Bill payments

Payments by bill of exchange - 2021 are one of the forms of non-monetary payments used in the economic market.

These types of transactions are regulated by special norms of bill of exchange legislation, however, in the absence of such special norms, the general norms of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) should be applied to them, taking into account their features (clause 1 of the resolution of December 4, 2000 of the Plenum of the Armed Forces of the Russian Federation No. 33, Plenum Supreme Arbitration Court of the Russian Federation No. 14, hereinafter referred to as Resolution No. 33/14).

Thus, the main regulatory legal acts of bill of exchange legislation are:

- Law “On promissory notes and bills of exchange” dated March 11, 1997 No. 48-FZ (hereinafter referred to as Law No. 48-FZ);

- Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR “On the implementation of the Regulations...” dated 08/07/1937 No. 104/1341 (hereinafter referred to as Regulation No. 104/1341).

The general rules in relation to transactions with bills include Art. 143, 153–181, 307–419 of the Civil Code of the Russian Federation (from 06/01/2018, Articles 815–816 of the Civil Code of the Russian Federation lost force).

Accounting for settlements with bills of exchange

Accounting for bills of exchange is regulated by the following regulatory documents: - PBU 15/01 “Accounting for loans and credits and the costs of servicing them”, approved by Order of the Ministry of Finance of Russia dated 02.08.2001 No. 60n;

— PBU 19/02 “Accounting for financial investments”, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n;

— PBU 8/01 “Conditional facts of economic activity”, approved by Order of the Ministry of Finance of Russia dated November 28, 2001 No. 96n;

— Chart of accounts for accounting of financial and economic activities of organizations and Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n;

— Letter of the Ministry of Finance of Russia dated October 31, 1994 No. 142 “On the procedure for reflecting in accounting and reporting transactions with bills of exchange used in settlements by organizations for the supply of goods, work performed and services rendered” (hereinafter referred to as Letter No. 142) - in the part that does not contradict Chart of accounts and later PBU;

- the relevant chapters of the Tax Code of the Russian Federation.

It is traditional to divide bills of exchange into financial and commodity, although such a division is not directly provided for by law.

Commodity (settlement) bills are bills that are received by sellers (suppliers) directly from buyers (customers). In this case, the bill of exchange is used as a means of obtaining a deferred payment or a commercial loan (Article 823 of the Civil Code of the Russian Federation).

Financial bills are bills that were previously purchased by the buyer for cash as a lender (Article 815 of the Civil Code of the Russian Federation). In this case, the bill of exchange is used as a means of formalizing the issuance of a loan (credit). In addition, financial bills include bills purchased on the secondary bill market with the aim of making a profit from an increase in market value or receiving a discount (interest). In this case, the bill acts solely as a security.

Such terminology, although used in everyday life, is not normatively defined. It does not reveal the influence that the bill of exchange has on the state of settlements between the buyer and seller of goods (works and services), and therefore is not rational.

More functional is the classification of bills of exchange as a settlement instrument for own bills of exchange, that is, bills of exchange of the buyer, and bills of exchange of a third party. This classification is enshrined in clause 2 of Art. 172 of the Tax Code of the Russian Federation.

When the buying organization pays the seller with a bill of exchange, the obligations for which lie with itself, for the organization it is its own bill. For the seller organization receiving such a bill of exchange, this is a buyer's bill of exchange.

If the obligee on a bill of exchange is a person other than the buyer, usually not the seller, that is, a third party in relation to the parties to the transaction, such a bill of exchange will be a bill of exchange of a third party for both the buyer and the seller. A bill of exchange of a third party can be a bill of exchange previously purchased for cash, or a bill of exchange received in payment for goods (work, services).

REFERENCE

The regulation on bills of exchange and promissory notes was put into effect by Resolution of the Central Executive Committee and Council of People's Commissars of the USSR dated 08/07/37 No. 104/1341. Applied on the territory of the Russian Federation in accordance with the Law of March 11, 1997 No. 48-FZ “On Bills of Exchange and Promissory Notes”.

In accordance with Articles 1 and 75 of the Regulations “On Bills of Exchange and Promissory Notes,” a bill of exchange is a unilaterally expressed unconditional obligation of the drawer to pay a certain amount of money to the bill holder. In other words, the issuance of one’s own bill indicates that one party (supplier or lender) has already fulfilled its obligations, and the second (issuing bill) party is nominating its obligation. What is the point of such an innovation? The main thing, in my opinion, is that the party that has fulfilled the obligations is no longer obliged to prove this in court, but can exercise its rights by presenting a bill of exchange or assigning claims under the bill of exchange (transfer by endorsement).

Thus, the main purpose of the bill is to simplify settlements through a series of endorsements. This is what distinguishes it from other securities. This is confirmed by both the history of the return of bills of exchange to economic circulation in the early 90s (see Letter No. 142) and the widespread use of interest-free bills in modern practice.

The ongoing debate about whether a bill of exchange is a means of payment is caused by the formal attitude towards a bill of exchange as a security and the fact that in the Civil Code of the Russian Federation bills of exchange are directly mentioned only in Chapters 42 “Loan and Credit” and 44 “Bank Deposit” as a means of formalizing borrowed relations , and in Chapter 46 of the Civil Code of the Russian Federation “Settlements”, settlements with bills of exchange are not regulated as an independent type of settlement. We will be guided by the principle of substance over form and consider the accounting of bills of exchange taking into account the purpose of their acquisition or use using specific examples.

Settlements with the buyer's own bill of exchange

Situation 1. According to the supply agreement, the supplier shipped products to the buyer in the amount of 1180 rubles, including VAT - 180 rubles. To secure the debt, the buyer issued his own bill of exchange to the supplier with a nominal value of 1,300 rubles. The maturity date of the bill is six months.

In the accounting records of the drawer (buyer), transactions are reflected as follows:

Debit 60 subaccount “Payments for goods” Credit 60 subaccount “Bills issued”

— 1180 rub. - novation of accounts payable into a bill of exchange

Debit 97 Credit 60 subaccount “Bills issued”

— 120 rub. - discount on bill

Debit 91 subaccount 2 “Other expenses” Credit 97

— 20 rub. monthly - equal recognition of operating expenses in the amount of the corresponding share of the discount (in order to unify accounting and tax accounting, income can be reflected at 60 rubles quarterly)

Debit 60 Credit 51

— 1300 rub. — payment of the bill at par upon its presentation for redemption.

For tax purposes, the drawer (buyer) has the opportunity to reduce the tax base for income tax by the amount of interest due on the bill, since according to subparagraph. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, non-operating expenses taken into account when taxing profits include expenses in the form of interest on debt obligations of any type, including interest accrued on securities issued by the taxpayer. The amount of interest accrued on a debt obligation for tax purposes can be recognized either in full or in part using one of the methods at the choice of the taxpayer (Article 269 of the Tax Code of the Russian Federation).

In the accounting of the bill holder (seller), transactions can be reflected as follows:

Debit 62 subaccount “Bills received” Credit 62 subaccount “For shipped goods, works, services”

— 1180 rub. — receipt of a bill of exchange for debt (maintenance of the sub-account “Bills received” is not directly provided for in the Chart of Accounts, but is provided for in clause 5 of Letter No. 142)

Debit 62 subaccount “Bills received” Credit 91 subaccount 1 “Other income”

— 20 rub. monthly - operating income is recognized in the amount of the corresponding share of the discount (a one-time reflection of the entire amount of the discount using account 98 is impractical from the point of view of simplifying VAT accounting; quarterly recognition of income is possible)

Debit 51 Credit 62 subaccount “Bills received”

— 1300 rub. — funds received upon presentation of a bill for redemption.

In the tax base for income tax, income in the form of a discount on a bill of exchange can be included as income associated with the sale of products in accordance with clause 2 of Art. 249 of the Tax Code of the Russian Federation, which will ensure the identity of accounting and tax accounting.

A slightly different reflection of this operation seems more appropriate and clearly demonstrates the essence of the innovation made:

Debit 58 Credit 62 subaccount “For shipped goods, works, services”

— 1180 rub. — reflection of the received bill of exchange as a financial investment, which meets the criteria of PBU 19/02, since income on the bill of exchange is expected to be received in the amount of the discount

Debit 58 Credit 91 subaccount 1 “Other income”

— 60 rub. — operating income is recognized quarterly in the amount of the corresponding share of the discount

Debit 51 Credit 58

— 1300 rub. — funds received upon presentation of a bill for redemption.

With this method of accounting, the identity of accounting and tax accounting can be ensured by recognizing the discount as non-operating income in accordance with clause 6 of Art. 250 Tax Code of the Russian Federation.

As for the issues of submitting VAT for deduction, the new version of Art. 172 of the Tax Code of the Russian Federation removed most of the issues related to settlements with bills of exchange. The main remaining feature is the need to restore VAT in cases where the actual amount of payment on the bill is less than the amount indicated in the invoice. In addition, it must be remembered that the discount (interest) income of the bill holder increases the VAT tax base only to the extent that it exceeds the refinancing rate of the Bank of Russia in the period of income recognition. That is, for the purpose of calculating VAT, income within the refinancing rate is recognized as non-operating income, and in excess of the rate - as income related to payment for goods.

Payments by a third party bill of exchange previously received for the supply of goods

Situation 2. The bill holder, experiencing a lack of working capital, three months before the due date, transferred a bill with a face value of 1,300 rubles, received from the drawer-buyer, in payment of accounts payable to his supplier in the amount of 1,180 rubles.

In the accounting records of the organization transferring such a bill, the specified operation is recorded as follows:

Debit 60 Credit 62 subaccount “Bills received”

— 1180 rub. — repayment of accounts payable by the buyer’s bill of exchange is reflected. The transfer of the buyer's bill of exchange by endorsement is reflected in accounting directly, without using account 91 “Other income and expenses”, since we consider the bill of exchange as a settlement instrument

Debit 91 Credit 62 subaccount “Bills received”

— 60 rub. - a loss from the disposal of the bill is reflected, since operating income in the amount of 60 rubles has already been accrued for three months.

In addition, let us not forget that until the repayment of the bill of exchange, the endorser is jointly and severally liable for its payment (if the endorsement was made without appropriate reservations), and, therefore, the endorsed bill of exchange must be accounted for in off-balance sheet account 009 “Securities for obligations and payments issued” until the moment of repayment of the bill or the expiration of the period for its presentation.

For tax purposes, recognition of this loss may be controversial, since neither Art. 268, nor art. 279, nor art. 280 of the Tax Code of the Russian Federation does not contain specific instructions on the procedure for attributing to expenses previously accrued but not actually received interest income.

You should also be prepared for disputes with tax authorities about the need to distribute “input” VAT on general business expenses, since they tend to treat settlement by a third party bill as an independent transaction (sale of a security) not subject to VAT. However, the arbitration practice of 2005 indicates that the courts recognize the dual nature of the bill of exchange and, if the transfer of the bill of exchange does not lead to the receipt of additional income, but is made solely for settlements, when resolving such a dispute, they side with the taxpayer (resolutions of the Federal Antimonopoly Service of the North-Western District dated 09.11.2005 No. A56-10224/05, FAS Volga-Vyatka District dated 22.12.2005 No. A43-10282/2005-32-373).

Accounting for the new bill holder is carried out as accounting for the financial investment described in the previous section.

Settlements with a third party bill of exchange previously purchased for money

In modern practice, bills of exchange from reliable issuers are often purchased specifically for payments for supplied goods (for example, bills of exchange from Sberbank).

Situation 3. Let’s say the debt for the purchased goods is 1300 rubles. The accounting of the organization transferring such a bill will depend on whether the bill was purchased earlier at its face value or at a discount. For clarity, we assume that the acquisition of a bill of exchange and its transfer occur in the same reporting period.

Let's assume a bill with a face value of 1,300 rubles. purchased for 1180 rubles, then the following entries must be made in accounting:

Debit 58 Credit 51

— 1180 rub. — financial investments are reflected at the cost of acquisition

Debit 76 Credit 91 subaccount 1 “Other income”

— 1300 rub. - a bill of exchange was transferred in payment for the goods (in this case, the transfer of this bill of exchange must be considered as the sale of a security)

Debit 91 subaccount 2 “Other expenses” Credit 58

— 1180 rub. — the cost of purchasing the bill is expensed

Debit 60 Credit 76

— 1300 rub. — accounts payable are repaid by transfer of the bill of exchange.

If the bill has a nominal value of 1300 rubles. purchased for its nominal value, the accounting entries will be different:

Debit 76 Credit 51

— 1300 rub. — the acquisition of a bill of exchange for payment for goods is reflected (such a bill of exchange cannot be considered as a financial investment, since one of the criteria of PBU 19/02 is not met - the ability to bring economic benefits in the future)

Debit 60 Credit 76

— 1300 rub. — accounts payable are repaid by transfer of a bill of exchange.

In both cases, the bills of exchange transferred by endorsement must continue to be accounted for in off-balance sheet account 009, as indicated in the previous section.

Tax accounting for income tax will be similar to accounting. But the distribution of “input” VAT in the first of the considered options will be difficult to avoid. To do this, it will be necessary to prove that general business expenses relate exclusively to transactions subject to VAT. However, in such cases there is positive arbitration practice (resolutions of the FAS of the North-Western District dated November 22, 2004 No. A26-2582/04-28 and dated February 13, 2006 No. A05-2843/2005-26).

It should be noted that due to the dual nature of the bill (a means of payment and a security at the same time), the proposed posting schemes are not indisputable and cannot be unambiguously confirmed by references to regulatory documents.

Functions of a bill

A bill of exchange is an important financial instrument that performs certain functions:

A promissory note is primarily a means of obtaining a loan. Using a bill of exchange, you can pay for purchased goods or services, repay a loan received, or provide a loan. For creditors, the formal and material strictness of the bill, its easy transferability and speed of debt collection are attractive.

Another function of a bill of exchange is the ability to use it as security for transactions. In other words, the holder of a bill of exchange has the right to receive money on a bill of exchange earlier than the deadline established in it in two ways: by discounting the bill of exchange in a bank or by obtaining a loan secured by the security he has.

A bill of exchange serves as a tool for monetary settlements. In addition, it is able to speed up settlements, since before payment the bill passes through several holders, extinguishes their obligations and thereby reduces the need for real money.

The advantages of such lending

It has recently gained widespread popularity, especially at enterprises whose efforts form a single industrial group. After all, it is on the basis of such a loan that payments for product items/services are made.

Here are the main positive nuances that you should count on when using this type of loan:

- no need to make an advance payment for the desired product item or service, which significantly facilitates mutual relations between the parties;

- acquisition by the buyer of not only a commodity item, but also a deferred payment, which helps expand opportunities for further purchase of goods;

- low interest rate, generating demand for purchased goods or services, as well as creating favorable transaction conditions for all parties;

- a high level of guarantees for the supplier against possible force majeure circumstances, because all risks are now on the side of the banking organization.

This type of lending has many features. Particular liquidity is observed in securities belonging to the largest and most popular banking structures.

What is a bill of exchange?

A promissory note is similar to a promissory note. It confirms that the maker (the one who issued the bill) is obligated to pay the creditor (the buyer of the bill) a certain amount within a certain period. The maker of the bill is also called the debtor, the payment of money is called repayment of the bill.

Most often, bills of exchange are used by companies to pay each other. Less often, they issue promissory notes to borrow development money from people.

Private individuals also have the right to issue promissory notes instead of promissory notes, but practically no one uses this opportunity.

Distinctive features of the bill

The distinctive features of the bill are as follows:

- Abstractness of the bill. That is, the obligations under the bill have only a monetary value and are not directly related in any way to the specific obligations of the drawer.

- Possibility of transfer to third parties without documenting such a transaction;

- Indisputability of the bill. That is, the requirements under the bill are unconditional for execution and are implemented in full.

- Solidarity bill. That is, all persons involved in the execution and circulation of the bill bear responsibility for the bill.

- Documentation of the bill. That is, the bill is drawn up in the form of a strict reporting form in paper form.

- In case of failure to pay the debt within the stipulated period, no legal proceedings are required. In this case, it is enough to make a notarial protest.

Other documentation features

Presentation of the checks in question to financial institutions is carried out taking into account registers and established forms. Next, the entries from the register are compared. After this, the papers are checked from the point of view of their reliability.

From the legal side, it means checking the correctness of filling in the data on the parties involved in signing the document

It is also important to verify the authenticity of these signatures. If there are violations, they are deleted from the register. From an economic point of view, the reliability of the document is checked, that is, the possibility of making an appropriate payment using it.

If during verification some documents turn out to be unsatisfactory, they are often deleted from the register. As for the remaining elements, they must be taken into account with a permit from the manager.

Calculation scheme

The form of payment by bills of exchange has its own procedure, according to which you can find out the specifics of working with these documents. First of all, there are two participants: the giver and the holder, the buyer and the supplier, respectively. At the first stage, an agreement is formed between them, which stipulates the obligation to repay on time. The second part is the exchange of the document for goods or previously defined services, that is, items specified in the main agreement.

When the specified time arrives, banks' transactions with bills occur. Their holder transfers the paper to his bank, and this intermediary, in turn, sends it to the institution serving the person who issued the paper. Next, the funds are transferred to the holder’s account and the procedure is completed. There is a modified scheme that includes mediation between the banks of the domicile - a third party who must repay the paper at the place of residence (domicile) of the payer; this procedure is called domiciliation of existing bills. But any other place can be chosen, documented and in writing, the latter is required to eliminate the risk.

Algorithm for the type of financing under consideration

The implementation of the contract will be impossible and void if several aspects are not observed.

- A legal entity should create an appropriate request and go through a set of necessary procedures and prepare documentation, and then receive loan funds in the specified amount.

- Elements are used to pay for goods that have already been received by recipients from suppliers.

- After the sale of commodity items and receipt of real resources from the legal entity, an application must be made to the bank in order to return the borrowed amount.

- Suppliers who own a check have two options for solving this problem: carry out settlement transactions with partners or contact a banking organization in order to receive a specific monetary value identical to the size of the bill. If the first option is preferable, the transfer occurs to the next hands.

This is what bill lending looks like in practice, and then it’s time to familiarize yourself with its forms.

How does a bill differ from a deposit?

Often sellers of bills of exchange claim that these are practically identical financial products, but the return on the bill will be higher than on the deposit. In some cases this may indeed be true. But at the same time, sellers usually remain silent about the risks associated with the purchase of a bill.

- The bill is not insured.

Bank deposits are insured by the state. If the bank’s license is revoked, its depositors will definitely get their money back, up to 1.4 million rubles. In the case of a bill of exchange, even if it is issued by a bank, there are no guarantees in force majeure situations. Investments in bills of exchange are not covered by the deposit insurance system. Bill holders belong to the third - last - line of creditors. This means that if the license is revoked, the bank that issued the bill may no longer have money left to pay off debts to them. - You cannot repay a bill before the due date indicated on it.

The deposit can be withdrawn at any time, although usually with a loss of interest. This will not work with a bill of exchange. If it indicates a specific repayment period, the money cannot be received until that moment.

- Income on the bill is subject to tax.

The tax is 13%. For example, if the income on a bill is 20,000 rubles, 2,600 rubles of this will have to be paid as income tax.

Income from bank deposits is taxed only in exceptional cases: if the interest on the deposit exceeds the key rate by 5 percentage points. There are practically no such offers on the market. Therefore, it is worth carefully assessing the benefit when the interest on the bill is only slightly higher than the rate on the deposit.

Ivan Nikitich was not told about all these risks. He encountered misselling when, under the guise of one product - a bank deposit - he was sold a completely different one. You can learn how to avoid finding yourself in such a situation and what to do if an unnecessary product or service is imposed on you from the text “Misselling, or How not to buy a pig in a poke.”

Key loan forms

Currently, it is customary to talk about two key types of this loan - dative and bearer. In practice, a huge number of different types of such lending are used.

- Acquiring a check for the purpose of carrying out subsequent settlement activities with counterparties.

- Drawing up contracts on the basis of which the client is assigned an obligation to return certain percentages.

- Purchasing product items at a discount.

- Receiving a certain amount of money, with the agreement acting as collateral for the transaction.

- Issuing a check with a long circulation time.

This lending is in demand and popular today; in this regard, it is necessary to take into account several of its points.

What problems does the bill solve?

Using a bill of exchange solves the following problems:

- creates conditions for the unconditional receipt of funds for goods supplied, work performed or services rendered;

- makes it possible to conclude a purchase and sale transaction for goods, works, services without the condition of prepayment;

- can be used as an effective means of payment between legal entities and individuals, for offsetting mutual claims;

- may be the object of sale or purchase or be the subject of a pledge.

General scheme of bill payments

The scheme for settlements with bills in the general case is as follows:

- When paying with simple bills:

- the buyer of goods/recipient of services (drawer) issues a bill of exchange to the seller/service provider (drawer) as confirmation of his obligation to pay for the goods/services in the future;

- the holder of the bill fulfills his obligation to the drawer, for example, through the sale of goods or the provision of services;

- the holder of the bill presents the bill for payment;

- repayment of a promissory note directly by the drawer, i.e. fulfillment of the obligation to pay for a good or service.

- When paying with bills of exchange:

- the buyer of goods / recipient of services (drawer, drawer) sends to the debtor (drawee) a bill of exchange (draft) issued in the name of the recipient of funds (remitee), for example, the seller;

- the drawee sends the accepted bill to the drawer (if the drawee does not accept the bill, the bill of exchange is subject to notarization);

- the drawer transfers such a bill to the remitter by means of an endorsement - an endorsement (Chapter II of Regulation No. 104/1341);

- the remitter presents the bill of exchange to the drawee for payment;

- the drawee carries out the cancellation of the bill, i.e. payment.

IMPORTANT! When resolving disputes related to bill settlements, the following conclusions of the law enforcement officer may be useful (see the decision of the Supreme Court of the Russian Federation dated February 15, 2018 No. 305-ES17-17027 in case No. A40-90813/2016): - if a promissory note is not presented, the holder loses his rights in relation to persons obligated under the bill, except the drawer;

- the drawer of a promissory note is obliged in the same way as the acceptor of a transferable bill;

- the claims of the holder of the bill against the drawer arising from the promissory note are extinguished upon the expiration of three years from the date of payment.

maturity date

The maturity date is the date on which the note must be paid. It is either directly indicated in the promissory note or determined in some other way. The most common ways to indicate the maturity date are:

- A specific date, for example: “November 14, 20xx.”

- A certain number of months from the date of execution of the bill, for example: “3 months from the date of execution.”

- A certain number of days from the date of execution of the bill, for example: “60 days from the date of execution.”

If you directly indicate the maturity date of the bill of exchange, no difficulties arise. If the repayment date is determined by the number of months from the date of execution of the bill, the same date of the corresponding next month is taken. For example, a bill dated January 20 with a maturity date of 2 months from the date of execution must be paid on March 20.

If the maturity date occurs after a certain number of days from the date of execution of the bill, then it can be calculated by adding the exact number of days. It is important to exclude the date of execution of the bill and include the date of its repayment. For example, a bill dated May 20 with a maturity date of 90 days, in accordance with the above calculation, must be paid on August 18:

| Remaining days in May (31 – 20) | 11 |

| Days in June | 30 |

| Days in July | 31 |

| Days in August | 18 |

| Total days | 90 |

What else could be dangerous about buying a bill?

The main risk - not returning the money paid for the bill - can arise in several other cases.

The bill was issued by scammers

Absolutely any company has the right to issue a bill of exchange, and fraudsters can take advantage of this. For example, they will sell bills that they are not going to pay at all and disappear. In this case, the creditor will most likely have to say goodbye to his money forever.

The bill is incorrectly drawn up

There are very strict requirements for drafting a bill of exchange. It must contain the following mandatory details:

- Heading

. It should say what kind of paper it is - “Promissory Note” or “Bill of Exchange”. A promissory note is used when there are only two parties to a transaction - the debtor and the creditor. A bill of exchange is used very rarely - if a third party appears in the transaction (he is called the payer). He returns the money to the creditor instead of the debtor. - Amount to be paid

. It must be written without corrections - both in numbers and in words. If the bill is interest-bearing, the interest must be specified separately. - The date and place of drawing up the bill, that is, the place where it was purchased

. If the place of drawing up the bill is not specified, it is considered to be the address of the debtor. - Payment term

. It can be indicated in different ways. The first option is to write on the bill a specific date when it must be repaid. Another option is the inscription “on presentation”. It means that payment can be demanded at any time within a year from the date of drawing up the bill. In addition, it is allowed to indicate a certain period when you can receive money. For example, “upon presentation, but not earlier than February 3, 2021 and no later than February 3, 2021.” If the due date is not written at all, it is considered to be a bill payable at sight. - The place where the payment is to be made

. If it is not indicated, then the money must be paid in the same place where the bill was drawn up. If there is also no information about the place of issue, then the place of payment will be considered the address of the drawer (promissory note) or payer (bill of exchange). - Creditor's name

. This is the full name of the company or the last name, first name, patronymic of a person, as well as their full addresses. - Signature of the drawer

. The bill must be signed manually. If a bill of exchange is issued by a company, it must bear the seal of the organization, as well as the signature of the general director and, preferably, the chief accountant. - Details of the debtor

. The full name and address of the legal entity or the surname, first name, patronymic and place of registration of the person are indicated. The bill of exchange must contain the details of both the drawer and the payer.

If any of the required details are missing, then the document drawn up is not considered a bill of exchange. This will be important if the creditor has to collect the debt through court. The procedure for a bill of exchange is simpler and faster than for other obligations.

But you can write out a bill on any sheet of paper; special forms are not required for this.

The bill must be paid by another company than the one from which you bought it.

Each creditor can sell or simply give it to another owner - this is completely legal. On the reverse side of the bill or on a separate sheet indicate the name and details of the legal entity or the surname, first name, patronymic of the person to whom the bill is transferred, as well as the name or name of the previous owner. If it is a company or organization, then a seal must be affixed.

And here you need to be very careful. Next to the name of the previous owner of the bill it may be written: “without negotiability on me.” Such an entry means that this person or company does not assume any obligations under the bill to subsequent holders of the bill. The last owner will have to claim the debt from the one who originally issued the bill - from the debtor, in the case of a bill of exchange - from the payer. And finding them can be difficult.

If there is no mark “without recourse to me” opposite the name of the previous owner of the bill, then he is jointly and severally liable with the debtor or payer to repay the obligations. This means that the creditor can demand the entire amount from one of them or distribute it among the defendants in any proportion.

Therefore, when purchasing a bill of exchange, you always need to find out who will ultimately have to pay for it.

The bill was lost

The bill is issued on paper and is not stored electronically. If the bill is lost, you will have to prove in court that it was there. As evidence, you can provide, for example, a bill of exchange purchase and sale agreement.

Formulas for calculation operations

Commercial elements are created on the basis of a specific transaction for the sale of goods and services, when the buyer, making payment actions, offers this type of payment.

As for financial checks, they act as clear evidence of the presence of a loan. Bank papers are a type of such documents.

With the growth of commodity circulation in the vastness of our country, commercial structures are increasingly interested in various types of financial transactions

When implementing them, it is important that cash flow remains at the same level

Therefore, when choosing loans, absolutely every party wins if they are able to choose a competent approach to their processing.

Features of accounting actions

This process is an operation in which the holder is issued with amounts before the due date. At the same time, the banking institution retains some profit for itself (discount). Its value can be calculated using the simplest economic formula.

And now it’s time to familiarize yourself with the decoding of this equality. It is assumed that the unknown figure “S” acts as a percentage (discount), the indicator “V” in the numerator symbolizes the cost criterion of the bill, and “t” is the period that remains until the time of payment on it (its measurement is carried out in days). As for the parameter “r”, the annual rate is taken as it.

There is also a certain procedure within which all objects of bill lending are determined:

- finding all percentage numbers for each item (this is the amount and term divided by 100);

- receiving interest payments on all securities that are accounted for on a certain day, then they must be added up;

- multiplying the obtained values by the discount rate, which is first divided by 360 (the number of days in a year).

The discount is retained by the organization at the time it is recorded. A commercial entity that is engaged in writing off a certain amount can simultaneously use several discount rates.

Their indicator traditionally depends on the period remaining until payment, as well as on the reliability of the payer and the conditions of other institutions.

Check in international payments

A check is a type of security containing an unconditional order from the drawer to the bank to pay the amount indicated in it to the check holder (clause 1 of Article 877 of the Civil Code of the Russian Federation). The payer of a check is a bank where the drawer has his own funds, which the drawer is authorized to dispose of by issuing checks.

This method of mutual settlements is currently not so widespread in international practice and is used when it is necessary to quickly pay for goods received or services provided using cash.

The legal regulation of the use of checks in international payments is based on the special Geneva conventions of 1930–1931, including:

- "Uniform Check Law";

- "Convention on Stamp Duty in Respect of Cheques";

- "A Convention for the Purpose of Resolving Certain Conflicts of Laws Relating to Bills of Exchange and Promissory Notes."

***

So, one of the common forms of non-monetary settlements between parties for obligations is settlement by bills of exchange. Depending on who the drawer entrusts with the obligation to cancel the bill, such securities are divided into simple and transferable.

Securities exchange agreement – bonds and bills Read more

***

Was the article useful? Subscribe to our channel RUSYURIST in Yandex.Zen!

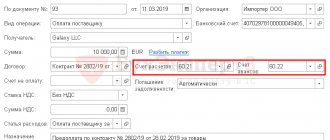

Accounting entries

To correctly reflect the receipt of a bill on the balance sheet (plus) or its debit, it is necessary to use postings. The company's accountants must correctly use the system of accounts and subaccounts, using them to form debt receipts, possible movements of income on bills, as well as write-offs in case of repayment. A sample of each posting is presented in the table.

| Operation | Giver (Dt/Kt) | Holder (Dt/Kt) |

| Debt formation | 60calc/60veks | 62veks/62calculation |

| Appearance on the balance sheet | 9 | 8 |

| Interest-bearing bill on balance sheet | 91/60veks | 62veks/91 |

| Payment of bills | 60veks/51 | 51/62veks |

| Write-offs from off-balance sheet accounts | Kt 009 | Kt 008 |

If we mean someone else’s bill of exchange as an received asset that is capable of generating income (discount type of paper), then postings are used (Dt 58-2/Kt **):

- purchase - 76;

- payment by third party paper - 62;

- acceptance as a contribution to the management company - 75;

- exchange of property occurred - 91;

- admission on a free basis - 91.

When removed from the balance sheet, the certificate should also be reflected in postings, taking into account exactly how the minus occurred. The sale or payment of a paper requires the use of Dt 76 Kt 91, but if the delivery was paid for at its expense, then it is necessary to use the posting Dt 60 Kt 91. The contribution of the bill to the capital company, at which it is removed from the balance sheet, is indicated by the combination Dt 58-1 Kt 91 If a loan was issued, then posting Dt 58-3 Kt 91 is required. A property exchange transaction in which the bill of exchange has changed the owner is reflected by the previous owner with posting Dt 10 Kt 91. Income tax (VAT) is not paid when selling a debt paper, there is no need to indicate this.

The document must be correctly formatted