Hello! In this article we will talk about the destruction of accounting documents.

Today you will learn:

- What is meant by accounting document flow and what are the storage periods for basic accounting documents;

- Why do you need to destroy documents?

- How to correctly and in what form to formalize the procedure for recycling the organization’s documents;

- What methods exist for destroying information on paper and electronic media;

- What may lead to the loss of a document due to the fault of the employee. Types of disciplinary measures.

Content

- Reasons for destroying documents

- Preparation for destruction of accounting documents

- Act of destruction of accounting documents

- How electronic media are destroyed

- What to do if the document is lost

- Fines for document destruction

- Conclusion

Any company, organization or individual entrepreneur, regardless of its form of ownership, has its own document flow. But the time comes when there is not enough space for new documents. What to do in such a situation? Where to put old documents, how long should they be present in the accounting department? How to destroy after the expiration date?

Reasons for destroying documents

Document flow is the movement of all documents in the accounting department from the date of receipt to final execution, or filing them in the file and depositing them in the archive for storage. Accounting documentation reflects all expenses and income of the company.

Several types of documents are involved in movement:

- Official papers that are created in a given organization move only within its framework and are stored here.

- Documents developed in this company, intended for other companies, contractors. They are called outgoing.

- Incoming, that is, developed by another company and must be kept in the file of the receiving organization.

Each document in the process of operation of the enterprise is subject to a number of actions:

- Transfer from another person to the accounting department, or development during a business transaction;

- Processing of each by an accountant, that is, acceptance, filling, posting to accounts, if possible;

- Checking the design and completion by a higher organization;

- Delivery for storage.

Accounting documents make up more than half of the total document flow in an enterprise. Let's take a closer look at what rules exist for storing such documentation.

Recently, electronic document management has become very widespread. An accountant needs to remember that files containing a particular document, or an archived database of software products, are also subject to long-term storage.

All types of documents that need to be stored for any period of time are subject to the following regulated and normative documents that define the rules and periods of storage in the archive:

- Federal Law No. 125 “On archiving in the Russian Federation”, dated October 22, 2004.

- Decision of the Federal Archive of February 6, 2002, which determines the rules for storing forms in the archive.

- Articles 24, 23, 89 of the Tax Code of the Russian Federation, defining storage periods.

- Order of the Ministry of Culture of the Russian Federation No. 558, dated 08/25/10

The entire documentary base that requires long-term storage can be divided into groups:

- Primary , which includes forms for accounting for fixed assets, inventory, and payroll;

- Reporting documents , that is, the final output forms for submitting reports to the pension fund, social insurance, and tax authorities. Reporting may also include acts of audits and inspections;

- Information information about the organization , that is, this is an accounting policy that includes documents regulating accounting, personnel work, drawing up and processing of document flow at the enterprise.

Such information is stored for various periods of time, since in the course of the company’s activities, accounting employees often resort to them in order to use the information contained in them.

| Reason for storage | Deadlines |

| For accounting purposes | At least 5 years. The month and year of the processed documents must be indicated on the cover of the case. |

| For tax accounting purposes | According to the tax code, such documents are stored for 4 years or more |

| All other documents confirming the work of the organization | Throughout the entire period of operation of the company |

What concerns in the context of each document? What are the storage periods for documents?

For example , contracts and additional agreements to them are stored for five years or more from the expiration date. Powers of attorney, certificates of completed work, and salary statements are also kept for at least five years. But if there are no personal accounts for payroll, then the statements should be stored for a longer time, even up to 75 years, if this is provided for in the organization itself.

There are documents whose statute of limitations increases to 75 years.

These include:

- Documents that contain information about employees, personal cards, personal wage accounts, contracts concluded directly with employees.

- Financial statements.

- Reporting to the bodies of the Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat based on the results for the year. Quarterly reports must be available for at least 6 years.

Information about imposed penalties is stored for at least five years.

The main storage period for all documents is five years, in some cases more, but not less.

Purpose of the act of writing off documents

Important!

Each company accountant should have a good understanding of how much and how certain papers should be stored at the enterprise. There are some types of documents that are inviolable, so they must be available to the company at all times and in optimal form, so their destruction is not allowed.

It does not matter in what field of activity the organization operates, or what its size is, since all the rules are the same for each company.

How to prepare documents for transfer to the company archive - see here:

Reasons for drawing up an act

Most often, the write-off of documentation, which involves its destruction, occurs due to the fact that the period during which it is required to be stored in the company expires. This time usually occurs by January 1 of the new calendar year.

Other reasons for drawing up a write-off report include:

- significant damage to documents, and it may occur as a result of a fire, flood or other emergency situations that could not be influenced in any way by the organization’s employees;

- theft of papers of a company that should be officially registered;

- force majeure circumstances, namely the impact of various natural elements.

Important! Any reason must be documented, since if Federal Tax Service employees discover a lack of necessary documentation in the company, then if there is no evidence of objective reasons for this situation, this may lead to the imposition of a significant fine.

For example, if there was a theft at an enterprise, then law enforcement agencies should be called, who will issue the corresponding document to the head of the company.

What types of documents can be drawn up

The act of writing off documents depends on what kind of documentation is being written off. The papers most often subject to write-off are:

- Accounting documentation. It additionally includes tax reporting. If a report is submitted for a year, it does not have a shelf life. If reports are submitted quarterly, they must be kept for at least five years. If they are submitted monthly, they must be maintained by the company for one year following the reporting year. Acts on the basis of which financial statements are destroyed are drawn up separately. At the same time, the general procedure for storage and destruction is used for them, which is prescribed in Federal Law No. 125. The act certainly indicates what kind of documentation is to be written off, what type of tax it relates to, and also for what period of time it was compiled.

- Primary documents. It must be kept by companies for at least five years. Destruction is considered a specific process that requires the drawing up of a separate act. If such papers are requested in the future by tax inspectors, then a correctly drawn up act will serve as evidence of the impossibility and objectivity of their failure to submit.

- Archival papers. This usually includes various personnel papers, which include orders or personal files. The optimal shelf life for them is 75 years.

- Documents for destruction. This includes various not very important papers that may clutter up the archive. They are not considered significant, and are also not usually checked by various regulatory authorities. But even their destruction must be recorded by an appropriate act.

- Documents whose storage period has expired. Each document generated at the enterprise has a limited shelf life. Usually they are transferred to the archive with an indispensable mark, which indicates until what year the documentation should be kept. If this period expires, then destruction must occur using a special act, which states as the reason that the storage period has already passed.

How to write off receivables with an expired statute of limitations - read here.

To write off any document, it is necessary to issue a corresponding order, represented by an order, and a special expert commission is convened. The commission should include specialists from different sections of the company who are professionals in a particular field.

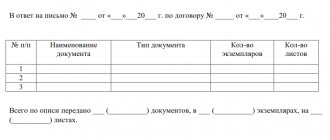

Form of document write-off act.

Preparation for destruction of accounting documents

You cannot throw away or destroy any accounting documents yourself, since the information contained in them may be required during audits by audit companies.

Many employers keep the entire documentary base and do not destroy it even after the expiration of the five-year period, simply due to ignorance of the laws on destruction or archiving.

Let us consider in detail the procedure for destroying documents:

Destruction of accounting documents is an important procedure in an enterprise that requires special attention and execution. If it is not carried out in accordance with the law, the organization may be subject to administrative liability, and in some cases criminal liability.

Only those documents and electronic files that have “gathered dust” in the archive are designated for destruction, that is, they have expired.

First of all, you need to determine the documents by value. For this purpose, a special expert commission is created, which determines the importance of each document and the possibility of destroying documents with an expired storage period.

For a more correct and comprehensive assessment, an archive employee, chief accountant, lawyer, and deputy head of the organization are invited to the commission. Members of this composition can also be independent, that is, people attracted from outside with the appropriate education.

The leader writes an order to create this commission. This commission is drawn up once and is valid each time documents are written off for disposal.

Experts' responsibilities include:

- Compiling a register of all archive documentation.

- Compiling a list of documents whose storage period has expired and are subject to destruction.

- Drawing up a disposal act.

- If required, document waste paper is weighed.

- Directly present at the liquidation process.

Using these powers, experts draw up an act that includes a list of documents to be destroyed. How to arrange destruction correctly?

A sample order is presented below:

Moscow

December 31, 2021

Joint Stock Company "Lutik" ORDER No. 4223

On approval of the composition of the commission for the destruction of primary accounting documents of JSC “Lutik”

In order to conduct an examination of the value of documents completed by office work, guided by Instruction No. 125, approved by order of JSC “Lutik” dated 725 of 04/08/2013.

I ORDER:

1. Create an expert commission consisting of the following: Nezabudkin P.P. – financial director – chairman of the commission; Medunitsyna L.N. – deputy chief accountant – member of the commission; Romashkina M.N. – senior accountant – member of the commission.

2. Conduct an examination of documents completed by office work, located in the archives of JSC “Lutik” until January 17, 2021.

3. Draw up and submit for approval an act on the allocation for destruction of documents that are not subject to storage by January 19, 2017.

4. I reserve control over the execution of this order.

Director

P.P. Dandelions

Chief Accountant

IN AND. Landysheva

Step 3. An act on the allocation for destruction of documents that are not subject to storage is drawn up.

The act of allocating documents for destruction is drawn up in 2 copies, signed by the chairman and members of the expert commission and approved by the head of the company.

Act of destruction of accounting documents

- Download the act

The form of the act is developed by the members of the commission and signed by each of them and the director, certified by the seal of the organization. A clearly developed list is included in the act indicating the start dates for storage and the dates for removal from it.

If a large number of paper information media are removed from storage at a time, then they can be handed over as secondary raw materials. When there is a waste paper collection point nearby, an agreement is concluded with it for the recycling of waste paper.

Next, the paper bale is taken for delivery. Employees of such a point issue a waste paper acceptance certificate indicating the weight of the paper and the price per kilogram, and also calculate the total amount. The money received for a pile of unnecessary documentation appears in the accounts of the enterprise.

The commission may decide to destroy manually, that is, the usual tearing of forms, if the amount of paper is small. You can shred documents using a special machine called a shredder. When a sheet of paper is passed through this machine, it is cut into very thin strips, which can later be burned or chemically dissolved.

When burning paper, you can run into problems with firefighters, so it is better to hand over the paper to recycling plants or waste paper collection points.

Another method of destruction may be dissolution using chemical acids or other chemical products, which will also harm the environment. Typically, the latter method of getting rid of paper is very expensive.

All actions for the destruction of paper are reflected in writing in the act of destruction of documents, signed by the relevant members of the examination and independent people present during the process.

How are papers destroyed?

Their destruction is considered a simple process, and all documents whose shelf life expires are written off from the beginning of the next year. But for this to happen, an audit must already be carried out.

Important! If papers are removed from the state archive, then a special invoice is drawn up for this.

All acts subject to destruction are described in a special list presented in the write-off act. It indicates all the papers that will be destroyed, their quantity and numbers. Here you will learn how to write off accounts payable with an expired statute of limitations.

All files that are planned to be written off must be kept separately from other papers. The act made is initially approved by the head of the company, for which a commission gathers and considers the issue.

The fact of destruction is confirmed by an act of destruction of documents, and often the documents are burned or special devices are used. The procedure is carried out in the presence of commission members, who then certify the process with their signatures.

Important! Often at one enterprise it is necessary to destroy a lot of papers, and in this case you can hand them over to special companies specializing in this process.

How to draw up a write-off act

It does not need to describe each case in detail, so only information is entered into it:

- name of the documents, for example, order or certificate;

- the dates when they were created are indicated;

- case number according to the inventory;

- shelf life;

- article number, for which you need to focus on the above List.

At the end of the document, it is certainly written down how many files are destroyed, and the document is also signed by a commission, which must consist of three or more people. The signature of the head of the company is placed at the top.

A sample of filling out an act on the allocation for destruction of documents that are not subject to storage.

How electronic media are destroyed

In addition to paper media, information can, and has recently, been stored increasingly on electronic media. Electronic documents are usually stored on the servers of large companies or on the main computer of a small organization.

The commission of the same composition carries out the procedure for their culling according to the accepted scheme. That is, a list of expired files that are subject to disposal is determined, then the disposal itself occurs.

Several methods are used to destroy electronic documentation:

- Demagnetization is a method of influencing a storage medium using a magnetic field. It is used when the media acts as a separate element, for example, an audio or video cassette, floppy disks (floppy disks), hard drives. This procedure renders removable media unusable and their further use is impossible.

- Erasing information or overwriting it . This method is used to reuse the media. Electronic files are erased by specialists, these can be programmers or hired specialists in this field, from a server or from the hard drive of the main computer.

- Mechanical destruction is the most reliable, since you can visually verify the results. This method uses chemical reagents, mechanical damage to the media, burning or melting.

The entire course of action must be reflected in the act of destruction of electronic files.

The main thing is that when destroying any type of documents, you need to make sure that there are no saved copies, that the confidentiality of information is maintained, and that documents necessary for any lengthy court cases are not destroyed.

The commission itself determines the timing of destruction; this is the time during which the entire disposal procedure will take place.

When to destroy documents

Documents that have expired or have lost their practical value are destroyed. To complete this process, an act of the correct form must be drawn up, on the basis of which important papers are destroyed. Before its formation, an examination is required to determine the value of specific documentation.

To correctly determine the storage period, which makes it possible to determine whether it is possible to destroy various acts, it is necessary to use a special nomenclature of files for each company. Often there is a need to clarify deadlines for various departmental documents or standard acts.

Important! Each organization has the ability to increase the storage period, but cannot reduce it.

When studying this period, it is taken into account in what field of activity the organization operates, as well as what nuances are indicated in various regulations, which include various Federal Laws, articles of the Tax Code or regulations issued by the Government.

How official documents are stored and disposed of

To determine the rules on the basis of which documents are stored, one should take into account the provisions of a special List issued by the State Archive back in 2006.

This document specifies which papers and acts must be retained for a short period of time, usually represented by one year, three or five years, and which must be retained for 10, 50 or 75 years. Some documents cannot be destroyed at all.

It does not matter in which archive the acts will be located, so each company has the opportunity to create even its own archive.

Only after it is determined that specific papers can already be destroyed, their recycling begins. To do this, they can be torn or crossed out, and then thrown away.

It is allowed to use special technical devices to tear them, after which they cannot be restored.

Sample of filling out the act of write-off and destruction of documents.

What documents are never written off?

There are certain acts that cannot be destroyed. They are certainly stored permanently, so there are no deadlines for their maintenance. Such significant securities include:

- annual reports related to the payment of taxes or accounting;

- balance sheets prepared at the end of the year;

- accounting reports for the year.

Important! Acts confirming the payment of taxes, as well as the correctness of the calculation of these fees, are constantly preserved.

It is the commission that must determine which papers should be permanently stored at the enterprise. All of them are included in a special list, after which this list is signed by the head of the company. Next, the documentation is submitted to the archive, which can be its own or state.

What to do if the document is lost

There are times when for some reason a document may be lost or lost.

This may occur in the following force majeure situations:

- Fire;

- An earthquake, with the complete destruction of the building where the archive is stored;

- Flood;

- Robbery.

In this case, the documents should be restored to the extent possible, although such a procedure is difficult and in some cases impossible.

In the event of natural disasters and damage to document flow information media, it is necessary to record this precedent in writing. Such written registration will extend the time for information recovery.

If damage or loss occurred due to the fault of an employee, then what to do in this situation? The culprit must be given a written explanation of the fact and reason for the loss, with the help of which the boss will decide what measures to take against the employee.

Such measures are regulated by Art. 193 Labor Code. A penalty or other disciplinary measure against the perpetrator is formalized by personnel orders, followed by dismissal.

Fines for document destruction

If damage or loss of a document occurs due to the fault of an employee, then he can be held liable for the destruction of:

- Administrative liability - may arise in the event of loss or violation of the rules for storing documents, or during disposal ahead of schedule, which can distort financial indicators during inspections. A fine in the amount of 2 - 3 thousand rubles is issued to the official.

- Tax - imposed on each document not provided during the inspection, up to 200 rubles, up to 10 thousand rubles. for lost or destroyed documents for any tax period, up to 30 thousand rubles. when damaged over several periods.

- Criminal - if an audit reveals that due to the loss of documents, taxes were not paid, then the fine increases from 100 thousand rubles. up to 300 thousand rubles. The official responsible for the destruction of documents that led to the robbery of the state may have their wages garnished for 1-2 years. Or he may be arrested for 2 years with removal from his position. If taxes were not paid on a particularly large scale, then penalties will range from 200 thousand rubles. up to 500 thousand rubles, wage arrest from 1 to 3 years, or arrest for 5 years with suspension for 3 years.

The manager is obliged to ensure that the lost documentation is restored. Because if this rule is not followed, the company will be punished.

Conclusion

All responsibility for document management falls on the shoulders of the chief accountant. It is he who must monitor his subordinates when preparing and maintaining accounting records in structural units or certain groups.

Having ascertained the correctness of the document, the chief accountant stitches the files together and transfers them for storage to the organization’s archive, indicating the storage period for the file. After the expiration of this period, a special commission is created that determines the documents for destruction.

This procedure must be in effect in every company, otherwise any omissions may negatively affect the financial resources of officials or the organization itself.