So, the enterprise has fixed assets and other property that is subject to write-off. Disposal requires additional costs, so in many companies industrial waste “temporarily” lies on the territory of the organization for many years.

At the same time, some fixed assets that no longer have a residual value, which increases property tax, remain subject to transport tax. All movable assets listed in paragraph 1 of Article 358 of the Tax Code, before they are written off from registration, will annually “lighten the pocket” of the organization in the amount of transport tax, the rates of which depend on the engine power. Thus, trash that is not used in business activities will worsen its results.

But fixed assets that are not suitable for further use can be disassembled into spare parts, turned into scrap metal, or left unchanged. And thus reduce costs. The most profitable way is to obtain materials that can later be reused in production activities or sold to someone who needs them.

Inspiration and ingenuity will help you find a use for worn-out assets. For example, parts that are still working can be removed from a decommissioned vehicle and sold or stored as spare parts. It is better to sell used tires to a tire shop. To find a buyer for junk, you can use sites with free classified ads. After the fate of outdated operating systems has been decided, you need to start documenting them.

What you need to know about written-off property:

GOST 30772-2001 “Resource conservation.

Waste management. Terms and definitions" clause 3.12 Consumer waste

- remnants of substances, materials, items, products, goods (products or articles) that have partially or completely lost their original consumer properties for use for direct or indirect purposes as a result of physical or moral wear and tear in the processes of public or personal consumption (life activity), use or operation.

1.1. The written-off property is in fact removed from circulation. Its further use is impossible due to partial or complete loss of consumer properties, or obsolescence. This is what caused the write-off. And objects and products that have lost their consumer properties are waste (GOST 30772-2001). Accordingly, an organization that generated waste as a result of write-off of property is a waste generator.

1.2. Any actions performed with waste are regulated by the Federal Law “On Production and Consumption Waste” dated June 24, 1998 No. 89-FZ (hereinafter referred to as 89-FZ). Waste management is defined by 89-FZ as the activity of collecting, accumulating, transporting, processing, recycling, neutralizing, and disposing of waste. , and such activities are subject to licensing .

Federal Law “On Amendments to the Federal Law “On Production and Consumption Waste” ...” dated December 29, 2014 No. 458-FZ

Legal entities and individual entrepreneurs carrying out activities for the collection, transportation, processing, disposal of waste of hazard classes I - IV are required to obtain a license to carry it out before July 1, 2021. After July 1, 2021, carrying out this activity without a license is not permitted.

1.3. Legal entities (as well as individual entrepreneurs), in the course of their activities, waste of hazard classes I - V are generated, are obliged to draw up and approve the corresponding waste passports, and in the absence of a type of waste in the Federal Classification Catalog of Waste (hereinafter referred to as FKKO), are obliged to classify the corresponding waste to a specific hazard class.

(Article 14 89-FZ and paragraphs 7 and 10 of the Rules for certification of waste of I - IV hazard classes, approved by Decree of the Government of the Russian Federation of August 16, 2013 No. 712)

1.4. Temporary storage of waste until it is transferred to an organization engaged in collection, transportation, processing, disposal, neutralization and disposal is called “waste accumulation” and is also regulated by 89-FZ and is called waste accumulation. The maximum period for waste accumulation is 11 months.

Reuse

As the proverb says: “Everything is useful on the farm.” Indeed, materials from dismantling old property can form the cost of new property, in other words, they are used in production.

When materials are released from warehouses to production, they are written off from material assets and credited to the appropriate cost accounts, and for management needs they are taken into account in expenses. In this case, the price of materials at which they were accepted into the warehouse is reflected in the cost of the finished product received, or increases the amount of fixed assets produced with their participation.

For example, when liquidating an obsolete operating system, materials with a total market value of 10,000 rubles were taken into account. The indicated reserves were used in full:

- When repairing another fixed asset by a repair team;

- When reconstructing (creating) another fixed asset;

- In the production of finished products;

- For general business needs.

In the accounting department of the organization, in each case, various entries will be made on the accounting accounts:

Debit 23 Credit 10 - material expenses for repairs are reflected; Debit 08 Credit 10 – materials for the reconstruction of the operating system were written off; Debit 20 Credit 10 – materials used for production; Debit 26 Credit 10 – materials are included in general business expenses.

In tax accounting, property obtained as a result of dismantling or disassembling fixed assets decommissioned is recognized as inventory. Such goods are included in material costs. In this case, the amount of costs is equal to the amount previously included in non-operating income (clause 2 of Article 254 of the Tax Code).

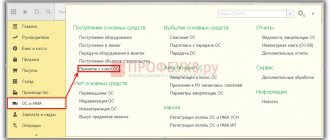

Procedure for writing off property.

2.1. After generating a list of property to be written off, it should be examined by a full-time ecologist, a person acting as an ecologist, or an ecologist of an organization providing environmental support services. An ecologist should:

- — determine what types of waste will be generated as a result

- — make sure that your institution (enterprise) has the appropriate waste passports

- — if the institution (enterprise) does not have the necessary waste passports, it is necessary to develop these passports and send them by notification to the Department of Rosprirodnadzor for the Northwestern Federal District (hereinafter referred to as Rosprirodnadzor).

Important!

If the FKKO does not have the type of waste that will be generated after write-off, the procedure becomes more complicated. See below for more details.

2.2. The next step is to decide which organization will be involved in further waste management. In doing so, you should make sure that:

- — the involved organization has a license to collect, transport, process, utilize, neutralize and dispose of waste of I-IV hazard classes

- — in the annex to such a license the FKKO codes corresponding to the types of waste that will be generated after write-off are indicated

- — according to the FKKO codes you are interested in, the activities that the ecologist has identified for further waste management are permitted

Example

The organization writes off property:

- tables

- armchairs

- assembled computers

- phones

The environmentalist determines that after write-off the following types of waste will be generated:

| Property | Name of waste according to FKKO | FKKO code |

| tables | furniture waste from dissimilar materials | 49211181524 |

| armchairs | ||

| assembled computers | computer system unit that has lost its consumer properties | 48120101524 |

| LCD computer monitors that have lost their consumer properties, assembled | 48120502524 | |

| keyboard, mouse with connecting wires, which have lost their consumer properties | 48120401524 | |

| phones | telephone and fax machines that have lost their consumer properties | 48132101524 |

The ecologist also determined the following:

| Name of waste according to FKKO | FKKO code | Availability of an exit passport | Intended type of appeal |

| furniture waste from dissimilar materials | 49211181524 | Yes | Collection, transportation, placement |

| computer system unit that has lost its consumer properties | 48120101524 | Yes | Collection, transportation, processing, disposal |

| LCD computer monitors that have lost their consumer properties, assembled | 48120502524 | Yes | Collection, transportation, processing, disposal |

| keyboard, mouse with connecting wires, which have lost their consumer properties | 48120401524 | Yes | Collection, transportation, processing, disposal |

| telephone and fax machines that have lost their consumer properties | 48132101524 | No | Collection, transportation, processing, disposal |

Based on the information received, it is clear that it is necessary to develop 1 waste passport and find an organization that has in its application the waste codes and types of activities indicated in the table. It is important to understand that organizations that are engaged in placement (landfills), as a rule, do not conduct other activities, and are not involved in processing and recycling (disassembling equipment and processing its parts into secondary resources). Therefore, it will be necessary to find 2 organizations with a license and conclude two contracts. This is most often inconvenient. In this case, it would be more rational to contact a company that, for example, has a license to collect and transport the entire list of waste, to process and dispose of everything that must be disposed of, and also has the opportunity to attract a contractor with a placement license.

It is worth noting that it is advisable to do everything listed in the second paragraph before the property is written off. The process of developing passports, finding an appropriate contractor and concluding contracts can take a long time. Including more than 11 months, which means there is a risk of violating legal requirements. The sooner this process is started, the less written-off property will “clutter” the premises of your organization, and the less the risk of violating laws.

2.3. The next step is write-off. The implementation of this procedure in commercial organizations is regulated by internal orders and instructions, and can vary greatly from company to company. Therefore, we will talk exclusively about the write-off of property on the balance sheet of state and municipal institutions and enterprises.

The main difference between such enterprises and institutions from commercial ones is that they are not the owners of property, but only manage it. Accordingly, the write-off process is associated with its coordination with regulatory authorities and higher structures. In particular, the write-off of property in St. Petersburg is regulated by Decree of the Government of St. Petersburg dated September 19, 2014 No. 877 “On the procedure for making decisions on the destruction of property owned by the state of St. Petersburg” (as amended as of January 31, 2021).

According to clause 2.1 of Article 2 of the Procedure for making decisions on the destruction of property owned by the state of St. Petersburg (hereinafter referred to as the Procedure): “The decision to recognize movable property as unusable is made by the KIO.” Why is a “Submission on recognizing movable property as unusable” (hereinafter referred to as the Submission) sent to the KIO, which must contain:

- — Information that allows you to individualize movable property, including name, individual number (factory, registration, inventory and others), as well as its characteristics, including technical ones, and location.

- — Copies of title documents for movable property.

- — Information about the technical condition of movable property, allowing one to draw a conclusion about the impossibility and economic inexpediency of its restoration and (or) other use, including information about the direct inspection of movable property and the reasons for the movable property becoming unusable (reports, photo, film, video materials etc).

- — Information about the presence in movable property or its components of substances, properties, parts that are potentially dangerous to humans and (or) the environment, as well as non-ferrous, precious or rare earth metals.

- — Copies of documents containing information on the application of measures to bring to justice persons guilty of rendering movable property unusable, as well as other measures to protect the property interests of St. Petersburg (if any).

- — Proposal on the most appropriate method of executing the decision to destroy movable property that has become unusable.

- — Proposals for the further use of components and materials of movable property that has fallen into disrepair.

At the same time, in case of consideration of the issue of recognition of movable property, which is the property of the treasury of St. Petersburg, the original (replacement) cost of which exceeds the amount of accrued depreciation, as having fallen into disrepair, the KIO ensures that the movable property is examined for its technical condition, which is carried out by a legal entity or an individual entrepreneur who is not interested in making decisions specified in paragraph 2.8 of these Regulations (note by the Civil Code of Disposal - this means recognizing property as unusable or refusing it), who, in accordance with current legislation, has the right to engage in activities to conduct an inspection of movable property for its technical condition.

It is worth noting that, despite the fact that the provision of inspection of property by third parties is imposed by order on KIO, in real life, institutions themselves turn to companies that have the right to determine the technical condition of property and issue certificates of defects, which are then included in the Submission. At the moment, such activities are not regulated by the legislation of the Russian Federation and are not subject to mandatory licensing or certification. Therefore, CIOs are satisfied with voluntarily received certificates.

After the KIO recognizes the property as having fallen into disrepair, it is subject to write-off. However, the final disposal of property from the institution’s balance sheet occurs only after the submission of documents to the KIO confirming the disposal of such property. Typically, disposal takes up to two months.

Write-off of inventories

Materials that have become unusable or obsolete can be written off from the warehouse. A deduction is also made when shortages or loss of assets are identified due to fires and natural disasters.

Unfortunately, the Ministry of Finance of the Russian Federation in this case suggests that the taxpayer, when registering materials, reflect their market value as part of non-operating income, as required by paragraph 13 of Article 250 of the Tax Code (letter dated April 19, 08 No. 03-03-06/2/58). At the same time, financial department specialists believe that it does not matter at all whether the specified property will participate in production or commercial activities, or is subject to disposal.

If the law is read literally, this conclusion can be considered correct, however, if the company manages to prove the zero value of the written-off materials, additional tax payments can be avoided.

What to do if the FKKO does not have the type of waste you need:

In this case, the waste generator is required to confirm the hazard class of the waste. To do this, you need to contact an accredited laboratory to obtain an analysis of the component composition of the waste. Based on the conclusion about the component composition, the hazard class is calculated.

When the hazard class of waste is received, a hazardous waste passport is issued for the waste, in which the waste group code is indicated as the waste code. The issued passport is certified by the head of the institution (enterprise) and, together with a package of documents, is transferred to Rosprirodnadzor.

The package of documents is regulated by Order of the Ministry of Natural Resources and Ecology of the Russian Federation dated December 5, 2014 No. 541 “On approval of the Procedure for classifying waste of I-IV hazard classes to a specific hazard class.”

Rosprirodnadzor sends a proposal to introduce a new FKKO code to the Federal State Budgetary Institution “Federal Center for Analysis and Assessment of Technogenic Impact” (FSBI “FCAO”). FSBI "FCAO" together with FSBI Ural Research Institute "Ecology" analyzes the received materials (documents) and makes a decision to enter a new code into the FKKO and notifies Rosprirodnadzor about this. And Rosprirodnadzor notifies the applicant that the applicant has been assigned the FKKO code.

After entering the code into the FKKO, you need to correct the previously developed waste passport, in accordance with the information received from Rosprirodnadzor, and again notify Rosprirodnadzor about the development of a new passport.

How to take into account the values recovered during disposal?

Material assets (MV) obtained from the disposal of fixed assets can be sent to:

- for sale.

In this case, they are reflected as part of current assets in the form of a balance sheet and are classified as goods or materials with their allocation into a special subclass, for example, “MC received during disposal”;

- for use in the normal activities of the company as inventory.

Then such values are reflected as part of current assets on the balance sheet, but are classified as part of a similar class of inventory held by the company.

What mistakes do waste managers make today and how to avoid them:

From 2013 to July 1, 2021, collection, transportation, processing and disposal activities were not subject to licensing. During this period, a practice developed when service and repair companies and enterprises involved in the procurement of scrap metals took on the work of recycling. However, at the moment, the involvement of such organizations entails a violation of the law. As mentioned above, written-off property is waste, and only licensees can perform any actions with waste.

The removal of circuit boards containing precious metals from decommissioned computer and office equipment is a waste treatment activity and cannot be carried out by enterprises that do not have a waste management license. The Assay Office certificate is currently not sufficient to carry out this work. After withdrawal, boards containing precious metals are subject to transfer only to refineries, the official list of which is established by the legislation of the Russian Federation.

Equipment containing ferrous or non-ferrous metal, after decommissioning, becomes waste and cannot be collected and transported by enterprises licensed to process (harvest) metal, but must be transferred as waste in accordance with the procedure established by law for processing and disposal. And only after recycling, secondary resources, including scrap metals, are transferred to enterprises licensed to procure scrap metals.

For organizations engaged in waste disposal activities, special conditions for updating licenses are provided. Such enterprises must re-register them before January 1, 2021. Some of these licenses indicate codes for waste groups that include waste generated when property is written off. In this regard, a false understanding may arise that, for example, decommissioned equipment can be placed at a landfill. However, it is not. Disposal of waste at a landfill is possible only if this waste cannot be disposed of. And waste must be processed and disposed of only in that part that cannot be disposed of after processing.

What documents are required for reporting:

1. Waste acceptance and transfer certificate. Contains information about who the waste was transferred to, in what quantity, and what further actions were taken with it. Required for reporting to the Department of Rosprirodnadzor for the Northwestern Federal District.

2. Certificate of presence/absence of scrap precious metals. Issued on the basis of a Certificate of special registration with the Assay Chamber of the Russian Federation. Necessary for the implementation of the Instructions on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of the Russian Federation dated August 29, 2001 No. 68n.

3. A certificate of scrap ferrous and non-ferrous metals extracted from waste, indicating the quantity and cost, taking into account the costs of extraction, as well as indicating the enterprise that has a license for the procurement of scrap metals, to which the recovered scrap was transferred.

4. Payment documents. If the above secondary resources were extracted from the transferred waste, the organization that disposed of the waste must transfer the funds received from the sale of such scrap to the account of the waste generator, unless otherwise provided by the disposal agreement.