Economic disputes and violation of contractual obligations by counterparties may give rise to litigation. Claims from regulatory authorities against organizations that do not pay taxes and fees on time are also not uncommon. The court may rule in favor of one side or the other. The accounting service is faced with the need to reflect the amounts of actual damage, lost profits, legal costs, repayment of debt to the injured party, and payment of such amounts for won lawsuits. The issues of tax accounting of “judicial” amounts are also relevant.

How is damage different from harm and losses ?

Legal costs and legal "income"

How to take into account the costs of an organization to pay state fees in connection with filing a claim in court, as well as the amounts received from the debtor-defendant after winning the case?

Experts from the GARANT Legal Consulting Service, Tatyana Sinelnikova and Elena Koroleva, explain. How to reflect in the accounting and tax records of an organization the costs of filing a claim (state duty) and the amounts received from the defendant after winning the case in court?

Tax accounting

In accordance with Art. 101 of the Arbitration Procedure Code of the Russian Federation, legal costs consist of state fees and legal costs associated with the consideration of the case by the arbitration court. According to Art. 110 of the Arbitration Procedure Code of the Russian Federation, legal expenses incurred by persons participating in the case, in whose favor a judicial act was adopted, are recovered by the arbitration court from the side (of the defendant).

According to paragraph 1 of Art. 333.16 of the Tax Code of the Russian Federation, state duty is a fee levied on the persons specified in Art. 333.17 of the Tax Code of the Russian Federation, when they apply to state bodies, local government bodies, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and normative legal acts of local government bodies, for committing in relation to these persons carry out legally significant actions provided for in Chapter 25.3 of the Tax Code of the Russian Federation, with the exception of actions performed by consular offices of the Russian Federation.

Payers pay the state fee when applying to the Constitutional Court of the Russian Federation, courts of general jurisdiction, arbitration courts or magistrates - before filing a request, petition, statement, statement of claim, complaint (including appeal, cassation or supervisory) (clause 1, paragraph. 1 Article 333.18 of the Tax Code of the Russian Federation).

According to paragraph 10 of Art. 13 of the Tax Code of the Russian Federation, state duty refers to federal fees.

Subclause 10, clause 1, art. 265 of the Tax Code of the Russian Federation provides that non-operating expenses include legal expenses and arbitration fees.

In accordance with paragraphs. 1 clause 7 art. 272 of the Tax Code of the Russian Federation, the date of non-operating expenses in the form of taxes (advance payments for taxes), fees and other obligatory payments is the date of accrual of taxes (fees).

Since the state duty is a federal fee and based on the fact that the state duty is used to pay statements of claim, the date of recognition of expenses in the form of a state duty should be considered the date of filing the statement of claim in court (see letter of the Ministry of Finance of Russia dated December 22, 2008 N 03-03-06/2 /176).

It should be noted that legal costs are included as expenses that reduce taxable profit, regardless of their recovery from the losing party (resolution of the Federal Antimonopoly Service of the North-Western District dated July 21, 2008 in case No. A56-24492/2007).

Based on clause 3 of Art. 250 of the Tax Code of the Russian Federation, fines, penalties and (or) other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damages, are recognized as non-operating income.

Accordingly, if the court decides to reimburse the defendant for legal expenses incurred by the plaintiff, then the specified compensation (refund) is included in non-operating income. In this case, the state duty and the amount of losses must be included in the income.

At the same time, according to paragraphs. 4 p. 4 art. 271 of the Tax Code of the Russian Federation, the specified income is recognized on the date of entry into legal force of the court decision (letters of the Ministry of Finance of Russia dated 08/16/2010 N 03-07-11/356, dated 01/18/2005 N 03-03-01-04/2/8, Federal Tax Service of Russia in Moscow dated 04/08/2008 N 20-12/034110). A similar opinion was expressed by the judges in the resolution of the Federal Antimonopoly Service of the West Siberian District dated August 23, 2011 N A81-5018/2010, in the resolution of the Seventeenth Arbitration Court of Appeal dated July 14, 2011 N 17AP-5272/11, in the resolution of the Fifth Arbitration Court of Appeal dated October 1, 2009 N 05AP-1306/2009.

Thus, for profit tax purposes, legal expenses in the form of state fees are subject to inclusion in the non-operating expenses of the organization, and the amounts received to reimburse them, as well as the amount of losses, are included in non-operating income.

As for compensation of the amount of the principal debt awarded for collection by the court, on the basis of Art. 249 of the Tax Code of the Russian Federation and Art. 39 of the Tax Code of the Russian Federation, this amount is not included in taxable income, since it should have been reflected in tax accounting on the date of sale of goods (work, services) (see also letter of the Ministry of Finance of Russia dated September 20, 2010 N 03-03-06/1/597 ).

With regard to VAT, we point out that Chapter 21 of the Tax Code of the Russian Federation does not contain a direct indication of the need to charge VAT on amounts subject to reimbursement from the defendant, since in this case there is no sale. Consequently, we believe that in the case under consideration there is no object of VAT taxation (Article 146 of the Tax Code of the Russian Federation).

Accounting

In accounting, the state duty associated with filing claims or other statements in the arbitration court is taken into account as part of other expenses (clause 12 of PBU 10/99 “Expenses of the organization”, hereinafter referred to as PBU 10/99).

Paragraph 18 of PBU 10/99 establishes that expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity). The date of expenditure in the amount of state duty paid by the organization should be considered the date of filing the statement of claim.

The following accounting entry is made on this date:

Debit 91, subaccount “Other expenses” Credit 68

- a state fee is charged when filing a claim.

Payment of the state duty is reflected by the posting:

Debit 68 Credit 51

- state duty is transferred to the budget.

Fines, penalties, penalties, as well as proceeds to compensate for losses caused to the organization are recognized in the organization’s accounting as part of other income (clause 8 of PBU 9/99 “Income of the organization” (hereinafter referred to as PBU 9/99)).

The specified penalties, as well as compensation for losses, are accepted for accounting in amounts awarded by the court or recognized by the debtor in the reporting period in which they were recognized by the debtor or the court made a decision on their collection (clause 10.2 and clause 16 of PBU 9/99) .

In the case under consideration, other income in the form of reimbursement of state duties, penalties and (or) losses should be recognized on the date of the court decision.

Fines, penalties and penalties that are recognized by the debtor or for which court decisions on their collection have been received are included in the financial results and, before they are received or paid, are reflected in the balance sheet of the recipient and the payer, respectively, under the headings of debtors or creditors (clause 76 of the Regulations on maintaining accounting records and financial statements in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n).

To account for settlements of claims, the Chart of Accounts and instructions for its use, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, provide for account 76 “Settlements with various debtors and creditors” with the opening of a separate subaccount 76-2 “Settlements for claims”.

On a dedicated sub-account, analytical accounting is maintained for each counterparty and individual claims.

The following entries are made in the accounting:

Debit 51 Credit 76, subaccount “Calculations for claims”

- funds have been received under the writ of execution;

Debit 76, subaccount “Settlements on claims” Credit 91, subaccount “Other income”

- reimbursement of the state duty paid when going to court and the losses incurred are reflected.

In accounting, the amount of receivables can either be repaid by the debtor or written off on the basis of clause 77 of the Regulations on Accounting and Financial Reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n.

In the case under consideration, the debt is repaid on the basis of a court decision; taking into account this fact, it is advisable to transfer the receivables reflected in account 76 to the subaccount “Settlements of claims” on the date of the court decision.

The following entries are made in accounting:

Debit 76, subaccount “Calculations for claims” Credit 76;

Debit 51 Credit 76, subaccount “Calculations for claims”.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Determination of legal costs by the judicial authority

Recognition of costs incurred is carried out by the court in each specific case. Costs cannot be allocated to the losing party without filing a claim. The need to cover expenses must be addressed to the court and a request must be included in the statement of claim or in the form of additional demands stated during the hearing. When covering expenses, several repayment options arise.

| Procedure | Compensation of expenses |

| The fee was paid by the plaintiff, the application was not submitted to the court | Refunds are made by the territorial office of the Federal Tax Service before the expiration of 3 years. |

| The fee has been paid, the claim has been satisfied pre-trial | In some cases, the amount of fees and costs is returned in a separate claim. |

| The claims were partially satisfied | The costs incurred by the plaintiff are partially compensated, in part of the recognition of the claim or at the discretion of the court |

| The defendant has no obligation to pay state duty | Only expenses are subject to compensation; the amount of state duty to the plaintiff is not covered. |

Expenses incurred by the plaintiff in the course of pre-trial consideration of claims are not covered. Expenses often include costs for the services of lawyers. The courts do not recognize such expenses and do not attribute them to the losing party.

In some cases, the losing party may be able to avoid paying the winning party's costs. In order for the court to make a decision, it is necessary to apply to the court to provide documentary evidence of the difficult financial situation, the unintentionality of the motives for causing the damage, and to pay off the claims during the proceedings or upon receipt of a deferment.

What is a penalty as an accounting object?

A penalty is a penalty determined by law or contract for failure to fulfill obligations by one party to the agreement to the other (others). From an accounting point of view, it is legitimate to consider a penalty:

- other income of the receiving party (clause 7 of PBU 9/99);

- other expenses of the obligated party (clause 11 of PBU 10/99).

Penalties as income are reflected in accounting in the reporting period in which the title documents on the basis of which the penalty was formed appeared. Such a document could be, for example, a court decision or a bilateral act of the parties to the agreement (clause 16 of PBU 9/99). The penalty as income or expense must be reflected in the balance sheet before the actual settlements of the parties (clause 76 of the regulations by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

The main accounting account for generating entries for penalties is 76. Let's study how it and its subaccounts are used to reflect transactions related to the payment of a penalty by a business entity (or its receipt of corresponding income from a counterparty).

Accounting for state duties on transactions not related to the main activity

The state duty for carrying out actions not related to the main activity of the company should be charged to other expenses (clause 11 of PBU 10/99):

Dt 91.2 Kt 68/state duty.

Such an entry will be used, in particular, when calculating the state duty paid upon the alienation of certain types of assets (clause 11 of PBU 10/99).

The state duty paid for participation in the trial is taken into account in the same way.

For tax accounting of other expenses, see our material.

How are fines (penalties) paid by the obligated party to the contract reflected in accounting?

The party to the contract, which is obliged to compensate the counterparty for losses by paying a penalty, will generate the following entries:

- Dt 91.2 Kt 76 (the penalty was recognized on the basis of a title document);

- Dt 76 Kt 51 (the penalty is transferred within the time limits specified by law or contract).

If the penalty is paid to an individual in cash, this will be reflected by the posting: Dt 76 Kt 50.

In cases provided for by law, when making settlements with an individual, not only the penalties paid - fines (penalties) are reflected in the accounting records, but also the taxes and contributions accrued on them.

So, if the recipient of the penalty is an individual who is not registered as an individual entrepreneur, then the following correspondence may additionally be drawn up:

- When the penalty arose within the framework of legal relations under an agreement, payments under which are subject to insurance premiums (for example, under a civil process agreement for the performance of work by an individual):

- Dt 76 Kt 68 (personal income tax charged for a penalty);

- Dt 68 Kt 51 (NDFL paid);

- Dt 91.2 Kt 69 (contributions are calculated for the amount of the penalty - pension and medical, in accordance with subparagraph 1, paragraph 1, article 420 of the Tax Code of the Russian Federation);

- Dt 69 Kt 51 (dues paid).

- When the penalty arose within the framework of other legal relations:

- Dt 76 Kt 68 (personal income tax charged);

- Dt 68 Kt 51 (NDFL paid).

An example of such a penalty is compensation to an individual under a shared construction agreement (letter of the Ministry of Finance of Russia dated September 15, 2017 No. 03-04-06/59629). Contributions for this type of penalty are not charged.

In both of these cases, personal income tax must be paid no later than the next day after the calculations are made (clause 6 of Article 226 of the Tax Code of the Russian Federation). Contributions, if any, are made, as usual, by the 15th day of the month following the date in which the payments were made.

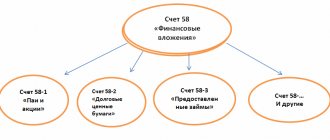

How to write off debt on a short-term loan?

The Ministry of Finance proposes to write off loan obligations as expenses in accordance with letter No. 03-03-06/1/23763 dated April 24, 2015. This rule is relevant for both interest-bearing and interest-free loans, as well as assignment of the right of claim.

Loan debts are written off as non-operating expenses when calculating income tax.

Guided by paragraph 2. paragraph 2 of Art. 265 of the Tax Code of the Russian Federation , when calculating income tax, non-operating expenses should include losses that the taxpayer received in the reporting period. If the taxpayer has created a reserve for doubtful debts, then in this case all amounts that are not covered by the financial reserve should be classified as bad debts.

Postings for writing off a non-repaid loan:

| Debit | Credit | Operation description |

| Dt 58/3 | Kt 51 | Loan provided by transfer from current account |

| Dt 91/2 | Kt 58/3 | Writing off the unreturned amount as non-operating expenses |

Loans received are written off in the same way. They only apply to non-operating income:

| Debit | Credit | Operation description |

| Dt 51 (50) | Kt 66/3 | Getting a short-term loan |

| Dt 66/3 | Kt 67 | Short-term loan moved to long-term |

| Dt 67 | Kt 91/1 | Non-operating income accrued on non-reimbursed loan |

Penalty under an employment contract: how to take into account personal income tax and contributions?

If we are talking about the payment of a penalty to an individual under an employment contract (in the general case - in connection with a delay in wages), then other entries will be reflected in the accounting records:

- Dt 91 Kt 73 (the employer's penalties to the employee for wages have been accrued);

- Dt 73 Kt 51 or 50 (penalties paid).

The use of entries, which in turn are associated with the calculation of personal income tax and social contributions for penalties under employment contracts, is characterized by certain nuances.

A penalty under an employment contract is not subject to personal income tax if it is accrued within the limits established by the provisions of Art. 236 Labor Code of the Russian Federation. This is stated in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation and is confirmed by the Ministry of Finance of Russia in letter dated February 28, 2017 No. 03-04-05/11096.

If a collective agreement or a specific employment contract establishes higher standards, then personal income tax is also not charged on interest. But if such standards are not established at the enterprise, then when a higher compensation is actually paid, personal income tax is charged on the difference between this compensation and the standards prescribed in the Labor Code of the Russian Federation (letter of the Ministry of Finance of Russia dated November 28, 2008 No. 03-04-05-01/450).

Subscribe to our newsletter

Contributions for penalties under an employment contract are generally always accrued (letter of the Ministry of Labor of Russia dated April 27, 2016 No. 17-4-OOG-701). Although in judicial practice there are also opposing positions (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13). But strictly speaking, according to the letter of the law, contributions must be calculated and, in order to avoid legal disputes, it is recommended.

If you need to reflect personal income tax on a contractual penalty, the following entries apply:

- Dt 73 Kt 68 (personal income tax withheld for a penalty);

- Dt 68 Kt 51 (NDFL paid).

Insurance premiums are reflected in the same entries as in the case of a civil contract.

Write-off from the account by court decision

And therefore they are faced with malicious debtors among them.

When all attempts to resolve this situation have been exhausted, the company's management has no choice but to go to court to collect the debt.

Let's consider a situation where the court made a decision in favor of the creditor and, in addition to the debt, ordered the debtor to return legal costs and imposed a penalty.

Attention The Presidium of the Supreme Arbitration Court of the Russian Federation thinks the same way.

Therefore, if the amount is large, it is worth starting a dispute with the tax office.

If legal proceedings do not attract, then for peace of mind it is better to charge VAT.

How to take into account the penalty for the entitled party?

In turn, the party that receives the counterparty’s penalty under the contract will reflect the following entries in the accounting records:

- Dt 76 Kt 91.1 (the penalty was recognized by the court or the parties in accordance with the supporting document);

- Dt 51 Kt 76 (the penalty is credited to the company’s current account).

Note that according to account 76, it makes sense for the authorized party (by the way, as well as the obligated party) to use a separate sub-account to account for penalties and other penalties under civil contracts - 76.2.

Separate nuances characterize the establishment of the company’s obligation to charge VAT on the received penalty (if the taxpayer works under the OSN). This issue is highly controversial. It will be useful to familiarize yourself with the arguments for and against the calculation of VAT in legal relations involving the formation of a penalty.

Penalty and VAT: should tax be charged?

There are 2 opposing points of view regarding this issue:

- VAT must be charged because, in accordance with subparagraph. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is formed from any amounts that are associated with payment for goods sold (and there is no obvious reason to consider the amount of the penalty as an exception).

- There is no need to charge VAT, since the agreement on penalties in accordance with Art. 331 of the Civil Code of the Russian Federation is drawn up separately from the main agreement of the parties. Therefore, the penalty should not be associated with payment for goods (letter of the Ministry of Finance of Russia dated 06/08/2015 No. 03-07-11/33051).

If we talk about the type of penalty accrued on the basis of Art. 317.1 of the Civil Code of the Russian Federation (on interest for illegal withholding of funds), the Ministry of Finance allows VAT to be charged on the amount of such a penalty if there is a connection between it and payment for goods, without explaining the specific criteria for establishing the fact of such a connection (letter from the Ministry of Finance of Russia dated 03.08.2016 No. 03-03-06/1/45600).

Thus, the taxpayer determines whether or not to charge VAT. If there is objectively no reason to consider the penalty related to the receipt of payment for the goods, no tax is charged.

There are many types of penalties: for late payment, for downtime, for exceeding limits, etc. The Tax Guide ConsultantPlus will help you determine the calculation of VAT on the amounts of various types of penalties. You can take advantage of a free trial if you don't have K+ yet.

But if the company believes otherwise, then VAT transactions will be reflected (by the authorized party) in the accounting registers using the following entries:

- Dt 91.2 Kt 76 (sub-account “VAT”) - VAT is charged on the amount of the calculated penalty;

- Dt 76 Kt 68 - VAT is charged on the amount of the penalty received;

- Dt 68 Kt 51 - VAT on the penalty has been paid.

The penalty under the contract can be written off by the entitled party. Let's study which entries reflect this in accounting.

Debt collection through court posting

The seller issued an invoice, which Brando LLC paid. However, the goods were never shipped.

The company filed a claim in the arbitration court.

— the portion of the advance amount collected by the bailiffs has been received.

In the future, the accountant will make a similar entry as the bailiffs collect the remaining debt from the supplier. Charge VAT on the amount of the penalty only if you have collected the debt from the buyer. So, we have sorted out the income and income tax.

What about VAT? It is clear that this question does not arise in relation to the principal amount of the debt.

Types of existing penalties

Before considering the question of how to post a fine or penalty in accounting, let’s figure out what sanctions of this kind may be. They are divided into two groups:

- Accrued by counterparties to each other in connection with violation of contractual obligations.

- Arising in case of non-compliance with tax legislation.

Sanctions of the first group are provided for in the texts of agreements concluded between counterparties as mutual and can equally arise for each of the parties. For example, penalties are usually established for the buyer for late payment, and for the supplier for failure to meet the delivery deadline. More serious sanctions (in the form of a fine) are intended to ensure the fulfillment of obligations that seriously affect the very fact of the functioning of the counterparty or lead to significant losses for it (including due to failure to fulfill obligations to a third party). The amount of sanctions arising between counterparties is indicated in the contract either directly (such as the amount of interest for each day of delay in payment or delivery) or by describing the calculation algorithm.

Situations in which penalties and fines are assessed for violations of tax legislation are given in the Tax Code of the Russian Federation; there are also indications of their specific amounts, and, in necessary cases, calculation algorithms. Here, taxpayers usually become the payers of sanctions, although in a number of cases (for example, a delay in the return of overpaid tax to the budget or the amount of VAT to be refunded), the same kind of responsibility is established for the tax authorities.

Thus, a specific legal entity may turn out to be both a payer and a recipient of payments from both groups, and accounting entries for fines and penalties will arise not only when accounting for expenses on them, but also when reflecting income.

Composition of expenses in bankruptcy

The insolvency procedure is carried out under the supervision of the Arbitration Court. The body determines the stage of the procedure and the manager conducting financial control of the operations. Covering expenses is carried out at the expense of the debtor and is not compensated by third parties. Expenses subject to judicial approval include:

- Manager's remuneration.

- Payment for current activities in the form of postal, office, and transportation expenses.

- Amounts required for publication of notifications about the start of the procedure in the Bulletin.

- Funds spent on holding public auctions of the debtor's property.

- Payments for the services of appraisers, auditors, experts and others.

When determining the amount of expenses, the validity of the expenses, reasonable amount and proportionality to the result are taken into account.

Reflection in accounting of sanctions under contracts with counterparties

How can accounting entries reflect fines or penalties that arise in relations with counterparties? Expenses or income generated by a legal entity in this case are among others (clause 7 of PBU 9/99 and clause 11 of PBU 10/99, approved by orders of the Ministry of Finance of Russia dated May 6, 1999 No. 32n and No. 33n). The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) recommends using account 91 to reflect them, the credit of which will show income, and the debit - expenses.

The corresponding account for account 91 in the entry for reflecting a fine or penalty in accounting will be settlement account 76, to which the Chart of Accounts provides for the opening of a sub-account called “Settlements for claims.” Analytics in this sub-account is organized by counterparties and each arising claim.

That is, the entries for the accrual of penalties will look like this:

- Dt 91 Kt 76 from a legal entity reflecting the claim addressed to it (i.e. its expense);

- Dt 76 Kt 91 from a legal entity that has submitted a claim to its counterparty and is counting on the receipt of funds to its address.

The amount accompanying these postings will be determined in the same way for both entries: as corresponding to the volume of accruals, either recognized by the debtor or established by the court (clause 10.2 of PBU 9/99, clause 14.2 of PBU 10/99). Accordingly, the moment of reflection in accounting will coincide with the moment of either recognition or adoption of a court decision.

Payment of sanctions will be expressed by posting Dt 76 Kt 51 (transfer to the counterparty) or Dt 51 76 (receipt from the counterparty).

Postings according to the organization’s writ of execution

Content

Home » For a lawyer » Postings on writs of execution Return back to Writ of Execution To account for mandatory deductions on writs of execution to account 76, open the sub-account “Settlements on writs of execution”.

Penalties for delay are assessed on the date of recognition by the debtor or on the day the court decision enters into legal force ().

When deducting amounts under writs of execution from an employee’s salary, make an accounting entry: Debit 70 Credit 76 subaccount “Settlements under writs of execution” - deducted from the employee’s salary under writs of writ. When paying the withheld funds to the claimant from the cash register, make the following entry: Debit 76 subaccount “Settlements under writ of execution” Credit 50 – the amount withheld under the writ of execution was issued to the recipient.

When transferring the withheld funds to the claimant’s bank account, make an entry: Debit 76 subaccount “Settlements under writ of execution” Credit 51 – the amount withheld under the writ of execution is transferred to the recipient. Reflect the commission for the transfer with the following entries: Debit 76 subaccount “Settlements under the writ of execution” Credit 51 – the bank withheld a commission for the transfer of the amount withheld under the writ of execution.

The fee for a bank transfer or postage is paid by the debtor, that is, the employee (Part 3 of Article 98 of Law No. 229-FZ). Therefore, deduct the commission for a bank transfer from the employee’s salary: Debit 70 Credit 76 subaccount “Settlements under writs of execution” - the commission for a bank transfer of the amount under a writ of execution is repaid from the employee’s salary.

If the withheld amount is transferred by mail, make the following entries: Debit 71 Credit 50 - the amount of alimony has been issued for reporting, which must be sent by postal order, and money to pay the postage; Debit 76 subaccount “Settlements under writs of execution” Credit 71 – the amount withheld under the writ of execution was transferred by postal order, the postage was paid. Debit 70 Credit 76 subaccount “Settlements under writs of execution” - the postal fee for transferring the amount under the writ of execution is paid from the employee’s salary.

How to reflect the accrual and payment of tax penalties and fines in accounting

The basis for making entries for penalties or fines assessed for payment to the budget are documents with the amounts of these payments issued by the tax authority:

- decisions based on the results of the audit;

- requirements for payment of taxes (contributions).

For the taxpayer, they represent an expense that must be reflected on account 99 or account 91, depending on the type of tax.

For which taxes the Ministry of Finance requires penalties and interest to be reflected on account 99, and for which on account 91, find out from the Typical Situation from ConsultantPlus by receiving a free trial access.

The corresponding account for tax sanctions will be account 68, in which both penalties and fines should be allocated for each tax (contribution) in the analytics.

The accrual of sanctions in favor of the tax authorities will thus be reflected by the entry Dt 99 (91) Kt 68, and the entry for payment of fines or penalties will look like this: Dt 68 Kt 51.

If the payer of sanctions against a legal entity turns out to be a tax authority, then the accounting entries in this case will be similar to those used when calculating similar payments arising under contractual relationships with other counterparties:

- Dt 76 Kt 91 - accrual of income under sanctions;

- Dt 51 Kt 76 - receipt of funds for their payment.

The Chart of Accounts does not provide for the attribution of such income to account 99. The use of account 91 in this posting indicates the preference for reflecting tax sanctions paid by the taxpayer through account 91, since this provides a more convenient comparison of income and expenses.

Repayment of debts of accountable persons

Accountable persons are employees of the organization who received funds for expenses for the enterprise with the condition of subsequent reporting for them. The basis for transferring the amount to account is the order of the manager, or a certified statement by him of the person receiving the money on account.

An order must be issued for each issue of an amount for reporting. It must include the full name of the employee, the amount issued for the report, the date of its return and the order number.

If the amount is received by an employee upon application, then the manager will certainly put a note on paper about the amount, the period for which it is received, and put a date and signature.

Typically, amounts of money are reported for the following types of expenses:

- business trips;

- household security;

- payment for fuel and lubricants.

The employee to whom the funds were issued for accounting is obliged to report for them to the accounting department of the enterprise. This must be done using an advance report, to which documents confirming expenses are attached.

If not all amounts have been spent, then the remainder is returned to the company's cash desk. If the amount was overspent, and there is evidence that it was necessary, then the overspending is returned to the employee. The necessity of the expenses incurred is checked and certified by the company management.

If the employee received funds for travel expenses, then the advance report and the unspent amount should be submitted to the accounting department no later than 3 working days upon return.

The write-off of spent funds issued against the report is reflected in the credit of account 71, the basis is the employee’s advance report:

| Debit | Credit | Operation description |

| Dt 20 (26, 10, 08) | Kt 71 | Money issued on account |

| Dt 50 | Kt 71 | Return of unused amount to the cashier |

If an employee purchased inventory items at retail, then when checking by the tax office, you may have to present not only a sales receipt, but also a cash receipt. With the exception of the list of goods for the sale of which a cash register is not required.

If the employee has not returned the amount after the deadline, the following entries are made:

| Debit | Credit | Operation description |

| Dt 94 | Kt 71 | Reflection of the accountable amount |

| Dt 70 | Kt 94 | The unrefunded amount is withheld from the employee's salary. |

Such an action can be taken by the organization’s management no later than a month after the return date, and with the consent of the employee.

Results

Sanctions reflected in accounting in the form of penalties and fines arise:

- in relations between counterparties due to violation of contractual relationships;

- in case of non-compliance with the requirements of tax legislation.

In both cases, a specific legal entity may be both a payer and a recipient of payments under sanctions. That is, entries for fines and penalties will reflect either expenses or income in his accounting:

Accounting analytics should be organized by counterparties and claims (for account 76), types of taxes and sanctions (for account 68), and assignment of sanctions (for account 91).

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.