How is the “signature” requisite completed?

Info

Determine that in the absence of one of the officials specified in paragraph 1 of this order, his powers in terms of signing are exercised by the remaining official. 3. The signing of the main documents listed in Appendix No. 1 to the order by the indicated officials shall be carried out in strict accordance with the scope of powers and the procedure for making a decision on their signing, established by the Charter of Rosinka LLC and the powers of attorney issued to them.

Secretary-Clerk I.N. Savushkina familiarize the officials specified in the order with this order, distribute the order to all employees of the Kostroma branch of Rosinka LLC for information. 5. I reserve control over the execution of this order.

Director of the Kostroma branch of ROSINKA LLC Sayurov D.G. Sayurov Agreed: Chief Legal Adviser A.K. Ivanova A.K.

If the power of attorney is drawn up on several sheets, it should be stitched and the sheets numbered; The binding is affixed with the signature of the person authorized to sign powers of attorney on behalf of the organization, and a seal is affixed. The following documents are used in the article:

- Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “On approval of the Regulations on accounting and financial reporting in the Russian Federation.” In ed. from 12/24/10.

- Instruction of the Bank of Russia dated September 14, 2006 No. 28-I “On opening and closing bank accounts and deposit accounts.”

In ed. from 25.11.09. - Civil Code of the Russian Federation (part one) dated November 30, 1994 No. 51-FZ. In ed. from 06.12.11, as amended.

Legal entities issue such documents, as a rule, to their employees: lawyers, chief accountants, heads of departments, etc. The document is usually drawn up by either the secretary or the company’s lawyer, then the power of attorney is handed over to the manager for signature.

Do not use sub-power of attorney - it is better to issue a power of attorney to several persons at once.

Sometimes powers of attorney are issued with the right of substitution, but this entails the need to have this document certified by a notary. Therefore, most often, the management of organizations prefers to issue powers of attorney to several representatives at once.

The power of attorney can be general (with unlimited powers); special (for carrying out instructions during a designated period) or one-time (for the implementation of one specific task).

If a power of attorney is filled out to sign strictly defined documents, they must be entered very clearly, preferably each document as a separate subparagraph.

A power of attorney can be presented to any organization: both government (courts, tax inspectorates, post offices, extra-budgetary funds, etc.) and commercial (banks, other organizations and enterprises).

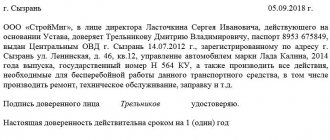

There are no clearly defined standards for filling out a power of attorney; however, when drawing it up, you must follow the basic rules recommended in office work when issuing documents of this kind. Among other things, a power of attorney for the right to sign documents must necessarily include information about the principal and personal information about the authorized person. The validity period of the power of attorney and signatures of both parties must also be indicated here.

It should be noted that the broader the powers of the trustee, the more detailed information about the parties should be included in the power of attorney.

- At the very top of the document the word “Power of Attorney” is written and the number of the power of attorney for internal document flow is indicated, if necessary. Below, in one line, the locality in which the document is drawn up and the date of its completion (day, month (in words), year) are indicated.

- Next, you should enter the details of the legal entity-trustor: the full name of the enterprise (indicating its organizational and legal form), OGRN, INN, KPP (can be found in the constituent papers of the organization), its legal and actual address.

- Then we fill in the position of the employee on whose behalf this document is being drawn up. Usually this is a director, general director of an organization or a person authorized to sign such papers: his last name, first name, patronymic (first name and patronymic can be indicated as initials), as well as the document on the basis of which the principal acts (as a rule, in this document) should be indicated. The line is written “Based on the Charter”, “Power of Attorney” or “Regulations”).

- Now personal information about the principal. Here you enter his last name, first name, patronymic and identification document (name, series, number, when and by whom it was issued), registration at the place of residence.

- The next part of the document contains a detailed description of the powers that the principal entrusts to the authorized representative: here you need to enter a complete list of documents that the representative has the right to sign.

- Then the period for which the power of attorney was issued is indicated. In the appropriate line you should enter the date until which the power of attorney is valid. Here you can specify any period, but if there are no specific numbers, then the power of attorney will automatically be considered valid for a year from the date of signing.

- After this, you need to indicate whether the representative has the right to delegate his powers to anyone.

- Next, the authorized person puts his signature on the document, which is certified by the head of the organization.

The latter also signs the power of attorney and puts the seal of the company. It must be said that starting from 2021, legal entities are not required to use seals when preparing documents.

We invite you to read: Rights and obligations of a co-borrower under a mortgage

The law does not oblige principals to certify all powers of attorney issued by notaries. However, there are certain types of powers of attorney that still need to be notarized. In particular, it is necessary to certify powers of attorney presented to certain government organizations (for example, courts), as well as to perform certain actions (receiving documents from government bodies, etc.). Here it would be better to call a notary and consult specifically on your case.

An order can be written by any employee of the enterprise whose duties include performing this task, who has the necessary competence, knowledge and skills in drawing up administrative documents. Most often, this is a legal adviser, personnel officer or secretary.

But whoever is directly involved in writing the order must submit it to the director of the company for review and approval, since without his signature this document will not be considered valid.

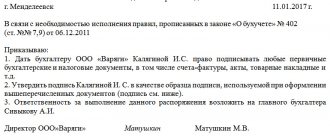

According to generally accepted standards for drawing up orders, any such document must have some basis. In this case, this is the Federal Law on Accounting dated December 6, 2011 No. 402 (Articles 7 and 9). At the same time, the order can indicate either a direct link to it or simply write “In order to ensure compliance with the norms of current legislation” - such wording will also not be considered a violation.

Today there is no single unified order form for everyone for the right to sign primary documents, so enterprises and organizations can write it in any form or according to a model approved in the accounting policy of the enterprise. However, some standards must still be adhered to. In particular, the order must indicate:

- order number,

- date of compilation,

- Company name,

- the locality in which the enterprise is registered.

In the main part, it is necessary to list everyone who is given the right to sign primary documents, indicating:

- positions,

- surname-name-patronymic,

- a list of documents that a particular employee has the right to sign.

It should be noted that the order may concern either one employee of the organization or an entire group of persons.

The approach to drawing up orders can also be absolutely anything: companies have the right to use simple A4 or A5 sheets or their own letterhead to write these administrative documents. In this case, the order can be written by hand or printed on a computer - this does not play any role in determining the legality of the document.

However, with all this, the order must be certified by the signature of the head of the enterprise or any other employee authorized to endorse such papers.

In addition, everyone who is mentioned in it, as well as the employees appointed responsible for its execution, must be familiar with the document for signature. Whether or not to put a stamp on the order is the choice of the originator, since it relates to the internal document flow of the company, and also from 2021 year, the requirement for the mandatory use of seals and stamps in the activities of legal entities was abolished by law.

The order is usually drawn up in a single original copy.

After the order is properly written, executed and issued, for the entire period of validity it must be kept together with other administrative papers of the company. After losing its relevance, it should be transferred to the archive, where it should be stored for the period established by law or local regulations (but not less than three years), then it can be disposed of.

Important

Arbitration practice in this regard is contradictory. For example, the judges of the Supreme Arbitration Court of the Russian Federation, in their ruling dated September 12, 2011 No. VAS-12001/11, emphasized that Chapter 21 of the Tax Code of the Russian Federation does not specify how exactly to sign invoices. This means that facsimile signatures are allowed. At the same time, there is also arbitration practice in favor of tax authorities. Moreover, some judges consider facsimile signatures as a sign that the buyer did not exercise caution when choosing a supplier.

And therefore the inspectors justifiably removed the costs. This conclusion is contained in the resolution of the Federal Antimonopoly Service of the North-Western District dated September 14, 2010 No. A66-9259/2009. How to get new documents from suppliers If you ask for changes verbally, it is not a fact that the counterparty’s accounting department will immediately issue new documents. Therefore, send a letter to the supplier with a request to quickly redo the primary documents and invoices.

We invite you to read: A police officer has the right to deliver citizens who are

In this case, an order must be prepared in advance, identifying the responsible persons if it is necessary to sign primary documents. Do I need a power of attorney? Partial delegation of authority in the matter of signing primary documents is a very convenient tool. This helps to optimize and improve the work process, even in the absence of the manager.

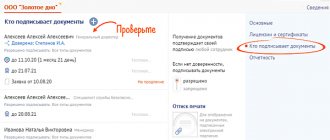

Who has the right to sign primary documents

A power of attorney on behalf of a legal entity can only be issued by the general director or founders of this legal entity. In accordance with paragraphs. 7.5, 7.6 Instructions of the Central Bank of Russia No. 28-I dated September 14, 2006, on financial documents, the right of first signature belongs to the head of the legal entity (sole executive body), as well as other persons (except for the persons specified in paragraph 7.

6 of this Instruction), vested with the right of first signature by an administrative act of a legal entity, or on the basis of a power of attorney issued in the manner established by the legislation of the Russian Federation, and the right of second signature belongs to the chief accountant of the legal entity and (or) persons authorized to maintain accounting records, on on the basis of an administrative act of a legal entity.

- Themes:

- Document flow

- HR records management

- Office work in accounting

The right to sign primary documents can be transferred to officials or individuals on the basis of an order or power of attorney. Delegation of authority to sign primary accounting documents allows for a rational distribution of responsibilities between the employees of the enterprise, and for its management - to reduce the time spent on signing some minor accounting and personnel records documents. The article describes the procedure for transferring the right to sign primary documents of an enterprise.

The right to sign primary documents: order or power of attorney

According to Art. 9 Federal Law “On Accounting” dated December 6, 2011 No. 402, each fact of the economic life of an enterprise is subject to registration as a primary accounting document. Primary documents include any papers related to accounting and tax accounting:

- invoices;

- money orders;

- acts;

- extracts;

- certificates;

- waybills, etc.

Let us turn to the opinion of the Russian Ministry of Finance, expressed on this matter in Information dated December 4, 2012 No. PZ-10/2012. According to it, the head of each organization must determine a list of persons who will be given the opportunity to certify primary accounting documents.

The right of first and second signature is distinguished. The first belongs to the leader. To grant such a right, a sample order on the right of first signature is used. The second belongs to the chief accountant of the organization. If necessary, the director of the enterprise determines who should delegate the certification of certain papers. Basically, it is provided to employees who, due to their duties, often have to work with the primary office: heads of separate divisions and branches, accounting employees, employees of economic departments, etc. Third parties not related to the company are not given the opportunity to sign papers.

If it is necessary to delegate authority, the manager decides how to grant his employee the right to sign. This can be done in two ways:

- using a power of attorney to sign the primary document;

- approval of a special order.

Now let's figure out in what cases it is necessary to draw up a power of attorney, and in what cases - to issue an order.

Procedure for granting signature rights

First of all, the management of the enterprise identifies employees who, due to their line of work, constantly encounter various types of documents. Then it is decided how to grant them the right to sign. This can be done in two ways:

- drawing up a special power of attorney,

- writing an order.

A power of attorney is appropriate in cases where documents are signed not only on the territory of the enterprise, but also in other places: for example, when a freight forwarder driver receives cargo from a warehouse of a partner organization or when an accountant receives a bank statement, etc. Another distinctive feature of a power of attorney is that it can be issued not only to a full-time employee of the enterprise, but also to an outside person. The order applies only to those employees who are registered in the company and receive the right to sign strictly internal corporate documents.

After drawing up the order, the head of the enterprise must certify the signatures of the subordinates mentioned in it with his autograph. The duration of the order is determined individually: it can be of an indefinite nature, or it can be drawn up for a period of one quarter, six months, a year, etc. depending on the situation within the company.

That is, each primary document must contain the personal signature of the person responsible for the operation. According to Order of the Ministry of Finance of the Russian Federation No. 34n dated July 29, 1998, all documents accompanying the execution of business transactions with tangible assets must be signed by the head of the organization and the chief accountant or authorized persons.

According to the Instruction of the Central Bank of Russia No. 28-I dated September 14, 2006 (clause 7.5, clause 7.6), the primary right to sign primary accounting documents is granted to officials representing the sole executive power. Other persons may also be granted the right of first signature.

The basis is a power of attorney issued in accordance with the legally established procedure. The right of the second signature is assigned to the accountant responsible for accounting.

Otherwise, it is necessary to have an order (instruction) from a legal entity containing an instruction on granting the employee the right of the first or second signature or a corresponding power of attorney. The right to sign can be granted to both full-time employees and third parties. At the same time, the right of first signature cannot be granted to the chief accountant or other persons having the right of second signature.

It is also not allowed to vest one person with the right of first and second signature at the same time (in accordance with clause 7.9 of the Instruction of the Central Bank of the Russian Federation dated September 14, 2006 No. 28-I). In the absence of a chief accountant position in the organization's staff, his responsibilities for maintaining accounting records and granting the right to sign financial documents may be assigned to the general director. The assignment of such duties is formalized by an appropriate order.

We invite you to read: Fine for lack of registration at the place of stay in 2021

Right of first and second signature of financial documents

In financial law, it is customary to operate with such concepts as “right of first signature” and “right of second signature” of financial documents. Thus, the first signature belongs to the head of the organization, and the second signature remains with the chief accountant or persons who maintain accounting records.

Finished works on a similar topic

- Coursework The right to sign financial documents 450 rub.

- Abstract The right to sign financial documents 230 rub.

- Test work The right to sign financial documents 190 rub.

Receive completed work or specialist advice on your educational project Find out the cost

It is worth noting that, having the authority to transfer his right to other persons, the manager cannot transfer his right of first signature to the accountant or persons who make the second signature. In addition, it is impossible for one person to make both the first and second signatures at the same time.

Give the right to sign documents to an authorized employee

The definition of powers in powers of attorney of authorized officials has the same shortcomings. Thus, powers of attorney can be with almost the same powers - in case of interchangeability.

In addition, the powers of not all employees are certified by a power of attorney. Thus, the director of an enterprise, who is the sole executive body, in accordance with the law, generally acts without a power of attorney.

Important

Thus, despite the convenience of determining the authority to sign enterprise documents in a power of attorney issued to an official, this method of delimiting authority is not suitable for all cases. If, nevertheless, the division of powers of the signatories is decided to be regulated in the issued powers of attorney, Sample No. 2 can be taken as an example of the required wording.

Attention

How to certify the right to sign primary documents - by order or power of attorney The main criterion for distinguishing between an order for the right to sign primary documents and a power of attorney in this case is that the validity of a document of the first type applies only to employees of the business entity, the second - to any persons specified in the document. The drawing up of orders and powers of attorney is regulated by different branches of law - labor and civil, respectively. The choice of an order as a normative act certifying the transfer of the right to sign the primary document will be optimal in cases where only internal documents are intended to be signed.

At the same time, there is absolutely no need (primarily from the point of view of the security of the transfer of corporate information) to grant unnecessary powers to third parties.