How to correctly fill out the RSV-2 PFR form for peasant farms

- Column 2 contains the full names of employees, line by line. The data must fully correspond to the passport data. Distortions and typos are not allowed.

- In the third column, enter the employee’s SNILS number.

- Column 4 shows the birth years of all members of the peasant farm.

- Columns 5 and 6 are filled in according to the employee’s application to join the farm. The start and completion dates of the work are indicated. If a person was a member of the peasant farm throughout the year, the dates of the reporting period are entered in the fields.

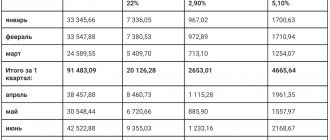

- Columns 7 and 8 show the amounts of contributions calculated for payment to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

- The “Total” line summarizes all data on the amount of deductions.

One of such documents is the calculation of accrued and paid contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund , compiled according to the RSV-2 form. The report is a form filled out in the prescribed manner, containing information about the enterprise, calculation of contributions to the Pension Fund of the Russian Federation and transfers to the Federal Compulsory Medical Insurance Fund. Certified by the signature of the head and the seal of the organization.

RSV 2 form for 2021 for peasant farms

At the same time, the list of required documentation may have certain differences depending on the type of economic activity of the subject. ContentsForm RSV-2 - designed to record deducted and paid fees for compulsory insurance in the Pension Fund, as well as for medical insurance in the Federal Fund. It is intended for reporting by heads of peasant farms. -farms and is a form certified by their signature and the seal of the enterprise, including calculation formulas and required information. Important: with the advent of the new form, changes have occurred in the list of persons authorized to form it, the date of submission and the version of its preparation. When applied new form of calculation of RSV-2 PFR - watch in this video: Calculation of the new form

For the reporting periods, the first quarter, half a year, nine months of the calendar year, the place of presentation code “120” is indicated in the calculation. In this case, section 1 with appendices and section 3 (with identification of individuals) for hired workers are filled out, and for the year in the Calculation, the code of the place of presentation “124” is indicated and section 1 with appendices, section 3 (with identification of individuals) is filled out for hired workers , as well as section 2 and appendix 1 (with identification of individuals) - for members of peasant farms, including the head.

Reports for peasant farms without employees and deadlines for 2019

- within 5 days after the end of the month when income under the OSN was received for the first time;

- when income increases or decreases by 50% or more compared to that reflected in the previously submitted 3-NDFL declaration or form 4-NDFL.

Thus, in accordance with Rosstat order No. 263 dated 06/09/2015, all individual entrepreneurs were required to submit reports to the department in Form No. 1-entrepreneur by 04/01/2016. This order was issued in accordance with the provisions of paragraph 2 of Art. 5

RSV for peasant farms for 2021

- make payments to employees, then they submit the DAM to the tax authority at the place of registration, within the time limits established for payers-employers - no later than the 30th day of the month following the billing (reporting period), then for the reporting periods the first quarter, half a year , nine months of the calendar year, the place of presentation code “120” is indicated in the Calculation, while section 1 with appendices and section 3 (with identification of individuals) for hired workers are filled out, and for the billing period of the calendar year the place of presentation code “124” is indicated in the Calculation, in this case, section 1 with appendices is filled out, section 3 (with identification of individuals) for hired workers, as well as section 2 and appendix 1 to section 2 (with identification of individuals) - for members of peasant farms, including the head.

- the amount of insurance contributions for pension and health insurance as a whole for a peasant (farm) farm is determined as the product of a fixed contribution by the number of members in the peasant farm, including the head.

Section 3: personalized information about each employee

This section is intended to reflect individuals who receive income subject to insurance premiums. Additional sections allow you to correctly distribute all the information. Let's look at them in more detail.

Start of sheet 3

On line 010 of the initial calculation of insurance premiums for the 1st quarter of 2021, enter “0–”. If you adjust data for the 1st quarter, then in the updated calculation you will need to indicate the adjustment number (for example, “1–”, “2–”, etc.).

In field 020 of sheet 3, show the code of the billing (reporting) period. The first quarter corresponds to the code “21”. In field 030, indicate the year for the billing (reporting) period of which information is being provided – “2017”.

In field 040, reflect the serial number of the information. And in field 050 - the date of presentation. Here's an example:

Subsection 3.1: who received the income

In subsection 3.1 of the calculation, indicate the personal data of the employee to whom the organization or individual entrepreneur issued payments or rewards. The explanation of filling out the lines and a sample are given below:

| Lines of subsection 3.1 Filling | Filling |

| 060 | TIN |

| 070 | SNILS |

| 080, 090 and 100 | Full name |

| 110 | Date of Birth |

| 120 | Code of the country of which the individual is a citizen |

| 130 | Gender code: “1” – male, “2” – female |

| 140 | Identity document type code |

| 150 | Details of the identity document (for example, passport series and number) |

| 160, 170 and 180 | Sign of an insured person in the system of compulsory pension, medical and social insurance: “1” – is an insured person, “2” – is not an insured person |

Subsection 3.2: payments and pension contributions

Subsection 3.2 as part of the calculation must contain information:

- on payments in favor of individuals (for example, employees);

- on accrued insurance contributions for compulsory pension insurance.

In this subsection, you will be faced with the need to fill out the columns of subsection 3.2.1, indicated in the table:

| Subsection graphs | 3.2.1 Filling |

| 190 | The serial number of the month in the calendar year (“01”, “02”, “03”, “04”, “05”, etc.) for the first, second and third month of the last three months of the billing (reporting) period, respectively. That is, in calculations for the 1st quarter of 2021, you need to show: 01, 02 and 03 (January, February and March). |

| 200 | Code of the category of the insured person (from Appendix 8 to the Procedure for filling out the calculation of insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551). The code for employees under employment contracts is HP. |

| 210 | The amount of payments to employees for January, February and March 2017. |

| 220 | The base for calculating pension contributions not exceeding the maximum value is 876,000 rubles. |

| 230 | Amount of payments under civil contracts. |

| 340 | Amount of insurance premiums |

| 250 | The total amount of payments in favor of the employee, not exceeding the maximum value, is 876,000 rubles. |

Also included in subsection 3.2 is another subsection 3.2.2. It needs to record payments from which pension contributions are calculated at additional rates. This subsection might look like this:

RSV form for the 3rd quarter of 2021: new or old form

The main argument in favor of abolishing fines and penalties for late payment of insurance premiums was that insurance premiums, which must be paid monthly, act as advance payments. But according to the law, the policyholder is obliged to pay all insurance payments for a year. If advance payments are not made on time, penalties and interest will not be charged. In this regard, the Supreme Court determined that there is no violation of the law in case of late payment of fees. Consequently, policyholders cannot be held liable. The final date for payment of all contributions is the last day of the billing year. This means that contributions calculated in full for 2021 must be paid by December 31, 2019.

We recommend reading: Http Dgi Mos Ru Housing Regcitizensinfo Poryadkovyy Nomer V Ocheredi

In general, the report is filled out with a cumulative total from the beginning of the year, so it is more correct to say “calculation of insurance premiums for nine months.” Information for the third quarter only will be presented in section 3 of the report.

Results

The unified calculation of insurance premiums for 2020-2021 only seems voluminous. In fact, the majority of policyholders do not fill out some of the sheets. The new DAM has its own nuances of filling out and requires careful attention to the reliability of the data included in it. If you are late in filing, the minimum fine will be 1,000 rubles.

Read about how to clarify the ERSV here.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

RSV: due dates in 2021, new table

DAM (calculation of insurance premiums) is the tax reporting of companies and entrepreneurs on the amounts of remuneration to individuals subject to contributions to compulsory health insurance, compulsory medical insurance and compulsory social insurance for sick leave and maternity leave. The DAM form also reflects information on the accrued amounts of mandatory payments and the amount of transfers to the budget.

According to the DAM, the deadlines for delivery in 2021 are the same - no later than the 30th day of the month following the end of each period - 1st quarter, half-year, 9 months and full year. These dates do not coincide with the deadlines for transferring payments. Unlike reports, which are submitted quarterly, companies and entrepreneurs have to make payments monthly, by the 15th day of the next month.

Payment of contributions in an incomplete calendar period

When conducting activities during an incomplete period after registration or in the year of exclusion from the register, the amount of contributions is determined based on the months and days of the incomplete period.

Example of calculation for a partially worked year

The peasant farm was registered as an individual entrepreneur on September 26, 2017. In the year of opening, the farm consisted of a head; there were no other members or hired workers. During the reporting period, the peasant farm must pay contributions:

- For OPS for October-December 2021: C1 = 23,400 / 12 x 3 = 5,850 rubles;

- For OPS for September 2021: C2 = 23,400 / 12 / 30 x 5 = 325 rubles;

- For compulsory medical insurance for October-December 2021: C3 = 4,590 / 12 x 3 = 1,147.5 rubles;

- For compulsory medical insurance for September 2021: C4 = 4,590 / 12 / 30 x 5 = 63.75 rubles.

The amount of fixed contributions changes annually. The amount of contributions is not reflected in changes in amounts accepted during the year. When the minimum wage amount increases, the amount of the fixed contribution from the beginning of the year does not change. The new minimum wage will be valid for calculations only from January next year.

How can the head of a peasant farm report on contributions for 2017?

If a peasant farm makes payments to employees, the DAM is submitted to the tax office at the place of registration no later than the 30th day of the month following the reporting period (first quarter, half year, nine months of the calendar year). In the calculation, the code for the place of presentation “ 120 ” is indicated, and section 1 with attachments and section 3 (with identification of individuals) for hired workers are filled out.

In accordance with Article 419 of the Tax Code of the Russian Federation, if the payer of insurance premiums simultaneously belongs to several categories of payers of insurance premiums, he calculates and pays insurance premiums for each basis.

Taxes and contributions paid by peasant farms

If a peasant farm has been registered as a legal entity, it can use in its activities:

- Unified Agricultural Sciences;

- OSN;

- USN.

This is clearly regulated by the Tax Code of the Russian Federation.

So, if the taxation system is classical, then you need to pay:

- If you own taxable objects, then property tax;

- Land tax, if there are objects subject to taxation;

- Transport tax (if any);

- VAT;

- Personal income tax, if more than 5 years have passed since registration.

There are no specific points when using “simplified”. Everything is calculated according to the general scheme.

If you use the unified agricultural tax, make payments in the standard manner.

In a situation where the peasant farm was not registered as a legal entity, this means that the head of the peasant farm is an entrepreneur. Then in his activities he can apply similar taxation systems.

RSV for peasant farms for 2021

But you not only need to submit a report, you need to draw it up correctly. How is RSV-2 issued in 2021? RSV-2 is sent to the Pension Fund as a settlement document for accrued and paid pension contributions and payments for compulsory health insurance.

This report belongs to the list of mandatory reporting and failure to submit it leads to the application of penalties. For late submission of the report, a fine of five percent of the amount of contributions accrued for the last three months of the billing period is assessed. Moreover, every month of delay is taken into account, including incomplete ones.

Liability for failure to provide

If the calculation is not provided on time, the violator will be charged a fine of 5% of the total amount of insurance premiums for the last 3 months of the calculation period.

But we note that when the fine is calculated, the amount of those contributions that you transferred on time will be removed from the calculation. It is also important that the amount of the fine cannot be less than 1000 rubles, but not more than 30% of the contribution amount.

Example. If you did not transfer all the required contributions for 2021 on time, then you will pay a fine for being late in the amount of 1000 rubles. If only part is paid on time, then be prepared to pay the difference between the amount that you reflected in the calculation and the amount that has already been transferred to the budget.

Deadlines for submitting calculations for insurance premiums in 2021: a single table

- in section 1 “Summary data on the obligations of the payer of insurance premiums” of the calculation, a new field “Type of payer (code)” appears;

- subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations to section 1” in the new form became Appendix 1.1;

- in Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to section 1” below the field “Number of insured persons, total (persons)” a new field “Number of individuals from whose payments are calculated insurance premiums, total (persons)”;

- in section 3 “Personalized information about insured persons”, the “Adjustment number” field has been renamed to “Indicator of cancellation of information about the insured person”.

The calculation of insurance premiums must be submitted no later than the 30th day of the month following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation). If the date falls on a weekend or non-working holiday, then the due date is postponed to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Zero reporting on contributions

Submitting calculations for insurance premiums is the responsibility of policyholders who pay income to individuals (clause 7 of Article 431 of the Tax Code of the Russian Federation), an exemption from which is not provided for by law.

In this regard, during periods of inactivity and non-payment of wages to employees, insurance premium payments will still have to be submitted. They will be issued according to the rules of zero reporting:

- in the amount of required sheets;

- with reflection of data about the policyholder and the necessary codes (report period, Federal Tax Service, OKTMO, KBK);

- with affixing the number 0 or a dash in the fields intended for data on accrued contributions.

Read more about the rules for registering zero payments for contributions in this material .

Failure to submit a zero calculation for contributions will be the basis for charging the policyholder a fine in the amount of 1000 rubles. (clause 1 of article 119 of the Tax Code of the Russian Federation). Read more about the fine related to failure to submit an insurance premium report here .

Important! In case of failure to submit the ERSV (both zero and completed) within 10 days after the due date, the tax authorities will block the company’s current accounts. We talked about this in more detail here.

Filing zero reporting on insurance premiums will serve as a source of information for the Federal Tax Service that:

- due to non-accrual of payments to individuals, the policyholder has no grounds for charging contributions;

- he is not one of the policyholders who calculated payments and contributions, but did not submit the calculation on time.

Features of the presentation of the DAM by heads of peasant farms

- 83 – 1st quarter upon deregistration, as an individual entrepreneur (head of a peasant (farm) enterprise);

- 84 – half a year when deregistered as an individual entrepreneur (head of a peasant (farm) enterprise);

- 85 – 9 months upon deregistration, as an individual entrepreneur (head of a peasant (farm) enterprise);

- 86 – year when deregistered as an individual entrepreneur (head of a peasant (farm) enterprise).

- do not hire employees, then they submit a calculation of insurance premiums to the tax authority at the place of registration before January 30 of the calendar year following the expired billing period, indicating the code of the place of submission “124”. In this case, Section 2 and Appendix 1 (with identification of individuals) are filled out for members of the peasant farm, including the head.

- make payments to employees, then the DAM is submitted to the tax authority at the place of registration no later than the 30th day of the month following the billing (reporting period). For the reporting periods, the first quarter, half a year, nine months of the calendar year, the place of presentation code “120” is indicated in the calculation. In this case, section 1 with appendices and section 3 (with identification of individuals) for hired workers are filled out, and for the year in the Calculation, the code of the place of presentation “124” is indicated and section 1 with appendices, section 3 (with identification of individuals) is filled out for hired workers , as well as section 2 and appendix 1 (with identification of individuals) - for members of peasant farms, including the head.

We recommend reading: How to Get Money from the Tax Office When Buying an Apartment

When to submit and how to fill out the DAM for heads of peasant farms

Payments and other remunerations made by peasant farms in favor of individuals hired by the head of the peasant farm to work on a farm, within the framework of labor relations, on the basis of Article 420 of the Tax Code of the Russian Federation, are subject to insurance contributions in the generally established manner and such payers have an obligation to submit the DAM.

- do not hire employees, then they submit the DAM to the tax authority at the place of registration before January 30 of the calendar year following the expired billing period, indicating the code of the place of presentation “124”, while Section 2 and Appendix 1 to Section 2 are completed (with identification individuals) - for members of peasant farms, including the head.

RSV for 2021 for peasant farms

The BukhSoft program automatically fills out a new form of the Calculation form with the following rules: 1. Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation, insurance contributions for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds by payers insurance premiums that do not make payments and other remuneration to individuals (hereinafter referred to as the Calculation) are submitted by the payers named in paragraph 2 of part 1 of article 5 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation” Federation, Social Insurance Fund, Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds" (hereinafter referred to as Law No. 212-FZ) at the place of registration with the territorial bodies of the Pension Fund of the Russian Federation (hereinafter referred to as the PFR) within the following periods:

Moreover, if the heads of peasant farms, both with and without members of the peasant farm: do not hire workers, then they submit to the tax authority at the place of registration before January 30 of the calendar year following the expired billing period, indicating the code of the place of presentation “124”.

Payment of contributions on income exceeding 300 thousand rubles

The conduct of peasant farm activities must have a certain direction. The list of activities is defined in clause 1 of Article 1 of the Federal Law No. 74-FZ dated June 11, 2003. Peasant farms are not prohibited from conducting activities other than the listed types, but the main focus should be on agricultural production. If the activity complies with the rules specified in the Federal Law, the head of the peasant farm must pay only fixed amounts of payments for members without taking into account the amount of income and without paying an additional amount of 1%, paid when the income exceeds 300 thousand rubles. In this case, the chosen taxation system or their combination does not matter (

RSV for 2021 for peasant farms

The changes affected the fact that information on insurance premiums, which previously belonged to different funds and was provided by different reports (RSV-1 and 4-FSS), is now grouped into the ERSV 2021. Only insurance premiums “for injuries” are excluded.

In the calculation, the code of the place of presentation “120” is indicated, while section 1 with attachments and section 3 (with identification of individuals) for hired workers are filled out. For the billing period “calendar year”, the calculation indicates the place of presentation code “124”, while section 1 with appendices is filled out, section 3 (with identification of individuals) - for employees, as well as section 2 and appendix 1 to section 2 (with identification of individuals) - for members of peasant farms, including the head of the farm.

Deadlines for submitting calculations for insurance premiums for the 1st quarter of 2021

- Minimum – 1000 rub. from the organization.

- 5% of the unpaid amount of contributions due according to the unsubmitted report for all calendar months of delay.

- Maximum – 30% of the unpaid amount of contributions due according to the unsubmitted report.

The format for submitting the report is determined depending on the number of personnel (clause 10 of Article 431 of the Tax Code). If the indicator is 25 people or less, the DAM can be provided both “on paper” and in electronic form. If there are more than 25 employees, reporting is submitted only electronically. The submission deadline does not change depending on the method of submission.

Insurance premiums for peasant farm participants

Contributions for insurance are paid by the head of the peasant farm. The farm uses the labor of farm members and hired workers. In the first case, the calculation and payment of fixed contributions is made for each member of the peasant farm depending on the size of the minimum wage; in the second case, deductions for insurance are made in the standard manner by applying rates to the amount of income.

A peculiarity of paying contributions to peasant farms is the likelihood of employees being classified in both categories. If a member of the household is also an entrepreneur, he or she must independently pay fixed contributions as an individual entrepreneur and deductions by the heads of the household as for a member of the peasant farm .

Fines and liability for late submission of RSV-1 in 2021

The insured, which can be either an organization or a private entrepreneur, may be held accountable by regulatory authorities. In such cases, fines may be assessed if the reporting was not provided at all or if the document was submitted with a significant missed deadline.

The first two sections and the title page must be completed. This requirement is established by the norms specified in paragraph No. 3 of the established procedure for filling out the calculation. The remaining sections of the documentation under review are included in the final reports only when necessary.