Citizenship Ukraine personal income tax

Regardless of whether your place of permanent registration is Russia, Ukraine, Belarus or another country, when filling out tax forms and other documents related to work and income, you must know all the necessary codes, OKIN, citizenship, etc. Until they are entered in the appropriate boxes, the document will be considered invalid, since it will not provide complete and comprehensive information about you.

In paragraph 2.3 “Taxpayer status” the taxpayer status code is indicated. If the taxpayer is a tax resident of the Russian Federation, the number 1 is indicated, if the taxpayer is not a tax resident of the Russian Federation, the number 2 is indicated, if the taxpayer is not a tax resident of the Russian Federation, but is recognized as a highly qualified specialist in accordance with Federal Law dated July 25, 2021 N 115- Federal Law “On the legal status of foreign citizens in the Russian Federation”, then the number 3 is indicated.

Application

In the Appendix “Information on income and corresponding deductions by month of the tax period” you need to indicate information about income accrued and actually received by your employees, both full-time and according to the GPA, in cash, in kind, and in the form of material benefits. You must indicate income by month of the tax period and the corresponding deductions for each tax rate.

If you are filling out a certificate with characteristics 1 or 3, in the Appendix you must indicate in the appropriate fields the serial numbers of the months, income codes, and the amounts of all accrued and actually received income by the employee.

If you fill out a certificate with features 2 or 4, in the Appendix you need to indicate the amount of income actually received, from which the company was unable to withhold personal income tax.

Standard, social and property tax deductions do not need to be indicated in this Appendix.

On each help page you must indicate the accuracy and completeness of the information:

- “1” if the certificate is submitted by a tax agent;

- “2” if the certificate is submitted by an authorized representative.

Country code for 2 personal income tax

In clause 2.9 “Address in the country of residence” for individuals who are not tax residents of the Russian Federation, as well as foreign citizens, the address of residence in the country of permanent residence is indicated. In this case, the code of this country is indicated in the “Country Code” field, then the address is written in any form (letters of the Latin alphabet are allowed).

For those who do not have an official job, and who receive salaries in envelopes or are temporarily unemployed, in order to confirm their income, the best option would be a personal income tax certificate 2 for the Federal Migration Service, which can be purchased from our company.

Citizenship Ukraine personal income tax

The workshop was created for the production of military products. The workshop specialists have developed and mastered a technology for purifying helium-3. The production of high-quality gas used in various fields of technology and scientific research has been established.

In clause 2.9 “Address in the country of residence” for individuals who are not tax residents of the Russian Federation, as well as foreign citizens, the address of residence in the country of permanent residence is indicated. In this case, the code of this country is indicated in the “Country Code” field, then the address is written in any form (letters of the Latin alphabet are allowed).

Citizenship codes: what are they and where to find them

Next, continuing to work with the help, you should repeat the number from paragraph 2.5, but in line 2.9. Next, indicate the detailed address where the person for whom the document is being filled out lives. If we are talking about a foreign citizen, it is not the Russian temporary registration where the registration was carried out that is entered, but information about the foreigner’s place of residence in his homeland, the code of which he indicates, taking it from the all-Russian classifier. For convenience, the line can be filled in with both Cyrillic characters and Latin characters.

We recommend reading: How to work as a carrier with VAT

Russian citizens will need to indicate the code combination of numbers assigned by the Russian Federation in the 2-NDFL certificate. It is written in paragraph 2.5 of the second block of the document called “Data on a civilian.” The OKSM of the Russian Federation is assigned the number 643. It must be entered in the above column.

How to find the code number

All citizenship and country codes are placed in a single OKSM classifier, adopted on January 14, 2001 by Gosstandart in Resolution No. 529-st.

Let's look at some numbers from the document.

Table 1. Countries of the world and codes

| Azerbaijan | 031 |

| Belarus | 112 |

| Kazakhstan | 398 |

| Russia | 643 |

| Türkiye | 792 |

| Ukraine | 804 |

We recommend additional reading: Decoding the income code 2300 in personal income tax certificate 2

Most often, residents of Ukraine, Belarus and other adjacent countries find employment in Russia. The OKSM has all countries with full names, abbreviations alpha-1 and alpha-2.

Information about each employee is necessary to accumulate information about citizens working in Russia, generate statistical data, tax control and reduce the chances of subjects evading fiscal payments (the more information is required, the more difficult it is to hide something).

All information received by the inspectorate is entered into the AIS-Tax database and will be taken into account when making decisions related to taxation. For example, if, according to the form submitted by the employer, the employee’s income was 100,000 rubles. for a year, and then this employee submitted a forged certificate to obtain a tax deduction and indicated an income of 200,000 rubles, then the forgery will be detected.

Also, thanks to the code, the Federal Tax Service can check whether a citizen of another state has residence in Russia, because the rates for residents and non-residents are different (Article 224 of the Tax Code of the Russian Federation).

Please note that not all Russians are residents, and foreigners are non-residents. Resident status is established by Article 207 of the Tax Code of the Russian Federation: it is acquired by persons who stay in the Russian Federation for more than 183 days in 12 consecutive months (not mandatory in one calendar year). Travel for treatment and study for 6 months is acceptable.

Rates:

- resident – 13%;

- non-resident – 30%.

In the cases specified in Article 224 of the Tax Code of the Russian Federation, a non-resident is subject to a lower tariff (highly qualified specialist, etc.). Also, some income of both residents and non-residents is sometimes subject to increased (35%) or reduced (15%, 9%) rates.

Attention! If errors or contradictions are identified in the documentation, the Federal Tax Service has the right to request clarification. For example, if in one form you indicated Russian citizenship for an employee, and in another - foreign citizenship, then questions may be asked of you.

Citizenship country code Ukraine in 2 personal income tax

Since citizen T did not have a permanent job and at the same time paid alimony for the maintenance of a child from a previous marriage, the plaintiff asked to assign alimony in a fixed amount in the amount of 0.5 of the subsistence minimum for herself and in the amount of the subsistence minimum for each of the children.

Certificate 2-NDFL - instructions for filling out Certificate on form 2-NDFL. When filling out a certificate for a non-resident, use. In the certificate there is 2 personal income tax in the section, although the employee is not obliged to do so. Citizenship country code Russia for reference 2 personal income tax.

What to follow when filling out

All reports established by the Federal Tax Service of Russia are contained in the relevant orders. The orders include several attachments. Among them:

- form form;

- format for electronic submission;

- instructions for filling out paper and computer versions.

There may be other applications, but the above 3 sections are required. Why is this important - any document submitted to the Federal Tax Service must be filled out according to the instructions. Sometimes, in addition to them, the Federal Tax Service or the Ministry of Finance also issues clarifications, answers questions in special letters, and publishes control ratios that the submitted reports must comply with.

Important! When filling out personal income tax certificate 2, follow the rules developed by the Federal Tax Service of Russia.

In some cases, disputes arise that are resolved in court. Judicial rulings are another source of action algorithm, but Form 2 of Personal Income Tax is not so complex and conflicting a form as to cause disagreements among users.

The latest form 2 of personal income tax was introduced by order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/02/2018. There are 5 applications attached to it:

- Help for the Federal Tax Service.

- Procedure for filling out the form.

- Electronic format – file requirements.

- Procedure for submitting reports.

- Form for employees.

Appendix No. 2 will help you fill out the form correctly. The upper half of the first sheet of Form 2 Personal Income Tax – information about the employee, incl. date of birth, passport details, citizenship (country). What does the instruction say about the latter?

Note! In paragraph 3.7 of the third section of the Procedure for filling out personal income tax certificate 2, it is indicated that the country code is written according to the OKSM classifier (countries of the world).

However, the classifier is not included in the instructions due to its large size. Therefore, you need to look for it yourself.

Citizenship and country code for reference 2 Personal income tax: formation features

- in the “Document Code” column, select the corresponding code from Appendix No. 1 to the order of the tax service. For example, for reference 2 personal income tax: indicator for a residence permit - 12, for a passport indicate 21, for a military ID - 07;

- in the data field about the series and number of the form, fill out information about the identity document without indicating the sign No.

Filling in the country code can sometimes be confusing. How to find the code? For example, for the Republic of Belarus it may not be difficult - it is 112, for Ukraine - 804, but not all countries are listed in the general classifier. In this case, choose the code of the state that issued the personal identification document. faces.

Certificate title 2-NDFL

This is the simplest part of the help. First you need to fill in the fields with the basic registration data of the company and indicate the period for which the certificate is submitted:

- TIN and checkpoint of the company;

- serial number of the certificate in the reporting tax period;

- reporting year;

- name of the tax agent company;

- reorganization code and TIN/KPP of the reorganized organization;

- OKTMO code;

- telephone.

If you are preparing a corrective or canceling certificate to replace the previously submitted one, you must indicate the corresponding number in the “Adjustment number” field. In the “Adjustment number” field you need to enter:

- "00" if this is the primary form;

- “01”, “02”, etc., if this is a corrective certificate that is submitted instead of the previously submitted one; you need to indicate a value one greater than that indicated in the previous certificate;

- “99”, if this is a canceling certificate that is submitted instead of a previously submitted one.

Ukrainian citizenship code for 2 personal income taxes

It is adapted to ISO parameters. OKSM is intended to identify world powers, and is used in the process of exchanging information intended to solve economic, social and cultural problems. The objects of the classifier are the countries themselves, which are of interest for foreign policy and other types of communications.

This document is also contained directly on the Gosstandart website, but only in the initial version, and all its editions are separate. That is, the user himself will have to check all changes with the initial version of the resolution, which is extremely inconvenient.

Is it possible to issue a child deduction for a new employee who did not bring a 2-NDFL certificate from his previous job? Do I need to clarify the certificate if the income code is incorrect? The answers to these and other questions regarding 2-NDFL certificates are in the article.

Russia country code for filling out personal income tax certificate 2

The income of a person with a Russian indigenous background must be taken into account in the 2-NDFL certificate. Each field of the document is formatted according to established rules. Moving on to the second block “Data about an individual” we must fill out all the lines of paper. Having reached paragraph 2.5 “Citizenship”, we will already need information from the all-Russian classifier of countries of the world described above, which is where all state codes are indicated. If a person has citizenship, the Russia country code for the 2-NDFL certificate is 643.

Any physical labor of a migrant must be documented. The document for each person has a single form, but the data entered may vary depending on the situation, so each line requires special study.

We recommend reading: How to find out the queue for kindergarten by the child’s last name

2-NDFL: foreign worker

Here, indicate the numeric code of the country of which your foreign worker is a citizen, in accordance with the All-Russian Classifier of Countries of the World (Resolution of the State Standard of Russia dated December 14, 2021 N 529-st). For example, if your employee is a citizen of the Republic of Belarus, then in the “Citizenship (country code)” field, enter the code “112”.

This field must be filled out if the foreign worker is registered for tax purposes in the Russian Federation (clause 1 of the Appendix to the Order of the Ministry of Finance of the Russian Federation dated October 21, 2021 N 129n). True, even if a foreigner has a Russian TIN, but you do not indicate it in the 2-NDFL certificate, nothing bad will happen (see, for example, Letter of the Federal Tax Service dated 09/06/2021 N BS-4-11 / [email protected] ).

Field "Character"

In the certificate form, in the section devoted to general information about the payer and tax agent, there is a “Sign” field. This field shows the basis on which income information is presented:

- “1” must be entered if the information is presented with personal income tax withheld, in accordance with paragraph 2 of Article 230 of the Tax Code of the Russian Federation;>

- “2” must be put if the tax agent - the company was unable to withhold personal income tax, in accordance with paragraph 5 of Article 226 and paragraph 14 of Article 226.1 of the Tax Code of the Russian Federation;

- “3” must be put if the information is submitted by the legal successor, the information is presented with the withholding of personal income tax from payments to employees, in accordance with paragraph 2 of Article 230 of the Tax Code of the Russian Federation;

- “4” must be entered if the information is provided by the legal successor and personal income tax was not withheld from payments to employees, in accordance with paragraph 5 of Article 226 and paragraph 14 of Article 226.1 of the Tax Code of the Russian Federation.

Systematization of accounting

The uranium-graphite reactor was created as an experimental testing complex, where technological processes were developed, original assemblies of fuel elements and structural materials for nuclear power plants were tested. Production of various isotopes was carried out.

In paragraph 2.5 “Citizenship” the numeric code of the country of which the taxpayer is a citizen is indicated. The country code is indicated according to the All-Russian Classifier of Countries of the World (OKSM). For example, code 643 is the code of Russia, code 804 is the code of Ukraine. If the taxpayer does not have citizenship, the code of the country that issued the document proving his identity is indicated in the “Country Code” field.

Citizenship (country code) in 2-NDFL

Most programs that offer to fill out 2-personal income tax make it possible to automatically select the desired code from a directory by country name. Those who fill out certificates manually will have to look for the number in the classifier themselves.

By Decree of the State Standard of Russia dated December 14, 2021 No. 529-st, the list of all states - the “All-Russian Classifier of Countries of the World” (OCSM) - was put into effect and published for use. In addition to the names, it contains codes - each country has a unique letter and number designation.

What is the personal income tax rate if the employee does not have citizenship?

The legislation establishes a uniform procedure for determining the tax status of personal income tax payers. If during the 12 months preceding the date of payment of income, the employee was in Russia for 183 calendar days or more, he is recognized as a tax resident. If during the 12 months preceding the date of payment of income, the employee was in Russia for less than 183 calendar days, he is not recognized as a tax resident. This follows from the provisions of paragraph 2 of Article 207 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated May 5, 2021 No. 03-04-06-01/115.*

The status of the income recipient is determined by the number of calendar days that the person was actually in Russia over the next 12 consecutive months. A person is considered a tax resident if he has been in Russia for 183 days or more.* An exception to this rule is made for citizens living in the Republic of Crimea and the city of Sevastopol. During 2021, they are recognized as tax residents of Russia if, as of March 18, 2021, they had permanent residence in Crimea or Sevastopol and remained in these regions after their annexation to Russia. Regardless of how long they were in Russia before this date. This procedure is provided for in paragraph 17 of the Regulations, approved by Resolution of the State Council of the Republic of Crimea dated April 11, 2021 No. 2021-6/14, and Article 14 of the Law of Sevastopol dated April 18, 2021 No. 2-ZS.

We recommend reading: How to pay for an orientation lecture for correspondence students

Design rules

If some indicator provided in the certificate is missing, then this line is not filled out. You cannot put a dash in empty fields. If there is no value for the total indicators, zero (“0”) is indicated.

All amounts, with the exception of personal income tax, are reflected in rubles and kopecks. If there are no kopecks in certain amounts, then two zeros are put on the certificate. In this case, the amount of income tax withheld or subject to withholding from the employee is reflected in the certificate only in whole rubles. If the certificate does not fit on one page, you must fill out the required number of pages. Please note: if during the year an individual was paid income taxed at different rates, then sections 1, 2 and 3, as well as the Appendix, are completed for each of the rates.

On the second and subsequent pages, fill in the following fields: “TIN”, “KPP”, “Page”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number”, “Submitted to the tax authority (code)” and sections required to be filled in.

For income, the specifics of taxation of which are determined in accordance with Articles 214.1, 214.3, 214.4 of the Tax Code of the Russian Federation, several deduction codes may be indicated in relation to one income code.

In this case, the first deduction code and the deduction amount are indicated below the corresponding income code, and the remaining deduction codes and amounts are indicated in the corresponding columns in the lines below. EXAMPLE OF COMPLETING FORM 2-NDFL An employee of Aktiv JSC, Ivanov, is one of its founders. Ivanov was given a salary of 15,000 rubles. (income code 2000). The total amount of wages accrued to Ivanov for the year was 180,000 rubles. In addition to wages, Ivanov received the following income: - in February - financial assistance due to a difficult financial situation in the amount of 3,000 rubles. (not indicated in the certificate, since the amount is less than 4,000 rubles); - in April - material benefits from purchasing goods from the organization at reduced prices in the amount of 13,000 rubles. (income code 2630);—in May, June, July—material benefit from borrowed funds received from the organization in the amount of 800 rubles. for each month (income code 2610). The total amount of material benefits received was 2,400 rubles. (800 rubles × 3 months); - in August - a valuable gift worth 3500 rubles. (not indicated in the certificate, since it is less than 4,000 rubles); - in November - financial assistance in connection with the death of a member of his family in the amount of 7,000 rubles. (not indicated in the certificate); - in December - dividends in the amount of 25,000 rubles, paid for nine months of the last year (income code 1010). Ivanov has two children aged four and eight years. Therefore, he should be given a tax deduction in the amount of RUB 1,400. for each child. In the Certificate Appendix, the Aktiva accountant will indicate the amount of income taxed on personal income tax at a rate of 13%, by type (wages, financial assistance, etc.). At the same time, the amounts of income received by Ivanov are taxable at a rate of 13%, are reflected for each month of the current year. In the column “Amount of income” they reflect the entire amount of income without tax deductions. Section 3 indicates the amount of standard tax deductions to which Ivanov is entitled. Ivanov’s income for 2021 will not exceed 350,000 rub. Therefore, he can use the deduction for two children (1,400 rubles/month for each child) until December inclusive. The amount of standard tax deductions to which Ivanov is entitled is 16,800 rubles. for each child. Thus, Ivanov’s total income will be 15,000 rubles. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 13,000 rub. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 15,000 rub. + 25,000 rub. = 218,000 rubles. The tax base was 184,400 rubles. = 193,000 rub. (salary) – 33,600 rubles. (tax deductions) + 25,000 rub. (dividends). Amount of tax calculated and withheld: RUB 184,400. × 13% = 23,972 rubles. The income tax was transferred to the budget in full. Separately, you need to fill out sections 1, 2, and the Appendix for the tax rate of 35%. The Appendix indicates income taxed at the rate of 35%. These incomes are reflected for each month of the current year in which they were received by Ivanov. The amount of all income reflected in the Appendix is indicated in section 2: 800 rubles. + 800 rub. + 800 rub. = 2400 rubles. The calculated, withheld and transferred amount of tax must also be indicated in section 2: 2400 rubles. × 35% = 840 rub.

How to submit 2 personal income taxes for an employee of a citizen of Ukraine

If the person’s income was paid by the head office of the organization, then in the certificate in form 2-NDFL, indicate the TIN, KPP and OKTMO at the location of this particular office. If the organization is the largest taxpayer, indicate the checkpoint assigned by the interregional (interdistrict) inspectorate of the Federal Tax Service of Russia for the largest taxpayers.

When filling out the table in Section 3, use the “Income Codes” and “Deduction Codes” reference books. These directories were approved by order of the Federal Tax Service of Russia dated November 17, 2021 No. ММВ-7-3/611. Individual codes are assigned to each type of income and each type of tax deduction. For example, income in the form of wages corresponds to code 2021. For income from the rental of vehicles, income code 2400 is applied, for income from rental of other property - code 1400. When paying remuneration under other civil contracts (except for royalties ) use code 2021, when paying temporary disability benefits - code 2300.

Section 2 “Total amounts of income and tax based on the results of the tax period”

Section 2 reflects data on the amounts of tax accruals and withholdings, tax rates and the tax base.

Here is the data:

- tax rate;

- total income;

- the tax base;

- calculated tax amount;

- the amount of fixed advance payments;

- amount of tax withheld;

- tax amount transferred;

- the amount of tax excessively withheld by the tax agent;

- the amount of tax not withheld by the tax agent.

If you fill out forms 2-NDFL with sign 2 or 4:

- in the “Total amount of income” field, you must indicate the amount of accrued and actually received income from which tax was not withheld by the tax agent, reflected in the Appendix;

- in the “Calculated tax amount” field, you must indicate the calculated but not withheld tax amount;

- in the fields “Amount of tax withheld”, “Amount of tax transferred” and “Amount of tax excessively withheld by the tax agent” indicate zero values;

- in the “Amount of tax not withheld by the tax agent” field, you must indicate the calculated amount of tax that the tax agent did not withhold in the tax period.

note

The book “Annual Report 2018” contains all the relevant information on the preparation of annual reports. The editors have collected and updated all the changes, without which it is impossible to submit the finished report!

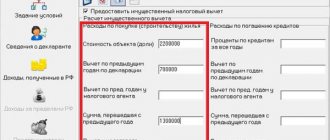

Section 3 “Standard, social and property tax deductions”

This reflects information about standard, social and property tax deductions that the company provided to employees. In the “Deduction Code” field, you must indicate the appropriate code.

In the “Deduction Amount” field, the deduction amounts corresponding to the specified code are indicated. The number of completed lines in this field depends on the number of types of tax deductions that were provided to the taxpayer.

In the “Notification type code” field you need to indicate:

- “1”, if the employee has provided you with the Notification he received from the tax office confirming his right to a property tax deduction;

- “2”, if the employee provided you with the Notification he received from the tax office confirming the right to a social tax deduction;

- “3”, if you, as a tax agent company, have received a Notification from the tax office confirming your right to a tax reduction on fixed advance payments.

Don’t forget to also include in the form the number, date of the notification, and code of the tax authority that issued the notification.

If you have received several notifications, you need to fill out several lines, enter all received notifications and their details (date, number, etc.)

On the following sheets of the certificate, fill in the fields “TIN”, “KPP”, “Page”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number”, “Submitted to the tax authority (code)”, “ Notification type code”, “Notification number”, “Date of issue of notification”, “Code of the tax authority that issued the notification”.

Citizen of Ukraine personal income tax rate

Payment conditions for refugees To obtain refugee status, you must provide a number of documents to the migration service. The main condition is persecution in the homeland or a threat to health and life. The status is assigned for 3 years; if after this time the threat to the person does not disappear, the period is extended.

3 tbsp. 224 of the Tax Code of the Russian Federation: highly qualified specialist Letter of the Ministry of Finance dated January 24, 2021 N 03-04-05/3543; refugee; a person who has received temporary asylum in the Russian Federation; patent worker. Hiring such an employee adds additional responsibilities to the employer, namely: