It is very important to issue an invoice correctly and without errors. After all, it depends on whether the buyer will be able to deduct the VAT allocated in such a document. Here you will find detailed recommendations on how to fill out each column of the invoice in a given situation.

All the advice here is general - both in case of shipment and in case of advance payment. For information on what else to consider when receiving an advance payment, read: How to draw up and register an invoice for an advance payment.

We also remind you that from January 1, 2013, instead of an invoice, you can issue a universal transfer document (UDD). This document, like an invoice, can be the basis for a deduction from the buyer. Read more about this document in the recommendation: How to draw up a UPD (UCD).

In what ways and in what form to issue an invoice?

An invoice must be issued every time you sell goods, work, services or property rights. This can be done in one of two ways - on paper or electronically.

The first method is the generally accepted standard. The paper form of the invoice and the rules for filling it out are approved in Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. In this case, the invoice can be filled out:

- using a computer;

- by hand;

- combined (partly using a computer, partly by hand).

If necessary, additional details can be entered into this form (letter of the Federal Tax Service of Russia dated July 18, 2012 No. ED-4-3/11915). To do this, add new lines (columns) to the invoice. The Russian Ministry of Finance recommends placing them after the signatures of the manager and chief accountant (letter dated November 24, 2015 No. 03-07-09/68169).

The second method, electronic, is used less so far. To transmit an invoice to the buyer electronically, you need to obtain his consent. In addition, your and your counterparty’s means of receiving, exchanging and processing invoices electronically must be compatible. They must comply with established formats and procedures. This is stated in paragraph 2 of paragraph 1 of Article 169 of the Tax Code of the Russian Federation.

Invoices are issued and received electronically in the manner approved by Order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n. Electronic formats of invoices were approved by orders of the Federal Tax Service of Russia dated March 24, 2021 No. ММВ-7-15/155 and dated March 4, 2015 No. ММВ-7-6/93. Until July 1, 2021, both formats operate in parallel. That is, during the period from May 7, 2021 to June 30, 2021, you can issue (compile) invoices in any of these formats. From July 1, 2021, it is prohibited to use the old electronic format in relations with counterparties. This procedure is established by paragraphs 2 and 3 of the order of the Federal Tax Service of Russia dated March 24, 2021 No. ММВ-7-15/155.

Situation: is it possible to issue one invoice for several contract agreements addressed to one customer?

Yes, you can. But provided that the certificates of completion of work under all contracts are signed on the same day or on different days, but within five days.

Current legislation does not prohibit issuing one invoice for several acts of work performed and even under different contracts (letter of the Ministry of Finance of Russia dated November 10, 2015 No. 03-07-09/64493). However, the invoice must be issued within five calendar days after the completion of the work (rendering of services). This is the requirement of paragraph 3 of Article 168 of the Tax Code of the Russian Federation. Therefore, the invoice can only include the cost of those works that were completed no earlier than five calendar days before the invoice is issued. That is, certificates of work performed (services rendered) under all contracts must be signed either on the same day or on different days, but within five days.

For example, acts of acceptance of completed work are signed:

- under agreement No. 1 - July 6;

- according to agreement No. 2 - July 10.

On July 10, the contractor issued one invoice for the cost of work performed under both contracts. The deadline established for issuing an invoice under agreement No. 1 had not expired by July 10.

Another situation. Acceptance certificates for completed work were signed by:

- under agreement No. 1 - July 6;

- according to agreement No. 2 - July 14.

In this case, it is impossible to include the cost of work performed under different contracts in one invoice. By July 14, the period allotted for issuing an invoice under contract No. 1 had expired.

What invoice details are required to be filled in?

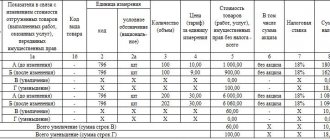

Here is a complete list of details that must be filled in in the invoice for goods shipped, services provided, work performed or property rights transferred:

- serial number and date of compilation;

- name, address and identification numbers of the seller and buyer or contractor and customer;

- name and address of the shipper and consignee - only for shipped goods;

- number of the payment order or other payment and settlement document - if payment took place before shipment or on the same day;

- the name of the goods shipped or a description of the work performed, services provided and property rights transferred, their units of measurement, when they can be determined;

- the quantity of goods shipped or the volume of work performed and services provided in the specified units of measurement, when they can be determined;

- name of currency;

- price per unit of measurement, if possible, under the contract excluding tax. In case of application of state regulated prices - taking into account the amount of tax;

- the cost of goods shipped, work performed, services provided, transferred property rights without tax;

- the amount of excise duty on excisable goods;

- tax rate;

- the amount of tax based on current tax rates;

- the cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, taking into account the amount of tax;

- country of origin of the goods - only for imported goods;

- customs declaration number – only for imported goods.

This follows from the provisions of paragraphs 5 and 6 of Article 169 of the Tax Code of the Russian Federation.

Start filling out the invoice with the serial number and date of preparation.

Invoice number and date it was issued

Please indicate the number and date of the invoice on line 1.

You can number invoices in the order that is convenient for you. Write it down in your accounting policy. This is usually a simple numbering in ascending order from the beginning of each calendar year. But another procedure may be provided. The main thing is that the numbering is increasing and continuous.

The law does not provide for the ability to resume the numbering of invoices from the first serial number. However, from the letter of the Ministry of Finance of Russia dated October 11, 2013 No. 03-07-09/42466, we can conclude that deviation from the established procedure is not an error due to which the buyer may be deprived of the right to a tax deduction. The main thing is not to violate the chronology (subparagraph “a”, paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Advice: if an organization has violated the numbering of invoices, then such an error does not need to be corrected. This violation is not grounds for refusal to deduct VAT.

The main thing is that the rest of the invoice is drawn up correctly. And so that the invoice with the “wrong” number is indicated in section 9 of the VAT return with the same number.

An error in the invoice number does not prevent you from determining:

- seller and buyer or performer and customer;

- name and cost of goods sold, work performed, services provided, property rights transferred;

- tax rate and VAT amount charged to the buyer.

And if so, then tax inspectors do not have the right to refuse the buyer to deduct VAT on such an invoice.

This follows from paragraph 2 of paragraph 2 of Article 169 of the Tax Code of the Russian Federation.

An invoice is issued within five calendar days from the date of shipment of goods, provision of services, performance of work or transfer of property rights. Using this rule, write the date on line 1.

This follows from the provisions of subparagraph “a” of paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 and paragraph 3 of Article 168 of the Tax Code of the Russian Federation.

Situation: how to number invoices if products are shipped both from the head office and from separate divisions of the organization?

Number invoices in ascending order. To the invoice numbers of a separate division, add the index of this division.

To do this, add a separating line “/” to the invoice serial number and enter the digital index of the separate division. The digital index is approved in the order on accounting policies. This will allow you to determine which division of the organization issued the invoice. This procedure follows from paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 and letter of the Ministry of Finance of Russia dated October 11, 2013 No. 03-07-09/42466.

It is not necessary to maintain separate books of purchases and sales for separate divisions. It is enough to register the invoices in the appropriate books of the parent organization. The same applies to intermediary organizations, which must maintain invoice logs. Invoices issued (received) by separate divisions as part of intermediary activities can be recorded by the organization in its accounting journal. This conclusion follows from the letter of the Ministry of Finance of Russia dated March 24, 2015 No. 03-07-11/16050.

Common Mistakes

One of the typical mistakes when filling out invoices is the situation when, when issuing a document relating to the delivery of goods and provision, both the “Consignee” and “Consignee” are forgotten to fill out. In this case, the Federal Tax Service Inspectorate, having examined the document, may declare that all details are not indicated - and, accordingly, there will be no tax deduction.

Another, smaller error is the incorrectly specified name of one of the parties. The rules require that names be written in the same way as in the statutory documents. However, if the error is minor and allows the party to be identified, a deduction will be granted .

Finally, it is an equally minor mistake to leave a blank line instead of a dash if the other details are filled out correctly. But the absence of a full address according to the Unified State Register of Legal Entities is a significant error, which may become a reason for refusal to deduct.

Seller information

In line 2 “Seller”, write down the full or abbreviated name of your organization according to the constituent documents. In line 2a “Address”, indicate the information that is specified in your constituent documents. In line 2b, enter the TIN and KPP of the seller, that is, your organization.

This procedure is provided for in subparagraphs “c”–“e” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The procedure for filling out these lines by tax agents has some peculiarities.

Situation: which checkpoint should be indicated in the invoice if the organization is registered with the tax authorities on two grounds - with the tax inspectorate at its actual location and with the interregional inspectorate of the Federal Tax Service of Russia as the largest taxpayer?

In the invoice, please indicate the checkpoint assigned by the interregional inspectorate and indicated in the notice of registration as the largest taxpayer. The fifth and sixth digits of this checkpoint have a value of 50. This approach will simplify control over the correct application of deductions by counterparties of the largest taxpayer. Indeed, in this case, the checkpoints indicated in the invoices and VAT returns (including in section 9) will coincide.

However, even if the largest taxpayer indicates in the invoice the checkpoint assigned at the location of the organization, this will not be an error. Based on such an invoice, the buyer will be able to deduct the VAT charged to him without any problems. This is stated in the letter of the Federal Tax Service of Russia dated September 7, 2015 No. GD-4-3/15640.

What to do if the factual and legal do not coincide?

No matter how complex the structure of the enterprise, no matter how many addresses the organization has, when issuing an invoice, you should be guided by the requirement to enter in lines 2a and 6a legal addresses that coincide with those indicated in the extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

At the same time, the legislation allows the introduction of additional lines and details into the accepted forms of documents (Resolution of the State Statistics Committee of Russia dated March 24, 1999 No. 20).

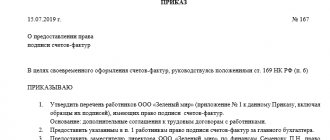

Changes made to the forms of primary documents must be approved by order of the enterprise.

Shipper and consignee

Fill in lines 3 “Consignor and his address” and 4 “Consignee and his address” only when selling goods.

If your organization is both a seller and a shipper, then write “aka” on line 3. If you indicate all the data - full or abbreviated name, postal address, then this will not be a violation (letter of the Ministry of Finance of Russia dated September 1, 2009 No. 03-07-09/44).

If the buyer independently exports the goods sold to him, in line 3 of the invoice, indicate the same name of the shipper, which is reflected in the consignment note (letter of the Ministry of Finance of Russia dated September 15, 2014 No. 03-07-RZ/46026). Most often this will be the seller himself or the carrier company. In any case, as experts from the Russian Ministry of Finance note, an error in the name of the consignor cannot be the reason for the buyer’s refusal to deduct input VAT (clause 5 of Article 169 of the Tax Code of the Russian Federation).

In line 4 “Consignee and his address” indicate the full or abbreviated name of the consignee in accordance with the constituent documents and his postal address. This procedure applies regardless of whether the consignee and the buyer are the same person or not.

When preparing invoices for work performed or services provided, put dashes in lines 3 and 4.

This is stated in subparagraphs “f” and “g” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: is it possible to write “the same person” in the invoice on line 4 “Consignee and his address” if the buyer and the consignee are the same person?

No you can not.

This is not provided for by the rules. It only says that in line 4 you need to write the full or abbreviated name of the consignee according to the constituent documents and his postal address.

Only in relation to the shipper is the opportunity to write “he” specifically provided. But for the consignee, no. Therefore, so that the buyer does not have problems with the deduction, fill out line 4 “Consignee and his address” strictly according to the established rules.

All this is provided for by subparagraphs “g” and “i” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. This is also indicated in the letters of the Ministry of Finance of Russia dated July 21, 2008 No. 03-07-09/ 21 and the Ministry of Taxes of Russia dated February 26, 2004 No. 03-1-08/525/18.

Situation: Do I need to indicate the postal code of the shipper and consignee on the invoice?

Yes need.

After all, the postal code is an integral part of the address. Therefore, be sure to indicate it on the invoice. Otherwise, during an audit, tax inspectors may declare that the invoice does not contain all the required details. This will be grounds for refusing to deduct input VAT to the buyer. This conclusion follows from paragraph 2 of Article 169 of the Tax Code of the Russian Federation and Article 2 of Law No. 176-FZ of July 17, 1999. Similar explanations are contained in the letter of the Federal Tax Service of Russia for Moscow dated February 17, 2015 No. 16-15/013654.

Situation: how to indicate information about the buyer and consignee on the invoice if the products are shipped to the location of a separate division of the purchasing organization?

If you ship products to a separate division, still issue an invoice in the name of the purchasing organization itself. However, in line 4 “Consignee and his address” and the buyer’s checkpoint, indicate the details of the separate division.

This follows directly from the rules. Thus, in lines 6 “Buyer”, 6a “Address” and TIN of the buyer indicate the information of the purchasing organization. A separate division of Russian companies is not a separate organization. Therefore, fill out this information based on the constituent documents of the purchasing organization.

But for line 4 “Consignee and his address” and the buyer’s checkpoint, it is possible to indicate information about a separate consignee unit.

All these rules are spelled out in subparagraph “g” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, and this is also indicated in the letter of the Ministry of Finance of Russia dated May 15, 2012 No. 03-07-09/55.

Situation: what information about the seller or shipper should be included in the invoice if the goods (work, services) are sold by a branch or separate division?

It all depends on the division of which organization - Russian or foreign - sells goods (work, services).

Russian organization

Issue invoices on behalf of the organization. This is explained by the fact that branches and other separate divisions are not separate taxpayers (Articles 11, 19 of the Tax Code of the Russian Federation).

In line 2b of the checkpoint invoice, write down the separate division, and in line 3 “Consignor and his address” - his details. Prepare invoices in the same way when performing work (rendering services). The only peculiarity is the rules for filling out line 3 “Consignor and his address”: you need to put a dash in it.

There is one exception. Invoices of departments for shipment of goods for export to the Republic of Belarus and Kazakhstan. Due to the specifics of electronic document flow between the tax authorities of the countries participating in the Customs Union, such invoices can indicate the checkpoints of the parent exporting organizations.

This procedure follows from the provisions of subparagraph “e” of paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 and letters of the Ministry of Finance of Russia dated April 3, 2012 No. 03-07-09/32, dated April 1, 2009. No. 03-07-09/15, Federal Tax Service of Russia dated July 8, 2014 No. GD-4-3/13250.

Foreign representation

If goods, works or services are sold by a representative office of a foreign organization registered in Russia, then it is recognized as an independent taxpayer. Such a unit issues invoices on its own behalf. Therefore, on lines 2, 2a and 2b of each invoice, indicate its name and address. Enter this data in accordance with the documents on the basis of which the representative office was opened and registered for tax purposes in Russia. This follows from paragraph 3 of Article 169 of the Tax Code of the Russian Federation and is confirmed in the letter of the Ministry of Finance of Russia dated April 30, 2008 No. 03-07-11/171.

Situation: how to fill out line 4 “Consignee and his address” in the invoice when selling goods if an entrepreneur receives them?

Please indicate the surname, first name, patronymic and place of residence of the individual entrepreneur or the delivery address of the goods.

In general, the legislation does not explain this situation. There are no special rules for entrepreneurs. And those that are established indicate: the information in line 4 “Consignee and his address” must be written down in accordance with the constituent documents of the recipient. However, entrepreneurs do not have constituent documents. Moreover, even registration documents do not contain all the necessary information. Thus, the postal addresses of entrepreneurs are not recorded either in the certificates of their state registration or in the tax registration certificates.

But what to do then? Take all the necessary information from the documents at your disposal. For example, from a purchase and sale agreement or an additional agreement to it. In these documents, the last name, first name, patronymic of the entrepreneur and the address of his place of residence and delivery of goods are indicated.

This approach does not contradict current legislation. The names and addresses of consignees are indicated on invoices for a specific purpose. So that tax inspectors can check the reality of the transaction, identify its participants and verify the validity of the deduction of input VAT by the buyer. Therefore, by indicating in line 4 of the invoice, for example, the address of a warehouse rented by an entrepreneur or the address of his residence, you will not violate anything.

All this follows from the provisions of paragraph 2 of paragraph 2 and subparagraph 3 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “g” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. In arbitration practice there are examples of court decisions confirming the legitimacy of such a conclusion (see, for example, the resolution of the Federal Antimonopoly Service of the East Siberian District dated January 19, 2009 No. A74-1458/08-F02-6959/08).

An example of an invoice for goods sold to an entrepreneur. Goods are shipped to the location of the warehouse rented by the entrepreneur

On June 5, Torgovaya LLC entered into a contract with entrepreneur A.A. Ivanov, an agreement for the supply of a batch of Russian-made Omega toasters. The contract price is 130,980 rubles. (including VAT – RUB 19,980). The entrepreneur is registered at the address: 117461, Moscow, Sevastopolsky Prospect, 48, apt. 256.

According to the agreement, the goods are shipped to a warehouse rented by the entrepreneur at the address: Moscow, st. Sretenskaya, 56. The goods were shipped on June 6. On the same day, the Hermes accountant issued an invoice to the entrepreneur.

Payment and settlement details

Fill in line 5 “To the payment and settlement document” when selling against a previously received prepayment. On line 5 indicate:

- number and date of the payment and settlement document (documents) of the buyer to whom the advance was transferred - full or partial prepayment;

- number and date of the cash receipt - for cash sales.

In line 5 put a dash:

- if there was no prepayment (subclause 4, clause 5, article 169 of the Tax Code of the Russian Federation);

- if the advance was transferred on the day of shipment of goods, performance of work, provision of services or transfer of property rights (letter of the Ministry of Finance of Russia dated March 30, 2009 No. 03-07-09/14);

- receiving an advance in kind.

This is stated in subparagraph “h” of paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Long payment document numbers in line 5 can be shortened. This would not be a mistake; on the contrary, such an approach is acceptable. For example, if the payment order number consists of more than three digits (say, 125478), only the last three digits (478) can be shown on the invoice. This is enough to correctly identify the payment and apply the VAT deduction. Such clarifications are in the letter of the Ministry of Finance of Russia dated September 19, 2014 No. 03-07-09/46986.

The procedure for filling out line 5 of the invoice by tax agents has some peculiarities.

Situation: is it possible to indicate in line 5 of the invoice, instead of the details of the cash receipt, the details of the receipt for the cash receipt order? An invoice is issued after the goods have been shipped.

No you can not.

After all, a deduction can be obtained only if you have a cash receipt, regardless of the presence of a receipt for the cash receipt order. A receipt is not a payment document. Therefore, on line 5 of the invoice, indicate the number and date of the cash receipt. If this condition is not met, during the inspection the tax inspectors will refuse to deduct VAT on such an invoice. This follows from paragraph 2 of Article 169 of the Tax Code of the Russian Federation. There are similar conclusions in letters of the Ministry of Finance of Russia dated April 24, 2006 No. 03-04-09/07 and dated October 4, 2005 No. 03-04-04/03.

Situation: how to correctly fill out line 5 of the shipment invoice if the advance payment for delivery was transferred in parts (several payment orders)?

On line 5 of the invoice, indicate the details (numbers and dates) of all payment orders.

This conclusion allows us to draw subparagraph 4 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation. A similar point of view is expressed in the letter of the Ministry of Finance of Russia dated March 28, 2007 No. 03-02-07/1-140.

If representatives of one party to the transaction are different organizations

Situations are possible when one person acts as a supplier, but the cargo is actually sent from the warehouse of another. This occurs, in particular, during transit deliveries, when the goods are sent to the recipient without registration at the warehouse of the intermediary seller. In this case, in fact, there are not two, but three parties involved in the transaction :

- supplier (seller);

- sender of the cargo;

- buyer-consignee.

In the event that the shipper and the seller do not coincide with each other, this fact must be reflected in the invoice indicating the name, address and details of each of them. Lack of data may result in the tax deduction not being provided.

IMPORTANT : Transactions are also possible where the buyer and consignee do not match. In this case, complete data must also be provided for each of them.

Now you know what to do in situations where the seller and the shipper are different legal entities. The same applies to cases where the buyer and consignee are different organizations.

In the materials of our specialists you can find out many interesting details about the invoice. Read about what codes are in an invoice, how to indicate transaction codes and various quantities in a document, why and in what cases an order is needed to sign invoices, how to fill out the “country code” column, and also what a customs declaration or number is customs declaration.

Buyer information

In line 6 “Buyer”, write down the full or abbreviated name of the buyer. In line 6a “Address” – the address of the buyer. Indicate the name and address of the buyer in the same way as in its constituent documents. In line 6b, indicate the buyer’s tax identification number and checkpoint.

If you are selling something to a separate division of a client, then in line 6b “TIN/KPP of the buyer” put down its KPP, not the head unit. The TIN will be common for the organization (letter of the Ministry of Finance of Russia dated September 1, 2009 No. 03-07-09/43).

This is stated in subparagraphs “i”–“l” of paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: who should the buyer indicate on the invoice if the goods are shipped to one organization and paid for by another?

The buyer should indicate in the invoice the organization with which the contract for the supply of goods was concluded.

Indeed, in such situations, the payer does not become the owner of the goods. He only fulfills the agreement with the buyer. And the seller who received payment from a third party does not have any obligations to it. Therefore, issue the invoice and delivery note in the name of the buyer in accordance with the contract. In the invoice, reflect the information specified in the constituent documents:

- in line 6 “Buyer” – full or abbreviated name;

- in line 6a “Address” – the address of its location (legal address);

- in line 6b “TIN/KPP of the buyer” - identifying numbers assigned to him.

This follows from the provisions of subparagraphs “g” and “i”–“l” of paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, as well as Article 313 of the Civil Code of the Russian Federation.

How to enter information?

The following elements are required to be completed:

- post office index;

- name and type of subject of the Russian Federation;

- name of the locality;

- Street;

- House number;

- structure;

- frame.

Grammatical and spelling errors are allowed, which make it possible to unambiguously correctly evaluate the information received, for example:

- the postal code appears at the end of the address line;

- an error in writing the abbreviation - not “Krasnova street”, but “Krasnova street”;

- the presence of commas between the names and numbers of the house and office;

- capital letters instead of caps.

What does a correctly completed column look like?

A correctly completed column looks like this:

- 185000, REPUBLIC OF KARELIA, CITY OF PETROZAVODSK, KOROMYSLOVAYA STREET, 15, 8.

- 198231, CITY OF SAINT PETERSBURG, ORDZHONIKIDZE STREET, BUILDING 16, LETTER B, OFFICE 87.

- 653023, ALTAI REGION, CITY BARNAUL, STREET IVAN BRONEVOY, 12 D.

The following photo shows an example of filling out address lines in an invoice:

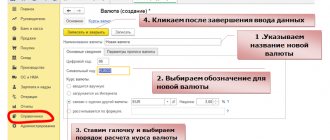

Currency information

In line 7, indicate the digital code and name of the currency according to the All-Russian Currency Classifier OK (MK (ISO 4217) 003-97) 014-2000. This must be done also for non-cash settlements under the contract. For example, here is the information written in this line:

- “Russian ruble, 643” – if the price (tariff) is determined in Russian rubles and kopecks;

- “US dollar, 840” – if the price (tariff) is determined in US dollars and cents;

- “euro, 978” – if the price (tariff) is determined in euros and euro cents.

You can issue an invoice in a foreign currency only if both the prices and settlements under the contract are expressed in foreign currency. If prices are expressed in currency or conventional units, and calculations are carried out in rubles, then in line 7 indicate “Russian ruble, 643”.

This follows from the provisions of paragraph 7 of Article 169 of the Tax Code of the Russian Federation and subparagraph “m” of paragraph 1 of Appendix 1 to Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137.

Attention: the buyer will be denied a deduction if the incorrect code and currency name are indicated on the invoice. Tax inspectors classify this as an error. It does not allow you to correctly determine the cost of goods (works, services, property rights) and the amount of VAT claimed. This was stated in the letter of the Ministry of Finance of Russia dated March 11, 2012 No. 03-07-08/68.

Name of goods, works, services

In column 1, indicate the name of the product or a description of the work performed, services provided, and property rights. This procedure is provided for both invoices that are issued upon shipment or upon receipt of an advance payment.

This is stated in subparagraph “a” of paragraph 2 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: can the name of the trademark be written in a foreign language on the invoice? This name is also indicated in the certificate of conformity for the product.

Yes, you can. The main thing is to indicate the name of the product in Russian.

This follows from paragraph 9 of the Accounting and Reporting Regulations and is confirmed in the letter of the Federal Tax Service of Russia dated December 10, 2004 No. 03-1-08/2472/16 and Article 6 of the Convention for the Protection of Industrial Property of March 20, 1883.

For example, it would be correct to fill out column 1 of the invoice as follows: “Satellite phone PETR 1990.” In this case, all requirements regarding the correct completion of invoices will be met.

Situation: is it possible to fill out one invoice for both goods and services at the same time?

Yes, you can. In this case, write down services, works and goods in the invoice as independent items.

Indeed, for different groups: goods, works and services, quantitative and cost indicators will differ (letter of the Ministry of Finance of Russia dated May 24, 2006 No. 03-04-10/07).

In addition, be sure to complete line 3, “Consignor and his address,” and line 4, “Consignee and his address.” For services and works, they are marked with dashes. But, when at least one product is recorded in the invoice, they must be filled out - you cannot put dashes in these lines (subparagraph 3, paragraph 5, article 169 of the Tax Code of the Russian Federation, subparagraph “e”, paragraph 1 of Appendix 1 to the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Situation: is it necessary to decipher the composition of construction and installation work performed under a construction contract in column 1 “Name of goods (description of work performed, services provided), property rights" of the invoice?

If a short title of the work allows inspectors to correctly identify it, then a detailed description is not required. Next to the short name, it is enough to indicate the details of the contract or other document from which the scope of work can be determined.

A description of the work performed is a mandatory detail of the invoice (subclause 5, clause 5, article 169 of the Tax Code of the Russian Federation). However, this provision does not provide for the obligation to provide a complete transcript of the work performed. In addition, if the invoice contains any inaccuracies that do not prevent the identification of the name of the work, the tax inspectorates have no right to refuse a deduction on such an invoice. This position is confirmed by the letter of the Ministry of Finance of Russia dated May 10, 2011 No. 03-07-09/10.

So that the tax inspectorate can obtain information about what kind of work was performed, in column 1 next to the short name, indicate the details of the relevant contract. In addition, inspectors can obtain a detailed breakdown of the work performed from the estimate, the report in form No. KS-2 and a certificate of the cost of work performed in form No. KS-3. The validity of this approach is confirmed by arbitration practice (resolutions of the FAS Moscow District dated July 19, 2012 No. A41-34328/11, dated February 6, 2012 No. A40-46403/11-91-198, Volga District dated December 1, 2011 No. A65-4112/2011, West Siberian District dated October 17, 2011 No. A45-25079/2009).

If in column 1 you indicate only a short name without reference to the relevant agreement, the inspectors will most likely refuse the deduction. Indeed, in this case they will not be able to determine what work was performed.

How to fill out the lines correctly?

If it concerns the shipper. According to the rules established by the current edition of Resolution No. 1137, the lines relating to the shipper are filled in as follows :

- The full name is indicated, but an abbreviation is also allowed.

- The address is indicated according to the Unified State Register of Legal Entities.

- If he and the seller are one person, then, according to paragraphs. “e” clause 1 of section I of the resolution, in the corresponding line you can write “he”. If the sender of the goods is not the seller, but another person, the mail address of the shipper is indicated. Finally, if the invoice is issued under an agreement relating not to goods, but to services or work, nothing is written on the line - a dash is placed.

- If the document is issued by an agent acting on his own behalf, but purchasing goods from two or more sellers, in the line “Consignor” all of them are indicated, but separated by a semicolon.

Now about situations when we fill out lines about the consignee. Resolution No. 1137 establishes similar standards for the consignee :

- The name is indicated - full or abbreviated.

- The address according to the Register is indicated.

- If the invoice is for services, a dash is placed in the column concerning the recipient of the cargo. The wording “aka” is not provided for by the resolution.

- If there are two or more consignees, the names and addresses of each are indicated separated by a semicolon.