If a company has chosen “income minus expenses” as an object of taxation, then it needs to correctly determine the expenses that can be taken into account when calculating the single tax. A complete closed list of expenses is given in Article 346.16 of the Tax Code of the Russian Federation. Since the list of “allowed” expenses is closed, any deviation from it is regarded by tax authorities as a violation. Often the grounds for claims are entertainment expenses, expenses for information, consulting and marketing services, etc.

The Ministry of Finance of Russia, in letter No. 03-11-11/36060 dated May 20, 2019, explained the procedure for accounting for certain types of expenses when applying the simplified taxation system.

note

When calculating a single tax, only paid expenses must be classified as expenses (that is, after they are actually paid). In addition, costs must be economically justified, that is, related to the generation of income, and documented.

Rates of simplified tax system

The rates of the simplified tax system are determined by the provisions of Art. 346.20 Tax Code of the Russian Federation.

1. The amounts of general tax rates under the simplified tax system for each of the taxable objects (clauses 1, 2 of Article 346.20 of the Tax Code of the Russian Federation) are given in the table.

| Object of taxation | Total tax rate, percentage |

| "Income" | 6 |

| "Income minus expenses" | 15 |

2. The opportunity for all subjects of the Russian Federation to establish by relevant laws:

- for the “Income” object, rates can be reduced in the range from 1 to 6 percent;

- the size of differentiated tax rates ranging from 5 to 15 percent in relation to the object of taxation “Income minus expenses”, depending on the category of taxpayers (clause 2 of Article 346.20 of the Tax Code of the Russian Federation);

- tax rate of 0 percent for individual entrepreneurs registered for the first time after the entry into force of the relevant laws of the constituent entities of the Russian Federation and carrying out entrepreneurial activities in the production, social and (or) scientific sphere (clause 4 of Article 346.20 of the Tax Code of the Russian Federation);

- for taxpayers of the Crimean Peninsula and the city of Sevastopol who apply the simplified tax system with the object “Income minus expenses”, the rate can be reduced to 3 percent (clause 3 of article 346.20 of the Tax Code of the Russian Federation).

From 01/01/2021, increased tax rates are introduced for a number of cases:

- 8 percent - for the object of taxation “income”;

- 20 percent - for the object “income minus expenses”.

They are used when (clauses 1.1, 2.1 of Article 346.20 of the Tax Code of the Russian Federation):

- income in the reporting (tax) period, determined by the cumulative total from the beginning of the tax period, amounted to more than 150 million rubles, but did not exceed 200 million rubles;

- the average number for the reporting (tax) period exceeded 100 people, but not more than 30 employees.

The increased rate applies to the portion of the tax base that falls on the period from the beginning of the quarter in which the excesses occurred. The calculation of the simplified tax system using the increased rate has its own peculiarities.

From 01/01/2021, in a number of cases, when calculating tax or advance payment, it will be necessary to sum up the following values (clauses 1, 3, 4 of Article 346.21 of the Tax Code of the Russian Federation):

- the product of the regular rate and the tax base (according to the applicable simplified tax system object) for the reporting period preceding the quarter in which the excess occurred;

- the product of the increased rate and the difference between the tax base (according to the applied object of the simplified tax system) for the reporting (tax) period and the tax base for the reporting period preceding the quarter in which the excess occurred.

If the excess is allowed in the first quarter, then the increased rate is established for the entire tax period. Otherwise, the calculation procedure will not change.

Form for filling out a declaration under the simplified tax system for organizations and individual entrepreneurs

The declaration under the simplified tax system is submitted only at the end of the year. There are no quarterly reports.

The form, procedure for filling out, as well as the format for submitting a tax return in electronic form for taxes paid under the simplified tax system are approved by Order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3/ [email protected]

The form makes it possible to reflect in the declaration the amount of the trade tax, which reduces the amount of calculated tax under the simplified tax system, as well as the amount of tax calculated using a 0 percent rate in accordance with clause 4 of Art. 346.20 Tax Code of the Russian Federation.

To check the correctness of filling out the declaration under the simplified tax system, you can use the control ratios of the tax return indicators for the tax paid in connection with the application of the simplified tax system (sent by letter of the Federal Tax Service of the Russian Federation dated May 30, 2016 No. SD-4-3 / [email protected] ).

Transition to simplified tax system

The transition from the taxation system used by the enterprise to the simplified taxation system is formalized by a notification from the Federal Tax Service. A person submits an application to change the taxation regime according to the simplified tax system, form No. 26.2-1, which is also used by newly registered enterprises or individual entrepreneurs. The document must be submitted no later than December 31 of the year preceding the transition (Article 346.13 of the Tax Code of the Russian Federation).

Procedure for filling out the notification:

- the document contains a taxpayer attribute code that allows you to isolate the transition to the simplified tax system from UTII (code “2”) or another type of taxation (code “3”).

- The form contains data on the income received by the organization or individual entrepreneur and the residual value of fixed assets. Data is indicated as of October 1 of the current year.

- the taxpayer indicates the start date of maintaining the simplified tax system. The application of the simplified taxation system begins from the beginning of the calendar year, except for persons applying UTII.

- the form contains information about the selected object of taxation under the simplified tax system.

For persons who use only UTII in accounting and have ceased to use the type of taxation, the transition to the simplified tax system is made from the beginning of the month of the current year in which activities on imputed income were stopped. A special feature of the transition from UTII is that there is no need to indicate the income received. Taxpayers using UTII do not keep track of revenue for imputed income. If, simultaneously with UTII, an organization or individual entrepreneur used OSNO, the revenue received by the enterprise is indicated in the notification.

The procedure for filling out a declaration under the simplified tax system “Income minus expenses” for 2020

What is required to be filled in:

- title page;

- section 2.2;

- section 1.2.

Section 3 must only be completed by non-profit organizations. The remaining sections are for the simplified tax system “Income”.

Section 2.2 is completed first. Lines 210-223 reflect income and expenses from the income and expenses ledger. And in lines 240-243 - the difference between them, that is, the tax base. If in some periods income is less than expenses, the tax base is not shown and dashes are added. Losses are reflected in lines 250-253.

Line 230 is filled in only if losses from previous years are carried forward.

In lines 270-280, advance payments and tax are calculated according to the formulas specified in the declaration.

Then section 1.2 is completed. Only 5 lines are filled in. OKTMO is placed in line 010 - you can find it on the website of the Federal Tax Service of the Russian Federation (https://www.nalog.ru/rn77/service/oktmo/).

Lines 020, 040, 070 show advance payments paid for the first quarter, half a year and 9 months. If at the end of half a year or 9 months there was an amount to be reduced, instead of lines 040 or 070, lines 050 or 080 are filled in.

Then one of three lines is filled in: 100, 110 or 120. If at the end of the year it is necessary to pay additional tax, its amount is indicated in line 100, if the minimum - in line 120. Line 110 is filled in if the calculated tax for the year is normal (line 273 section 2.2) or minimum (line 280 of section 2.2) - turned out to be less than advance payments. It indicates the difference between the tax and advance payments, which can be returned or offset.

Example. Filling out a declaration under the simplified tax system with the object “Income minus expenses” for 2021

| Period | Cumulative income, rub. | Cumulative expenses, rub. | Tax base, rub. (gr. 2 - gr. 3) | Calculated advance payments and tax for the year, rub. (gr. 4 x 15 percent) |

| 1 | 2 | 3 | 4 | 5 |

| I quarter | 870 000 | 350 000 | 520 000 | 78 000 |

| Half year | 1 305 000 | 700 000 | 605 000 | 90 750 |

| 9 months | 1 400 000 | 703 000 | 697 000 | 104 550 |

| Year | 1 800 000 | 870 000 | 930 000 | 139 500 |

In 2021, the organization’s address did not change, and the tax base for losses from previous years did not decrease.

The minimum tax for 2021 is 18,000 rubles (1,800,000 rubles x 1 percent).

The amount of tax for the year is greater than the amount of the minimum tax (139,500 rubles more than 18,000 rubles), which means that the tax calculated in the general manner must be paid to the budget.

Advance payments and taxes for 2021 are as follows.

For the first quarter - 78,000 rubles.

For the six months - 12,750 rubles (90,750 rubles - 78,000 rubles).

For 9 months - 13,800 rubles (104,550 rubles - 90,750 rubles).

For the year - 34,950 rubles (139,500 rubles - 104,550 rubles).

In the details of the title page “Tax period” you must indicate code “34”.

Sections 1.2 and 2.2 of the declaration are filled out as follows:

The procedure for filling out a declaration under the simplified tax system “Income” for 2021

With the taxable object “Income” you need to fill out:

- title page;

- section 2.1.1;

- section 1.1.

Section 3 is for non-profit organizations, and section 2.1.2 is for trade tax payers.

The remaining sections are needed for the simplified tax system “Income minus expenses”.

In section 2.1.1 on line 102 the sign “1” is added.

Lines 110–113 indicate income for the first quarter, half year, 9 months and year on an accrual basis from the beginning of the year, and lines 130–133 indicate advance payments and tax calculated from them for the year.

Lines 140–143 reflect the amounts of contributions and benefits that reduce tax.

In section 1.1, only 5 lines are filled in. OKTMO is placed in line 010 - you can find it on the website of the Federal Tax Service of the Russian Federation (https://www.nalog.ru/rn77/service/oktmo/).

Lines 020, 040, 070 indicate advance payments payable for the first quarter, half a year and 9 months. Line 100 shows the tax payable for the year.

If the simplified tax system is used with the object of taxation “Income”, you must pay a “simplified” tax on the entire amount of income (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). In this case, the expenses incurred are not taken into account when calculating the tax base, and the taxpayer is not required to confirm them with documents (letters of the Ministry of Finance of the Russian Federation dated June 16, 2010 No. 03-11-11/169, dated October 20, 2009 No. 03-11-09/353).

An organization or individual entrepreneur has the right to reduce the amount of the calculated “simplified” tax (advance payments) by the costs of payment (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation):

- insurance contributions for compulsory pension insurance;

- insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

- insurance premiums for compulsory health insurance;

- insurance contributions for compulsory social insurance against accidents at work and occupational diseases;

- temporary disability benefits.

Example. Filling out a declaration under the simplified tax system with the object “Income” for 2021

| Period | Cumulative income, rub. | Calculated advance payments and tax for the year, rub. (gr. 2 x 6 percent) | The amount of paid contributions and benefits by which advance payments and tax for the year can be reduced, rub. Tax deduction (NV) (gr. 4 < gr. 3 x 50 percent) |

| 1 | 2 | 3 | 4 |

| I quarter | 870 000 | 52 200 | 26 100 |

| Half year | 1 305 000 | 78 300 | 39 150 |

| 9 months | 1 400 000 | 84 000 | 42 000 |

| Year | 1 800 000 | 108 000 | 54 000 |

In 2021, the organization's address did not change and no trading fee was paid.

To determine the advance payment payable at the end of the reporting period, there is a formula:

AP = APrasch - NV - APisch,

where APrasch is an advance payment attributable to the tax base determined from the beginning of the year to the end of the reporting period for which the calculation is made;

NV - tax deduction in the amount of contributions paid for compulsory social insurance and temporary disability benefits paid to employees;

APisch - the amount of advance payments calculated (to be paid) based on the results of previous reporting periods (in the current tax period).

Thus, advance payments and tax payable for 2021 will be as follows:

For the first quarter - 26,100 rubles (52,200 rubles - 26,100 rubles).

For the six months - 13,050 rubles (78,300 rubles - 39,150 rubles - 26,100 rubles).

For 9 months - 2,850 rubles (84,000 rubles - 42,000 rubles - 26,100 rubles - 13,050 rubles).

For the year - 12,000 rubles (108,000 rubles - 54,000 rubles - 26,100 rubles - 13,050 rubles - 2,850 rubles).

Code “34” is entered on the title page in the “Tax period” detail.

Sections 1.1 and 2.1.1 of the simplified taxation system declaration are filled out as follows:

The procedure for filling out a declaration under the simplified tax system for individual entrepreneurs for 2021

An individual entrepreneur pays (letters from the Ministry of Finance of the Russian Federation dated November 16, 2017 No. 03-15-05/75662, dated September 4, 2017 No. 03-15-05/56580):

- a fixed payment for yourself, which does not depend on the amount of income;

- additional contribution for yourself on income over 300,000 rubles per year;

- contributions for employees.

Fixed payment for 2021 - 40,874 rubles. It includes a contribution to compulsory medical insurance - 32,448 rubles and a contribution to compulsory medical insurance - 8,426 rubles (clause 1 of Article 430 of the Tax Code of the Russian Federation).

Due to the pandemic, in 2021, a reduced fixed payment was introduced for individual entrepreneurs, whose main type of activity according to the Unified State Register of Individual Entrepreneurs is on the List of affected industries, approved by Decree of the Government of the Russian Federation of April 3, 2020 No. 434. The amount of the reduced fixed payment is 28,744 rubles. It includes a contribution to compulsory pension insurance - 20,318 rubles. and compulsory medical insurance contribution - 8,426 rubles. (Clause 1.1 of Article 430 of the Tax Code of the Russian Federation).

The deadline for payment of the fixed payment for 2021 is no later than December 31, 2020. It can be paid in installments throughout the year or in a lump sum. Contributions for compulsory pension and health insurance must be transferred to the budget in two separate payments. The simplified tax system “Income minus expenses” does not separately reduce the tax on contributions. All contributions paid both for yourself and for the employee are included in expenses (clause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation). If the individual entrepreneur has selected the object “Income minus expenses”, then fill in:

- title page;

- section 1.2;

- section 2.2.

The rules for filling them out are the same as for organizations.

If the entrepreneur has selected the “Income” object, then fill in:

- title page;

- section 1.1;

- section 2.1.1.

An individual entrepreneur using the simplified tax system “Income”, who has employees, reduces the tax on contributions both for himself and for his employees (letter of the Ministry of Finance of the Russian Federation dated February 10, 2017 No. 03-11-11/7567). But the total amount of the reduction cannot be more than 50 percent of the calculated tax (clause 3, clause 3.1, article 346.21 of the Tax Code of the Russian Federation). The tax is reduced in the same order as for organizations.

Individual entrepreneurs on the simplified tax system “Income” without employees reduce the tax on contributions for themselves paid since the beginning of the year. For what period they were accrued does not matter (letters of the Ministry of Finance of the Russian Federation dated 03/01/2017 No. 03-11-11/11487, dated 01/27/2017 No. 03-11-11/4232). For example, in January 2021, an individual entrepreneur paid a fixed payment for 2021. The tax for 2020 cannot be reduced on it, but the advance payment for the first quarter of 2021 can be reduced. Tax can be reduced by the entire amount of contributions. If contributions are greater than the tax, the tax is considered zero.

Therefore, the filling rules are slightly different if the individual entrepreneur does not have employees:

- in line 102 of section. 2.1.1 you must specify code 2;

- and in lines 140–143 - insurance premiums for yourself, for which the tax is reduced.

Example. Filling out a declaration under the simplified tax system “Income” for individual entrepreneurs without employees.

In 2021, the income of individual entrepreneurs amounted to 150,000 rubles for each quarter. In March 2021, he paid an additional contribution to compulsory pension insurance for 2021 - 1,800 rubles, in December 2020 - a fixed payment of 40,874 rubles.

I quarter

Advance payment - 9,000 rubles (150,000 rubles x 6 percent) is reduced by an additional contribution to the compulsory pension insurance. Advance payment payable - 7,200 rubles (9,000 rubles - 1,800 rubles).

Half year

Advance payment - 18,000 rubles (150,000 rubles + 150,000 rubles) x 6 percent) reduced by an additional contribution to compulsory pension insurance and the advance payment for the previous period. Advance payment payable - 9,000 rubles (18,000 rubles - 1,800 rubles - 7,200 rubles)

9 months

Advance payment - 27,000 rubles (150,000 rubles + 150,000 rubles + 150,000 rubles) x 6 percent) reduced by an additional contribution to compulsory pension insurance and advance payments for previous periods. Advance payment payable - 9,000 rubles (27,000 rubles - 1,800 rubles - 7,200 rubles - 9,000 rubles).

Year

The tax calculated at the end of the year is 36,000 rubles (150,000 rubles + 150,000 rubles + 150,000 rubles + 150,000 rubles) x 6 percent) is reduced by an additional contribution to compulsory pension insurance - 1,800 rubles, a fixed payment - 40,874 rubles and advance payments for previous periods - 25,200 rubles (7,200 rubles + 9,000 rubles + 9,000 rubles). The calculated tax amount for the year is 36,000 rubles less than the amount to be reduced - 67,874 rubles (1,800 rubles + 40,874 rubles + 25,200 rubles), so there is no need to pay tax.

When simplified tax system 15% is more profitable than simplified tax system 6%

Beginning entrepreneurs often mistakenly judge the profitability of these tax regimes by the interest rate, believing that the lower it is, the lower the tax amount will be. To assess the real profitability of a particular taxation system, it is worth taking into account the amount of expenses that will be accepted for deduction by the tax authority.

Practice shows that 15% (“Income minus expenses”) is more profitable for those whose expenses amount to 60% or more of income. This indicator can be approximately calculated, even if the activity is just beginning.

Also, the tax can be reduced by the amount of insurance premiums paid to the Pension Fund and the Compulsory Medical Insurance Fund for employees of an LLC or individual entrepreneur. Individual entrepreneurs can reduce the tax base through fixed insurance payments for themselves. Contributions are included in expenses, thereby reducing the tax base. Taking this into account, the simplified tax system of 15% will definitely be more profitable than the simplified tax system of 6%, given the level of expenses.

Minimum tax under the simplified tax system

For taxpayers who have chosen the object of taxation “Income minus expenses”, the legislator introduced such a concept as a minimum tax (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

The minimum tax is a mandatory minimum amount of a “simplified” tax. Only individual entrepreneurs who are allowed to apply a 0 percent rate on the basis of clause 4 of Art. 346.20 of the Tax Code of the Russian Federation (paragraph 2 of this paragraph).

The minimum tax rate is determined in paragraph. 2 clause 6 art. 346.18 of the Tax Code of the Russian Federation and amounts to 1 percent of income for the tax period. It is unchanged and is applied in the specified amount, even if the law of a constituent entity of the Russian Federation establishes a reduced differentiated rate in accordance with clause 2 of Art. 346.20 of the Tax Code of the Russian Federation (see also letter of the Ministry of Finance of the Russian Federation dated May 28, 2012 No. 03-11-06/2/71).

A taxpayer is required to pay the minimum tax if the amount of tax calculated by him for the tax period in accordance with the general procedure is less than the minimum tax. This rule is established in paragraph. 3 paragraph 6 art. 346.18 Tax Code of the Russian Federation.

The minimum tax must be paid even when a loss is received at the end of the year and the amount of tax calculated in the general manner is zero (see, for example, letters of the Ministry of Finance of the Russian Federation dated June 20, 2011 No. 03-11-11/157, dated April 1, 2009 No. 03-11-09/121, Federal Tax Service of the Russian Federation dated July 14, 2010 No. ShS-37-3/ [email protected] , Federal Tax Service of Moscow dated December 9, 2010 No. 16-15/ [email protected] , resolutions of the Federal Antimonopoly Service of the West Siberian District dated May 20, 2008 No. F04-3006/2008 (5051-A45-27), FAS Central District dated January 22, 2007 No. A08-2668/06-9).

The difference between the minimum tax paid and the amount of tax calculated in the general manner can be included in expenses in subsequent tax periods. In particular, by this amount you can increase the amount of losses that are carried forward to the future in accordance with clause 7 of Art. 346.18 Tax Code of the Russian Federation. This is stated in paragraph. 4 paragraph 6 art. 346.18 of the Tax Code of the Russian Federation (see also letters of the Ministry of Finance of the Russian Federation dated June 20, 2011 No. 03-11-11/157, dated May 11, 2011 No. 03-11-11/118, dated October 8, 2009 No. 03-11-09/342, dated 08/17/2009 No. 03-11-09/283, dated 04/01/2009 No. 03-11-09/121, Federal Tax Service of the Russian Federation dated 07/14/2010 No. ШС-37-3/ [email protected] ).

For example: the amount of the minimum tax at the end of 2021 was 5,000 rubles, and the amount of tax calculated in the general manner is 4,500 rubles. The difference in the amount of 500 rubles (5,000 rubles - 4,500 rubles) can be attributed to expenses in 2021 (and if a loss occurs, reflected in losses). The specified difference can be included in expenses (or the amount of loss can be increased by it) in any of the subsequent tax periods.

This conclusion follows from paragraph. 4 paragraph 6 art. 346.18 Tax Code of the Russian Federation. The Ministry of Finance of the Russian Federation also agrees with him.

At the same time, the department emphasizes that the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner for several previous periods can be included in expenses at a time (letter of the Ministry of Finance of the Russian Federation dated January 18, 2013 No. 03-11-06/2/03, dated 09/07/2010 No. 03-11-06/3/125).

For example, when calculating the single tax based on the results of 2012 and 2013, the organization formed a positive difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner. An organization has the right to include it in expenses when calculating tax based on the results of 2014 or 2015 or another tax period following it.

The amount of the minimum tax is calculated for the tax period - a calendar year. This follows from paragraph. 2 clause 6 art. 346.18 Tax Code of the Russian Federation. Therefore, there is no need to calculate and pay the minimum tax based on the results of the first quarter, half a year, or 9 months.

The minimum tax is calculated as follows:

MN = NB x 1 percent,

where NB is the tax base, calculated on an accrual basis from the beginning of the year to the end of the tax period. The tax base for the purpose of calculating the minimum tax is income determined in accordance with Art. 346.15 Tax Code of the Russian Federation. In the case of combining the simplified tax system with another tax regime, for example, with the patent taxation system, the amount of the minimum tax is calculated only from income received from “simplified” activities (letter of the Ministry of Finance of the Russian Federation dated February 13, 2013 No. 03-11-09/3758 (sent by letter to the Federal Tax Service RF dated 03/06/2013 No. ED-4-3/ [email protected] )).

The minimum tax is paid in the same manner as the “simplified” tax.

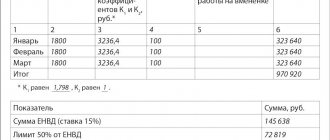

An example of calculating the minimum tax.

The organization "Winter", which applies the simplified tax system (taxation object "Income minus expenses"), during the tax period received income in the amount of 100,000 rubles, and its expenses amounted to 95,000 rubles. That is, the tax base for the tax is equal to 5,000 rubles (100,000 rubles - 95,000 rubles).

1. The amount of tax, based on income received during the tax period and expenses incurred, will be 750 rubles (5,000 rubles x 15 percent).

2. The amount of the minimum tax: income received during the tax period (without reducing it for expenses) is multiplied by 1 percent. The minimum tax amount will be 1,000 rubles (100,000 rubles x 1 percent).

3. We compare the amount of tax calculated in the general manner and the amount of the minimum tax (750 rubles less than 1,000 rubles).

4. We pay a minimum tax of 1,000 rubles to the budget, since its amount exceeded the amount of tax calculated in the general manner.

How to take into account advance payments towards payment of the minimum tax?

Organizations or individual entrepreneurs using the simplified tax system with the object “Income minus expenses”, based on the results of each reporting period, calculate the amount of the advance payment according to the rules of clause 4 of Art. 346.21 Tax Code of the Russian Federation. At the same time, previously calculated amounts of advance tax payments under the simplified tax system are counted when calculating the amount of tax for the tax period (clause 5 of Article 346.21 of the Tax Code of the Russian Federation).

If for a tax period the amount of tax calculated in the general manner is less than the calculated minimum tax, then the “simplified” person with the tax object “Income minus expenses” pays the minimum tax (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

The provisions of Ch. 26.2 of the Tax Code of the Russian Federation does not directly provide for the right of a taxpayer to count against the payment of the minimum tax the advance payments he has made for tax under the simplified tax system. However, this right follows from the declaration form under the simplified tax system, which was approved by Order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3 / [email protected] , since section 1.2 provides for line 120, which indicates the amount of the minimum tax payable for the tax period . At the same time, clause 5.10 of the Procedure for filling out this declaration, approved by Order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3/ [email protected] , stipulates that if the amount of calculated tax for a tax period is less than the amount of calculated minimum tax for a given period, then the amount of the minimum tax payable for the tax period is indicated minus the amount of calculated advance tax payments.

Zero declaration according to the simplified tax system

If for some reason taxpayers temporarily suspend their business activities and do not receive income, they do not need to assess and pay tax.

But a declaration must be submitted. The fact is that the obligation to submit a declaration does not depend on the results of business activities. This conclusion was confirmed by the Constitutional Court of the Russian Federation in Ruling No. 499-О-О dated June 17, 2008.

In this regard, the question arises: which declaration should be submitted - a single (simplified) or a zero one?

This depends on the movement of funds through bank accounts (at the cash desk).

If money has passed through bank accounts (at the cash desk), you need to file a regular tax return under the simplified tax system.

If there are no income and expenses, a declaration with zero indicators (zero declaration) is submitted.

Transition from OSNO to simplified taxation system (USN) VAT recovery

When an individual entrepreneur switches from OSNO to the simplified tax system, he will need to pay VAT, which the entrepreneur took into account in the deduction for the balance of goods, materials, and fixed assets not used in activities on the date on which the transition is made. The simplicity of identifying VAT payable by individual entrepreneurs lies in the fact that unused balances are allocated and reflected in the reporting under OSNO.

Before making the transition to the simplified tax system, an individual entrepreneur must reform the data to identify VAT payable to the budget:

- conduct an inventory and determine the amount of inventory balances, including VAT amounts received from suppliers and not used in activities.

- identify VAT on balances previously accepted for deduction when maintaining OSNO. The amount of VAT to be paid to the budget is determined.

- conduct an inventory of fixed assets to identify individual entrepreneurs’ property, fully depreciated and registered, underdepreciated, for which a VAT deduction was taken into account.

- calculate the amount of VAT related to the balance of fixed assets for payment to the budget.

- include the received VAT amounts in the declaration submitted based on the results of the 4th quarter of the year preceding the transition from OSNO.

- pay VAT to the budget. Late payment entails the imposition of penalties on the control authorities.

The most difficult is the transition from OSNO to the simplified tax system and VAT restoration in cases where an individual entrepreneur uses more than one type of taxation. Special conditions for VAT recovery apply when combining regimes before the transition to the simplified tax system. A simplified taxation system for individual entrepreneurs allows you to save UTII when switching from OSNO to simplified tax system.

If, simultaneously with OSNO, UTII was used, taking into account input VAT in the cost of goods, then when switching to the simplified tax system, part of the goods related to UTII is transferred to a new period. There is no need to restore VAT on goods for subsequent sale under UTII.

Similar services on the topic

- Registration of a patent for an invention

- Taxation of individual entrepreneurs

- Conducting business intelligence

- Registration with Rosfinmonitoring

- Registration with the Assay Office

- Trademark registration

- Obtaining a duplicate TIN and OGRN

- Extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs

- Making stamps

- Opening a current account

- Obtaining OKVED codes

- Inclusion in the register of microfinance organizations

Unified (simplified) declaration under the simplified tax system

Taxpayers have the right to submit a single (simplified) declaration subject to the following conditions (paragraphs 2–4, paragraph 2, article 80 of the Tax Code of the Russian Federation):

- there is no movement of funds in their bank accounts and cash registers;

- they do not have objects of taxation for one or more taxes.

This situation may arise if business activities are temporarily suspended, there is no income, and expenses are not incurred.

The form of the simplified declaration and the procedure for filling it out were approved by Order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n. True, this reporting is inconvenient and is rarely used in practice.

What to pay attention to:

- It is necessary to carefully monitor that there are no cash transactions on bank accounts. Tracking this is quite labor-intensive, especially those payments that the bank can write off automatically (for example, its commission for cash transactions). However, in this case, you cannot submit a single (simplified) declaration. If, not knowing about the expense transaction, you submit a simplified declaration instead of a regular one, then the tax authorities may fine you under Art. 119 of the Tax Code of the Russian Federation.

- according to paragraph 2 of Art. 80 of the Tax Code of the Russian Federation, a single (simplified) declaration is submitted quarterly: no later than the 20th day of the month following the expired quarter, half-year, 9 months, calendar year.

At the same time, the Ministry of Finance of the Russian Federation expressed the opinion that it is possible to submit a single (simplified) declaration only at the end of the tax period, since Ch. 26.2 of the Tax Code of the Russian Federation does not provide for the obligation to file tax returns based on the results of reporting periods (letter dated 05/05/2017 No. 03-02-08/27798). This approach, in our opinion, may lead to claims from the tax authorities. Therefore, for clarification on the question of whether it is possible not to submit a single (simplified) declaration based on the results of the reporting periods, we recommend contacting your tax authority. Note that a regular declaration under the simplified tax system is submitted only once a year (Article 346.23 of the Tax Code of the Russian Federation).

- It makes sense to submit a single (simplified) declaration if it replaces reporting on several taxes at once. But with the simplified tax system, it is unlikely to be possible to take advantage of such an advantage, since instead of the main taxes (income tax, personal income tax, VAT, property tax), organizations and entrepreneurs pay one “simplified” tax.

Therefore, if business activity is temporarily not carried out and there is no income, then it is advisable to submit a regular zero declaration according to the simplified tax system to the tax authorities.

Simplified taxation system for LLCs

An enterprise registered in the form of an LLC has the opportunity to apply a simplified form of taxation when fulfilling the restrictive conditions relating to the general provisions and the LLC. Foreign organizations and microfinance organizations, budget institutions of all levels do not have the right to use the simplified tax system in accounting. A simplified taxation system is used for LLCs by organizations that do not have branches or representative offices. When using the simplified tax system by an organization in the form of an LLC, its share of participation in the authorized capital of legal entities should be no more than ¼ of the total cost.

A simplified taxation system for LLCs is used, mainly for small businesses. The use of the simplified tax system allows you to replace the payment of VAT, income and property taxes to an LLC.

There are exceptions in which the taxpayer deducts VAT using the simplified tax system. VAT must be paid if:

- LLC purchases goods from non-resident sellers with their subsequent sale in Russia.

- The LLC issues an invoice to another LLC or individual entrepreneur with allocated VAT at the request of the buyer. VAT paid to the budget is not included in income subject to a single tax under the simplified tax system and in expenses taken into account when calculating the tax base of the simplified tax system.

- The LLC conducts the affairs of the organization on the basis of a division under a simple partnership agreement.

- acts as a tax agent - carries out transactions for the purchase or registration of lease of municipal or federal state property.

- carry out transactions under agency agreements and trust management of property. In case of transactions for the sale of goods or their acquisition on one’s own behalf, the invoice is issued without payment.

The simplified taxation system for LLCs allows such operations to be carried out, subject to compliance with the document flow. Unlike enterprises with other types of taxation, LLCs using the simplified tax system must keep logs of invoices in the event of issuing documents.

When conducting LLC operations using the simplified tax system, it is necessary to issue an invoice with VAT allocated, register it in the journal, submit a VAT return and pay the VAT amount to the budget. There is no VAT deduction. Simplified residents who pay VAT are deprived of the right to reduce the VAT tax base by deducting input VAT amounts. A peculiarity of VAT taxation for persons using the simplified tax system is that there is no need to submit electronic forms of accounting books.

The Federal Tax Service does not accept deductions for invoices issued by simplified companies in the form of an LLC or individual entrepreneur. According to the tax inspectorate, the simplified taxation system for LLCs is not a VAT payer, which does not allow the buyer to take advantage of the deduction. The issue is being contested in court and has positive precedents.

A distinctive feature of the simplified tax system for individual entrepreneurs from the simplified tax system for individual entrepreneurs is the need to maintain accounting records. In connection with the maintenance of transactions in the ledger of income and expenses (KUDiR) under the simplified tax system, the organization has the right to simplified accounting. For small or micro-enterprises that apply the simplified taxation system for LLCs, annual financial statements are submitted in a minimum number of balance sheet forms. In accounting for the simplified tax system for individual entrepreneurs, there is no need to maintain accounting records.

Features of the design of the KUDiR accounting book:

- The journal is kept in chronological order.

- The simplified tax system accounting book, generated in electronic form, is printed, numbered and stitched at the end of the reporting or tax periods.

- from the beginning of the tax period of the simplified tax system, a new accounting book is opened.

- KUDiR submission to the Federal Tax Service is not carried out simultaneously with reporting.

- The book totals are generated by reporting periods to obtain data on the amount of advance payments.

Maintaining KUDiR in accounting under the simplified tax system in the accounting of LLCs and individual entrepreneurs is of great importance. The book is a tax register for obtaining indicators of the taxable base for the calculation and subsequent payment of the single tax paid when maintaining the simplified tax system.

Deadlines for submitting a declaration under the simplified tax system for organizations and individual entrepreneurs

The deadline for submitting the declaration is established by Art. 346.23 Tax Code of the Russian Federation.

Let's take a closer look at them.

Table “Deadlines for submitting simplified taxation system declaration”

| Organizations | IP |

| No later than 03/31/2021 (clause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation) | No later than 04/30/2021 (clause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation) |

| Upon termination of activities subject to the simplified tax system: no later than the 25th day of the month following the month in which such activity ceased (clause 2 of Article 346.23 of the Tax Code of the Russian Federation) | |

| If you lose the right to use the simplified tax system before the end of the tax period: no later than the 25th day of the month following the quarter in which this right was lost by them (clause 3 of Article 346.23 of the Tax Code of the Russian Federation) | |

If the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, then the declaration must be submitted no later than the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). This rule also applies when the deadline for filing a declaration falls on a Saturday, which is a working day for your inspection. In this case, the Monday following the weekend will also be considered the deadline for filing the declaration.

In 2021, due to the coronavirus pandemic, the deadline for submitting declarations under the simplified tax system for both organizations and individual entrepreneurs was extended by three months (clause 3 of the Decree of the Government of the Russian Federation dated April 2, 2020 No. 409).

Application for simplified tax system

The right to use the simplified tax system is granted upon registration of an organization or individual entrepreneur. An organization or individual entrepreneur submits an application to the simplified tax system simultaneously with the constituent documents and within 30 days from the date of registration of the enterprise with the Federal Tax Service indicated in the certificate.

If the application deadline for the simplified tax system is not met, the enterprise will not be able to apply the special taxation system and will automatically switch to the OSNO. The generally established form is assigned to all enterprises after registration in the absence of an application for transition to conduct a special type of taxation.

Features of registration notification:

- the application is submitted on Form No. 26.2-1.

- the document contains the taxable object chosen by the taxpayer.

- For newly registered organizations or individual entrepreneurs, a footnote is provided for the beginning of the application of the simplified tax system from the date of registration.

- compliance of the restrictive parameters of the number and revenue with the required conditions is not subject to verification due to the lack of activity before submitting the notification.

The application is drawn up in manual or typewritten form on a standard form. Empty cells on the form are crossed out. Submission of the notification is made in person or through a representative in the presence of a power of attorney executed in the prescribed manner. Powers of attorney from organizations (for example, LLC) are accepted on the company's letterhead with the signature and seal of the legal entity. Representatives of individual entrepreneurs must present a power of attorney certified by a notary.

The right to use the simplified tax system for an organization or individual entrepreneur arises upon receipt of a notification from the Federal Tax Service; the tax inspectorate does not issue a certificate. An enterprise can receive confirmation of the right to maintain the simplified tax system, for example, to submit data to judicial authorities or partners, upon written request:

- appeal to the tax authorities is made in any form.

- confirmation of the maintenance of the simplified tax system by an organization or individual entrepreneur is made by the Federal Tax Service according to form No. 26.2-7.

- a response to the submitted request will be received by the taxpayer within 30 calendar days.

- a notification letter of form No. 26.2-7 is sent to the organization at its location, individual entrepreneur - to the registration address.

When carrying out a reorganization through the merger of enterprises, an application for the use of the simplified tax system must be submitted to the Federal Tax Service again, regardless of whether the organizations used the simplified taxation system previously. The requirement to submit a notice of application of the simplified tax system is based on the termination of the existence of the reorganized organization. Submission of a notification to a newly created enterprise is carried out within 30 calendar days from the date of entering information into the register.

Deadlines for paying taxes and advance payments under the simplified tax system

Table “Deadlines for payment of taxes and advances under the simplified tax system”

| Organizations | IP |

| Pay tax and advances according to the simplified tax system at their location | They pay tax and advances under the simplified tax system at their place of residence |

| Advance payments: are subject to transfer no later than the 25th day of the first month following the expired reporting period (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). In connection with the coronavirus pandemic, for organizations and individual entrepreneurs included as of 03/01/2020 in the register of SMEs, whose main activity according to the Unified State Register of Legal Entities (USRIP) is in the List of affected industries, approved by Decree of the Government of the Russian Federation of 04/03/2020 No. 434, the deadlines for paying taxes for 2021 and first quarter of 2020. In addition, an automatic installment plan of 12 months is provided. It is valid from the month following the month of the new tax payment deadline. Taxes and contributions are paid at 1/12 of the amount payable no later than the last day of each month of the installment plan (clauses 1, 1(1) of Government Resolution No. 409 dated April 2, 2020). Thus, the new terms of advance payments for the specified category of payers:

Another support measure has been provided - exemption from paying the simplified tax system for the second quarter of 2021 (Article 2 of the Law of October 15, 2020 No. 320-FZ, Article 4.1 of the Law of July 24, 2007 No. 209-FZ). The following are exempt from paying an advance payment under the simplified tax system: — organizations included as of March 10, 2020 in the register of SMEs, whose main type of activity according to the Unified State Register of Legal Entities is in the List of Affected Industries; — Individual entrepreneur with the main type of activity according to the Unified State Register of Individual Entrepreneurs from the List of Affected Industries. In 2021, regional authorities may further extend the deadlines for making certain payments (Clause 4, Article 4 of the Tax Code of the Russian Federation). | |

| simplified tax system: no later than March 31 of the year following the expired tax period (clause 7 of article 346.21, clause 1 of clause 1 of article 346.23 of the Tax Code of the Russian Federation) for 2021 - 03/31/2021 | simplified tax system: no later than April 30 of the year following the expired tax period (clause 7 of article 346.21, clause 2 of clause 1 of article 346.23 of the Tax Code of the Russian Federation) for 2021 - 04/30/2021 |

| When terminating an activity for which the simplified taxation system was applied, taxpayers must pay tax no later than the 25th day of the month following the month in which, according to the notification submitted to the tax authority, such activity ceased (clause 7 of Article 346.21, p. 2 Article 346.23 Tax Code of the Russian Federation) | |

| If they lose the right to use the simplified tax system, taxpayers must pay the tax no later than the 25th day of the month following the quarter in which they lost this right (clause 7 of article 346.21, clause 3 of article 346.23 of the Tax Code of the Russian Federation) | |

If the last day of the deadline for paying the tax (advance payment) falls on a weekend and (or) a non-working holiday, the tax (advance payment) must be transferred no later than on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Late transfer of tax (advance payment) entails the accrual of penalties in accordance with Art. 75 of the Tax Code of the Russian Federation (clause 2 of Article 57, clause 3 of Article 58 of the Tax Code of the Russian Federation).

Simplified taxation system

Among the permitted regimes, the simplified taxation system (STS) is the most common for accounting, primarily for individual entrepreneurs (IP).

The simplified tax system is in demand due to the simplicity of accounting, the ability to select an object of taxation and the combination of accounting with UTII and PSN. The disadvantages of the simplified tax system include the presence of restrictions on permissible types of activities, physical indicators of numbers and fixed assets, and revenue. A controversial indicator is the absence of the need to impose VAT, which reduces the tax burden, but reduces the ability to work with VAT paying companies.

Method of submitting a declaration according to the simplified tax system

Taxpayers have the right to choose how to submit a declaration under the simplified tax system: on paper or in electronic form (clause 3 of article 80 of the Tax Code of the Russian Federation).

Tax returns are required to be submitted exclusively in electronic form (paragraph 2, 4, paragraph 3, article 80 of the Tax Code of the Russian Federation):

- taxpayers whose average number of employees for the previous calendar year exceeds 100 people;

- newly created (including during reorganization) organizations with more than 100 employees;

- largest taxpayers.

When submitting a tax return in electronic form, it must be transmitted via telecommunication channels using an enhanced qualified electronic signature (clause 1 of Article 80 of the Tax Code of the Russian Federation).

Organizations and individual entrepreneurs whose average number of employees for the previous calendar year exceeds 100 people are no longer entitled to apply the simplified tax system (clause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation). “Simplers”, as a rule, do not meet the criteria for classifying taxpayers as the largest, approved by Order of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation dated May 16, 2007 No. MM-3-06/ [email protected]

Therefore, most organizations and individual entrepreneurs under the simplified tax system use the electronic method of filing reports at their own discretion.

The procedure for submitting a tax return in electronic form is determined by the Federal Tax Service of the Russian Federation in agreement with the Ministry of Finance of the Russian Federation (clause 7 of Article 80 of the Tax Code of the Russian Federation). The current procedure was approved by Order of the Ministry of Taxes of the Russian Federation dated April 2, 2002 No. BG-3-32/169 (hereinafter referred to as the Procedure for submitting a declaration in electronic form).

The declaration in electronic form is submitted in accordance with the established format.

When filing your return electronically, please keep the following in mind:

- The day of submission of reports to the tax office is the date of its sending, recorded in the confirmation of the specialized telecom operator (paragraph 3, paragraph 4, article 80 of the Tax Code of the Russian Federation, paragraph 4, section II of the Procedure for submitting a declaration in electronic form, paragraph 2.2 of the Procedure for filling out the declaration) ;

- Having received such a declaration, the tax authority is obliged to provide you with a receipt for acceptance of the declaration within 24 hours (paragraph 2, paragraph 4, article 80 of the Tax Code of the Russian Federation, paragraph 3, section II of the Procedure for submitting a declaration in electronic form);

- if you submitted a declaration in electronic form, you do not need to duplicate it and submit it on paper (clause 6 of section I of the Procedure for submitting a declaration in electronic form).

Place of submission of the declaration under the simplified tax system

Organizations that use the simplified tax system submit a declaration at their location (clause 1 of article 346.23 of the Tax Code of the Russian Federation, clause 1.2 of the Procedure for filling out the declaration). And individual entrepreneurs - “simplified” - at the place of residence, that is, at the registration address (clause 2 of article 11, clause 1 of article 346.23 of the Tax Code of the Russian Federation, clause 1.2 of the Procedure for filling out the declaration). This also applies to the case when they actually conduct business in another place, for example, in another region (letters from the Federal Tax Service in Moscow dated 06/02/2009 No. 20-14/2/ [email protected] , dated 03/05/2009 No. 20-14/2/019619, dated 02/05/2009 No. 20-14/2/ [email protected] ).