Forms of personalized accounting

Since 2021, changes have come into force in the accounting procedure for insurance premiums, which employers calculate from payments to their employees. Control over their accrual and payment was transferred to the Federal Tax Service. In this regard, the reporting submitted to the Pension Fund was also reformed. The reporting provided to the Pension Fund of the Russian Federation is necessary for organizing the registration of citizens in the pension system, monitoring the insurance period, and tracking the right to assign an early pension. Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 approved personalized accounting reporting, which is still used today:

- SZV-STAGE;

- SZV-ISH;

- SZV-KORR;

- EDV-1.

Use free instructions from ConsultantPlus experts to correctly fill out the SZV-STAZH for 2021.

Who submits the new EFA-1 form and when to do it in 2021

Reports on personalized accounting are provided to the Pension Fund. All organizations and individual entrepreneurs that hire employees are required to take EDV-1:

- under employment contracts;

- under civil law contracts.

Employers-insurers are required to calculate and pay insurance premiums from the remuneration paid to employees in accordance with the rules of Chapter 34 of the Tax Code of the Russian Federation. Insurance premiums, among other things, are paid for compulsory pension insurance.

The reporting form in question is not an independent document. It is an additional inventory form to the main report. Thus, who and when takes EFA-1 in 2021 depends on the timing and order of submission of the main forms listed above. It is provided by all policyholders until 03/01/2021. In addition, a report will have to be prepared if the employee has applied for a pension.

Determining the type of information

Filling out EDV-1 for 2021 is necessary when providing other forms of accounting: SZV-STAZH, SZV-ISKH and SZV-KORR. The rules for filling it out depend on which of these reports the inventory is compiled for.

Let's look at how to fill out the EFA-1 form for 2021 in the Pension Fund program, similar.

In any case, filling out a report begins with determining its type. Reporting happens:

- Initial - submitted during the initial submission complete with the main document.

- Corrective - provided if corrections are made to section 5 of the original reporting.

- Cancelling - provided if the data specified in the original form in section 5 is canceled.

The type of form provided must be indicated by placing an “X” in the appropriate box.

Policyholder report on form EDV-1

The current EFA-1 is the format of the accompanying document, according to which all obligated persons, except individual entrepreneurs without employees, report. It summarizes information about the policyholder. The document has been introduced since 2021 and is submitted to the Pension Fund of Russia branch at the place of registration of the obligated person, together with SEV-STAZH, SEV-KORR, SEV-ISKH. The structure of the form is made up of 5 sections and can include different types of information:

- “Initial” - generates a standard set of documents along with one of 3 key forms of personalized reporting.

- “Initial” together with “Correcting” (if section 5 is being adjusted).

- “Initial” together with “Cancelling” (if the data in section 5 is cancelled).

The required type is marked at the corresponding position with an “X”.

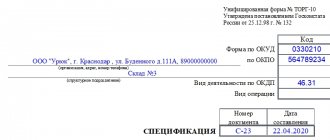

Form EDV-1

| Set of documents | Explanations | Submission deadlines |

| ODV-1 together with SEV-STAZH | EDV-1 contains generalized information about the number of employees for whom information is available in CMEA-STAGE; sections 1,2,5 of the accompanying form are filled out; upon dismissal, the employee is given an excerpt from the CMEA-STAZH, while the EDV-1 is not issued | 1. Submitted annually immediately after the expired reporting period before March 1. 2. When an employee retires, this package of documents is transferred to the Pension Fund of the Russian Federation within 3 days after the application of the future pensioner is submitted |

| ODV-1 together with SEV-ISKH | The package is generated when the deadlines for submitting documentation are missed; information is entered according to sections 1.2,4 of OVD-1; relevant for those obligated persons who did not maintain personalized reporting until 2021. | The policyholder has the right to submit it at any time if he deems it necessary |

| EDV-1 together with SEV-KORR | Used when correcting recorded data on personal personal accounts; Only sections 1-3 of EDV-1 are filled in (does not apply to CMEA-CORR “Special”) | Submitted at the initiative of the policyholder when there is a need to correct errors when they are detected |

There is no such thing as zero EFA-1. The personalized information entered in this form is transferred along with the listed Pension Fund documents for the purpose of organizing individual accounting. Reports can be submitted electronically or on paper.

Submission of personalized reporting late, even by a day, or failure to submit it is grounds for holding the policyholder liable. Penalties are imposed for violation of deadlines. The obligated person is charged 500 rubles. for each employee for whom information is not provided.

The obligation to generate and submit the listed personalized documents arises from the policyholder only when concluding employment contracts (EAP) between the employer and the employee.

Sections that are always filled

Sections 1, 2 and 3 are completed regardless of which main report the inventory is attached to.

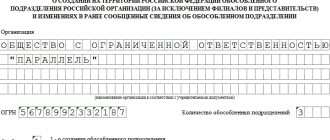

Section 1 reflects information on the policyholder (organization or individual entrepreneur) transferred to the Pension Fund for maintaining individual (personalized) records (EFV-1):

- registration number in the Pension Fund of Russia: has 12 characters and is assigned when registering a company with the Pension Fund of Russia;

- TIN and checkpoint;

- name of the insured.

Section 2 is intended to indicate the period for which reports are submitted. It must indicate the year. And a coded designation of the time period for which the report is provided:

- quarter;

- half year;

- year;

- another time interval for which reporting was to be submitted.

Currently, the SZV-STAZH report is submitted once a year, so the reporting period code in EFA-1 for this report is always 0. A complete list of reporting period codes for previous years can be found by referring to the appendix to the procedure for filling out personalized accounting forms.

Section 3 is intended to indicate the number of persons for whom information is filed in the main report. Opposite the name of the corresponding form indicated in column 1, we reflect the number of insured persons in column 2. Only one line is filled in in this tabular part.

SZV-STAZH and EDV-1 for 2021: deadlines, filling procedure, sample

It is handed over together with an inventory - form EDV-1.

SZV-STAZH information consists of 5 sections:

Section 1 "Information about the policyholder"

The following information is indicated:

- registration number in the Pension Fund of Russia;

- TIN;

- Checkpoint.

Information type

From the frame on the right, select only one “Information Type”, for example, “Initial” - put an X.

We select the “Pension Assignment” type of information when submitting information for insured persons, who, in order to establish a pension, need to take into account the period of work of the calendar year, the deadline for submitting reports for which has not yet arrived, that is, it is submitted on the date of expected retirement.

The “Additional” information type is submitted for insured persons, the data for which, presented in the form with the “Initial” type, is not taken into account on individual personal accounts due to an error contained in them.

- short name of the organization.

Section 2 “Reporting period”

Calendar year is 2021.

Section 3 “Information about periods of work of insured persons”

In column 1 No. pp - there is continuous numbering. Each person is assigned a number.

Columns 2–4 “Last name, first name, patronymic” - are indicated in the nominative case, in accordance with SNILS. To be filled out once.

Column 5 - SNILS

Columns 6–7 “Operation period” - within the reporting period. Each period of work or absence (vacation, sick leave, other reasons) is filled in on a separate line. The start and end dates of the periods are entered in the corresponding columns.

If the information type is “Pension assignment,” column 7 is filled in by the date of expected retirement.

For unworked periods in column 11, the corresponding value is selected from the classifier.

For example:

DLOTPUSK - paid leave;

VRNETRUD - sick leave;

CHILDREN - parental leave for children up to one and a half years old.

Columns 8–13 - are filled in if the employee has the right to early retirement. They contain codes from reference books.

Civil legal relations are reflected in column 11 with codes:

AGREEMENT - if payment under the agreement was made during the reporting period;

NONOPLDOG - if there is no payment for work under the contract.

If an employee performs work full-time during a part-time work week, the period of work is reflected according to the actual working time worked.

If the employee performs work part-time, the volume of work (share of the rate) in this period is reflected.

Section 4 “Information on accrued (paid) insurance contributions for compulsory pension insurance”

Section 5 “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision”»

- are filled out only when applying for a pension.

When section 4 EDV-1 is filled out

This part of the inventory is filled out only if it is submitted together with SZV-ISH or SZV-KORR reports with the “special” type. It contains information about the calculation and payment of insurance premiums for the reporting period. These reporting forms are submitted for periods up to 2021. During these periods, policyholders transferred information about paid contributions to compulsory pension insurance directly to the Pension Fund. Starting from 2021, calculations for insurance premiums are transferred to the Federal Tax Service.

If there is a need to adjust information about accrued contributions for one employee, this entails changes in information about accruals and debts for the entire policyholder as a whole. In order for the Pension Fund to be able to correctly correct information previously submitted by the company, Section 4 is intended.

Let's show with an example how to fill out section 4 of EFA-1. The company submitted the DAM to the Pension Fund for 2021 with the following data:

| 2016 | Debt at the beginning of the reporting period, rub., kopecks. | Insurance premiums accrued, rub., kopecks. | Insurance premiums paid, rubles, kopecks. | Debt at the end of the reporting period, rub., kopecks. | ||

| Total | For 2015 | For 2021 | ||||

| For the insurance part of the pension | 100 000,00 | 2 000 000,00 | 1 950 000,00 | 100 000,00 | 1 850 000,00 | 150 000,00 |

In 2021, it was discovered that information was not submitted for one employee. According to it, for 2021, contributions to the insurance part of the pension were calculated in the amount of 10,000 rubles. The organization submits information for this employee using the SZV-ISH form and fills out section 4 of the inventory as follows:

Step-by-step instructions for filling out and sample

If a representative of the enterprise’s personnel service is filling out the document, then he must understand the rules of this process.

To correctly form the ADV-1 form, the following steps are performed:

- personal information about the new employee is entered, for which his full name, date of birth and gender are indicated;

- information for filling out the form is taken exclusively from official documentation received from a specialist, so the data must match the information from the passport;

- the place of birth given in the passport is indicated, and not only the city is entered, but also the region, district and country;

- the citizenship of the new hired specialist is selected;

- the place of registration and the address of the citizen’s actual place of residence is indicated;

- indicate contact information represented by telephone number and email address;

- passport details are entered, and it is allowed to use other identification documents;

- a correctly formed application form of the insured person is signed by the direct employee, if there are no serious reasons for the director of the enterprise to carry out this process;

- at the end the date of compilation is indicated, after which the documentation is transferred to the representatives of the Pension Fund, and an accompanying inventory is attached to it.

Any hired specialist can understand the rules for creating the ADV-1 form. If false or incorrect information is entered, this will lead to negative consequences. Funds transferred in the form of insurance premiums for an employee will not accumulate in his individual account. Therefore, you will have to check and draw up a new questionnaire.

How to fill out section 5 of the EFA-1 form

This section is filled out by policyholders when submitting the initial SZV-STAZH or SZV-ISKH only if the information contains data on employees who have the right to early assignment of a pension. Such persons include:

- those employed in hazardous and difficult working conditions;

- public transport drivers;

- civil aviation employees;

- professional rescuers, fire service workers;

- those employed in work with convicts;

- other persons named in paragraphs 1-18 of part 1 of article 30 of the Federal Law of December 28, 2013 No. 400-FZ.

Section 5 contains data on the number of such workers, their positions, codes of special working conditions and codes corresponding to positions from lists No. 1 and No. 2 of professions that give the right to preferential pensions (Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10).

Sample filling

To determine whether you need to take EFA-1 for 2021 and which sections of the report to fill out, use our cheat sheet.

How to fill out the EFA-1 report for 2021:

| Main report | Main report view | Chapter | ||||

| 1 | 2 | 3 | 4 | 5 | ||

| SZV-STAZH | Initial, contains information about persons entitled to early pension assignment | + | + | + | — | + |

| In all other cases | + | + | + | — | — | |

| SZV-ISH | Contains information about persons entitled to early pension assignment | + | + | + | + | + |

| In all other cases | + | + | + | + | — | |

| SZV-KORR | Corrective | + | + | + | — | — |

| Canceling | + | + | + | — | — | |

| Special | + | + | + | + | — | |

Since the SZV-KORR and SZV-ISKH reports are used less and less, we will show a sample of filling out the inventory for the SZV-STAZH form.

Filling out the SZV STAZH in 1C ZUP 3.1

Content

What is it regulated by?

Based on the Pension Fund Resolution of December 6, 2021 N 507p, from 2021 new forms SZV-STAZH , ODV-1 , SZV-KORR and SZV-ISKH for sending personalized accounting data for employees to the Pension Fund.

The main annual form sent is the SZV-STAZH (Information on length of service) and the appendix to it form (Insured Information) EDV-1 .

How to generate the form SZV-STAZH and ODV-1 in 1C ZUP?

I would like to immediately note that these forms are automatically filled out in the 1C: Salary and Personnel Management 3.1 configuration automatically, provided that personnel records are correct in the program.

To generate these forms, it is recommended to have the latest release of the 1C configuration installed, otherwise the data may not be correct and may not be uploaded or loaded for sending to the Pension Fund.

In order to create and generate a report in the form SZV-STAZH , go to the section Reporting, certificates - 1C-Reporting .

In the report log that opens, click on the Create

In the window that opens for selecting the required form of reports, expand the section Reporting by individuals , as in the picture.

In the list, you need to find and select the report Information on the insurance experience of insured persons, SZV-STAGE and click on the Select .

In the SZV-STAZH document window that opens, you need to fill in the organization, the period for which the report is being submitted; in our case, we are submitting the report for 2020 2021 , as well as Type of information: Initial .

Next, click on the Fill , after which the SZV-STAZH formation document will be filled in by the employees who worked during the selected period.

It is important that all individuals have their SNILS , and it is also important to check that registration data in the Pension Fund of the Russian Federation is filled out correctly in the organization’s card on the Funds . Please pay attention to filling out the fields: PFR registration number, code of the territorial body of the PFR.

To check the periods of work of employees, you can print a printed form SZV-STAZH by clicking the Print .

Printed form SZV-STAZH in 1C ZUP 3.1

Also, to check and correct the periods , you can enter the Work Experience Information by double-clicking on the desired employee from the list.

In this form, you can change the data within this report for sending to the Pension Fund, but if you fill it out again, the data will not be saved.

If the periods of service are not formed correctly, then most likely an error was made in the personnel documents, or the necessary documents simply were not generated and posted in the program.

It is necessary to check the correctness of filling out documents Vacation, Business trip, personnel transfers, appointments, dismissals and other paid and unpaid absences.

If you have an active subscription to ITS and connected to the 1C-Reporting , the generated SZV-STAZH report and EDV-1 form can be sent directly from 1C.

If 1C-Reporting is not connected, then after checking and printing the report, upload it using the Upload and send it to the Pension Fund via VLSI or Kontur.

If the report is accepted by the Pension Fund of Russia, it is necessary to set the appropriate flag in the document so that the document cannot be edited.