Life does not stand still. Some companies expand and open new stores in another area or city. Some hire staff to work outside the office, send workers on long business trips, and rent warehouses in other regions. In some cases, separate units (SU)1 may arise. Do you have an OP? When is it considered created? We will answer these questions in our article.

Note. We will not talk about branches and representative offices, since they are automatically registered with the Federal Tax Service based on information in the Unified State Register of Legal Entities 2.

STS and separate division in 2020-2021

Before opening a separate division under the simplified tax system or switching to a simplified system if there are such divisions, you need to figure out whether the legislation allows the use of the simplified tax system by taxpayers who have separate divisions. Let's do so.

Subp. 1 clause 3 art. 346.12 of the Tax Code of the Russian Federation prohibits the use of a simplified system by organizations with branches.

A branch is a separate division located outside the location of a legal entity and performing all its functions or part of them, endowed with property by the legal entity that created it, operating on the basis of provisions approved by this legal entity and specified in the Unified State Register of Legal Entities (clauses 2, 3 of Article 55 of the Civil Code of the Russian Federation).

Tax legislation has its own definition of a separate division.

According to paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, a separate division of an organization is any territorially separate division from it, at the location of which stationary workplaces are equipped, that is, workplaces created for a period of more than 1 month. In this case, a worker means a place where the employee must be or where he needs to arrive in connection with his work, which is directly or indirectly under the control of the employer (Part 6 of Article 209 of the Labor Code of the Russian Federation).

A separate division of an organization is recognized as such regardless of whether its creation is reflected in the constituent and other organizational and administrative documents of the organization, and regardless of the powers vested in the specified division.

As you can see, the concept of a separate division in the Tax Code of the Russian Federation is broader than a branch. It follows that the presence of divisions in an organization that are not branches does not prevent the application of the simplified taxation system. This has been confirmed more than once by regulatory authorities (letters from the Ministry of Finance of Russia dated April 22, 2019 No. 03-11-11/29010, dated June 5, 2018 No. 03-11-06/2/38208, etc.).

Thus, it is possible to open a separate division under the simplified tax system in 2020-2021. The main thing is that it does not have any signs of a branch. Such a representative office could be, for example, a production workshop, store or warehouse located outside the head office.

At the location of each separate division (except for a branch or representative office) of the organization, it is necessary to register with the tax authority (clauses 1, 3, 4 of Article 83 of the Tax Code of the Russian Federation). This must be done even if only 1 job has been created.

When the OP will definitely not be there

If any of the above characteristics are absent, then an OP is not required to be created. For example:

- workers have a traveling nature of work (drivers, couriers, sales representatives, insurance or advertising agents), they visit other organizations and stationary jobs are not created for them 12;

- An employment contract on remote work has been concluded with the employee. At the same time, the employee works outside the location of the employer or its separate division, outside a stationary workplace controlled by the employer, and interacts with the employer remotely, for example via the Internet 13. It turns out that the definition of remote work given in the Labor Code of the Russian Federation allows not to recognize an EP at the location work of a remote employee. The Ministry of Finance agrees with this14;

- Private security company employees work at security posts equipped and provided to them by the company that is the customer of security services 15. At the same time, at the security posts there is no property of the private security company and the security guard’s workplace is not under the control of the employer. For the same reasons, an OP is not created by auditing firms, organizations that rent out their staff to other organizations or entrepreneurs (outsourcing and outstaffing), companies that provide technical or maintenance services for equipment, cleaning and other companies whose employees perform official duties in other organizations. ;

- the organization has real estate that is leased, which means that this company does not create for itself a single stationary workplace in which its employees will work 16;

- activities on a ship do not lead to the creation of a private enterprise, since it is impossible to establish the exact address of the place where such activities are carried out 17.

How to register a unit with the tax authority

To register with the tax authorities at the location of a separate division that is not a branch or representative office, you must send a message to the tax office about the creation of a separate division.

If the division is a representative office or branch, the inspection carries out registration of the organization at its location independently on the basis of information from the Unified State Register of Legal Entities (clause 3 of Article 84 of the Tax Code of the Russian Federation).

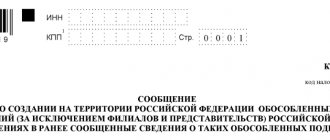

The message is submitted to the inspectorate at the place of registration of the organization (clause 4 of Article 83, subclause 3 of clause 2 of Article 23 of the Tax Code of the Russian Federation). It is submitted in form S-09-3-1, approved by order of the Federal Tax Service of Russia dated 09/04/2020 No. ED-7-14 / [email protected] The submission period is 1 month from the date of creation of the unit.

The methods for submitting a message are as follows:

- in person at the inspection (submitted by the manager or an authorized representative by proxy);

- by mail in a valuable letter with an inventory of the contents;

- via telecommunication channels in electronic form.

Having received the message, within 5 working days the tax office will carry out registration with subsequent notification of the applicant (paragraph 2, paragraph 2, article 84 of the Tax Code of the Russian Federation) - it is drawn up according to form 1-3-Accounting, approved by order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6/ [email protected]

It is not required to submit to the Federal Tax Service any documents confirming the creation of a separate division (clause 2.1 of the letter of the Federal Tax Service of Russia dated September 3, 2010 No. MN-37-6 / [email protected] ).

If several separate divisions are created in one municipality, the federal cities of Moscow, St. Petersburg and Sevastopol in territories under the jurisdiction of different tax authorities, you can register at the location of one of the divisions - at the choice of the organization.

Information about the choice of tax authority must be indicated in the notification in form 1-6-Accounting, approved by order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6 / [email protected] , sent to the inspectorate along with the message about the creation of an OP (clause 4 Article 83 of the Tax Code of the Russian Federation).

Is there an OP?

In practice, there are also controversial situations.

Carrying out work at the customer's construction site

Quite often, disputes arise about the creation of an EP in the case of sending employees on long-term (for a period of more than 1 month) business trips. This is especially true for companies performing construction work. After all, at the place of work they can install cabins and use their own machinery or equipment. Moreover, all this happens on someone else’s territory (not controlled by the employer).

Disputes about whether an OP is formed in this case have to be resolved in court. The court may take the side of the tax authorities if it finds that the creation of permanent jobs by inspectors has been proven. For example, tax officials from the North Caucasus District 19 succeeded in this. The courts took into account that, under the terms of the contract, the company, as a general contractor, was obliged to ensure compliance with labor safety rules and requirements during the period of work. This means that the company had to control the working conditions of its workers in the workplace. According to the protocols of interrogation of witnesses, one of the employees of the general contractor company was constantly at the construction site during the period of work. And the judges came to the conclusion that at least one permanent workplace was created at the place where the work was performed by the company.

If inspectors do not prove the creation of jobs, the court will side with the company. Thus, FAS CO 20 took into account that the contractor’s employees, while on the customer’s territory, were controlled not by the contractor, but by the customer. And the fact that the contractor’s employees were at the customer’s construction site for a long time does not confirm the creation of the OP.

What is the penalty for failure to register a unit?

For violation of the deadline for sending a message to the inspectorate about the opening of a separate division, the organization may be held accountable under clause 1 of Art. 126 of the Tax Code of the Russian Federation.

This is a fine of 200 rubles. for each document not submitted.

In this case, officials of the organization may face administrative liability under Art. 15.6 Code of Administrative Offenses of the Russian Federation - fine from 300 to 500 rubles.

For conducting activities without tax registration on the grounds provided for by the Tax Code of the Russian Federation, the organization may be held liable under clause 2 of Art. 116 of the Tax Code of the Russian Federation - a fine of 10% of the income received as a result of such activities, but not less than 40,000 rubles. But this rule does not apply to failure to register an OP.

How to place an order

There are no rules for the execution of the order or its content, so it can be written on a simple blank sheet of A4 or even A5 format or company letterhead, either by hand or in printed form. At the same time, a printed version on letterhead will be much more advantageous, since it initially contains the details of the organization, legible text, and looks more solid.

The order is issued in a single copy , but if necessary, an unlimited number of copies can be made.

Registration of an OP with the Social Insurance Fund

In terms of contributions for injuries, the insurer must register at the location of the separate unit if (subclause 2, clause 1, article 6, clause 11, article 22.1 of the law “On compulsory social insurance...” dated July 24, 1998 No. 125-FZ , order of the FSS of the Russian Federation dated April 22, 2019 No. 217):

- it is not abroad;

- has its own current account;

- calculates and issues salaries.

It is necessary to register with the Social Insurance Fund at the location of the unit within 30 calendar days from the date of creation of the OP (subclause 2, clause 1, article 6 of Law No. 125-FZ).

The registration procedure and the list of documents to be submitted are determined by Order of the Ministry of Labor of Russia dated April 29, 2016 No. 202n. In accordance with paragraphs. 6, 10 to receive notification of registration (Appendix 1 to the above order) the following are submitted to the fund at the location of the unit:

- application (form approved by order of the Federal Social Insurance Fund of the Russian Federation dated April 22, 2019 No. 217);

- a certificate from the bank confirming the opening of a branch account;

- a document confirming that the division pays payments to individuals (for example, a copy of the regulations on the separate division, which indicates the corresponding authority).

Copies may be paper or electronic.

The fund receives all other information from the Federal Tax Service and other social insurance departments through interdepartmental exchange.

Within 3 working days from the date of receipt of the documents, the FSS will register the organization with subsequent notification (clause 14 of Appendix 1 to Order No. 202n).

For violating the deadline for registering an enterprise with the Social Insurance Fund, a company may be fined (Article 26.28 of Law No. 125-FZ):

- if there is a delay of up to 90 days inclusive - by 5,000 rubles;

- more than 90 days - by 10,000 rubles.

A fine is also provided for the head of a legal entity - in the amount of 500 to 1,000 rubles. (Article 15.32 of the Code of Administrative Offenses of the Russian Federation).

Homeworkers

Another controversial case is how to evaluate the work of a homeworker.

After all, in accordance with the concluded employment contract, he will work at his place of residence and use for work tools and mechanisms allocated by the employer or purchased by him at his own expense 21. Is an OP formed at the place of residence of such workers? If the employer provides the homeworker with the equipment necessary for work (for example, a computer, printer, telephone, etc.) and this is specified in the employment contract, then it will not be easy for the company to justify its non-involvement in the organization of the employee’s workplace. If the employee uses exclusively his property, then it will be difficult for the tax authorities to prove that an OP is being created in the homeworker’s apartment. Moreover, this apartment is not under the control of the employer (which is one of the signs of OP 22), for example, he cannot freely enter the premises where the homeworker works, or monitor working conditions (compliance with labor protection, sanitation requirements, etc. ). In such a situation, the Ministry of Finance recommends that the company contact the tax office to make a decision on creating OP 23. In general, it is better to conclude a remote work agreement with the employee and thereby avoid disputes with the tax authorities.

Registration of an OP with the Pension Fund of Russia

A division is also registered with the Pension Fund only if it pays benefits to employees and has a bank account (subclause 3, clause 1, article 11 of the Law “On OPS” dated December 15, 2001 No. 167-FZ). But you do not need to submit any documents to the Pension Fund. We have already mentioned that when vesting the OP with the authority to pay remuneration to individuals, you send a corresponding message to the Federal Tax Service. And she already transfers all the information to the Pension Fund.

The deadline for submitting such a message is one month from the date of issuance of the order to vest the OP with the appropriate powers (letter of the Ministry of Finance dated 05/05/2017 No. 03-15-06/27777).

OP should admit

Let's say an organization decides to rent premises for storing raw materials. This warehouse is located at a different address from its location. In fact, the premises will be closed and will open several times a month only for the time of delivery or removal of raw materials. Workers will not be permanently present at the warehouse, but they will come there periodically to import/export raw materials. At the same time, the Ministry of Finance believes that the time an employee spends in a warehouse does not matter, because he arrives there in connection with his work and performs his work there, which means this leads to the creation of a stationary workplace and, accordingly, OP 18.