The decision of the first instance did not suit anyone

Based on the results of the on-site inspection, the company was assessed additional large amounts of VAT, income tax, penalties and fines. According to inspectors, the company improperly included in expenses the costs of purchasing spare parts from a number of contractors and deducted VAT on these transactions. The transactions are unrealistic, the partners have created a formal document flow to obtain an unjustified tax benefit (UTB).

The regional Federal Tax Service supported its colleagues, but the first two courts “rejected” the inspectorate’s decision regarding the additional assessment of the entire amount of income tax with its own penalties and fines.

This state of affairs did not suit anyone. Both the company and the Federal Tax Service prepared cassation appeals.

The organization did not agree with the conclusion about the legality of additional VAT charges (with penalties and fines) on transactions with these counterparties. According to the company, the documents presented in the case materials confirm the reality of its acquisition of spare parts from these business partners. The inspection did not prove that the transactions were aimed at obtaining INV, nor did it establish the fact of the creation of money return schemes. These counterparties were active legal entities, had current accounts and carried out real activities. The handwriting examination was carried out with violations.

Fiscal officials were not satisfied with the judges’ decision in the “profitable” part. After all, the Federal Tax Service provided evidence:

- production by the company of spare parts, allegedly purchased from the above-mentioned contractors, on its own according to customer drawings;

- the unreality of business operations with these business partners, which indicates illegal cost accounting.

The inspectors noted that the courts did not take into account that the company positions itself on the market as a large plant with the necessary equipment and qualified personnel. It has been proven that this organization has unaccounted for material, which casts doubt on the arbitrators’ conclusion that it is impossible for it to independently manufacture spare parts. The judgment that the Federal Tax Service Inspectorate must necessarily determine the amount of the company’s actual tax liabilities is also not fair.

What to do if the tax office sent a report with additional VAT charged

Recently there was a case when, for an on-site inspection, which according to the organization was planned for 2021, the office department made requests for the previous three years. During the inspection, three acts were sent with additional VAT charges. How and where does it all begin?

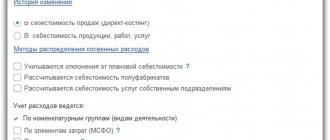

First, let's understand one simple thing: the tax program automatically launches an audit for your organization. And everything can be fine with your reporting. But there are also your counterparties who may also make mistakes in providing information. In addition to checking the accuracy and completeness of information about the transaction, the correctness of the primary reflection in the reporting, they also check information on restored and received advances for your transactions. If you have advance invoices, then the rules for closing such transactions should not be violated. All this is just an automatic check for your organization.

Next, a specialist from the pre-verification analysis department will get down to business, who will not only check the transaction itself for economic justification and meaning, but will also examine the reliability of information on your organization in terms of the availability of production facilities, retail and warehouse premises, the presence of activities and payment of rent at the legal address of the organization .

Through interrogation, he will determine the officials in possession of information throughout the transaction process. Then he will make inquiries to the relevant tax authority of your counterparty and receive information from there. Determines who signs and submits the reports and from which premises and IP address the report was sent. This process takes quite a long time. You can use this stage to your maximum advantage in order to avoid receiving a VAT statement, since at this stage you and your organization are directly involved in the process.

If the tax authority makes a decision about the unreliability of the completeness of the transaction or incorrect restoration of advances or does not see the justification for the economic meaning of the transaction, then the audit report will come to you with the line “additional VAT has been charged”

What to do if this does happen?

Should I immediately pay for what was sent? 1. Estimate the accrued amount, sometimes it is very insignificant. The act is only a consequence of the fact that your supplier (this could be a representative of a micro-business, an individual entrepreneur, did not report on the sale to you due to lack of accounting or reported untimely and is already solving this problem). In this case, you should not start the process of working with this act. Check with your counterparty or pay additional VAT on the act if you have no one to check with. In 2, 3 years this may well happen. It may be cheaper and less time consuming.

2. If we are talking about a significant amount or the act contains several transactions at once, then there is no need to run and pay VAT on it.

Any act can be appealed, including one in which additional VAT is charged.

It is better to engage in this process with full dedication.

An appeal against an act must necessarily contain information on each point of the act, otherwise there is no point in sending it to the tax authority, because in response you may receive that the appeal was not accepted due to the lack of information on point No... 3. The objection to the tax audit report contains the following meaning:

According to the paragraph of the descriptive part of the act, it is necessary to indicate the existence of contracts, acts, invoices, UPD and fulfillment of obligations for payments on account of the counterparty whose transaction was in question. Their presence and the timely provision of information of this nature in full to the tax authority upon request is clearly confirmation of the transaction and is disputed only by the presence of the evidence base.

If the tax office does not provide such confirmation with the act, then the decision will be made in your favor. Be sure to indicate that the obligations under the transaction were fulfilled on time.

- There may be questions about employees and payroll taxes. You must confirm and describe the entire process of official presence of a particular employee related to the transaction. Attach payment orders, statements certified by the bank, employment contracts, certificates. The more information you provide on a given issue, the more likely it is that the objection will be accepted.

- The minimum tax accrued on your report can be confirmed by the presence of documents on the deductions taken in the declaration, which is an indisputable fact in your favor.

- Regarding the point of coincidence of the IP address when sending a report, it can be justified by the presence of one outsourced accounting department, if this occurs, in other cases there should be no coincidence.

- Regarding the point of visual inspection of signatures in the original documents provided for the transaction, the absence of seals, the absence of primary documents on the part of the counterparty, one should indicate the lack of documentary confirmation of the progress of the check for availability, their presence on the part of the tax authority, as well as the absence of notifications about the presence of such confirmation.

As a result, we can write that all the conclusions of the contractor inspector on your part are not supported by evidence that indicates this.

Objections are not the only way to appeal an act with additionally charged VAT, but, most likely, the final one. There is also the human factor of the presence of the tax office and the relationship between your organization and it, which can help to avoid additional charges at any stage of this audit.

What was the cassation based on?

The district court did not satisfy both cassation appeals.

A tax benefit cannot be considered justified if:

- transactions are not accounted for in accordance with their actual economic meaning;

- transactions not driven by business purposes are reflected;

- received without connection with real business activity.

This follows from paragraphs 3 and 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53.

The main thing is not the formal presentation by the company of all the necessary documents, but the reality and actual economic content of the financial and economic relations of the company and its counterparty.

The tax office assessed additional VAT. How to dispute?

An example of a VAT error and, as a result, additional VAT charges

An example from my personal legal practice. All names and characters are fictitious, any similarity is purely coincidental. The company was charged additional VAT and the transactions were recognized as fictitious in order to obtain tax benefits. It must be remembered that when conducting audits, the tax authority considers the participants in the purchase and sale chain up to the fifth generation.

Imagine that you paid the counterparty. Your counterparty, in turn, paid the next counterparty and so on down the chain. As a result, taxes cannot be collected from the final buyer; let’s say there is nothing to take. Your enterprise is operating and now you are charged additional VAT.

When making additional assessments, tax authorities rely on a pre-collected evidence base. Based on my experience as an operative, I can say that the tax office carries out the following activities: Contents

All the signs of the scheme are there

To prove its case, the company provided contracts, invoices, specifications and delivery notes.

Regarding VAT, the arbitrators supported the inspectors. The conclusion is based, in particular, on the following facts:

- business partners lack transport, real estate and personnel;

- expenses for renting premises, utilities, taxes payable to the budget are minimal;

- for transactions there is no specification form and information about transport invoices, although the contracts provide for the delivery of spare parts from sellers to the buyer;

- suppliers did not have special vehicles for transporting spare parts, and there were no payments for the rental of such vehicles;

- The carriers with whom the company collaborated explained that such goods and materials were not delivered to it. The buyer’s own cars were also not used for these purposes;

- documents on behalf of one of the counterparties were signed by a disqualified manager;

- three supplier firms were created shortly before transactions with the company were made;

- in documents for the supply of spare parts received from end buyers, the company is listed as the manufacturer;

- the movement of money through the current accounts of these partners was of a transit nature, plus the accounts were used for cash withdrawal;

- It was revealed that the managers of the counterparties were nominal. Handwriting examination carried out in accordance with Art. 95 of the Tax Code of the Russian Federation, showed that the documents were not endorsed by them, but by other persons. The judges, after examining the society’s argument that the expert did not have a sufficient number of handwriting samples, rejected it. There is no evidence sufficient to refute the expert's conclusions.

So, the society did not refute the unreality of the operations. It turns out that there is a formal document flow aimed at obtaining NNV, therefore additional VAT has been accrued correctly.

Interrogation and verification of counterparties

All counterparties to transactions with which the investigation has determined to be questionable are interviewed. Each counterparty writes an explanatory note about the completed transaction, and as soon as one of the counterparties reports that he was a nominee, you will be charged additional VAT.

In practice, there are often cases when counterparties testify that for monetary or other compensation they agreed to open a company and provided their passport. These could be students or people with little social and moral responsibility for their lives.

They may be held financially responsible and for this reason they willingly make contact with the tax authority and testify that they did not enter into any transactions and were the nominal owners of the company. Table of contents

Are there grounds for reducing the fine?

According to society, the fine does not correspond to the gravity of the offense. The company presented documents evidencing its charitable activities, which should be regarded as a mitigating circumstance.

The cassation noted that the reduction of fines in accordance with Art. 112 and 114 of the Tax Code of the Russian Federation is a right, not an obligation of the court. The presence of mitigating circumstances is determined individually in each specific case.

The arbitrators found no reason to reduce the size of the sanction.

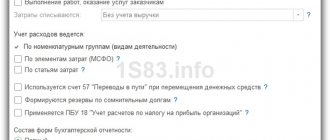

Checking supply contracts

Today, verification of supply contracts occurs at a high level and down to the smallest details. The tax office can check vehicle routes using the Plato system.

To clarify whether the technical data of the vehicle specified in the delivery documents allowed the dimensions of the transported cargo to be accommodated. The organization's fleet has its own vehicles for cargo transportation, etc. And this is a small number of possible verification options.

The tax authority analyzes each situation in as much detail as possible and transmits the received data to the court. In court, this data will appear in the evidence base, based on which the court will make a decision. Table of contents

"Profitable" aspect

If there is doubt about the validity of a tax benefit, the amount of fiscal obligations is determined taking into account the real nature of the transaction and its actual economic meaning. This follows from Art. 247, paragraph 1, art. 252 of the Tax Code of the Russian Federation and clauses 3, 7 of the Resolution of the Plenum of the Supreme Arbitration Court No. 53. Determination by auditors of the amount of expenses actually incurred by the company is possible on the basis of sub-clause. 7 clause 1 art. 31 of the Code. We are talking about a calculation method based on the information available to the Federal Tax Service about the organization, and sometimes on data about similar taxpayers.

It has been proven that these contractors did not supply spare parts to the company. But the auditors did not refute the very fact of his acquisition of these goods and materials. In addition, the end buyers confirmed the purchase of spare parts from the company, which the Federal Tax Service refers to in the VAT episode.

The judges found that the company manufactured some of the supplied parts itself, and purchased some from other organizations and modified them according to customer requirements.

So, the fact that the company incurs costs for the purchase of spare parts is not refuted. However, there is no indisputable evidence of the production of spare parts exclusively by society. Therefore, the actual size of the expected tax benefit and the purposes incurred should have been determined based on market prices applied for similar transactions, which the inspectorate did not do. This means that the conclusion that the additionally assessed income tax (with penalties and fines) does not correspond to the real size of the company’s tax liabilities is legitimate.

Let us note that in this part the verdict is fully consistent with the trend. A complete withdrawal of expenses in such a situation is unlawful. If an organization does incur real expenses, its “profitable” obligations must be determined by calculation. Inspectors usually don’t bother themselves with this, which is why they lose (see Resolution of the AS SZO dated 03/02/2021 No. F07-17411/2020, Determination of the RF Armed Forces dated 09/07/2017 No. 307-KG17-10555).

Court decisions on similar disputes

The court's conclusion was made without taking into account the norms of tax legislation. The Tax Code of the Russian Federation establishes a closed list of conditions for obtaining a tax deduction. Tax amounts presented to the taxpayer after the purchased goods have been registered and in the presence of invoices are subject to deductions. The fact of purchasing goods for transactions subject to VAT is also important (Articles 169, 171, 172 of the Tax Code of the Russian Federation). There is no talk about the mandatory payment of taxes to the budget in these articles. At the same time, taxpayers are free and independent in their actions and cannot be held responsible for the actions of third parties. This approach is reflected in the resolutions of the Federal Antimonopoly Service of the Moscow District dated October 25, 2010 No. KA-A40/13657–10 and dated March 5, 2013 No. A41-12501/12. The court noted that the Tax Code of the Russian Federation does not make the payer’s right to deduction dependent on the fulfillment of legal obligations by its counterparties. The law does not stipulate the connection between obtaining the right to deduction and fulfilling the obligation to pay tax to the budget on the part of the supplier. Therefore, imposing the negative consequences of counterparties’ failure to fulfill their tax obligations on the payer is unlawful. However, the tax authorities’ arguments also found support in arbitration practice. The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 9833/08 dated January 27, 2009, indicated that the norms of the Tax Code of the Russian Federation provide for the possibility of VAT reimbursement from the budget if there are actual business transactions and transactions with real goods. This, in turn, involves paying this tax to the federal budget. Accordingly, you cannot receive a deduction without paying tax.

Unjustified VAT refund scheme: how to expose >>>

Tax lawyer and auditor

How to defend your rights and the rights of your company?

It's very simple, you just need an auditor and a tax lawyer. The tax lawyer prepares a comprehensive schematic evidence base and provides all the necessary documents to the auditor. The auditor, in turn, confirms the legality of the transactions carried out by your company.

I recommend preparing all evidence during the pre-trial stage.

The later you prepare evidence of your innocence, the less chance there is of including this evidence in the case file. Unfortunately, at the final instances, additional evidence is no longer accepted, but a decision is made on the basis of available documents.

I hope the article was useful. Laws change quickly, the information is relevant today.

Table of contents