Registration of purchase of components for a new fixed asset (OS)

First of all, in 1C 8.3 all OS components must be capitalized as equipment. A receipt document with the Equipment type is suitable for this. Let’s find the document by going to: Purchases – Receipts (acts, invoices):

Follow the link, click on Receipt and select Equipment from the list that opens:

Next, fill out the document according to the rules and put all the necessary information in the header:

- Organization – select the one you need from the list (if there are several);

- Warehouse – where the components will be located;

- Counterparty – indicate the supplier;

- Agreement – indicate the agreement with the supplier:

Then, on the Equipment tab, add the components that arrive using Add:

We will sequentially select the item, indicate the quantity and price. The 1C 8.3 program will calculate the remaining details automatically.

It is important to note here that the accounting account should be 07, since components are purchased for further assembly. VAT account 19.01 VAT on the acquisition of fixed assets.

Let’s post the document by clicking Post and using the Dt/Kt button we’ll see what kind of postings we got. From the figure below we see that the 1C 8.3 program made all the necessary postings:

- Dt 07 Kt 60.01 – equipment was received from the supplier to the account Equipment for installation;

- Dt 19.01 Kt 60.01 – for the amount of VAT:

If you need to enter more components into the 1C 8.3 database, but on a different day or from a different supplier, etc., then this is done in a similar way, each time creating a new receipt document.

Purchase of components for a future fixed asset in 1C 8.3

In the program, such an operation is reflected as a receipt of goods and services with the type of operation “Equipment”. Let's fill out the document according to our requirements:

Please note that the component accounting account is 07 (equipment for installation), and the VAT account is 19.01 (VAT on operating systems). To set up accounting accounts, use the Item Accounting mechanism.

The 1C program will generate the following transactions:

The components of the future fixed asset have arrived at the warehouse.

Installation (assembly) of received equipment

Now that all the necessary components are in stock, you can begin assembling (installing) the equipment. You can easily do this in 1C 8.3 using the document Transfer of equipment for installation: OS and intangible assets – Transfer of equipment for installation:

Let's create a new document and move on to filling out the header:

- Construction object - we will indicate the OS that will be obtained during the assembly process;

- Cost account – account for accounting of the construction project;

- Cost item – indicate the item for accounting for construction costs;

- Organization – indicate the one you need (if there are several);

- Warehouse – specify a warehouse, equipment will be written off from it.

Next, in the document table, we will add all the components that arrived at account 07. We will indicate the quantity, and the invoice will be entered automatically:

Click Post and close. Let's see what postings the document made: the 1C 8.3 Accounting 3.0 program generated the correct postings - Dt 08.03 Kt 07 transfer of equipment for installation:

If installation (assembly) of the OS from components occurs on the side

There are cases when the installation (assembly) of the OS from components occurs externally. Then these expenses are documented in 1C 8.3 with the document Receipt: Purchases - Receipt (acts, invoices). The document is created in the same way as at the stage of purchasing components, and we select the type of operation Equipment:

We are interested in the Services tab. Here we will add a new line where we indicate the name of the service. Be sure to indicate the cost account 03/08 and indicate the construction project in the first subconto:

After completing the document, we will evaluate what movements were generated by the 1C 8.3 program. We see that assembly services are included in the initial cost of the OS:

Transfer of equipment for installation

The next stage is installation or assembly of equipment. Naturally, we will collect them from the material assets received from the supplier, which are already on account 07.

The 1C document that will help us assemble is called “Transfer of equipment for installation”; in the interface it is located on the “OS and Intangible Materials” tab. Let's create a new document:

The construction object, in this case, is just a new OS made from components. In the “Equipment” tabular section, you need to indicate the quantities of the item and the accounting account - 07.

In wiring, the 1C 8.3 system will generate wiring 08.03-07, that is, the transfer of components for assembly:

If you plan to involve a third-party service provider in the assembly of components, this operation can also be reflected on account 08.03, using the document “Receipt of goods and services”, where the value of the subconto will be our new computer.

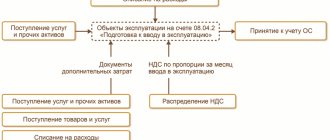

Acceptance of the collected OS for accounting

After all costs have been collected on account 08.3, it is necessary to accept the collected OS for accounting in the 1C 8.3 database. Let's move on: fixed assets and intangible assets - Acceptance for accounting of fixed assets:

By clicking on the link, we will go to the Acceptance for accounting of fixed assets journal, where we will add a new document. Let's fill it out. In the header:

- Organization – select the one you need from the directory (if there are several of them);

- Event – indicate the OS event. For example, Acceptance for accounting with commissioning;

- MOL – we will indicate the financially responsible person;

- OS location – indicate the storage location from the reference. Divisions:

Next, on the Non-current asset tab:

- Type of operation – indicate the type of operation. In the example under consideration – Construction site;

- Method of receipt – method of receipt of the OS;

- Construction object – indicate our construction object;

- Warehouse – where equipment is stored;

- The account is the one where the equipment is accounted for.

If everything is filled out correctly, then after clicking Calculate amounts, the 1C 8.3 program will automatically generate the initial cost of the operating system according to accounting and accounting records. This amount will be debited from the account on 03/08:

Let's go to the Fixed Assets tab. The document table here is not filled in yet. To fill it out, you need to create an OS:

Let's go to the Fixed Assets directory by clicking on the Fixed Assets field in the tabular section. There we will add a new element by clicking Create:

Most of the details will be filled in after the OS is accepted for accounting, so for now we will only fill in the name and accounting group:

Click Record and Close. Let's select a new OS in the document of acceptance for accounting:

Let's move on to the Accounting tab. Let's fill in:

- Accounting account;

- Accounting procedure;

- Depreciation account;

- Method of reflecting depreciation expenses;

- Useful life:

Also, by analogy, fill in the required fields on the Tax Accounting tab:

Let's post the document by clicking Post. Let's see what postings were generated by the 1C 8.3 program. We see that the OS from the components in 1C 8.3 has been successfully accepted for accounting.

From the document of acceptance for accounting in 1C 8.3, you can also print the Certificate of Acceptance and Transfer of OS:

An example of filling out the Certificate of Acceptance and Transfer of OS (OS-1):

We can also create a “turnover” to make sure that all actions are correct: Reports – Balance sheet:

We see that on 07 and 08.03 the accounts were closed, and in 1C 8.3 on 01.01 a new OS, assembled from components, appeared in debit:

Thus, we learned how to assemble the main tool from components in 1C 8.3. On the PROFBUKH8 website you can read other free articles and video tutorials on the 1C Accounting 8.3 (8.2) configuration. A full list of our offers can be found in the catalog.

How in 1C 8.2 (8.3) to make changes to the information on the fixed assets, in the case when the fixed assets are first used in one division and depreciation is calculated according to one account, then the fixed assets are transferred to another division, the MOL changes, the account for accounting for depreciation costs changes - see our video lesson:

Give your rating to this article: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

How to record the replacement of spare parts for fixed assets?

In accordance with the provisions of paragraph 8 of IAS 16 Property, Plant and Equipment, items such as spare parts, standby equipment and auxiliary equipment are recognized in accordance with this IFRS if they meet the definition of property, plant and equipment.

Otherwise, such items are classified

as inventories.

Consequently, a set of spare parts for a fixed asset is recognized as a stock.

According to the provisions of paragraph 35 of IAS 2 Inventories, some inventories may be allocated to other asset accounts, for example, inventories used as a component of property, plant and equipment,

created in-house. Inventories allocated to other assets are recognized as expenses over the useful life of the relevant asset.

According to the provisions of paragraph 12 of IAS 16 “Fixed Assets”, the organization does not include in the book value of an item of fixed assets the costs of day-to-day maintenance of the item.

These costs are recognized

in profit or loss as incurred.

Routine maintenance costs consist primarily of labor and consumables, but may also include the cost of minor components. The purpose of these costs is often described as "repairs and routine maintenance" of an item of property, plant and equipment.

In the case indicated in the question, the replacement of spare parts in a fixed asset does not relate to current repairs (daily maintenance of the facility), and therefore, the purchased set of spare parts for a fixed asset cannot be attributed to the expenses of the period; their cost must be attributed to the initial cost of the fixed asset .

Based on the provisions of paragraph 13 of IAS 16 “Fixed Assets”, elements of some fixed assets may require regular replacement. For example, a furnace may require relining after a set number of hours of use, and aircraft interiors, such as seats or galleys, may need to be replaced several times over the life of the fuselage. Items of property, plant and equipment may also be acquired for the purpose of periodic replacement, carried out less regularly, for example to replace internal partitions in a building, or to make a one-time replacement. An organization includes in the carrying amount of an item of property, plant and equipment the costs of partial replacement of such an item at the time of their occurrence if the recognition criteria are met.

In this case, the carrying amount of the replaced parts is written off

in accordance with the provisions of this standard on derecognition (see paragraphs 67-72 of IAS 16 “Property, Plant and Equipment”).

Taking into account the provisions of paragraph 70 of IAS 16 “Property, Plant and Equipment”, if an organization recognizes in the carrying amount of an item of property, plant and equipment the costs of replacing part of this item, then it ceases to recognize the carrying amount of the replaced part, regardless of whether this part was depreciated separately or not .

If it is impracticable for an entity to determine the carrying amount of the part so replaced, the entity may use the replacement cost as an indication of the value of the replaced part at the time it was acquired or constructed.

Accounting entries:

Debit 1310 Credit 3310 – entry of the purchased set of spare parts into inventories;

Debit 2933 Credit 1310 – write-off of the purchased set of spare parts for major repairs of fixed assets;

Debit 2410 Credit 2933 – assigning accumulated expenses for major repairs to the initial cost of the fixed asset;

Debit 7410 Credit 2410 – write-off of old spare parts from the initial cost of the fixed asset.