Report form 6-NDFL

The report on financial information 6-NDFL is submitted to the federal tax authorities within the established time frame. You can find a sample form and instructions for filling it out on the Unified Portal of State Regulations. The first reporting on this form was submitted for the 1st quarter of 2017. At the same time, no one has abolished the declaration in form 2-NDFL, so it also needs to be submitted to the tax authorities.

All companies, enterprises and individual entrepreneurs that used the services of hired workers during the reporting period must submit 6-NDFL reports to the fiscal service. At the same time, 6-NDFL is filled out not for a specific employee, but for the entire enterprise as a whole, and contains total information about the income people received during the year.

Correlation of two reports

In the 1st quarter of 2021, a column was added to the report - “Income deductions”. It reflects data that ensures the return of part of the income paid to the budget. After filling out a particular form, the accountant must check it and make sure that the figures reflected in it are correct and reliable.

The due dates for each of the two reports are the same. They must be submitted to the tax authorities no later than April 1 of the year following the reporting year. If the due date falls on a weekend, then in accordance with the Labor Code it is postponed to the next working day. Considering that April 1, 2021 falls on a Saturday, the financial report can be submitted on April 3 of the current year.

Control ratios

When preparing tax reporting, not only internal relationships of indicators are checked, but also inter-documentary ones. One of these checks is the ratio of 2 personal income taxes and 6 personal income taxes. The comparison must be made according to the formulas proposed by the Federal Tax Service, this way you can guarantee the accuracy of the check being carried out. If there is a discrepancy between the reflected information between tax reports or a discrepancy between the specified dates for payment of the tax liability, taxpayers face a fine of 500 rubles (Article 126.1 of the Tax Code of the Russian Federation). But, if the discrepancy between 2nd personal income tax and 6th personal income tax was discovered by the tax agent earlier than the inspector, then he can avoid paying a fine by submitting an updated version of the report.

Inter-documentary control ratios will be monitored by fiscal service inspectors. First of all, the annual personal income tax form 6 in Section 1 must reflect the amount of calculated income and applicable tax deductions equal to the amount specified in personal income tax certificate 2 for all employees as a whole. Section 2 must indicate the correct dates for tax remittance; discrepancies between the dates are regarded as the formation of arrears for personal income tax.

Table. Control ratios of indicators 2 personal income tax and 6 personal income tax, verification using developed formulas.

| Ratio | Formula | Note |

| First | Cell 020 6 personal income tax = cells “total amount of income of individuals” for all certificates 2 personal income tax | The total amount of receipts includes income subject to taxation. If an employee was accrued an amount included in the list of Article 217 of the Tax Code of the Russian Federation, but not exceeding the established limit, then he is not included in the personal income tax base. |

| Second | Cell 025 6 personal income tax = code 1010 of all certificates 2 personal income tax | Cell 025 6 personal income tax, 2 personal income tax for 2021 using code 1010 displays the amount of dividends paid. This amount must be included in the total total income calculation (cell 020). |

| Third | Cell 040 6 personal income tax = cell “calculated tax” of all certificates 2 personal income tax | The calculated tax liability is calculated using the formula: accrued income – tax deductions * tax rate. |

| Fourth | Box 080 6 personal income tax = cell “unwithheld tax” for all certificates 2 personal income tax | According to certificates 2 of personal income tax and 6 of personal income tax for 2021, the amount of the liability that the taxpayer was unable to withhold from accrued income for individuals is indicated. This is possible with rolling payments. |

| Fifth | Cell 060 6 personal income tax = number of certificates 2 personal income tax | Cell 060 indicates the number of full-time employees to whom taxable income was accrued, and personal income tax certificate 2 is submitted for each individual employee. In this case, it is worth taking into account those workers with whom a fixed-term employment contract was drawn up; 2 personal income taxes, 6 personal income taxes reflect all individuals to whom income amounts were paid. |

Knowledge of the formulas developed for reconciliation of inter-documentary indicators will allow taxpayers to check themselves at the stage of preparing annual documentation and promptly identify possible errors. This reduces the risk of making a mistake and eliminates the need to prepare explanations or updated forms for tax authorities.

How do the data in 2-NDFL and 6-NDFL compare?

The amount in section 1 of the 6-NDFL calculation must be equal to the amount indicated in 2-NDFL and section 2 of the income tax return. At the same time, sections 1 and 2 of the 6-NDFL calculation are never equal to each other.

Section 2 of the 6-NDFL calculation should indicate the amounts that you transferred to the budget. If this equation is not met, then you have tax arrears.

What needs to be done before submitting the 6-NDFL calculation

- Check row metrics.

- Check whether the control ratios are met in 6-NDFL (letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11 / [email protected] ).

- Check the amounts of personal income tax transfers to the budget for all periods.

- Check the indicators of the annual calculation of 6-NDFL with certificates of 2-NDFL and appendices 2 to the income tax return.

- Reconcile 6-NDFL with the RSV for the same period (see control ratios in the letter of the Federal Tax Service dated March 20, 2019 No. BS-4-11 / [email protected] ).

Indicators for verification for 2021

Since 2021, a new regulation has been in force - Letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 03/23/2021. It provides control ratios for the new report forms from Order No. ED-7-11/ [email protected]

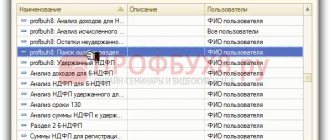

The reconciliation procedure is included in a separate attachment to this letter. The information is presented in the form of a table that contains:

- type of reference ratio;

- a reference to the norms of fiscal legislation that may have been violated;

- a detailed statement of the error, violation or discrepancy;

- recommendations for the inspector (what actions to take in relation to the taxpayer).

IMPORTANT!

The use of control ratios for checking reporting forms is not mandatory for tax agents. But reconciliation of individual indicators will allow you to avoid claims from controllers.

Table of control ratios for the 2021 report:

| What to check (ratio type) | What was violated (link to legal acts) | What kind of error (wording) | What to do (controller actions) |

| Page 110 is equal to or greater than 130 | Articles 126.1, 210, 23, 24 of the Tax Code of the Russian Federation | If the income accrued to individuals is less than the total value of deductions, then the deductions are overstated | The inspector sends a request to the tax agent to provide explanations or adjust the indicators within five working days (clause 3 of Article 88 of the Tax Code of the Russian Federation). If, after the clarifications received or in the absence of clarifications from the tax agent, a violation of the legislation on taxes and fees is established, the Federal Tax Service specialist draws up an inspection report (Article 100 of the Tax Code of the Russian Federation) |

| (page 110 - page 130) / 100 * page 100 = page 140 (taking into account the ratio of lines 110 and 130) | If the difference between line 110 and line 130 / 100 * line 100 is more or less than 140, then the calculated income tax is overestimated or underestimated. The permissible error in both directions is calculated as follows: page 120 * 1 rub. * number of lines 021 (clause 6 of article 52 of the Tax Code of the Russian Federation) | ||

| Indicators 140 greater than or equal to p. 150 | Articles 126.1, 227.1, 23, 24 of the Tax Code of the Russian Federation | If 140 is less than 150, then the tax agent has overestimated the fixed advance payment | |

| Page 110 at a specific rate from page 100 is equal to the sum of the lines “Total amount of income” at the same income tax rate from the certificate of income and tax amounts of an individual - Appendix No. 1 to the calculation, presented for all taxpayers of an organization or individual entrepreneur. This ratio applies to the calculation for the tax period | Articles 126.1, 226, 226.1, 230, 23, 24 of the Tax Code of the Russian Federation | If page 110 is less or more than the specified indicators, then the report underestimates or overstates the amount of accrued income tax | |

| Page 111 is equal to the total income in the form of dividends (code 1010) in appendices No. 1 to the calculation, presented for all taxpayers. This ratio applies to the annual calculation | If the equality is not satisfied, then the income in the form of dividends is underestimated or overestimated | ||

| Letter No. BS-4-11 / [email protected] explains whether there are control ratios of line 140 and 2-NDFL - yes, here they are: line 140 for a specific tax rate is equal to the sum of the lines “Tax amount calculated” at this rate in appendices No. 1 to the calculation (applied for the tax period) | If the equality is not satisfied, then the calculated income tax is underestimated or overestimated | ||

| Page 170 is equal to the sum of the lines “Amount of tax not withheld by the tax agent” from all appendices No. 1 to the calculation (applied for the tax period) | If equality is not satisfied, then the tax not withheld by the tax agent is underestimated or overestimated | ||

| Line “Tax base” from section 2 of appendix No. 1 (certificate) at rates of 13% or 15% = line “Total amount of income” in section 2 - the sum of all lines “Deduction amount” from appendix “Information on income and corresponding deductions by tax month period" - the total value of all lines "Deduction amount" of section 3 (applied for the tax period). By analogy, we carry out control for other personal income tax rates. | If equality is not met, then the tax base does not correspond to the calculated value: it is overestimated or underestimated | ||

| Line “Calculated tax amount” of Section 2 of Appendix No. 1 to the calculation of 6-NDFL - “Tax base” * “Tax rate” / 100 = no more than 1 ruble (applied for the tax period). | If the result of the action is more than 1 ruble, the calculated personal income tax does not correspond to the calculated value | ||

| (Sum of the lines “Amount of income” of the Appendix “Information on income and corresponding deductions” - the sum of all lines “Amount of deduction” of the Appendix * per rate / 100) - “Amount of tax calculated” of section 2 of Appendix No. 1 to the calculation of 6-NDFL = no more 1 ruble, and the calculated personal income tax is more than 0 (we apply for the tax period) | If the result of the action is more than 1 ruble, the calculated personal income tax does not correspond to the calculated value | ||

| Line “Amount of unwithheld tax” of Section 4 of Appendix No. 1 = absolute value (“Amount of income from which personal income tax is not withheld”, Section 4 of Appendix No. 1 * rate / 100 - “Amount of unwithheld tax” of Section 4 of Appendix No. 1) = no more 1 ruble, and the amount of unwithheld personal income tax is greater than 0 (applied for the tax period) | If the result of the action is more than 1 ruble, the non-withheld personal income tax does not correspond to the calculated value | ||

| Line “Total amount of income” of sections 2 of Appendix No. 1 = the sum of all lines “Amount of income” of Appendix “Information on income and corresponding deductions”, and this line is greater than 0 (apply for the tax period) | If the total income is not equal to the total value of all incomes, then this result does not correspond to the calculated value | ||

| The line “Amount of income from which personal income tax is not withheld” of section 4 of appendix No. 1 to 6-NDFL is less than or equal to the line “Total amount of income” of section 2 of appendix no. 1, and the unwithheld personal income tax is greater than 0 (applied for the tax period) | If income for which personal income tax is not withheld exceeds total income, this indicator does not correspond to the calculated value | ||

| The number of individuals with income at a specific rate is equal to the number of sections 2 of Appendix No. 1 | If equality is not achieved, then the number of individuals is overestimated or underestimated | ||

| Page 130 = the sum of the lines “Deduction Amount” of Section 3 of Appendix No. 1 + the sum of the lines “Deduction Amount” of the Appendix “Information on Income and Corresponding Deductions” of Appendix No. 1 | If the total amount of deductions is not equal to the total amount of all deductions, then the indicator does not correspond to the calculated value | ||

| Page 150 at a specific personal income tax rate = the sum of the lines “Amount of fixed advance payments” of section 2 of appendices No. 1 | If the total amount of fixed advance payments is not equal to the sum of all fixed advance payments, then the indicator does not correspond to the calculated value |