Tax agent is a person who is entrusted by the Tax Code of the Russian Federation with the obligation to transfer taxes to the budget when carrying out the following operations:

- Purchasing goods from a foreign company;

- Rent of state or municipal property;

- Sale of state property;

- Purchase of electronic services.

Any organization, including individual entrepreneurs, can become such a person when implementing the above operations. It does not matter whether the person pays VAT or is exempt from it, and what tax regime applies.

VAT accounting for such a person in the company’s accounting program 1C 8.3 is carried out through accounts 68.32 and 76.AN “VAT” and “VAT Calculations” when performing the duties of a tax agent. Such a person is required to generate invoices, but the procedure for issuing them will have its own specifics.

Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

On February 25, the Organization entered into a lease agreement for municipal non-residential premises with the Moscow Property Department. The organization acts as a tax agent for VAT (paragraph 1, clause 3, article 161 of the Tax Code of the Russian Federation).

According to the agreement, the monthly rent is 224,200 rubles. in view of VAT. Rent is paid in advance on a monthly basis no later than the 10th day. In this case, the first payment must consist of rent for the first and last month of rent.

On March 1, the rental property was transferred by the lessor under the acceptance certificate.

On March 09, the Organization transferred to the landlord an advance payment for the first and last month of rent in the amount of 380,000 rubles.

On March 31, the landlord submitted a certificate for rental services.

Let's look at step-by-step instructions for creating an example. PDF

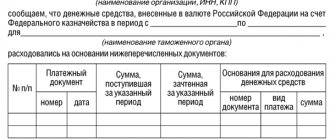

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Acceptance of leased property for accounting | |||||||

| March 01 | 001 | — | 2 500 000 | Acceptance of leased property for accounting | Manual entry - Operation | ||

| Transfer of advance payment to the lessor | |||||||

| March 09 | 60.02 | 51 | 380 000 | 380 000 | Transfer of advance payment to the supplier | Debiting from the current account - Payment to the supplier | |

| Introducing the Federation Council as a tax agent | |||||||

| March 09 | 76.NA | 68.32 | 68 400 | Issuance of SF by a tax agent | Invoice issued by tax agent | ||

| — | — | 68 400 | Reflection of VAT in the Sales Book | Sales book report | |||

| Reflection in accounting for rental services | |||||||

| March 31 | 26 | 60.01 | 190 000 | 190 000 | 190 000 | Accounting for service costs | Receipt (act, invoice) - Services (act) |

| 19.04 | 60.01 | 34 200 | 34 200 | Acceptance for VAT accounting | |||

| 60.01 | 76.NA | 34 200 | 34 200 | ||||

| 60.01 | 60.02 | 190 000 | 190 000 | 190 000 | Advance offset | ||

| Payment of VAT to the budget by a tax agent | |||||||

| April 25 May 25 June 25 | 68.32 | 51 | 22 800 | Payment of VAT to the budget (monthly, 1/3 per quarter) | Debiting from a current account – Tax payment | ||

| Acceptance of VAT for deduction by a tax agent | |||||||

| 30 June | 68.02 | 19.04 | 34 200 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 34 200 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

Tax agents for VAT using a practical example in 1C: Accounting

Published 08/07/2019 11:45 Author: Administrator Who are tax agents? These are organizations that calculate and remit taxes for taxpayers. We most often encounter the concept of “tax agent” when accounting for income tax, when we withhold personal income tax from the income of individuals. But you can also be a tax agent when accounting for VAT. The best part is that your tax system doesn't matter. Even if you use the simplified tax system or UTII, then, subject to certain conditions, you will still have to take into account “someone else’s” VAT. This obligation is enshrined in Art. 161 Tax Code of the Russian Federation. Let's consider situations in which an organization becomes a tax agent for VAT:

— when leasing federal and municipal property;

— when purchasing or selling services of foreign persons;

- when selling confiscated property, treasures and other valuables;

- when transporting goods by rail in the interests of another person on the basis of commission agreements, commissions or agency agreements;

— in the absence of a transfer of ownership of the vessel within forty-five calendar days from the date of registration of the vessel in the Russian International Register of Ships;

- when selling scrap and waste of ferrous and non-ferrous metals, secondary aluminum and its alloys, raw animal skins, as well as waste paper in the Russian Federation (this clause applies only to the general taxation system).

The most common example is the rental or purchase of state property from the authorities, administration or local governments themselves. Let's look at it in more detail.

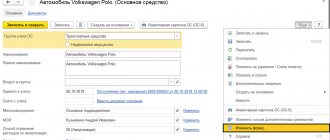

Let's start by setting up the program's functionality. Go to the “Administration” - “Functionality” section and check the box on the “Calculations” tab - “Organization - tax agent for VAT”.

Then we will reflect the receipt of leased municipal property from the lessor. To do this, we will create a debit entry for off-balance sheet account 001. Enter the document “Operation entered manually” in the “Operations” section.

The end of the month came, and the landlord gave us certificates of services rendered. This means you need to enter “Receipts (acts, invoices)” (section “Purchases”). Important details when filling out the document “Receipt of Services: Act” are the agreement with the municipality and the cost item. In the agreement, in addition to the number, date and name, you must check the box “The organization acts as a tax agent for the payment of VAT”, select the type of agency agreement and enter the general name for the invoice.

If you have not previously reflected such transactions, then you need to create a new cost item; in the “Type of expense” column, be sure to select “Rent of federal and municipal property.

The completed document “Receipt of Services: Act” will look like this:

When posting, movements will be created on the following accounts:

Dt 44.01 Kt 60.01 for rental cost excluding VAT

Dt 19.04 Kt 60.01 for the amount of VAT received

Dt 60.01 Kt 76.NA for the amount of accrued VAT (as a tax agent).

We will make a payment to the municipality for the rented non-residential premises; for this you need to create a “Debit from the current account”.

Please pay attention to the payment amount and VAT rate.

The document will generate the posting: Dt 60.01 Kt 51.

Let's move on to the tax agent's responsibility for registering an invoice. To perform this operation, we will use special processing:

In the window that opens, click on the “Fill” button, and then on “Run”

The information window “Invoice registration completed” should appear. The registered document can be viewed in the “Sales” - “Invoices issued” section. Let's check the correspondence of the accounts in the posting: Dt 76.NA Kt 68.32.

It’s time to pay VAT, let’s fill out the “Debit from the current account”. Pay attention to the VAT account: account 68.02 must be changed manually to 68.32 and indicate the lessor.

Also, do not forget to indicate the payer status in the payment order: 02 - tax agent.

Now let's see how our operations affected section 2.1 of the VAT Declaration.

The declaration section is filled in automatically. Pay attention to the transaction code - it must correspond to the type of transaction for which you are a tax agent.

We will also check the reflection of the invoice in section 9 “Information from the sales book”. The line with VAT from the rental of municipal property should contain the transaction type code – 06.

It should be noted that if the rental of municipal property is free of charge, then the tenant (tax agent) must calculate and pay VAT to the budget at a rate of 20/120, taking as the tax base the amount of rent calculated on the basis of market prices taking into account tax (letter from the Ministry of Finance of Russia dated 04/02/2009 No. 03-07-11/100).

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+1 Alina Kalendzhan 01/19/2021 20:26 I quote Elena:

Good afternoon. Please, when filling out an invoice from the Agent (we are the principals), an invoice appears in the purchase book from both the supplier0 and the agent (reissued). How to accept correctly

Good afternoon.

Read our articles: Commission trading in 1C: Accounting - accounting with the commission agent and Commission trading in 1C: Accounting - accounting with the principal. Quote 0 Alina Kalendzhan 01/19/2021 20:23 Quote Elena Polunina:

The article is good, but how is the account closed on April 19?

Good afternoon.

The document “Creating purchase ledger entries” generates the posting Dt 68.02 Kt 19.04. It is important that the special “Tax Agent” tab is filled out in this document. Quote 0 Elena 01/19/2021 16:55 Good afternoon. Please, when filling out an invoice from the Agent (we are the principals), in the purchase book there is an invoice from both the supplier and the agent (over-invoiced). How to accept correctly

Quote

+4 Elena Polunina 04/28/2020 07:47 The article is good, but how is the account closed on 04/19?

Quote

-1 Nadezhda Galkina 04/20/2020 18:33 Very useful article, thank you very much!!!

Quote

0 Olga Shulova 10/15/2019 08:41 Quoting Eugen:

How to close 76NA? After registering the issued invoice, it will remain unlocked, you can only close it with handles...

In the document “Receipt (act, invoice)” posting Dt 60.01 Kt 76.NA After registering the invoice Dt 76.NA Kt 68.32 If the receipt document in your case does not generate a posting, then check the contract settings and the correctness of filling out the document.

The first part of the article describes important nuances Quote -1 Eugen 10/14/2019 21:15 How to close 76NA? After registering the issued invoice, it will remain unlocked, you can only close it with handles...

Quote

+4 Ivan 08/11/2019 15:20 Very good article, thank you very much. I myself recently needed to correctly reflect such transactions, so I had to look for information on the Internet. I found it, but I didn’t know about processing and cost items.

Quote

Update list of comments

JComments

Acceptance of leased property for accounting

Accounting for leased property is organized on off-balance sheet account 001 “Leased fixed assets” at the cost specified in the agreement (Instructions for using the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n). Analytical accounting is maintained for each leased property.

Reflection of leased non-residential premises in accounting is documented in the document Transaction entered manually, type of transaction Transaction in the section Transactions – Accounting – Transactions entered manually.

Let's look at the features of filling out the document Operation entered manually according to this example:

- Dt – account 001;

- Subconto 1 – lessor, selected from the Counterparties directory;

- Subconto 2 – leased fixed asset, selected from the Fixed Assets directory;

- Amount – the cost of the leased property, usually specified in the lease agreement.

If the contract or the transfer and acceptance certificate does not indicate the value of the leased property, and it is not agreed upon in an additional agreement, then it is recommended to establish in the accounting policy a method for determining the value of the leased property (clause 7 of PBU 1/2008), for example, based on the market value property.

It is recommended to open an inventory card for the rented premises (clause 14 of the Guidelines for OS accounting).

Transfer of advance payment to the lessor

When leasing municipal property from local governments, the tenant acts as a tax agent for VAT (clause 3 of Article 161 of the Tax Code of the Russian Federation).

A tax agent for VAT in 1C 8.3 in the Contracts , in the VAT should: PDF

- check the box The organization acts as a tax agent for the payment of VAT ;

- select the appropriate Type of agency agreement - Rent (paragraph 1, clause 3, article 161 of the Tax Code of the Russian Federation);

- indicate the Generalized name of goods for the tax agent invoice .

Find out in more detail about the legislative part and settings in 1C when performing the duties of a tax agent during a lease.

The transfer of rent to the landlord is reflected in the document Write-off from the current account, transaction type Payment to supplier in the Bank and cash desk section – Bank – Bank statements – Write-off button.

Let's look at the features of filling out the document Write-off from a current account using this example:

- VAT rate - set to Without VAT .

- Amount – the amount of the rental payment minus VAT.

Renting municipal property in 1C 8.3 - transfer of advance payment under a rental agreement.

Postings

Other types of operations

The responsibilities of the tax agent in terms of paperwork when carrying out the remaining operations listed at the beginning of this article are similar to the responsibilities for leasing. The most important thing is to correctly indicate its type in the contract with the counterparty. In the 1C program they are briefly designated as: rent, sale of property, non-resident, electronic services. In parentheses next to each type there is a link to an article of the Tax Code of the Russian Federation, which establishes the obligation of a tax agent.

Fig. 19 Other types of operations

It is also very important to correctly fill out the accounting account and cost item in the “Receipt of Services” documents. And when carrying out operations to sell property, you must very carefully keep records of fixed assets.

Here we looked at situations where an organization or individual entrepreneur can assume the responsibility of an agent paying VAT, described in detail the sequence of document preparation by an organization-tax agent, and also saw the opportunities that the 1C 8.3 program provides for accounting for such transactions.

Issuing an invoice as a tax agent

create a document Invoice (issued tax agent type of invoice) from the document Write-off from current account for transfer of rent by clicking the Create based .

In the invoice (hereinafter referred to as SF), the transaction type code “Tax agent, art. 161 of the Tax Code of the Russian Federation.”

In the field Payment document No. from the document Invoice issued, the number and date of the payment order for the transfer of rent are automatically indicated (clause 3, clause 1 of the Rules for filling out an invoice, approved by Government Decree of December 26, 2011 N 1137).

Nomenclature column the Explanation of the amount at VAT rates section is filled in with the general name specified in the agreement with the counterparty. PDF

If in the Invoice document issued by the tax agent the wording is in the Nomenclature and Service Content columns, additional. the information differs from each other, then in column 1 of the printed form of the Federation Council the following will be displayed:

- information from the column Contents of the service, additional. information , if completed.

- information from the column Nomenclature , if the column Contents of the service, additional. information is not filled in.

Tax agent invoice 1s 8.3.

VAT tax agent: postings in 1s 8.3

Tax agent invoice 1s 8.3

An invoice issued by a tax agent is drawn up according to the general rules, but is issued in one copy (clause 3 of Article 168 of the Tax Code of the Russian Federation).

The tax agent invoice form can be printed by clicking the Print in the document Invoice issued invoice type Tax agent . PDF

The amount of VAT calculated and withheld by the tax agent is reflected in the Sales Book.

Sales Book report can be generated from the Reports -VAT - Sales Book section. PDF

VAT declaration

In the VAT return, the calculated VAT by the tax agent is reflected as follows:

In Section 2 “The amount of tax payable to the budget, according to the tax agent”: PDF

- line 060 - the amount of calculated VAT according to the tax agent;

- page 070 - operation code "1011703".

A separate Section 2 must be completed for each lessor.

In Section 9 “Information from the sales book”:

- invoice issued by the tax agent. Operation type code "".

How to fill out an invoice as a tax agent

In line 2 “Seller”, tax agents purchasing goods (work, services) from foreign organizations that are not tax registered in Russia (clause 2 of Article 161 of the Tax Code of the Russian Federation), as well as tax agents leasing state or municipal property directly from bodies of state power and local self-government or purchasing (receiving) state or municipal property on the territory of Russia that is not assigned to state (municipal) organizations (clause 3 of Article 161 of the Tax Code of the Russian Federation), provide the full or abbreviated name of the seller or lessor (specified in the agreement with a tax agent), for whom they fulfill tax payment obligations.

Line 2a “Address” must indicate the address (in accordance with the constituent documents) of the seller or lessor (specified in the agreement with the tax agent) for whom the tax agents fulfill the obligation to pay tax.

In line 2b “TIN/KPP of the seller” the following must be entered:

- a dash – if the invoice is filled out by a tax agent purchasing goods (work, services) from a foreign organization that is not tax registered in Russia (clause 2 of Article 161 of the Tax Code of the Russian Federation);

- INN and KPP of the seller or lessor (specified in the agreement with the tax agent), for whom the tax agent fulfills the obligation to pay tax, in all other cases (clause 3 of Article 161 of the Tax Code of the Russian Federation).

This is stated in subparagraphs “c”–“d” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

When drawing up an invoice for work performed (rendered and 4 “Consignee and his address” tax agents purchasing work (services) from foreign organizations that are not tax registered in Russia (clause 2 of Article 161 of the Tax Code of the Russian Federation), as well as tax agents leasing state or municipal property directly from state authorities and local self-government or acquiring (receiving) state or municipal property on the territory of Russia that is not assigned to state (municipal) organizations (clause 3 of Article 161 of the Tax Code of the Russian Federation), put dashes .

If goods are purchased from foreign organizations that are not tax registered in Russia, then in the line “Consignor and his address” you must indicate the name and postal address of the consignor, and in the line “Consignee and his address” - the name and postal address of the consignee.

This is stated in subparagraphs “e”–“g” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The procedure for filling out line 5 “To the payment and settlement document” has some peculiarities.

When purchasing (receiving) or renting state (municipal) property, in this line you must indicate the number and date of the payment document confirming payment for the property or transfer of rent.

When purchasing works (services) from foreign organizations that are not tax registered in Russia, in line 5, indicate the number and date of the payment document confirming the transfer of the withheld VAT amount to the budget.

When purchasing goods from foreign organizations that are not tax registered in Russia, in line 5, indicate the number and date of the payment document confirming payment for the purchased goods.

If the payment was made in non-cash form, indicate a dash in line 5.

This is stated in subparagraph “h” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

In line 7 “Currency: name, code”, indicate the name of the currency according to the All-Russian Classifier of Currencies and its digital code (subparagraph “m”, paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). If in the contract the price of a product (work, service) is indicated in foreign currency and its payment is also made in foreign currency, the tax agent can draw up an invoice in foreign currency (Clause 7 of Article 169 of the Tax Code of the Russian Federation).

When filling out the invoice columns, tax agents purchasing goods (work, services) from foreign organizations that are not tax registered in Russia (clause 2 of Article 161 of the Tax Code of the Russian Federation), as well as tax agents leasing state or municipal property directly from bodies of state power and local self-government or those acquiring (receiving) state or municipal property on the territory of Russia that is not assigned to state (municipal) organizations (clause 3 of Article 161 of the Tax Code of the Russian Federation), must adhere to the following rules.

When full payment for goods (work, services) is made, the invoice columns should be filled out in the manner established by paragraph 5 of Article 169 of the Tax Code of the Russian Federation.

In case of partial payment, dashes are placed in columns 2–4, and columns 10–11 are not filled in.

For both full and partial payment (including non-cash payments), please indicate:

- in column 1 - the name of the goods supplied, property rights (description of work, services);

- in column 7 - the estimated tax rate (10/110 or 18/118) or the entry “Without VAT”;

- in column 9 - the sum of the indicator in column 5 and the indicator calculated as the product of the indicator in column 5 and the tax rate of 10 or 18 percent, divided by 100;

- in column 8 - the amount of tax calculated as the product of columns 9 and 7, in rubles and kopecks without rounding (letter of the Ministry of Finance of Russia dated April 1, 2014 No. 03-07-RZ/14417);

- in column 6 - the amount of excise tax, and if the product is not excisable, then indicate “Without excise duty”.

This procedure for filling out invoices is established in Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

After filling out all the required details of the invoice drawn up on paper, it must be signed by the head and chief accountant of the tax agent organization (other persons authorized to do so by order of the head or by a power of attorney on behalf of the organization). If the tax agent is an entrepreneur, he must personally sign the invoice and indicate in it the details of his registration certificate. This procedure is established by paragraph 6 of Article 169 of the Tax Code of the Russian Federation.

With regard to the preparation of previous forms of invoices, similar explanations were contained in the letter of the Federal Tax Service of Russia dated August 12, 2009 No. ШС-22-3/634.

When calculating tax, as well as when issuing an advance (partial payment), including in non-monetary form, tax agents purchasing goods (work, services) from foreign organizations that are not tax registered in Russia (Clause 2 of Article 161 of the Tax Code RF), as well as tax agents leasing state or municipal property directly from state authorities and local self-government or acquiring (receiving) state or municipal property on the territory of Russia that is not assigned to state (municipal) organizations (clause 3 of Article 161 of the Tax Code RF), draw up an invoice and register it in the sales book (clause 15 of section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). When presenting VAT for deduction in accordance with paragraph 3 of Article 171 of the Tax Code of the Russian Federation, previously issued invoices for advance payments (partial payment) are registered in the purchase book (clause 23 of section II of Appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

An example of drawing up an invoice for the amount of an advance paid for the upcoming delivery of production equipment. A Russian organization (tax agent) purchases equipment from a foreign organization that is not tax registered in Russia

Alpha LLC, on a 100% prepayment basis, purchases a milling machine from a Ukrainian company for use in production activities subject to VAT. The cost of equipment under the contract is 590,000 rubles. in view of VAT. Settlements under the agreement are carried out in rubles. A Ukrainian organization is not registered for tax purposes in Russia. The place of sale of the machine is Russia (Article 147 of the Tax Code of the Russian Federation). Therefore, Alpha must withhold VAT from the cost of the machine. The amount of VAT that Alpha must withhold from the income of a Ukrainian organization as a tax agent is RUB 90,000. (RUB 590,000 × 18/118).

On June 21, by payment order No. 275, the Alpha accountant transferred payment to the Ukrainian organization (minus VAT) and drew up an invoice from Fr. In line 5 of the compiled invoice, the Alpha accountant indicated the details of the payment document with which payment was transferred to the Ukrainian company (dated June 21, No. 275). On June 21, the invoice was recorded in the sales ledger.

VAT withheld from the income of the Ukrainian organization was transferred to the budget by payment order dated June 21 No. 276.

The equipment acceptance and transfer certificate was signed by the parties on July 5. On this day, the machine was accepted for accounting and Alpha acquired the right to deduct the withheld VAT. On July 5, Alpha's accountant registered the compiled invoice in the purchase book and presented the VAT amount for deduction.

Alpha's accountant reflects settlements with suppliers in the following sub-accounts opened to account 60 “Settlements with suppliers and contractors”:

- “Calculations for advances issued”;

- “Settlements for property (work, services).”

The following entries were made in Alpha's accounting.

21st of June:

Debit 60 subaccount “Calculations for advances issued” Credit 68 subaccount “Calculations for VAT” - 90,000 rubles. – VAT is withheld from the amount of the advance paid to the Ukrainian organization;

Debit 60 subaccount “Settlements for advances issued” Credit 51 – 500,000 rub. – the advance payment of the Ukrainian organization is transferred (minus the withheld VAT);

Debit 68 subaccount “Calculations for VAT” Credit 51 – 90,000 rubles. – transferred to the budget VAT withheld from the income of the Ukrainian organization.

5'th of July:

Debit 08 Credit 60 subaccount “Payments for property (work, services) ” – 500,000 rubles. – a milling machine was accepted for accounting as part of capital investments;

Debit 19 Credit 60 subaccount “Payments for property (work, services)” – 90,000 rubles. – reflects the “input” VAT on the cost of the machine;

Debit 60 subaccount “Settlements for property (work, services)” Credit 60 subaccount “Settlements for advances issued” – 590,000 rubles. – the advance paid to the Ukrainian organization is credited;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 90,000 rubles. – VAT withheld and transferred to the budget is accepted for deduction.

The same rule applies if a tax agent purchasing goods (work, services) from a foreign organization that is not tax registered in Russia refuses delivery before shipment and the seller returns the previously received advance payment (partial payment). In this case, previously issued invoices for advance payments (partial payment) are recorded in the purchase book after all adjustments related to the return are reflected in the accounting records. In this case, the invoice can be registered in the purchase book no later than one year from the date of the buyer’s refusal to supply. This is stated in paragraph 22 of Section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Reflection in accounting for rental services

Costs for renting non-residential office space in accounting are included in expenses for ordinary activities and are recorded in the account “General business expenses” (clause 5, clause 7 of PBU 10/99, Instructions for the use of the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31 .2000 N 94).

In tax accounting, such costs will be classified as indirect expenses and taken into account at a time to reduce the taxable base for income tax (Article 318 of the Tax Code of the Russian Federation).

The provision of rental services is registered with the document Receipt (act, invoice) transaction type Services (act) in the section Purchases - Purchases - Receipt (acts, invoices) - button Receipt - Services (invoice).

Let's look at the features of filling out the document Receipt (act, invoice) using this example.

- Act No. from – number and date of the Act of provision of services for rent.

When renting, you don’t have to draw up a monthly act if it is not provided for in the contract.

To document rental expenses there must be:

- agreement and certificate of acceptance and transfer of property (Letter of the Ministry of Finance of the Russian Federation dated June 15, 2015 N 03-07-11/34410)

- agreement and payment documents confirming the fact of rent payment (Letter of the Ministry of Finance of the Russian Federation dated August 26, 2014 N 03-07-09/42594).

In this situation, the supplier will not allocate VAT in the primary documents, but since in 1C in the document Receipt (act, invoice) the VAT rate is set at 18%, then you need to set:

- VAT — in the VAT the value of VAT in the amount of ;

- Amount – the amount under the contract, including VAT;

- VAT rate – rate 18% ;

- VAT will be calculated automatically from the Amount at the specified rate.

Renting municipal property in 1s 8.3: reflection in accounting.

Postings according to the document

Income tax return

In the income tax return, rental expenses are reflected as indirect expenses: PDF

- Sheet 02 Appendix No. 2 page 040 “Indirect costs”.

Payment of VAT to the budget by a tax agent

Payment of VAT by the tax agent when renting to the budget should be carried out in the usual manner, i.e. in equal shares no later than the 25th day of each of the three months following the expired tax period (clause 1 of Article 174 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation 07.07.2009 N 03-07-14/64).

Payment of VAT to the budget is reflected in the document Write-off from the current account transaction type Payment of tax in the Bank and cash desk section - Bank - Bank statements - Write-off.

The document fields are filled in as follows:

- Tax - VAT;

- Type of obligations - Tax;

- Accounting account - 68.32 “VAT when performing the duties of a tax agent”;

- Amount - the amount of VAT paid on the statement, which must be at least 1/3 of the calculated VAT amount by the tax agent on the declaration.

For settlements with the budget in 1C, the tax agent uses account 68.32 “VAT when performing the duties of a tax agent.”

The account has three sub-accounts:

- Counterparties;

- Agreements;

- Calculation documents.

This analytics must be completely filled out in the document Write-off from the current account in the Reflection in accounting . Otherwise, VAT will not be automatically deducted in the future.

Be careful with the execution of the Payment order - when issuing a payment order for the payment of VAT to the budget, in field 101 “Compiler status”, code 02 “tax agent” is filled in. PDF

Postings according to the document

Acceptance of VAT for deduction by a tax agent

VAT is accepted for deduction if the conditions are met (clause 2, clause 3 of Article 171 of the Tax Code of the Russian Federation):

- the tax agent is a VAT taxpayer;

- VAT was paid by the tax agent to the budget;

- services purchased for activities subject to VAT;

- there is a correctly executed SF, drawn up by the NA itself;

- services are accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

Acceptance of VAT for deduction is formalized by the document Generating purchase ledger entries in the Operations section - Closing the period - Regular VAT operations - Create button.

To comply with the control ratios specified in the appendix to the Letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 N GD-4-3 / [email protected] , VAT deduction is possible only in the next period, after submitting a VAT return, which reflects the VAT calculated by the tax agent (Letter Federal Tax Service of the Russian Federation dated September 13, 2011 N ED-4-3/ [email protected] ).

To automatically fill out the Tax Agent , you must use the Fill .

Postings according to the document

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

VAT declaration

In the VAT return, the VAT accepted for deduction by the tax agent will be reflected as follows:

In Section 3, page 180 “The amount of tax paid to the budget by the taxpayer as a buyer - tax agent, subject to deduction”: PDF

- the amount of VAT subject to deduction.

In Section 8 “Information from the purchase book”:

- invoice issued by the tax agent. Operation type code "".

Property rental

Let us dwell in detail on the responsibilities of such a person when renting property. In other cases, accounting is carried out similarly.

From the main menu of the program in “Purchases-Receipts (acts, invoices)”, click the “+ Receipts” button.

Fig.1 Property rental

The program prompts you to select the type of admission. We select “Services (act)”, the program creates a new document “Receipt of services (act)”. We carefully fill out the details and pay special attention to the agreement with the counterparty.

Fig.2 Agreement

We indicate the type of agreement “With a supplier”, select - as a tax agent with the type of agency agreement - “Rent”. The receipt document, in our case this is an act, is processed in the usual way, but, unlike a regular purchase, we do not create an invoice (we look at the status in the lower left corner of the screen - an invoice is not required).

Fig.3 Receipt of services

We post our document and track the transactions using the DtKt button.

Fig.4 Wiring

The postings use auxiliary account 76.NA instead of the usual settlement account. To reflect this type of VAT, special processing is used. It is located in the “Bank and cash desk” section, then “Registration of invoices”, and select “Tax agent invoices”.

Fig.5 Tax agent invoices

It should also be added that our document will be included in the list of invoices of the tax agent only if it is paid, and the “Write-off from the current account” document has also been posted. If all these conditions are met, the list of invoices will look like this:

Fig.6 List of invoices

By clicking the "Run" button, invoices are created and registered. We check the document. Please note that the VAT rate is 20/120, and the transaction type code is 06.

Fig.7 Checking the document

We check the correctness of the formation of transactions using the DtKt button. Let's pay attention to the accounting accounts - 68.32 and 76.NA.

Fig.8 Let us pay attention to the accounting accounts - 68.32 and 76.NA

The amount of VAT subject to mandatory payment to the budget is included in the Sales Book report. We find it in the “Reports” section, then “VAT-Sales Book”. Specify the period and click “Generate”.

Fig.9 Specify the period and click “Generate”

The VAT declaration is generated in the “Reports” section, then “1C-Reporting”, then “Regulated reports”. Select “Create” and select “VAT Declaration” from the list that opens.

Fig. 10 VAT declaration

We indicate our organization and period, select “Fill”. The declaration is ready, all that remains is to check it. The amount payable to the budget will be displayed in the second section on line 060.

Fig. 11 Checking the declaration

Next, you need to issue a payment order to pay the tax. Please ensure that all details are filled out correctly.

Fig. 12 Registration of PP for tax payment

A payment order may become the basis for “Write-off from the account”. We check the type of transaction – “Payment of tax”, as well as the write-off account – 68.32.

Fig. 13 Checking the type of operation

We check whether the transaction is reflected correctly in the accounting records. We use the DtKt button.

Fig. 14 We check the correctness of the reflection of the transaction in accounting

Next you need to accept VAT for deduction. To do this, create the document “Creating purchase ledger entries.” We find the document in the “Operations” menu, submenu “VAT routine operations” and click “Create”. In the list that appears, look for “Creating purchase ledger entries.”

Fig. 15 Creating purchase ledger entries

Go to the “Tax Agent” tab and fill in the required data.

Fig. 16 Go to the “Tax Agent” tab

We post the document, then check the correctness of the postings, press the DtKt button. Please also note that the “Seller Name” field will display the seller himself, and not the tax agent.

Fig. 17 Checking the wiring

The wiring has formed. Now let's check the VAT return again. The amount of tax to be deducted will be reflected in section 3, line 180.

Fig. 18 Checking the VAT return again