Foreign exchange transactions under factoring agreements between residents and financial agents (factors)

By virtue of the provisions enshrined in Part 4 of Art. 9, part 5 art. 19 of Law N 173-FZ, the resident factor is obliged to notify the resident-client in writing about the fulfillment by the non-resident debtor of the obligations stipulated by the contract between the resident client and the non-resident debtor. In addition, the resident client is obligated to ensure, within the terms of the foreign trade agreement (contract), that the non-resident receives the foreign currency or currency of the Russian Federation due under such foreign trade agreement (contract) to the bank (correspondent) account of the resident financial factor.

In order to implement the right established by Part 4 of Art. 9, part 5 art. 19 of Law N 173-FZ, currency control agents are provided with: an agreement (contract) of financing for the assignment of a monetary claim (factoring) and (or) an agreement on the subsequent assignment of a monetary claim, a written notification of the assignment (subsequent assignment) to the factor, documents confirming the execution of foreign exchange operations and settlements.

You may be interested in: Collection of accounts receivable from legal entities.

Currency resident of the Russian Federation: what operations are allowed

The main regulatory act regulating foreign exchange transactions is Federal Law-173 dated December 10, 2013.

It contains a complete list of operations that can be performed by Russian residents with foreign accounts. Conventionally, all payments in foreign currency can be divided into the following types:

- between residents;

- between residents and non-residents;

- between residents and non-residents from the EAEU countries or countries with which automatic data exchange operates.

Depending on the participants in the transaction, the list of permitted operations differs significantly.

List of permitted transactions between residents

In Art. 9 FZ-173 states that currency transactions between residents of the Russian Federation are prohibited, with the exception of the following:

- currency transfers to resident accounts both in Russia and abroad (the latter is limited to an amount of 5,000 USD per day);

- transaction related to payment for business trips;

- payment of wages outside the Russian Federation;

- tax refund for purchases (for example, Tax Free);

- payment of mandatory payments (taxes, fees);

- receiving an insurance premium;

- purchase of goods/services by resident individuals who conduct commercial activities without creating a legal entity.

In general, the list of permitted transactions between residents includes 33 items and concerns almost all areas of life and activity. However, in this paragraph, most transactions relate to transactions between residents.

What transactions are allowed between residents without restrictions?

Special attention should be paid to operations that are allowed to be performed by residents of the Russian Federation without restrictions (clause 3 of article 9 of Federal Law-173):

- receipt and repayment of loans/credits and related payments;

- replenishment of demand and urgent accounts, as well as receiving funds back;

- fulfillment of obligations under guarantee, surety, and pledge agreements;

- purchase of bills from authorized banks;

- purchase and sale of currency not for business purposes

- payment of bank commissions.

It should be noted that this article deals with foreign exchange transactions, and not foreign accounts. That is, the above conditions apply in most cases to transactions with currency, but only if they are carried out on the territory of the Russian Federation.

What transactions are allowed between a non-resident and a resident

Residents can receive to their foreign accounts from non-residents:

- crediting interest accrued on the account balance;

- transfer of the minimum deposit required according to the agreement with the bank for opening an account;

- salary, pension, scholarship, alimony, other social payments;

- amounts paid under court decisions;

- insurance payments;

- returning an incorrectly credited transaction.

However, in the list of the above transactions with foreign accounts, there is no income received from non-residents from transactions of purchase and sale of real estate, securities, or rental. From January 1, 2020, individuals can transfer such payments to foreign accounts without restrictions if the following conditions are met:

- an account is opened in a bank of a member country of the Eurasian Economic Union (Belarus, Kazakhstan, Kyrgyzstan, Armenia); or

- an account is opened in a bank in a country with which Russia exchanges financial information automatically.

List of countries with which automatic exchange is carried out according to the Order of the Federal Tax Service dated November 3, 2020 No. ED-7-17/ [email protected] :

| Region | Countries |

| Europe | Andorra, Austria, Belgium, Bulgaria, Hungary, Germany, Greece, Denmark, Ireland, Iceland, Spain, Italy, Cyprus, Latvia, Liechtenstein, Luxembourg, Malta, Monaco, the Netherlands, Norway, Poland, Romania, San Marino, Slovakia, Slovenia, Finland, France, Croatia, Czech Republic, Switzerland, Sweden, Estonia, Japan |

| CIS | Azerbaijan |

| Asia | Bahrain, Israel, India, Indonesia, Qatar, China, South Korea, Kuwait, Lebanon, Malaysia, UAE, Pakistan, Saudi Arabia, Singapore, Turkey |

| Africa | Ghana, Mauritius, Nigeria, Seychelles, South Africa |

| North America | — |

| South America | Argentina, Belize, Brazil, Colombia, Costa Rica, Mexico, Panama, Uruguay, Chile |

| Oceania | Vanuatu, Marshall Islands, Nauru, Samoa |

| Caribbean Islands | Antigua and Barbuda, Aruba, Bahamas, Barbados, Grenada, Dominica, St. Vincent and the Grenadines, St. Lucia, St. Kitts and Nevis |

| Territories | Bermuda, British Virgin Islands, Gibraltar, Hong Kong, Greenland, Curacao, Macau, Montserrat, Cayman Islands, Cook Islands, Turks and Caicos Islands, Faroe Islands |

What transactions are allowed between residents and non-residents without restrictions?

If accounts are opened in the above countries, residents can freely receive, including:

- income from the rental of movable and immovable property;

- income from participation in capital: dividends;

- income from the sale of tangible and intangible assets;

- loans and credits for a period of more than 2 years;

- as well as other types of income.

It should be noted that such operations with foreign accounts opened in countries with which the Russian Federation does not exchange financial information are prohibited.

Responsibility of residents in the field of currency regulation

In addition, Article 2 of the Federal Law of June 29, 2015 N 181-FZ amended Part 4 of Art. 15.25 of the Code of Administrative Offenses of the Russian Federation, expressed in clarifying the responsibility of residents in the field of currency regulation. In general, the changes made to Article 15.125 of the Code of Administrative Offenses of the Russian Federation reflect those changes made to Law No. 173-FZ. In particular, the content of Article 15.25 of the Code of Administrative Offenses of the Russian Federation has been expanded - a resident client who has not ensured the receipt of currency in the bank (correspondent) account of the factor within the time period stipulated by the contract with the non-resident debtor is held liable. Similar changes were made to Part 6 of Art. 15.25 Code of Administrative Offenses of the Russian Federation.

In accordance with Article 3, the Federal Law comes into force 180 days after the day of official publication (published on June 30, 2015). Thus, the provisions of the Federal Law are subject to application from December 28, 2015.

You may be interested in: Preparation of a legal opinion.

Exchange control requirements

Legislation allows residents of the Russian Federation to open accounts abroad without restrictions. This does not apply to government employees. However, such actions must be reported within 1 month, and it does not matter whether an account is opened in a bank, neobank, payment system, investment fund, etc.

Residents who were on the territory of the Russian Federation for less than 183 days in the past calendar year were unable to submit a notification about opening/closing an account or changing details due to their permanent stay abroad, are required to notify the competent authority before June 1.

For example, in 2021, a resident was in Russia from January 1 to April 20, after which he flew to another country and stayed there until January 2021, as he could not return due to closed borders. In such situations, notification of account opening must be submitted by June 1, 2021.

Statement of movement of funds and financial assets

In addition to notification of the account, individuals, legal entities and individual entrepreneurs are required to submit a report on the movement of funds to the fiscal authorities. It contains all information about all accounts that the resident has.

Deadlines for filing a cash flow report:

- individuals – submit one report on all accounts at once by 01.06;

- legal entities and individual entrepreneurs - quarterly, within 30 days after the end of the quarter, a separate report on each account with supporting documents (account statements) is submitted.

Who may not file a cash flow statement

In Art. 12 provides for a number of conditions that exempt residents from filing a cash flow report:

- an account is opened in a bank located in a state of the EAEU or a state with which automatic exchange of financial information is carried out; And

- annual turnover and account balance at the end of the year do not exceed 600,000 rubles (~ 8,000 USD).

The exchange rate is determined by the Central Bank as of December 31 of the reporting year.

The procedure for making payments between residents and non-residents

In our state there are also no restrictions on conducting currency transactions between residents and non-residents. The only exceptions, perhaps, can be those cases in which the framework will be established to stop the decline in the country's cash reserves.

Just 12 years ago, a significantly larger number of restrictions were in effect, however, today the ban can only apply to transactions related to the purchase or sale of the currency of other countries, as well as checks in it. Such operations can only be carried out by banks that have the appropriate authority.

Let's sum it up

On the territory of our country there is a ban on conducting currency transactions between residents, with the exception of cases according to a certain list, when it will not apply. The introductory list is indicated above in the article, and you can study the full list yourself by opening Federal Law No. 173-FZ.

There is a list of legislative restrictions in the field of currency transactions. The full list can be studied on the pages of Law No. 173-FZ

As for currency transactions in which residents and non-residents take part, as well as transactions exclusively between non-residents, the law does not indicate any significant obstacles for them; it is only necessary to comply with the procedure established at the official level.

If the working day raises the least number of questions, then the banking day largely remains a mystery not only for the bank’s clients and partners, but sometimes even for the employees themselves. The need to independently determine the length of the banking day leads to frequent confusion in reports and documents due to the ambiguity of this concept. We talk about what a banking day is in a special article.

Is foreign currency borrowing allowed between residents?

Provided that a foreign currency loan is issued, the person receiving it receives a certain amount of funds in foreign currency, provided that it is returned within a specified period. The provision of funds can be either compensated or gratuitous.

Carrying out foreign currency loans between residents of our country in accordance with legislative act No. 173-FZ indicated earlier in the article is not allowed. However, in this case, exceptions are also provided that allow residents to obtain loans from relevant financial institutions.

If a loan agreement is drawn up between two residents who are economic entities of the country, then it must indicate the amounts exclusively in domestic currency.

There are no restrictions on foreign exchange transactions related to loan processing between residents and non-residents of our country.

Currency control when making payments in foreign currency

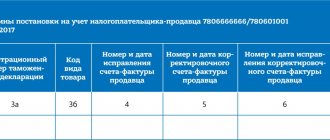

Along with the Transfer Application, the following documents must be submitted to the Bank:

- Supporting documents

- Information on currency transactions (if the payment is made under a contract (loan agreement) subject to registration with the bank, if there is insufficient information in the supporting documents for the bank to assign a code for the type of currency transaction, or if according to the Bank of Russia Instruction dated August 16 2021 No. 181-I submission of supporting and other documents to the bank is not provided)

If supporting documents were previously submitted to the bank, and the contract (loan agreement) was registered with the bank at the time of payment, then re-submission of supporting documents is not required.

Deregistration of a contract (loan agreement)

The client submits to the bank an application for deregistration of the contract (loan agreement) in the following cases:

- When transferring a contract (loan agreement) for servicing to another authorized bank (including transfer from one branch to another bank branch, from the bank’s head office to a bank branch, from a bank branch to the bank’s head office), as well as when the client closes all current accounts in bank Application for deregistration of a contract (loan agreement) under clause 6.1.1.;

- When the parties fulfill all obligations under the contract (loan agreement), including the fulfillment of obligations by a third party, Application for deregistration of the contract (loan agreement) under clause 6.1.2.;

- When a resident assigns a claim under a contract (loan agreement) to another resident person or when a resident transfers a debt under a contract (loan agreement) to another resident person, Application for deregistration of the contract (loan agreement) under clause 6.1.3.

- When a resident assigns a claim under a contract (loan agreement) to a non-resident or when a resident transfers a debt under a contract (loan agreement) to a non-resident Application for deregistration of the contract (loan agreement) under clause 6.1.4.;

- When fulfilling (terminating) obligations under a contract (loan agreement) on other grounds provided for by the legislation of the Russian Federation, Application for deregistration of the contract (loan agreement) under clause 6.1.5.

- Upon termination of the grounds for registering a contract (loan agreement) in accordance with the Instruction of the Bank of Russia dated August 16, 2017. No. 181-I, including due to the introduction of appropriate changes and (or) additions to the contract (loan agreement), as well as if the contract (loan agreement) was mistakenly registered in the absence of grounds for it in the contract (loan agreement) registration Application for deregistration of a contract (loan agreement) under clause 6.1.6.

In addition, the bank has the right to independently deregister the contract (loan agreement) after ninety calendar days following the date of completion of fulfillment of obligations under the contract (loan agreement) indicated in the bank control statement.

Currency control when making a payment in Russian currency in favor of a non-resident

When making payments in Russian currency, residents are required to comply with the requirements for filling out settlement documents established by the Bank of Russia Instruction dated August 16, 2017. No. 181-I

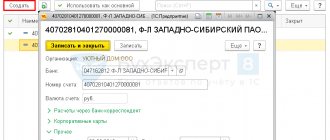

Before the text part in the “Purpose of payment” field of the payment document, the resident must indicate the code of the type of currency transaction in accordance with the Instruction of the Bank of Russia dated August 16, 2017. No. 181-I, which corresponds to the purpose of the payment, as well as the information contained in the supporting documents.

The specified information must be enclosed in curly braces and have the following form {VO<code of the type of currency transaction>} . Indentation (spaces) inside curly braces is not allowed. Separating characters "VO" are indicated in capital Latin letters (for example, {VO1110}).

Along with the payment document, the following documents must be submitted to the Bank:

- Supporting documents

- Information on currency transactions (if the payment is made under a contract (loan agreement) subject to registration with the bank)

If supporting documents were previously submitted to the bank, and the contract (loan agreement) was registered with the bank at the time of payment, then re-submission of supporting documents is not required.

Restrictions on transactions between residents and banks

Currency transactions carried out between authorized credit institutions and residents can be carried out without restrictions if they relate to a certain list of needs. We will find out which ones further in the table.

Table 2. Transactions between residents and banks without restrictions

| Situation | Description |

| Procedures related to lending | This category includes operations such as:

|

| Bank account transactions | Simple operations such as depositing funds or withdrawing funds from a bank account are not limited in any way. |

| Obtaining guarantees | Bank guarantees aimed at the resident’s performance of his duties may be freely provided. |

| Purchasing more fun banks | There are no restrictions on purchasing banknotes that were previously issued by an authorized bank and receiving payments on them upon presentation. |

| Purchasing foreign money | The list also includes the purchase of foreign currency in exchange for domestic rubles. |

| Commission | Also worth mentioning is paying commissions to banks. |

It should be noted that all these possibilities are open only when the resident interacts with a bank that has the appropriate authority. The fact is that these systems belong to the Central Bank market participant, and have the right to service and open brokerage-type accounts, which need to be opened by non-residents included in the list of their clients in order to subsequently carry out cash accounting.

If the law does not provide restrictions on transactions, it means that any conditions accompanying the transfer of funds are obligatory

If the conditions for conducting currency transactions are violated, for example, the deadline for receiving money to the accounts of residents of the country expires, then the party that turns out to be the offender may suffer the corresponding consequences in the form of a fine, the amount of which will be determined based on the current refinancing rate of the Central Bank of the Russian Federation.

Features of currency transactions between non-residents

On the territory of our country there are no restrictions on conducting currency transactions between persons classified as non-residents of the state. So, they can freely transfer money between their accounts, both in rubles and in foreign currency. Restrictions also do not apply if you have accounts in banks operating on the territory of our country or any foreign country.

Non-residents are allowed to conduct any transactions also with domestic securities on the territory of our country, provided that they continue to comply with the antimonopoly legislation of the country

Who may not comply with exchange control requirements

The following individuals are exempt from fulfilling the obligations provided for by Federal Law 173:

- living outside the Russian Federation for more than 183 days in a calendar year;

- if restrictive measures were applied to them and he had to stay on the territory of the Russian Federation more than necessary, for example, the closure of borders during a pandemic. In such cases, individuals do not lose their non-resident status.

There is also no need to submit a notification about reports if accounts are opened in branches of Russian banks abroad (clause 9 of article 12 of Federal Law-173).