Many accountants are familiar with this problem when input VAT from quarter to quarter creeps into the document Formation of purchase ledger entries , despite the fact that it was already accepted for deduction a long time ago.

Let's look at how to detect a “stuck” VAT, and, most importantly, how to correct the error, as well as:

- reasons for the appearance of “stuck” incoming VAT;

- generation of reports in 1C to identify “stuck” VAT;

- error correction methods.

1C provides a separate system of VAT registers, so it is often difficult for an accountant to deal with “stuck” incoming VAT on a supplier’s invoice from previous periods. This is especially important when accounting in the program is carried out with errors.

In this article, we will go in great detail, step by step, all the way from understanding the algorithm of the program in terms of incoming VAT, finding errors and offering ways to correct “stuck” VAT.

Who maintains separate VAT accounting

Separate VAT accounting must be carried out by those organizations that combine types of activities subject to VAT, as well as types of activities not subject to VAT.

The most common reasons for the need to distribute VAT is the need to distribute incoming VAT between types of activities for organizations that combine SST with UTII, or for organizations engaged in export trade. This is a non-exhaustive list of cases.

There are exceptions to the requirement to maintain separate VAT accounting. Thus, if in an organization the share of revenue from activities not subject to VAT or taxed at a rate of 0% does not exceed 5% of all revenue, the organization has the right not to share input VAT. Or an organization that is engaged only in exports and does not conduct operations in the domestic market also has the right not to maintain separate accounting.

When maintaining separate VAT accounting, it is important that the software product allows for the distribution of VAT by type of activity: part of the amount is accepted for deduction, and part is included in the cost. Such opportunities are provided by the software product “1C: Enterprise Accounting 8”, ed. 3.0.

Calculation of value added tax

When performing a taxable transaction, taxpayers have the obligation to calculate VAT. The procedure for calculating value added tax is established by the provisions of Article 166 of the Tax Code of the Russian Federation.

VAT amounts are calculated at the appropriate tax rate, which is a percentage of the tax base.

If transactions are taxed at different rates, separate accounting is maintained, and the amount of VAT is determined by adding up the tax amounts calculated separately for each transaction.

The taxpayer is also required to maintain separate accounting if part of the transactions he carries out are exempt from taxation.

VAT is calculated based on the results of each tax period, and payment is made no later than the 20th day of the month following the expired tax period.

The calculated VAT is reduced by the amount of the tax deduction. The amount of tax that the buyer paid when purchasing goods on the territory of the Russian Federation or when importing goods into the customs territory of the Russian Federation is accepted for deduction.

Only VAT payers have the right to use tax deductions.

If the taxpayer does not calculate the tax base for VAT, then he has no reason to deduct the amount of VAT paid in the cost of the purchased goods.

A taxpayer can deduct input VAT only if he has accepted for accounting the goods, works, and services purchased by him, which is confirmed by the relevant primary documents and invoices issued by the supplier.

In order to be able to apply a tax deduction, the Tax Code establishes certain requirements, failing which the taxpayer cannot apply the tax deduction. A tax deduction cannot be applied if:

- the taxpayer's expenses are economically unjustified;

- its business operations are unprofitable and unprofitable;

- invoices are not reflected (untimely reflected) in the accounting journal;

- there is no state registration of the acquired object, if it is mandatory;

- the counterparty was chosen without due diligence and caution, the counterparty from whom the taxpayer purchased the property did not comply with the requirements of tax legislation;

- the taxpayer’s actions are seen as a desire to extract unjustified tax benefits.

VAT accounting in 1C

Let's set up separate VAT accounting in 1C. Once the “Incoming VAT is kept separately accounted for” setting is set, when posting documents, the program will remember what subsequently happens to VAT in the context of each document. If VAT was accepted for deduction upon receipt, and in the future the organization makes a sale without VAT, then the VAT previously accepted for deduction will be automatically restored. When using this setting, batches of goods are automatically tracked for subsequent VAT accounting purposes.

This setting is set in the accounting policy using the “Taxes” hyperlink.

In edition 3.0, it became possible to maintain additional analytical accounting on account 19 - according to VAT accounting methods. Thanks to this analytics, it is possible to determine the need to distribute VAT at the time of purchase. With this setting, you can distribute VAT not only for indirect costs, but also for direct ones. To do this, in the “VAT Accounting Method” analytics, set the value to “Distribute”.

With further movement of inventory in the organization, it is possible to change this setting for a batch of items. For example, in the document for the receipt of goods and services, the method “Accept for deduction” was indicated, and at the time of inclusion in expenses it became clear that the inventories would be used for UTII activities, which means that VAT must be included in the cost. This operation will be performed by the document “Request-invoice”, where the VAT accounting method will be set to “Include in price”. After the invoice request is completed, the VAT amount will be automatically restored to the budget and included in expenses.

Fixing a bug with stuck VAT

We will show you how to make a correction in 1C if a “stuck” VAT is identified in the NU register.

As a result of identified errors regarding suspended VAT, the organization needs to write off the incoming VAT presented by the supplier Flower Arrangement LLC under SF No. 0000-000007 dated December 18, 2017, presented from the VAT .

Manually writing off incoming VAT

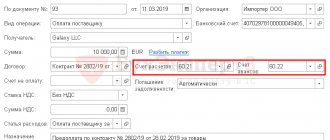

To write off incoming VAT according to the VAT register presented , we will use the document Transaction entered manually .

Step 1. Create a new document Operation entered manually : section Operations - Accounting - Operations entered manually - button Create - Operation.

Open the form for selecting VAT registers by clicking the MORE – Select registers button.

Step 2. On the Accumulation registers , check the VAT presented .

Step 3. Go to the VAT presented and click the Add to enter data on VAT write-off.

The Accounting and Tax Accounting tab is not filled in. The posting to write off VAT from the credit of account 19 has already been made previously. Records are generated only according to the VAT register presented.

For events where VAT is written off for expenses, a “reversal” operation is performed:

- Type of movement – Arrival ;

- The amount excluding VAT is negative;

- VAT is negative.

For events where VAT is accepted for deduction, the following entry is made:

- Type of movement – Consumption ;

- The amount excluding VAT is positive;

- VAT is positive.

Step 4. Save the document using the Save and close .

Step 5. Check the completion of the document Forming a purchase ledger entry - Fill out the document .

Data on the supplier invoice of Flower Arrangement LLC no longer falls into the document Creation of purchase ledger entries . The fix was completed correctly.

Write-off of VAT using a specialized document

To write off VAT in 1C, there is a special regulatory document Write-off of VAT : section Operations - Closing the period - Regular VAT operations - button Create - Write-off of VAT.

If an accountant wants to write off VAT and not deduct it at all, then it is better to use this document. He will immediately generate a posting for writing off VAT according to accounting and write off VAT according to the VAT register presented .

The document forms the necessary movements:

- in accounting; PDF

- presented in the VAT accumulation register . PDF

VAT must be deducted

If, as a result of the check, the entry for accepting VAT for deduction was not previously included in the Purchase Book and was not reflected in the VAT Declaration (Section 8), then in order to be able to exercise the right to deduct VAT in the Transaction entered manually document, you need to add and fill out a new tab for accumulation register Purchases .

An organization can exercise the right to accept VAT for deduction within 3 years from the moment the right to purchase goods arises (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

Accepting VAT for deduction manually will look like this:

register presented .

Register Purchases .

Reflection of VAT deduction in the Purchase Book : section Reports – VAT – Purchase Book. PDF

See also:

- Guide. VAT register presented

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- An invoice from an agent entered through Entering balances does not go into the Generation of purchase ledger entries Hello! created a new base for the existing organization. When entering balances...

- In the Formation of purchase ledger entries, a receipt without an amount appears. When generating a purchase ledger, a line appears in which there is no amount....

- Why does the document from the previous period appear in the document Formation of purchase ledger entries for the current quarter? You do not have access to view. To gain access: Complete...

- Document Formation of purchase ledger entries Document Formation of purchase ledger entries is used in cases where VAT…

Consignments of goods for VAT accounting

It must be remembered that when selling goods, VAT is written off for a specific batch of a document - since for the correct calculation and distribution of the amount of incoming VAT, the program uses the “Batch” of each document. In order for accounting for VAT purposes regarding batches to coincide with regulatory accounting and cost calculation, it is necessary to use the FIFO method of accounting for PMZ.

In order to maintain batch accounting for inventory accounts, you need to set this option in the settings. This can be done in the menu “Administration” – “Accounting parameters” – “Setting up a chart of accounts” – “By item, batches, warehouses”. In the settings menu that opens, you must set the “By batches (receipt documents)” flag.

Example.

Organization A purchased chairs. November 1 – 10 pcs. at a price of 1180 rub. per piece, VAT on top, as well as on November 15 - 10 pcs. at a price of 1550 rub. per piece, VAT on top. Let's assume that the organization sold 15 units. 20 November.

If we maintain FIFO accounting, then for both VAT and costing purposes the chairs will be written off as follows:

- 10 pieces. from the batch at a price of 1180 rubles.

- 5 pieces. from the batch at a price of 1550 rubles.

And if an organization maintains accounting at average cost and separate VAT accounting, then for VAT purposes the program will write off data from batch documents, as described in the FIFO case, and for the purpose of calculating cost the following will be written off:

- 15 pcs. without batch, but based on the cost of 1365 rubles. (1180 + 1550= 2730 / 2 = 1365)

Thus, for the purposes of VAT accounting, the program will calculate based on batches, and for the cost price - based on other amounts. For sales transactions on the domestic market, this situation is not incorrect, but in the case of exports and the use of a 0% rate, difficulties arise, since confirmation of the zero rate will occur immediately for batches of all receipts stored on balances.

For this reason, those organizations that apply a 0% rate or without VAT are recommended to use the FIFO method instead of average cost accounting. If you change the method of accounting for inventories, do not forget to document this change in the form of an order for the accounting policy of the organization.

Tax calculation procedure

The amount of VAT is the difference between the amount of VAT that is paid to the taxpayer by buyers of goods sold by him, the cost of which is increased by the amount of VAT, and the amount of VAT that is paid directly by the taxpayer himself when settling with suppliers for the goods he purchased. This difference is subject to payment to the budget.

If a taxpayer applies a single VAT rate to all of its transactions, then the tax base must be determined in total in accordance with the requirements of Article 153 of the Tax Code of the Russian Federation.

If, based on the results of tax calculations in a certain tax period, the amount of the tax deduction is greater than the total amount of VAT calculated based on the results of all taxable transactions performed by the taxpayer, the resulting negative difference must be reimbursed to the taxpayer (offset), VAT payable to the budget in this case is assumed to be zero.

In some cases, the obligation to calculate, withhold and transfer VAT to the budget may be assigned to tax agents.

For example, in the case of foreign persons who are not registered with the tax authorities of the Russian Federation and are not Russian taxpayers.

If such persons sell goods on the territory of the Russian Federation, then enterprises and individual entrepreneurs purchasing such goods are required to pay VAT.

In this case, they act as tax agents (clause 3 of Article 166 of the Tax Code of the Russian Federation). In this case, accounting is carried out separately for each transaction related to the sale of goods by foreign taxpayers.

The amount of VAT that must be paid by the tax agent to the budget is determined on the basis of the invoice and is paid by him in full.

A controversial issue regarding the calculation of VAT and the application of tax deductions is the absence of taxable transactions for the taxpayer in the reporting period.

According to the current arbitration practice, in the opinion of the courts, Chapter 21 of the Tax Code of the Russian Federation establishes the dependence of the tax deduction, the right to which is granted by the purchase of goods with VAT, on the taxpayer’s carrying out taxable transactions in the same reporting period.

According to the courts, the law does not call this a mandatory condition for applying a tax deduction. This approach is shared by the majority of arbitration judges.

This problem was resolved in a letter from the Ministry of Finance of the Russian Federation dated November 19, 2012 N 03-07-15/148 after consideration of requests from the Federal Tax Service of Russia and Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 3, 2006 N 14996/05.

In this letter, the Ministry of Finance commented on the situation, citing the fact that such a position may provoke abuse by unscrupulous taxpayers, and also provides unjustified advantages to a taxpayer using a zero VAT rate.

The Ministry of Finance came to the conclusion that the taxpayer’s use of tax deductions in those tax periods in which he did not have a tax base is justified. The Federal Tax Service of Russia shares the same opinion.

Author of the article

Distribution of VAT on fixed assets

In version 3.0, it became possible to distribute VAT on fixed assets. To do this, in the document “Acquisition of fixed assets” in the VAT accounting method, select the value “Distribute”. After an item of fixed assets has been accepted for accounting and the “VAT Allocation” document has been posted, this VAT will be distributed in proportion to revenue. In terms of the percentage of VAT for non-VAT taxable activities, this amount of VAT will be included in the initial cost of the fixed asset item. After this, depreciation of the object, as well as all analytical reports on fixed assets, will display the cost of the object, taking into account the amount of VAT included in the price.

Example.

In organization A, in the fourth quarter of 2021, revenue from activities subject to VAT amounted to 1 million rubles, revenue from activities subject to the payment of UTII amounted to 250,000 rubles. During the fourth quarter, services related to both types of activities were purchased in the amount of 50,000 rubles, VAT on top. An object of fixed assets worth 150,000 rubles was also purchased, VAT on top (Fig. 1).

To calculate the amount of VAT distribution, we calculate the percentage. Transactions excluding VAT accounted for 20% of total revenue. Accordingly, the VAT amounts are distributed as follows: 80% – “Accept for deduction”, 20% – “Include in price”. We calculate: 9000 * 20% = 1800 rubles, 27,000 * 20% = 5400 rubles. (Fig. 2).

The “VAT Allocation” document includes the amounts we indicated. And after completing the document, the amount for services is 1800 rubles. will be reflected in the cost accounts (in our case this is account 44). Amount 5400 rub. will be reflected in account 08, and then in correspondence Dt. 01 Kt. 08 will increase the initial cost of the fixed asset item (Fig. 3).

At the end of the quarter, the amount on account 19 in the “Accept for deduction” analytics is accepted for deduction by the document “Creating purchase ledger entries.” To analyze and evaluate the correctness of closing account 19, it is convenient to use a balance sheet with analytics on VAT accounting methods (Fig. 4).

For a more detailed analysis of the SALT for account 19, you can get it with analytics up to the counterparty and the movement document.

If your organization did not maintain separate VAT accounting in the program, but is required to do so, then to switch to separate accounting you need to set the settings indicated in the article and enter balances for batch accounting. You can enter batch accounting balances manually or with the help of a programmer.

Another situation when the “Maintaining separate VAT accounting” setting will help an organization is the need to write off inventory. Write-offs can be carried out for various reasons, for example, in the event of a identified shortage. In this case, since the goods are written off as a result of shortages (for activities not subject to VAT), the VAT previously accepted for deduction must be restored to payment to the budget. When using the specified setting, the program will automatically restore VAT for payment after posting the “Write-off of goods” document. If the separate accounting setting is not used, for correct accounting it is necessary to reflect this operation using the “VAT Restoration” document.

Determining the amount of stuck incoming VAT

In order to correct errors associated with “stuck” VAT, you must first determine for which invoices and in what amounts the incoming VAT is “stuck” in the program.

To do this, we suggest using the Express Check .

Express check

Step-by-step instructions for determining “stuck” VAT using the Express check .

Step 1. Open the Express check : section Reports – Accounting analysis – Express check.

Step 2. Complete the settings to search for “stuck” VAT: button Show settings – List of possible checks – Maintaining a book of purchases for value added tax – checkbox Correspondence of the VAT balance on purchased values in account 19 of the accounting system and in the VAT accounting subsystem.

Step 3. Generate a report using the Run check .

The program detected an error, i.e., a discrepancy between the balance of incoming VAT on account 19 in the accounting system and in the VAT accounting subsystem:

- there is no balance on account 19;

- presented in the VAT register is 381.36 rubles.

Other reports to identify stuck VAT

To identify “stuck” VAT, you can also use the setting of the Universal report Checking “stuck” VAT. But the downside is that it does not provide a breakdown of the invoices for which the incoming VAT is stuck.