Which depreciation group does the Data Storage System belong to?

OKOF code (version from 01.01.2021) 330.28.23.23 - Other office machines (including personal computers and printing devices for them; servers of various capacities; network equipment for local computer networks; data storage systems ; modems for local networks; modems for backbone networks)

OKOF code (version until 01/01/2021) 14 3020210 - Electronic computing equipment, including personal computers and printing devices for them; servers of various performance; network equipment of local computer networks; data storage systems ; modems for local networks; modems for backbone networks.

Network storage okof

ATTENTION! Do not confuse the boundary value of an object for accounting and tax purposes. From January 1, 2021, the cost criterion for accepting an object for accounting as fixed assets in tax accounting is 100,000 rubles. (law dated 06/08/2021 No. 150-FZ).

At the same time, according to the Tax Classification, computers are classified in the group “Other office machines”, which, along with computers, includes an extensive list of computer equipment: printing devices for computers, servers, network equipment for local area networks, data storage systems, etc. Therefore, for a laptop, the depreciation group will also be 2nd. And when a depreciable monoblock is accepted for accounting, the depreciation group for it will similarly be established from SPI over 2 years to 3 years inclusive. This means that the organization will be able to choose the depreciation period itself in the range from 25 months to 36 months inclusive. For the monitor supplied with the computer, OKOF and the depreciation group will also correspond to OKOF and the depreciation group of personal computers.

OKOF data collection terminal

The specialization of the store and its format also play a big role, since this is where the requirements for the design of the checkout area are born. For example, for a boutique, the appearance and even color of the equipment plays an important role. In a supermarket, the requirements are aimed at placing the equipment most conveniently relative to the movement of the cashier in the checkout box, thereby increasing the speed and quality of customer service, as the most important indicator of the operation of such a store.

How can you save money when purchasing POS systems by choosing different components (keyboard, monitor, etc.)? The main cost part in any POS system is the fiscal registrar and computer, so savings on peripheral equipment will be insignificant. Typically, the cost of peripheral equipment (cash drawer, barcode scanner) is less than 30% of the cost of the POS system.

Flash drive OKOF 2021

Are blinds a fixed asset or an inventory? Is the toilet a fixed asset or an inventory? Is a flash drive a fixed asset or an inventory? Is the printer a fixed asset or an inventory? Summary Are blinds a fixed asset or an inventory? It is necessary to determine what still belongs to fixed assets.

As a rule, all these points are included in the single cost specified in the contract, and therefore are taken into account in account 10.5 in one amount. In this case, VAT, which is contained in the cost, is reflected not on account 10, but on account 19, as for other purchased inventories.

OKOF hard drive

If the cost of the flash card is less than 1000 rubles. per unit, at the time of its transfer into operation on the basis of clause 43 of Instruction No. 25n, the accountant must write off its cost as expenses in the debit of account 1 40101 271 “Depreciation costs of fixed assets and intangible assets” or 2 10604 340 (271) “Increase in value production of materials, finished products (works, services)" (depending on from what sources and for what purpose the flash card was purchased) from the credit of account 0 10104 410 "Reduction in the cost of machinery and equipment."

In accordance with OKOF, external storage devices (code 14 3020340), which include “flash drives,” are included in group 14 3020210 “Peripheral devices and intersystem communication devices of computer systems and electronic machines,” which in turn is included in group 14 3020210 “ Electronic computer technology."

Establishment algorithm

To correctly classify a property object as an OS, it is necessary to check whether it has the following characteristics:

- the ability to bring economic benefits to the owner in future activities;

- the company does not plan its further resale;

- long-term use is possible (more than 12 months).

If the property meets all the specified characteristics, it is taken into account as a fixed asset.

All fixed assets are classified into groups with distinctive features depending on their useful life, which is understood as the time during which the object can serve the achievement of the company’s goals in economic and production activities.

In accounting and tax accounting, the OS Classification is used. The value of already recorded property, the use of which continues, is not revised this year.

New office for network storage

2 The objects of classification are fixed assets. The classifier was developed on the basis of harmonization with the System of National Accounts (SNA 2021) of the United Nations, the European Commission, the Organization for Economic Cooperation and Development, the International Monetary Fund and the World Bank Group, as well as with products by type of economic activity (OCPA2) (CPA 2021) and is intended, among other things, for the transition to the classification of fixed assets adopted in international practice based on the SNA 2021. As a result, the grouping of fixed assets in the Classifier, unlike the previous one, does not coincide with the grouping and analytical accounts.

We recommend reading: If the state fee was paid by another person, can it be accepted for consideration?

(hereinafter referred to as Instruction No. 157n), a grouping of fixed assets and an analytical accounting procedure are provided in accordance with the previous OKOF OK 013-94 classifier. Therefore, before the implementation of federal standards and changes in the procedure for applying the new OKOF for public sector organizations, it has been determined. What should you pay attention to when using the Classifier for accounting purposes? 1 is used to group fixed assets accepted for accounting (budget) accounting from January 1, 2021. In this case, objects accepted for accounting as part of fixed assets before this date are subject to reflection in accounting (budget) accounting in accordance with the grouping in accordance with the previous useful life of these objects, established taking into account fixed assets included in depreciation groups (hereinafter - OS classification). There is no need to transfer fixed assets accepted for accounting before January 1, 2021 to the new OKOF and recalculate depreciation.

Last changes

Previously, the coding of fixed assets was encrypted with 9-digit values in the format XX ХХХХХХХ. From 2021, the new encoding is of the form ХХХ.ХХ.ХХ.ХХ.ХХХ. Such changes significantly transformed the structure of OKOF.

Some names contained in the old classifier were removed, and in OKOF-2017 they were replaced with generalizing positions. For example, now there are no separate lines for unique types of various software, but a common object “Other information resources in electronic form” has appeared.

At the same time, the PF classifier contains new objects that had no analogues in the previous version. These include equipment that did not exist in the last century.

Among the changes was the new location of some fixed assets in relation to belonging to the depreciation group. This indicates the introduction of other operational periods for them, and, consequently, a change in the period for writing off their original cost in tax accounting.

Innovations apply only to operating systems introduced on January 1, 2021. There is no need to re-determine the depreciation group of fixed assets available to the enterprise. Depreciation on them will be carried out in the same manner.

For new property, special tools are provided for a convenient transition to the new OKOF - transition keys between editions (direct and reverse). OKOF-1994 and 2021 are available in Rosstandart order No. 458 of 2021. They are presented in the form of a comparative table with a comparison of specific property objects. With its help, a new encoding is simply selected.

Meaning of the OKOF code for the printer

- OKOF code for a laser printer (from January 1, 2021) is 320.26.2, the category “Computers and peripheral equipment” includes personal computers, various peripheral devices, including printers. Code 320.26.20.13 is used if the printer has a central processor (by default on all modern models).

- OKOF code until January 1, 2021 – 14 3020210, category “Electronic computing equipment”.

Why is correct group selection required, and what coding should be done if not explicitly stated? We are talking about writing off depreciation value. According to the third category, equipment is written off within 2-3 years. On the one hand, this is true in large companies. On the other hand, modern peripherals are designed to operate for at least 3 years. The manager of the enterprise will not encourage the write-off of expensive color laser printing equipment with a scanner from fixed assets. What conclusion can be drawn from this?

New office for network storage

Rationale for the conclusion: The issue of classifying material assets as fixed assets (including determining the OKOF code) or inventory is within the competence of the commission for the receipt and disposal of assets (clause 34 of the Instruction, approved by order of the Ministry of Finance of Russia dated December 1, 2021 N 157n, hereinafter - Instruction No. 157n, Commission). When classifying property as fixed assets, it is necessary that in relation to it the criteria listed in paragraphs are simultaneously met. 38, 39, 41, 45 Instructions No. 157n. In accordance with the provisions of Instruction N 157n, the purpose of applying the All-Russian Classifier of Fixed Assets is to determine the analytical accounting of fixed assets when they are registered (see letter of the Ministry of Finance of Russia dated December 27, 2021 N 02-07-08/78243). The grouping of fixed assets accepted for accounting from January 1, 2021 should be carried out in accordance with the grouping provided for by the All-Russian Classifier of Fixed Assets OKOF OK 013-2021 (SNS), approved by Order of Rosstandart dated December 12, 2021 N 2021-st (hereinafter - OKOF) (see letter of the Ministry of Finance of Russia dated December 27, 2021 N 02-07-08/78243). The objects of classification in OKOF are fixed assets. OKOF was developed on the basis of harmonization with the System of National Accounts (SNA 2021) of the United Nations, the European Commission, the Organization for Economic Cooperation and Development, the International Monetary Fund and the World Bank Group, as well as with the All-Russian Classification of Products by Type of Economic Activities (OKPD2) OK 034- 2021 (CPES 2021) and is intended, among other things, for the transition to the classification of fixed assets adopted in international practice based on the SNA 2021. As a result, the grouping of fixed assets in the Classifier, in contrast to the previous OKOF OK 013-94, approved by the Decree of the State Standard of the Russian Federation dated December 26 .1994 N 359 (hereinafter - OKOF OK 013-94), does not coincide with the grouping and analytical accounts according to Instruction N 157n. The OKOF code can be searched by the name of the fixed asset or by its purpose. The Vectorsolo network filter is a device for suppressing pulse and high-frequency interference in three circuits (phase-zero, phase-ground, zero-ground), protecting against power overload and short circuit (TBMP) * (1). A contextual search by object name, including word forms and possible synonyms, does not produce results, as does a search by object purpose. In such a situation, you can use the following technique: use the previous OKOF OK 013-94 and search on it, and then find the code from OKOF OK 013-2021, using the transition key between OK 013-94 and OK 013-2021 (SNS 2021), approved by order of Rosstandart dated 04/21/2021 N 458. According to OK 013-94, the line filter corresponds to code 16 2930361 “Voltage stabilizers”. According to the direct transition key, code 16 2930361 must be matched with a code selected from the code range 330.28.23-330.28.29. This interval contains group 330.28.23.2 “Office equipment”, detailed by code 330.28.23.23 “Other office machines”, as well as group 330.28.29 “Other general purpose machines and equipment, not included in other groups”. Despite the fact that in this case, due to the insignificant cost of the fixed asset (up to 3,000 rubles), the Commission does not need to determine the depreciation rate, the provisions of the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2021 N 1 ( hereinafter referred to as Classification), make it possible to clarify the selection of the OKOF code. According to the Classification, the second depreciation group (over 2 years up to 3 years inclusive) with code 330.28.23.23 includes equipment along with personal computers, printing devices, LAN network equipment, etc. The third depreciation group (over 3 years up to 5 years inclusive) with code 330.28.29 includes household appliances. At the same time, we recall that the useful life is determined by the longest period established for the depreciation group (from the first to the ninth) (clause 44 of Instruction No. 157n). Thus, based on the nature of use, as well as the warranty period of 3 years * (1), we can conclude that the most suitable code for a surge protector is code 330.28.23.23 “Other office machines.”

We recommend reading: Zemstvo paramedic in which regions is implemented

For your information: The definition of useful life is explained in paragraph 44 of Instruction No. 157n. In particular, the useful life can be determined: 1. According to the Classification; 2. Based on the recommendations contained in the manufacturer’s documents included with the property. If it was not possible to determine the useful life of the property using the listed methods, it can be determined by a decision of the Commission, taken, in particular, taking into account the expected period of use of this object, the expected physical wear and tear, depending on the mode of operation, the warranty period of use of the object (clause 44 of Instructions No. 157n). Thus, determining the useful life is possible not only through Classification. If this document does not give an unambiguous answer to the question of determining the useful life of the property, it can be determined in the second way or on commission.

What is vending machine depreciation and how to calculate it

Hello, friends.

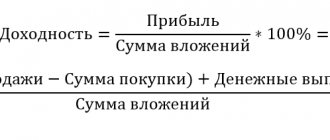

Some sellers and manufacturers of vending machines place on their websites forms for calculating the payback of vending equipment. For example, such forms can be seen at Wendland or on the website of the Siba-Vending company.

If we look carefully at these forms, then, among other data, we will see the columns “depreciation of machines” and “depreciation period of machines”. What do they mean? Let's figure it out.

What is depreciation

First, let's look at the classic definition of depreciation:

Depreciation is the gradual transfer of the value of a company's funds and its intangible assets to the final cost of the manufactured product.

If, after reading this sentence, everything immediately became clear to you, you are probably an accountant or economist. But for me, as, I think, for most vending machine operators, this definition of depreciation is a clever set of words... Therefore, let’s leave this scientific and economic jungle and look at what depreciation is using a specific example:

Suppose we bought a vending machine for a certain amount, for example, 245 thousand rubles. Like any technical device, our machine has a service life. For vending machines, this period is determined within the framework of the All-Russian Classifier of Fixed Assets (OKOF):

OKOF code 14 2919960 - machines for selling goods (vending machines and semi-automatic machines, change machines, cash registers and check-printing machines and other machines for selling goods) - over 7 years up to 10 years inclusive (fifth depreciation group). (In 2021, OKOF was changed, vending machines were assigned code 330.28.29.43 with an indefinite depreciation group, but this does not change the useful life of the machines.)

This does not mean at all that after this period the machine will be sent to a landfill; it can continue to work, but its physical and moral wear and tear by that time will be so significant that we will have to think about replacing it.

And so, in order for us to painlessly replace our vending machine with a new one, we will need to make monthly deductions from profits throughout its entire service life. This is depreciation.

As a result, through constant depreciation charges, a depreciation fund is formed, which is inviolable until the equipment is replaced.

That is, these are not deductions for current repairs and other operating expenses (although there is such a common but erroneous opinion), but an emergency reserve that allows you to save the initial amount of money invested in the machines within the business.

And this cash reserve has an important purpose - updating our fleet of vending machines.

How to calculate depreciation on a vending machine

Let's return to our example and calculate depreciation using the classic straight-line method. Let’s set the useful life of our vending machine to 7 years, make some simple calculations and get the depreciation rate:

1 / (7*12) * 100% = 1.1905%, Where: 7 is the useful life of the machine in years

12 – number of months in a year

Now let’s calculate the amount of monthly depreciation deductions:

(245000 * 1.1905%) / 100% = 2916.7 rubles per month Where: 245000 – cost of the machine

1.1905 is the depreciation rate, which we calculated a little higher.

Thus, if from the moment of purchasing a vending machine we set aside a monthly amount of 2917 rubles from the profit, then after 7 years the money spent on the equipment will be fully returned.

But can we use it to buy a new vending machine? Perhaps we can do some, but definitely not the one we want. Firstly, in 7 years, the cost of our vending machine model will increase, don’t go to grandma’s here. No one has canceled inflation and other government disasters.

Secondly, in addition to the physical wear and tear of the equipment, there is also obsolescence - the machine becomes technologically obsolete.

It may also happen that by that time our vending machine model will exist only on the used equipment market, and its updated, more modern analogues will have a completely different price tag.

For these reasons, the classical linear method “according to an economics textbook” will not suit us. Let's leave it for accounting and tax accounting; it definitely has no place in real business practice. And let's count differently.

We will use the linear method with periodic revaluation of equipment. Consider this situation:

By the end of the first year, the market value of our vending machine model was 258 thousand rubles, and by the end of the third year - 270 thousand rubles. Then the model was discontinued and, by the 7th year of operation of our machine, a new model with a similar configuration appeared at a price of 300 thousand rubles.

As we calculate: By the end of the second year, our depreciation fund is 35,004 rubles (2917 rubles * 12 months). Since the cost of the machine has increased to 258 thousand.

, we recalculate deductions based on the new price: (258000 * 1.1905%) / 100% = 3072 rubles per month Let’s calculate the underpayment for the first year: (3072 * 12 months) – 35.004 = 1860 rubles.

Let's distribute the underpayment among all further deductions for the remaining period:

1860/72 months=26; 3072+26=3098 rubles per month

For another couple of years, we regularly save 3,098 rubles per month. By the beginning of the 4th year, our fund was replenished by 109,356 rubles. With a new price increase to 270 thousand.

, again we recalculate depreciation charges in a similar way: (270000 * 1.1905%) / 100% = 3215 rubles per month Let's calculate the underpayment for previous years: (3215 * 36 months) - 109356 = 6384 rubles.

Let's distribute the underpayment among all further deductions: 6384/48 months = 133; 3215+77=3348 rubles per month

I think you understand the logic.

Deductions in the 7th year of operation of the vending machine, when the price of the model proposed for purchase is 300,000 rubles, will be calculated in the same way.

Our fund will be 109356+(3292*36 months) = 229884 rubles (300000 * 1.1905%) / 100% = 3572 rubles per month Let's calculate the underpayment for previous years: (3572 * 72 months) - 229884 = 27300 rubles We will distribute the underpayment among all further deductions :

27300 /12 months

=2275; 3572+2275=5847 rubles per month will be depreciation charges in the 7th year of the machine’s life.

Let's make a table by year:

| Year | Rubles per month | Rubles per year | Fund |

| 1 | 2917 | 35004 | 35004 rub. |

| 2 | 3098 | 37176 | RUB 72,180 |

| 3 | 3098 | 37176 | RUB 109,356 |

| 4 | 3348 | 40176 | RUB 149,535 |

| 5 | 3348 | 40176 | RUB 189,709 |

| 6 | 3348 | 40176 | RUB 229,884 |

| 7 | 5847 | 70164 | RUB 300,048 |

As a result, by the end of the 7th year of operation of our vending machine, we will receive the amount we need to replace it with new equipment in a normal configuration. The above situation is, of course, abstract. Prices for machines can increase abruptly, or they can grow steadily by 5-10% per year. But this does not change the essence of the calculation.

Despite the fact that this method of calculating depreciation reflects the real state of affairs and indeed allows you to promptly replace the machine with a new one, it has one significant drawback.

The amount of depreciation charges grows from year to year, while the machine itself wears out, and the share of profit in revenue is gradually reduced due to the increasing costs of repairing aging equipment.

In order to take this factor into account when calculating the depreciation of commercial equipment, another method is used, which is called the method of accelerated deductions with periodic adjustments. But more about this some other time.

Thank you for your attention.

Source: https://www.vendoved.ru/chto-takoe-amortizatsiya-torgovogo-avtomata-i-kak-ee-rasschitat/

Shock absorption group for flash drive

If an instrument of labor is owned by the taxpayer, is used to generate income, its useful life exceeds 12 months, but the cost is less than 100,000 rubles, then such a fixed asset is not recognized as depreciable property.

When analyzing the information array, we did not identify comments, explanations or any legal assessments of the actions of the legislator, who included the code of other office machines in the Classification, but did not name the code that is assigned to the main office equipment, for example, computers.

Registration

Fixed assets should be registered step by step in a certain sequence.

First you need to determine whether the object belongs to the OS. The service life of the asset in tax accounting must be more than 12 months and have a cost of 100 thousand rubles (clause 1 of Article 256 of the Tax Code of the Russian Federation). If these criteria are met, the value of the property cannot be attributed to expenses at a time. You need to choose a suitable group and useful life for it. After this, you can write it off through depreciation.

At the next stage, a depreciation group is selected. It starts with classification. If the type of property is not found in it, you should contact OKOF. First of all, the fixed asset type code, consisting of 9 digits, is determined. The group is located according to the first 6 designations, which must coincide with the Classifier encoding.

Fixed assets available in the Classifier:

| OS | Group | Service life, years | Where does it apply? |

| Printer | II | 2-3 | Electronic computer technology |

| Personal computer, laptop | II | 2-3 | |

| MFP printing | III | 3-5 | Photocopying facilities |

| Music center, plasma TV | IV | 5-7 | Television and radio receiving equipment |

| Office furniture | IV | 5-7 | Furniture for printing, trade, consumer services |

| A car | III | 3-5 | Cars |

| Freight car | III | 3-5 | Trucks with a carrying capacity of up to 0.5 tons |

The next step is to establish the useful life of the OS. You can select any number of years within the established limits. For property worth more than 100 thousand rubles, it is advisable to establish the same period in tax and accounting in order to avoid discrepancies.

Sometimes the necessary means are not available either in the Classifier, but in OKOF. In this case, it can be determined using the manufacturer’s recommendations or technical documents. Other options are sending a request to the manufacturer or seeking clarification from the Ministry of Economic Development.

At the final stage, you need to check the service life of the OS according to the documentation - enter information into the inventory card. When establishing different deadlines for tax and accounting, this must be reflected.

OS classification according to OKOF:

OKOF codes for office electronics

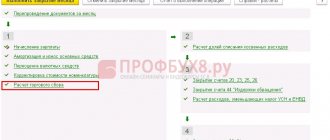

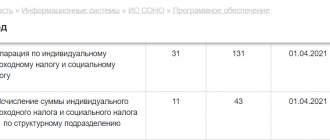

Answer: To replace OKOF in the 1C Accounting program of a government institution, you must use the “OKOF Replacement Assistant” processing. When replacing OKOF using this processing, the depreciation group in the fixed asset card will not change.

OKOF is applied in cases provided for by federal standards, unless otherwise established by the authorized bodies of state regulation of accounting. This proposal requires some explanation.

Which OKOF depreciation group does the car DVR belong to?

- cameras for printing documents and recording on removable media;

- digital photo and video cameras;

- cameras with instant image acquisition;

- film cameras and projectors;

- laboratory tools for photographer (videographer);

- main devices for reading information from removable micromedia.

- capacity and productivity of the facility;

- its wear, which, in turn, depends on how it is used, how many times it is repaired and whether preventive maintenance is carried out to extend its service life;

- legal regulations that may limit the use of the equipment (for example, if the DVR is rented).

We recommend reading: Sample purchase and sale agreement for military mortgage

Computer shock-absorbing group

The complex is ready for operation and is a monoblock (the shock-absorbing group is also the second), which is considered as a computer combined with a monitor in a single case and does not require additional equipment. But the situation is somewhat different with an object such as a monitor.

Note that a computer is a complex of structurally connected objects ready for operation. Therefore, a laptop (depreciation group 2), as well as a desktop computer that can immediately after purchase be included in the production process and begin generating income for the company, when registered, is subject to the same useful life of 2 to 3 years.

Accounting info

Pneumatic drive devices (pneumatic motors, pneumatic cylinders, pneumatic distributors, pneumatic tanks, pneumatic valves, pneumatic accumulators, other pneumatic equipment) (introduced by Decree of the Government of the Russian Federation of September 12, 2021 N 676)

- sample of filling out the act of commissioning of a fixed asset

- order for commissioning and establishing the useful life of a fixed asset. The document will be needed to secure the useful life of the fixed asset. Based on this period, monthly depreciation charges will be calculated.

Requirements for depreciation groups

Incorrect OS reflection causes many problems for enterprises. An important term used in their accounting is “fixed assets,” which include two types of property: tangible and intangible. Fixed assets are the tangible assets of a company. This conclusion is made on the basis of concepts enshrined in legislative norms.

Confirmation of the date of commissioning of the OS is carried out by drawing up a separate act about this. It is necessary to calculate property tax, VAT deductions, the start of depreciation, as well as to confirm the initial cost of the property, its service life, and the depreciation group established for it.

How to determine useful life

Initially, the depreciation group and useful life are established according to the Classification approved by the Government of the Russian Federation. Clause 2 of Article 258 of the Tax Code of the Russian Federation divides all fixed assets into 10 groups. The payer determines the service life independently within the limits established for each group (letter of the Ministry of Finance of the Russian Federation No. 03-05-05-01/39563 of 2021).

Group decoding is available in OKOF. It is used when there is no property in the OS Classifier. The search is carried out in one of two ways: by subclass encoding and by property class code.

In the absence of an object in both the OS Classifier and OKOF, the period is determined according to technical documents or manufacturer’s recommendations (clause 6 of Article 258 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/36323 of 2021).