, in case of suspicion, will need to prove how they contribute to the conduct of business activities.

In addition, all expenses must be paid, received and properly documented. The latter is done using the following documents:

- cash receipt;

- strict reporting forms;

- contracts;

- receipts;

- acts of acceptance and transfer;

- money orders;

- invoices, etc.

The presence of documents will confirm the fact of payment for the product or service, as well as its receipt by the merchant. If the tax office does not agree with the costs taken into account, his income will be revised, and the entrepreneur himself will be fined. Therefore, great attention must be paid to the correctness of registration of costs.

Also, all documents that confirm expenses must be kept for at least 4 years.

Example of expense accounting

When purchasing a product in a store, the receipt that the buyer receives is sufficient proof of the costs incurred. If an entrepreneur makes a purchase from an organization, then confirmation of payment will be a payment order with a bank mark, as well as an acceptance certificate.

There are cases when counterparties pay each other with products, the so-called barter. In this case, confirmation of the operation can be acts of acceptance and transfer of goods.