Where are the records of work records reflected?

To keep track of work books, as well as work book forms and inserts therein, employers must keep:

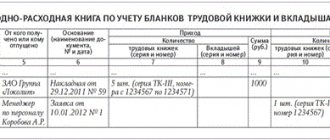

- receipt and expenditure book for accounting of work book forms and inserts in it;

- a book for recording the movement of work books and inserts in them.

The forms of these books are approved in the Instructions for filling out work books, approved by Resolution No. 69.

The income and expense book must be kept in the accounting department. This book contains information about the receipt and use of work book forms, indicating the series and number of each form.

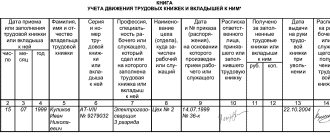

The book of accounting for the movement of work books and inserts in them is maintained by the personnel department or another division of the organization that processes the hiring and dismissal of employees. It registers all work books accepted from employees upon entry to work, as well as work books and inserts in them indicating the series and number issued to employees again. Upon receipt of a work book in connection with dismissal, the employee signs on the personal card and in the book for recording the movement of work books and inserts in them. Both books must be numbered, laced, certified by the signature of the head of the organization, and also sealed with a wax seal.

Electronic work books will be introduced in Russia from 2021. The Ministry of Labor stated that it is ready to consider the issue of transferring Russians to electronic work books. “The idea of switching to electronic personnel document management certainly deserves attention,” the department’s press service said. The transition to electronic work books was also supported by the Federal Service for Labor and Employment. At the same time, the head of the department, Vsevolod Vukolov, noted that this would reduce the volume of paper documents sent.

What information must be included in the work book?

General requirements

| Requirements | Contents and rules |

| Numbering of sections is continuous | Each entry has its own sequential number; violation of the sequence is considered an error and changes must be made. |

| Date format is fixed | Only Arabic numerals in the day, month, year format are allowed (05/12/2019 is correct, May 12, 2021 is incorrect). |

| By what means to deposit | Information is entered only with pens with black, purple or blue ink; the pen can only be ballpoint, gel or fountain pen. |

| Is the use of stamps and seals allowed? | Allowed when using a stamp with the name of the organization. In general, this issue is not regulated at the legal level, except in the case of issuing an insert in the labor report. |

| In what language is the information entered? | The official language is Russian, but in national republics it is allowed to make accompanying entries in their own language. |

| Deadlines for entering information | No later than 7 days after the start of work, and a work record is opened for each employee who has worked for more than five days. |

| How to introduce records | All employee records must be familiarized with a signature on a personal card, where the records are duplicated. The employee signs the document only upon dismissal. |

| How to fix errors | Depends on the section. On the title page, corrections are made through strikethroughs; in the “Information about the work” section, strikethroughs are prohibited; here the entry is considered invalid. |

Front page

This includes the personal data of the owner of the work book:

- FULL NAME.;

- date of birth;

- information about education;

- profession;

- speciality.

All information is entered based on the documents provided by the employee. The instructions for maintaining work books for 2021 did not add any new information. Information from the employee's words is not entered. After filling out, the personnel employee who entered the information puts his signature and gives it to the labor employee so that he can check whether everything is entered correctly. If everything is correct, the employee signs. If errors or inaccuracies are made, the form must be destroyed. In this case, a new employment form will be created, but the employee will no longer pay anything for it, because the mistake was made by the employer.

Job details

This section provides information:

- about hiring;

- promotion;

- translations (permanent);

- assignment of ranks;

- about dismissal.

All information is entered in strict accordance with the wording specified in the employee’s employment contract and the corresponding order. The employer is obliged to familiarize each entry made about work activity, transfer and dismissal to its owner against the signature in his personal card.

Information about awards

In essence, it is not much different from the previous section, but there are some nuances. This section contains information about the award:

- state awards;

- certificates of honor, badges, badges, diplomas;

- other types of incentives provided by a particular employer.

Information about cash bonuses, which are of a regular nature, is not included in this section.

What about the seal?

Federal Law No. 82-FZ of April 6, 2015 abolished the obligation for organizations created in the form of limited liability companies and joint stock companies to have seals, except in cases where such an obligation is provided for by federal law.

Information about the presence of a seal must be contained in the organization’s charter. In this regard, the Ministry of Labor of Russia issued an order dated October 31, 2016 No. 589n “On approval of clarification on certain issues of the application of the Rules for maintaining and storing work books, the production of work book forms and the provision of them to employers, approved by the Decree of the Government of the Russian Federation dated April 16, 2003. No. 225 “On work books.”

The order states that the affixing of a seal is carried out if it is available in the organization in the following cases:

- on the first page of the work book, insert in the work book;

- when certifying the receipt and expenditure book and the book of accounting for the movement of work books and inserts in them;

- when certifying entries made in the employee’s work book during his time working for a given employer upon dismissal of the employee (termination of the employment contract).

If the organization does not have a seal, the entries made in the employee’s work book during his time working in this organization are certified by the signature of the employer or the person responsible for maintaining work books.

What is the procedure for stopping maintaining a book of accounting for the movement of labor books

The procedure for formalizing the termination of maintaining a book of accounting for the movement of labor books is not established by law.

However, according to Rostrud specialists, in order to formalize this correctly, you will need:

- make a note about the termination of maintaining the accounting book. Put on the cover the date of the first entry and the date of the last entry, indicating the period and place of storage of the book;

- make a final inscription on the last completed sheet of the book “total entries on ... sheets.” Certify it with the stamp of the HR department.

These actions will have to be taken by the person who is responsible at the company for recording and storing work books.

Please keep in mind that after the book is transferred to the organization for archival storage, workers who have not abandoned the paper work book can be employed.

In this case, the employer will have to resume recording and storing work books.

Also on topic:

After choosing an electronic one, returning to a paper work book is impossible

How to fill out a paper work book correctly?

Forms of work books and inserts

The forms of the work book and its insert are stored in the organization as documents of strict accountability and are issued to the person responsible for maintaining work books, upon his application.

The employer is obliged to constantly have in stock the required number of work book forms and inserts in it, since he is obliged to make an entry in the work book for each employee who has worked for him for more than 5 days (if the work is his main one). It is not always possible to buy forms in 5 days, so these documents are usually purchased with some reserve. Their cost is included in the organization’s expenses: D-t 20, 26, 44 and K-t 60, etc.

According to clause 47 of the Rules for maintaining and storing work books, approved by Resolution No. 225, when issuing a work book or an insert in it, the employer charges the employee a fee in the amount of the costs of their acquisition.

A free work book and insert are issued only in two cases:

- if the employer has massively lost work books as a result of emergency situations (environmental and man-made disasters, natural disasters, riots and other emergency circumstances);

- in case of incorrect initial filling of the work book or the insert in it, as well as in case of their damage through no fault of the employee.

In these cases, new work books and inserts for them are paid for by the employer.

The fee set by the employer must include value added tax.

The cost of the work book (insert in it), at the request of the employee, can be deducted from his salary or paid by him to the organization’s cash desk.

Registration procedure for employment

In accordance with Art. 66 of the Labor Code of the Russian Federation, clause 3 of the Rules, the employer is obliged to maintain a Labor Code for each employee with whom an agreement has been concluded. A record of this must be made within 5 days after the new employee starts work. If a citizen is employed for the first time, the employer must give him the form. Before this, you need to receive a written application from the person applying for a job to open a work record book, indicating the reason for its absence. When issuing a TC to an employee, the manager charges him a fee equal to the cost of its acquisition.

Application for opening a work book, sample

Accounting

Funds received from employees are accounted for as income from the sale of other property on account 91, subaccount 1 “Other income”, in correspondence with account 73 “Settlements with personnel for other transactions” (if the money is deposited in the cash register) or 70 “Settlements with personnel for wages" (if there is an employee’s application for deduction from wages):

D-t 50, K-t 73 - payment for the work book was received from the employee;

D-t 73 (70), K-t 91–1 - revenue accrued for the sale of the work book to the employee;

Dt 91–2, Kt 68 VAT - VAT is charged for the sale of a work book to an employee.

Legislative regulation of the issue

The maintenance of work books and entries in them, as well as the storage of these documents, is regulated by several legislative acts:

- Labor Code, where Article 66 is devoted to this issue;

- Government Decree on maintaining labor records No. 225 dated April 16, 2003;

- Instructions for filling out work books (developed by Decree of the Ministry of Labor No. dated 10.10.2003).

Since 2003, the procedure for maintaining labor books in the Russian Federation has practically not changed, since over the course of 15 years only minor and few amendments have been made to these regulations.

What will be the violation of the rules?

Responsibility for organizing the work of maintaining, storing, recording and issuing work books and inserts in them rests with the employer.

The employer, by order (instruction), must appoint a specific employee who will be entrusted with the responsibility to carry out this work.

For violation of the established procedure for maintaining, recording, storing and issuing work books, officials bear responsibility established by the legislation of the Russian Federation. In particular, according to Art. 5.27 of the Code of Administrative Offenses of the Russian Federation for violation of labor legislation and other regulatory legal acts containing labor law norms, the following types of punishment are provided: a warning or an administrative fine:

- for officials in the amount of 1000 to 5000 rubles;

- for individual entrepreneurs - from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 rubles.

Commentary on the draft procedure for maintaining and storing work records: what should HR officers expect?

In recent years, you and I, colleagues, have observed an intensification of rule-making activities by various state bodies. As part of the “regulatory guillotine”, many outdated regulatory legal acts are repealed - some of them are completely consigned to history, and some are replaced with new ones that are more adequate to the current moment.

Even before the start of a radical revision of the legislation, from January 1, 2007, continuous length of service (duration of work without a break for one employer or for different employers, if the break in work did not exceed the established duration) was abolished as the basis for determining the amount of disability benefits. It was replaced by insurance experience, which does not depend on the duration and number of breaks between dismissal and subsequent employment.

From 01/01/2015, the procedure for determining the insurance period for the purpose of assigning a pension has seriously changed: now the periods for which the employer actually paid insurance premiums for the employee are mainly taken into account, therefore, for example, leaves without pay are no longer counted towards the pension insurance period (with the exception of one and a half years of leave without pay to care for a child, but not more than 6 years in total). Personnel officers noticed that the Pension Fund of the Russian Federation previously refused to accept reports if the report card contained the codes “NN”[1], and demanded that it be replaced with codes “DO”, “OZ”[2] or “PR”[3], because until 2015, this was important: leave without pay, unlike absenteeism, was counted towards the pension period. Now, for all these codes, payment is not accrued; accordingly, insurance premiums are not paid and, therefore, the days marked by them are not counted in the insurance period for a pension[4].

And now the main source for calculating the insurance period is not the work books of employees, but information about labor activity (hereinafter referred to as STD). Moreover, people can check through their personal account whether any periods are “lost” [5], and if a “shortage” is identified, contact the Pension Fund of the Russian Federation with an application and supporting documents, on the basis of which the missing periods will be included in the length of service.

Gradually, the paper work record book will become a thing of the past. Of course, this will not happen soon: for the second year we have been working with an electronic version of the work book, officially called STD. Employees whose work began before 2021 have the right to choose: keep the paper work book in active working condition or leave it only as a passive document about past experience and switch to STD.

But as practice shows, the vast majority of workers prefer to leave their work record books active, and this is understandable: in our country, people are accustomed to trusting paper documents more than electronic databases.

Therefore, there is no need to talk about the complete abolition of paper work records in the coming years. And confirmation of this is the draft order developed by the Russian Ministry of Labor “On approval of the form, procedure for maintaining and storing work books” (hereinafter referred to as the draft; Procedure). It is assumed that this document will replace the current ones:

• Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225 (hereinafter referred to as the Rules) and

• Instructions for filling out work books, approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (hereinafter referred to as the Instructions),

the provisions of which will be incorporated (included and combined) in the Procedure. Moreover, the plan is not a purely technical mechanical unification, but updating to modern requirements.

The draft provides that the order will come into force from the moment the resolution of the Government of the Russian Federation “On invalidating certain acts of the Government of the Russian Federation and certain provisions of certain acts of the Government of the Russian Federation” comes into force - it is obvious that this resolution will repeal the Rules, after which the Procedure will come into force.

LET'S RETURN TO THE PROJECT

Let's analyze the project, look at its advantages and disadvantages. Certain changes are quite appropriate, and, moreover, some of them are long overdue and overdue.

But some of the project’s ideas raise questions and great doubts.

Note. In our commentary, we will designate such dubious provisions of the project as follows: NB : flaw.

As a matter of fact, when we see that it is proposed to issue work record forms in a modified form, the first flaw catches our eye.

NB: defect. The idea of a new form of work book is striking in its lack of not only logic, but also of basic common sense. Why is it necessary to change the form of the work book by changing the number of pages in the sections “Information about work”[6] and “Information about awards”[7], if:

• firstly, employers and stores now have a huge number of unused forms, which, if a new form is approved, will have to be thrown away, i.e., incur material losses - and this in a situation where, due to the coronavirus pandemic, almost all of us have economic problems all employers, and many simply found themselves on the brink of survival[8] (in light of this, the phrase about the stamp on the title page of the work book, which is affixed by the organization in which the work book was filled out for the first time, sounds especially funny);

• secondly, from this year, workers who get a job for the first time will not be issued work books, i.e., only books already issued before 2021 will be maintained, and work book forms will only be needed to issue duplicates or new work books to replace lost ones (and then if employees don’t come in, switch to STD)?

It is doubtful that there is a digestible answer to this question...

NB: defect. The rules that approved the form of the insert in the work book will be cancelled. The order does not contain the liner mold. But it is the inserts that employers will primarily use for employees who wish to keep their paper work books active. But without an approved form, the release of inserts will be impossible. And the existing forms of inserts will lose their legitimacy. The explanatory note to the project states that “the forms of work books and inserts for them previously produced and purchased by employers will be valid and used in work,” but this is not clear from the text of the project itself.

NB: defect. The project provides for maintaining work records of remote workers “ by agreement of the parties to the employment contract.” This means that in order to make entries in the work books of employees, it is required that both the employee and the employer agree. However, there is a clear contradiction with the norm of Part 6 of Art. 312.2 of the Labor Code of the Russian Federation, according to which information about work activity is entered by the employer into the work book of a remote worker, who has the right to maintain a paper work book[9], at the request of the employee himself (and if he sends it to the employer by mail). Therefore, the employer has no right to agree or disagree. Thus, we see a contradiction between the draft Procedure and the Labor Code of the Russian Federation.

The ability to make entries not only with ink, paste and gel, but also with paint (using technical means such as stamps) and by transferring dyes (these are printers). The author knows of enterprises where software has been developed and equipment has been adapted for making entries in the work book using a printer. It is also known that not all GIT inspectors were sympathetic to this method. If this project idea is preserved, employers will no longer have such problems with inspection authorities.

The mention of a military ID, foreign passport, driver's license as identification documents on the basis of which the title page can be filled out has been removed, since such documents can only be either a passport of a citizen of the Russian Federation or a temporary identity card of a citizen of the Russian Federation.

The wording of educational records is brought into compliance with current legislation.

NB: defect. The line title “Profession, specialty” is left, while diplomas indicate qualifications and specialty.

NB: defect. The question arises: what to do if the employee’s education document was issued earlier and contains a previous version of the wording?

The project is supposed to give 5 working days to make any entries (and not just about hiring).

[1] An employee’s failure to appear at the workplace due to unclear circumstances.

[2] Code “DO” is unpaid leave that the employer has agreed to provide to the employee at his request. Code “OZ” is the same leave, but provided mandatory as required by law.

[3] Days (or hours) of an employee’s absence from work without good reason, i.e. absenteeism.

[4] This is not to be confused with the length of service for social insurance benefits - it includes the entire period from hiring to dismissal.

[5] https://pfrp.ru/faq/uznat-trudovoj-stazh-po-snils.html.

[6] 14 spreads instead of 10.

[7] 7 turns instead of 10.

[8] We sympathize with many private companies and individual entrepreneurs who have closed down, gone bankrupt, and the topic of work records has ceased to be relevant for them.

[9] That is, he got a job until 2021 and did not write an application to switch to STD.